Laboratory Gas Generators Market Report

Published Date: 31 January 2026 | Report Code: laboratory-gas-generators

Laboratory Gas Generators Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Laboratory Gas Generators market, covering current market trends, regional insights, and segment analysis from 2023 to 2033. It offers key forecasts and growth opportunities for stakeholders in this evolving industry.

| Metric | Value |

|---|---|

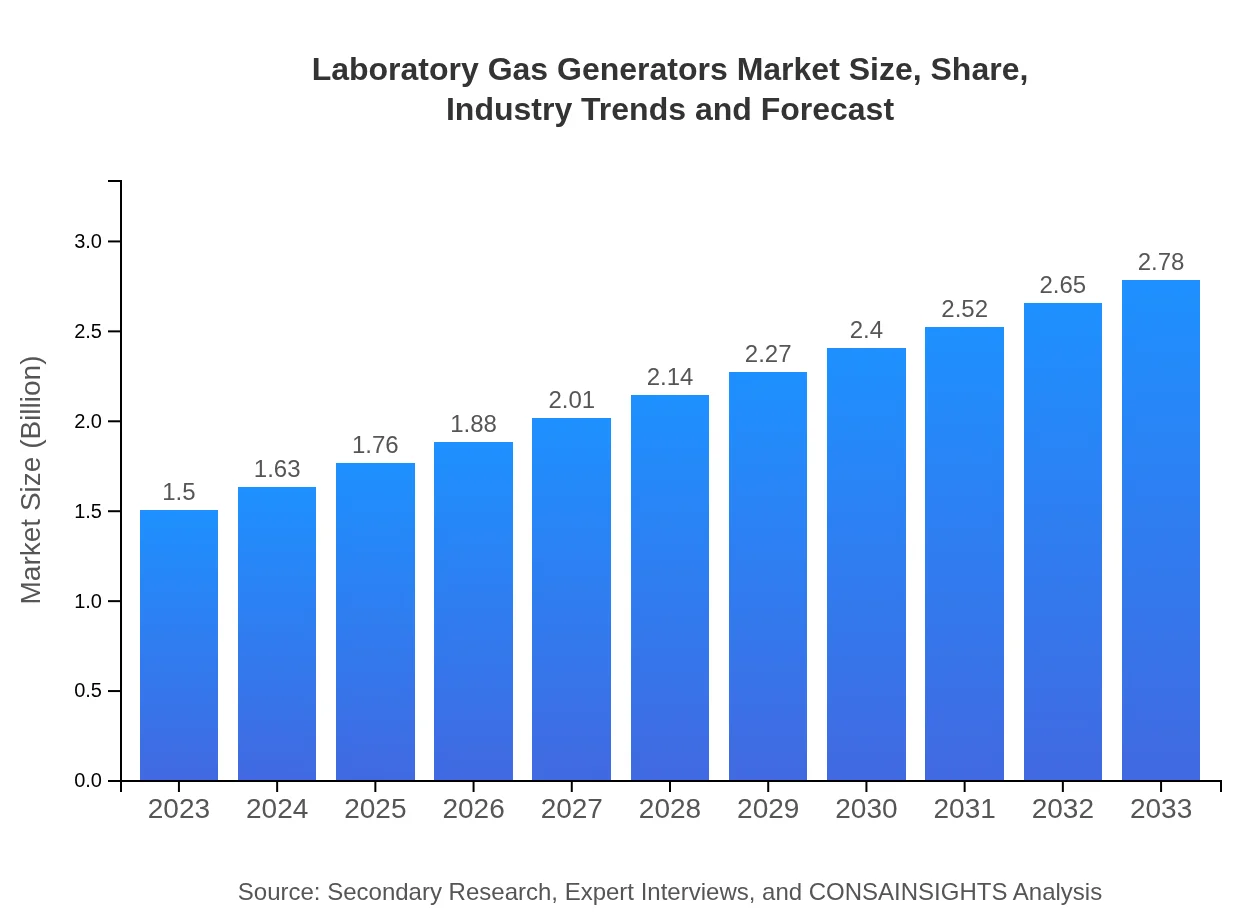

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Air Products and Chemicals, Inc., Parker Hannifin Corporation, Linde plc, Hydrogenics (a Cummins Inc. company) |

| Last Modified Date | 31 January 2026 |

Laboratory Gas Generators Market Overview

Customize Laboratory Gas Generators Market Report market research report

- ✔ Get in-depth analysis of Laboratory Gas Generators market size, growth, and forecasts.

