Injection Pen Market Report

Published Date: 31 January 2026 | Report Code: injection-pen

Injection Pen Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Injection Pen market, focusing on key insights and data for the forecast period of 2023 to 2033. It covers market size, growth trends, industry analysis, segmentation, regional insights, and future forecasts.

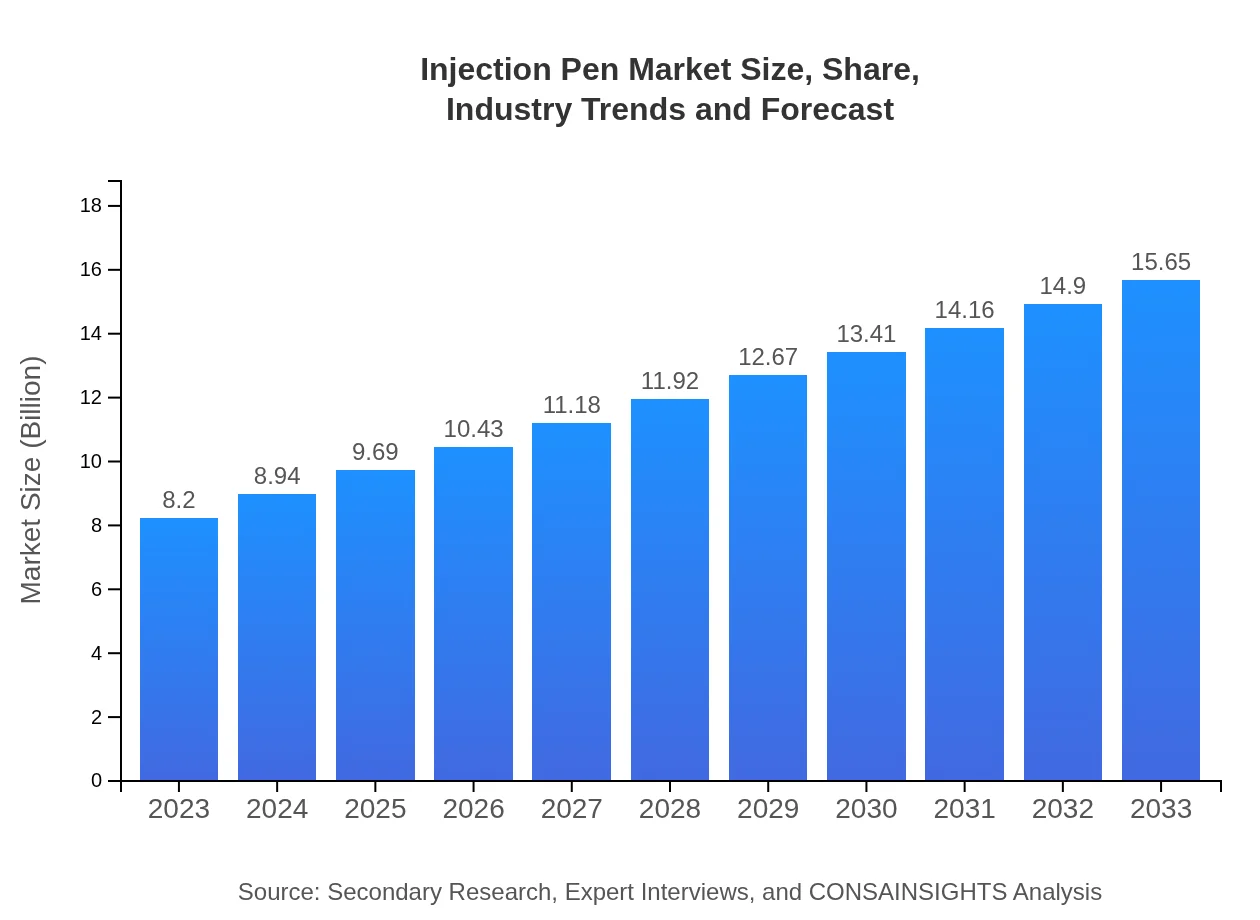

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.20 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $15.65 Billion |

| Top Companies | Novo Nordisk, Sanofi, Boehringer Ingelheim, Mylan, Roche |

| Last Modified Date | 31 January 2026 |

Injection Pen Market Overview

Customize Injection Pen Market Report market research report

- ✔ Get in-depth analysis of Injection Pen market size, growth, and forecasts.

