Infrastructure Solution Integration Service Market Report

Published Date: 31 January 2026 | Report Code: infrastructure-solution-integration-service

Infrastructure Solution Integration Service Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Infrastructure Solution Integration Service market, covering key insights, market dynamics, and forecasts from 2023 to 2033. The data elucidate trends, challenges, and opportunities shaping the industry landscape.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

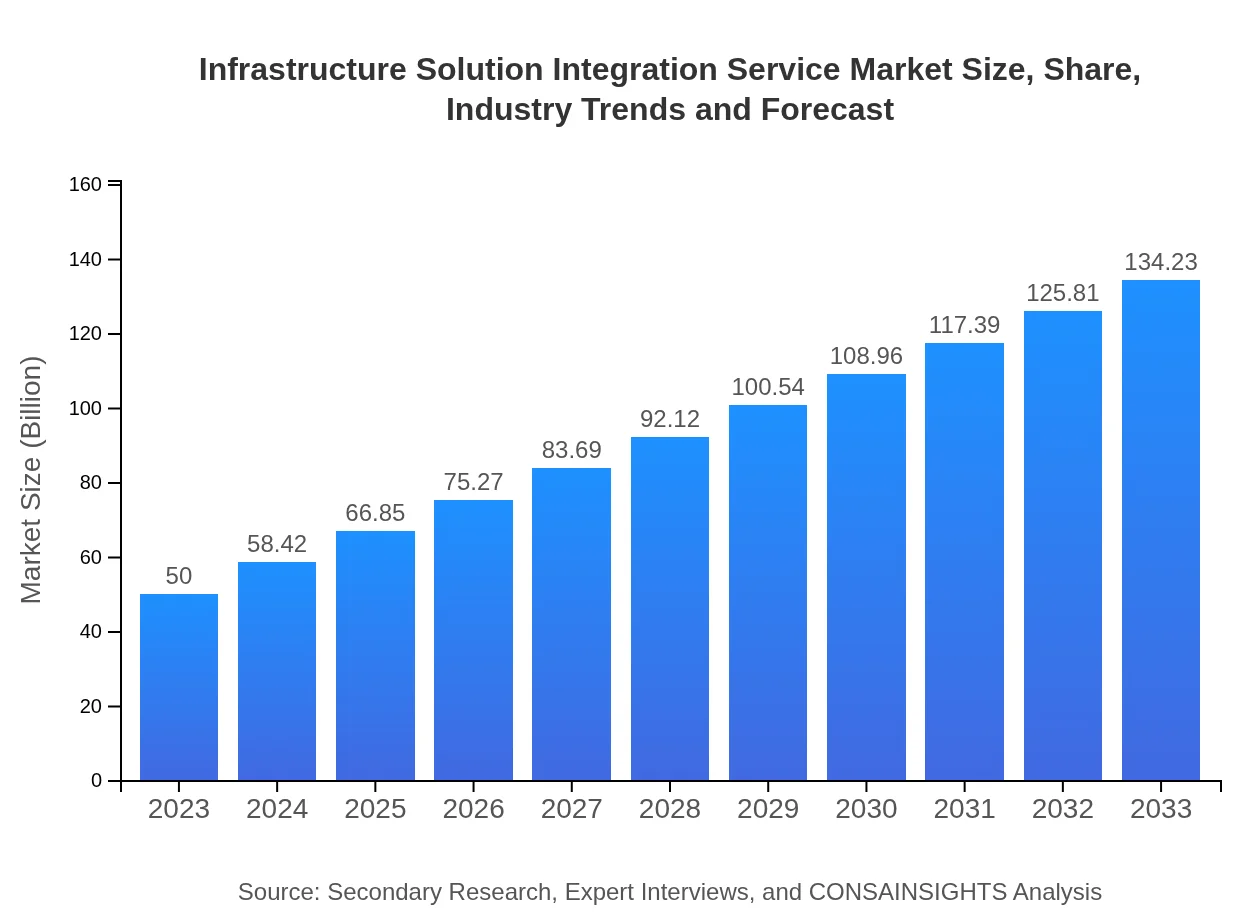

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $134.23 Billion |

| Top Companies | IBM, Accenture, Cisco, Oracle, Microsoft |

| Last Modified Date | 31 January 2026 |

Infrastructure Solution Integration Service Market Overview

Customize Infrastructure Solution Integration Service Market Report market research report

- ✔ Get in-depth analysis of Infrastructure Solution Integration Service market size, growth, and forecasts.

