Paper Coating Material Market Report

Published Date: 02 February 2026 | Report Code: paper-coating-material

Paper Coating Material Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the global Paper Coating Material market, including insights on market size, forecast data from 2023 to 2033, segmentation, technology advancements, and regional dynamics.

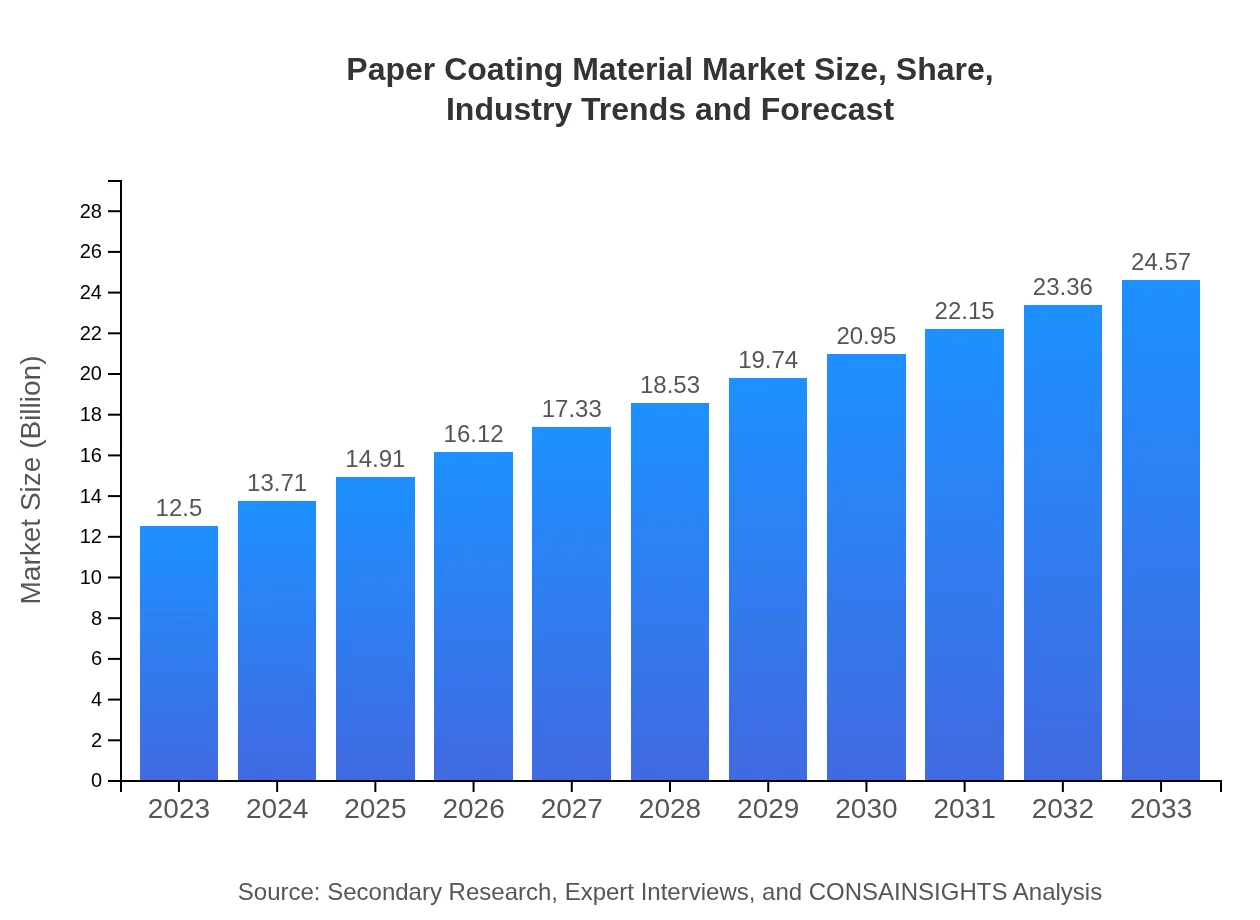

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.57 Billion |

| Top Companies | BASF SE, AkzoNobel N.V., Omya AG, Minerals Technologies Inc. |

| Last Modified Date | 02 February 2026 |

Paper Coating Material Market Overview

Customize Paper Coating Material Market Report market research report

- ✔ Get in-depth analysis of Paper Coating Material market size, growth, and forecasts.

