Car Navigation Market Report

Published Date: 31 January 2026 | Report Code: car-navigation

Car Navigation Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive overview of the car navigation market, focusing on trends, size, segmentation, and regional analysis for the forecast period from 2023 to 2033. Detailed insights will aid stakeholders in making informed decisions.

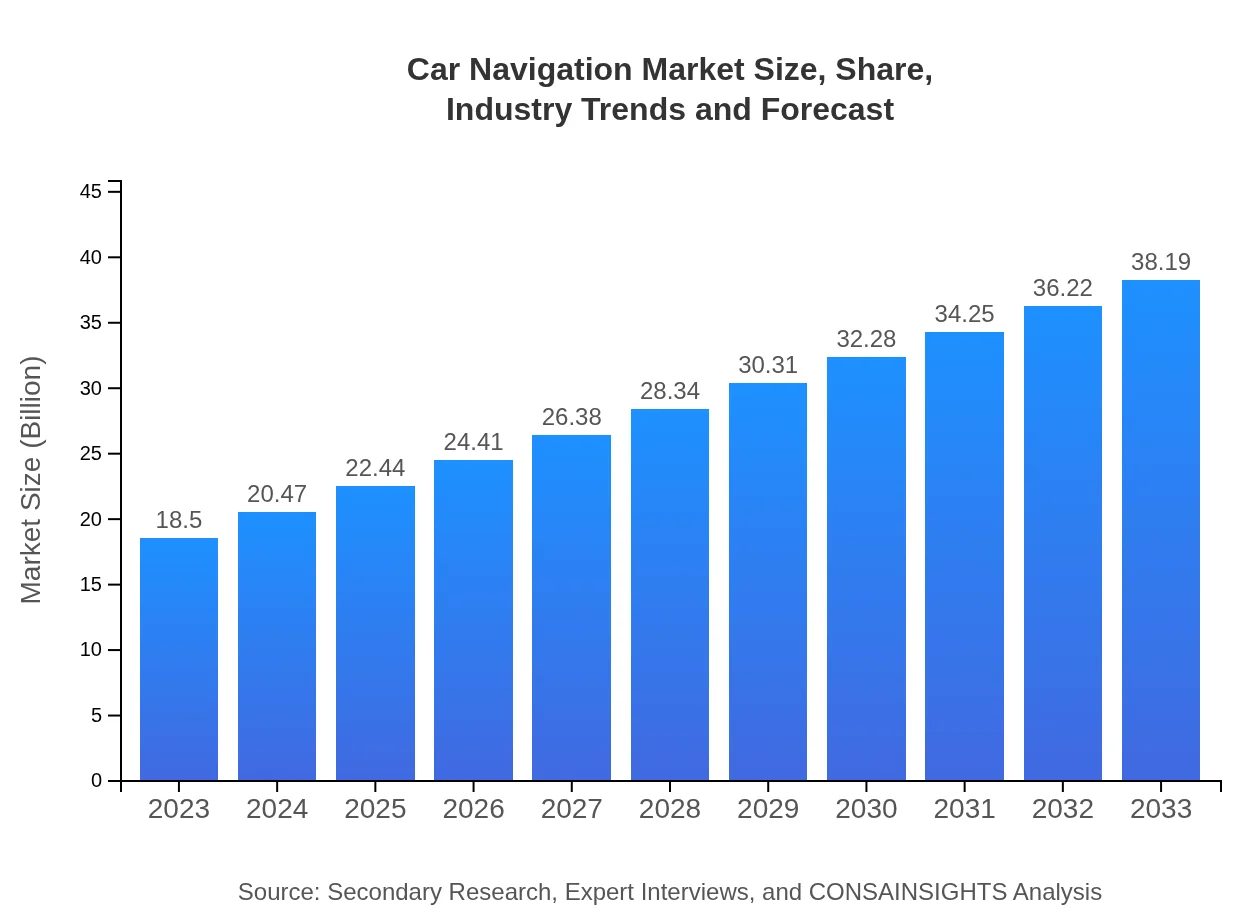

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $18.50 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $38.19 Billion |

| Top Companies | Garmin Ltd., HERE Technologies, TomTom NV, Google Maps, Apple Inc. |

| Last Modified Date | 31 January 2026 |

Car Navigation Market Overview

Customize Car Navigation Market Report market research report

- ✔ Get in-depth analysis of Car Navigation market size, growth, and forecasts.