- ✔ Understand Laboratory Gas Generators's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laboratory Gas Generators

What is the Market Size & CAGR of Laboratory Gas Generators market in 2023?

Laboratory Gas Generators Industry Analysis

Laboratory Gas Generators Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Laboratory Gas Generators Market Analysis Report by Region

Europe Laboratory Gas Generators Market Report:

In Europe, the market size starts at USD 0.48 billion in 2023, projected to increase to USD 0.88 billion by 2033. Stringent regulations on gas safety and efficiency drive adoption among laboratories across the region.Asia Pacific Laboratory Gas Generators Market Report:

In the Asia Pacific region, the Laboratory Gas Generators market was valued at USD 0.28 billion in 2023 and is projected to reach USD 0.51 billion by 2033. Rapid industrialization, coupled with growth in R&D activities, particularly in pharmaceuticals and environmental monitoring, is driving this growth.North America Laboratory Gas Generators Market Report:

North America, holding the largest market share with a valuation of USD 0.57 billion in 2023, is expected to expand to USD 1.05 billion by 2033. The prevalence of advanced laboratories and a focus on efficient gas production are major growth engines.South America Laboratory Gas Generators Market Report:

South America records a market size of USD 0.14 billion in 2023, forecasted to grow to USD 0.27 billion by 2033. The improving laboratory infrastructure and increased investments in environmental testing are key factors boosting the market.Middle East & Africa Laboratory Gas Generators Market Report:

The MEA region, albeit smaller, shows growth potential from USD 0.04 billion in 2023 to USD 0.07 billion by 2033, as laboratories advance in technology and seek better gas generation solutions.Tell us your focus area and get a customized research report.

