Log Management Market Report

Published Date: 31 January 2026 | Report Code: log-management

Log Management Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Log Management market, providing comprehensive insights and data from 2023 to 2033, including market size, growth projections, industry dynamics, segmentation, and key players that shape the landscape.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $15.33 Billion |

| Top Companies | Splunk Inc., Loggly (SolarWinds), ELK Stack (Elastic), IBM QRadar, Sumo Logic |

| Last Modified Date | 31 January 2026 |

Log Management Market Overview

Customize Log Management Market Report market research report

- ✔ Get in-depth analysis of Log Management market size, growth, and forecasts.

- ✔ Understand Log Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Log Management

What is the Market Size & CAGR of Log Management market in 2023 and 2033?

Log Management Industry Analysis

Log Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Log Management Market Analysis Report by Region

Europe Log Management Market Report:

Europe's market is projected to evolve from USD 1.51 billion in 2023 to USD 4.14 billion by 2033. The region's robust regulatory landscape encourages organizations to invest significantly in log management, driving innovations and technological adaptations across various industries, especially in healthcare and manufacturing.Asia Pacific Log Management Market Report:

In 2023, the Log Management market in the Asia Pacific region is valued at USD 1.20 billion, projected to grow to USD 3.27 billion by 2033. The rapid digitalization trends in countries like India and China are significant growth drivers, coupled with increasing IT infrastructure investments and a burgeoning emphasis on cybersecurity solutions.North America Log Management Market Report:

North America stands as the largest market for Log Management, with a value of USD 1.98 billion in 2023, anticipated to surge to USD 5.42 billion by 2033. This growth is fueled by increased cybersecurity threats, contributing to heightened demand for comprehensive log management solutions, especially within the BFSI sector and several government initiatives.South America Log Management Market Report:

South America’s Log Management market starts at USD 0.24 billion in 2023 and is expected to reach USD 0.66 billion by 2033. The growing awareness regarding cybersecurity risks and regulatory compliance in sectors such as banking and finance represents key growth opportunities.Middle East & Africa Log Management Market Report:

Valued at USD 0.67 billion in 2023 and expected to grow to USD 1.83 billion by 2033, the Middle East and Africa region is gradually embracing log management solutions. Rising cyber threats and growing awareness of data compliance standards are pivotal to this growth, as industries like oil & gas and telecommunications focus on enhancing their security postures.Tell us your focus area and get a customized research report.

