Kyc Aml Automation Software

Published Date: 31 January 2026 | Report Code: kyc-aml-automation-software

Kyc Aml Automation Software Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report provides an in‐depth analysis of the Kyc Aml Automation Software market, covering key insights, market size, segmentation, regional performance, technology trends, and competitive landscape. It details current market conditions and forecasts from 2024 to 2033, offering strategic intelligence for stakeholders to navigate evolving market dynamics effectively.

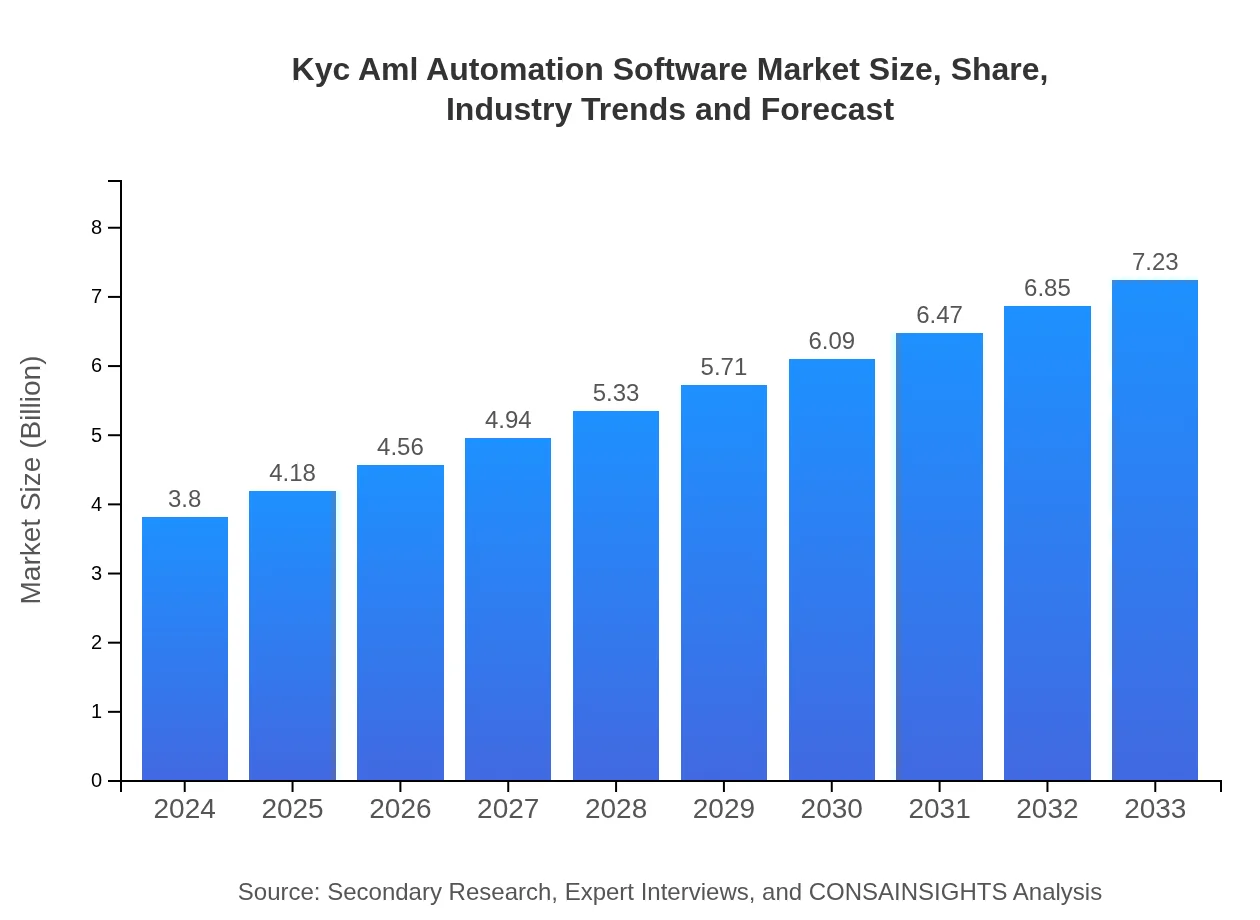

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $3.80 Billion |

| CAGR (2024-2033) | 7.2% |

| 2033 Market Size | $7.23 Billion |

| Top Companies | TechSecure Solutions, Compliance Innovators Inc., RegTech Global, FinGuard Technologies |