- ✔ Understand Car Navigation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Car Navigation

What is the Market Size & CAGR of Car Navigation market in 2023?

Car Navigation Industry Analysis

Car Navigation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Car Navigation Market Analysis Report by Region

Europe Car Navigation Market Report:

Europe’s car navigation market is expected to see an increase from $4.49 billion in 2023 to $9.27 billion by 2033. Stringent regulations regarding vehicle safety and environment are pushing the demand for sophisticated navigation systems that enhance driver assistance technologies.Asia Pacific Car Navigation Market Report:

The Asia Pacific region is experiencing significant growth, with a market size expected to expand from $4.02 billion in 2023 to $8.30 billion by 2033. Key factors include increasing consumer demand for technologically advanced vehicles and growing adoption of smart city initiatives. Countries like Japan and China are at the forefront, leading innovations in car navigation technologies.North America Car Navigation Market Report:

The North American market is anticipated to grow from $5.92 billion in 2023 to $12.22 billion by 2033, owing to the high penetration of advanced automotive technology and consumer preference for integrated navigation solutions. The presence of major automotive manufacturers and tech companies plays a critical role in market dynamics.South America Car Navigation Market Report:

In South America, the car navigation market is projected to grow from $1.48 billion in 2023 to $3.05 billion by 2033. The growth is driven by urbanization and the rise of the automotive sector, alongside a growing preference for digital solutions among consumers.Middle East & Africa Car Navigation Market Report:

In the Middle East and Africa, the market will grow from $2.59 billion in 2023 to $5.34 billion by 2033, spurred by increasing vehicle sales and rising demand for connected vehicle technologies. Initiatives by governments to improve infrastructure and transport systems also contribute to market growth.Tell us your focus area and get a customized research report.

