Industrial Fabric Market Report

Published Date: 02 February 2026 | Report Code: industrial-fabric

Industrial Fabric Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Industrial Fabric market, exploring trends, regional insights, market dynamics, and future forecasts from 2023 to 2033. It aims to offer valuable insights for stakeholders seeking to navigate this growing industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

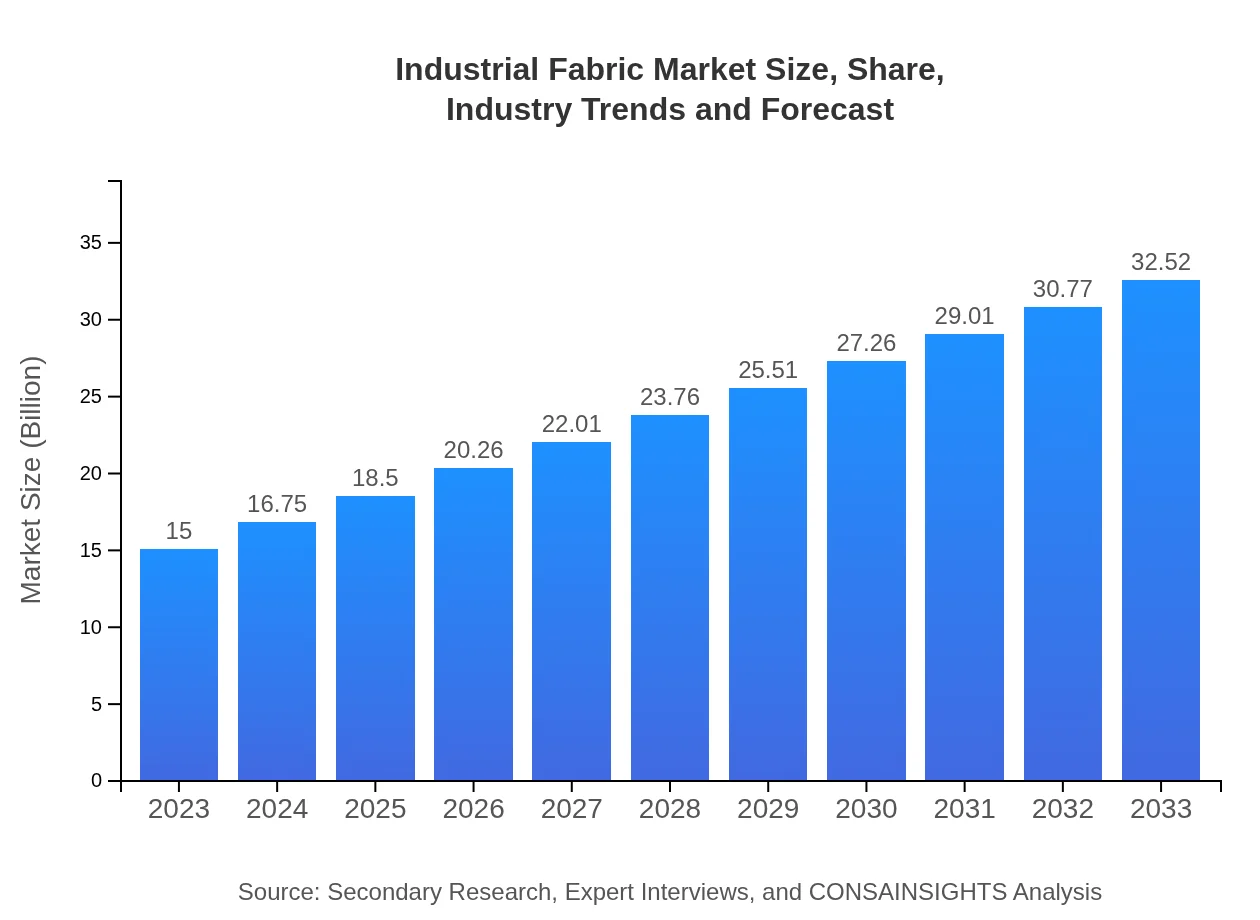

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $32.52 Billion |

| Top Companies | DuPont, TenCate, Berry Global |

| Last Modified Date | 02 February 2026 |

Industrial Fabric Market Overview

Customize Industrial Fabric Market Report market research report

- ✔ Get in-depth analysis of Industrial Fabric market size, growth, and forecasts.

