In Wheel Motor Market Report

Published Date: 02 February 2026 | Report Code: in-wheel-motor

In Wheel Motor Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the In Wheel Motor market from 2023 to 2033, including market trends, size, segment performance, regional insights, and key players. The report aims to equip stakeholders with essential information for strategic decision-making.

| Metric | Value |

|---|---|

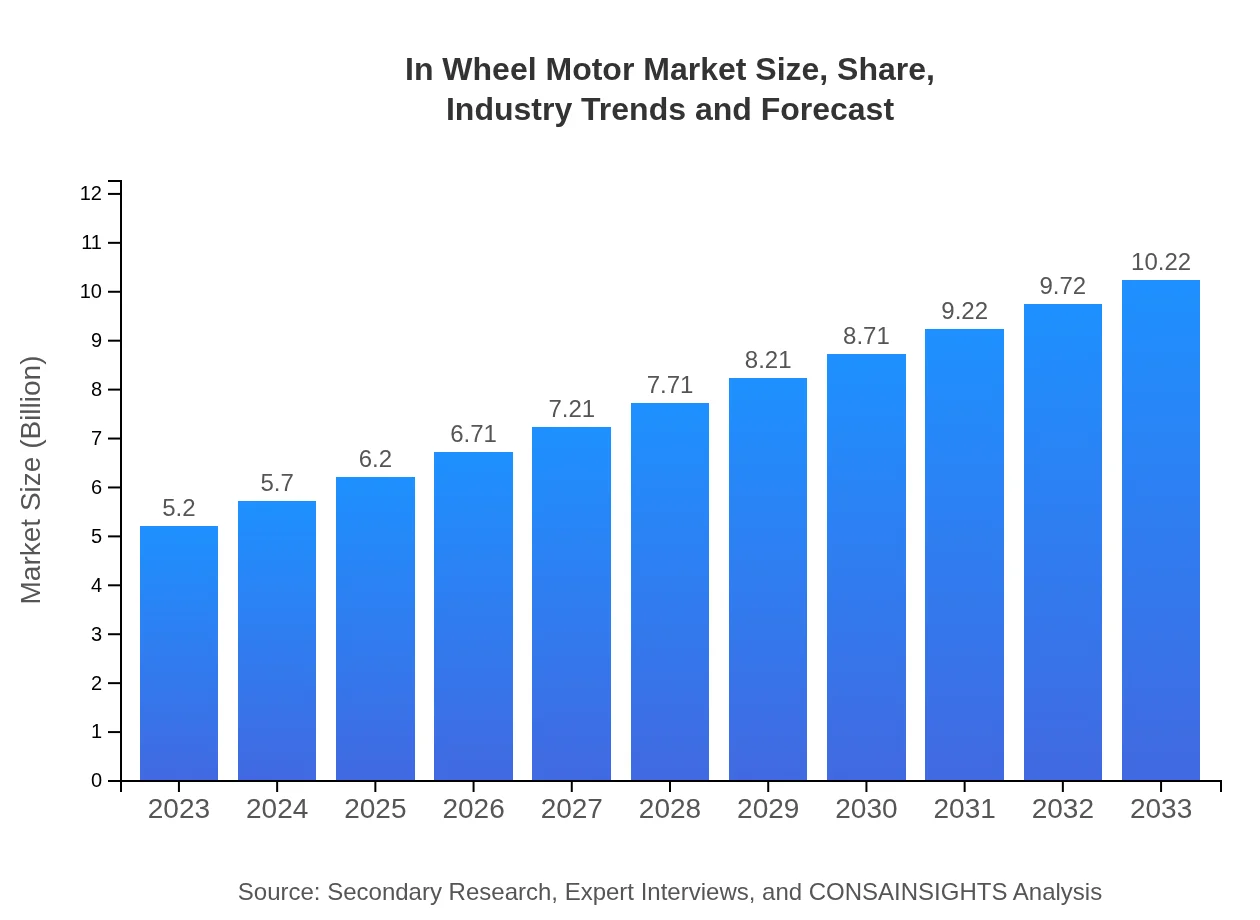

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Continental AG, Mitsubishi Motors Corporation, Denso Corporation, Yamaha Motor Co., Ltd. |

| Last Modified Date | 02 February 2026 |

In Wheel Motor Market Overview

Customize In Wheel Motor Market Report market research report

- ✔ Get in-depth analysis of In Wheel Motor market size, growth, and forecasts.