- ✔ Understand Injection Pen's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Injection Pen

What is the Market Size & CAGR of Injection Pen market in 2033?

Injection Pen Industry Analysis

Injection Pen Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Injection Pen Market Analysis Report by Region

Europe Injection Pen Market Report:

The European Injection Pen market was valued at $2.02 billion in 2023, and is projected to nearly double to $3.86 billion by 2033. The growing focus on chronic disease management and advanced healthcare solutions promotes this growth.Asia Pacific Injection Pen Market Report:

The Asia Pacific region, valued at $1.75 billion in 2023, is projected to reach $3.33 billion by 2033, showcasing a significant growth rate. The increasing prevalence of diabetes and other chronic conditions, along with government initiatives for better healthcare infrastructure, are driving this growth.North America Injection Pen Market Report:

North America remains the largest market for Injection Pens, valued at $3.07 billion in 2023, projected to reach $5.86 billion by 2033. The region's robust healthcare systems and high prevalence of diabetes and obesity are driving high adoption rates.South America Injection Pen Market Report:

In South America, the market was valued at $0.34 billion in 2023 and is expected to grow to $0.65 billion by 2033. Factors such as rising healthcare expenditures and the growing acceptance of advanced healthcare technologies are contributing to market growth.Middle East & Africa Injection Pen Market Report:

The market in the Middle East and Africa, valued at $1.02 billion in 2023, is anticipated to grow to $1.95 billion by 2033. Improved healthcare access and growing awareness of diabetes management will support this rise.Tell us your focus area and get a customized research report.

