Industrial Oils Market Report

Published Date: 02 February 2026 | Report Code: industrial-oils

Industrial Oils Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Industrial Oils market, covering insights into market trends, size forecasts, segmentation, and regional performance from 2023 to 2033. The analysis integrates current data, technological advancements, and expected growth trajectories.

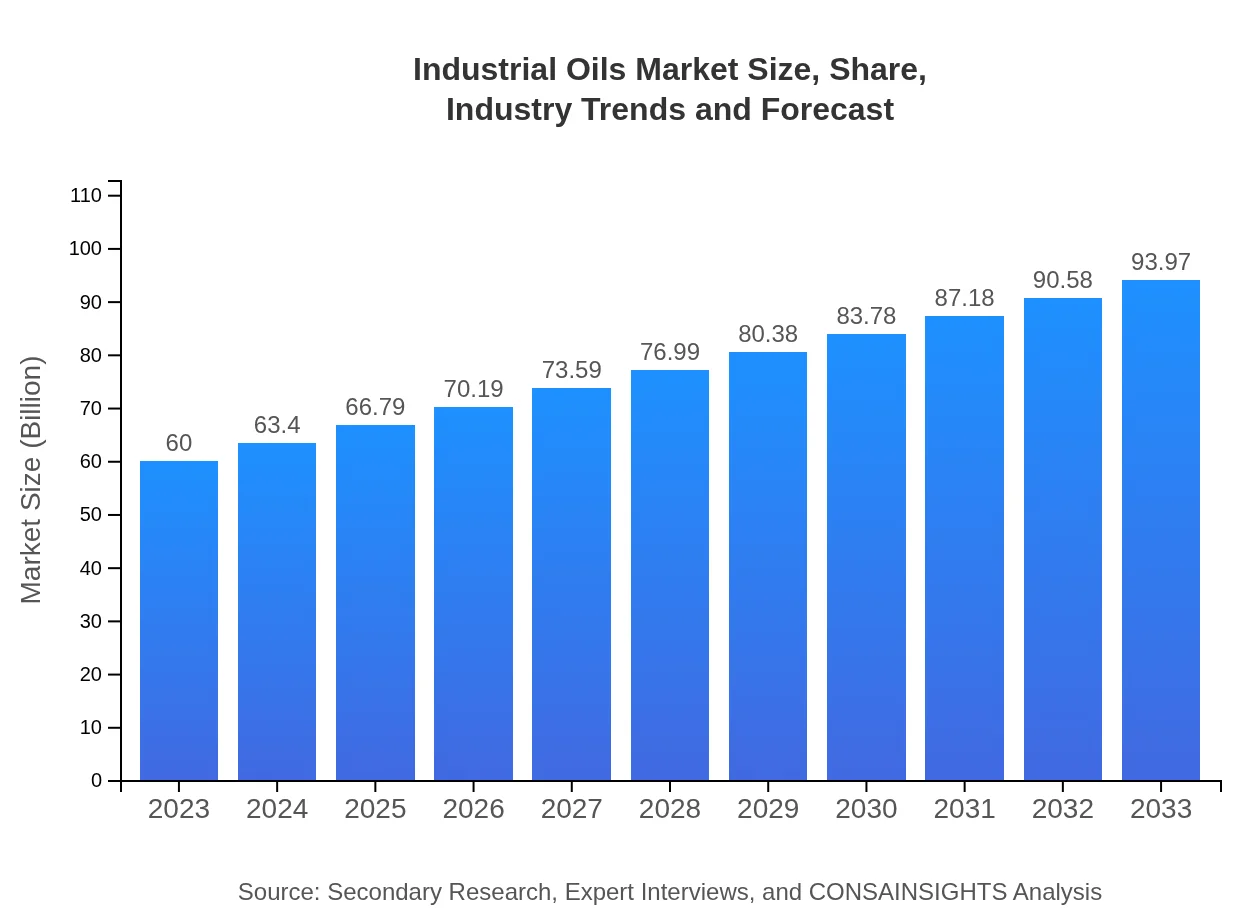

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $60.00 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $93.97 Billion |

| Top Companies | ExxonMobil, BP plc, Chevron, Shell, TotalEnergies |

| Last Modified Date | 02 February 2026 |

Industrial Oils Market Overview

Customize Industrial Oils Market Report market research report

- ✔ Get in-depth analysis of Industrial Oils market size, growth, and forecasts.