| Last Modified Date | 31 January 2026 |

Kyc Aml Automation Software Market Overview

Customize Kyc Aml Automation Software market research report

- ✔ Get in-depth analysis of Kyc Aml Automation Software market size, growth, and forecasts.

- ✔ Understand Kyc Aml Automation Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Kyc Aml Automation Software

What is the Market Size & CAGR of Kyc Aml Automation Software market in 2024?

Kyc Aml Automation Software Industry Analysis

Kyc Aml Automation Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Kyc Aml Automation Software Market Analysis Report by Region

Europe Kyc Aml Automation Software:

Europe exhibits steady growth with the market expected to grow from 1.00 billion in 2024 to 1.90 billion by 2033. Stringent data protection laws and an increasing need for real-time fraud detection and compliance management are driving the adoption of automation software. European regulatory frameworks are continually evolving, pushing financial institutions to invest in robust KYC and AML systems.Asia Pacific Kyc Aml Automation Software:

In Asia Pacific, the market is evolving rapidly with a projected increase from 0.82 billion in 2024 to 1.55 billion by 2033. This growth is driven by the region’s expanding digital infrastructure, increased investment in technology, and government initiatives to bolster compliance frameworks. Emerging economies are embracing digital automation in financial services, which has bolstered the demand for KYC and AML solutions.North America Kyc Aml Automation Software:

North America remains a significant market leader with robust investments in automated compliance systems. The market is anticipated to expand from 1.24 billion in 2024 to 2.36 billion in 2033, propelled by the strong presence of established technology providers, rigorous regulatory requirements, and a high rate of digital adoption among financial institutions.South America Kyc Aml Automation Software:

In South America, also characterized as Latin America in several reports, the market is set to grow from 0.24 billion in 2024 to 0.46 billion in 2033. Increasing regulatory oversight and a shift towards digitalization in financial transactions are the primary growth drivers. The region is witnessing a surge in partnerships between local tech firms and international compliance solution providers.Middle East & Africa Kyc Aml Automation Software:

In the Middle East and Africa, the market is projected to grow from 0.50 billion in 2024 to 0.96 billion by 2033. This growth is influenced by regional initiatives aimed at improving financial transparency and combating money laundering. Although the overall market size is smaller compared to other regions, significant strides in technology adoption and regulatory reforms are expected to drive market expansion.Tell us your focus area and get a customized research report.

