Managed Application Services Market Report

Published Date: 31 January 2026 | Report Code: managed-application-services

Managed Application Services Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Managed Application Services market, offering insights on trends, growth forecasts, and competitive landscapes from 2023 to 2033. The analysis includes regional breakdowns, market size, and contextual information to help stakeholders make informed decisions.

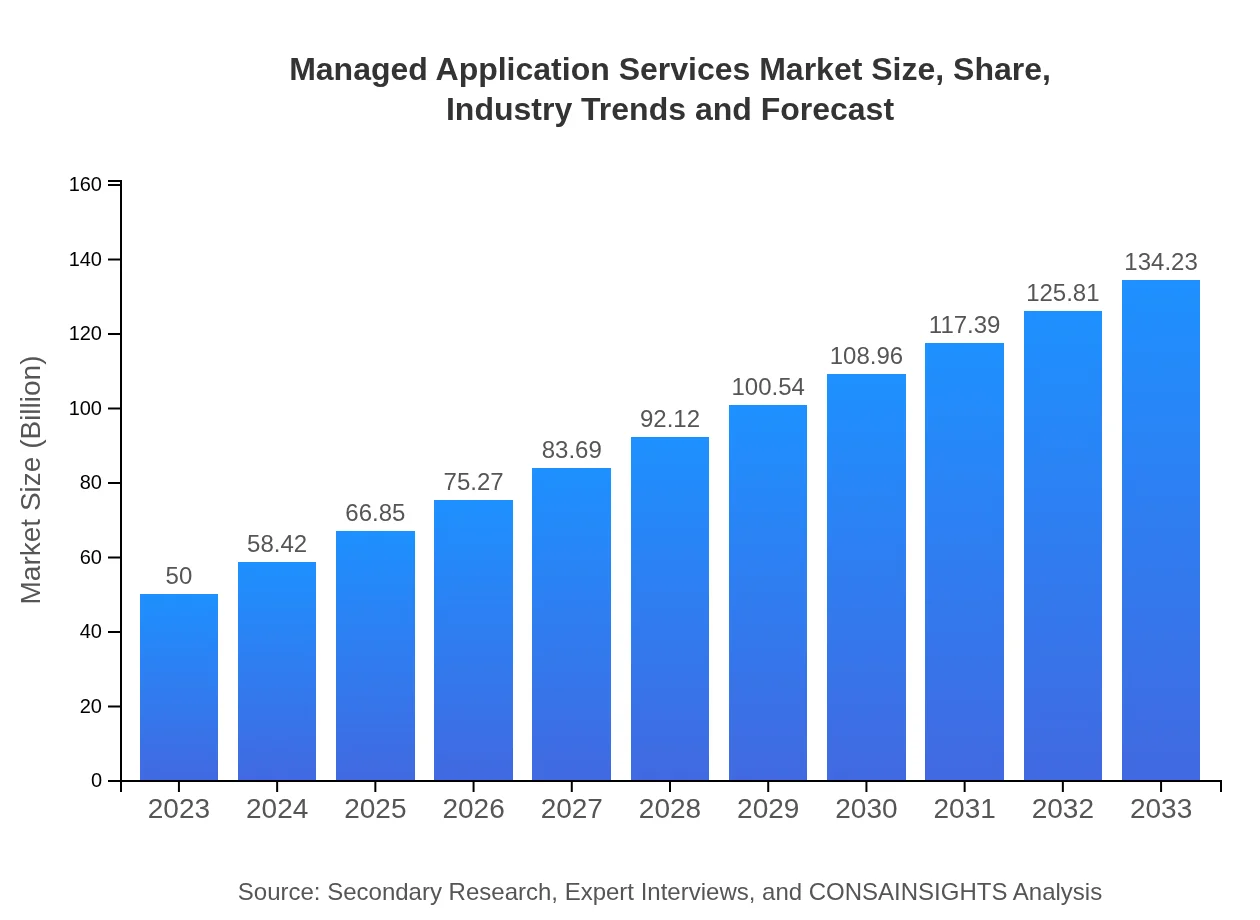

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $134.23 Billion |

| Top Companies | IBM, Accenture, TCS (Tata Consultancy Services), Cognizant, Hewlett Packard Enterprise |

| Last Modified Date | 31 January 2026 |

Managed Application Services Market Overview

Customize Managed Application Services Market Report market research report

- ✔ Get in-depth analysis of Managed Application Services market size, growth, and forecasts.

