Maritime Analytics Market Report

Published Date: 31 January 2026 | Report Code: maritime-analytics

Maritime Analytics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an expansive analysis of the Maritime Analytics market from 2023 to 2033. It delves into market size, segmentation, regional insights, key players, trends, and forecasts, offering valuable data-driven insights into the industry's future.

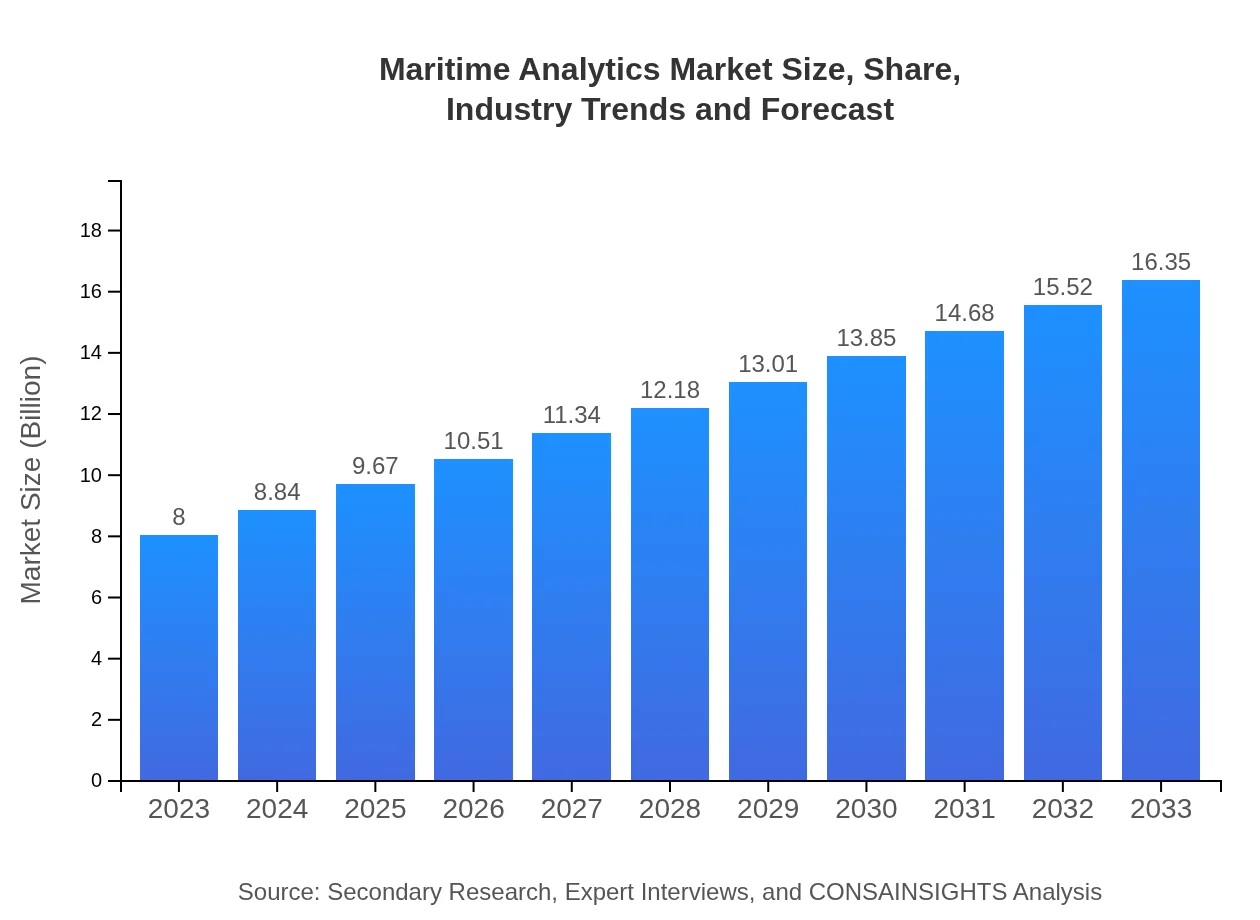

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $16.35 Billion |

| Top Companies | Kongsberg Gruppen, DNV, ABB, MarineTraffic |

| Last Modified Date | 31 January 2026 |

Maritime Analytics Market Overview

Customize Maritime Analytics Market Report market research report

- ✔ Get in-depth analysis of Maritime Analytics market size, growth, and forecasts.