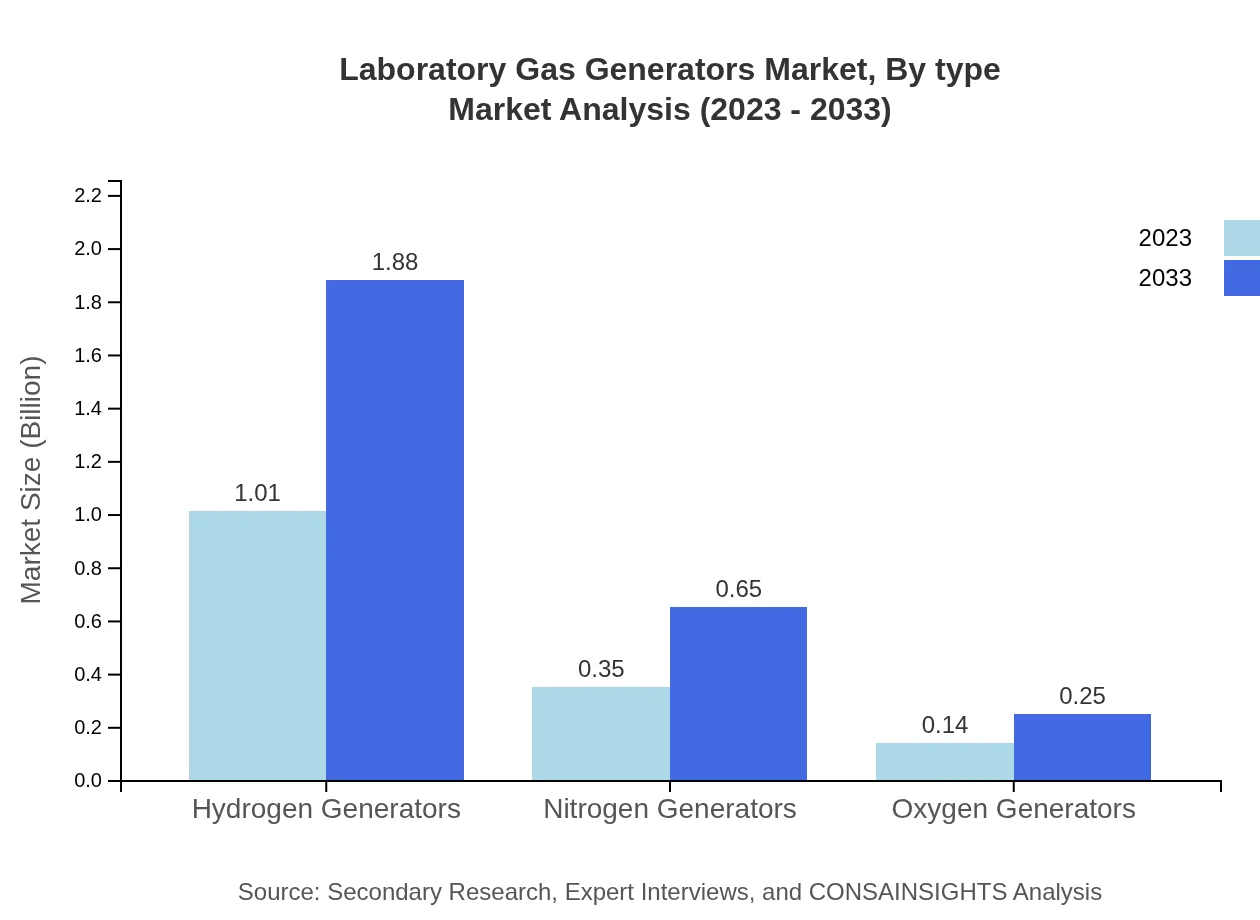

Laboratory Gas Generators Market Analysis By Type

Hydrogen Generators dominate the market with a size of USD 1.01 billion in 2023, expected to reach USD 1.88 billion by 2033, holding a 67.61% market share. Nitrogen Generators follow at USD 0.35 billion, growing to USD 0.65 billion (23.3% share). Oxygen Generators account for USD 0.14 billion, projected to reach USD 0.25 billion (9.09% share).

