Platinum Group Metals Market Report

Published Date: 02 February 2026 | Report Code: platinum-group-metals

Platinum Group Metals Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report analyzes the Platinum Group Metals (PGM) market, providing insights into market size, segmentation, regional trends, technological advancements, and key players. The forecast spans from 2023 to 2033, delivering data-driven predictions and trends to inform industry stakeholders.

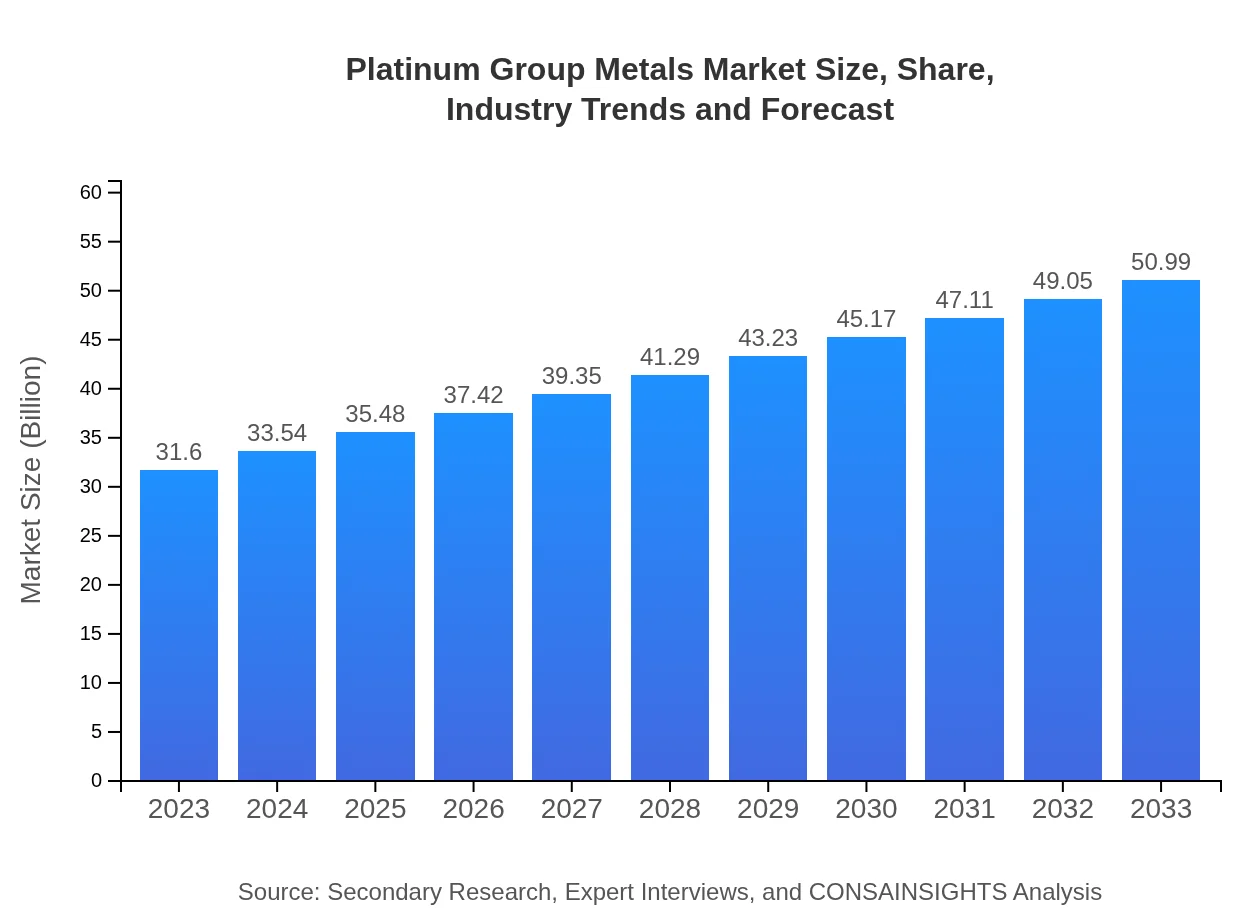

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $31.60 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $50.99 Billion |

| Top Companies | Anglo American Platinum, Impala Platinum Holdings, Norilsk Nickel, Sibanye Stillwater |

| Last Modified Date | 02 February 2026 |

Platinum Group Metals Market Overview

Customize Platinum Group Metals Market Report market research report

- ✔ Get in-depth analysis of Platinum Group Metals market size, growth, and forecasts.

