Lepidolite Market Report

Published Date: 02 February 2026 | Report Code: lepidolite

Lepidolite Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive overview of the Lepidolite market, covering market trends, forecasts, segmentation, and regional analysis from 2023 to 2033. It aims to furnish stakeholders with valuable insights and data to strategize effectively in this evolving market landscape.

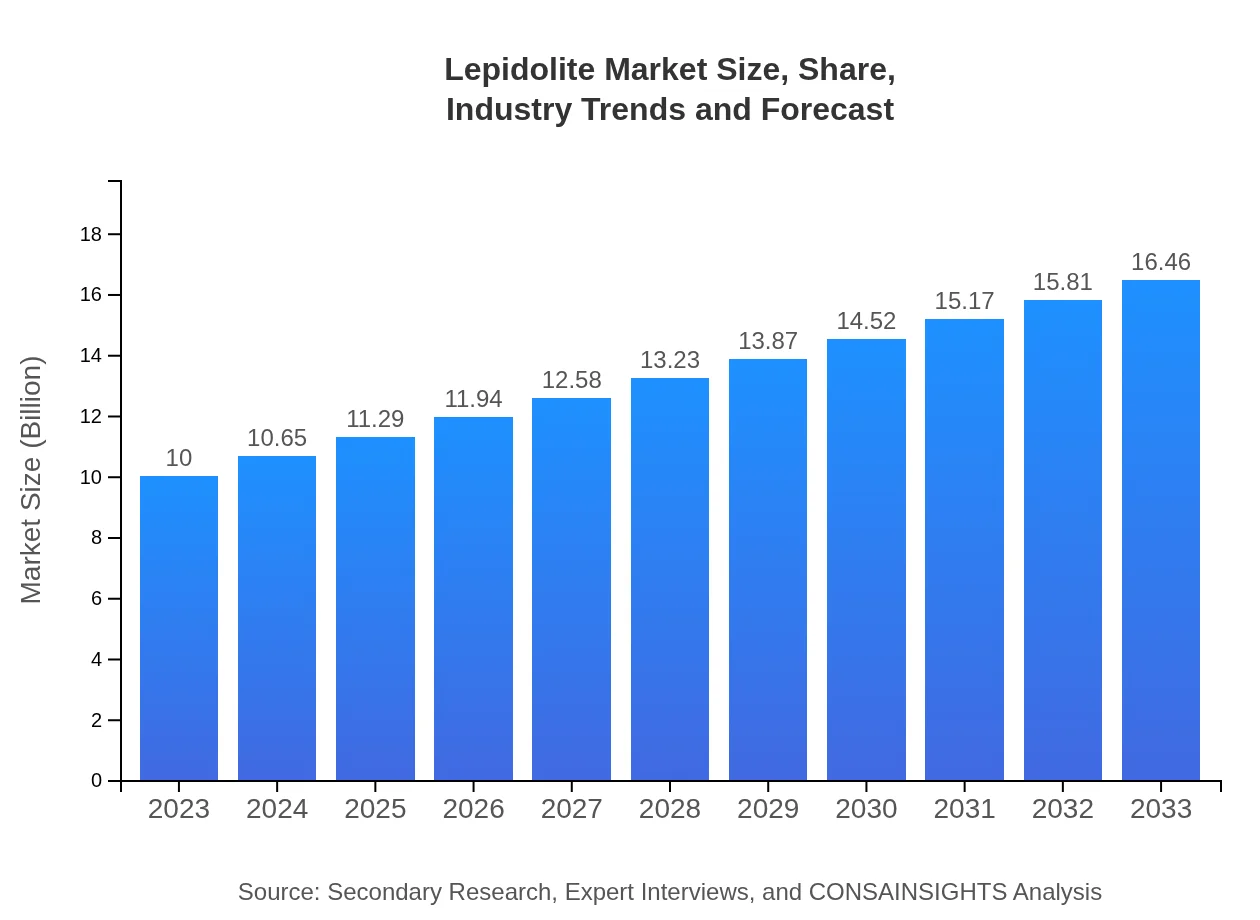

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Albemarle Corporation, SQM (Sociedad Química y Minera de Chile), Orocobre Limited |

| Last Modified Date | 02 February 2026 |

Lepidolite Market Overview

Customize Lepidolite Market Report market research report

- ✔ Get in-depth analysis of Lepidolite market size, growth, and forecasts.