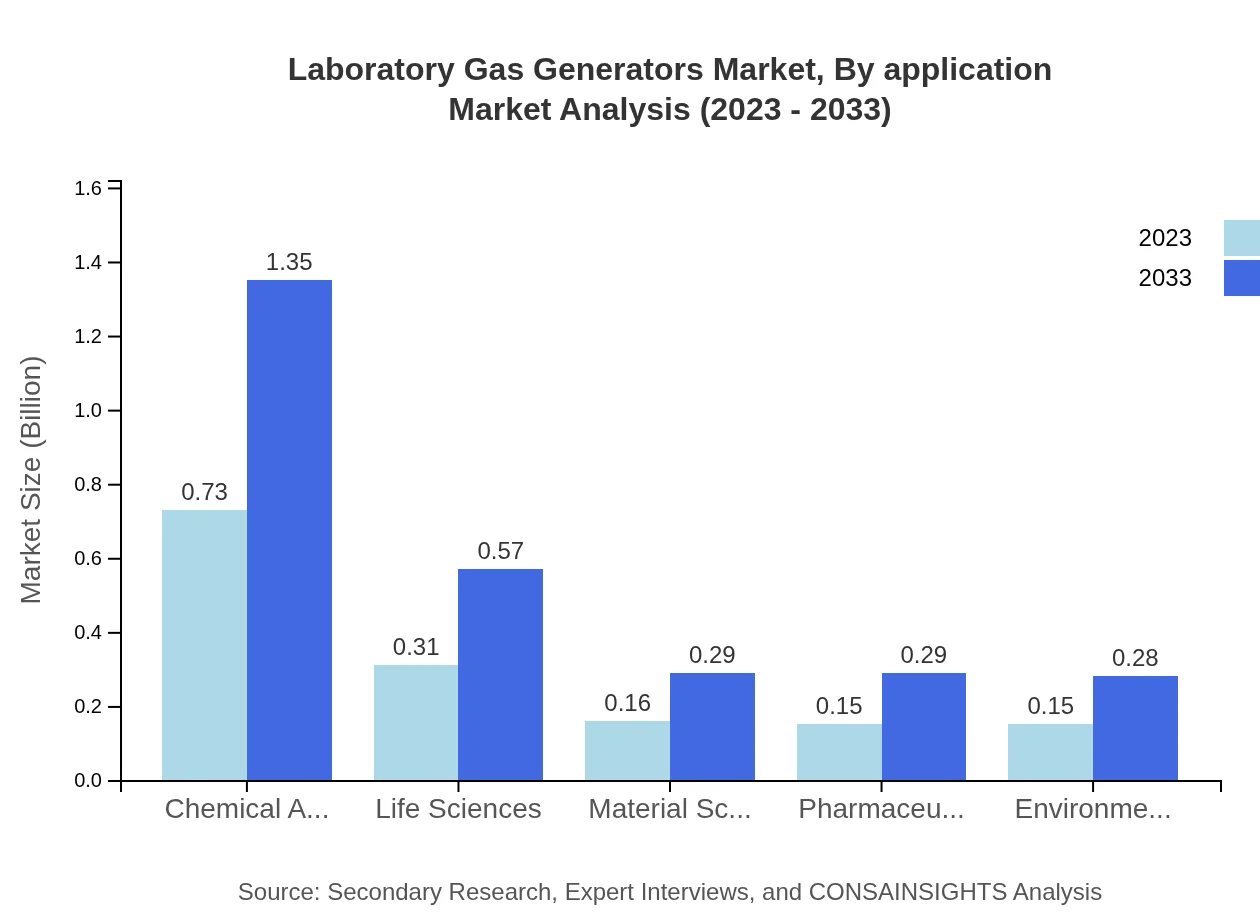

Laboratory Gas Generators Market Analysis By Application

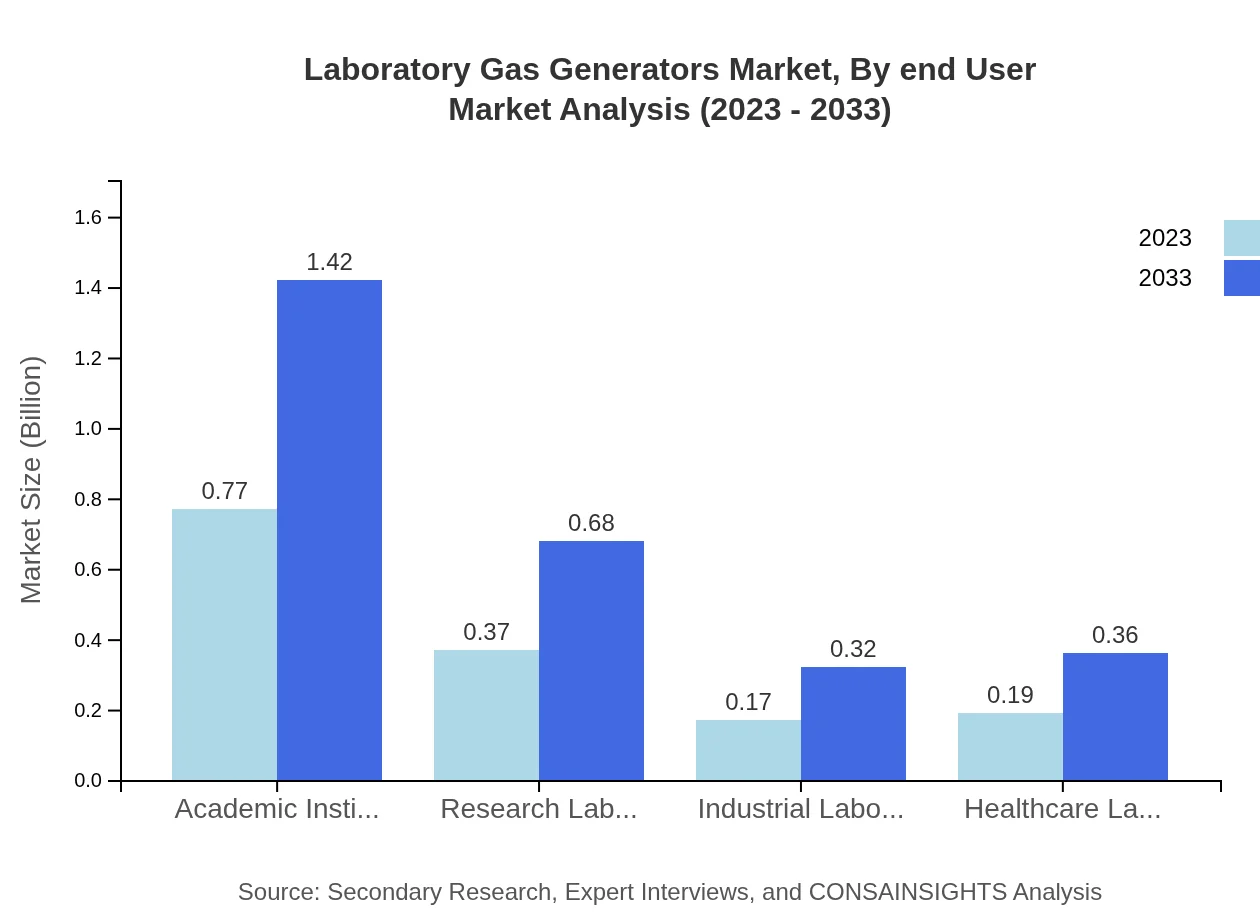

Academic Institutions dominate the application segment with USD 0.77 billion in 2023, anticipated to rise to USD 1.42 billion (51.27% share). Research Laboratories represent USD 0.37 billion (24.41% share), while Industrial Laboratories account for USD 0.17 billion (11.46% share), highlighting the significant role of educational and research sectors.