- ✔ Understand Maritime Analytics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Maritime Analytics

What is the Market Size & CAGR of Maritime Analytics market in 2023-2033?

Maritime Analytics Industry Analysis

Maritime Analytics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Maritime Analytics Market Analysis Report by Region

Europe Maritime Analytics Market Report:

Europe's Maritime Analytics market is expected to grow from $1.93 billion in 2023 to $3.94 billion by 2033, driven by stringent regulations, an emphasis on environmental stewardship, and advancements in maritime technologies for optimization.Asia Pacific Maritime Analytics Market Report:

In the Asia Pacific region, the Maritime Analytics market is projected to grow from $1.70 billion in 2023 to $3.48 billion by 2033. The growth is largely driven by increasing maritime trade, technological adoption, and investments in port infrastructure.North America Maritime Analytics Market Report:

North America leads the market with a size of $2.88 billion in 2023 anticipated to grow to $5.88 billion by 2033. Key factors include advancements in technology, significant R&D investments, and the need for data-driven decisions in shipping logistics.South America Maritime Analytics Market Report:

South America's market is expected to expand from $0.78 billion in 2023 to $1.59 billion by 2033. The emphasis on improving logistical efficiency and trade routes is fostering demand alongside government investments in maritime regulations.Middle East & Africa Maritime Analytics Market Report:

The Middle East and Africa region will see growth from $0.72 billion in 2023 to $1.46 billion by 2033. Factors include increased shipping activities and infrastructural developments which require enhanced analytics capabilities.Tell us your focus area and get a customized research report.