- ✔ Understand Infrastructure Solution Integration Service's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Infrastructure Solution Integration Service

What is the Market Size & CAGR of Infrastructure Solution Integration Service market in 2023 and 2033?

Infrastructure Solution Integration Service Industry Analysis

Infrastructure Solution Integration Service Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Infrastructure Solution Integration Service Market Analysis Report by Region

Europe Infrastructure Solution Integration Service Market Report:

Europe's market, valued at $14.15 billion in 2023, is projected to grow to $38.00 billion in 2033. There is a notable emphasis on regulatory compliance and data security, driving the demand for reliable integration solutions.Asia Pacific Infrastructure Solution Integration Service Market Report:

In 2023, the Asia-Pacific market was valued at $9.68 billion, anticipated to grow to $25.99 billion by 2033. Factors like increasing internet penetration, investment in digital infrastructure, and the rising number of tech startups contribute to this explosive growth.North America Infrastructure Solution Integration Service Market Report:

North America commands a significant portion of the market, with a valuation of $18.22 billion in 2023, expected to surge to $48.91 billion by 2033. The region's rapid technological advancements and strong focus on innovation make it a leader in the adoption of sophisticated integration services.South America Infrastructure Solution Integration Service Market Report:

The South American Infrastructure Solution Integration Service market was valued at $1.52 billion in 2023 and is forecasted to reach $4.09 billion by 2033. The growth is driven by the region's ongoing investment in modernizing IT infrastructures and evolving cloud adoption.Middle East & Africa Infrastructure Solution Integration Service Market Report:

The Middle East and Africa region saw a market size of $6.42 billion in 2023, set to increase to $17.24 billion by 2033. The surge in digital transformation initiatives and government-backed infrastructure projects are pivotal in this growth.Tell us your focus area and get a customized research report.