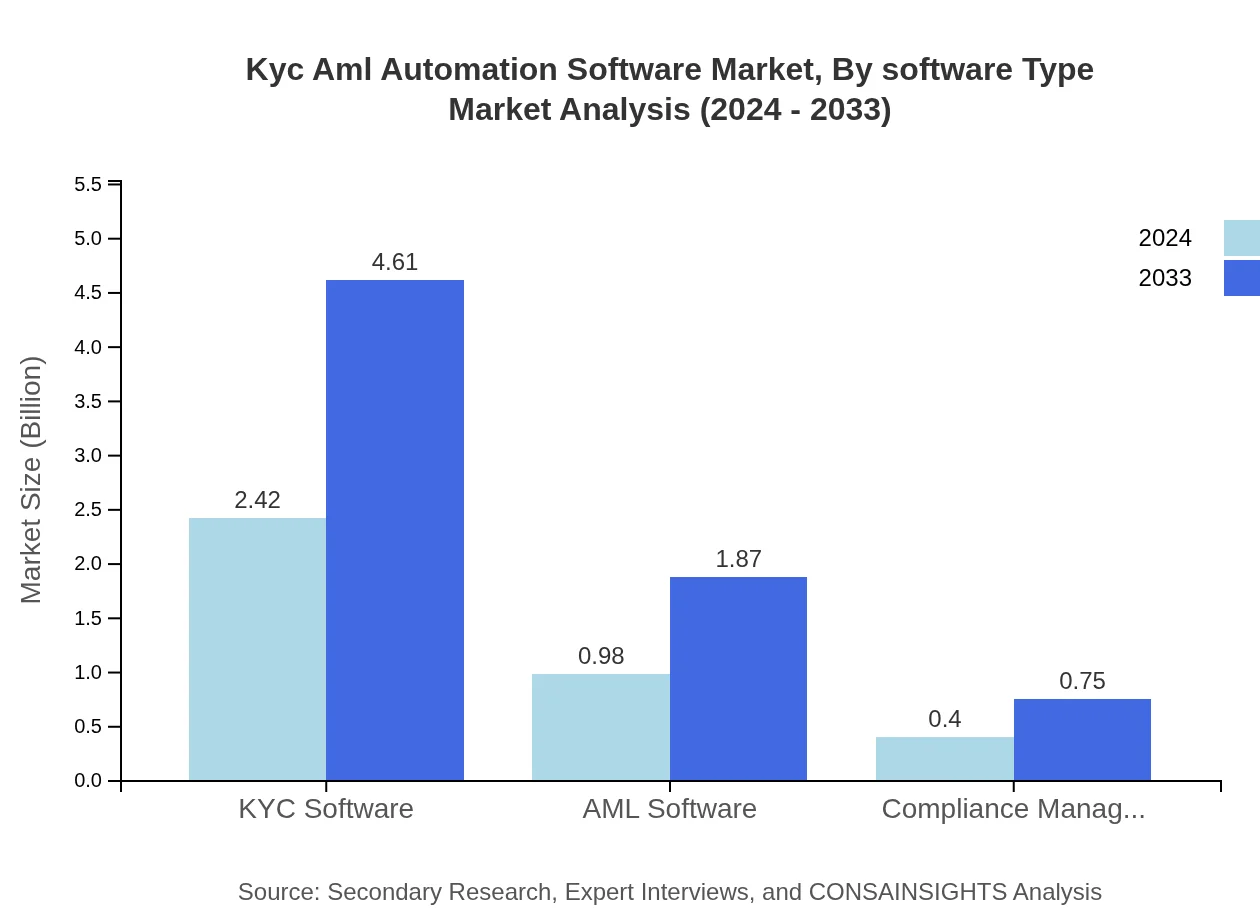

Kyc Aml Automation Software Market Analysis By Software Type

The by-software-type segment dissects the market into various product offerings, including specialized KYC Software, AML Software, and Compliance Management Software. In 2024, KYC Software achieved a market size of 2.42 units with a share of 63.78%, while AML Software reached 0.98 units capturing a 25.82% share, and Compliance Management Software recorded 0.40 units representing a 10.4% share. These segments are driven by the need for stringent verification processes and dynamic risk assessment tools. They are continually evolving to integrate real-time analytics, adaptive algorithms, and efficient processing protocols that help reduce operational risks and ensure regulatory adherence.