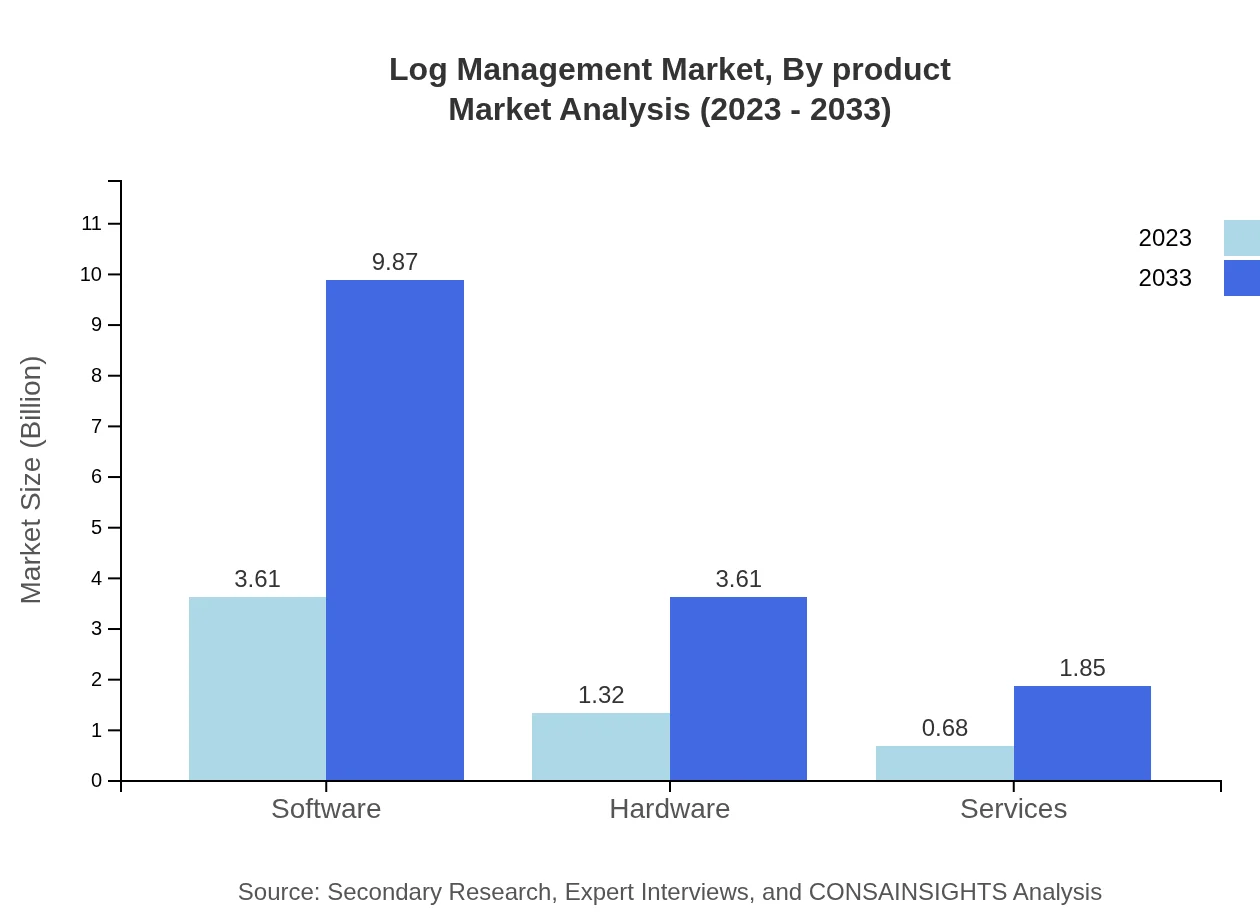

Log Management Market Analysis By Product

The software segment is the largest in the Log Management market, generating USD 3.61 billion in 2023 and expected to reach USD 9.87 billion by 2033, capturing a market share of 64.38%. Hardware products also make a notable contribution, valued at USD 1.32 billion in 2023, expanding to USD 3.61 billion by 2033. Services, although smaller, are critical for delivering continuous support and solution enhancements, worth USD 0.68 billion in 2023 and projected to grow to USD 1.85 billion in 2033.