- ✔ Understand Lepidolite's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Lepidolite

What is the Market Size & CAGR of Lepidolite market in 2023 & 2033?

Lepidolite Industry Analysis

Lepidolite Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Lepidolite Market Analysis Report by Region

Europe Lepidolite Market Report:

Europe is experiencing a robust growth trajectory, with expectations to increase from $3.16 billion in 2023 to $5.20 billion in 2033. The region's emphasis on green technologies and renewable energy initiatives contributes to the rising demand for Lepidolite in various applications.Asia Pacific Lepidolite Market Report:

The Asia-Pacific region is poised for notable market expansion, with a projected increase from $1.89 billion in 2023 to $3.12 billion in 2033. This growth is fueled by the high demand for electric vehicles and lithium-ion batteries, especially in countries like China and Japan. The strong manufacturing sector in the region further enhances market dynamics as industries adopt Lepidolite in diverse applications.North America Lepidolite Market Report:

In North America, the market is expected to escalate from $3.56 billion in 2023 to $5.86 billion by 2033. The region benefits from technological advancements in lithium extraction and a burgeoning electric vehicle sector, which amplifies the demand for Lepidolite as a key lithium source.South America Lepidolite Market Report:

South America, with a market value of $0.82 billion in 2023, is anticipated to grow to $1.35 billion by 2033. The presence of significant lithium reserves and a landscape favorable for mining operations position this region as a future leader in Lepidolite production and export, driven by increasing global lithium demand.Middle East & Africa Lepidolite Market Report:

The Middle East and Africa region presents unique opportunities, with a market slated to grow from $0.57 billion in 2023 to $0.94 billion by 2033. Investments in mining infrastructure and the exploration of local resources are central to boosting market presence in this less saturated region.Tell us your focus area and get a customized research report.