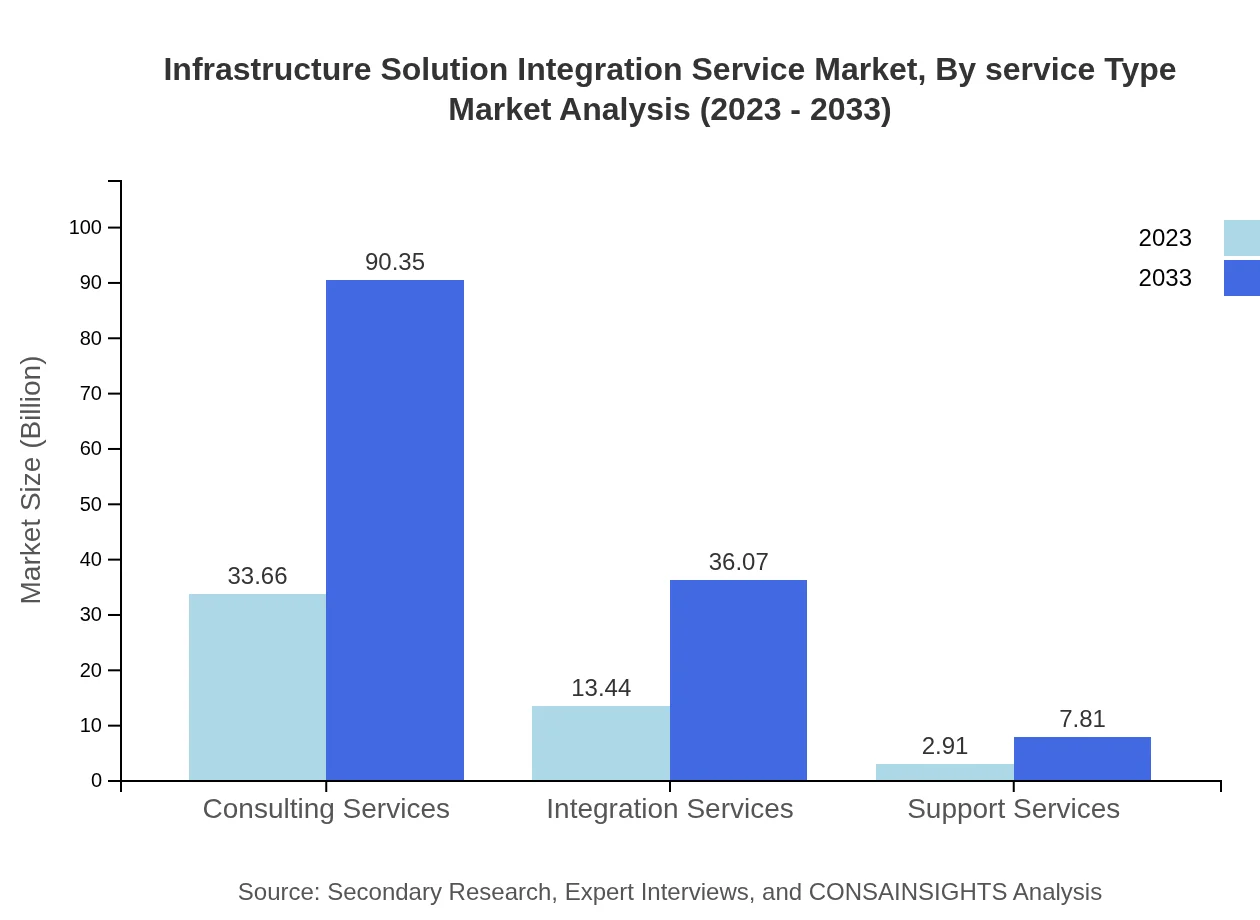

Infrastructure Solution Integration Service Market Analysis By Service Type

The service type segment includes several categories: Healthcare integration services led the market with a size of $28.43 billion in 2023, expected to reach $76.32 billion by 2033, representing a substantial share of 56.86%. Similarly, consulting services show significant growth from $33.66 billion to $90.35 billion, maintaining a 67.31% share. Integration services and support services also demonstrate noteworthy contributions to the overall market.