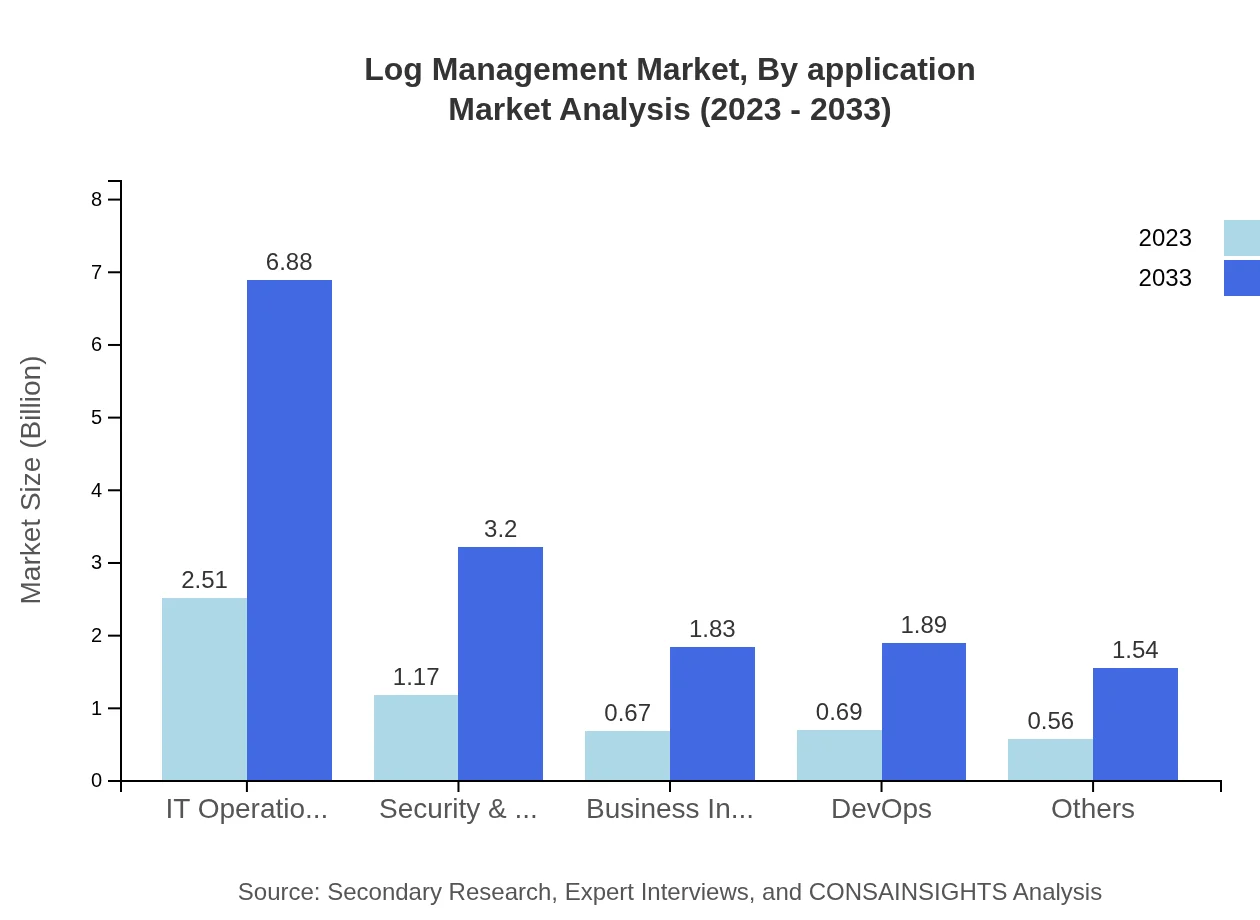

Log Management Market Analysis By Application

Within the Log Management market, IT operations hold a substantial share, accounting for USD 2.51 billion in 2023, projected to grow to USD 6.88 billion by 2033. Security & Compliance follows closely, with a size of USD 1.17 billion in 2023, expected to reach USD 3.20 billion. The BFSI sector highlights the importance of stringent compliance and security mandates driving the need for log management solutions.

