Polyethylene Terephthalate Pet Compounding Market Report

Published Date: 02 February 2026 | Report Code: polyethylene-terephthalate-pet-compounding

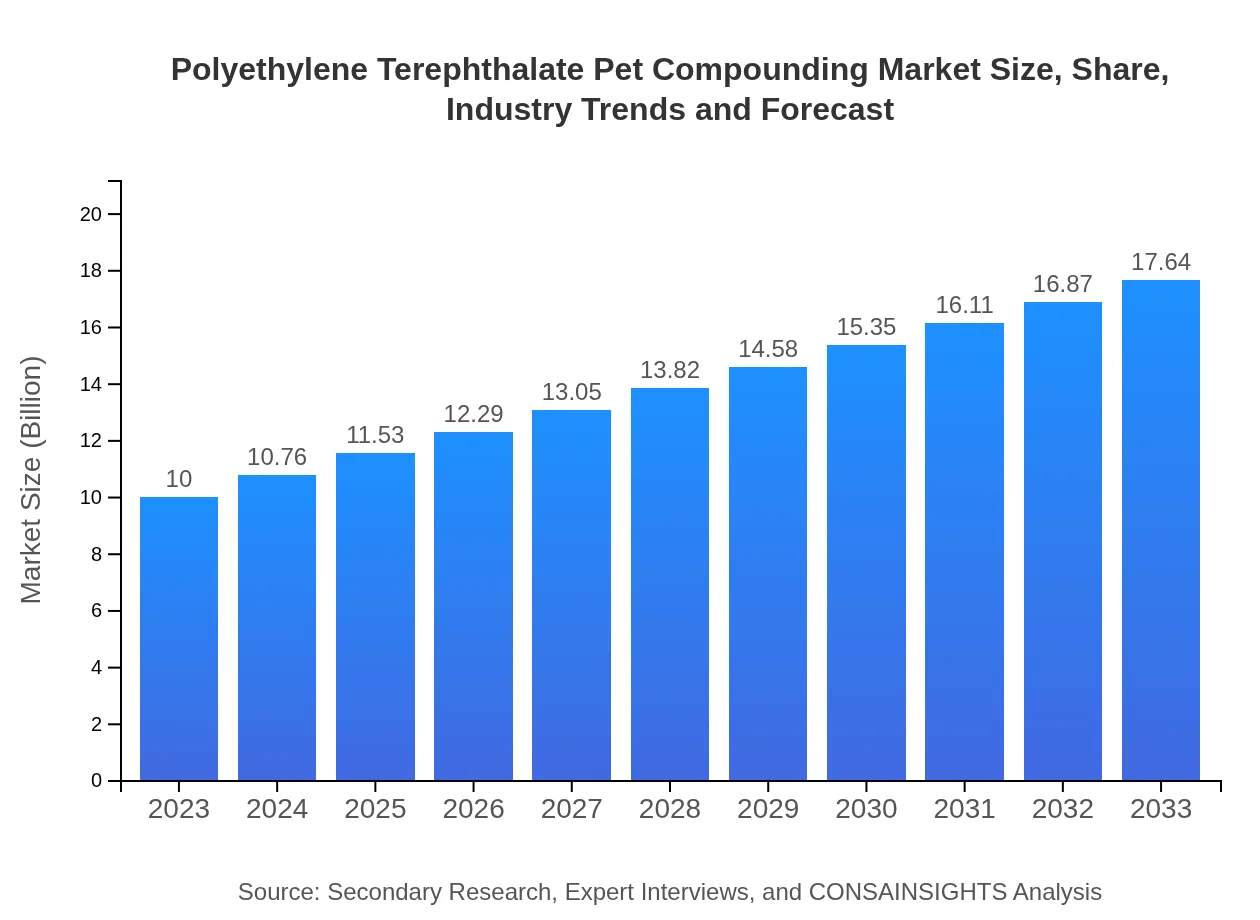

Polyethylene Terephthalate Pet Compounding Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Polyethylene Terephthalate (PET) compounding market, offering in-depth analysis and insights from 2023 to 2033, including trends, regional performance, and market forecasts.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $17.64 Billion |

| Top Companies | Indorama Ventures, M&G Group, SABIC, Alpek Polyester, TerraCycle |

| Last Modified Date | 02 February 2026 |

Polyethylene Terephthalate Pet Compounding Market Overview

Customize Polyethylene Terephthalate Pet Compounding Market Report market research report

- ✔ Get in-depth analysis of Polyethylene Terephthalate Pet Compounding market size, growth, and forecasts.

