Maritime Information Market Report

Published Date: 31 January 2026 | Report Code: maritime-information

Maritime Information Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Maritime Information market from 2023 to 2033, presenting insights on market size, trends, and forecasts across key segments and regional markets.

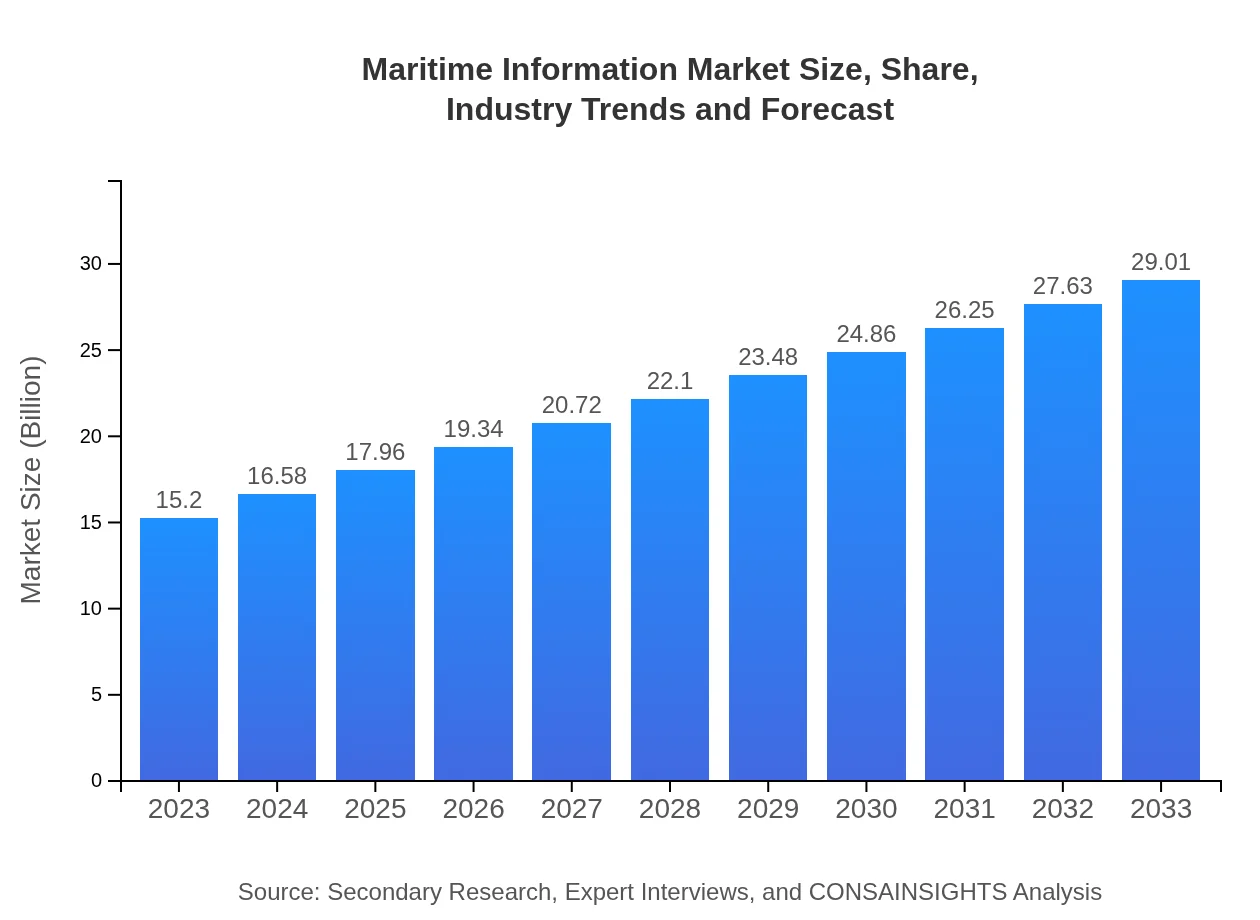

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.20 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $29.01 Billion |

| Top Companies | ABB, Kongsberg Gruppen, DNV GL, Raytheon Technologies |

| Last Modified Date | 31 January 2026 |

Maritime Information Market Overview

Customize Maritime Information Market Report market research report

- ✔ Get in-depth analysis of Maritime Information market size, growth, and forecasts.