- ✔ Understand Industrial Fabric's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Fabric

What is the Market Size & CAGR of Industrial Fabric market in 2033?

Industrial Fabric Industry Analysis

Industrial Fabric Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Fabric Market Analysis Report by Region

Europe Industrial Fabric Market Report:

The European Industrial Fabric market is notably significant, valued at $4.78 billion in 2023 and projected to grow to $10.37 billion by 2033. Greater investment in advanced manufacturing technologies and sustainable practices, alongside stringent safety standards, propels market growth.Asia Pacific Industrial Fabric Market Report:

In 2023, the Asia Pacific Industrial Fabric market is valued at approximately $2.89 billion and is expected to grow to $6.26 billion by 2033, driven by robust industrial growth and urbanization. The region's diverse manufacturing base and increasing infrastructure projects are key drivers of this growth.North America Industrial Fabric Market Report:

In North America, the Industrial Fabric market is valued at $4.84 billion in 2023, with an expected increase to $10.50 billion by 2033. The region is characterized by a strong regulatory environment and high demand from the aerospace and automotive sectors, driving innovation in fabric technology.South America Industrial Fabric Market Report:

The South American market for Industrial Fabric is relatively smaller, valued at around $0.40 billion in 2023. However, it is projected to reach $0.86 billion by 2033 as local manufacturing expands and industries requiring advanced fabrics become more prevalent.Middle East & Africa Industrial Fabric Market Report:

The Middle East and Africa market, valued at $2.09 billion in 2023, is expected to grow to $4.52 billion by 2033. The region is seeing increased infrastructure projects and a focus on industrial development, enhancing demand for durable industrial fabrics.Tell us your focus area and get a customized research report.