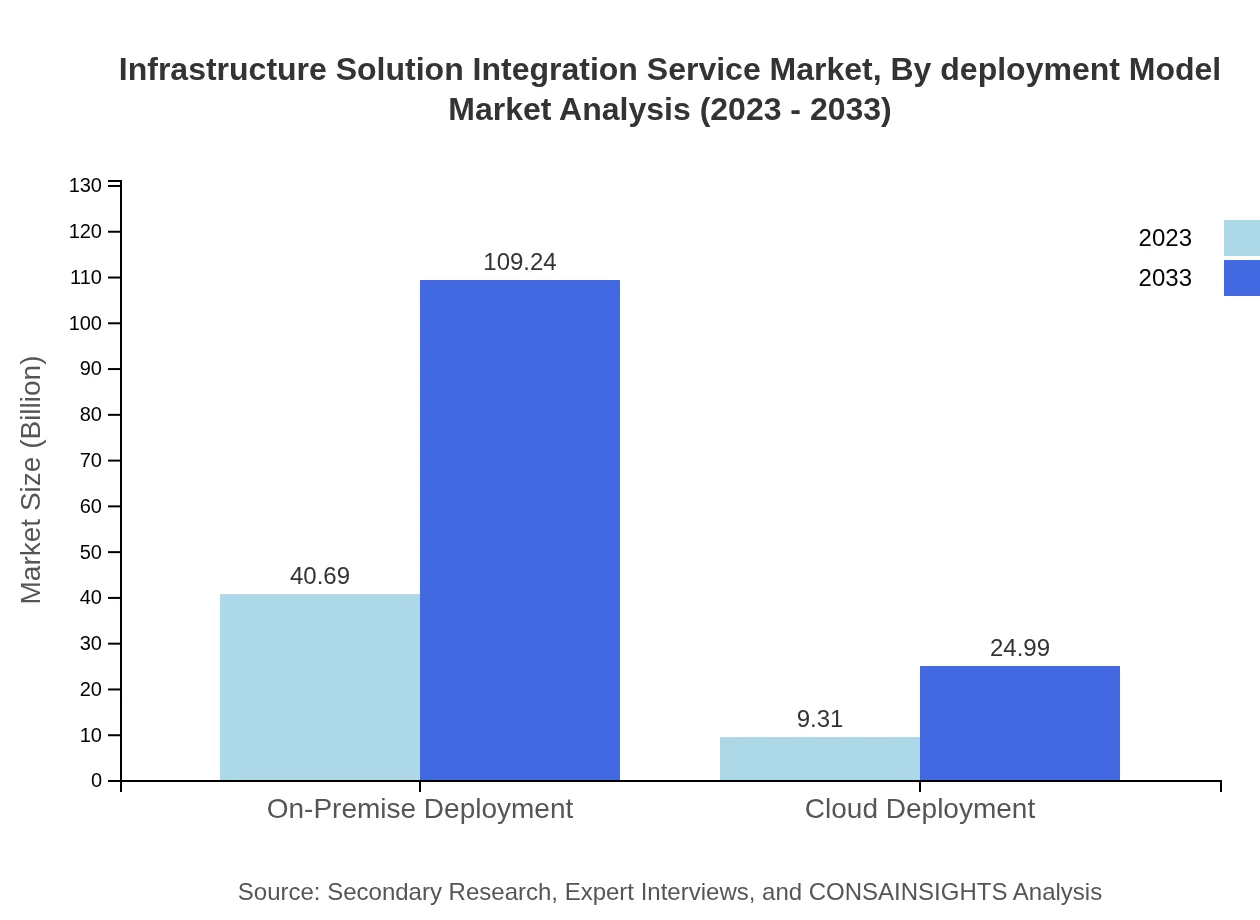

Infrastructure Solution Integration Service Market Analysis By Deployment Model

Underlying deployment models such as on-premise and cloud deployment depict varying performance metrics. On-premise solutions lead with a size of $40.69 billion in 2023 and are forecasted to expand to $109.24 billion by 2033, holding an 81.38% share. In contrast, cloud deployment anticipates growth from $9.31 billion to $24.99 billion, with an 18.62% market share, as organizations increasingly choose flexible deployment options.