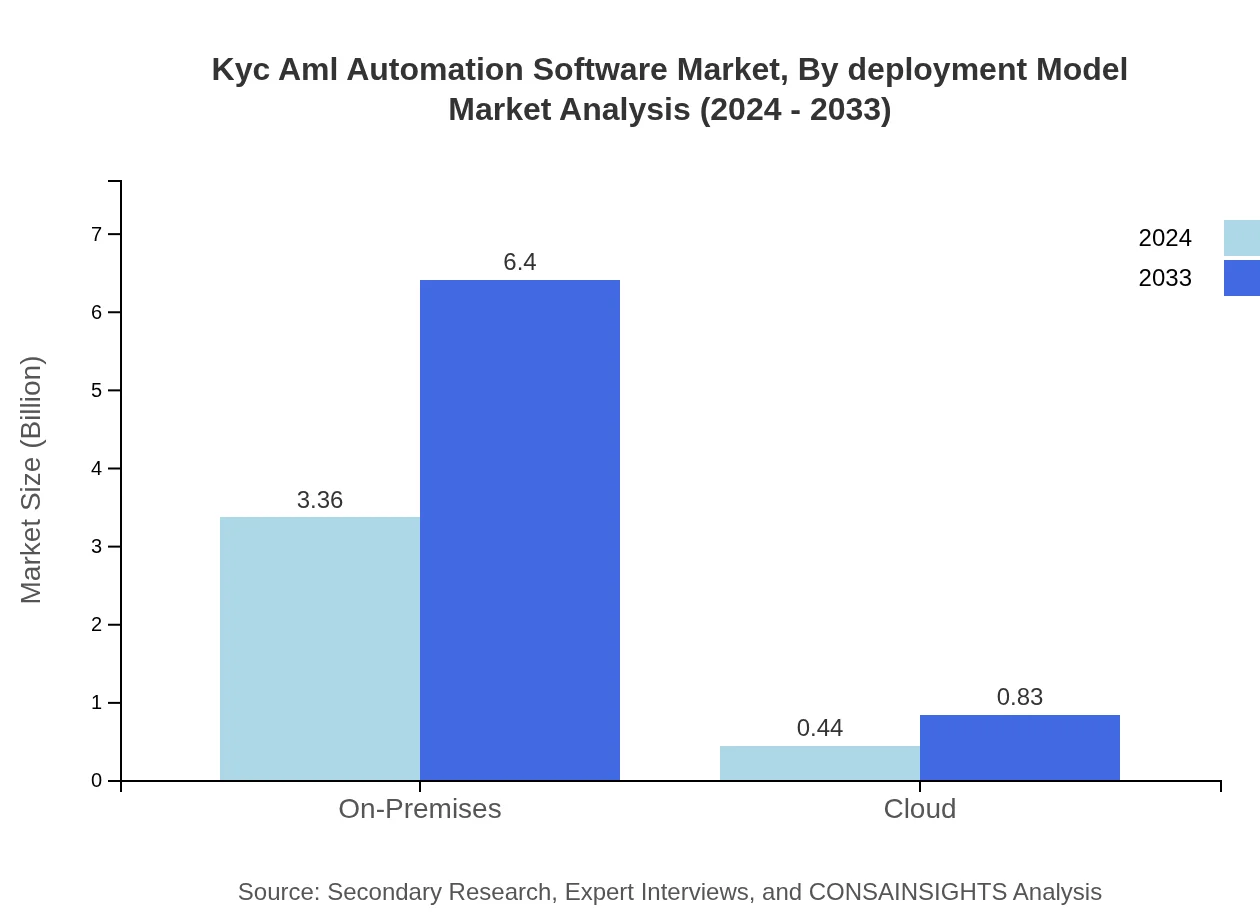

Kyc Aml Automation Software Market Analysis By Deployment Model

Deployment models are critical to addressing the diverse IT infrastructure requirements of organizations. The market is broadly categorized into on-premises and cloud-based solutions. In 2024, on-premises deployments commanded a significant portion of the market with a size of 3.36 units and a share of 88.46%, reflecting organizations’ preference for data security and control. Cloud deployments, on the other hand, accounted for a size of 0.44 units with a share of 11.54%, offering scalability, cost savings, and faster implementation. As businesses aim to balance control and flexibility, both deployment models are expected to evolve, with cloud-based solutions gaining traction due to advancements in encryption and data management technologies.