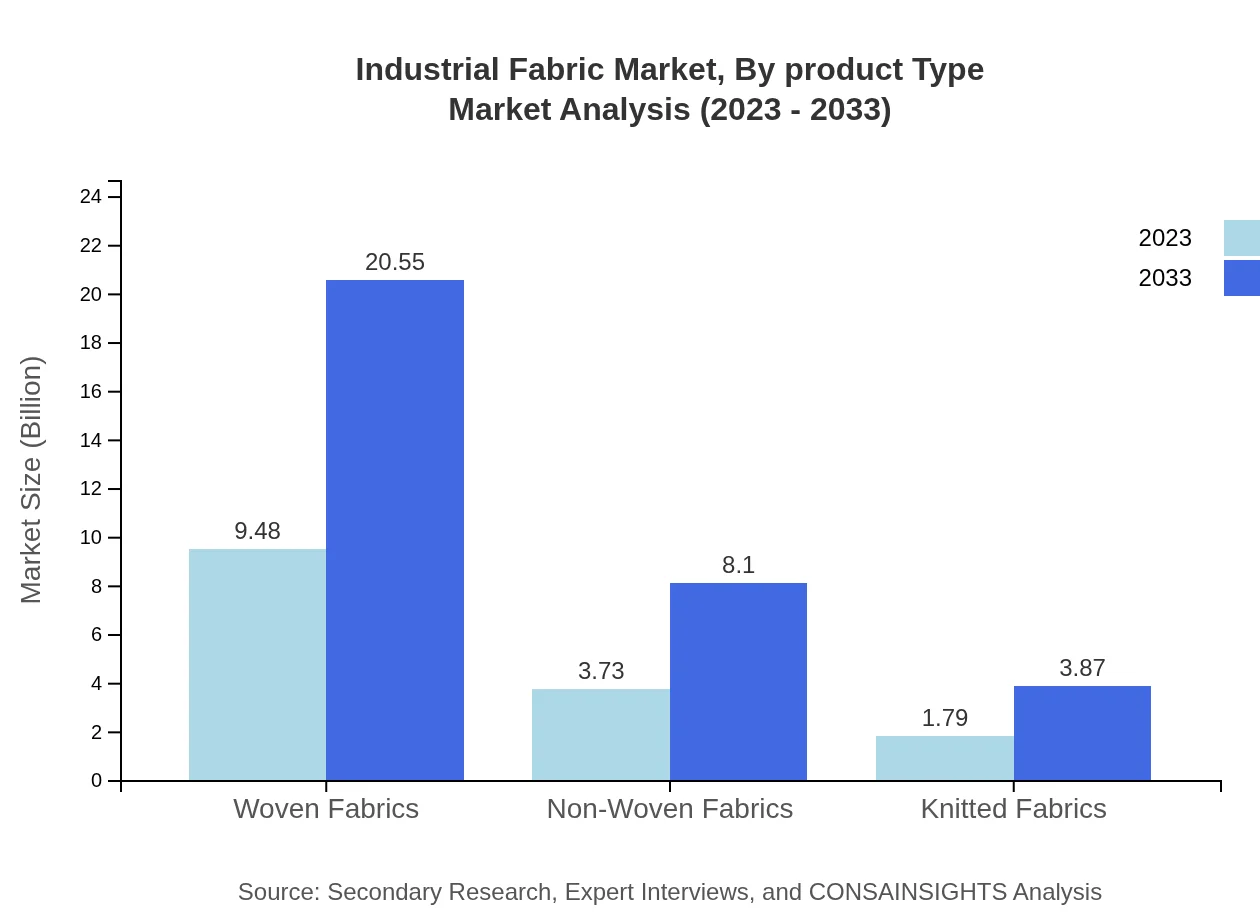

Industrial Fabric Market Analysis By Product Type

The Industrial Fabric market can be divided into various product types including Synthetic Fabrics, Natural Fabrics, Composite Fabrics, Woven Fabrics, Non-Woven Fabrics, and Knitted Fabrics. Synthetic Fabrics dominate the market size in 2023 at $9.48 billion, projected to reach $20.55 billion by 2033. Woven Fabrics also reflect similar growth trends. The combination of versatility and strength across these fabric types is driving their demand in various industries.