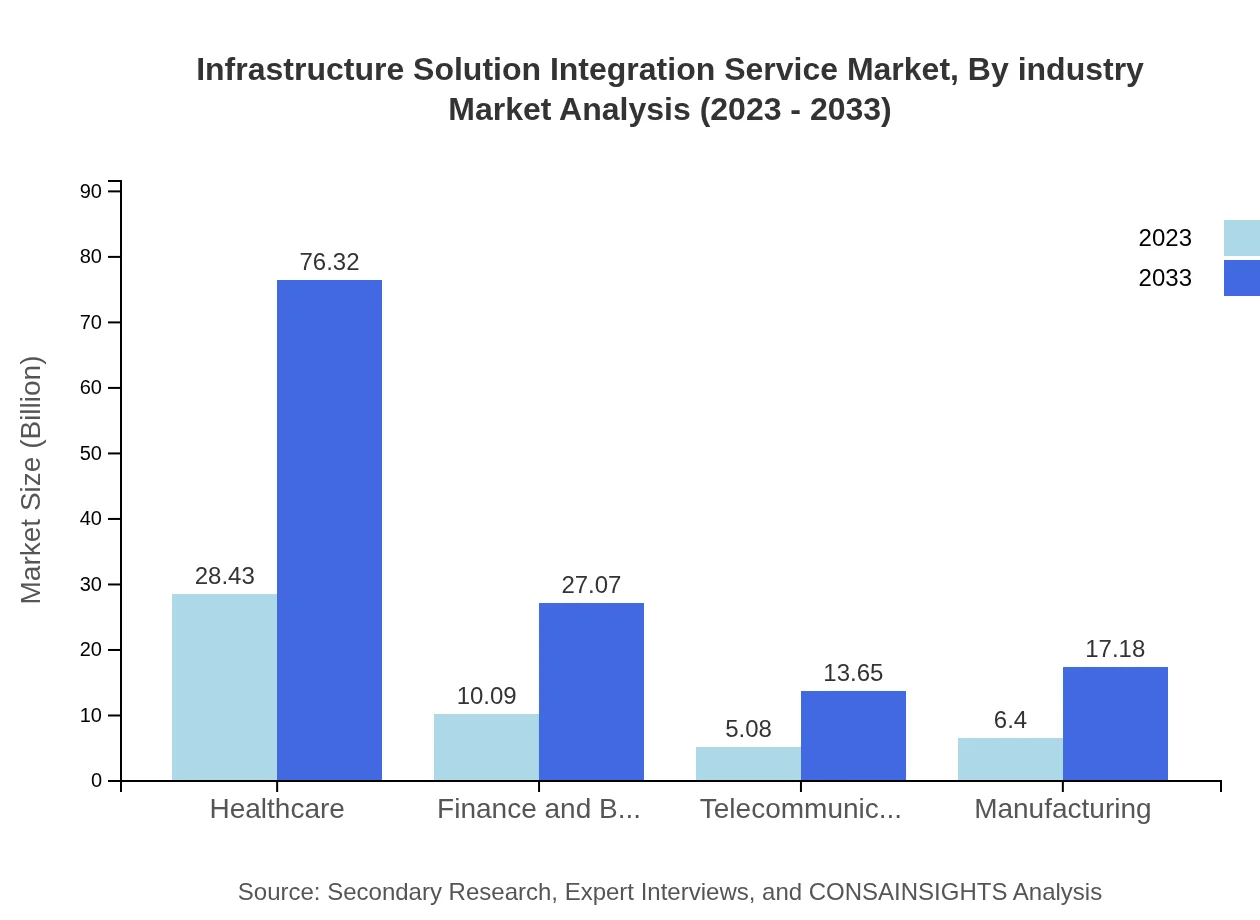

Infrastructure Solution Integration Service Market Analysis By Industry

Significant industries benefitting from integration services include healthcare, finance and banking, telecommunications, and manufacturing. The healthcare segment is projected to increase from $28.43 billion to $76.32 billion, reflecting the critical need for integrated solutions. The finance and banking sector follows, advancing from $10.09 billion to $27.07 billion, as regulatory mandates require seamless data interactions.