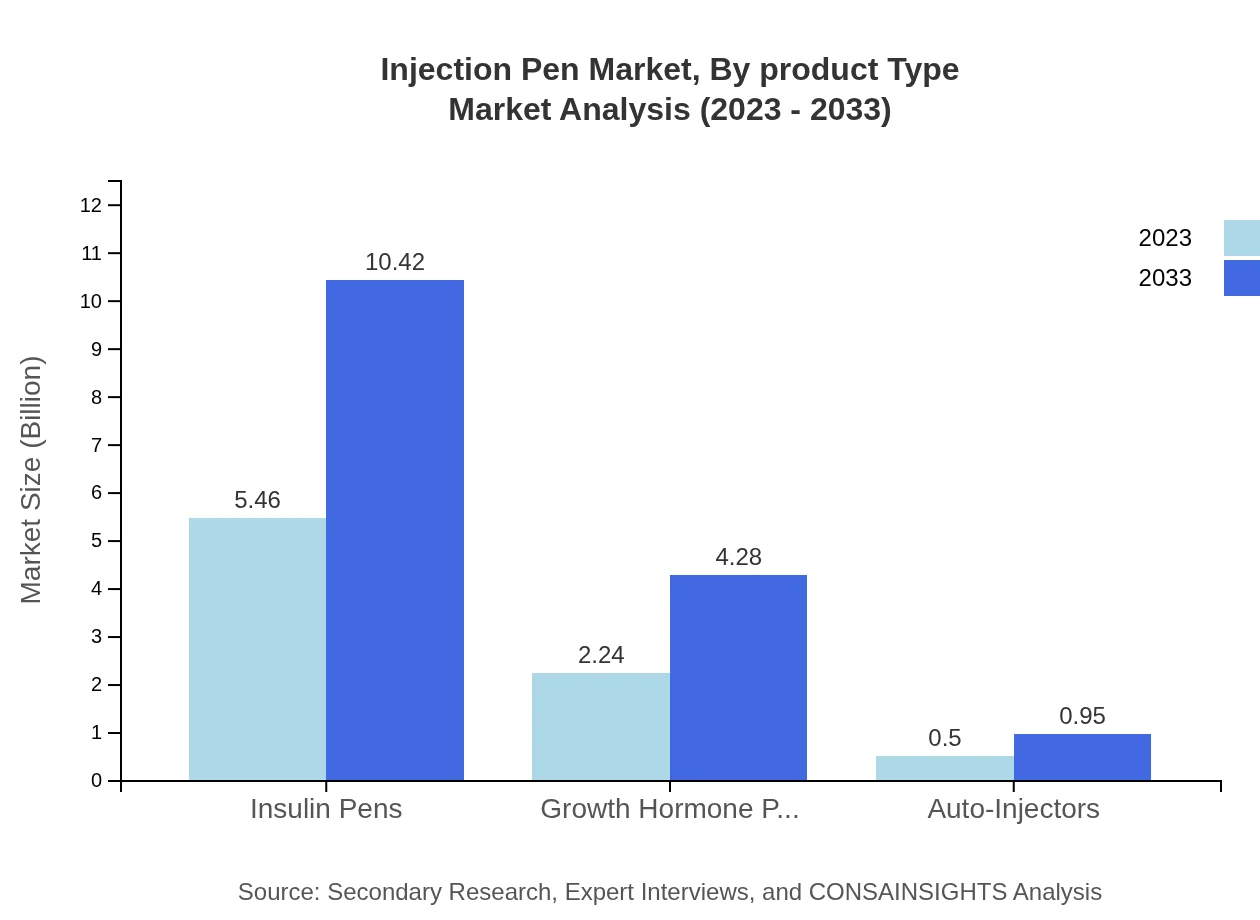

Injection Pen Market Analysis By Product Type

The market for Injection Pens can be segmented into insulin pens, growth hormone pens, auto-injectors, and manual injections. Insulin pens currently hold the largest market share of 66.6%, valued at $5.46 billion in 2023, expected to grow to $10.42 billion by 2033. Growth hormone pens account for 27.32% of the market share, valued at $2.24 billion in 2023 with a projected market size of $4.28 billion in 2033.