- ✔ Understand In Wheel Motor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in In Wheel Motor

What is the Market Size & CAGR of In Wheel Motor market in 2023?

In Wheel Motor Industry Analysis

In Wheel Motor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

In Wheel Motor Market Analysis Report by Region

Europe In Wheel Motor Market Report:

Europe leads the global market with a valuation of $1.40 billion in 2023, projected to reach $2.75 billion by 2033. Stringent regulations on emissions and a robust focus on innovation in automotive technologies significantly bolster growth.Asia Pacific In Wheel Motor Market Report:

The Asia Pacific region, valued at $1.04 billion in 2023, is expected to grow to $2.04 billion by 2033. The region is a manufacturing hub for electric vehicles and continues to lead in technological adoption, with an increasing focus on sustainable transportation solutions.North America In Wheel Motor Market Report:

North America is one of the leading markets, expected to rise from $1.97 billion in 2023 to $3.86 billion by 2033. The region benefits from strong investments in electric vehicle development and supportive government policies aimed at reducing emissions.South America In Wheel Motor Market Report:

The South American market is smaller, projected to grow from $0.26 billion in 2023 to $0.50 billion in 2033. Initiatives to promote electric mobility and urbanization are driving demand in this region, albeit at a slower pace compared to others.Middle East & Africa In Wheel Motor Market Report:

The Middle East and Africa market is anticipated to expand from $0.54 billion in 2023 to $1.07 billion by 2033. Despite being a smaller market, heightened interest in electric vehicle policies and infrastructure development is fostering growth.Tell us your focus area and get a customized research report.