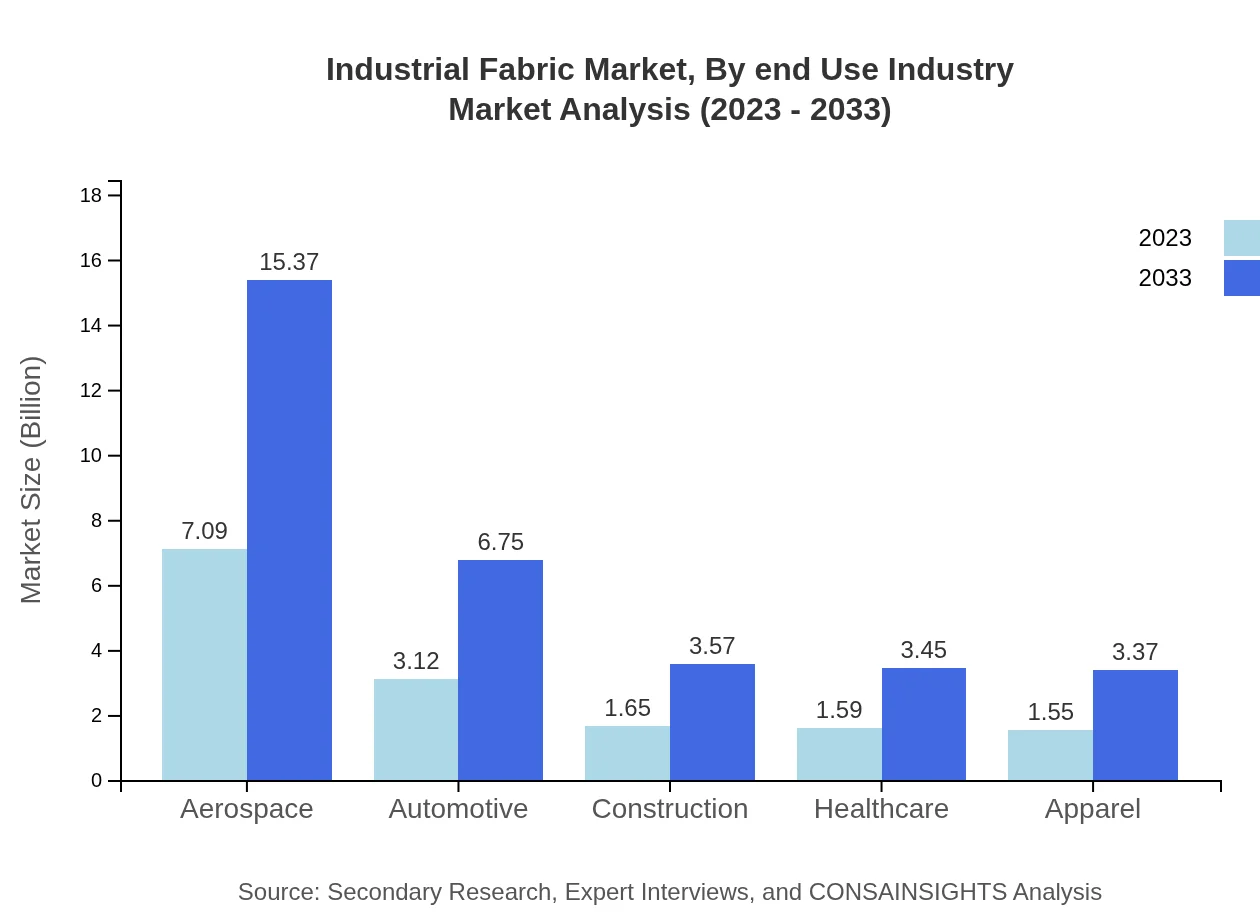

Industrial Fabric Market Analysis By End Use Industry

Major end-use industries for Industrial Fabric include Aerospace, Automotive, Construction, Healthcare, and Apparel. Aerospace leads with a market size of $7.09 billion in 2023, and expected growth to $15.37 billion by 2033. The Automotive sector also shows promising growth, from $3.12 billion to $6.75 billion in the same period, owing to rising vehicle production and the introduction of composite materials.