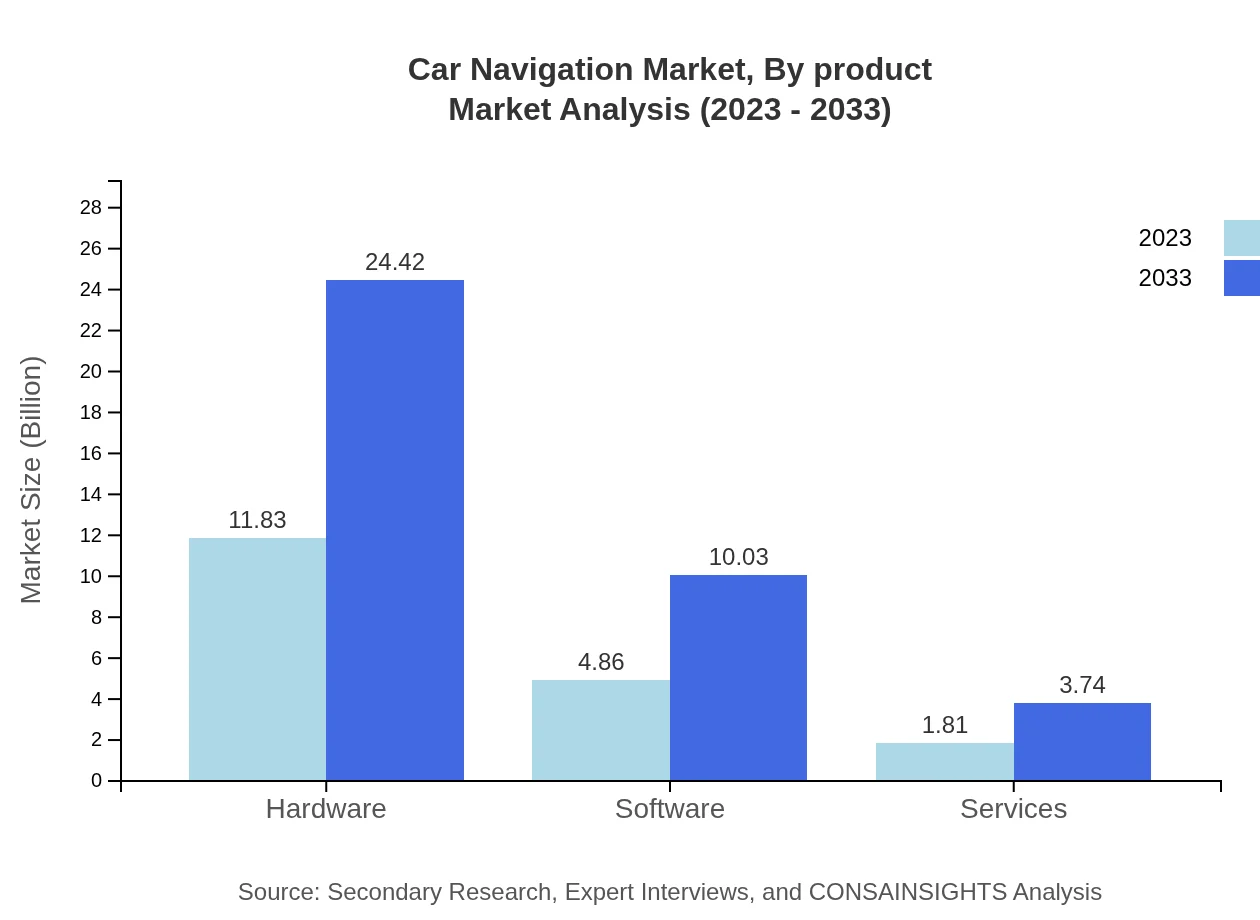

Car Navigation Market Analysis By Product

The product segmentation of the car navigation market includes hardware, software, and services. Hardware accounts for a significant market share due to the necessity of GPS devices in vehicles. Meanwhile, software solutions are also witnessing increased adoption as they provide enhanced functionality and user experience. Services related to mapping and regular updates are crucial, ensuring the effectiveness of navigation tools.