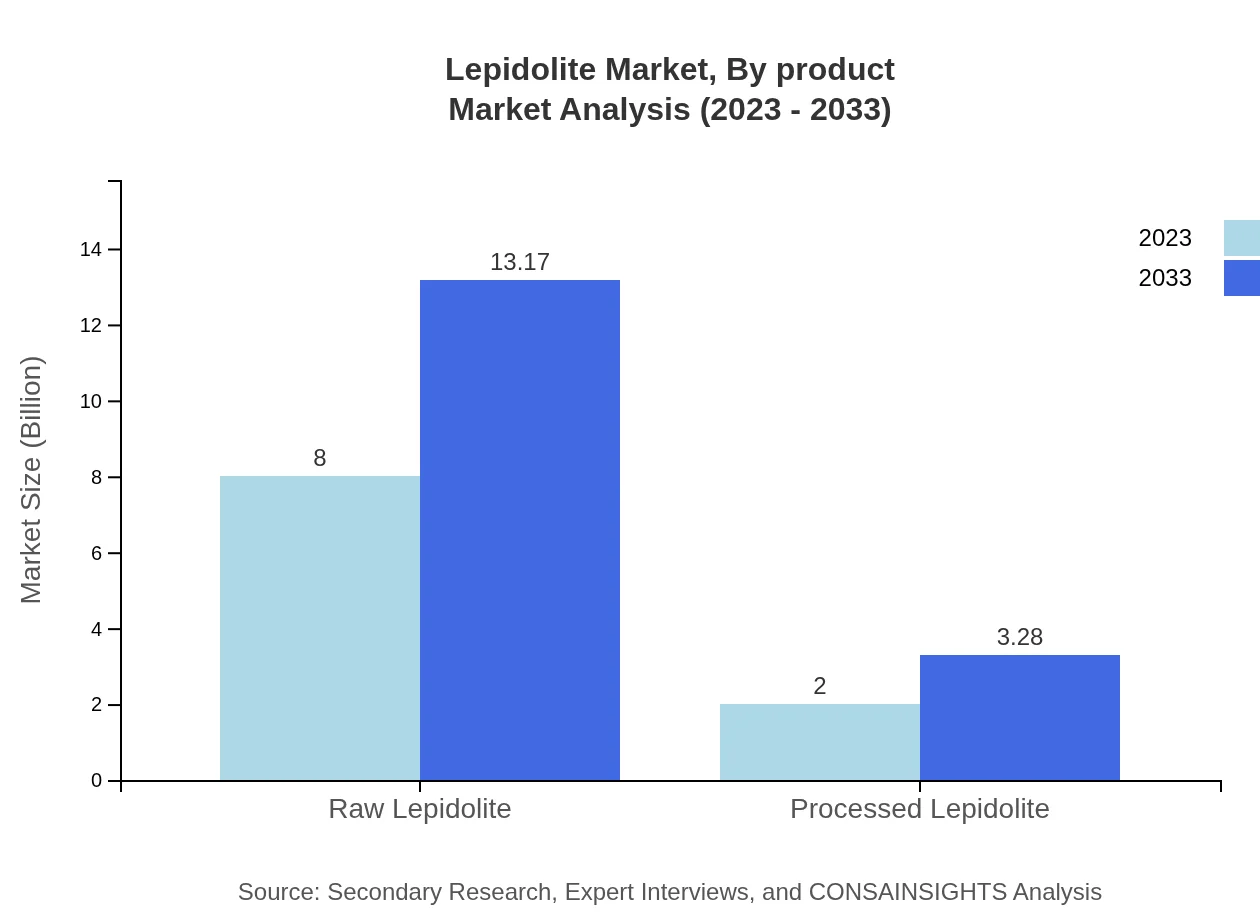

Lepidolite Market Analysis By Product

Raw Lepidolite dominates the market, achieving an impressive market size of $8.00 billion in 2023, expected to grow to $13.17 billion by 2033. Processed Lepidolite, while smaller at $2.00 billion in 2023, exhibits strong growth potential reaching $3.28 billion by 2033. This data underscores the significance of product refinement in enhancing market value and appeal.