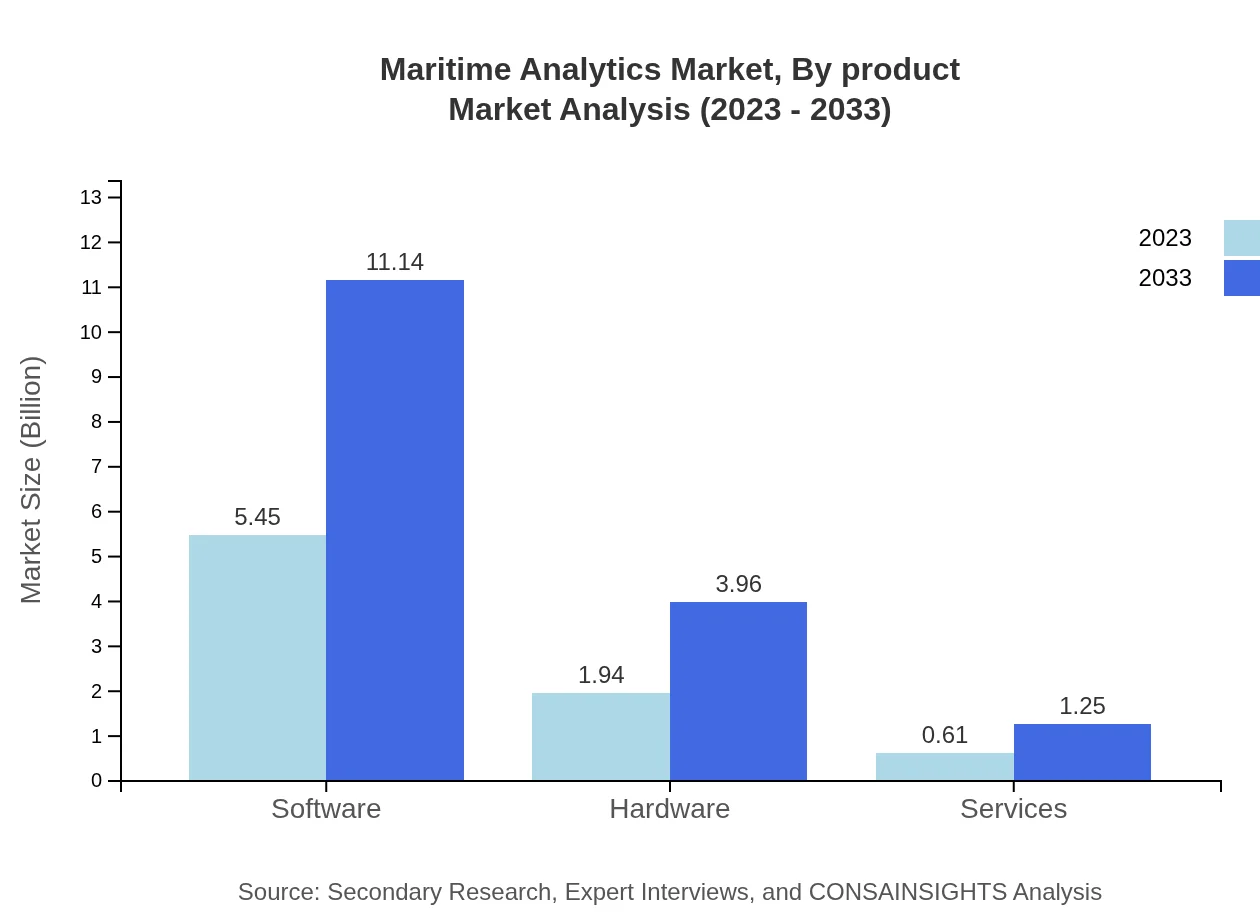

Maritime Analytics Market Analysis By Product

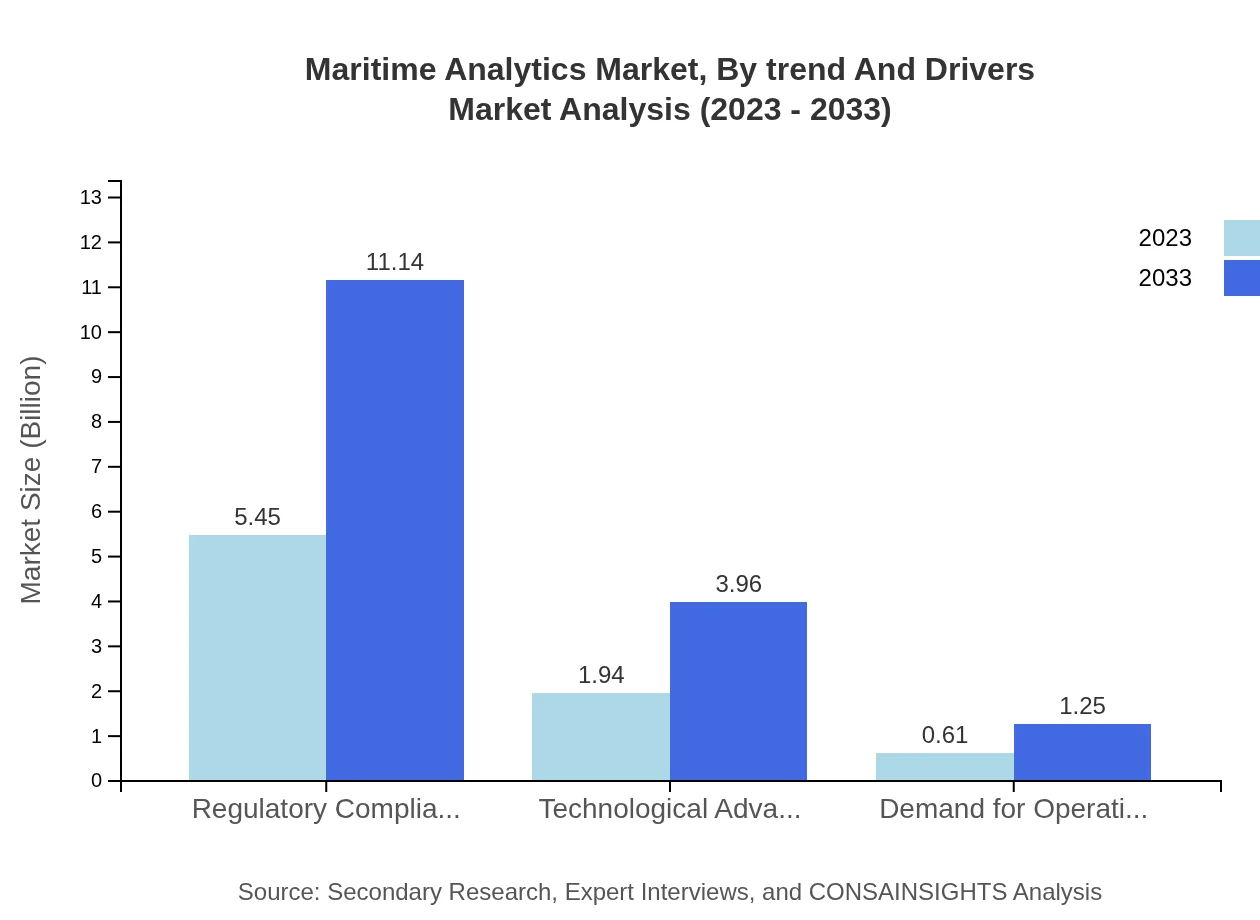

The Maritime Analytics market can be segmented into software, hardware, and services. Software solutions dominate the market with a size of $5.45 billion in 2023, expected to reach $11.14 billion by 2033. Hardware components account for $1.94 billion in 2023 and are projected to grow to $3.96 billion. Service offerings, primarily focused on consultation and implementation, show significant growth potential, from $0.61 billion to $1.25 billion.