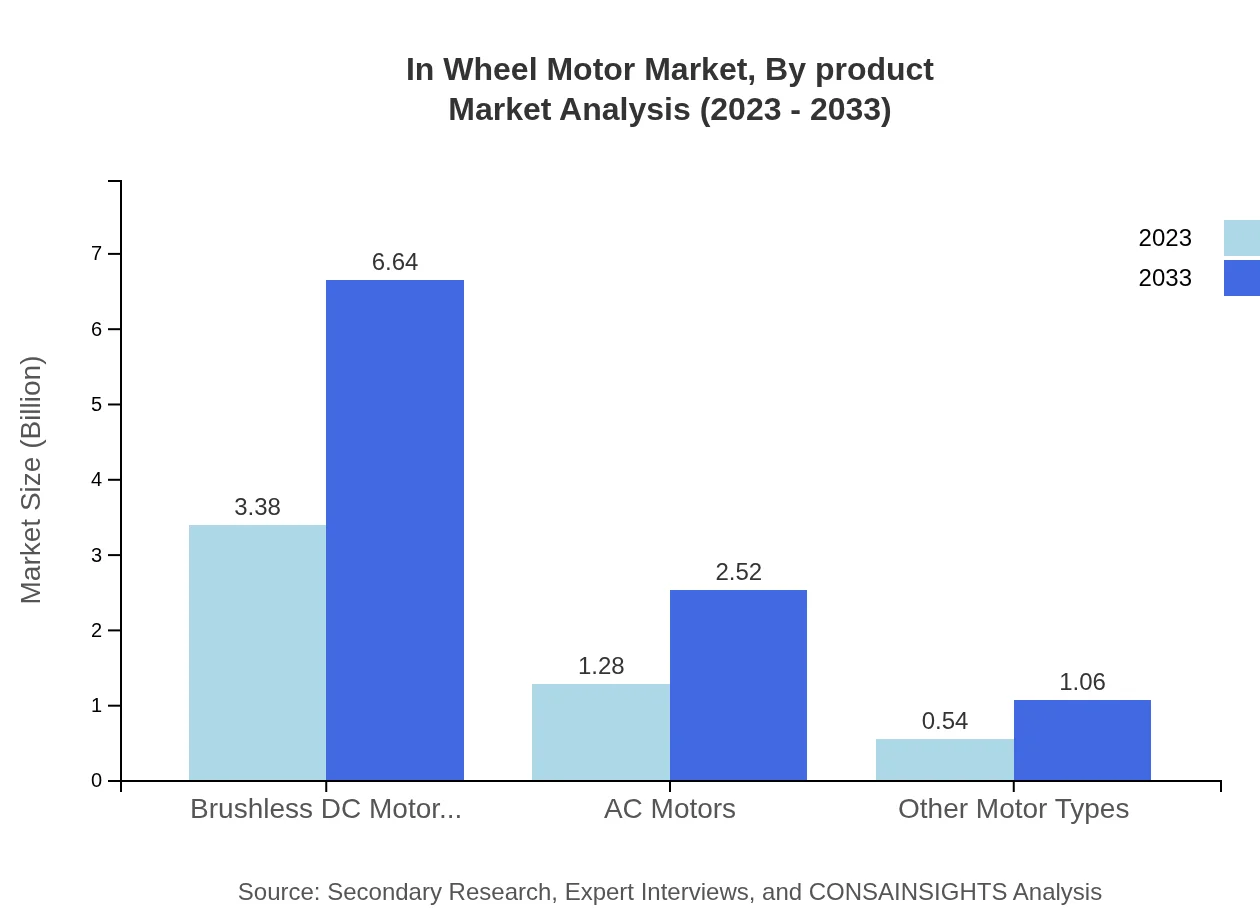

In Wheel Motor Market Analysis By Product

The In-Wheel Motor Market is segmented into Brushless DC Motors (BLDC), AC Motors, and Other Motor Types. BLDC motors dominate the market due to their high efficiency and low maintenance, with a market size of $3.38 billion in 2023 and projected to reach $6.64 billion by 2033. AC Motors also show significant growth potential, rising from $1.28 billion in 2023 to $2.52 billion by 2033.