- ✔ Understand Maritime Information's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Maritime Information

What is the Market Size & CAGR of Maritime Information market in 2023?

Maritime Information Industry Analysis

Maritime Information Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Maritime Information Market Analysis Report by Region

Europe Maritime Information Market Report:

Europe's Maritime Information market size is anticipated to be $4.08 billion in 2023 and could see a growth to $7.78 billion by 2033. The region is characterized by stringent regulatory frameworks and an emphasis on sustainability, driving investments in innovative maritime technologies.Asia Pacific Maritime Information Market Report:

In 2023, the Asia Pacific region is projected to account for approximately $3.21 billion in the Maritime Information market, anticipated to grow to $6.13 billion by 2033. This growth is fueled by increasing shipping activities driven by international trade and investment in maritime infrastructure reforms.North America Maritime Information Market Report:

North America is currently valued at $5.43 billion in 2023, predicted to grow to $10.37 billion by 2033. The region benefits from established shipping routes, technological advancements in maritime solutions, and the presence of leading maritime service providers.South America Maritime Information Market Report:

The South American Maritime Information market is valued at $1.18 billion in 2023 and is expected to reach $2.25 billion by 2033. Major developments in port infrastructure and shipping services are key factors supporting growth in this region.Middle East & Africa Maritime Information Market Report:

For the Middle East and Africa, the market is projected to grow from $1.30 billion in 2023 to $2.48 billion by 2033, driven by increased investment in oil exploration and efforts to modernize port facilities.Tell us your focus area and get a customized research report.