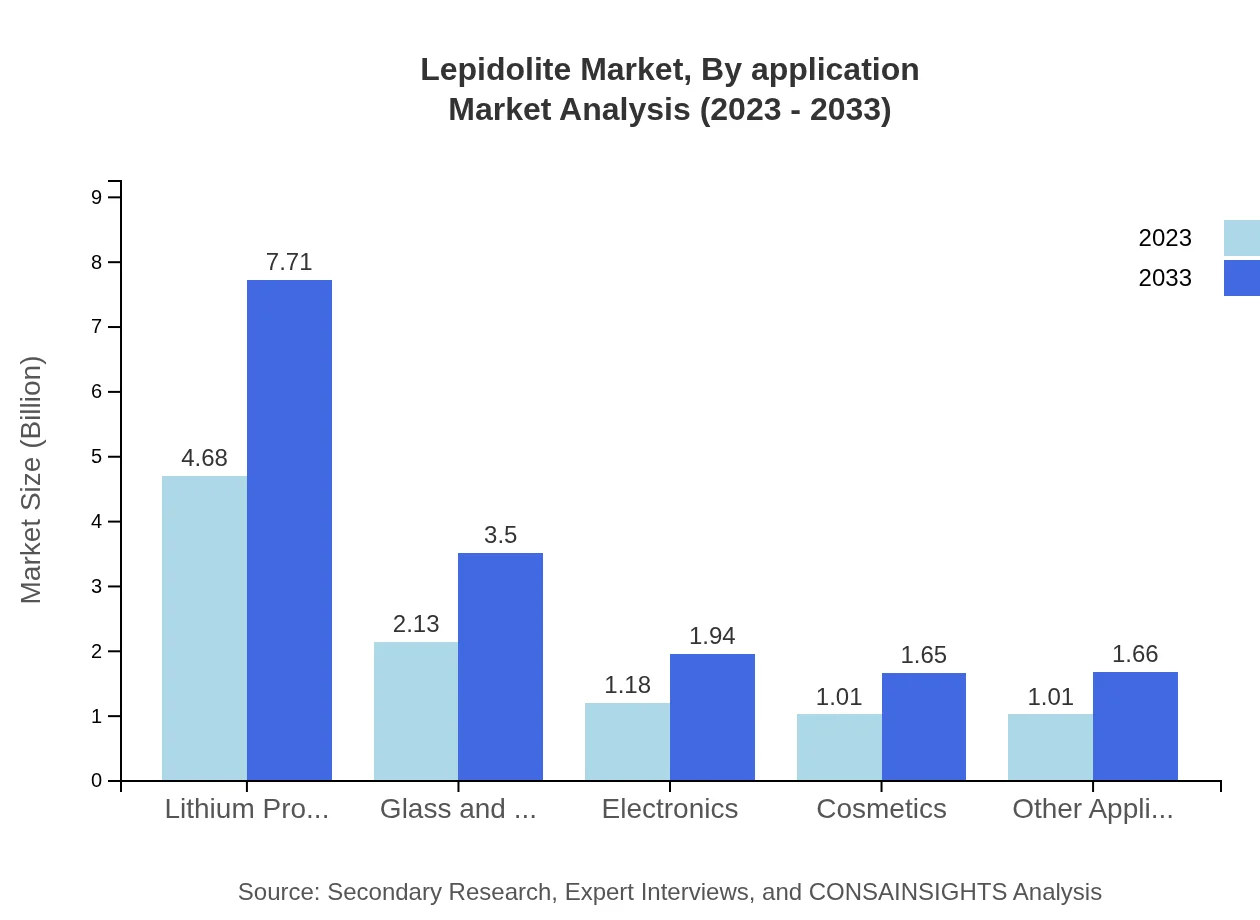

Lepidolite Market Analysis By Application

The primary applications of Lepidolite encompass lithium production, ceramics, electronics, and building materials. Lithium production commands a market size of $4.68 billion in 2023, expected to grow to $7.71 billion by 2033. The ceramics sector follows closely, with a size of $2.13 billion projected to expand to $3.50 billion within the forecast period. This demonstrates the versatility of Lepidolite across different industries.