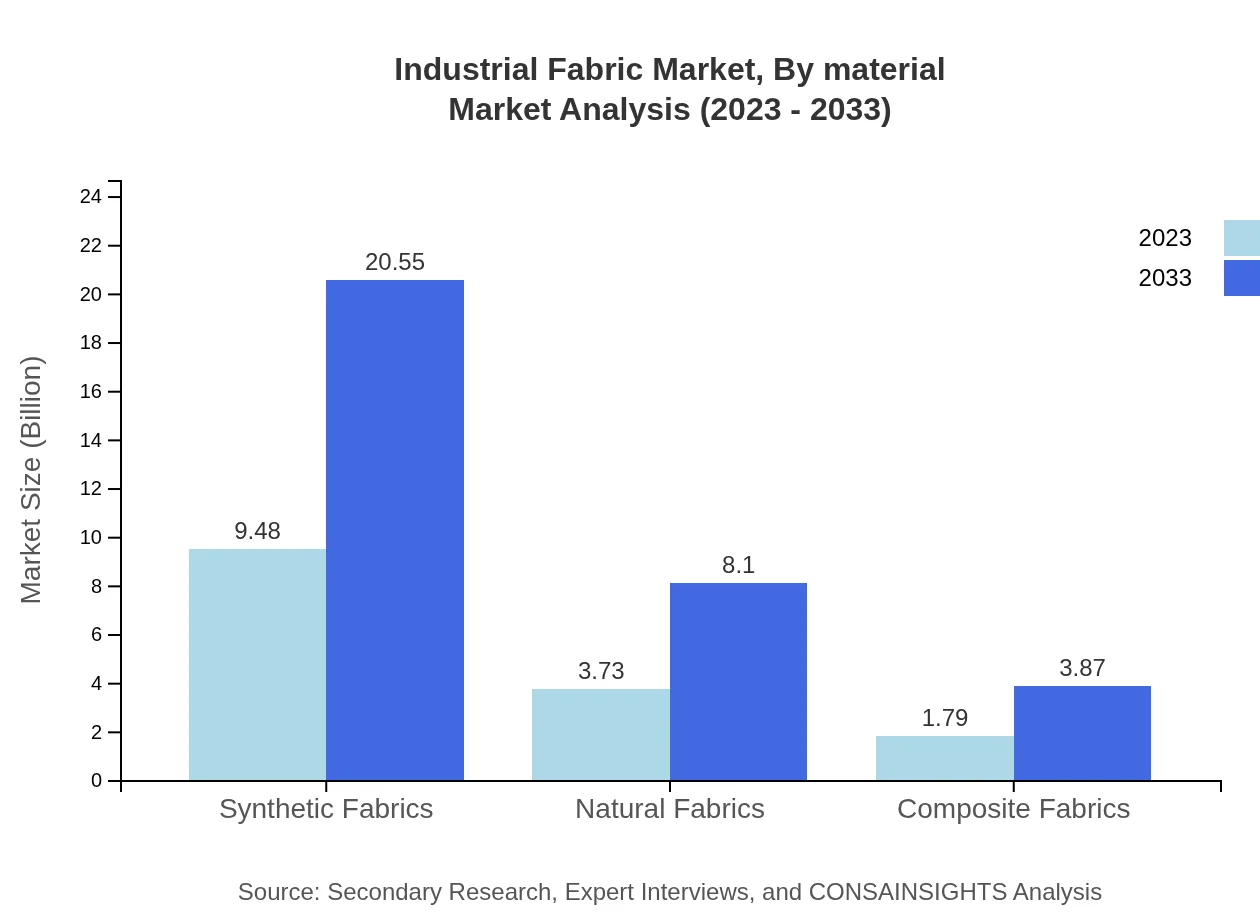

Industrial Fabric Market Analysis By Material

The market is segmented based on material types including Synthetic, Natural, and Composite materials. In 2023, synthetic materials account for approximately $15.65 billion, reflecting their growing preference due to durability and lower production costs. Natural Fabrics are valued at $3.73 billion and expected to grow to $8.10 billion by 2033, highlighting a trend towards eco-friendly materials.