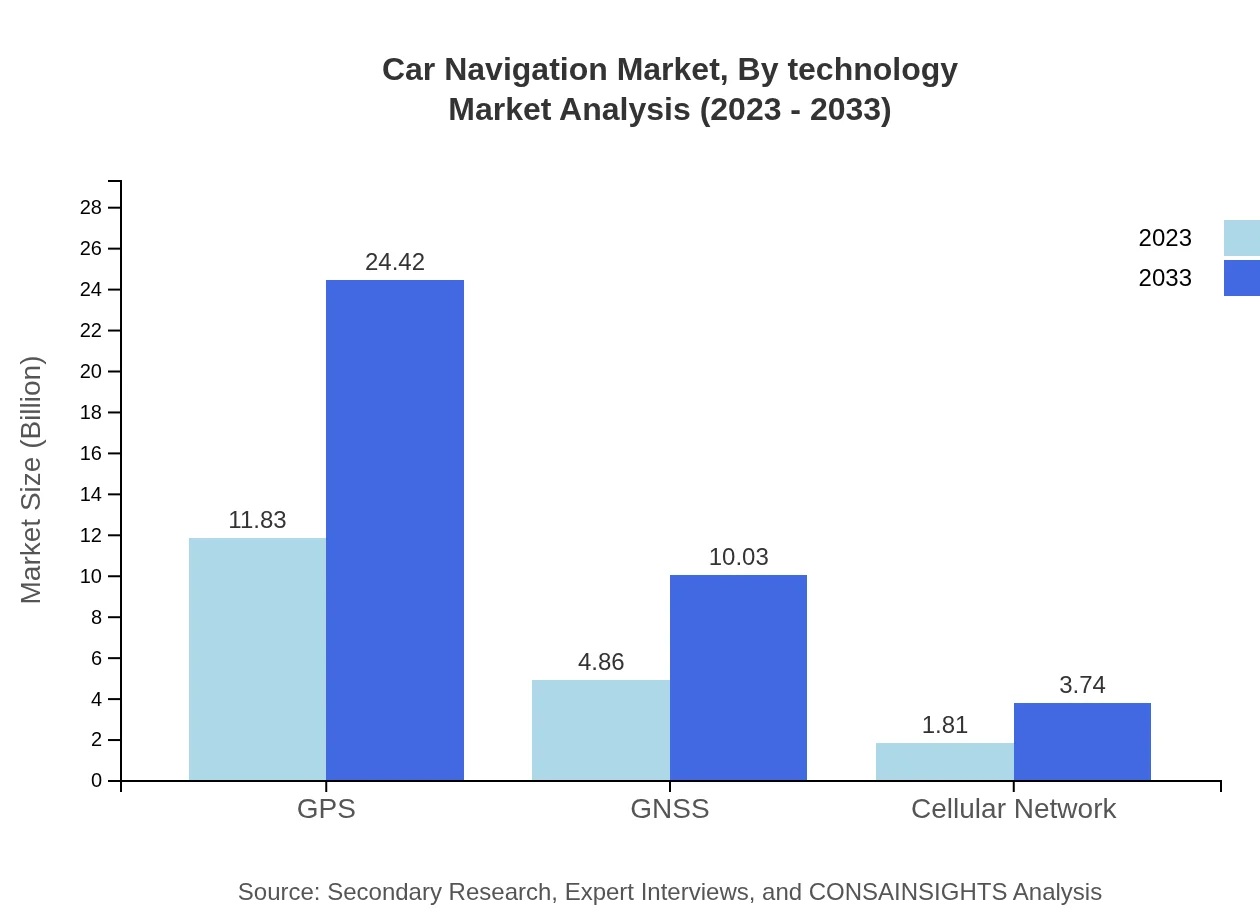

Car Navigation Market Analysis By Technology

The segment by technology mainly includes GPS, GNSS, and cellular networks. GPS technology remains dominant, representing the largest share due to its reliability and accuracy. GNSS is gaining traction, especially in regions with weaker GPS signals, while cellular networks are increasingly being integrated into navigation systems to provide supplementary data and enhance functionality.