- ✔ Understand Platinum Group Metals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Platinum Group Metals

What is the Market Size & CAGR of Platinum Group Metals market in 2023?

Platinum Group Metals Industry Analysis

Platinum Group Metals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Platinum Group Metals Market Analysis Report by Region

Europe Platinum Group Metals Market Report:

Europe, a leading region in PGM consumption, expects to grow from $10.06 billion in 2023 to $16.23 billion by 2033. The European Union's commitment to low emissions fuels demand for catalytic converters in vehicles. Additionally, the rebounding jewelry market offers significant opportunities, which aligns with growing consumer preferences for sustainable products.Asia Pacific Platinum Group Metals Market Report:

The Asia Pacific region is witnessing dynamic growth, with a market size projected to rise from $6.07 billion in 2023 to $9.79 billion by 2033. Key countries such as China and Japan dominate demand, primarily due to the automotive and electronics sectors. The region's growth is further supported by investments in green technologies and increased adoption of electric vehicles.North America Platinum Group Metals Market Report:

North America displays a robust market landscape, with a size anticipated to increase from $10.65 billion in 2023 to $17.19 billion in 2033. The presence of advanced automotive manufacturers and strong regulatory frameworks promoting emission reduction are critical growth drivers. Investments in innovative battery technologies also provide new avenues for PGM utilization.South America Platinum Group Metals Market Report:

In South America, the market is expected to grow from $1.79 billion in 2023 to around $2.88 billion by 2033. Limited mining activities and a nascent recycling industry present both challenges and opportunities. Countries like Brazil are focusing on developing local industries that could increase the use of PGMs in emerging applications, invigorating market demand.Middle East & Africa Platinum Group Metals Market Report:

The Middle East and Africa region's market is evolving, forecasted to expand from $3.04 billion in 2023 to $4.90 billion by 2033. South Africa remains a key player due to its vast PGM reserves. The regional dynamics are shifting towards technological innovations in mining and refining processes, enhancing product availability and driving market growth.Tell us your focus area and get a customized research report.