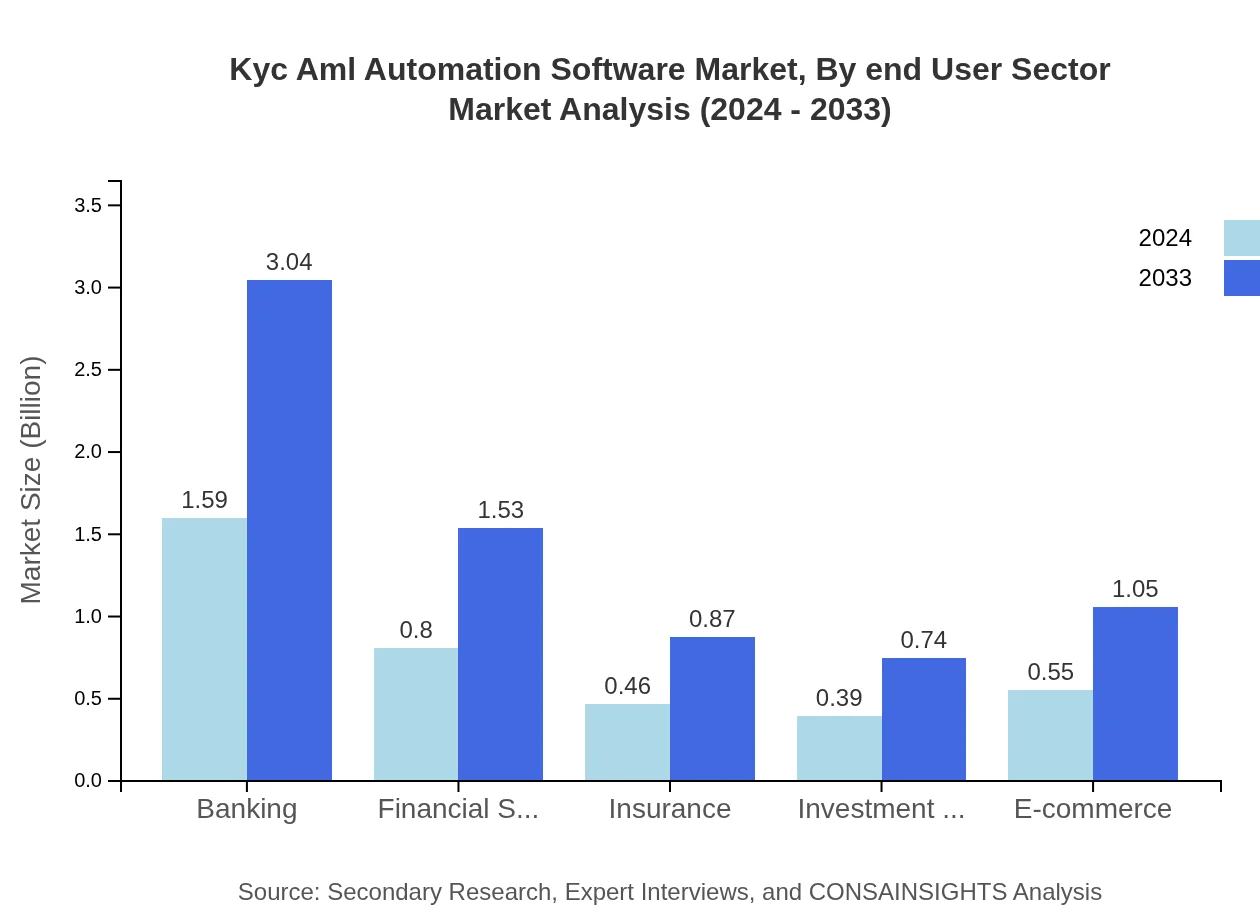

Kyc Aml Automation Software Market Analysis By End User Sector

The end-user sector segmentation covers vital industries including Banking, Financial Services, Insurance, Investment Firms, and E-commerce. In 2024, the banking sector led with a market size of 1.59 units and a share of 41.97%, reflecting its heavy reliance on automated compliance systems to manage large volumes of transactions. Financial Services followed with a size of 0.80 units and a share of 21.16%, while Insurance, Investment Firms, and E-commerce maintained market sizes of 0.46, 0.39, and 0.55 units with shares of 12.04%, 10.28%, and 14.55% respectively. The diverse application of the technology across these sectors highlights the critical nature of fraud prevention and due diligence, compelling a continuous upgrade in compliance software capabilities.