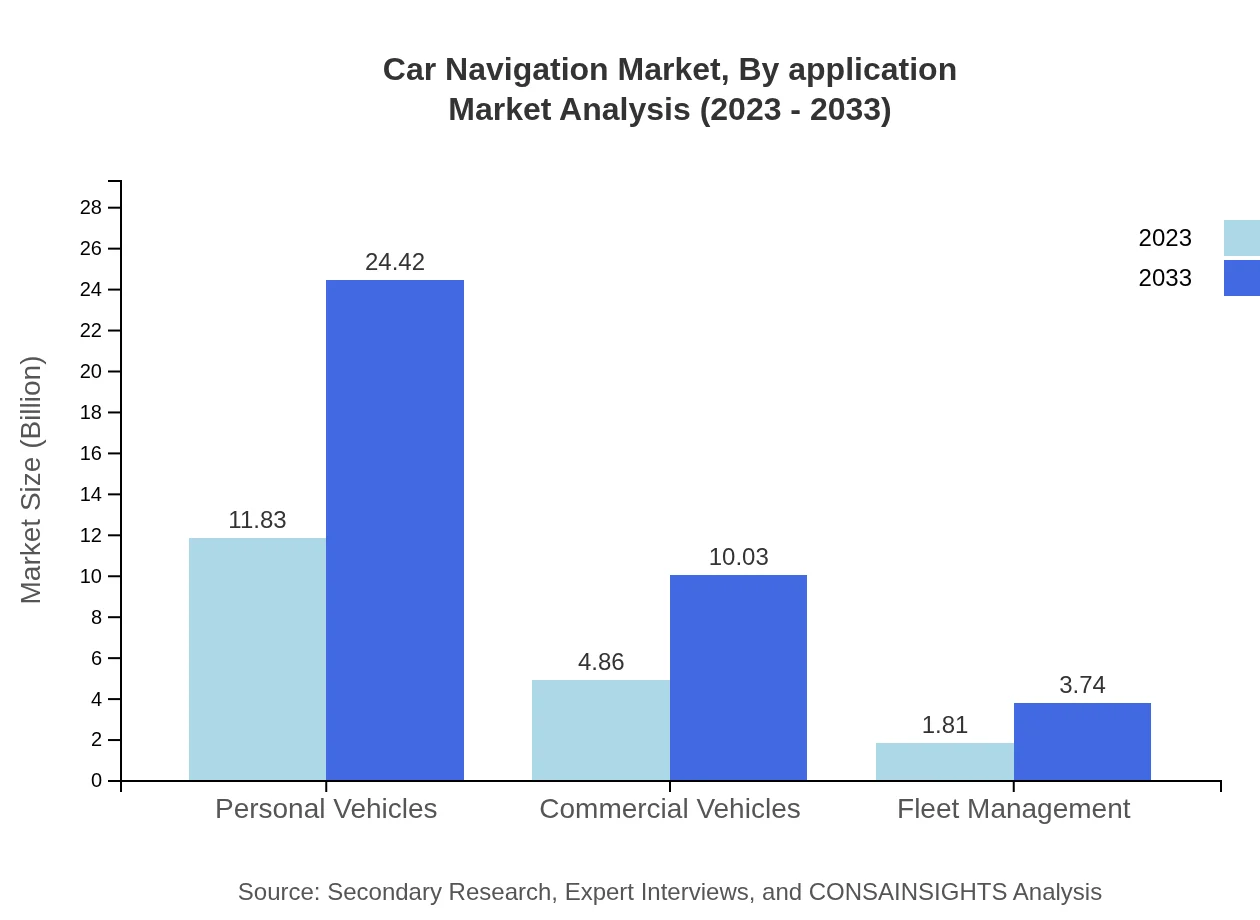

Car Navigation Market Analysis By Application

Applications of car navigation include personal vehicles, commercial vehicles, and fleet management. Personal vehicles dominate the market, attributed to the heavy consumption of navigation systems by individual users. However, commercial and fleet management applications are growing rapidly as businesses seek to optimize routes and improve logistics.