- ✔ Understand Industrial Oils's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Oils

What is the Market Size & CAGR of Industrial Oils market in 2023 and 2033?

Industrial Oils Industry Analysis

Industrial Oils Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Oils Market Analysis Report by Region

Europe Industrial Oils Market Report:

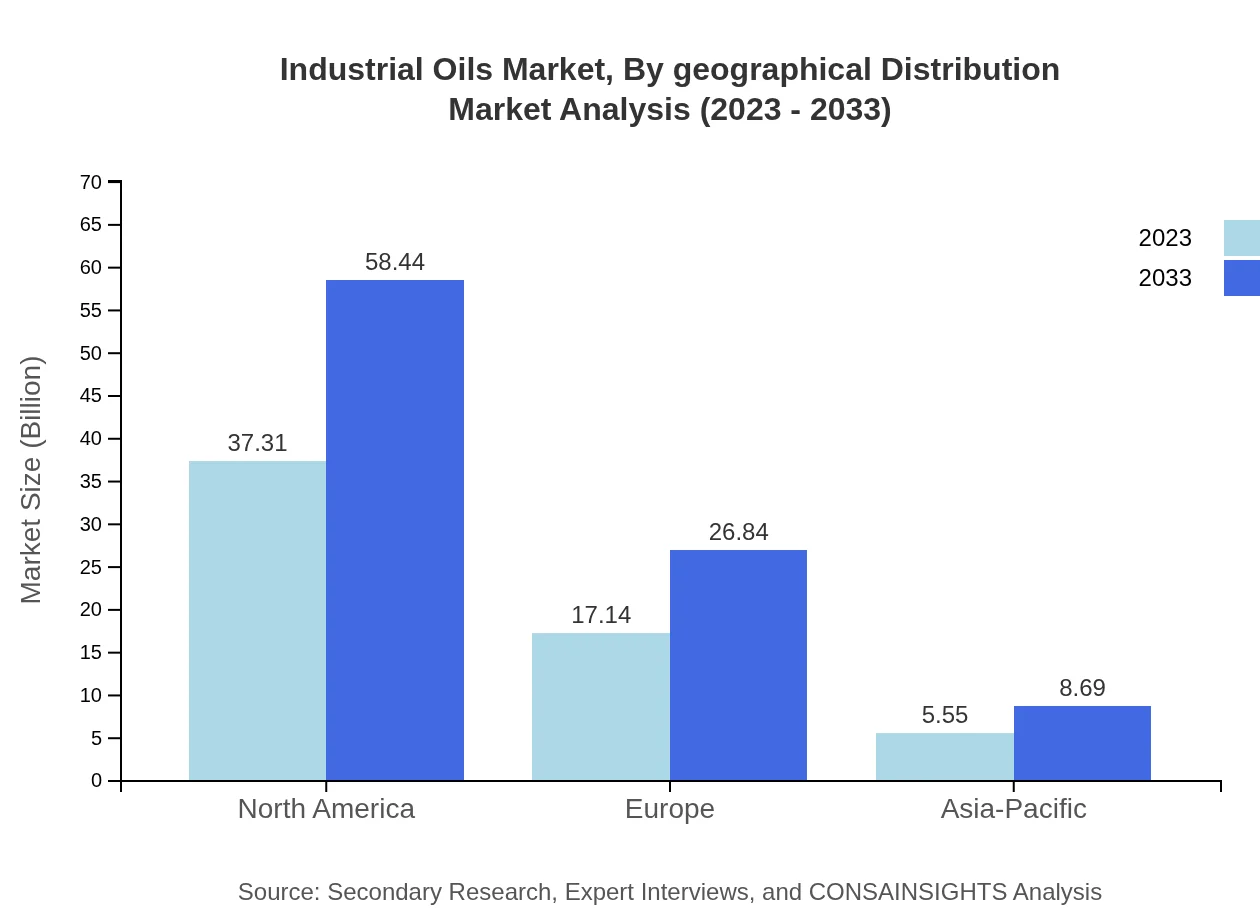

The European market for Industrial Oils is forecasted to grow from $16.43 billion in 2023 to $25.74 billion by 2033. The European Union’s stringent regulations on environmental sustainability are propelling sectors to adopt biodegradable and synthetic oils. The automotive industry’s shift towards electric vehicles is also reshaping lubricant needs, fostering growth in specialized oil products.Asia Pacific Industrial Oils Market Report:

In the Asia-Pacific region, the Industrial Oils market is anticipated to grow from $12.82 billion in 2023 to approximately $20.07 billion by 2033. This growth is driven by rapid industrialization and increasing consumer demand for automotive products. Key countries including China and India are leading the charge, enhancing production capacities and driving innovation in oil manufacturing.North America Industrial Oils Market Report:

North America is poised for substantial growth, with market projections showing an increase from $19.63 billion in 2023 to $30.75 billion by 2033. The region benefits from established manufacturing capabilities and a robust automotive industry. Investments in sustainable oil alternatives further elevate the market potential, with a strong emphasis on eco-friendly innovations.South America Industrial Oils Market Report:

In South America, the market size for Industrial Oils is expected to expand from $5.89 billion in 2023 to $9.23 billion by 2033. Growth in the region is largely influenced by the agricultural sector, where oils are integral to machinery and equipment operations. Additionally, increased foreign investments in local refining capabilities support this sector's development.Middle East & Africa Industrial Oils Market Report:

The Middle East and Africa are expected to see growth from $5.23 billion in 2023 to $8.19 billion by 2033. Oil production and refinement capabilities in the region strongly influence market dynamics. Additionally, rising demand in sectors such as construction and manufacturing contribute to this growth, supported by strategic investments in regional infrastructure.Tell us your focus area and get a customized research report.