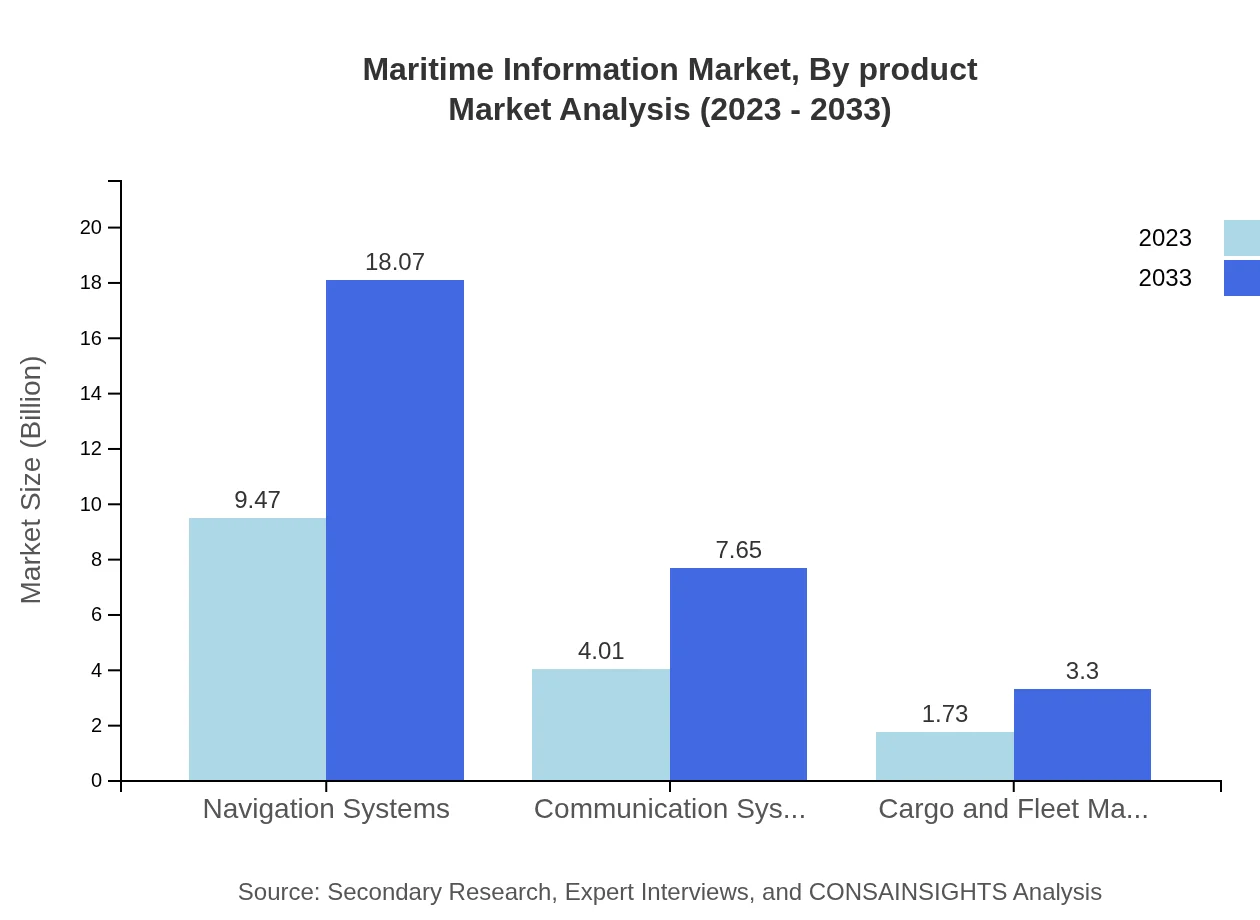

Maritime Information Market Analysis By Product

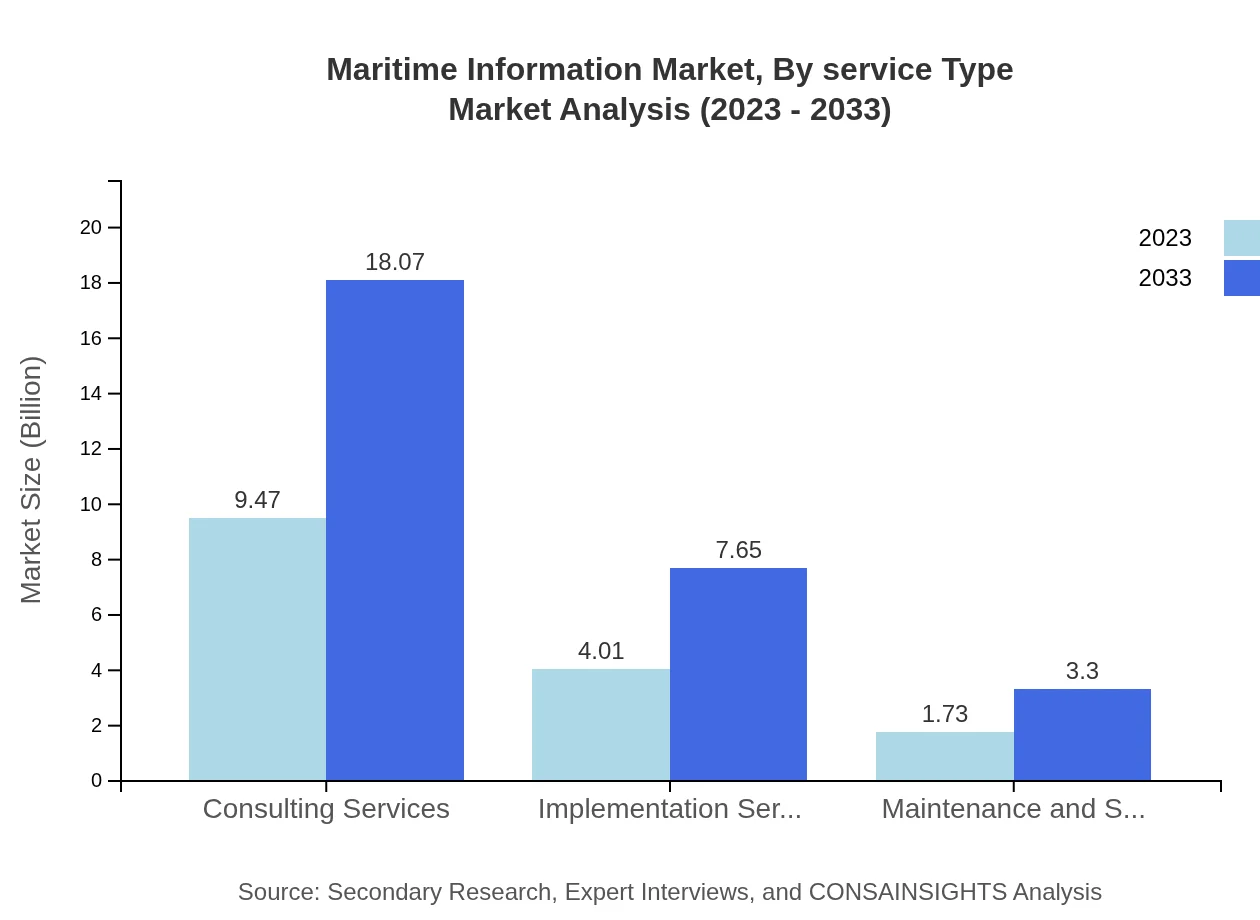

The key products in the Maritime Information market include Navigation Systems, Communication Systems, and Cargo and Fleet Management Systems. Navigation systems, accounting for $9.47 billion in 2023, are crucial for operational efficiency, estimated to grow to $18.07 billion by 2033. Communication systems, valued at $4.01 billion in 2023, are expected to reach $7.65 billion by 2033, reflecting their importance in maritime safety. Fleet management solutions enhance cargo handling and operational oversight.