- ✔ Understand Managed Application Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Managed Application Services

What is the Market Size & CAGR of Managed Application Services market in 2023 and 2033?

Managed Application Services Industry Analysis

Managed Application Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Managed Application Services Market Analysis Report by Region

Europe Managed Application Services Market Report:

Europe’s market size is poised to increase from $16.45 billion in 2023 to about $44.16 billion by 2033. The demand for innovative IT solutions and compliance with stringent data regulations spurs investments, creating a significant growth trajectory in managed services.Asia Pacific Managed Application Services Market Report:

The Asia Pacific region shows promising growth projections, expanding from $8.23 billion in 2023 to $22.11 billion in 2033. Rising digital adoption, coupled with increasing demand for cloud-based solutions, drives this growth. Countries like India and China play pivotal roles, supported by rapid economic growth and increased investment in technology.North America Managed Application Services Market Report:

North America leads the Managed Application Services market with a size of $17.97 billion in 2023, potentially reaching $48.24 billion by 2033. This region's growth is driven by robust technological advancements, greater corporate reliance on application efficiency, and an increasing emphasis on cybersecurity threats prevailing in the digital landscape.South America Managed Application Services Market Report:

In South America, the Managed Application Services market is expected to grow from $2.89 billion in 2023 to $7.76 billion in 2033. The growth is driven by improvements in IT infrastructure and an increasing number of small to medium enterprises looking to outsource application management for scalability and efficiency.Middle East & Africa Managed Application Services Market Report:

The Middle East and Africa region sees a growth trajectory from $4.46 billion in 2023 rising to $11.96 billion in 2033. Increased investment in technology and growing awareness of managed services among businesses are vital to market expansion in this region.Tell us your focus area and get a customized research report.