- ✔ Understand Paper Coating Material's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Paper Coating Material

What is the Market Size & CAGR of Paper Coating Material market in 2023?

Paper Coating Material Industry Analysis

Paper Coating Material Market Segmentation and Scope

Tell us your focus area and get a customized research report.

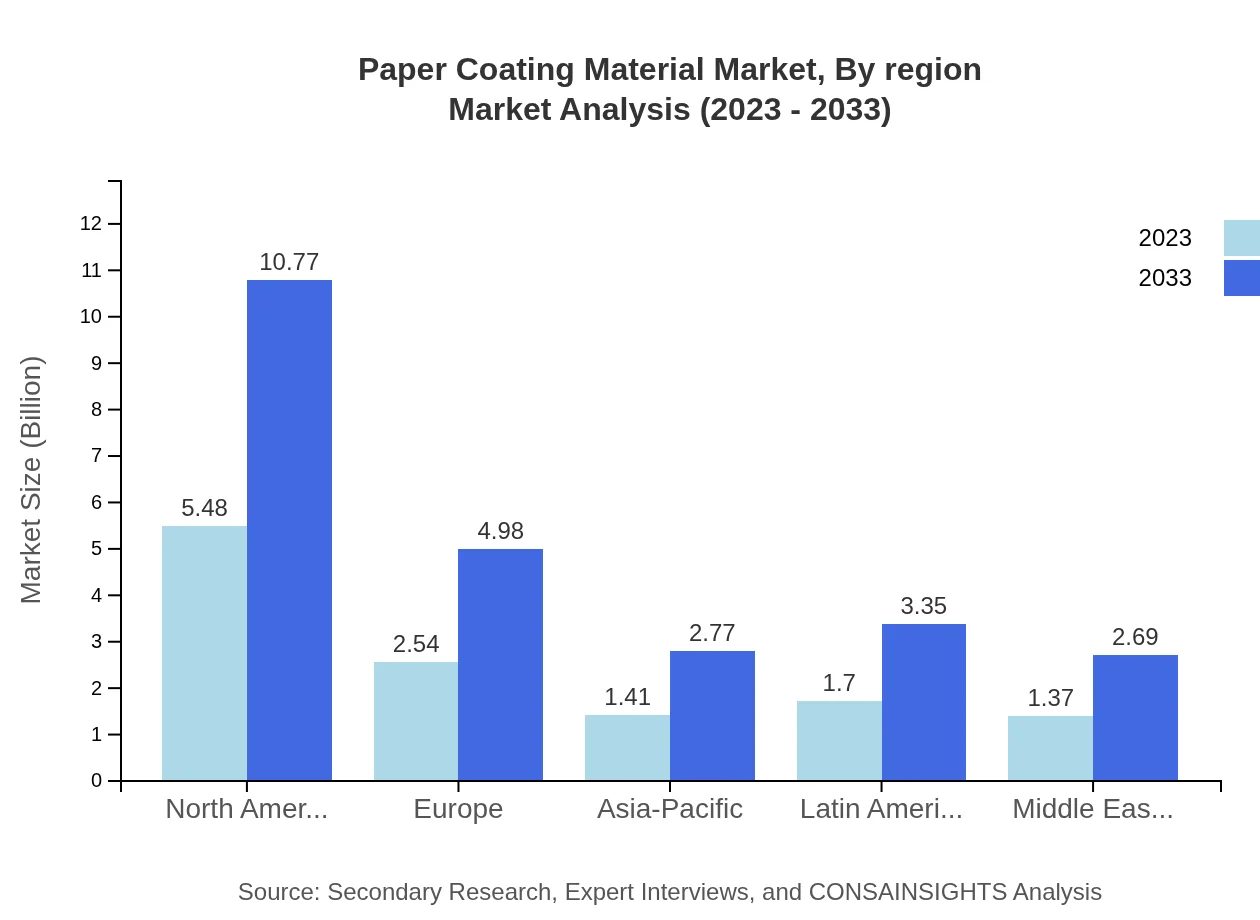

Paper Coating Material Market Analysis Report by Region

Europe Paper Coating Material Market Report:

In Europe, the market size was $3.12 billion in 2023, anticipated to grow to $6.13 billion by 2033. The demand for eco-friendly products and stringent environmental regulations influence the adoption of sustainable coating materials.Asia Pacific Paper Coating Material Market Report:

In 2023, the Paper Coating Material market in Asia-Pacific was valued at $2.63 billion with expectations to reach $5.17 billion by 2033. The region's rapid industrialization and increasing demand for packaging materials significantly contribute to this growth, along with heightened consumer demand for quality print materials.North America Paper Coating Material Market Report:

North America held a market size of $4.66 billion in 2023, with forecasts estimating growth to $9.16 billion by 2033. Driving factors include robust e-commerce growth and demand for sustainable packaging solutions that reinforce strong industry performance.South America Paper Coating Material Market Report:

The South American market for Paper Coating Material was valued at $0.34 billion in 2023 and is projected to reach $0.68 billion by 2033. Economic growth in countries like Brazil and Argentina, combined with a rising middle class, is boosting the consumption of coated paper products.Middle East & Africa Paper Coating Material Market Report:

The Middle East and Africa market for Paper Coating Material is emerging, with a valuation of $1.74 billion in 2023, expected to expand to $3.42 billion by 2033. Increased infrastructural developments and the rise in retail markets are key drivers of this growth.Tell us your focus area and get a customized research report.