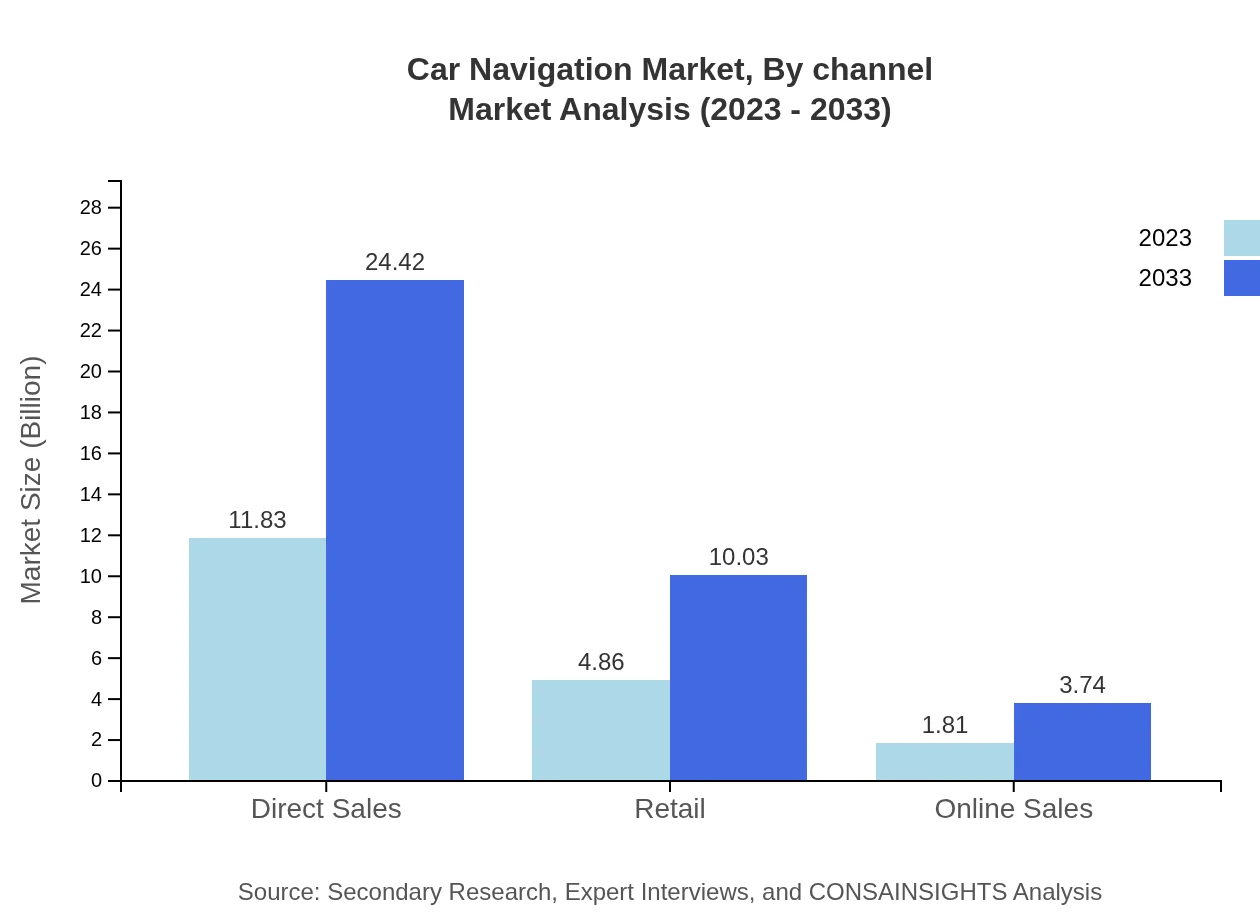

Car Navigation Market Analysis By Channel

Distribution channels for car navigation systems include direct sales, retail, and online sales. Direct sales represent the largest share, reaching $11.83 billion in size by 2023. Retail and online channels are also growing, as consumers increasingly prefer convenient digital shopping experiences.