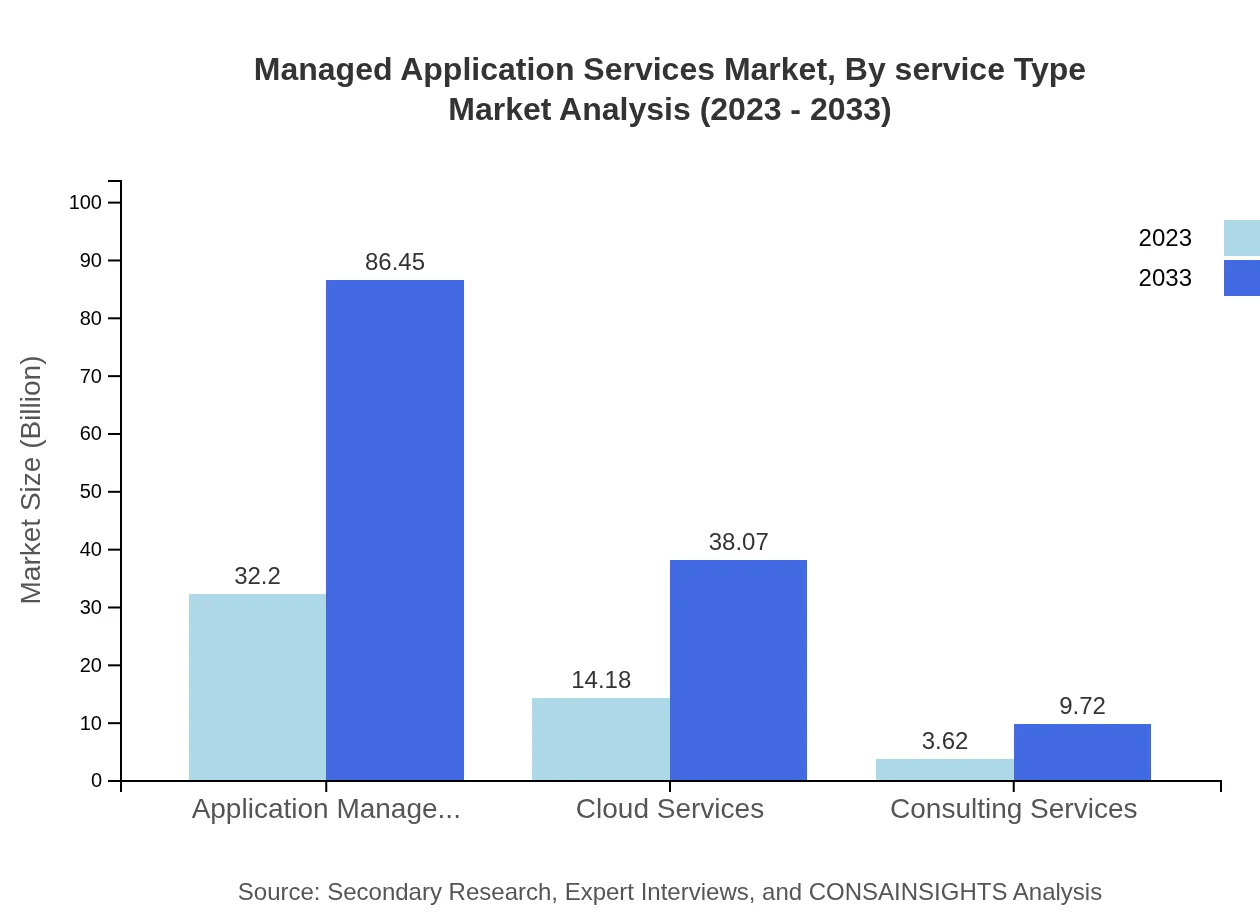

Managed Application Services Market Analysis By Service Type

The market is extensively segmented into service types, highlighting significant growth in Application Management Services, projected to grow from $32.20 billion in 2023 to $86.45 billion by 2033. Cloud Services will rise from $14.18 billion to $38.07 billion. Consulting Services, while smaller, are expected to grow from $3.62 billion to $9.72 billion, showcasing the vital role these services play in strategy formulation and execution.