Laboratory Gas Generators Market Analysis By End User

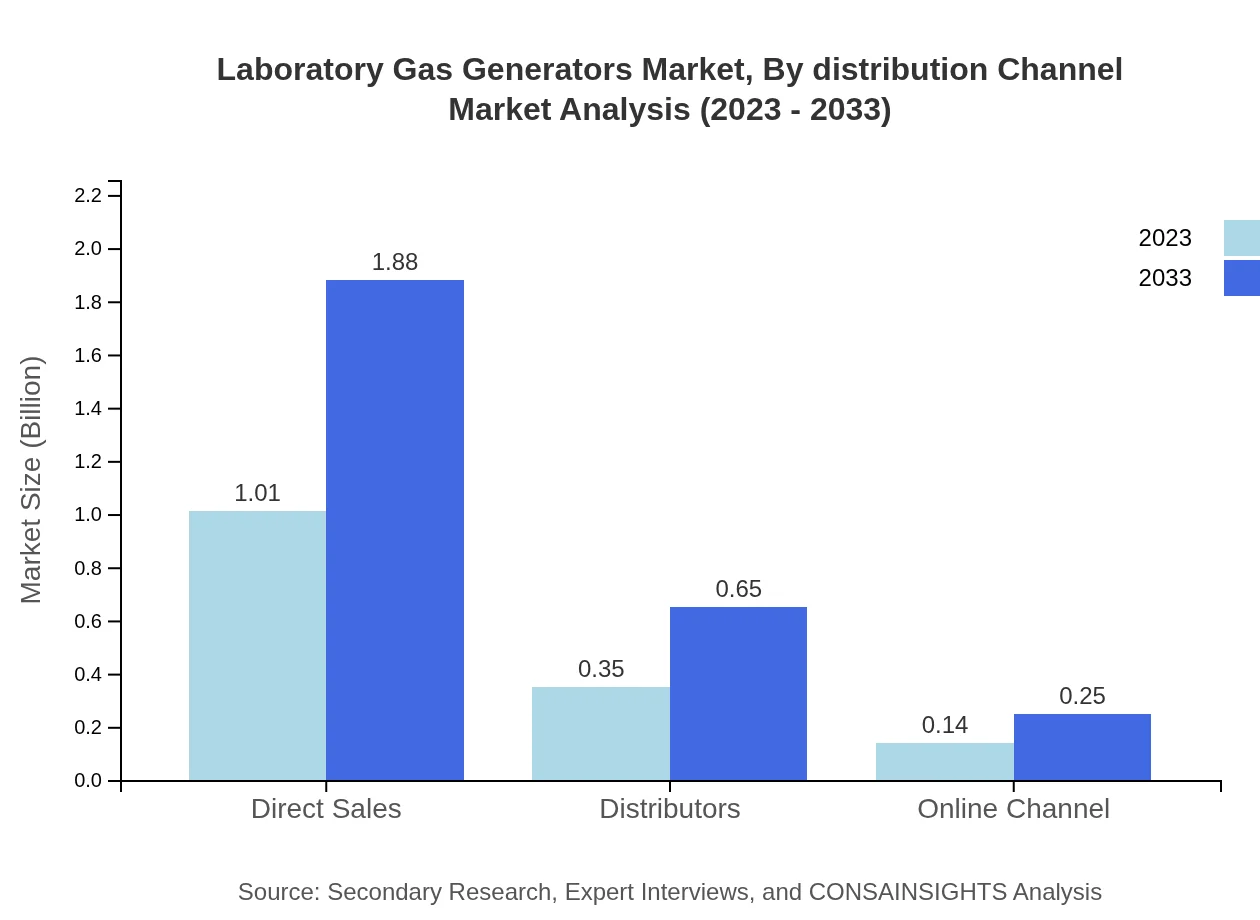

Direct Sales hold a share of 67.61% with USD 1.01 billion in 2023, projected to reach USD 1.88 billion. Distributors account for USD 0.35 billion (23.3% share), while Online Channels reach USD 0.14 billion (9.09% share), indicating a shift in sales approaches within the market.