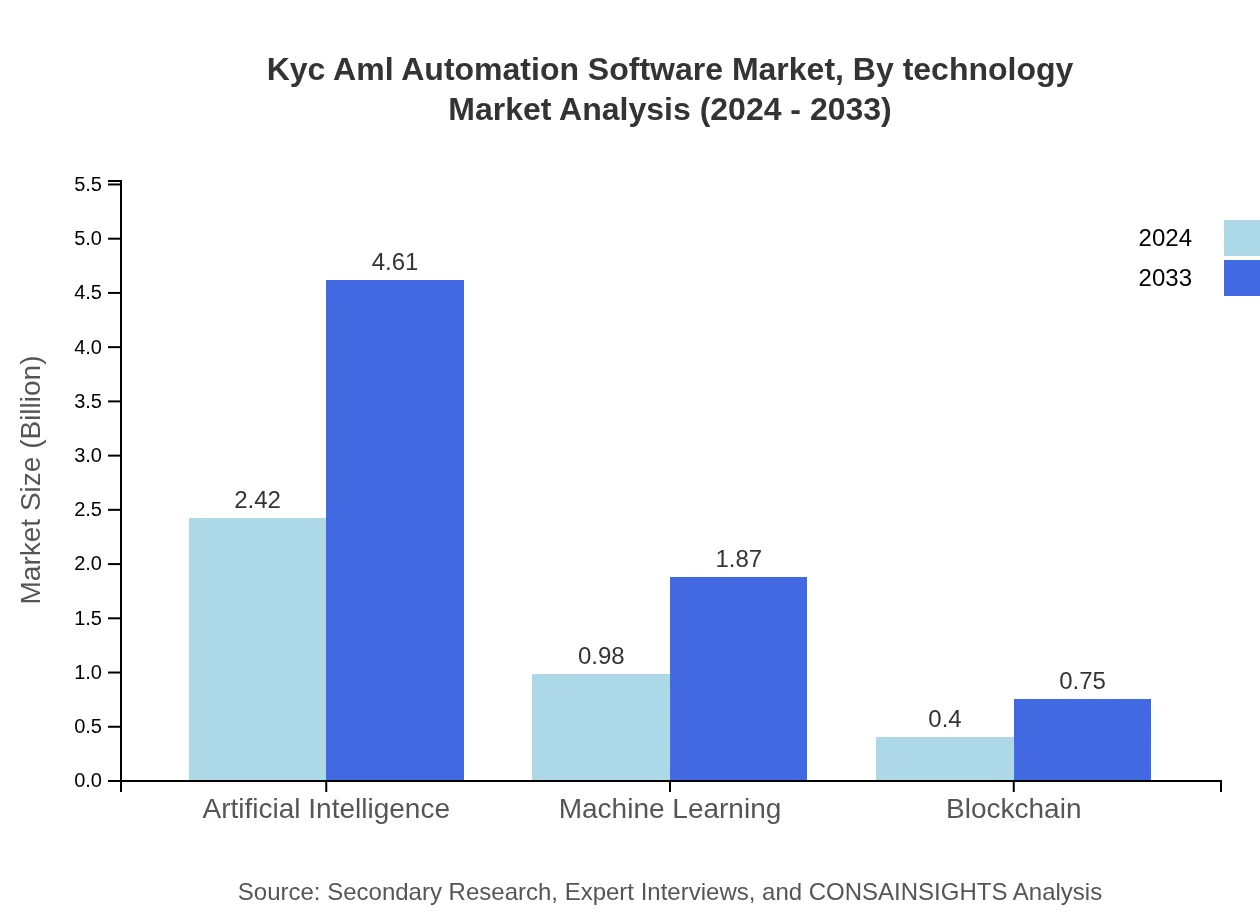

Kyc Aml Automation Software Market Analysis By Technology

Technological innovation remains at the heart of market advancements, with artificial intelligence, machine learning, and blockchain leading the charge. Artificial Intelligence dominated the technology segment with a market size of 2.42 units in 2024 and is expected to reach 4.61 units by 2033, consistently capturing a share of 63.78%. Machine Learning, with a market size of 0.98 units and a 25.82% share in 2024, demonstrates significant potential for growth with improved analytical capabilities. Blockchain technology, though smaller with a market size of 0.40 units and a share of 10.4%, is making steady inroads by enhancing transaction transparency and security. These technology-driven segments are critical as they underpin the efficiency and reliability of automated compliance systems across the industry.

Kyc Aml Automation Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Kyc Aml Automation Software Industry

TechSecure Solutions:

TechSecure Solutions is a leading provider specializing in cutting-edge KYC and AML software, offering innovative solutions that integrate artificial intelligence and machine learning to ensure robust financial compliance and risk management.Compliance Innovators Inc.:

Compliance Innovators Inc. has established itself as a key player in the automation software domain with a strong emphasis on secure, scalable, and intuitive compliance management systems, serving a global clientele across various financial sectors.RegTech Global:

RegTech Global is renowned for its advanced technology framework that streamlines regulatory processes through highly automated software solutions. Their products are designed to meet the evolving demands of regulatory fidelity and operational efficiency.FinGuard Technologies:

FinGuard Technologies delivers state-of-the-art solutions that combine powerful analytics with seamless integration capabilities, empowering financial institutions to effectively monitor, detect, and mitigate risks associated with fraud and money laundering.We're grateful to work with incredible clients.

FAQs

