Cardiac Monitoring Market Report

Published Date: 31 January 2026 | Report Code: cardiac-monitoring

Cardiac Monitoring Market Size, Share, Industry Trends and Forecast to 2033

This market report offers a comprehensive analysis of the cardiac monitoring industry, focusing on market size, segmentation, trends, and key players with insights for the forecast period from 2023 to 2033.

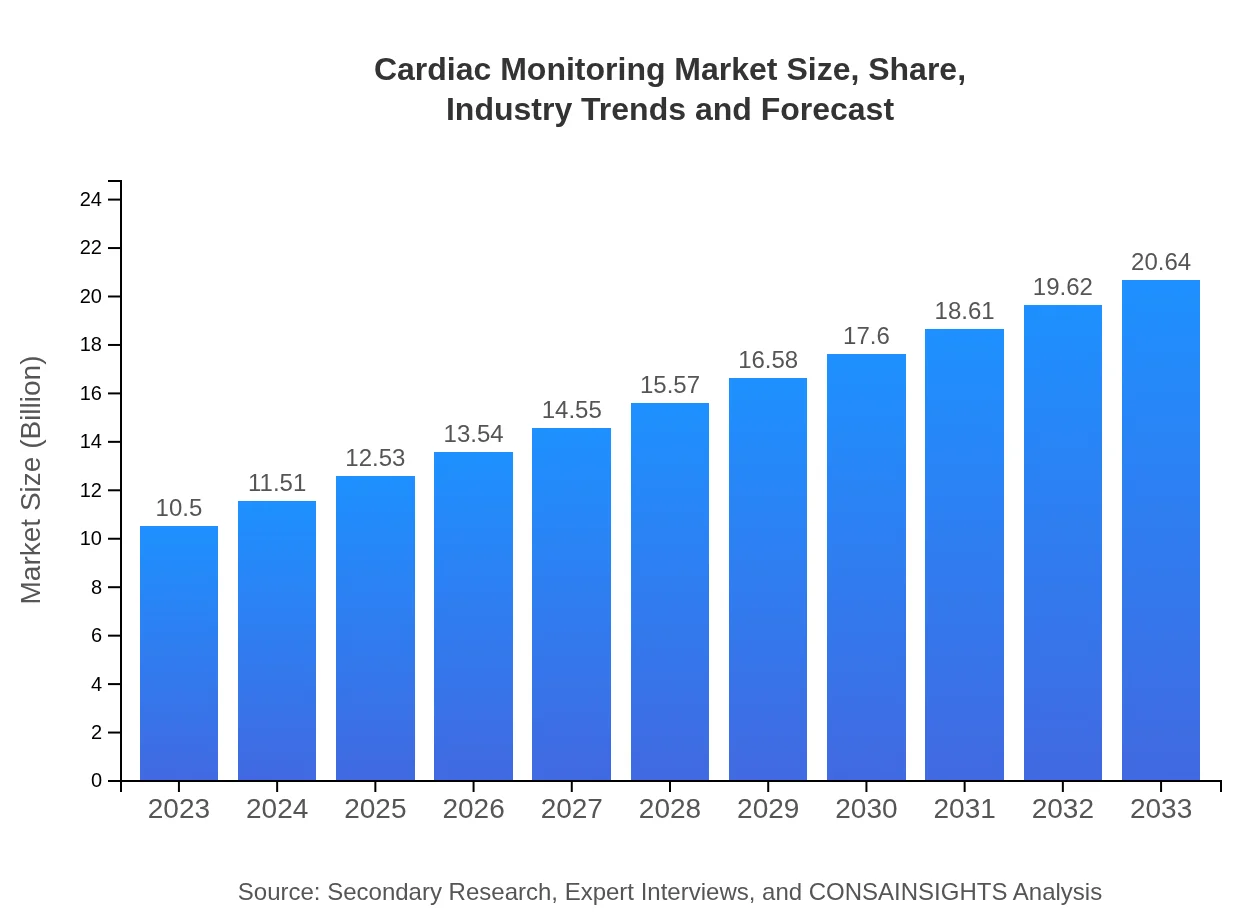

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Medtronic , Philips Healthcare, GE Healthcare, Boston Scientific Corporation, CardioNet |

| Last Modified Date | 31 January 2026 |

Cardiac Monitoring Market Overview

Customize Cardiac Monitoring Market Report market research report

- ✔ Get in-depth analysis of Cardiac Monitoring market size, growth, and forecasts.