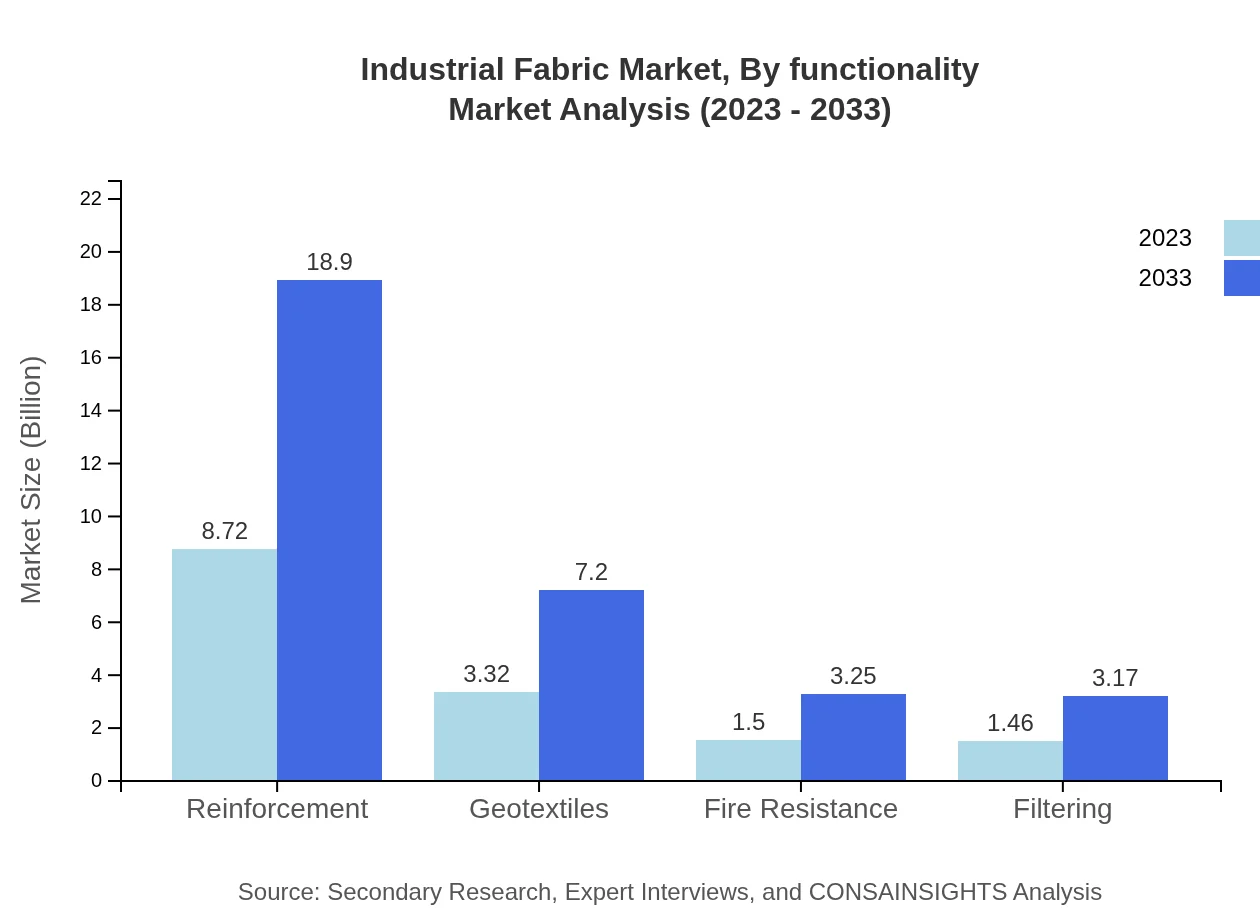

Industrial Fabric Market Analysis By Functionality

Functionality types include Reinforcement, Geotextiles, Fire Resistance, and Filtering applications. Reinforcement fabrics hold the largest market size at $8.72 billion in 2023, escalating to $18.90 billion by 2033 due to their demand in construction and manufacturing. Geotextiles are also crucial, growing alongside global infrastructure initiatives, indicating a robust future market.

Industrial Fabric Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Fabric Industry

DuPont:

DuPont is a leading player in the Industrial Fabric industry, known for its innovation in high-performance fabrics and commitment to sustainability.TenCate:

TenCate specializes in advanced textiles for industrial applications, offering reliable and durable fabric solutions across various sectors.Berry Global:

Berry Global manufactures engineered materials and innovative products, providing a broad array of industrial fabrics to meet diverse industrial needs.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Fabric?

The industrial fabric market is valued at approximately $15 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.8% over the next decade, indicating significant growth potential.

What are the key market players or companies in this industrial Fabric industry?

Key players in the industrial fabric market include large manufacturers and innovators that provide advanced fabric solutions across various sectors, such as aerospace, automotive, and construction, which are crucial for market growth.

What are the primary factors driving the growth in the industrial Fabric industry?

The growth in the industrial fabric industry is driven by increasing demand from various sectors such as automotive, healthcare, and construction, as well as advancements in fabric technology enhancing performance and application capabilities.

Which region is the fastest Growing in the industrial Fabric?

Among the regions, Europe shows the highest growth potential, increasing from $4.78 billion in 2023 to $10.37 billion by 2033, followed closely by Asia Pacific, indicating a shifting landscape in industrial fabric demand.

Does ConsaInsights provide customized market report data for the industrial Fabric industry?

Yes, ConsaInsights offers customized market report data for the industrial-fabric industry, ensuring that specific client needs and market dynamics are accurately addressed for strategic decision-making.

What deliverables can I expect from this industrial Fabric market research project?

From the industrial fabric market research project, you can expect detailed reports including market size analysis, regional insights, segment performance data, and trends to support informed strategic planning.

What are the market trends of industrial Fabric?

Current trends in the industrial fabric market include a shift towards sustainable materials, innovations in synthetic fabrics, and increased integration of smart technologies, aiming to fulfill growing consumer and industrial demands.