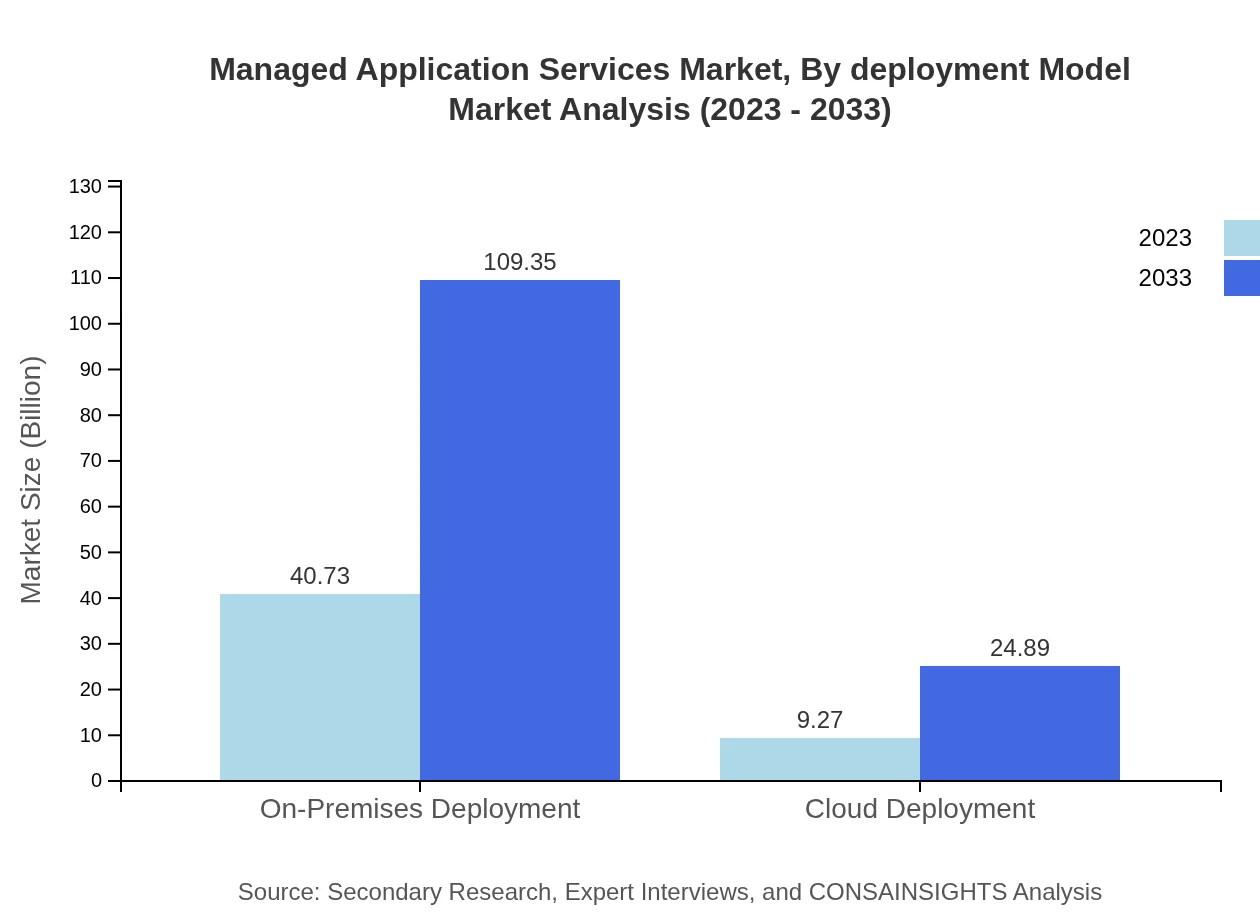

Managed Application Services Market Analysis By Deployment Model

Deployment models also showcase distinctive growth paths; On-Premises Deployment dominates with a rise from $40.73 billion in 2023 to $109.35 billion in 2033, providing critical control to enterprises. Cloud Deployment, though smaller, is projected to advance from $9.27 billion in 2023 to $24.89 billion by 2033, indicating increased confidence in cloud technologies.