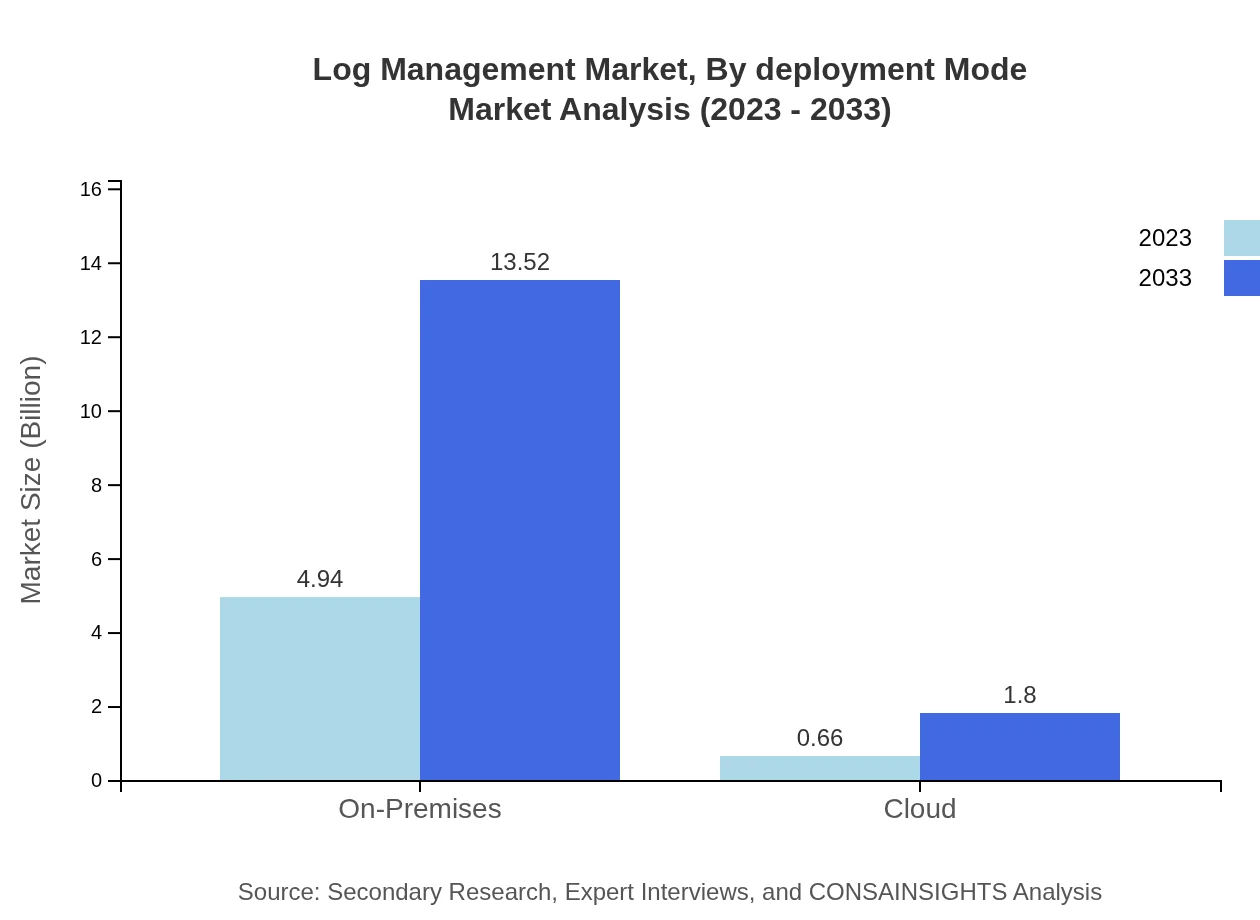

Log Management Market Analysis By Deployment Mode

The deployment mode analysis reveals that on-premises solutions dominate the market with USD 4.94 billion in 2023, maintaining an 88.23% share due to organizations' preferences for data control. In contrast, cloud deployments are also growing, valued at USD 0.66 billion in 2023 and expected to rise to USD 1.80 billion by 2033, reflecting a shift towards flexibility and scalability.