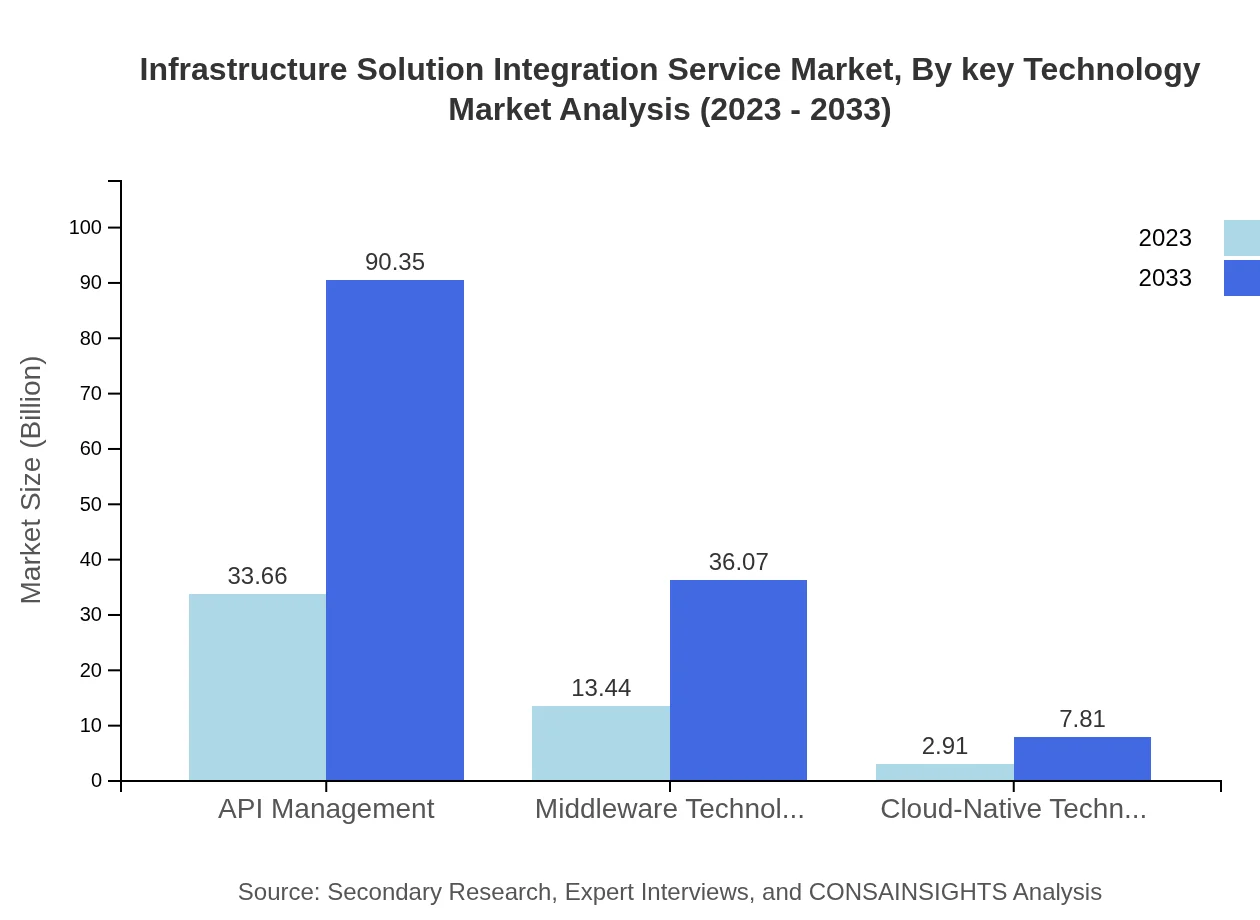

Infrastructure Solution Integration Service Market Analysis By Key Technology

Key technologies shaping the market include API Management, Middleware Technologies, and Cloud-Native Technologies. API Management is dominant, increasing from $33.66 billion in 2023 to $90.35 billion by 2033. Middleware Technologies are also growing, from $13.44 billion to $36.07 billion. However, Cloud-Native Technologies, although smaller at $2.91 billion in 2023, are gaining traction, suggesting an important focus on agile development and operational efficiencies.

Infrastructure Solution Integration Service Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Infrastructure Solution Integration Service Industry

IBM:

A leader in IT solutions, IBM provides advanced integration service technologies and consulting expertise, helping clients with digital transformation and operational efficiency.Accenture:

Accenture specializes in strategic consulting and technology implementation, offering comprehensive integration services that leverage analytics and cloud technologies.Cisco:

Cisco is notable for its networking solutions, providing integral support to enterprise-grade integration services focused on improving connectivity and communication.Oracle:

Oracle’s database and cloud technologies enable robust integration solutions that streamline business operations and data management.Microsoft:

Microsoft offers varied integration solutions through its Azure cloud platform, incorporating tools and services that enhance organizational connectivity.We're grateful to work with incredible clients.

FAQs

What is the market size of Infrastructure Solution Integration Service?

The Infrastructure Solution Integration Service market is poised at approximately $50 billion in 2023, with a robust CAGR of 10%, reflecting sustained growth through 2033. This growth pattern underscores the increasing need for integrated infrastructure solutions across various sectors.

What are the key market players or companies in the Infrastructure Solution Integration Service industry?

Key players in the Infrastructure Solution Integration Service industry include leading technology firms and service providers that specialize in integration solutions, cloud services, and consulting. Their innovative offerings and global reach significantly influence market dynamics and competitive landscape.

What are the primary factors driving the growth in the Infrastructure Solution Integration Service industry?

The growth of the Infrastructure Solution Integration Service sector is primarily driven by the rising demand for digital transformation across industries, effective resource management, and the increasing adoption of cloud technologies. Moreover, regulatory compliance and security concerns further propel market expansion.

Which region is the fastest Growing in the Infrastructure Solution Integration Service?

The North America region emerges as the fastest-growing market for Infrastructure Solution Integration Services, forecasted to reach $48.91 billion by 2033, up from $18.22 billion in 2023. Europe and Asia Pacific also exhibit robust growth rates, reflecting regional technology adoption.

Does ConsaInsights provide customized market report data for the Infrastructure Solution Integration Service industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the Infrastructure Solution Integration Service industry. This includes in-depth analysis and insights into market size, trends, and competitive landscape, ensuring comprehensive research outcomes.

What deliverables can I expect from this Infrastructure Solution Integration Service market research project?

Expect detailed reports featuring market size estimations, growth forecasts, regional analyses, and segmented data breakdowns. You will also receive strategic insights and recommendations to aid in decision-making, market entry, and competitive positioning.

What are the market trends of Infrastructure Solution Integration Service?

Current market trends include a shift toward cloud-native technologies, increased reliance on API management, and the growing importance of on-premises deployment solutions. Additionally, the focus on integrating digital solutions to enhance operational efficiency is prominent within the industry.