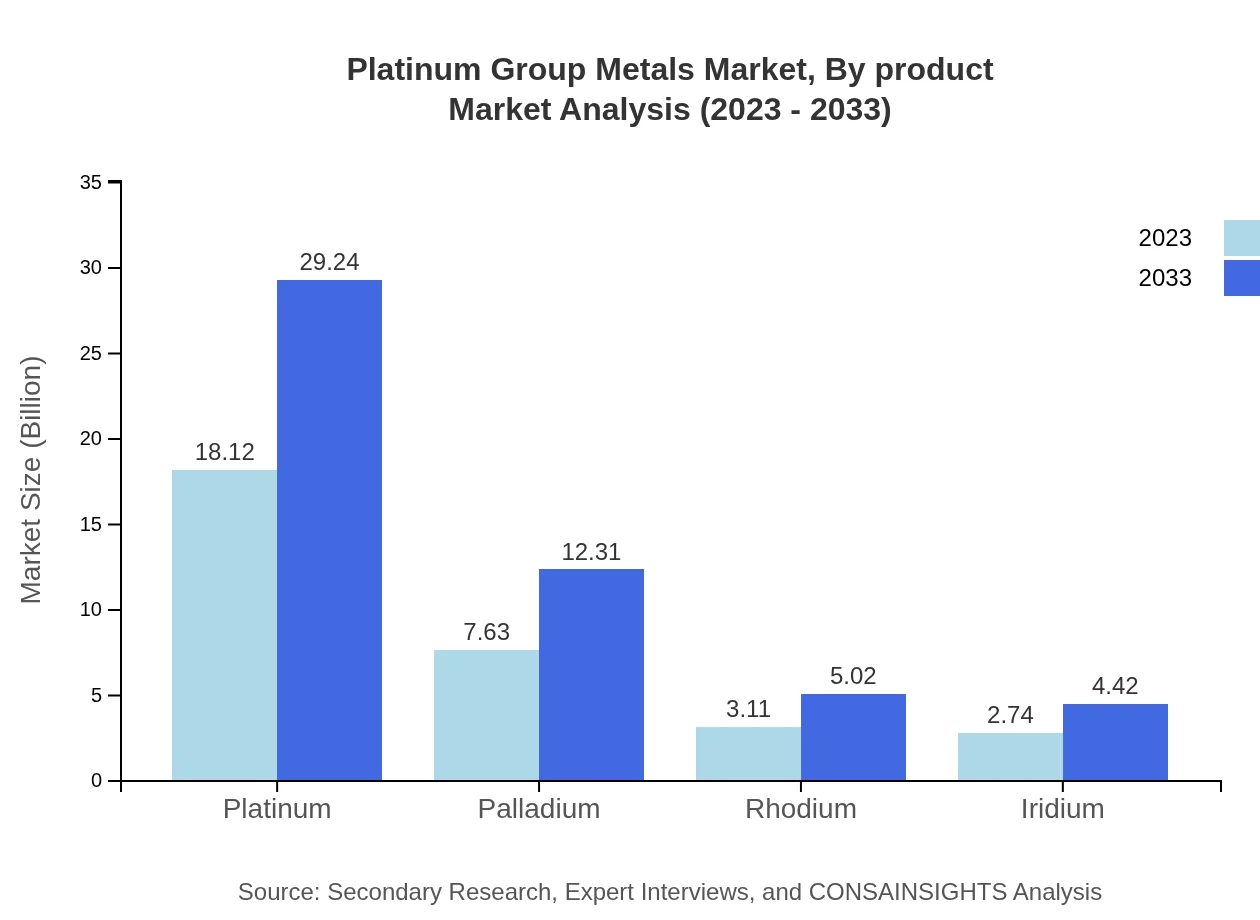

Platinum Group Metals Market Analysis By Product

The primary products in the PGM market are platinum, palladium, rhodium, and iridium. Platinum shows a significant market size increase from $18.12 billion in 2023 to $29.24 billion by 2033. Palladium follows with $7.63 billion in 2023, growing to $12.31 billion by 2033. Rhodium and iridium also contribute, with their respective valuations growing from $3.11 billion to $5.02 billion for rhodium, and $2.74 billion to $4.42 billion for iridium during the same period.