- ✔ Understand Cardiac Monitoring's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cardiac Monitoring

What is the Market Size & CAGR of Cardiac Monitoring market?

Cardiac Monitoring Industry Analysis

Cardiac Monitoring Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cardiac Monitoring Market Analysis Report by Region

Europe Cardiac Monitoring Market Report:

The European cardiac monitoring market is projected to increase from $2.76 billion in 2023 to $5.43 billion in 2033. This growth is attributed to the presence of established healthcare systems, strong regulatory support for new technologies, and an aging population requiring enhanced cardiac care solutions.Asia Pacific Cardiac Monitoring Market Report:

In the Asia-Pacific region, the cardiac monitoring market is projected to grow from $2.02 billion in 2023 to $3.96 billion by 2033, reflecting a strong CAGR of 7%. Factors driving this growth include rising disposable incomes, increased healthcare expenditure, and a focus on modernizing healthcare infrastructure in countries like India and China.North America Cardiac Monitoring Market Report:

North America remains the largest market, anticipated to grow from $3.75 billion in 2023 to $7.37 billion by 2033. Factors such as high healthcare expenditure, a strong focus on preventative care, and rapid technological adoption drive this market's growth. The United States, in particular, is a key player in innovation and market expansion.South America Cardiac Monitoring Market Report:

South America is expected to witness a gradual increase in market size from $0.57 billion in 2023 to $1.11 billion by 2033, primarily fueled by an increased emphasis on healthcare access and improvement in cardiac care. Local partnerships and support from governments are encouraging advancements in cardiac monitoring technology.Middle East & Africa Cardiac Monitoring Market Report:

In the Middle East and Africa, the market is posited to grow from $1.41 billion in 2023 to $2.76 billion by 2033. Investment in healthcare infrastructure, along with rising awareness of cardiovascular diseases, will bolster market development across this region.Tell us your focus area and get a customized research report.