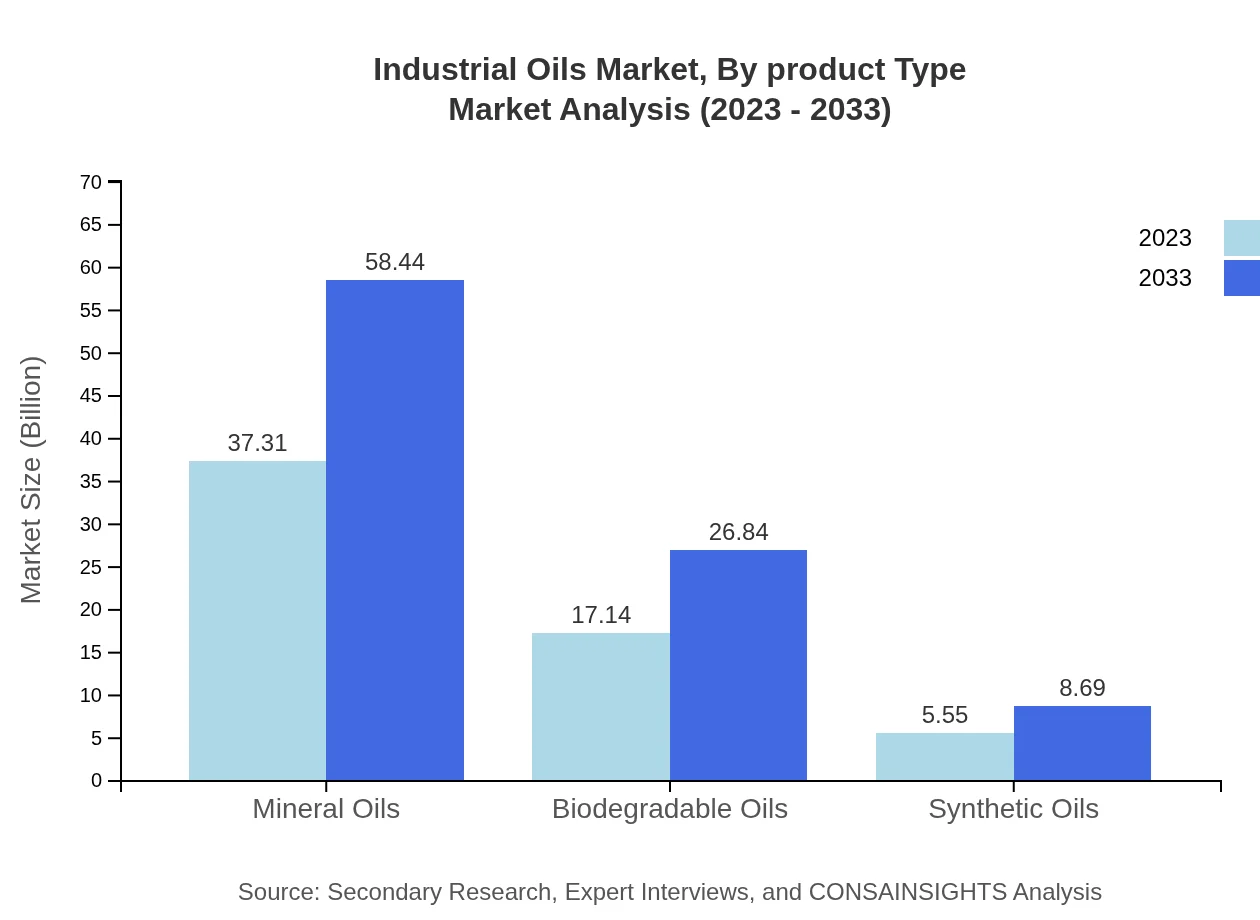

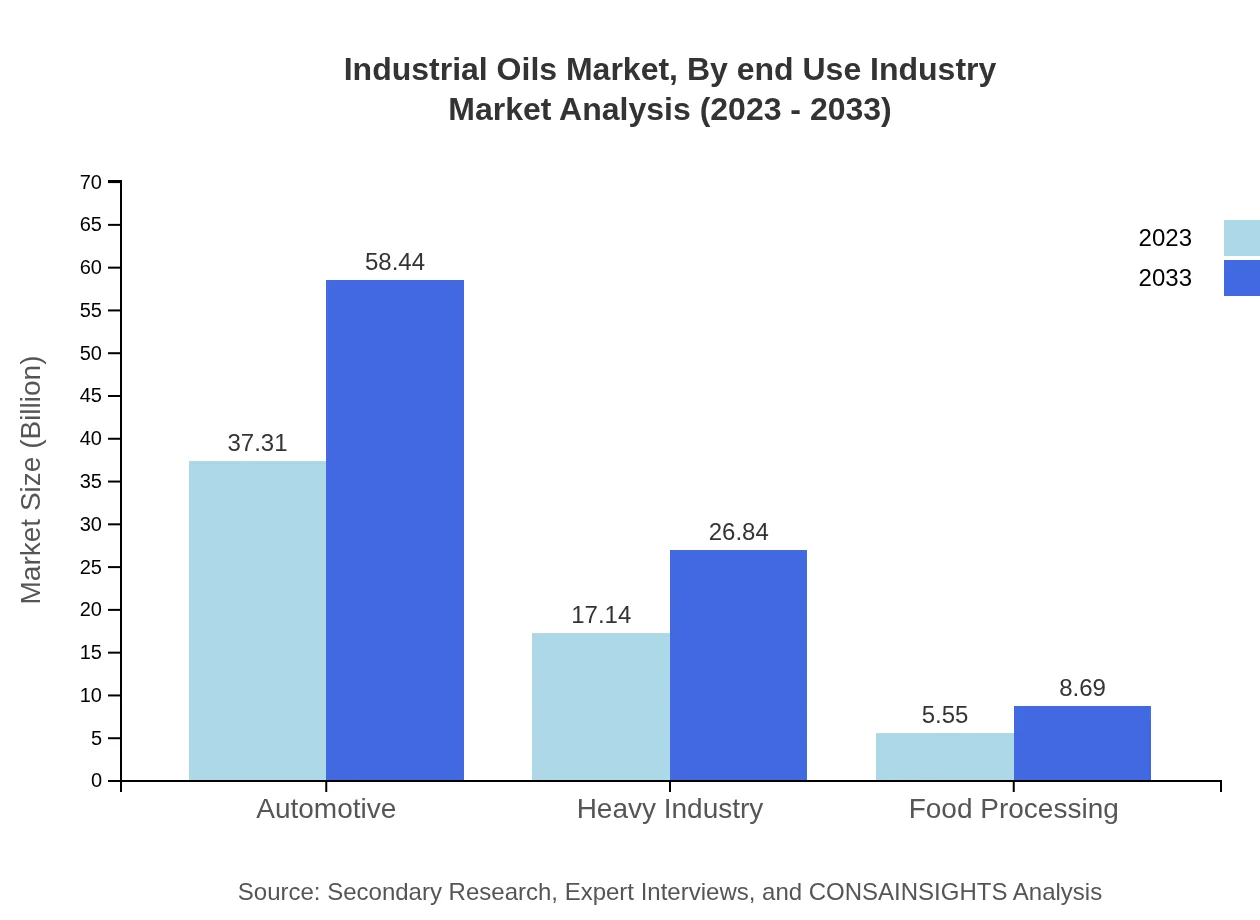

Industrial Oils Market Analysis By Product Type

The product type segment includes Mineral Oils, Biodegradable Oils, and Synthetic Oils. Mineral oils dominate the market with a size projection of $37.31 billion in 2023, increasing to $58.44 billion by 2033, holding a share of approximately 62.19%. Biodegradable oils, while smaller, are projected to grow from $17.14 billion to $26.84 billion, capturing 28.56% of the share. Synthetic oils represent a niche but necessary market, growing from $5.55 billion to $8.69 billion.