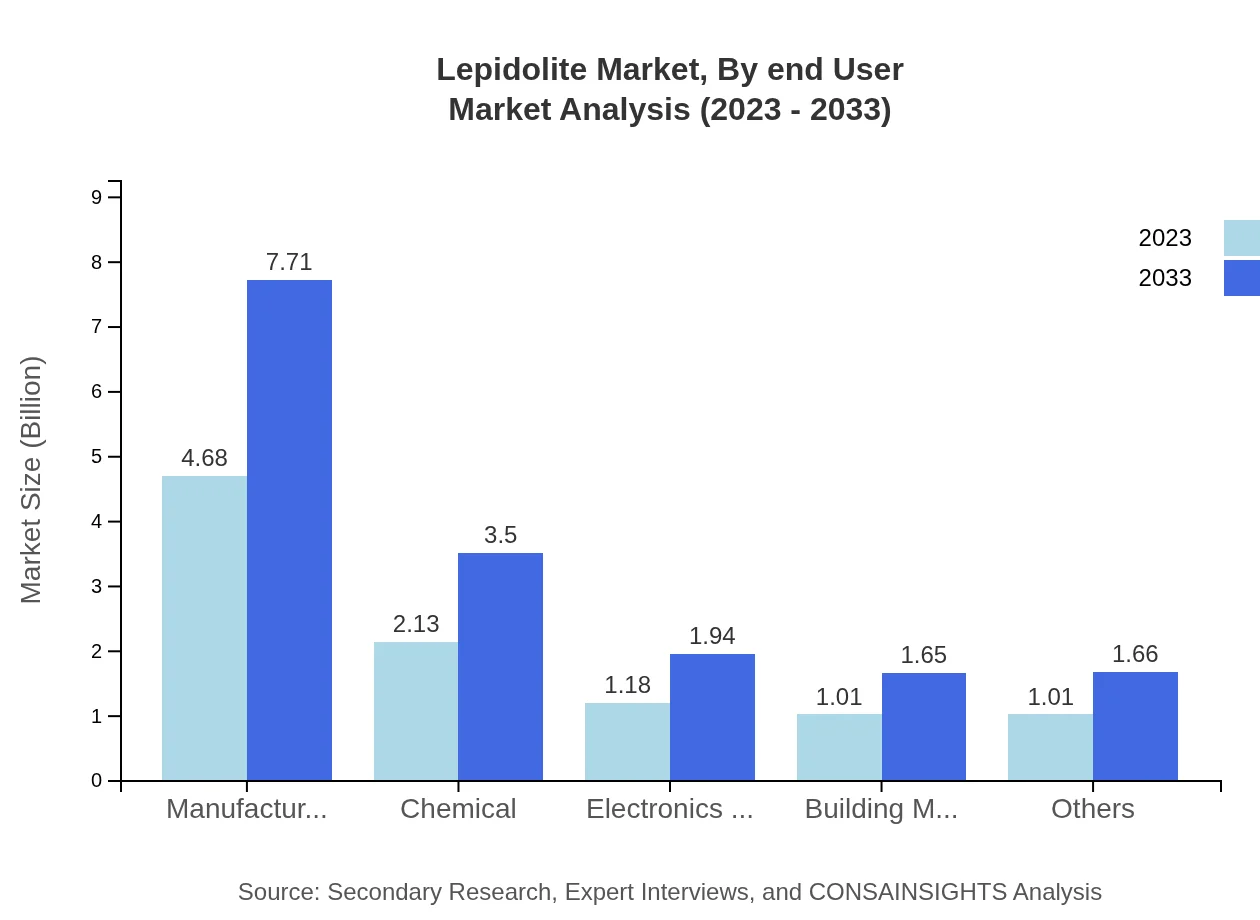

Lepidolite Market Analysis By End User

The end-user industries for Lepidolite are diverse, including automotive, electronics, and construction. The market share for the automotive sector, especially due to electric vehicles, constitutes a significant portion and is projected to expand as technology progresses and consumer preferences shift towards sustainable vehicles and materials.