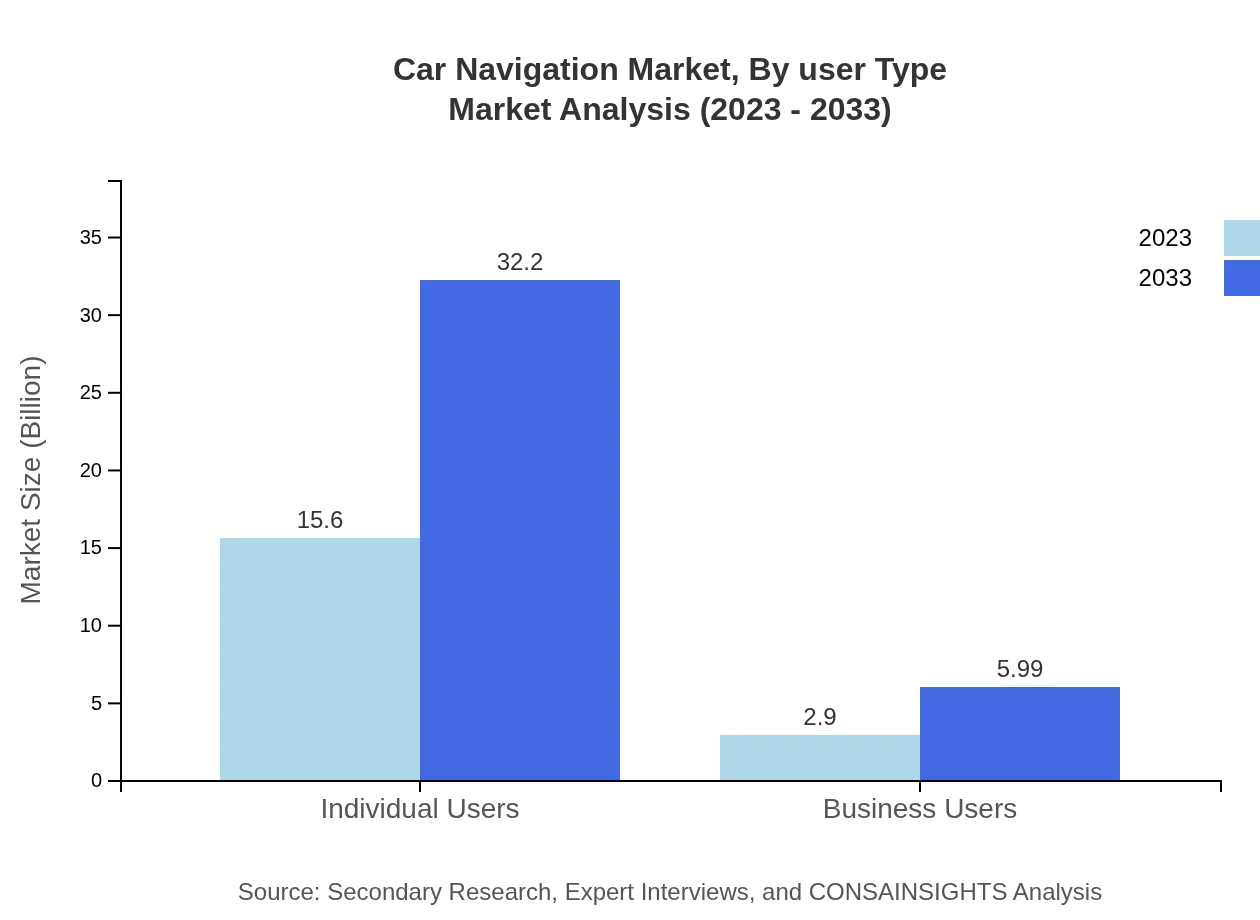

Car Navigation Market Analysis By User Type

The user type segmentation includes individual users and business users. Individual users dominate the market due to the high penetration of navigation systems in personal vehicles. Business users are also significant, especially in fleet management and logistics applications, indicating a growing trend of integrated navigation solutions in commercial sectors.

Car Navigation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Car Navigation Industry

Garmin Ltd.:

A leading provider of GPS navigation and wearable technology, Garmin offers a range of car navigation solutions known for their precision and user-friendly interfaces.HERE Technologies:

Specializing in mapping and location data, HERE Technologies provides advanced solutions for automotive navigation systems, enhancing connected vehicle experiences.TomTom NV:

A global leader in navigation technology, TomTom delivers innovative automotive navigation and mapping products that cater to both consumer and commercial needs.Google Maps:

As a prominent digital mapping service, Google Maps provides real-time navigation solutions and is increasingly being integrated into vehicle systems worldwide.Apple Inc.:

With its Apple Maps platform, the company provides integrated navigation solutions for Apple devices, enhancing the automotive navigation experience through its ecosystem.We're grateful to work with incredible clients.

FAQs

What is the market size of car Navigation?

The global car-navigation market is valued at approximately $18.5 billion in 2023, with an expected compound annual growth rate (CAGR) of 7.3%. By 2033, it is projected to significantly expand as technology continues to advance.

What are the key market players or companies in the car Navigation industry?

Key players in the car-navigation market include major tech firms such as Garmin, TomTom, and Google, along with automotive giants like Ford, BMW, and Toyota, which integrate these systems into their vehicles to enhance user navigation experience.

What are the primary factors driving the growth in the car Navigation industry?

Several factors contribute to the growth of the car-navigation industry including increasing consumer demand for advanced vehicle technologies, the proliferation of smart devices, and the need for efficient route planning solutions amid rising traffic congestion.

Which region is the fastest Growing in the car Navigation?

North America is the fastest-growing region in the car-navigation market, anticipated to increase from $5.92 billion in 2023 to $12.22 billion by 2033, driven by high vehicle ownership and advancements in GPS technology.

Does ConsaInsights provide customized market report data for the car Navigation industry?

Yes, ConsaInsights offers customized market report data tailored to the car-navigation industry, enabling clients to focus on specific segments, geographic areas, or particular technologies to meet their unique research needs.

What deliverables can I expect from this car Navigation market research project?

From the car-navigation market research project, clients can expect comprehensive reports detailing market size, forecasts, regional insights, competitive analysis, key trends, and strategic recommendations based on the collected data.

What are the market trends of car Navigation?

Key trends in the car-navigation market include the rise of autonomous driving technologies, integration with mobile applications, growth in usage of cloud-based navigation solutions, and increasing demand for real-time traffic data to enhance driving efficiency.