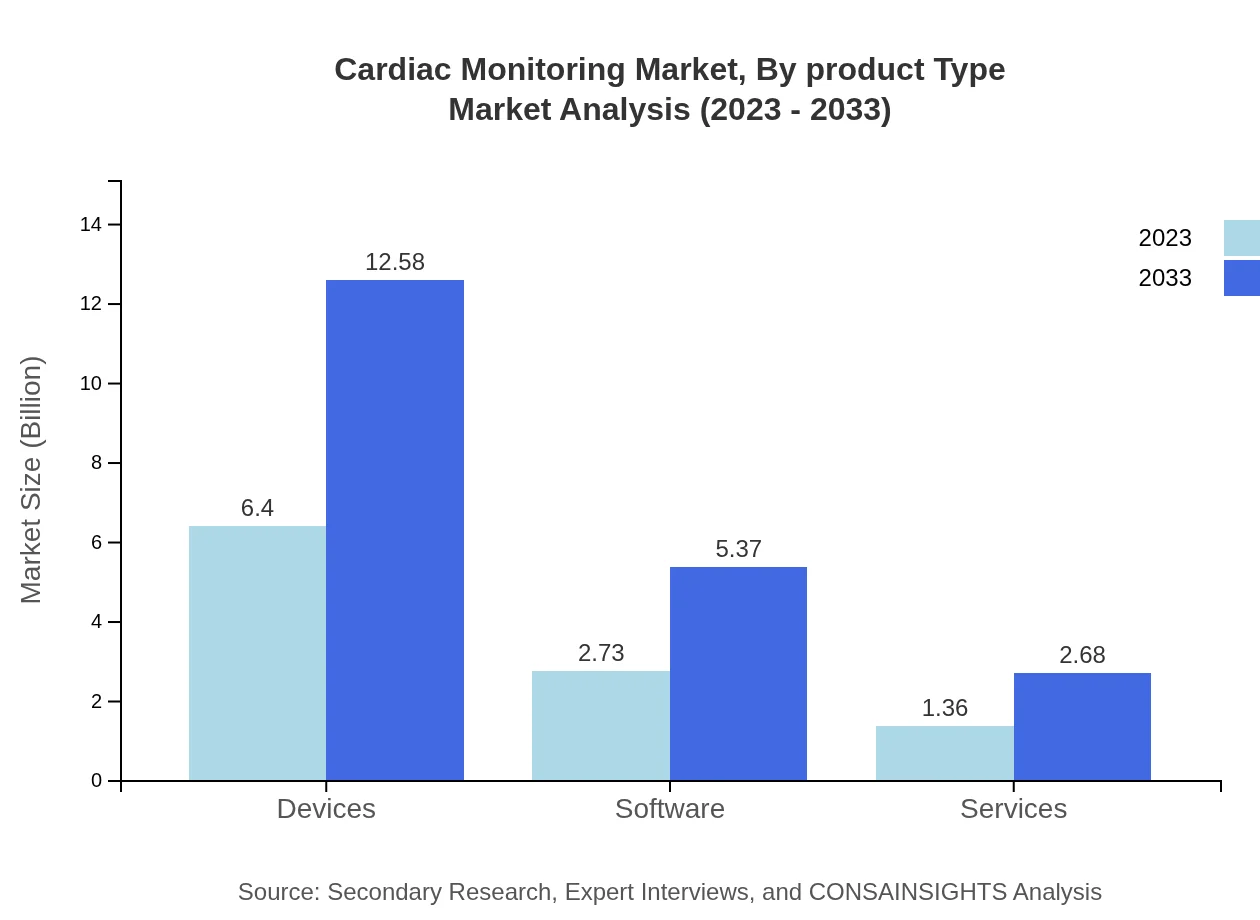

Cardiac Monitoring Market Analysis By Product Type

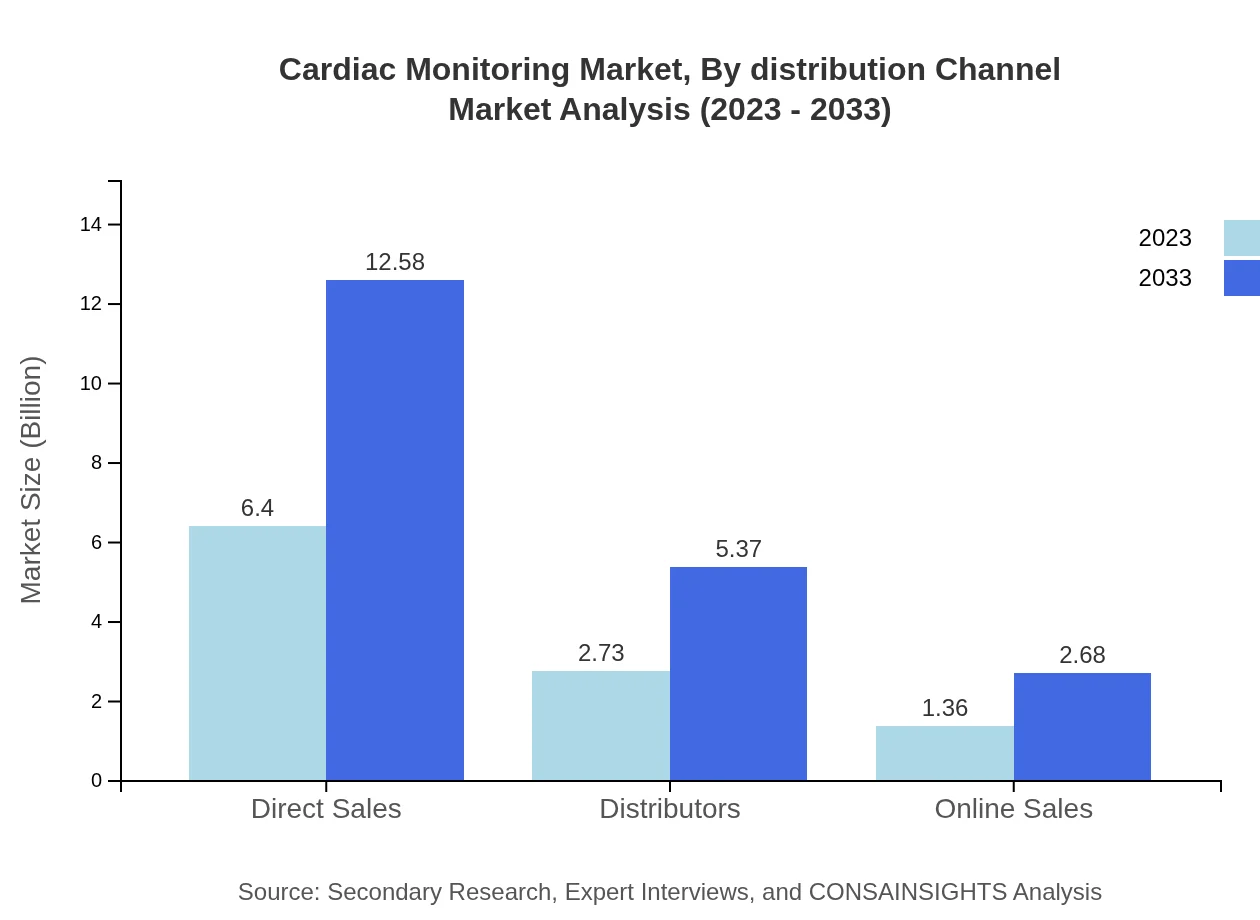

The cardiac monitoring market by product type shows promising growth across various technologies. In 2023, devices represent a leading market segment at $6.40 billion, expected to grow to $12.58 billion by 2033, capturing 60.97% of market share. Software solutions are also gaining traction, growing from $2.73 billion to $5.37 billion (26.04%). Services, while smaller in total size at $1.36 billion, will similarly show strong growth, supported by the demand for comprehensive support post-purchase.