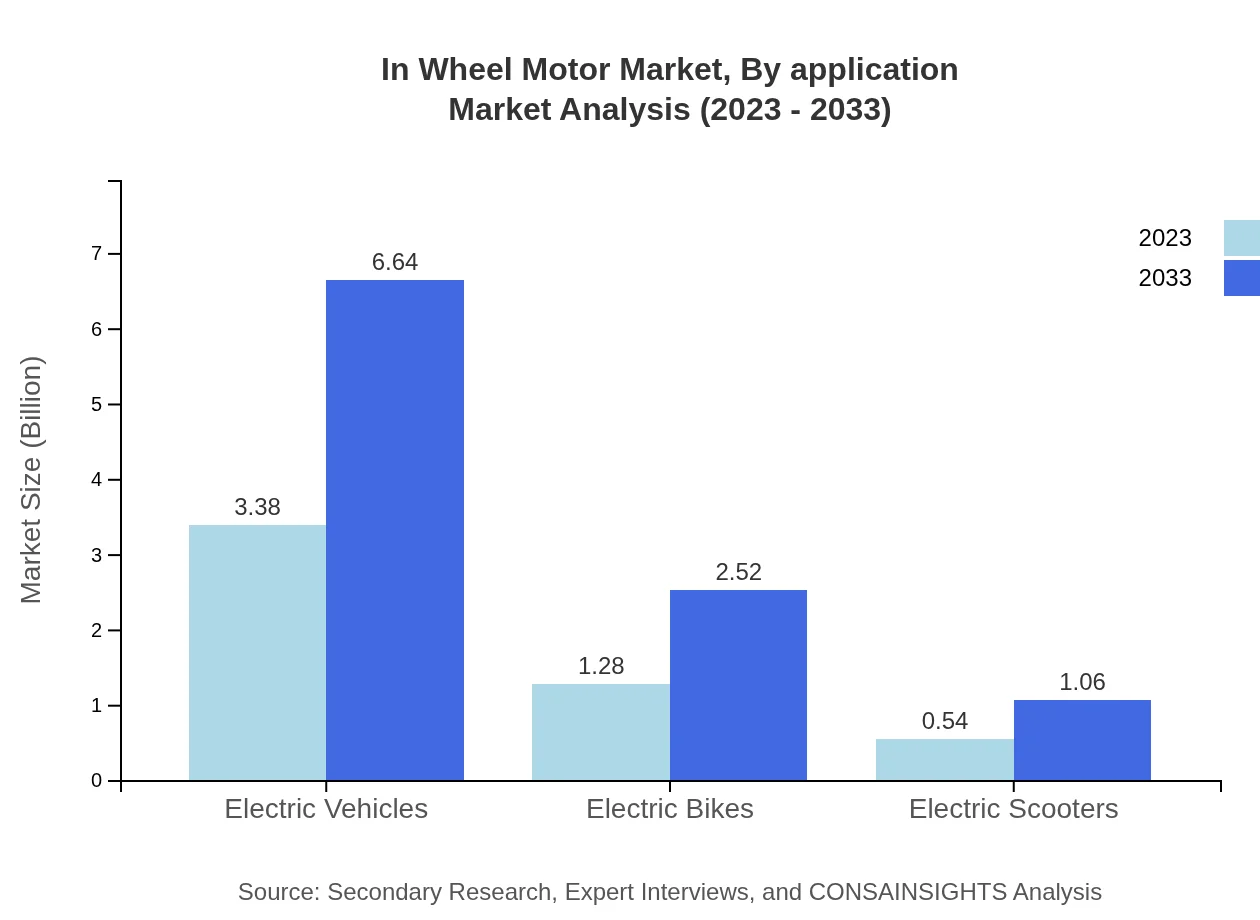

In Wheel Motor Market Analysis By Application

Applications of In-Wheel Motors include Electric Vehicles, Electric Bikes, and Electric Scooters. Electric Vehicles represent the largest segment, valued at $3.38 billion in 2023, projected to grow to $6.64 billion by 2033. Electric Bikes and Scooters are also expanding as urban mobility solutions, enhancing growth in this sector.