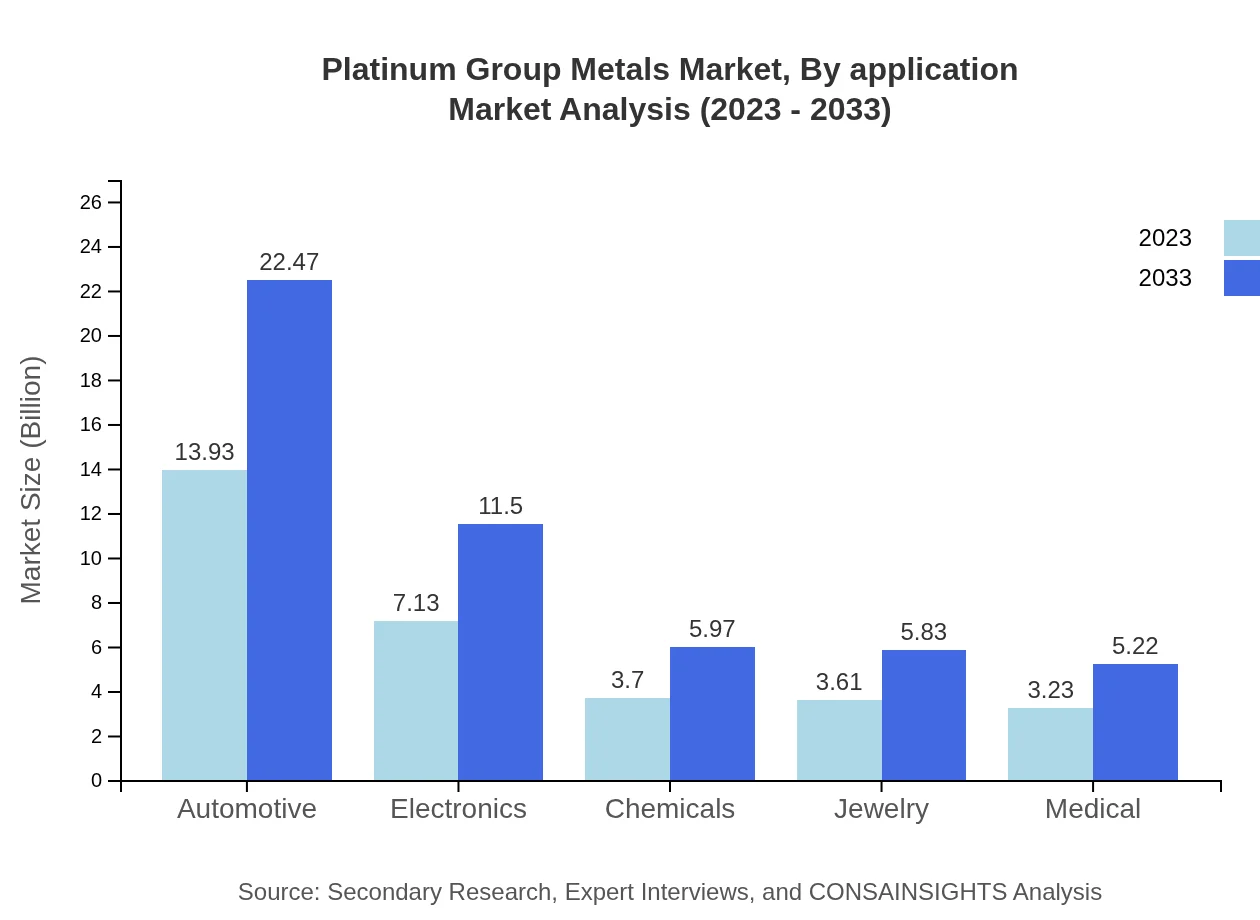

Platinum Group Metals Market Analysis By Application

The automotive industry dominates the PGM application segment, with an anticipated increase from $13.93 billion in 2023 to $22.47 billion by 2033, accounting for 44.07% of the overall market share. Other key applications include electronics with a size of $7.13 billion growing to $11.50 billion, chemical manufacturing from $3.70 billion to $5.97 billion, and jewelry manufacturing from $3.61 billion to $5.83 billion, showing stable demand across the sector.