- ✔ Understand Polyethylene Terephthalate Pet Compounding's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Polyethylene Terephthalate Pet Compounding

What is the Market Size & CAGR of Polyethylene Terephthalate Pet Compounding market in 2023?

Polyethylene Terephthalate Pet Compounding Industry Analysis

Polyethylene Terephthalate Pet Compounding Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Polyethylene Terephthalate Pet Compounding Market Analysis Report by Region

Europe Polyethylene Terephthalate Pet Compounding Market Report:

In Europe, the PET compounding market is forecasted to increase from $2.86 billion in 2023 to $5.04 billion by 2033. The region's strong regulatory framework promoting recyclability and sustainability drives innovation in PET compounding, especially in Germany and France.Asia Pacific Polyethylene Terephthalate Pet Compounding Market Report:

In the Asia Pacific region, the PET compounding market size is projected to grow from $2.02 billion in 2023 to $3.56 billion in 2033. The growth is driven by an expanding manufacturing base and increased demand from packaging and textile industries. Countries like China and India are at the forefront, supported by rising consumerism and urbanization.North America Polyethylene Terephthalate Pet Compounding Market Report:

The North American market for PET compounding is anticipated to grow from $3.32 billion in 2023 to $5.85 billion in 2033. The surge is attributed to the rising demand for eco-friendly packaging solutions and advancements in recycling technologies. The U.S. is the primary market, with heightened consumer awareness regarding sustainability.South America Polyethylene Terephthalate Pet Compounding Market Report:

South America's PET compounding market is expected to expand from $0.95 billion in 2023 to $1.67 billion by 2033. The growth is bolstered by increasing investments in the packaging sector and a shift towards sustainable practices among local manufacturers, particularly in Brazil and Argentina.Middle East & Africa Polyethylene Terephthalate Pet Compounding Market Report:

The Middle East and Africa region is projected to see market growth from $0.86 billion in 2023 to $1.52 billion in 2033. This growth is fueled by an increase in the manufacturing and consumption of PET products, particularly in the UAE and South Africa, driven by urbanization and infrastructure development.Tell us your focus area and get a customized research report.