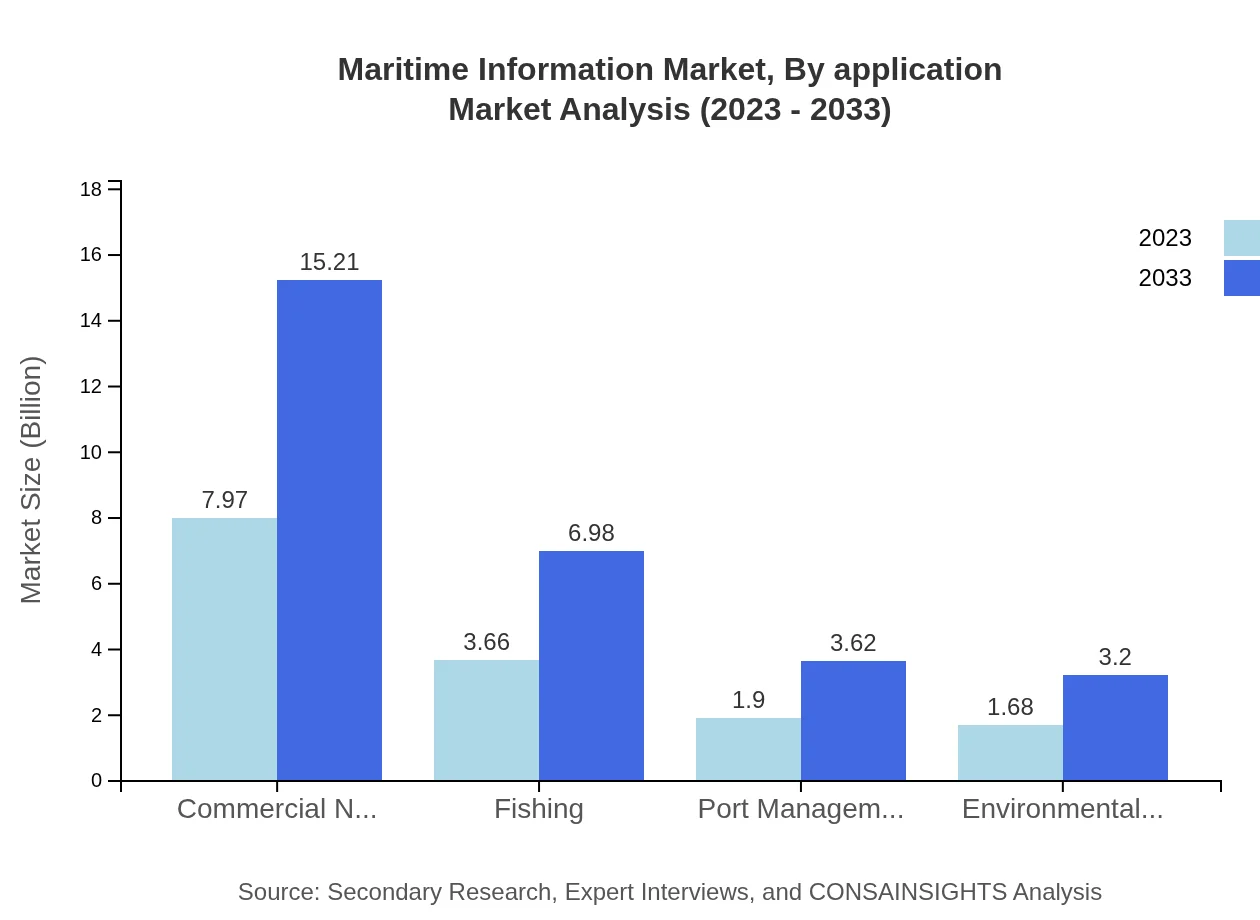

Maritime Information Market Analysis By Application

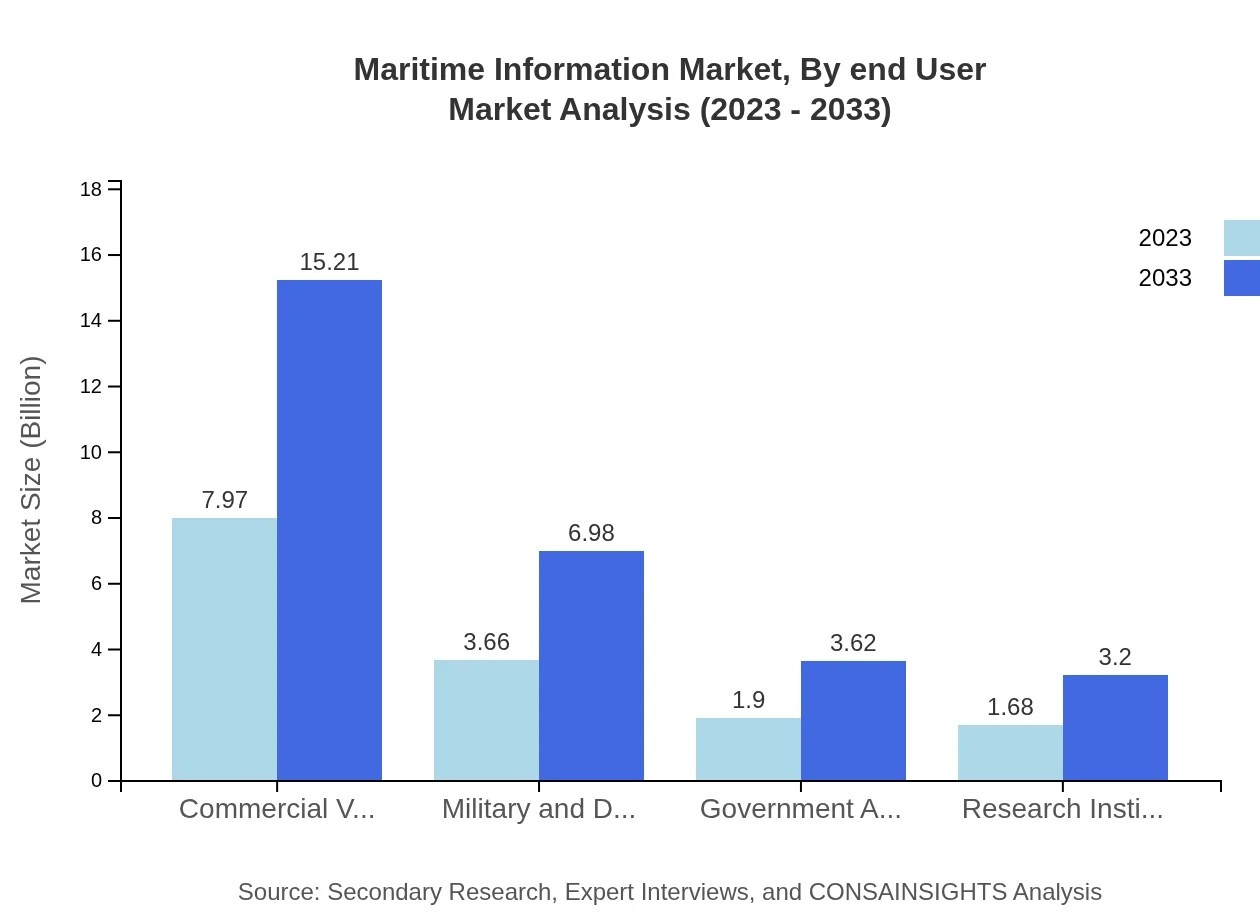

Applications of Maritime Information include Commercial Vessels, Military and Defense, Government Agencies, Research Institutions, and Environmental Monitoring. The Commercial Vessels segment significantly contributes to the market at $7.97 billion in 2023, projected to reach $15.21 billion by 2033. Military applications are estimated at $3.66 billion in 2023, which will grow to $6.98 billion by 2033, driven by defense investments and geopolitical factors.