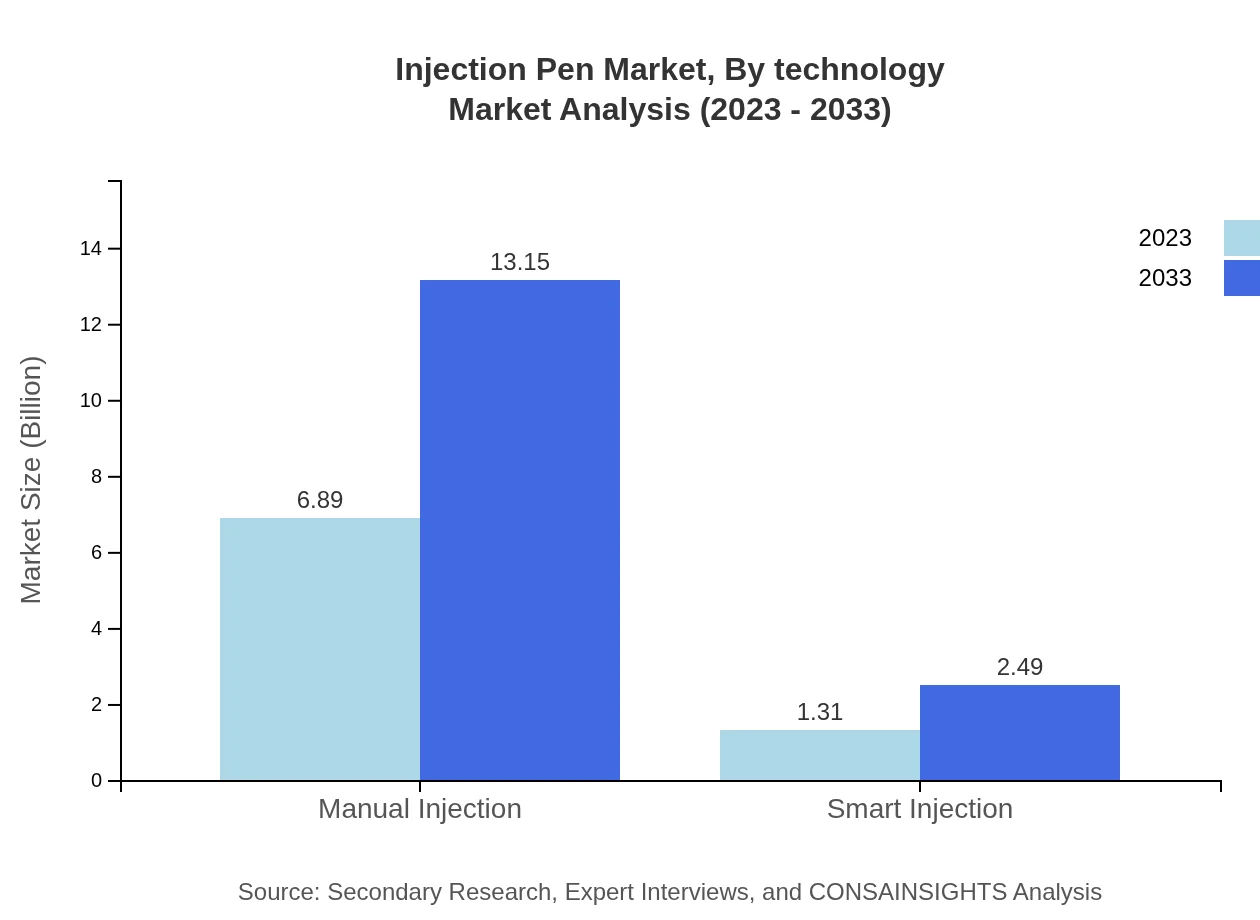

Injection Pen Market Analysis By Technology

The technology segment includes smart injection and manual injection pens. Manual injections dominate the market with 84.06% share, valued at $6.89 billion in 2023 and projected to reach $13.15 billion by 2033. Smart injections, although smaller in market share (15.94%), are growing rapidly, with expectations to reach $2.49 billion in 2033 from $1.31 billion in 2023.