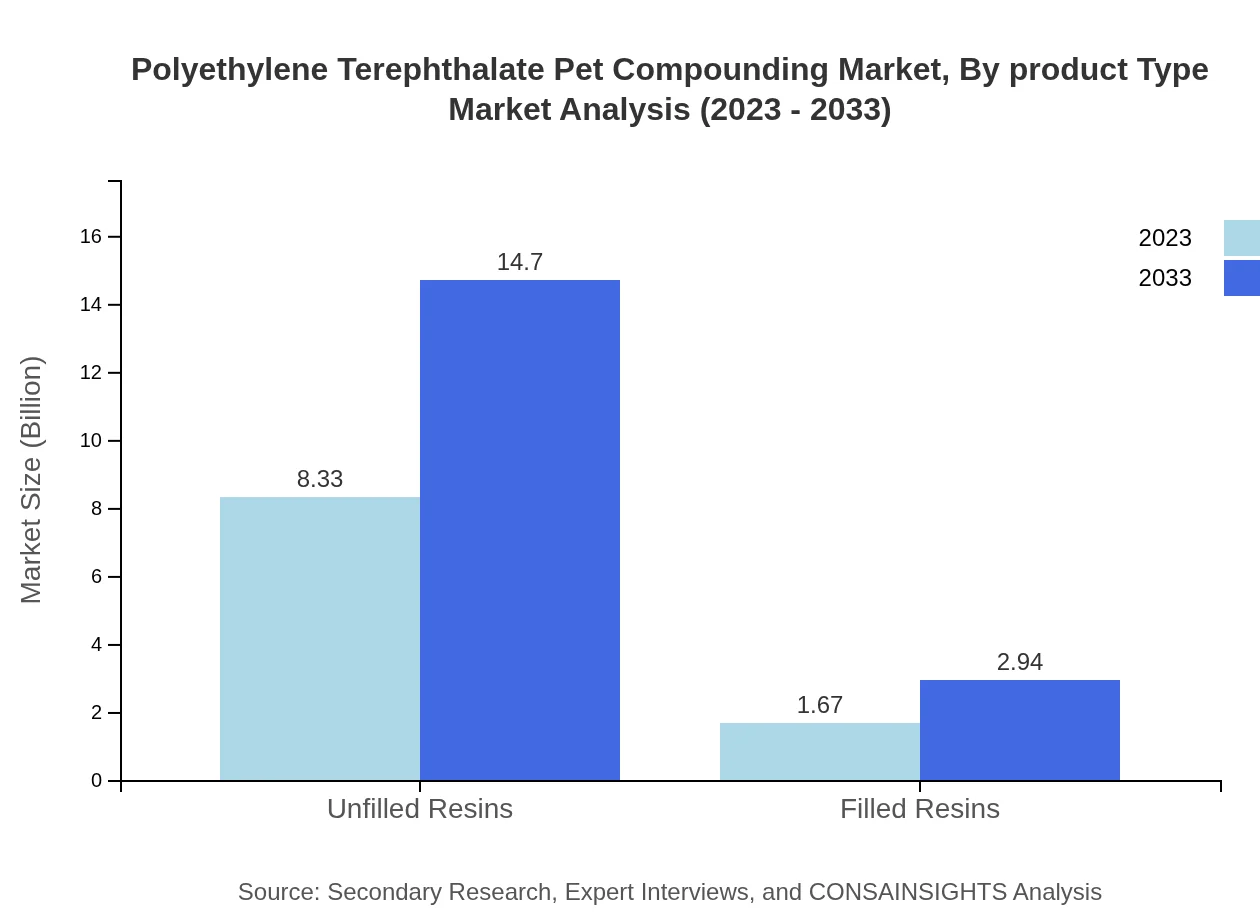

Polyethylene Terephthalate Pet Compounding Market Analysis By Product Type

The PET compounding market is dominated by unfilled resins, which accounted for approximately 83.33% of the market share in 2023. This segment is expected to grow from $8.33 billion in 2023 to $14.70 billion by 2033. Filled resins follow, constituting 16.67% of the market, projected to reach $2.94 billion by 2033.