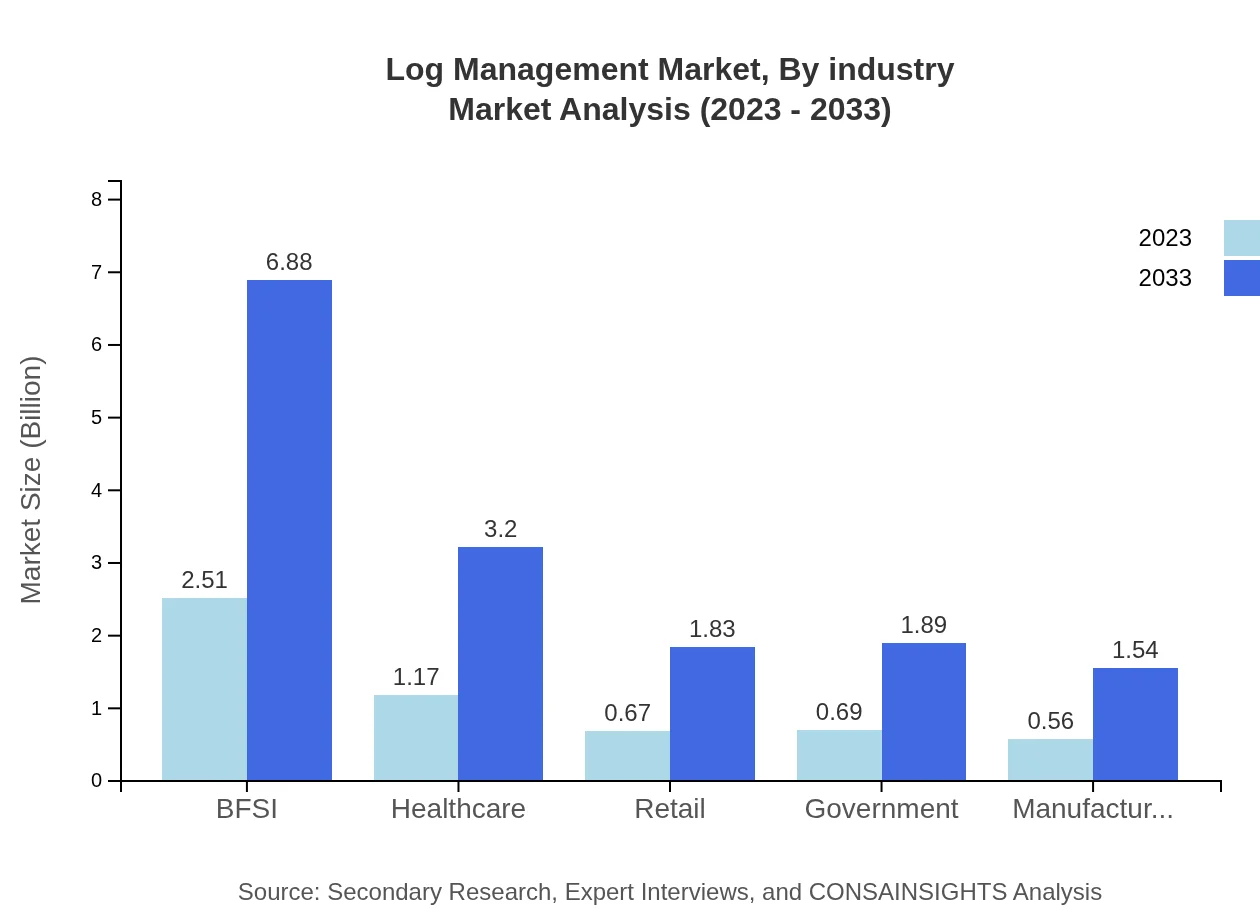

Log Management Market Analysis By Industry

Industries such as BFSI and healthcare are significant consumers of log management solutions, accounting for 44.87% and 20.85% of market shares respectively in 2023. Each sector's increasing regulatory pressures and the necessity for robust cybersecurity measures propel market growth. Emerging sectors, including retail and manufacturing, are also ramping up investments in log management as they digitalize operations.