How can the KYC-AML automation software report help align our marketing strategy with customer adoption trends?

The KYC-AML automation software market is projected to reach $3.8 billion by 2033, growing at a CAGR of 7.2%. Understanding customer adoption trends allows businesses to tailor marketing strategies that resonate with evolving client needs, therefore driving greater engagement.

What product features are in highest demand according to the KYC-AML automation software trends?

Features utilizing Artificial Intelligence dominate the KYC-AML automation market, which is expected to grow from $2.42 billion in 2024 to $4.61 billion by 2033. Demand for seamless user experience and regulatory compliance tools is also on the rise.

Which regions offer the best market entry and expansion opportunities in the KYC-AML automation software industry?

North America tops the market with a projected growth from $1.24 billion in 2024 to $2.36 billion by 2033. Europe and Asia Pacific also show strong potential, offering significant avenues for entry and expansion.

What emerging technologies and innovations are shaping the KYC-AML automation software market?

Key innovations include AI and Machine Learning, projected to grow from $0.98 billion in 2024 to $1.87 billion by 2033. Blockchain technology is also gaining traction, expected to rise from $0.40 billion to $0.75 billion.

Does the KYC-AML automation software report include competitive landscape and market share analysis?

Yes, the report provides a detailed competitive landscape, highlighting key players in the KYC-AML market and their market share. This aids companies in crafting strategies to enhance their competitive positioning.

How can executives use the KYC-AML automation software report to evaluate investment risks and ROI?

With insights on market size and segment performance, executives can assess growth trajectories, uncover potential risks, and calculate the anticipated ROI, ensuring informed investment decisions aligned with market dynamics.

What is the market size of KYC-AML automation software?

The KYC-AML automation software market is valued at $3.8 billion in 2033, with a steady growth projected at a CAGR of 7.2% from its current status.