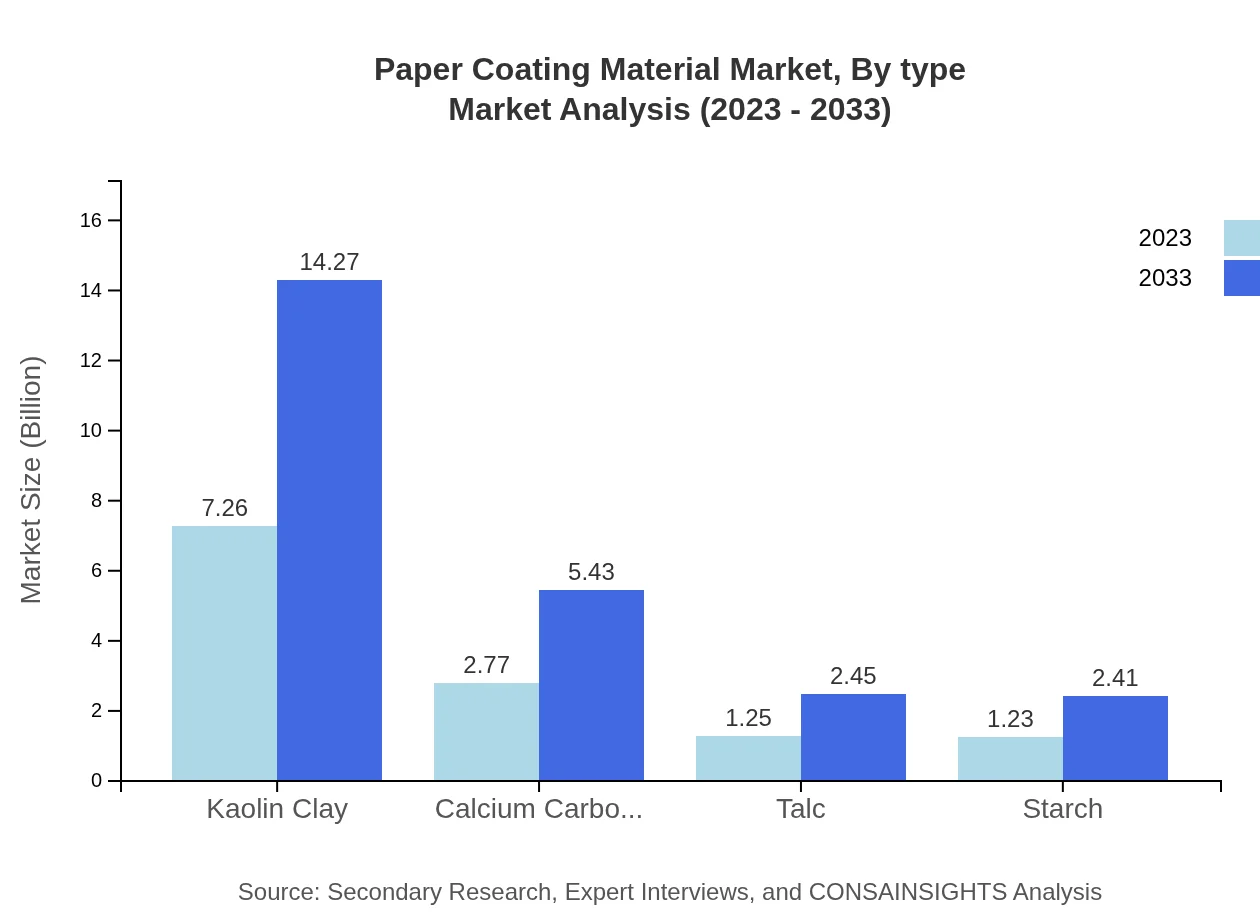

Paper Coating Material Market Analysis By Type

In terms of types, kaolin clay remains the dominant material, with a market size of $7.26 billion in 2023, projected to grow to $14.27 billion by 2033, retaining a market share of 58.08%. Calcium carbonate and talc are also significant, with respective sizes of $2.77 billion and $1.25 billion in 2023, growing to $5.43 billion and $2.45 billion by 2033.