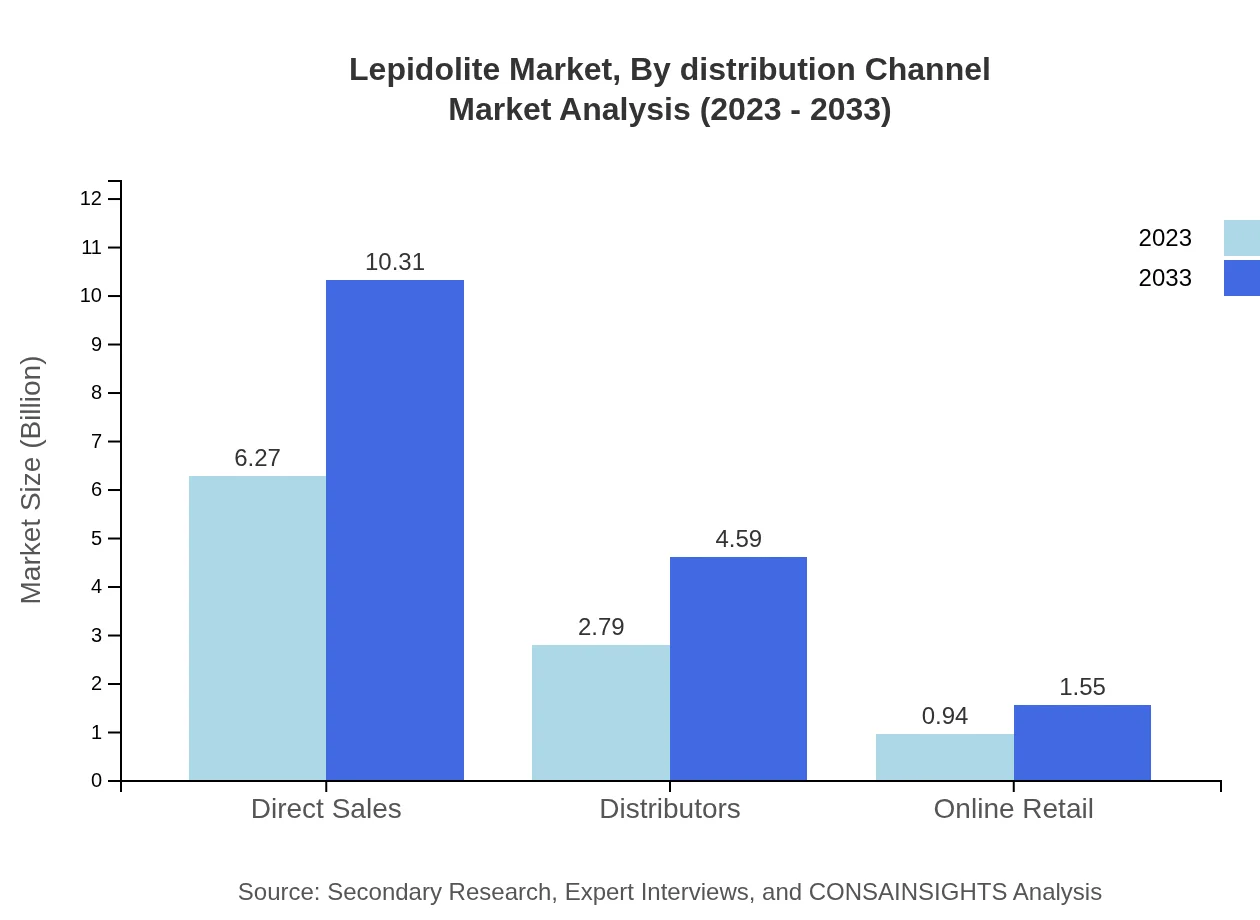

Lepidolite Market Analysis By Distribution Channel

Direct sales channels are the predominant method of distribution, holding a market size of $6.27 billion in 2023. This method is projected to increase to $10.31 billion by 2033, reflecting the tendency of customers to seek direct engagement with manufacturers for bulk and specialized products. Distributors and online retail are also instrumental in market accessibility, enhancing consumer choice and availability.