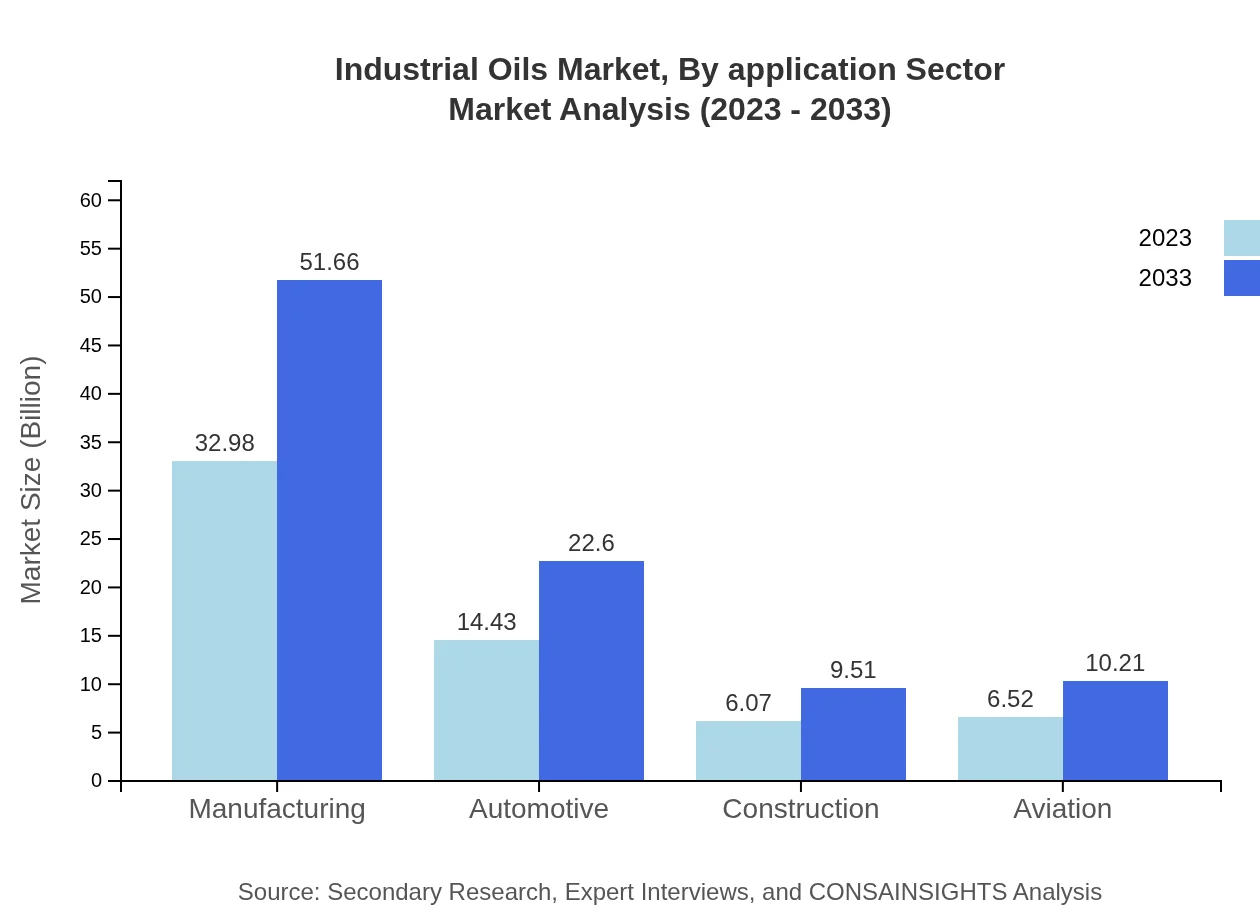

Industrial Oils Market Analysis By Application Sector

Application sectors include automotive, manufacturing, and heavy industry. The automotive sector dominates with expected market size growth from $14.43 billion to $22.60 billion by 2033. Manufacturing is also significant, projected to increase from $32.98 billion to $51.66 billion, whereas heavy industry will grow from $17.14 billion to $26.84 billion, maintaining a strong share due to ongoing industrial activities.