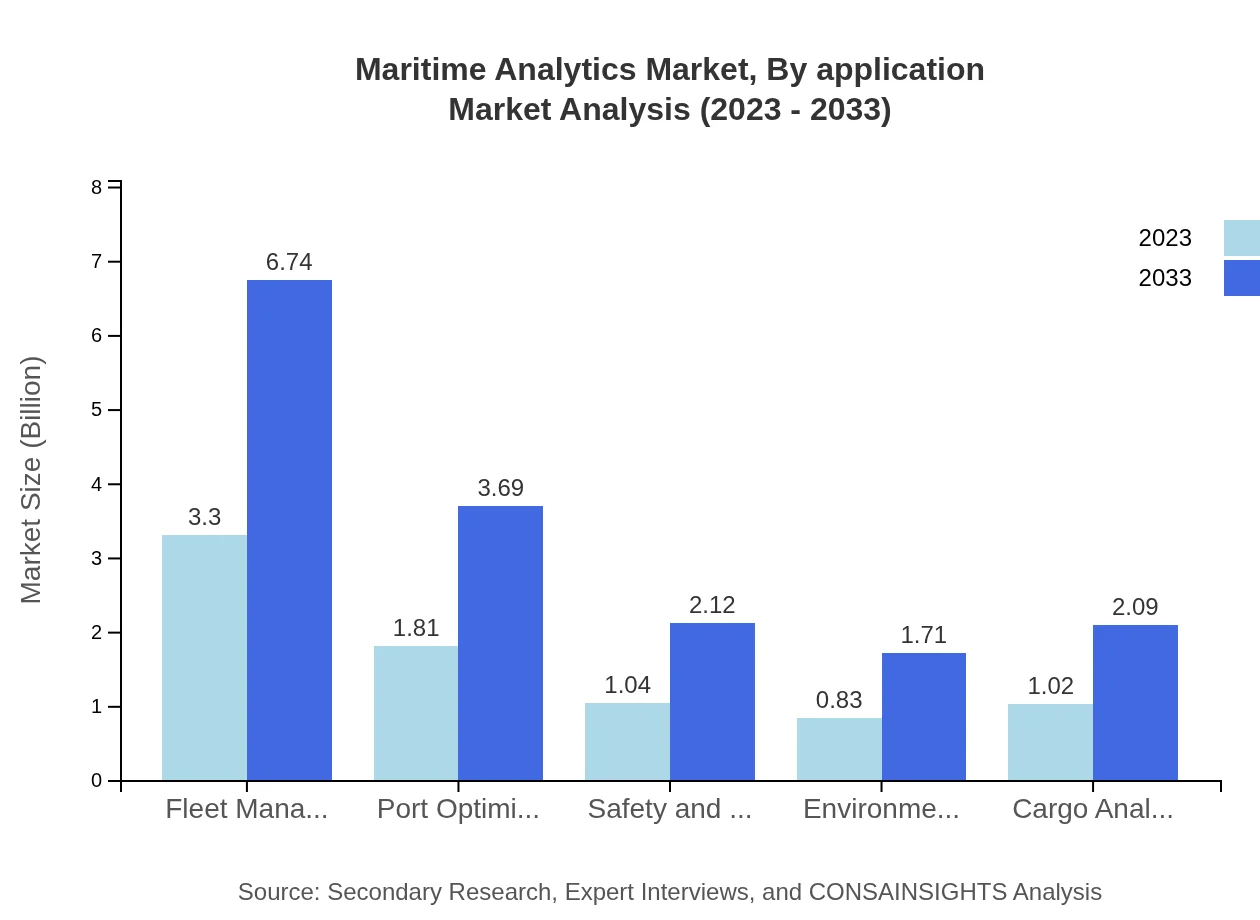

Maritime Analytics Market Analysis By Application

Applications in Maritime Analytics include fleet management, shipping companies, ports and terminals, government agencies, and research sectors. Fleet management and shipping companies represent the largest market shares, each around 41% in 2023. The need for efficiency in logistics drives growth in port optimization and safety analytics applications, essential for regulatory compliance.