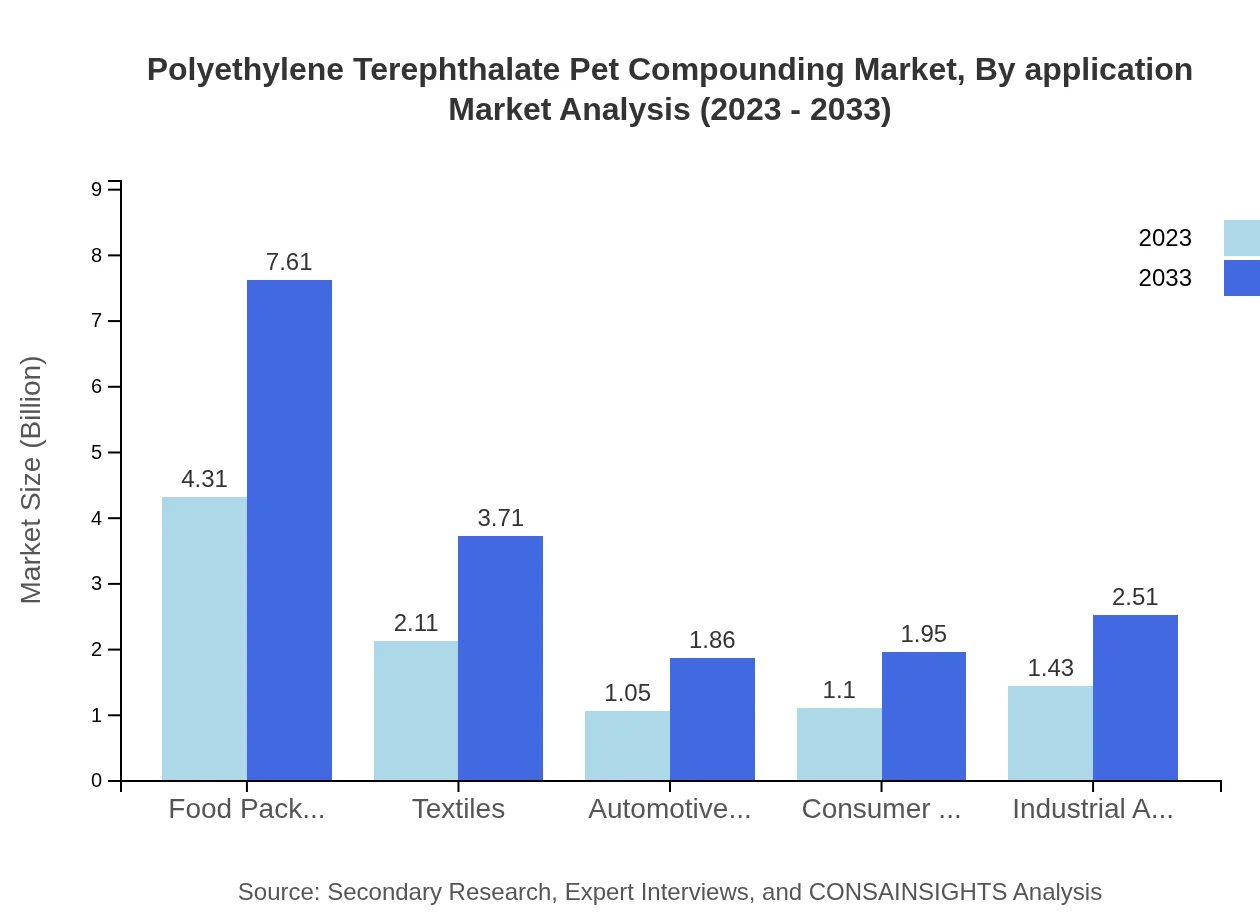

Polyethylene Terephthalate Pet Compounding Market Analysis By Application

The application segment highlights food packaging, textiles, and automotive parts. Food packaging remains the largest segment, projected to grow from $4.31 billion to $7.61 billion by 2033, capturing 43.13% of the overall market. Textiles and automotive parts also show growth potential, expected to reach $3.71 billion and $1.86 billion, respectively, by 2033.