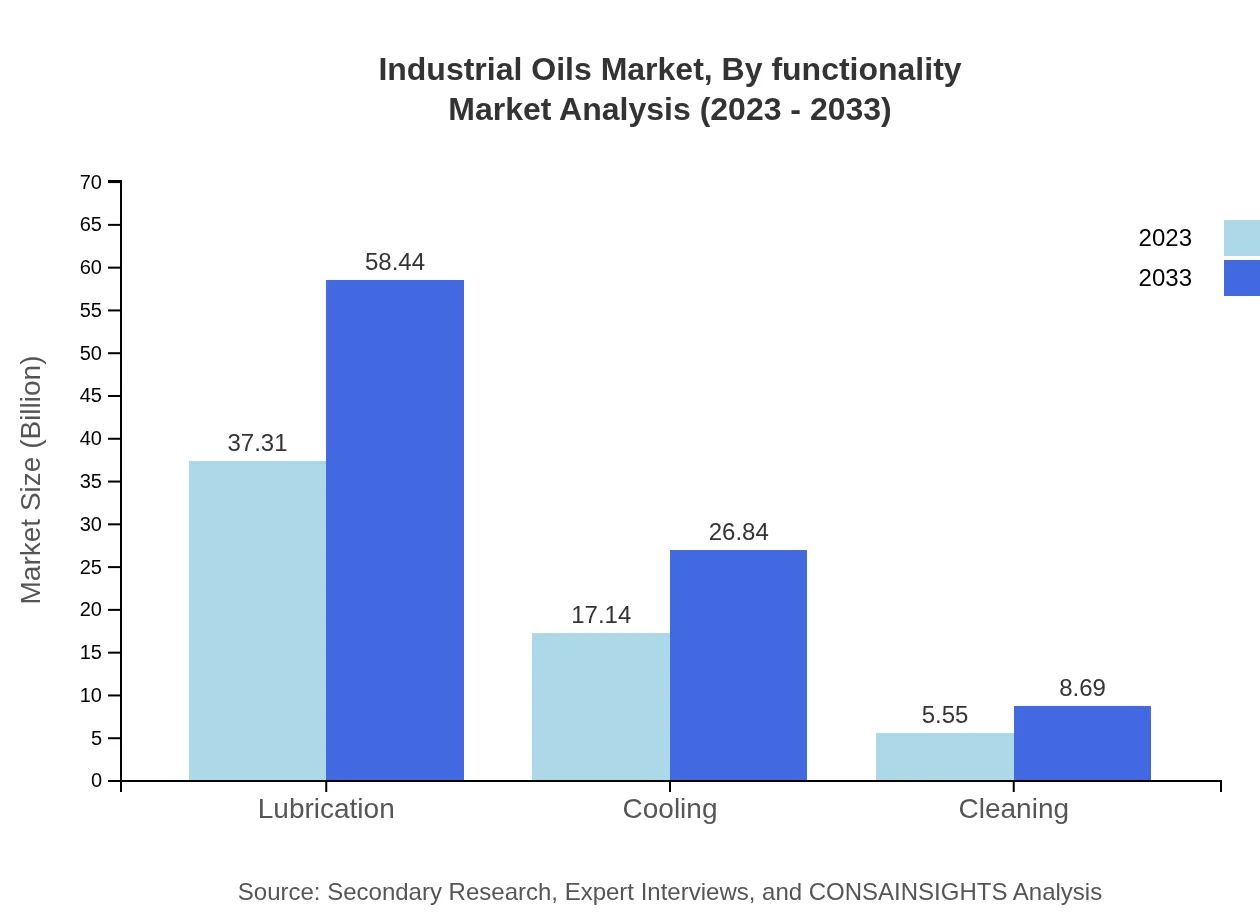

Industrial Oils Market Analysis By Functionality

Functionality segmentation shows lubricant oils have a dominant market share, expected to grow from $37.31 billion to $58.44 billion. Cooling and cleaning oils also play pivotal roles, with cooling oils increasing from $17.14 billion to $26.84 billion and cleaning oils from $5.55 billion to $8.69 billion, serving key industrial processes.

Industrial Oils Market Analysis By End Use Industry

The manufacturing sector holds the largest share of the market, growing from $32.98 billion to $51.66 billion as industrial activities ramp up. The automotive and aviation sectors also contribute significant demand, with automotive oils projected to grow substantially alongside continued advancements in transport technologies.

Industrial Oils Market Analysis By Geographical Distribution

Geographical distribution reveals North America and Europe as leading markets, with North America dominating due to robust production capabilities. Europe follows closely, driven by regulations on sustainability. Asia-Pacific is emerging rapidly, supported by significant industrial growth in countries like China and India.

Industrial Oils Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Oils Industry

ExxonMobil:

A leading global oil and gas company known for its extensive portfolio of lubricants and industrial oils aimed at enhancing performance across various applications.BP plc:

A prominent oil and gas company with a vast range of industrial oils including biodegradable and synthetic options designed for diverse industrial applications.Chevron:

An international corporation that produces a wide array of industrial oils, specializing in high-performance lubricants for automotive and heavy industries.Shell:

Known for its commitment to sustainability, Shell offers innovative lubricants and oils aimed at reducing environmental impact while improving operational efficiency.TotalEnergies:

Provides a comprehensive range of industrial oils, focusing on advanced technology and customer-oriented solutions in energy and lubrication.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Oils?

The global industrial oils market is currently valued at approximately $60 billion in 2023, with an expected growth rate of 4.5% CAGR forecasted through 2033.

What are the key market players or companies in this industrial Oils industry?

Key players in the industrial oils market include major companies such as Chevron, ExxonMobil, and TotalEnergies, which significantly contribute to market innovations and sustainable practices.

What are the primary factors driving the growth in the industrial oils industry?

The growth in the industrial oils market is driven by factors such as increasing demand from the automotive sector, rising industrial activities, and growing awareness of biodegradable oil alternatives.

Which region is the fastest Growing in the industrial oils?

The fastest-growing region in the industrial oils market is North America, with market growth projected from $19.63 billion in 2023 to $30.75 billion by 2033.

Does ConsaInsights provide customized market report data for the industrial Oils industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the industrial oils industry, ensuring clients receive relevant and actionable insights.

What deliverables can I expect from this industrial Oils market research project?

Deliverables include comprehensive market analysis, segmentation data, regional insights, competitor analysis, and market forecasts, all designed to support strategic business decisions.

What are the market trends of industrial Oils?

Current market trends show a shift towards sustainable and biodegradable oils, growth in synthetic oil usage, and increased investment in research and development for innovative oil solutions.