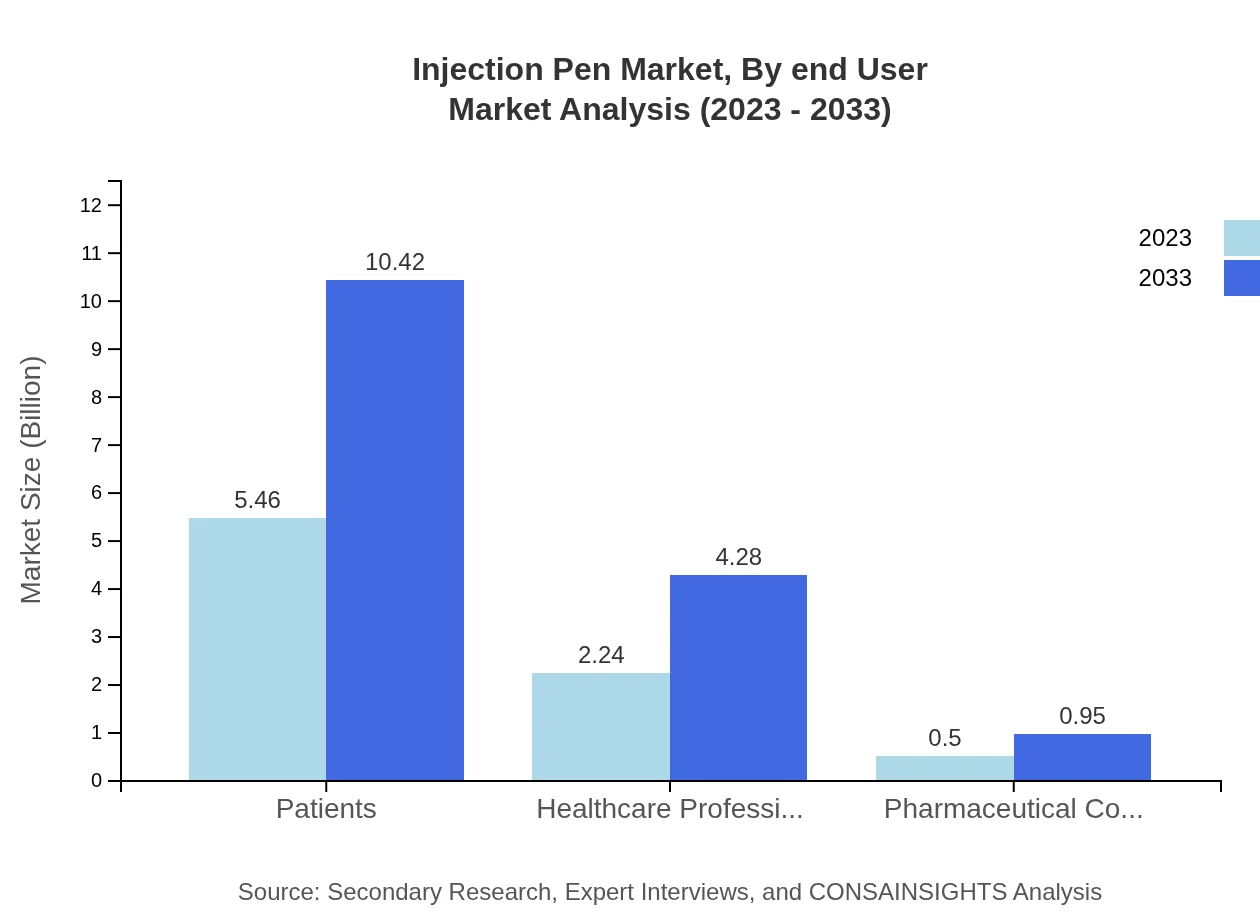

Injection Pen Market Analysis By End User

The end-user segmentation reflects needs from various parties within the healthcare system. Patients account for about 66.6% of the market size, expected to grow from $5.46 billion in 2023 to $10.42 billion by 2033. Healthcare professionals follow, holding 27.32% of the share, which will rise from $2.24 billion to $4.28 billion during the same period.