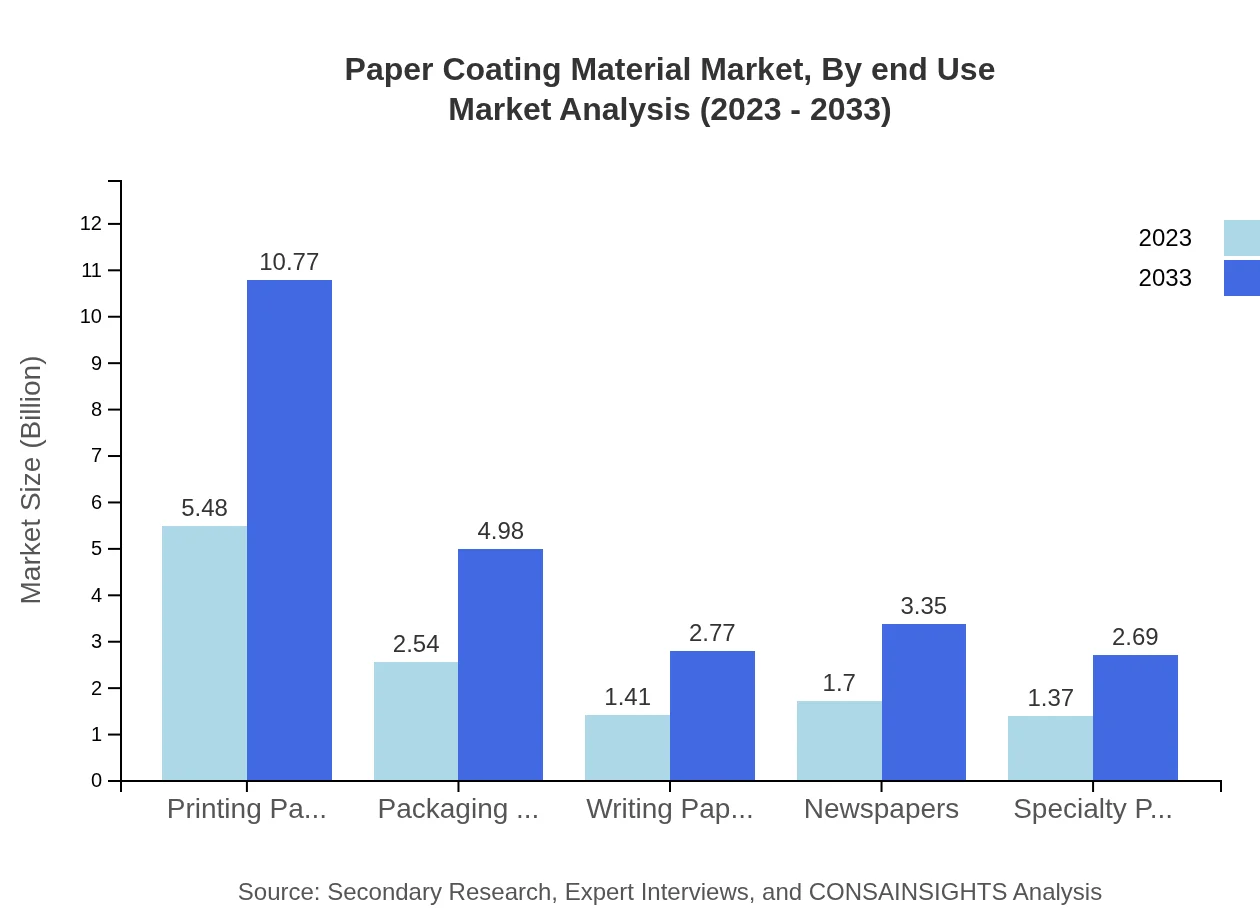

Paper Coating Material Market Analysis By End Use

The primary end-use categories include printing paper, with a market value of $5.48 billion in 2023 (43.85% market share), growing to $10.77 billion by 2033. Packaging paper is also noteworthy, with growth from $2.54 billion to $4.98 billion during the same period.