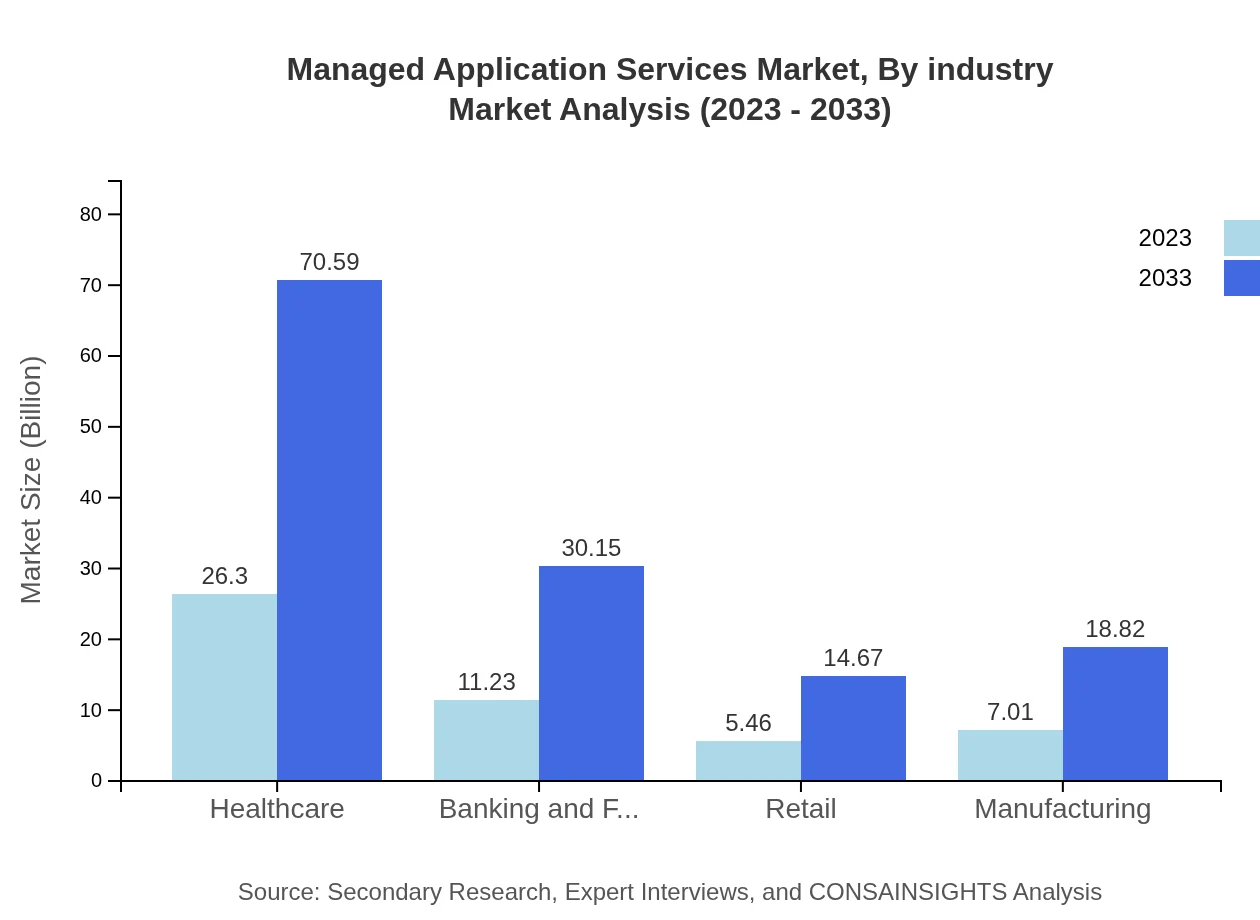

Managed Application Services Market Analysis By Industry

Industrially, Healthcare represents a leading segment, escalating from $26.30 billion in 2023 to $70.59 billion by 2033. Banking and Finance will grow from $11.23 billion to $30.15 billion, signaling confidence in managed services' crucial role in compliance. Retail and Manufacturing sectors are also expected to grow, driven by the need for efficient and adaptable IT solutions.