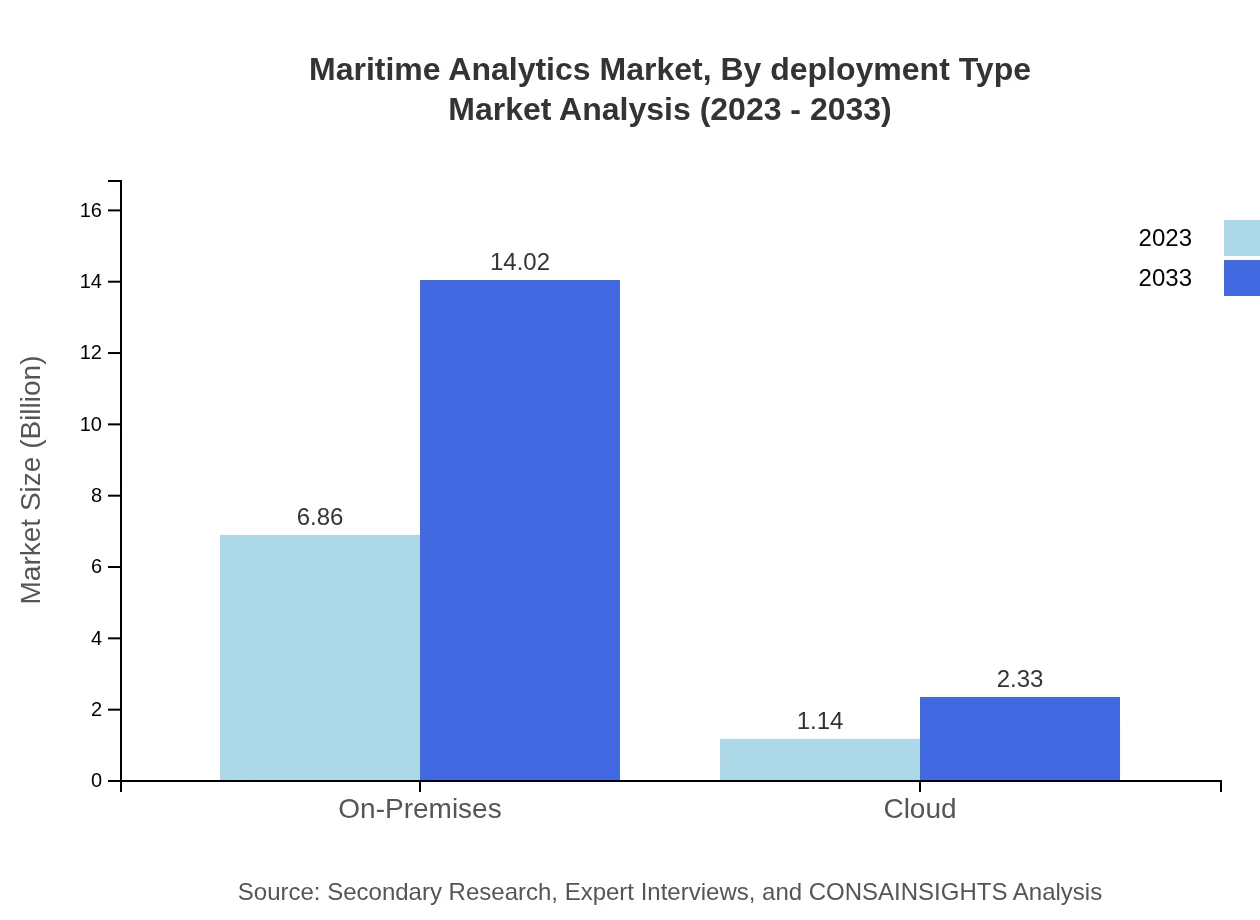

Maritime Analytics Market Analysis By Deployment Type

Deployment models in this market include on-premises solutions and cloud-based services. On-premises solutions, comprising 85.74% of the market share in 2023, are anticipated to grow from $6.86 billion to $14.02 billion by 2033, indicating a strong preference for proprietary systems amongst larger corporations. However, cloud-based solutions, accounting for 14.26% in 2023, are also gaining momentum as organizations seek flexibility and lower operational costs.