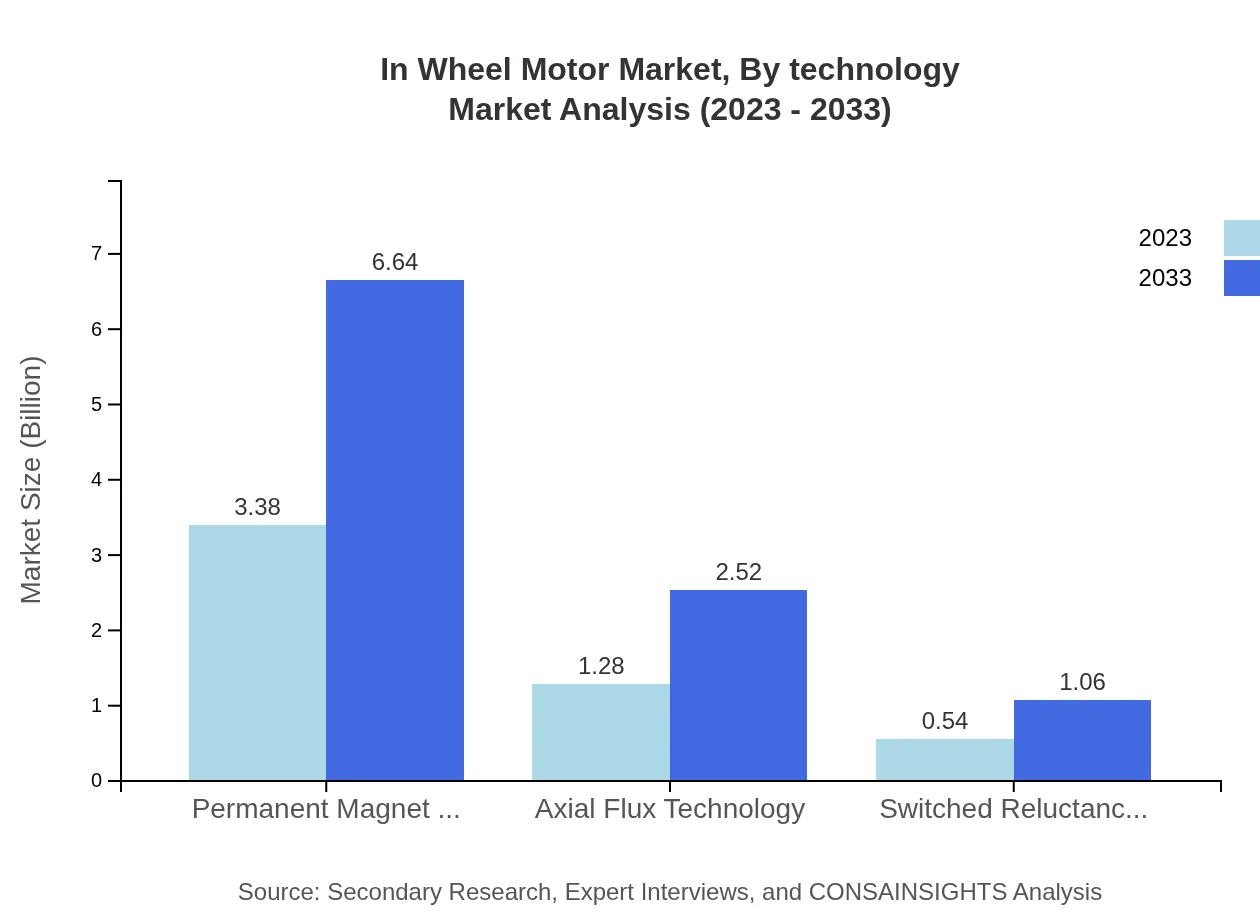

In Wheel Motor Market Analysis By Technology

The technology segment includes Permanent Magnet, Axial Flux, and Switched Reluctance Technologies. Permanent Magnet technology shows a significant market share with $3.38 billion in 2023 and is poised to reach $6.64 billion by 2033. Axial Flux motors gain traction due to their compact size and high efficiency, indicating notable growth.