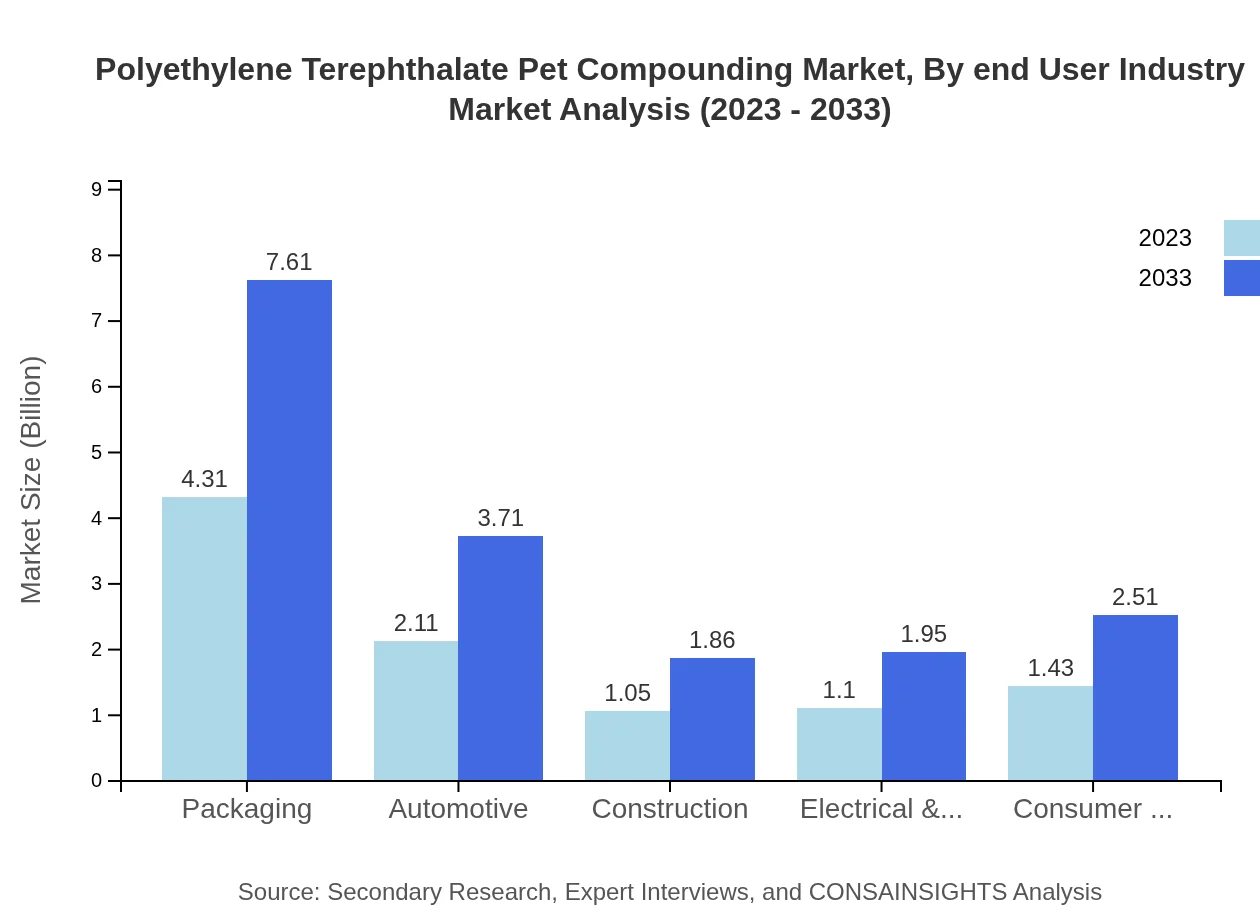

Polyethylene Terephthalate Pet Compounding Market Analysis By End User Industry

Notable end-user industries include packaging, textiles, automotive, and consumer goods. The packaging industry is set to maintain its dominance, while textile applications are emerging as a significant segment, especially with rising sustainability trends. This diversification positions the PET compounding market for sustained growth across various sectors.