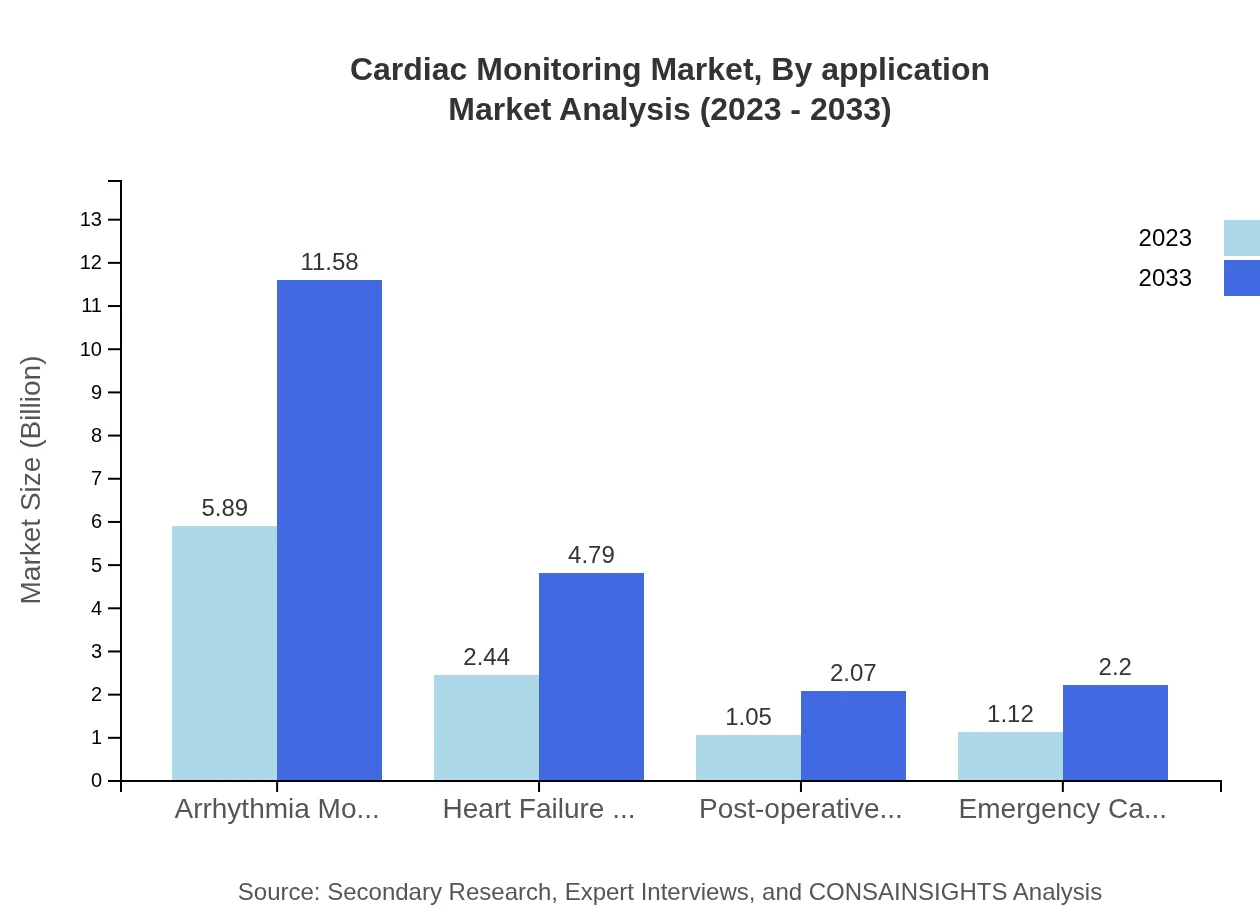

Cardiac Monitoring Market Analysis By Application

Focusing on applications, arrhythmia monitoring is the largest segment, with a size of $5.89 billion in 2023, projected to enhance this size to $11.58 billion by 2033. The second-largest category is heart failure management, initially valued at $2.44 billion, growing proportionately to $4.79 billion. This trend reflects a growing need for effective monitoring solutions in chronic disease management.