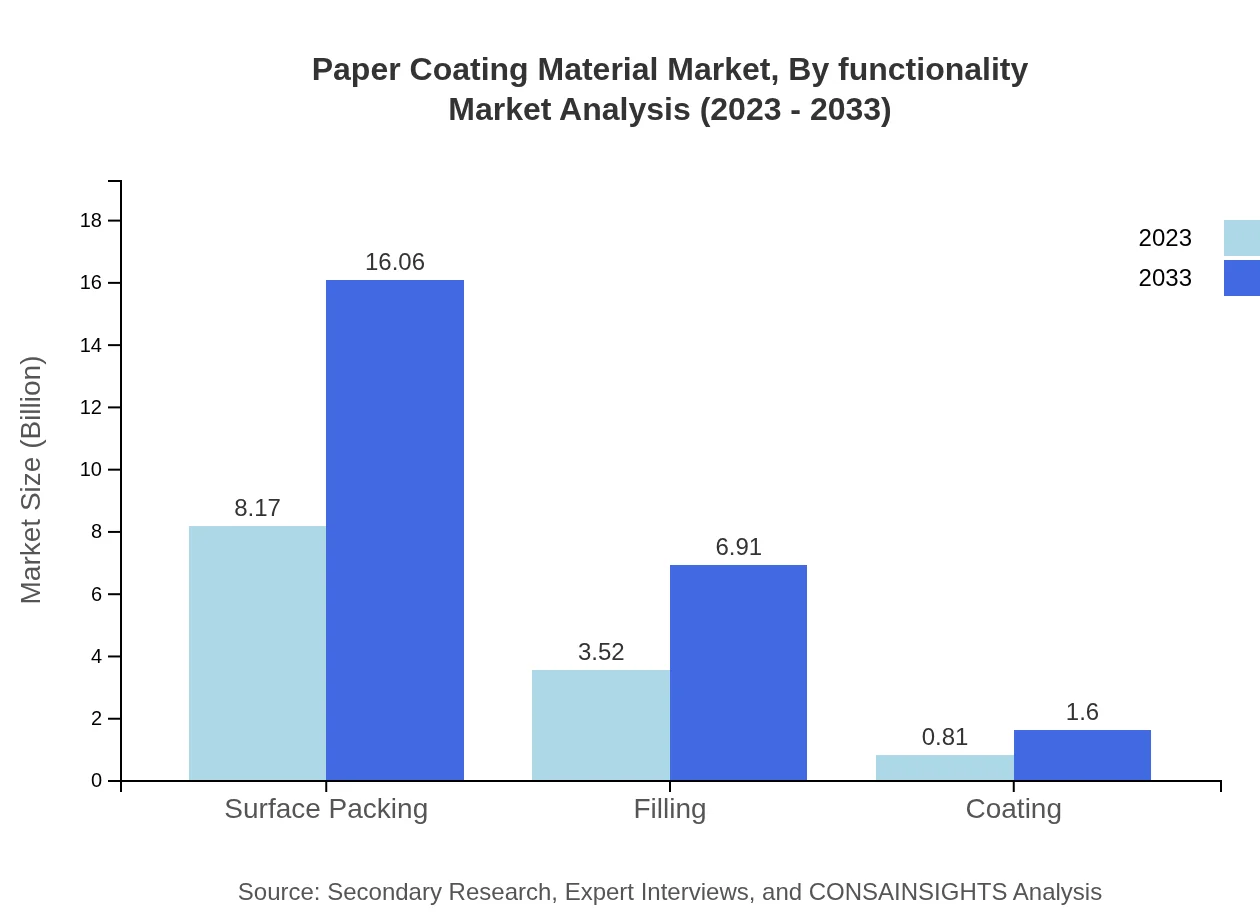

Paper Coating Material Market Analysis By Functionality

Functional categories cover surface packing, filling, and coating, where surface packing dominates with a market size of $8.17 billion in 2023, expected to grow to $16.06 billion by 2033, comprising 65.36% of the market share.

Paper Coating Material Market Analysis By Region

Regional analysis of the Paper Coating Material market highlights North America as the leading region, with significant market contributions, followed by Europe and Asia-Pacific, which are rapidly increasing their market shares due to rising demand.