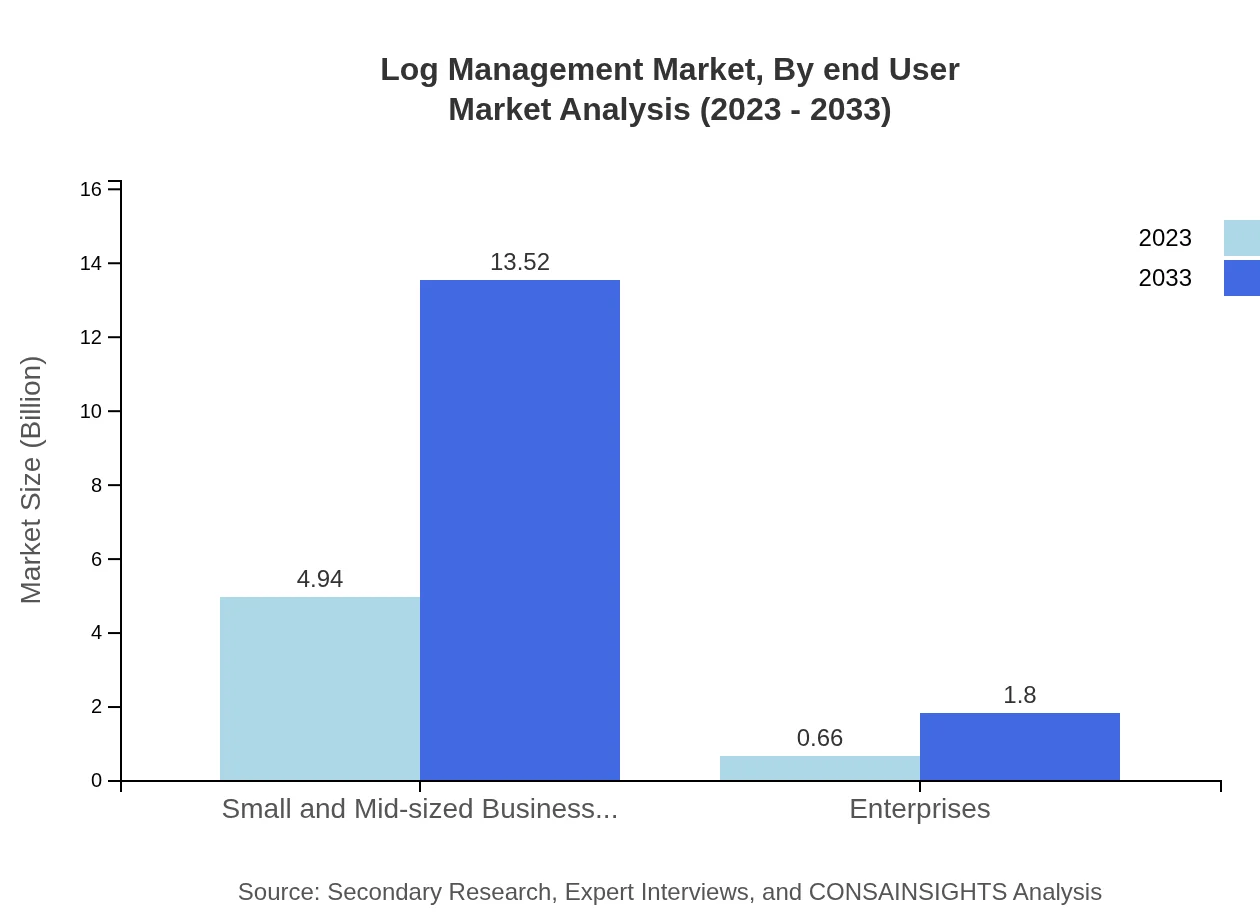

Log Management Market Analysis By End User

Small and mid-sized businesses account for the majority at 88.23%, emphasizing affordable, scalable solutions. In contrast, enterprises are also expanding their foothold in the market, moving from USD 0.66 billion in 2023 to USD 1.80 billion in 2033, recognizing the importance of comprehensive logging in their security and compliance frameworks.

Log Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Log Management Industry

Splunk Inc.:

A major player in the log management space, Splunk offers powerful solutions for searching, monitoring, and analyzing the machine-generated big data.Loggly (SolarWinds):

Loggly specializes in log management and analytics, providing user-friendly solutions that aggregate log data from multiple sources.ELK Stack (Elastic):

Elastic's ELK Stack is a popular open-source solution that facilitates the centralized storage, indexing, and analysis of log data.IBM QRadar:

IBM's QRadar offers advanced security intelligence and log management capabilities, empowering organizations to detect and respond to threats.Sumo Logic:

A cloud-native log management platform, Sumo Logic enables real-time data analytics focusing on securing applications and infrastructure.We're grateful to work with incredible clients.

FAQs

What is the market size of log management?

The log management market is projected to reach USD 5.6 billion by 2033, with a remarkable CAGR of 10.2% from 2023 to 2033.

What are the key market players or companies in the log management industry?

Key players in the log management market include Splunk, LogRhythm, IBM, and Sumo Logic, which are integral to driving innovations and setting competitive standards in this rapidly growing industry.

What are the primary factors driving the growth in the log management industry?

The growth in the log management industry is driven by the increasing need for regulatory compliance, the rise of cyber threats, and the growing importance of actionable insights from vast data sets.

Which region is the fastest Growing in the log management market?

The fastest-growing region in the log management market is North America, which is anticipated to grow from USD 1.98 billion in 2023 to USD 5.42 billion by 2033, reflecting a strong demand for security compliance.

Does ConsaInsights provide customized market report data for the log management industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the log management industry, enabling businesses to gain unique insights and strategies.

What deliverables can I expect from this log management market research project?

Deliverables from this log management market research project include in-depth market analysis, segmentation reports, competitive analysis, and future trend forecasts.

What are the market trends of log management?

Current trends in the log management market include increasing adoption of cloud-based solutions, emphasis on data security, and innovations in AI and machine learning for enhanced data analytics.