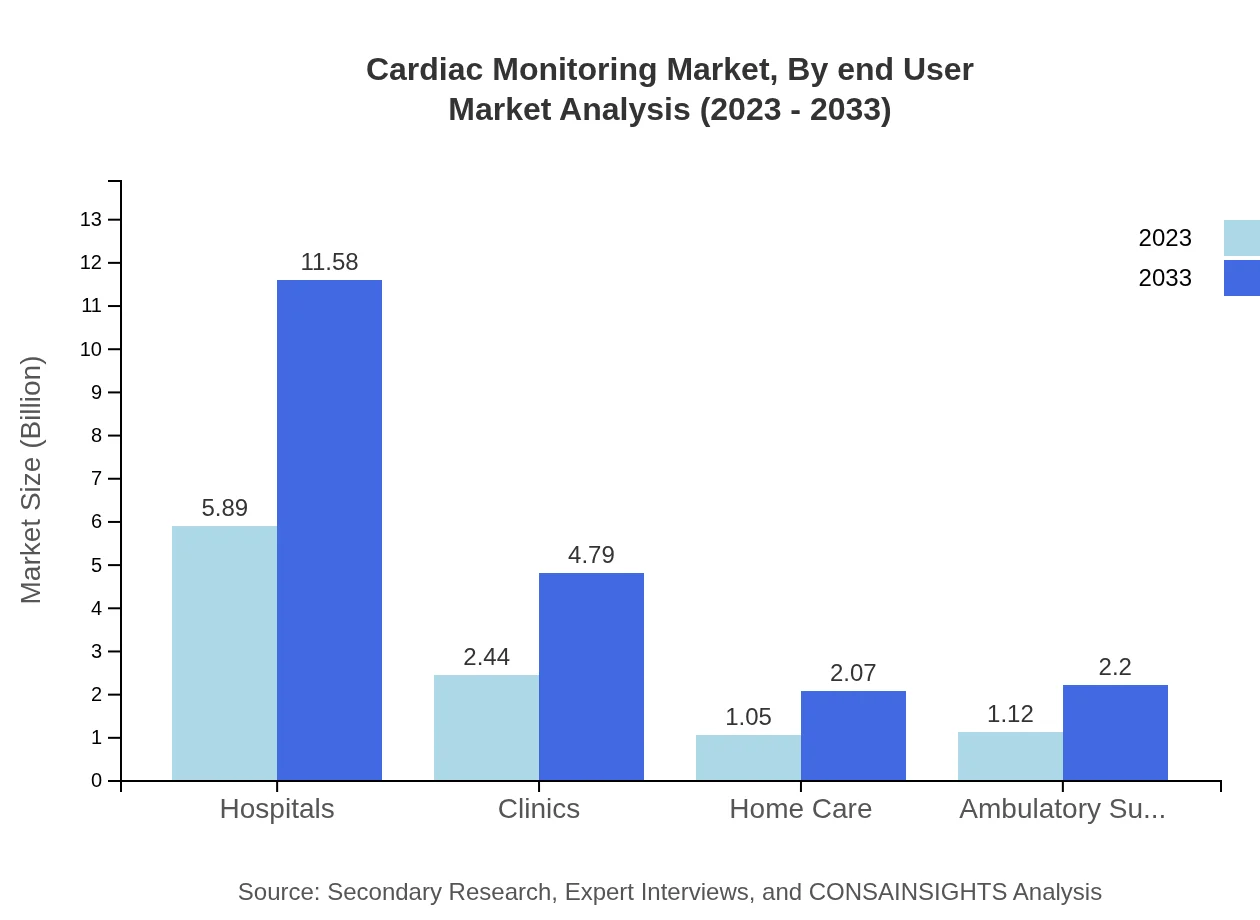

Cardiac Monitoring Market Analysis By End User

Hospitals dominate the end-user market segment, with expected growth from $5.89 billion (56.12%) in 2023 to $11.58 billion (56.12%) by 2033. Likewise, clinics and home care are also crucial segments, capturing shares of 23.23% and 10.01%, respectively. This distribution reflects evolving patient care models towards outpatient and home-based solutions.