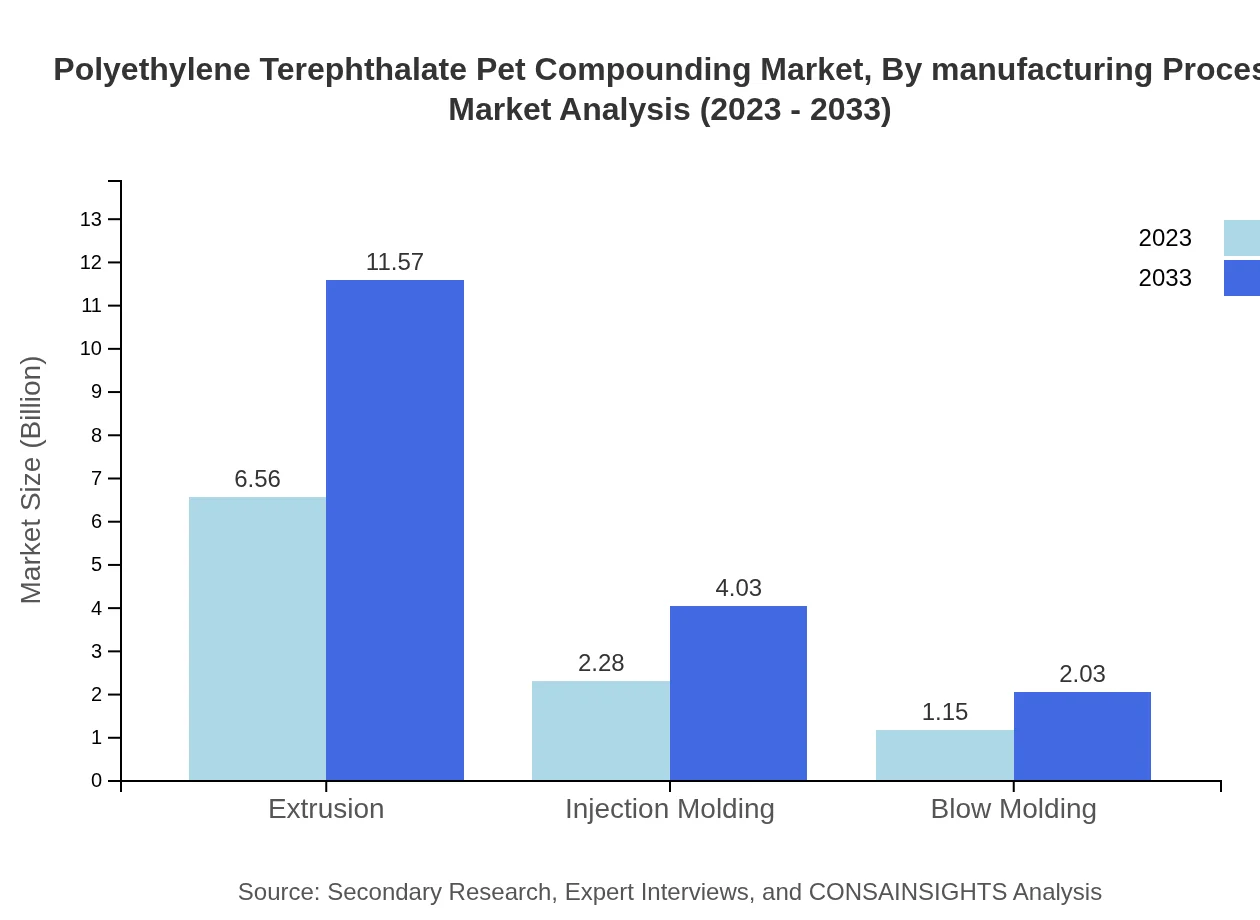

Polyethylene Terephthalate Pet Compounding Market Analysis By Manufacturing Process

The manufacturing process segment is led by extrusion and injection molding, together accounting for over 88% market share. Both processes are favored for their efficiency and versatility, further enhancing their adoption in producing consumer goods and packaging applications.