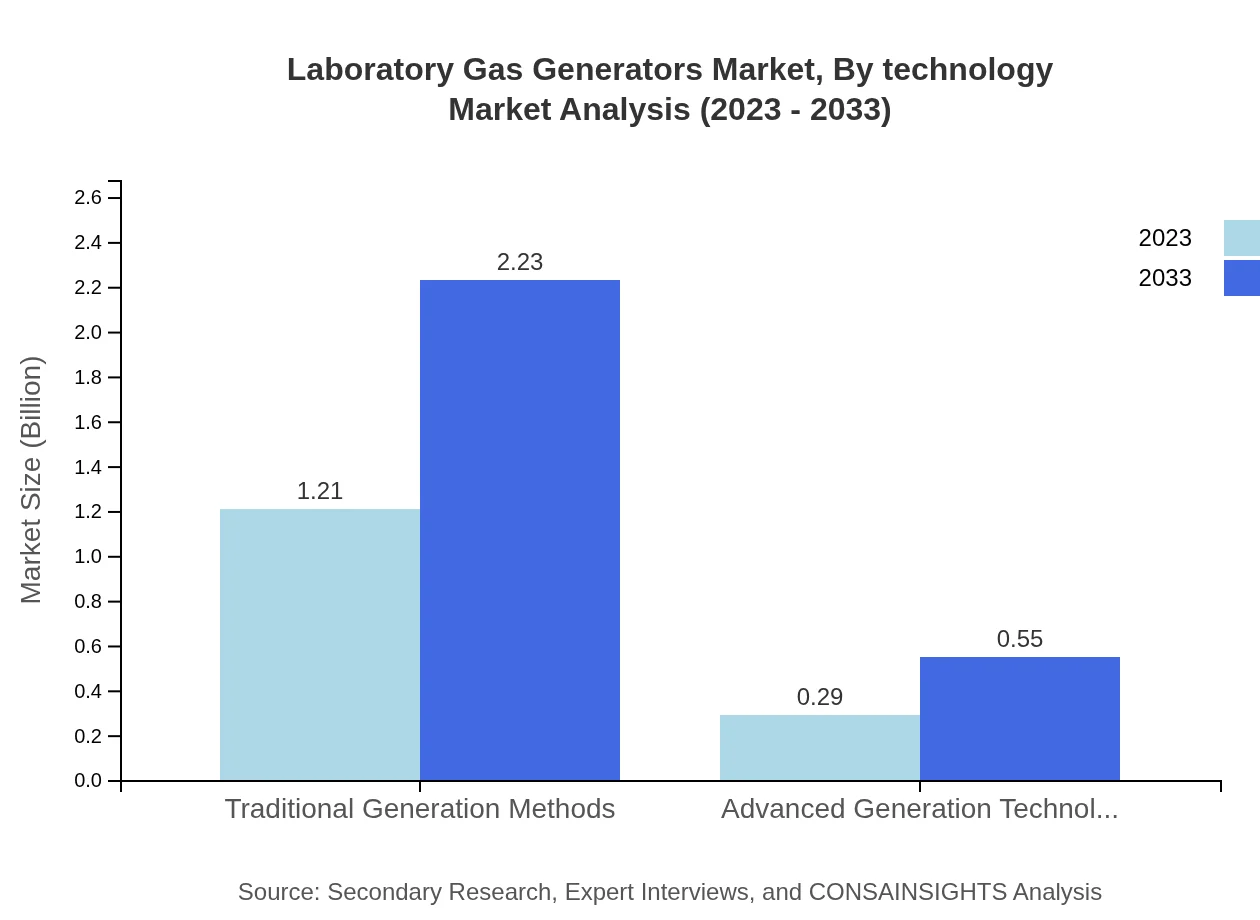

Laboratory Gas Generators Market Analysis By Technology

The market trends favoring Traditional Generation Methods contribute to a size of USD 1.21 billion in 2023, expanding to USD 2.23 billion (80.37% share). Advanced Generation Technologies show growth as well but stand at USD 0.29 billion (19.63% share), indicating an ongoing transition towards innovative technologies.

Laboratory Gas Generators Market Analysis By Distribution Channel

The distribution channels reveal Direct Sales as the primary mode, contributing USD 1.01 billion and expected to reach USD 1.88 billion by 2033, showcasing the rising reliance on direct vendor relationships in this market.

Laboratory Gas Generators Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laboratory Gas Generators Industry

Air Products and Chemicals, Inc.:

A leading supplier of industrial gases, Air Products offers a range of laboratory gas generators that support improved workflows and safety in laboratory settings.Parker Hannifin Corporation:

Parker Hannifin is known for its innovative gas generation technology and is committed to providing advanced solutions for laboratory and industrial applications.Linde plc:

Linde is a major global player in the industrial gas sector, specializing in high-efficiency gas generation systems that are integral to laboratory operations.Hydrogenics (a Cummins Inc. company):

Hydrogenics provides cutting-edge hydrogen generation technologies, focusing on sustainability and efficiency for laboratory gas generation solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of laboratory Gas Generators?

The global laboratory gas generators market is valued at approximately $1.5 billion in 2023, with a projected CAGR of 6.2%. This growth reflects increasing demand for efficient and cost-effective laboratory gas solutions over the next decade.

What are the key market players or companies in this laboratory Gas Generators industry?

Key players in the laboratory gas generators market include Parker Hannifin, Air Products and Chemicals, Inc., and Peak Scientific. These companies dominate through innovation, quality of products, and extensive distribution networks globally.

What are the primary factors driving the growth in the laboratory Gas Generators industry?

Growth drivers for the laboratory gas generators industry include the rise in research activities, advancements in laboratory technology, increasing demand for specialty gases, and the trend towards automation in laboratories, enhancing operational efficiency.

Which region is the fastest Growing in the laboratory Gas Generators?

North America is the fastest-growing region in the laboratory gas generators market, expected to grow from $0.57 billion in 2023 to $1.05 billion by 2033. This growth is propelled by significant investments in research and healthcare sectors.

Does ConsaInsights provide customized market report data for the laboratory Gas Generators industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the laboratory gas generators industry. This includes in-depth analysis, forecasts, and insights tailored to client specifications.

What deliverables can I expect from this laboratory Gas Generators market research project?

Deliverables from the laboratory gas generators market research project include comprehensive market analysis, regional and segment data, competitive landscape insights, and trend forecasts to support strategic decision-making.

What are the market trends of laboratory Gas Generators?

Current trends in the laboratory gas generators market include a shift towards hydrogen generators, increasing demand for advanced generation technologies, and a growing emphasis on sustainability practices within laboratory operations.