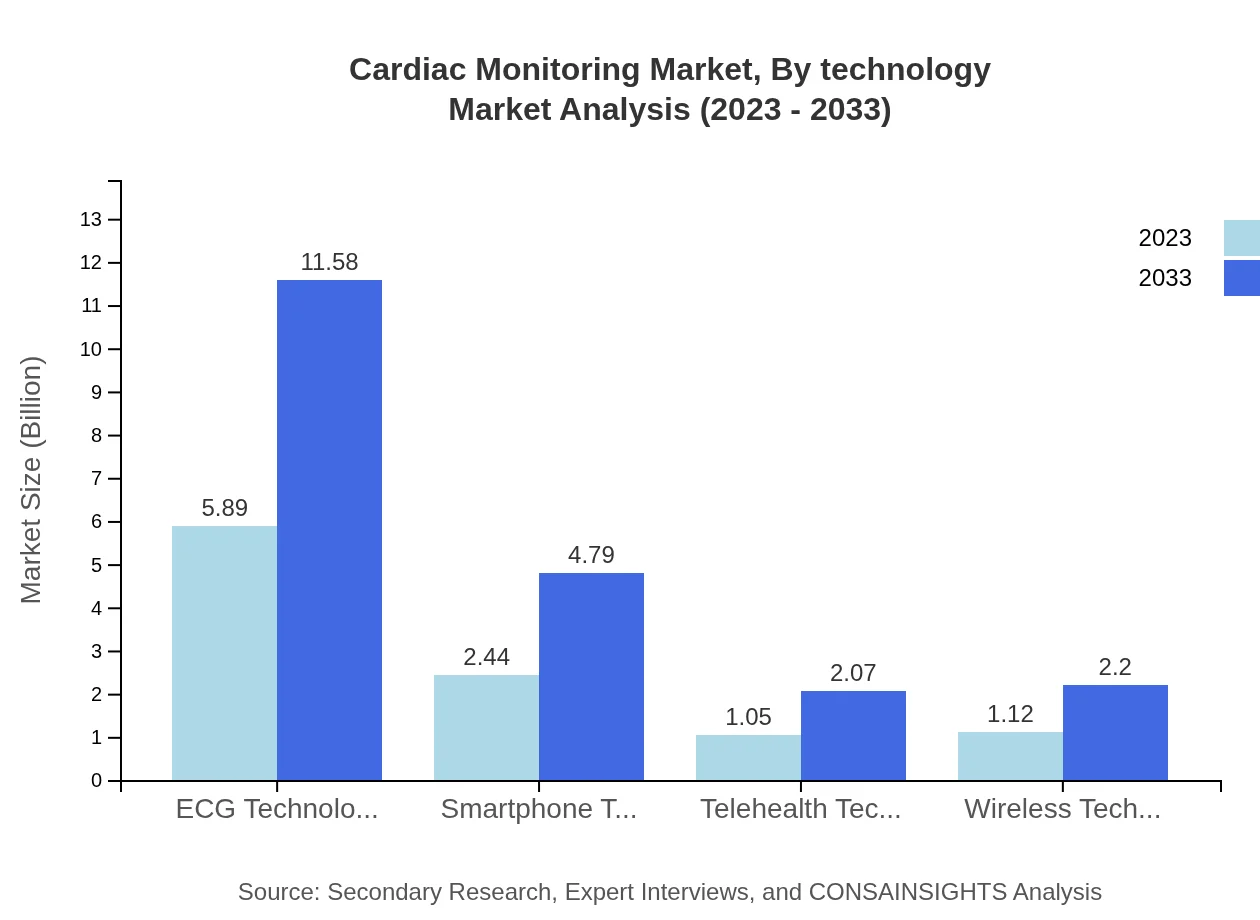

Cardiac Monitoring Market Analysis By Technology

Technology segmentation indicates that ECG technology leads at $5.89 billion in 2023 and is expected to mirror previous expansions up to $11.58 billion by 2033 (56.12%). Smartphone and telehealth technologies are pivotal as well, initially valued at $2.44 billion and $1.05 billion respectively, growing concurrently in significance amid escalating digital health trends.

Cardiac Monitoring Market Analysis By Distribution Channel

The distribution channels segment emphasizes the importance of direct sales, accounting for $6.40 billion (60.97%) in 2023. Distributors and online sales channels are also integral, contributing $2.73 billion and $1.36 billion respectively. These channels ensure accessibility and facilitate the necessary monitoring technologies across different healthcare settings.

Cardiac Monitoring Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cardiac Monitoring Industry

Medtronic :

A leading global leader in medical technology, Medtronic specializes in device solutions for cardiac monitoring, offering innovative products that enhance patient care.Philips Healthcare:

Philips Healthcare is recognized for its advanced cardiac monitoring solutions and innovations in patient monitoring systems, improving efficiency and outcomes in healthcare settings.GE Healthcare:

A key player in healthcare technology, GE Healthcare delivers solutions that simplify cardiovascular diagnostics and monitoring services worldwide.Boston Scientific Corporation:

Offers a range of advanced cardiac devices with a focus on innovation and technology, improving care and treatment for cardiac patients globally.CardioNet:

Specializes in remote patient monitoring services that provide comprehensive monitoring solutions for cardiac patients, ensuring timely interventions and optimal care.We're grateful to work with incredible clients.

FAQs

What is the market size of cardiac monitoring?

The global cardiac monitoring market is valued at $10.5 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching significant size as demand increases over the next decade.

What are the key market players or companies in the cardiac monitoring industry?

Key players in the cardiac monitoring industry include companies like Medtronic, Abbott Laboratories, Philips, GE Healthcare, and Biotronik, which lead in innovation and market share across various segments.

What are the primary factors driving the growth in the cardiac monitoring industry?

Key growth drivers include the increasing prevalence of cardiovascular diseases, technological advancements in monitoring devices, and a growing emphasis on preventive healthcare among patients and healthcare providers.

Which region is the fastest Growing in the cardiac monitoring market?

The North American region is the fastest-growing in the cardiac monitoring market, with a projected growth from $3.75 billion in 2023 to $7.37 billion by 2033, driven by high investment in healthcare technology.

Does ConsaInsights provide customized market report data for the cardiac monitoring industry?

Yes, ConsaInsights offers customized market reports tailored to client specifications, ensuring relevant and precise data pertinent to the cardiac monitoring industry for informed decision-making.

What deliverables can I expect from this cardiac monitoring market research project?

Deliverables include comprehensive market analysis, growth forecasts, competitive landscape reviews, regional data insights, and segment evaluations, directly addressing your strategic planning needs.

What are the market trends of cardiac monitoring?

Notable trends include the rise of telehealth applications, integration of AI in monitoring devices, increased focus on remote patient monitoring, and expanding demand for wearable cardiac devices in personal healthcare.