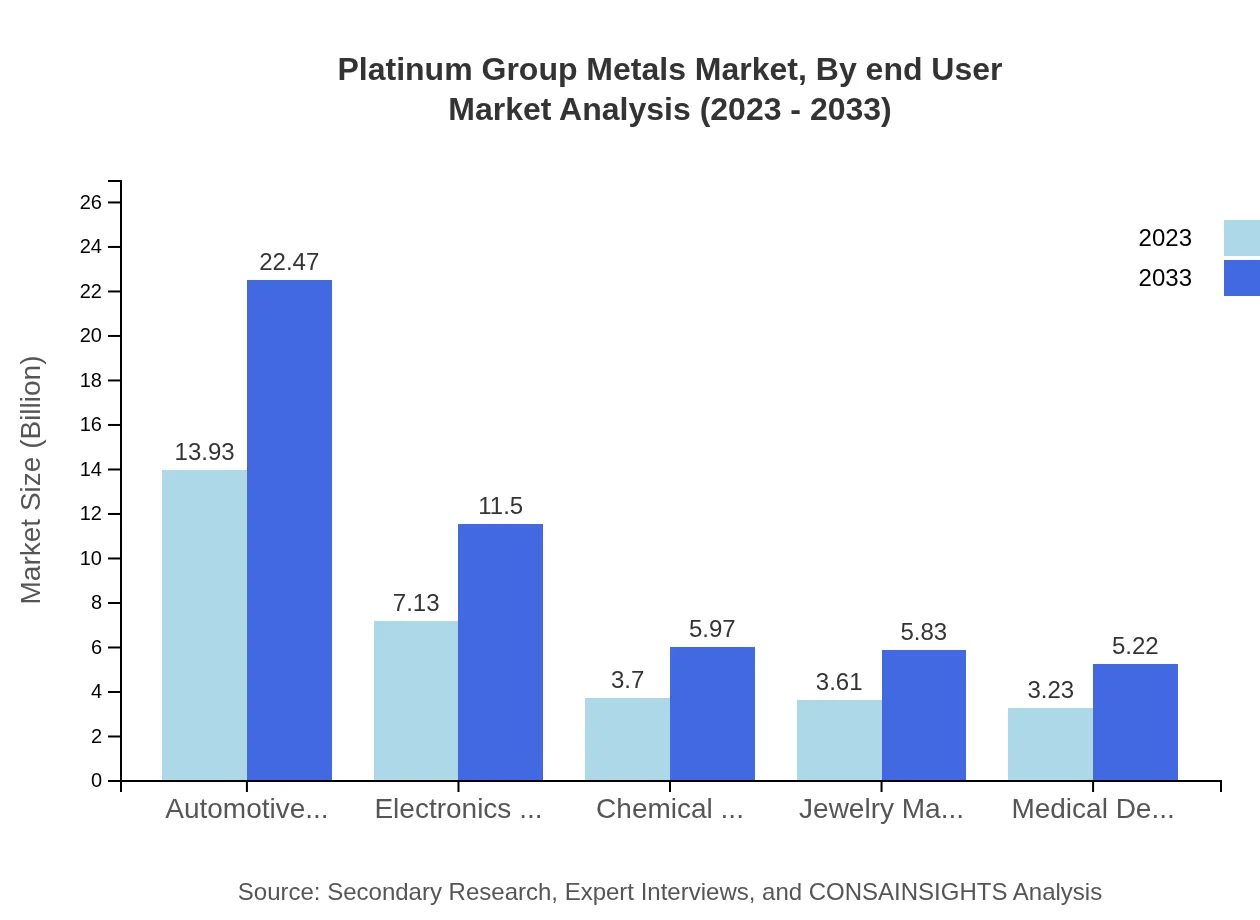

Platinum Group Metals Market Analysis By End User

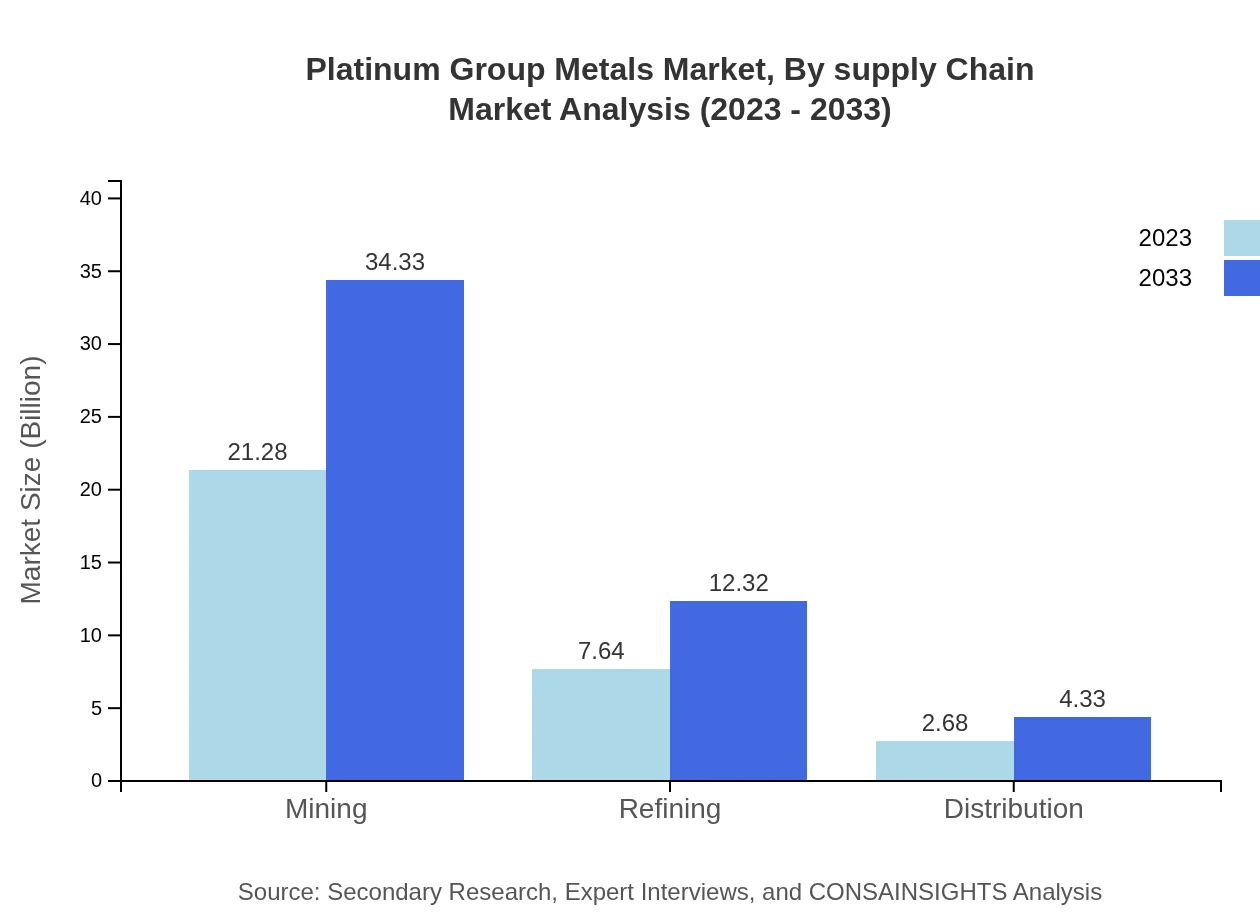

The end-user segmentation reflects varying dependency on PGMs, with the mining industry commanding a robust share of 67.34% in 2023, projected to rise alongside refining which grows from $7.64 billion to $12.32 billion. Distribution networks are also strengthening, with incremental growth from $2.68 billion to $4.33 billion as market dynamics shift, influenced by both local and global demand trends.

Platinum Group Metals Market Analysis By Supply Chain

The PGM supply chain involves extraction, refining, and distribution processes. The mining segment remains the largest contributor, yet an upward trend in refining capabilities denotes a transformation towards sustainable practices. The analysis indicates a gradual shift towards more integrated supply chain approaches, positioning companies to harness innovative recycling methods, further reducing environmental footprint and bolstering market position.

Platinum Group Metals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Platinum Group Metals Industry

Anglo American Platinum:

A leading PGM producer with a significant market share and commitment to sustainable mining practices, focusing on harnessing technology for improved efficiency.Impala Platinum Holdings:

One of the largest platinum producers, known for its extensive operations in South Africa, focusing on innovation and responsible production methodologies.Norilsk Nickel:

A diversified mining company and a major player in the PGM market, recognized for its strategic advancements in sustainable mining and processing.Sibanye Stillwater:

A prominent global player in precious metals, with significant investments in PGM mining and a strong focus on sustainability and community engagement.We're grateful to work with incredible clients.

FAQs

What is the market size of platinum Group Metals?