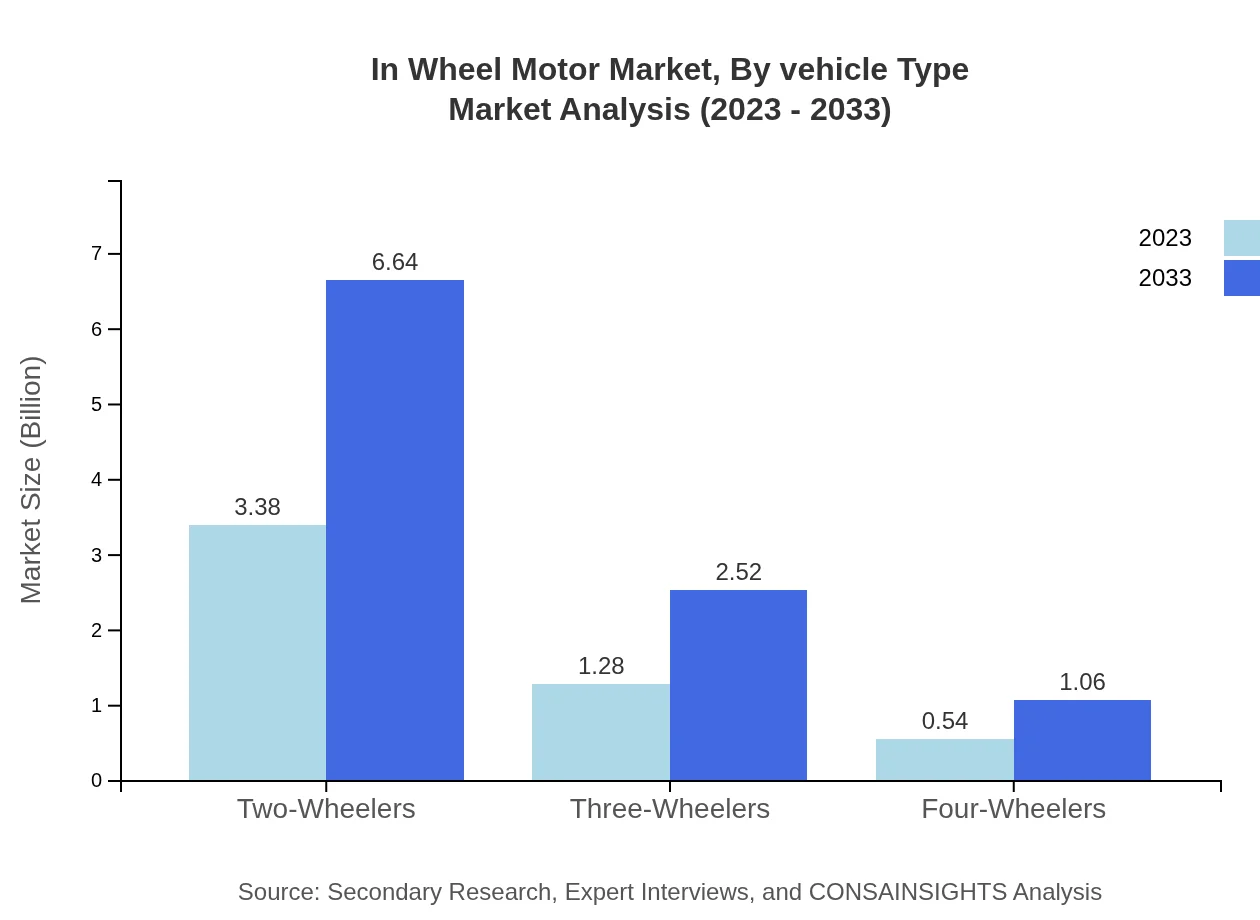

In Wheel Motor Market Analysis By Vehicle Type

Within the vehicle type segment, Two-Wheelers dominate with a market size of $3.38 billion in 2023, expected to reach $6.64 billion by 2033. Three-Wheelers and Four-Wheelers also contribute, particularly in urban and logistics applications. Their respective market sizes grow from $1.28 billion and $0.54 billion, indicating a strong upward trend.