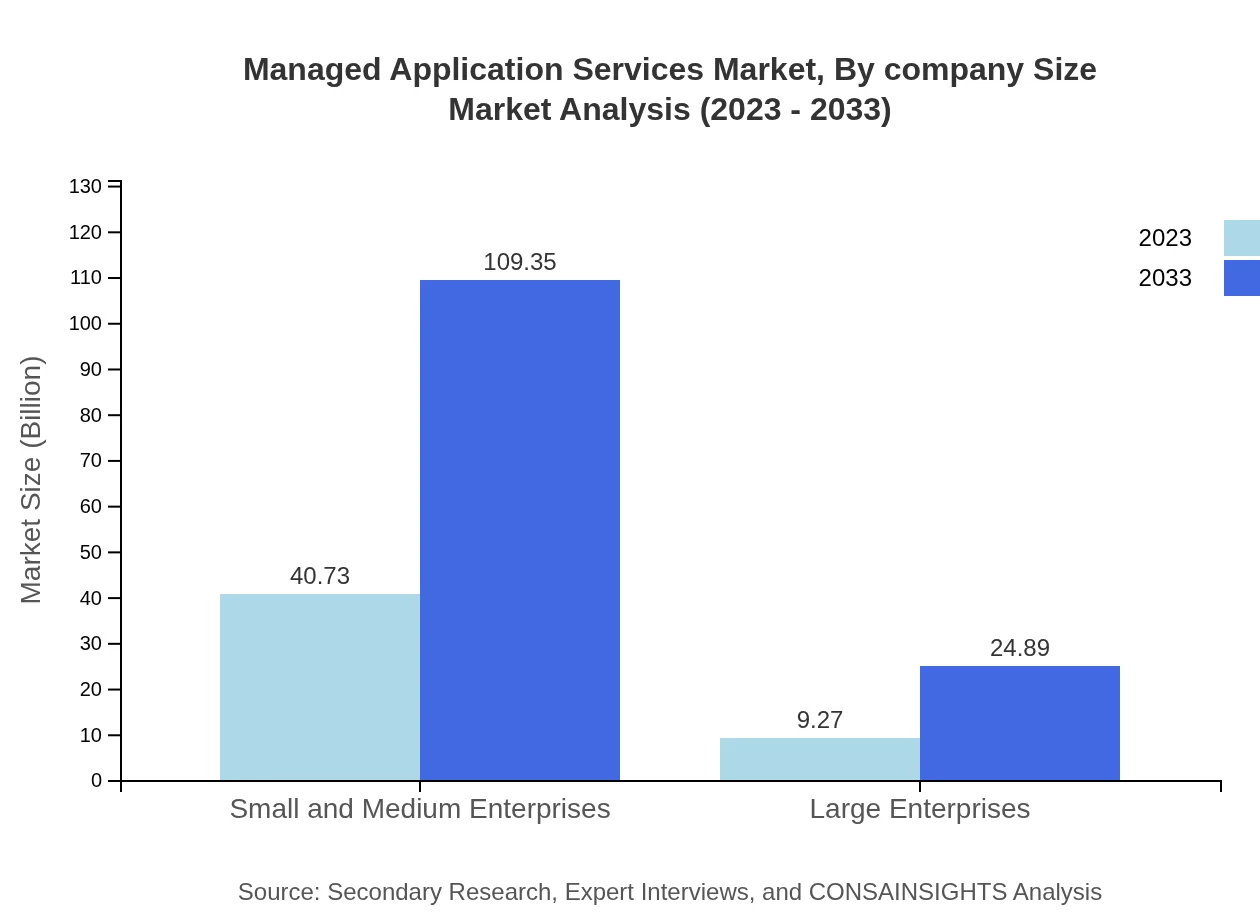

Managed Application Services Market Analysis By Company Size

In terms of company size, Small and Medium Enterprises dominate with a staggering growth from $40.73 billion in 2023 to $109.35 billion by 2033, indicating their increasing necessity for efficient managed services. Large Enterprises are also expected to grow from $9.27 billion to $24.89 billion, showcasing the importance of these services across organizational sizes.

Managed Application Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Managed Application Services Industry

IBM:

IBM is a pioneer in managed services, providing innovative solutions leveraging AI and cloud technologies to enhance business operations.Accenture:

Accenture offers comprehensive managed services, helping organizations navigate their digital transformation journeys effectively.TCS (Tata Consultancy Services):

TCS provides a wide range of managed IT services, enhancing operational efficiency for clients across various sectors.Cognizant:

Cognizant focuses on delivering industry-specific managed services that prioritize customer experience and operational excellence.Hewlett Packard Enterprise:

HPE specializes in managed services that drive innovation and reduce operational complexities for enterprises.We're grateful to work with incredible clients.

FAQs

What is the market size of Managed Application Services?

The Managed Application Services market is projected to grow from $50 billion in 2023 to significant increases by 2033, with a CAGR of 10%. This growth reflects the increasing demand for outsourced application management.

What are the key market players or companies in this Managed Application Services industry?

The Managed Application Services industry features leading players like IBM, Accenture, and Infosys. These companies dominate by providing innovative solutions and extensive expertise, ensuring continued market leadership through strategic partnerships.

What are the primary factors driving the growth in the Managed Application Services industry?

Key growth drivers in the Managed Application Services industry include the increasing need for businesses to enhance operational efficiency, the rise of cloud technology, and the demand for cost-effective solutions that allow companies to focus on core activities.

Which region is the fastest Growing in the Managed Application Services?

The fastest-growing region in the Managed Application Services market is projected to be North America, escalating from $17.97 billion in 2023 to $48.24 billion by 2033, driven by technological advancements and increasing digitalization.

Does ConsaInsights provide customized market report data for the Managed Application Services industry?

Yes, ConsaInsights provides tailored market report data for the Managed Application Services industry, catering to diverse client requirements and ensuring that insights are relevant to specific business contexts and strategic goals.

What deliverables can I expect from this Managed Application Services market research project?

From this market research project, expect comprehensive deliverables, including detailed market analysis, segmented data insights, competitive landscapes, and strategic recommendations aimed at enhancing decision-making for stakeholders.

What are the market trends of Managed Application Services?

Current trends in the Managed Application Services market include rapid adoption of cloud solutions, increasing focus on cybersecurity measures, and an emphasis on integrated service offerings to enhance overall operational efficiency.