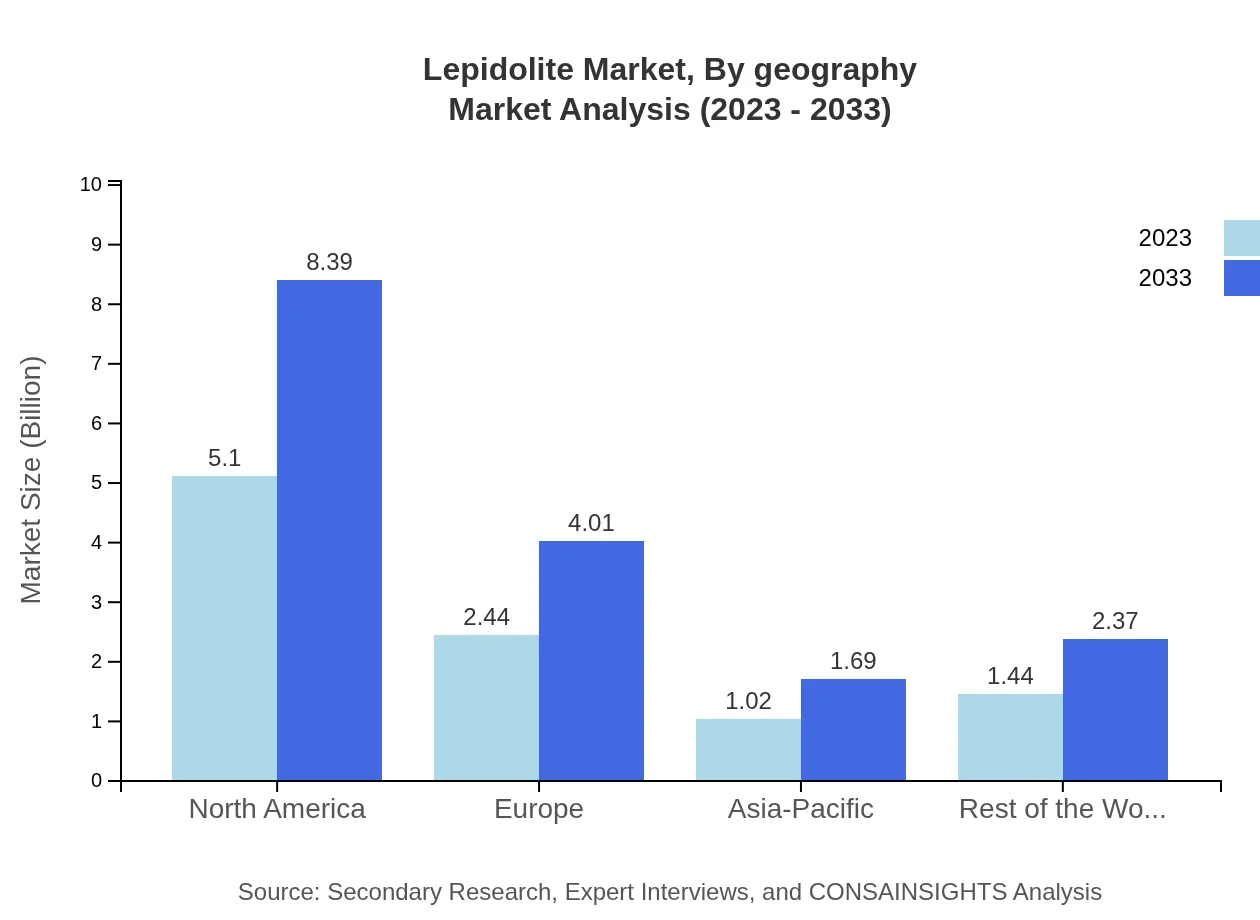

Lepidolite Market Analysis By Geography

Geographically, different regions exhibit varying levels of market dynamics influenced by local consumption rates, mining capabilities, and trade policies. North America and Europe currently dominate the market, but regions like Asia-Pacific and South America are rapidly catching up due to growing consumer markets and increased investment in lithium sourcing.

Lepidolite Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Lepidolite Industry

Albemarle Corporation:

A leading global producer of lithium compounds, Albemarle operates across the lithium supply chain, with a strong emphasis on sustainable operations and innovative extraction technologies.SQM (Sociedad Química y Minera de Chile):

Known for its significant lithium production and strategic investments in sustainable mining practices, SQM plays a vital role in the global supply of Lepidolite.Orocobre Limited:

Orocobre focuses on sustainable lithium mining in South America and contributes to the Lepidolite market with its commitment to environmental standards and community engagement.We're grateful to work with incredible clients.

FAQs

What is the market size of lepidolite?

The lepidolite market is estimated to reach around $10 billion by 2033, growing at a CAGR of 5% from 2023. Significant growth is expected across segments and regions, driven by rising demand in electronics and lithium production.

What are the key market players or companies in the lepidolite industry?

Key players in the lepidolite market include major mining companies and chemical manufacturers focusing on lithium extraction. These companies are enhancing their production capabilities to meet increasing demands from various industries.

What are the primary factors driving the growth in the lepidolite industry?

Driving factors include the rising demand for lithium in battery manufacturing, advancements in electronic gadgets, and increase in application in cosmetics and construction materials. Sustainability in mining practices also plays a crucial role.

Which region is the fastest Growing in the lepidolite?

North America is the fastest growing region for lepidolite, projected to reach approximately $5.86 billion by 2033. Europe and Asia-Pacific are also significant markets contributing to the overall growth.

Does ConsaInsights provide customized market report data for the lepidolite industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the lepidolite industry. This includes market size, growth trends, and competitive analysis.

What deliverables can I expect from this lepidolite market research project?

Deliverables include comprehensive reports detailing market size, trends, growth forecasts, regional analysis, and competitive landscape. Additionally, segment-specific insights will be provided for informed business decisions.

What are the market trends of lepidolite?

Current trends include increased investment in lithium production, higher demand for sustainable mining practices, and growth in electric vehicle markets. There is also a noted shift towards processed lepidolite products across industries.