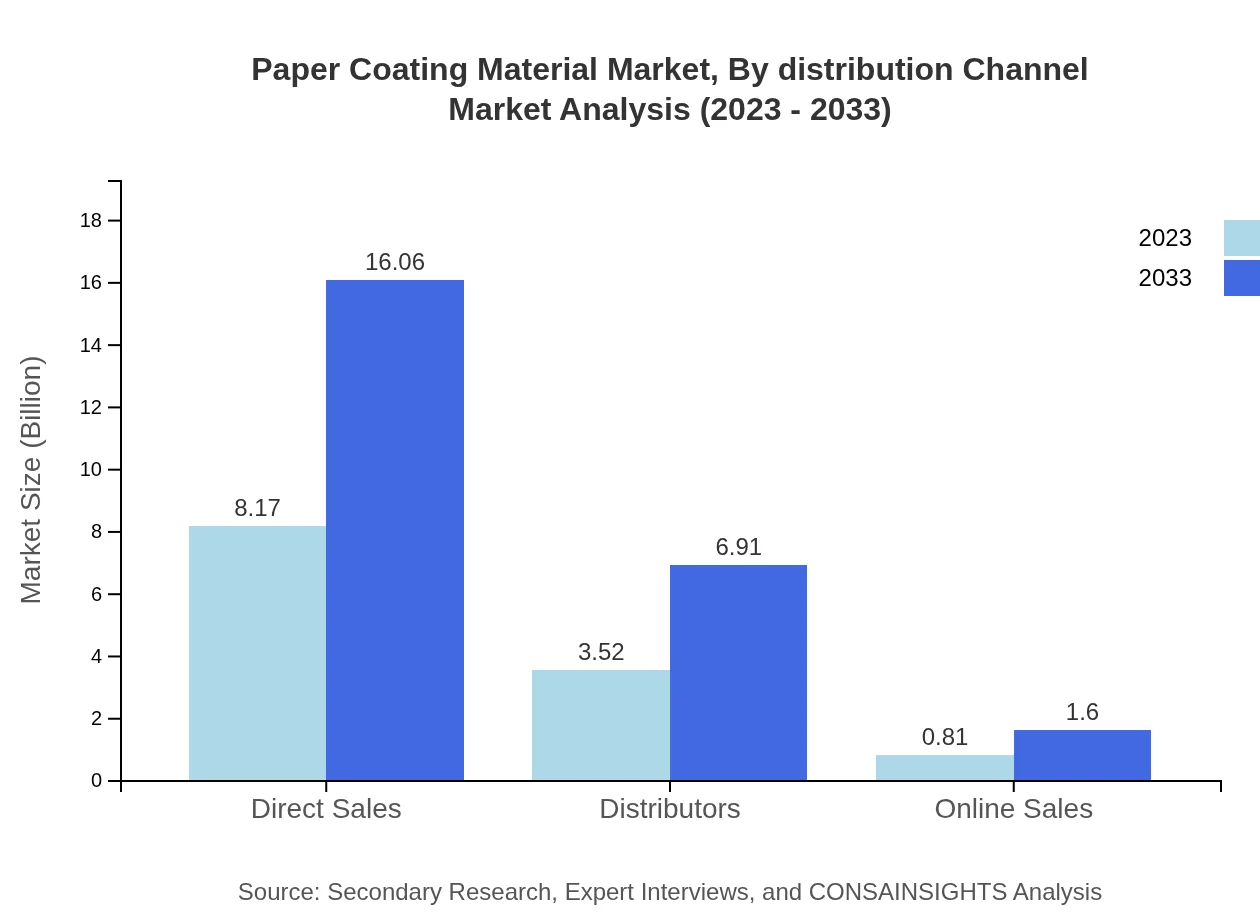

Paper Coating Material Market Analysis By Distribution Channel

Distribution channels include direct sales, which dominate with a 65.36% market share, followed by distributors at 28.13% and online sales presenting a growing segment at 6.51%. The preference for direct sales reflects manufacturers' direct engagement with large clients.

Paper Coating Material Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Paper Coating Material Industry

BASF SE:

A leading chemical manufacturer known for producing a wide range of coatings and advanced materials, including paper coating solutions.AkzoNobel N.V.:

A global paints and coatings company that also specializes in paper coatings, focusing on sustainability and technological innovation.Omya AG:

A Swiss-based company that is a leading supplier of calcium carbonate and kaolin for the paper industry.Minerals Technologies Inc.:

An international resource and specialty chemicals company with strong capabilities in advanced paper coating products.We're grateful to work with incredible clients.

FAQs

What is the market size of paper Coating Material?

The paper coating material market is valued at approximately $12.5 billion in 2023, projected to experience a CAGR of 6.8%. By 2033, the market size is expected to reach significant growth, emphasizing the rising demand for quality paper products.

What are the key market players or companies in the paper Coating Material industry?

Key players in the paper-coating material industry include major firms such as BASF SE, Imerys S.A., and Minerals Technologies Inc. These companies play vital roles in product innovation and market dynamics, driving advancements in coatings and additives.

What are the primary factors driving the growth in the paper Coating Material industry?

The growth in the paper-coating material industry is primarily driven by increasing demand for high-quality paper products in packaging, print media, and specialty applications. Sustainability trends and innovations in paper technology also contribute to this market expansion.

Which region is the fastest Growing in the paper Coating Material?

The Asia-Pacific region exhibits the fastest growth in the paper coating material market, expanding from $2.63 billion in 2023 to $5.17 billion by 2033, thanks to a rising demand for packaging and printing applications in developing economies.

Does ConsaInsights provide customized market report data for the paper Coating Material industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the paper-coating material industry. Clients can request focused insights that align with their strategical objectives and market interests.

What deliverables can I expect from this paper Coating Material market research project?

From the paper-coating material market research project, clients can expect comprehensive deliverables including detailed market analyses, trend identification, competitive landscape assessments, and insights into regional growth opportunities and segment forecasts.

What are the market trends of paper Coating Material?

Current trends in the paper-coating material market include a shift towards eco-friendly and sustainable products, the use of advanced coating technologies, and an increase in demand from emerging markets, particularly in packaging and high-end printing sectors.