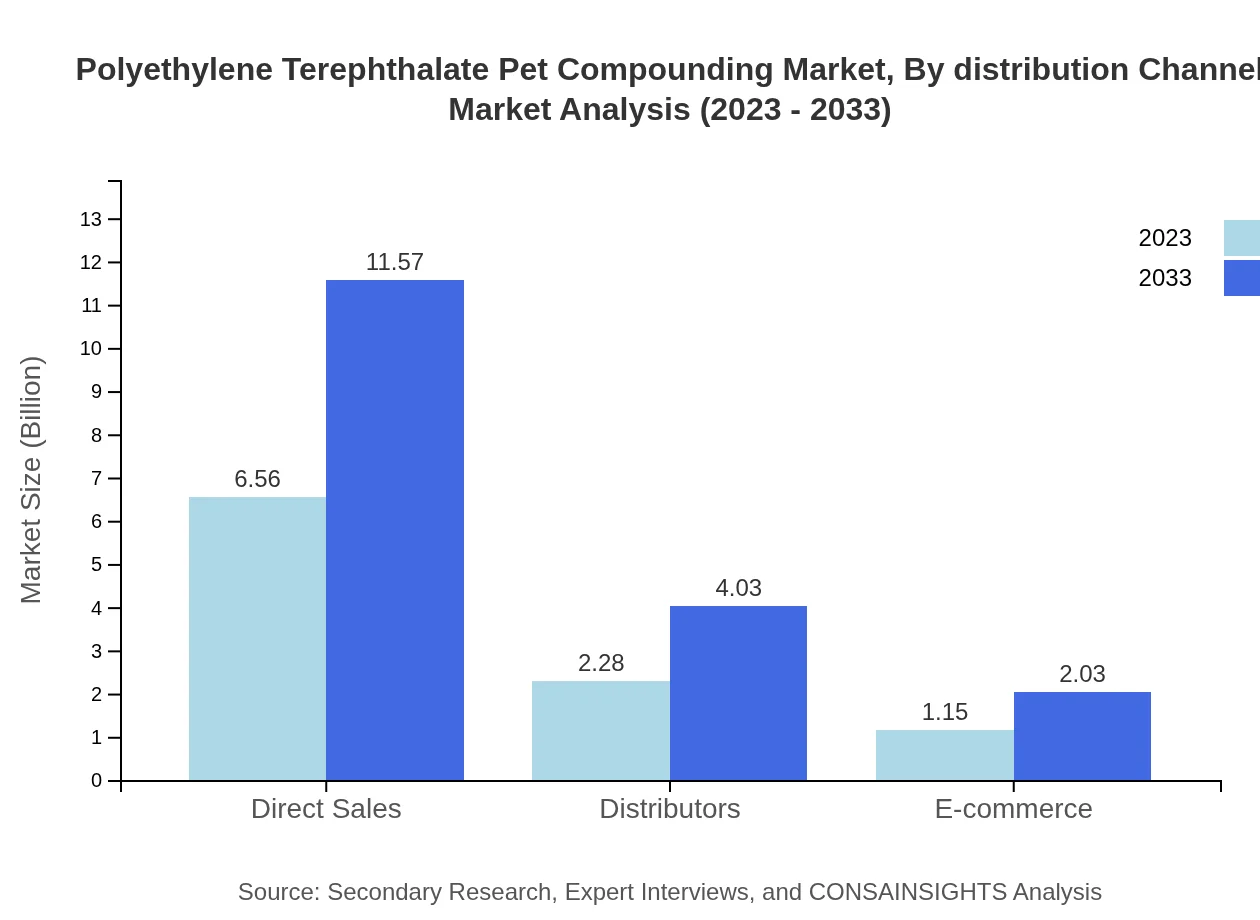

Polyethylene Terephthalate Pet Compounding Market Analysis By Distribution Channel

The distribution channels include direct sales, distributors, and e-commerce. Direct sales dominate with a 65.63% market share, valued at $6.56 billion in 2023. This is followed by distributors, which represent 22.84% of market share, gradually increasing due to e-commerce growth in the region.

Polyethylene Terephthalate Pet Compounding Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Polyethylene Terephthalate Pet Compounding Industry

Indorama Ventures:

Indorama Ventures is one of the largest global manufacturers of PET, committed to sustainability and innovation in the PET compounding industry.M&G Group:

M&G Group is a key player in the PET market, focused on producing high-quality PET products and advancing recycling technologies.SABIC:

SABIC has a robust portfolio in PET compounding, emphasizing sustainable solutions and innovative compounding technologies.Alpek Polyester:

Alpek is a leading supplier in the PET market, recognized for its significant contributions to high-performance PET formulations.TerraCycle:

TerraCycle is known for its innovative waste management solutions, enhancing the recycling and sustainability of PET products.We're grateful to work with incredible clients.

FAQs

What is the market size of polyethylene Terephthalate Pet Compounding?

The global market size for polyethylene-terephthalate (PET) compounding is projected to reach approximately $10 billion by 2033, growing at a CAGR of 5.7%. This growth reflects expanding applications across various industries and rising demand for sustainable materials.

What are the key market players or companies in the polyethylene Terephthalate Pet Compounding industry?

Key players in the polyethylene-terephthalate PET compounding market include prominent manufacturers and suppliers that specialize in thermoplastics, polymer formulations, and composite materials, contributing significantly to overall market dynamics and innovation.

What are the primary factors driving the growth in the polyethylene Terephthalate Pet Compounding industry?

Primary growth drivers for PET compounding include increased demand for lightweight and durable materials in automotive and packaging sectors, alongside stringent regulations promoting environmentally-friendly packaging solutions, thus bolstering market expansion.

Which region is the fastest Growing in the polyethylene Terephthalate Pet Compounding?

The fastest-growing region in the polyethylene-terephthalate PET compounding market is Europe, projected to grow from $2.86 billion in 2023 to $5.04 billion by 2033. This growth is driven by strong demand in packaging and automotive applications.

Does ConsaInsights provide customized market report data for the polyethylene Terephthalate Pet Compounding industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the polyethylene-terephthalate PET compounding industry, allowing clients to obtain detailed insights and forecasts relevant to their strategic planning.

What deliverables can I expect from this polyethylene Terephthalate Pet Compounding market research project?

From the polyethylene-terephthalate PET compounding market research project, you can expect comprehensive reports including market size analysis, forecasts, competitive landscape assessments, and detailed segmentation across regions and application areas.

What are the market trends of polyethylene Terephthalate Pet Compounding?

Market trends for polyethylene-terephthalate PET compounding include increasing adoption of recycled materials, enhanced technological developments in compounding processes, and a shift towards sustainable packaging solutions catering to consumer demand.