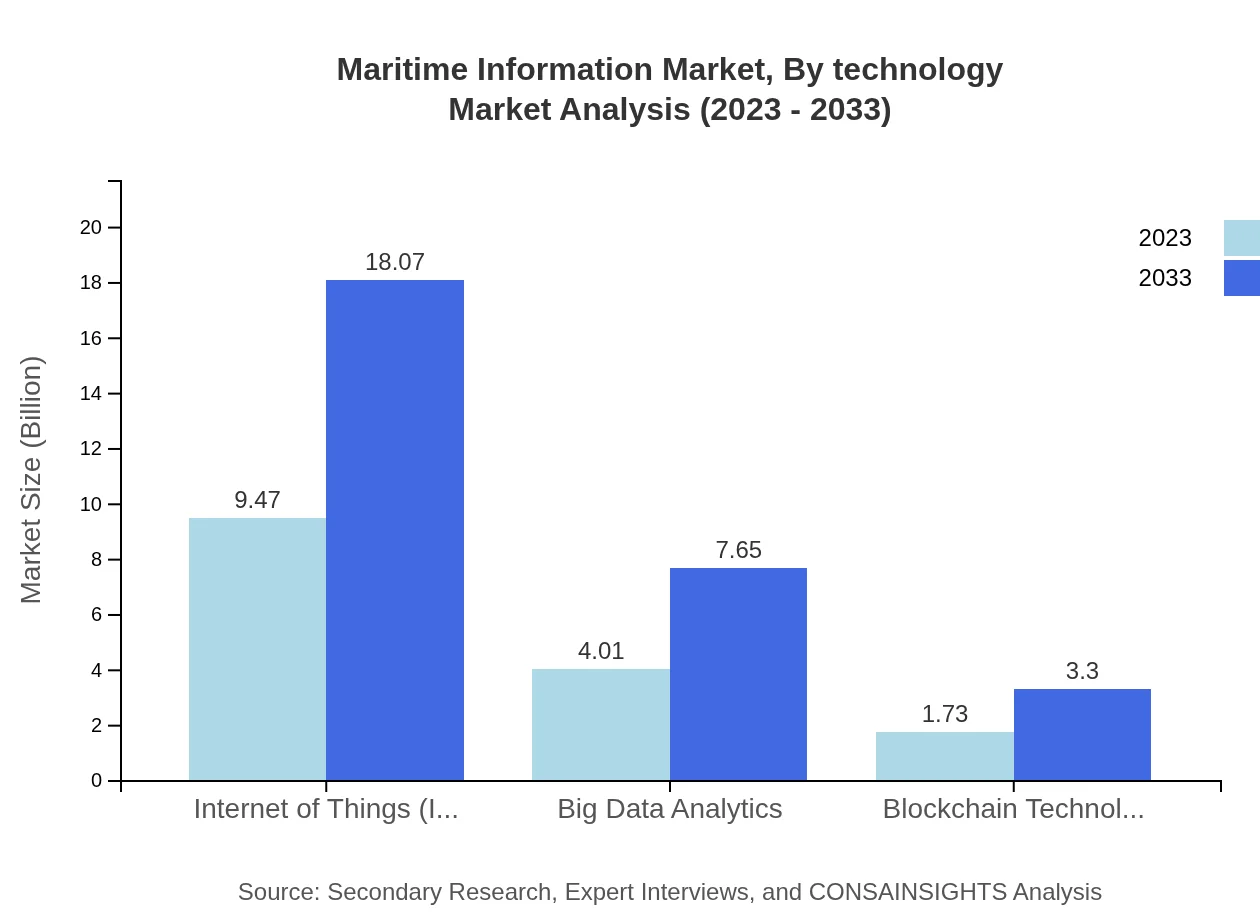

Maritime Information Market Analysis By Technology

Key technologies impacting the Maritime Information market include Internet of Things (IoT), Big Data Analytics, and Blockchain Technology. IoT solutions are expected to lead with market value projected from $9.47 billion in 2023 to $18.07 billion by 2033. Big Data Analytics is increasingly vital for operational decision-making, estimated to rise from $4.01 billion to $7.65 billion in the same timeframe, while Blockchain is anticipated to expand from $1.73 billion to $3.30 billion, enhancing transparency in maritime operations.

Maritime Information Market Analysis By End User

End-users of Maritime Information span Commercial Shipping Companies, Government Agencies, Defense Contractors, and Research Institutions. The commercial sector is expected to dominate, significantly contributing to market growth by facilitating cargo transport and management with the aid of advanced maritime technologies.

Maritime Information Market Analysis By Service Type

Service types in the Maritime Information market include Consulting Services, Implementation Services, and Maintenance and Support Services. Consulting services, with a substantial market value starting at $9.47 billion in 2023 and reaching $18.07 billion by 2033, underscores the essential advisory role technology plays in optimizing maritime operations.

Maritime Information Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Maritime Information Industry

ABB:

ABB is a leading global technology company that engages in electrification and automation solutions. They provide innovative maritime solutions focusing on greener and more efficient shipping operations.Kongsberg Gruppen:

Kongsberg offers high-tech systems and services for maritime industries including navigation, communication, and ship automation, supporting advancements in maritime operations.DNV GL:

DNV GL is a global quality assurance and risk management company, with significant contributions to maritime safety, environmental sustainability, and digital solutions.Raytheon Technologies:

Raytheon is a major player in defense and aerospace technologies, providing advanced systems crucial for military and surveillance applications in the maritime sector.We're grateful to work with incredible clients.

FAQs

What is the market size of maritime Information?

The maritime information market is valued at approximately $15.2 billion in 2023, with a projected CAGR of 6.5% from 2023 to 2033, indicating significant growth driven by technological advancements and increased global trade.

What are the key market players or companies in this maritime Information industry?

Key players in the maritime information market include major technology firms and established shipping companies that provide navigation, communication, and fleet management solutions, capitalizing on advancements in IoT and big data analytics.

What are the primary factors driving the growth in the maritime Information industry?

Growth in the maritime information industry is driven by increasing trade volumes, adoption of advanced navigation and communication technologies, the rise in IoT applications, and heightened focus on environmental monitoring and regulatory compliance.

Which region is the fastest Growing in the maritime Information?

The fastest-growing region in the maritime information sector is North America, expected to grow from $5.43 billion in 2023 to $10.37 billion by 2033, bolstered by technological advancements and increasing maritime activities.

Does ConsaInsights provide customized market report data for the maritime Information industry?

Yes, ConsaInsights specializes in providing customized market report data tailored to specific needs in the maritime information industry, offering valuable insights into market trends and forecasts.

What deliverables can I expect from this maritime Information market research project?

Deliverables from the maritime information market research project include comprehensive market analysis, trend identification, competitive landscape overview, regional insights, and detailed financial forecasts segmented by technology and application.

What are the market trends of maritime Information?

Current trends in the maritime information market include increased digitization, the rise of smart shipping solutions, the use of blockchain for transparency, and growing importance of data analytics for operational efficiency.