The platinum-group-metals market is valued at approximately $31.6 billion in 2023, with a compound annual growth rate (CAGR) of 4.8% projected until 2033, indicating substantial growth and demand across various industries.

What are the key market players or companies in this platinum Group Metals industry?

Major players in the platinum-group-metals market include Anglo American Platinum, Impala Platinum, and Norilsk Nickel, which dominate the production and distribution, significantly impacting global supply and pricing strategies.

What are the primary factors driving the growth in the platinum Group Metals industry?

Key growth drivers include rising demand in the automotive sector for catalytic converters, increased utilization in electronics, and a growing interest in investment by consumers, all supporting the expanding market landscape.

Which region is the fastest Growing in the platinum Group Metals?

North America is the fastest-growing region, expanding from a market size of $10.65 billion in 2023 to $17.19 billion in 2033, driven by automotive industry demands and technological advancements.

Does ConsaInsights provide customized market report data for the platinum Group Metals industry?

Yes, ConsaInsights offers customized market report data tailored to specific inquiries and business needs, providing clients with detailed insights and analyses pertinent to the platinum-group-metals industry.

What deliverables can I expect from this platinum Group Metals market research project?

Deliverables include comprehensive reports featuring market size, growth forecasts, strategic insights, competitive analysis, and region-specific trends, ensuring clients are well-informed for decision-making.

What are the market trends of platinum Group Metals?

Current market trends indicate a shift towards sustainable sourcing of platinum-group-metals, increased investment in clean technologies, and a projected rise in applications across various industrial sectors, which are reshaping the landscape.