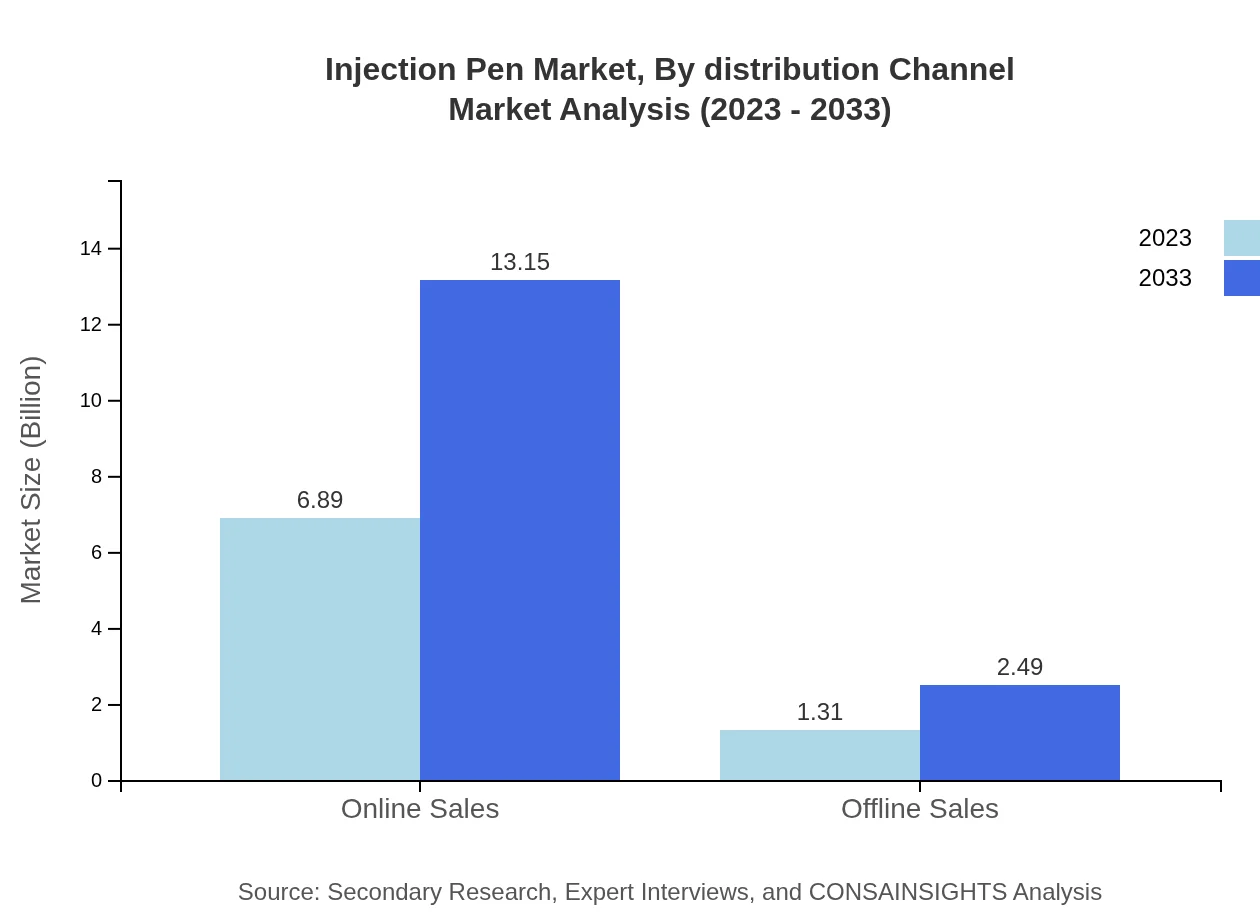

Injection Pen Market Analysis By Distribution Channel

The distribution of Injection Pens is primarily segmented into online and offline sales. Online sales dominate with an 84.06% share, valued at $6.89 billion in 2023, projected to reach $13.15 billion by 2033. Offline channels constitute 15.94%, expected to grow in line with consumer preferences during the forecast period.