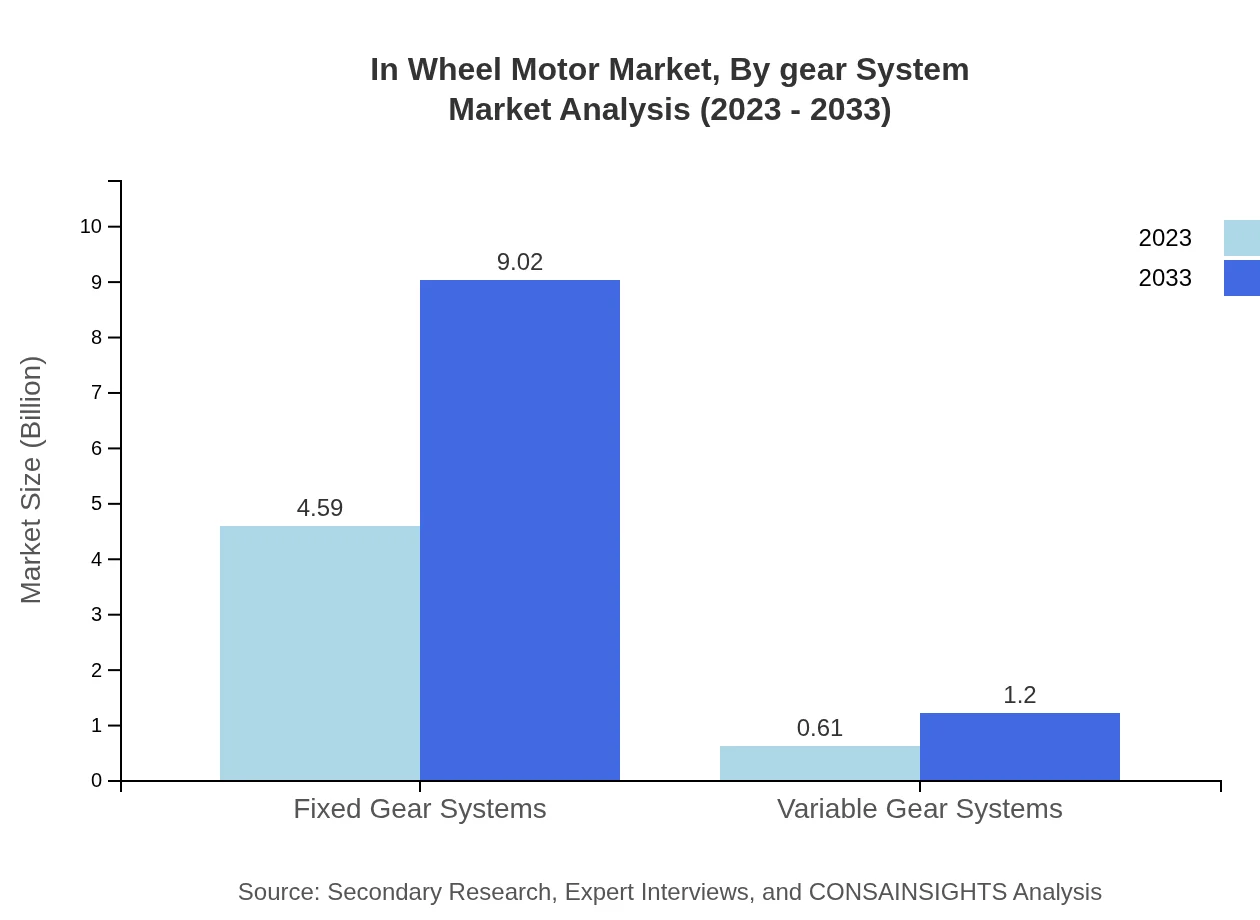

In Wheel Motor Market Analysis By Gear System

The gear system segment includes Fixed Gear Systems and Variable Gear Systems. Fixed Gear Systems hold a substantial market share with $4.59 billion in 2023, expected to reach $9.02 billion by 2033, attributed to their simplicity and reliability in electric vehicle designs. Variable Gear Systems, while smaller, demonstrate gradual growth due to their flexibility in various applications.

In Wheel Motor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in In Wheel Motor Industry

Continental AG:

Continental AG is a leading automotive supplier known for its advanced in-wheel motor technologies that enhance vehicle performance while providing efficiency and sustainability.Mitsubishi Motors Corporation:

Mitsubishi Motors Corporation is a major player in the electric vehicle market, developing innovative in-wheel motors integrated into their next-generation electric models.Denso Corporation:

Denso Corporation focuses on automotive technology and manufacturing, producing cutting-edge in-wheel motors aimed at enhancing the electric and hybrid vehicle experience.Yamaha Motor Co., Ltd.:

Yamaha Motor Company develops high-performance in-wheel motors, especially for two and three-wheel vehicles, contributing significantly to the electric mobility sector.We're grateful to work with incredible clients.

FAQs

What is the market size of in Wheel Motor?

The in-wheel motor market is estimated to reach USD 5.2 billion by 2033, growing at a CAGR of 6.8%. This growth signifies a robust demand for electric mobility solutions, highlighting the industry's potential for innovation and expansion.

What are the key market players or companies in this in Wheel Motor industry?

Key players in the in-wheel motor market include major manufacturers like Siemens, Continental AG, Schaeffler AG, and NSK Ltd. These companies are pivotal in advancing technological capabilities and expanding market reach, contributing to competitive dynamics.

What are the primary factors driving the growth in the in Wheel Motor industry?

The in-wheel motor industry is driven by the increasing demand for electric vehicles, advancements in power electronics, and growing environmental concerns. Additionally, regulatory support for electric mobility enhances adoption rates, propelling market growth.

Which region is the fastest Growing in the in Wheel Motor?

The North American region is the fastest-growing market for in-wheel motors, projected to grow from USD 1.97 billion in 2023 to USD 3.86 billion by 2033. This growth is fueled by rising electric vehicle adoption and technological advancements.

Does Consainsights provide customized market report data for the in Wheel motor industry?

Yes, Consainsights offers customized market report data tailored to the in-wheel motor industry. Clients can gain specific insights to meet their unique needs, aiding strategic decision-making and market entry strategies.

What deliverables can I expect from this in Wheel Motor market research project?

From the in-wheel motor market research project, expect detailed reports including market size, growth forecasts, segmentation analysis, competitive landscape, and insights on emerging trends, all tailored for informed business strategies.

What are the market trends of in Wheel motor?

Current trends in the in-wheel motor market include a shift towards brushless DC motors, increased focus on permanent magnet technology, and rising interest in electric two-wheelers and scooters, indicating a dynamic evolution in electric mobility solutions.