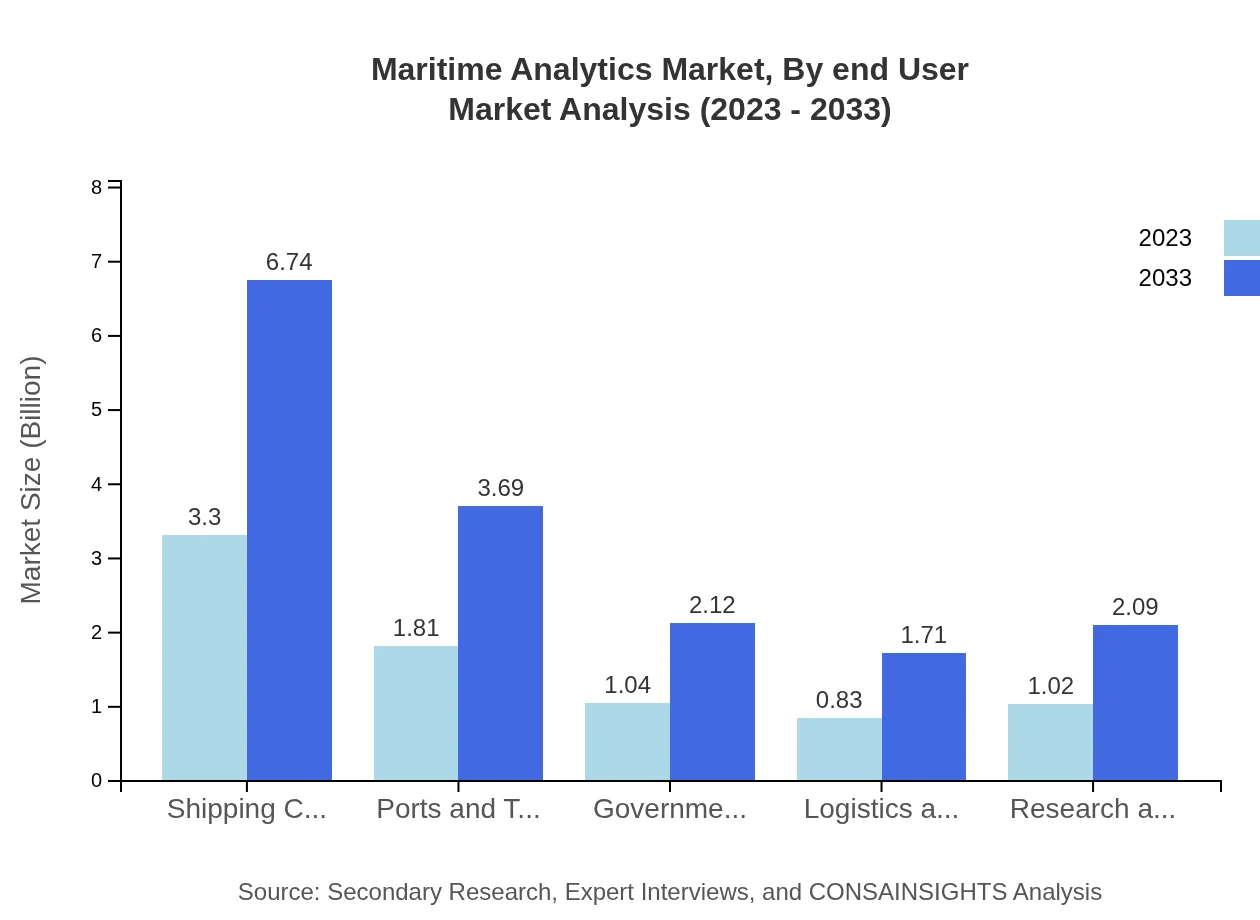

Maritime Analytics Market Analysis By End User

End-users include shipping companies, ports and terminals, government agencies, logistics suppliers, and research institutions. Shipping companies dominate with significant investment in analytics, reflecting directly on operational efficiency as they grow from $3.30 billion to $6.74 billion by 2033. Ports and terminals follow closely, focusing on optimization and compliance.

Maritime Analytics Market Analysis By Trend And Drivers

Emerging trends such as the demand for operational efficiency, regulatory compliance, and technological advancements are key drivers of the Maritime Analytics market. The emphasis on environmental monitoring is fostering new analytical tools to measure ecological impact, while the growing focus on safety and security measures is spurring demand for advanced analytics solutions that bolster operational integrity.

Maritime Analytics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Maritime Analytics Industry

Kongsberg Gruppen:

A leading provider of integrated maritime solutions and analytics, recognized for its technological advancements in automation and operational efficiency.DNV:

Specializes in risk management and quality assurance in shipping and maritime operations, well-known for its analytics services that enhance compliance and maritime safety.ABB:

Offers innovative technologies and services across the maritime sector, focusing on intelligent data analytics for efficiency and operational excellence.MarineTraffic:

An industry leader in ship tracking and maritime analytics, providing real-time data and insights to support decision-making in shipping and logistics.We're grateful to work with incredible clients.

FAQs

What is the market size of maritime Analytics?

The maritime analytics market is projected to reach $8 billion by 2033, growing at a CAGR of 7.2% from its current valuation. This robust growth indicates an increasing reliance on data analytics within the maritime industry to optimize operations.

What are the key market players or companies in this maritime Analytics industry?

Key players in the maritime analytics industry include prominent software providers, shipping companies, and technology firms. These organizations contribute significantly to the market, driving innovation and establishing competitive advantage through advanced solutions.

What are the primary factors driving the growth in the maritime analytics industry?

The growth of the maritime analytics industry is driven by increasing demand for operational efficiency, the necessity for safety and security measures, and technological advancements. These factors compel organizations to invest in analytics for informed decision-making.

Which region is the fastest Growing in the maritime analytics market?

Among various regions, North America emerges as the fastest-growing market for maritime analytics. It is projected to grow from $2.88 billion in 2023 to $5.88 billion by 2033, making it a vital area for analytics adoption.

Does ConsaInsights provide customized market report data for the maritime analytics industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the maritime analytics industry. This enables organizations to receive specialized insights relevant to their operational context.

What deliverables can I expect from this maritime analytics market research project?

Deliverables from the maritime analytics market research project typically include comprehensive market reports, regional analysis, segment breakdowns, trend assessments, and strategic recommendations to help navigate industry challenges.

What are the market trends of maritime analytics?

Market trends in maritime analytics reflect a shift towards data-driven decision-making, increased investment in software solutions, and a focus on regulatory compliance. These trends indicate a transformational period for the maritime industry leveraging analytics.