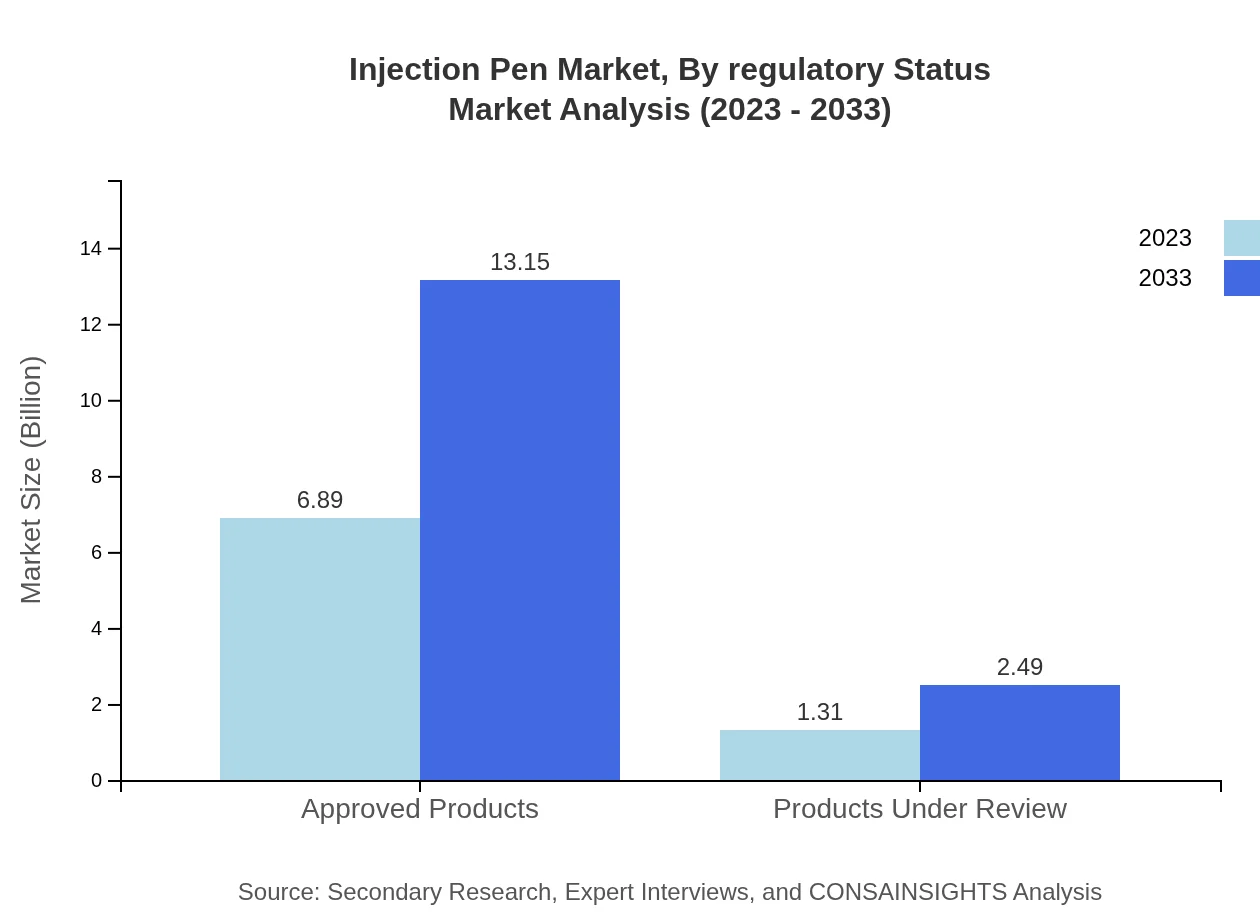

Injection Pen Market Analysis By Regulatory Status

The regulatory status segment includes approved products and those still under review. Approved products hold a significant share, valued at $6.89 billion in 2023 and expected to reach $13.15 billion by 2033. Products under review, while smaller, represent a growing segment, increasing from $1.31 billion to $2.49 billion in the same timeframe.

Injection Pen Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Injection Pen Industry

Novo Nordisk:

A leading global healthcare company with a robust portfolio of insulin pens and diabetes care solutions.Sanofi:

A prominent player with a strong presence in the diabetes medication market, specialized in innovative pen technology.Boehringer Ingelheim:

Involved in developing smart pens that enhance the self-injection experience for patients.Mylan:

Offers a range of generic drugs including injectable drugs and devices, contributing to the market growth.Roche:

Focuses on providing advanced diabetes management solutions, including a wide range of injection pens.We're grateful to work with incredible clients.

FAQs

What is the market size of injection Pen?

The injection pen market is valued at approximately $8.2 billion in 2023, with an expected CAGR of 6.5% through 2033. This growth reflects the increasing demand for efficient and convenient drug delivery systems worldwide.

What are the key market players or companies in this injection Pen industry?

Key players in the injection pen market include major pharmaceutical companies and medical device manufacturers such as Novo Nordisk, Sanofi, Eli Lilly, and Merck, known for their innovative products and market dominance.

What are the primary factors driving the growth in the injection pen industry?

Growth in the injection pen industry is primarily driven by the rise in diabetes and chronic disease prevalence, technological advancements in injection devices, increased adoption of self-administered therapies, and greater patient comfort.

Which region is the fastest Growing in the injection pen market?

The Asia Pacific region is the fastest-growing market for injection pens, projected to grow from $1.75 billion in 2023 to $3.33 billion by 2033, driven by rising health awareness and increased healthcare access.

Does ConsaInsights provide customized market report data for the injection pen industry?

Yes, ConsaInsights offers tailored market report data for the injection pen industry, allowing clients to receive insights specific to their needs, including detailed regional analysis and competitor profiling.

What deliverables can I expect from this injection Pen market research project?

Expect comprehensive deliverables including detailed market analysis reports, segmentation data, growth forecasts, competitive landscape reviews, and strategic recommendations tailored to the needs of stakeholders.

What are the market trends of injection pen?

Current trends in the injection pen market include a shift toward smart devices, increasing penetration of auto-injectors, growing online sales channels, and a rise in demand for biodegradable materials in device manufacturing.