Mass Transit Security Market Report

Published Date: 31 January 2026 | Report Code: mass-transit-security

Mass Transit Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Mass Transit Security market, including insights on market trends, segmentation, regional analysis, and forecasts for the period 2023-2033.

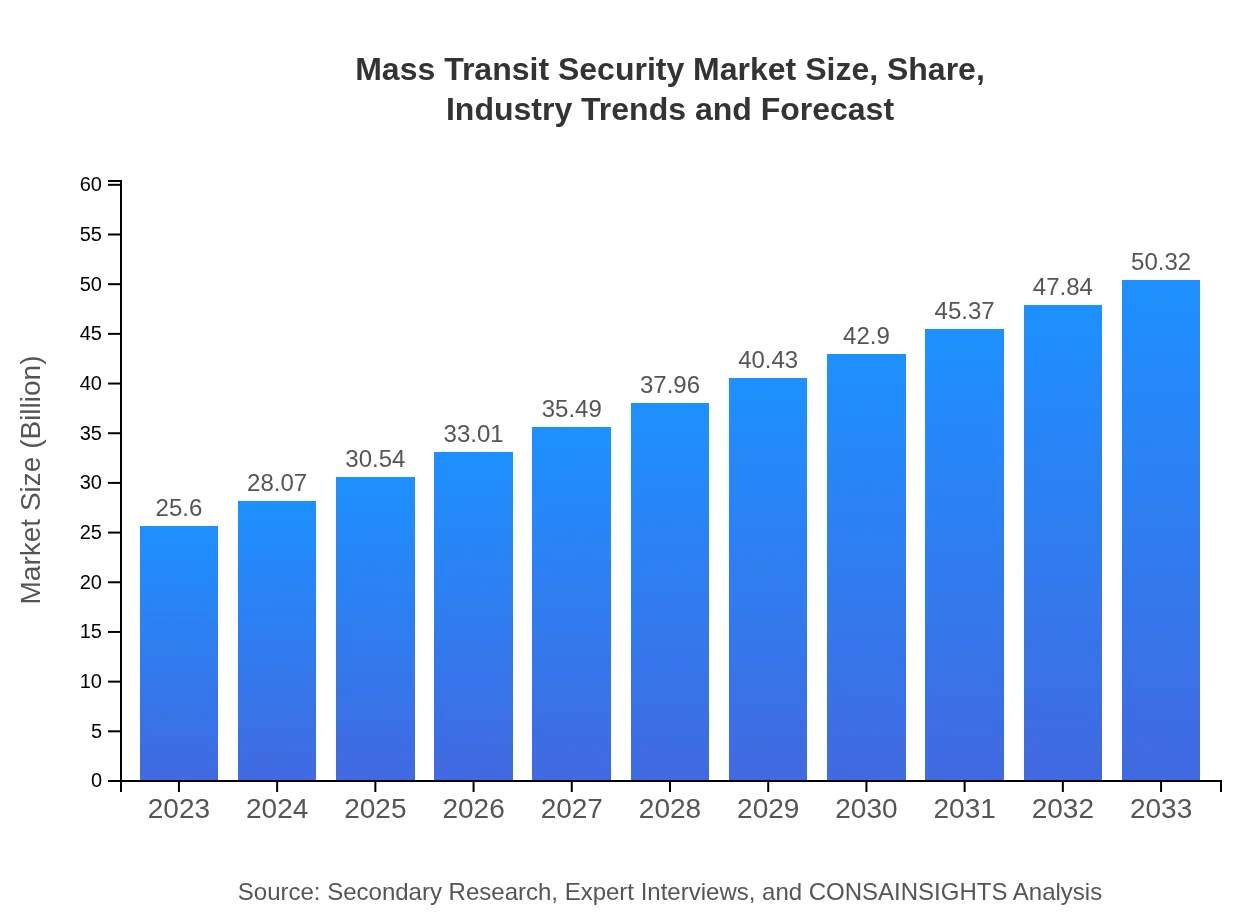

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $50.32 Billion |

| Top Companies | Hikvision, Honeywell , Siemens , Dahua Technology, Tyco Integrated Security |

| Last Modified Date | 31 January 2026 |

Mass Transit Security Market Overview

Customize Mass Transit Security Market Report market research report

- ✔ Get in-depth analysis of Mass Transit Security market size, growth, and forecasts.

- ✔ Understand Mass Transit Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mass Transit Security

What is the Market Size & CAGR of Mass Transit Security market in 2023?

Mass Transit Security Industry Analysis

Mass Transit Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mass Transit Security Market Analysis Report by Region

Europe Mass Transit Security Market Report:

In Europe, the market value is projected to grow from $7.72 billion in 2023 to $15.18 billion in 2033. European countries are increasingly adopting integrated security solutions to address growing risks and comply with stringent safety regulations.Asia Pacific Mass Transit Security Market Report:

In the Asia Pacific region, the Mass Transit Security market is projected to grow from $5.11 billion in 2023 to $10.04 billion in 2033. This growth is propelled by urbanization, rising public transit systems, and government initiatives to enhance security measures in populous cities.North America Mass Transit Security Market Report:

North America is a leading market, expected to increase from $8.25 billion in 2023 to $16.21 billion in 2033. Focused investments on advanced security technologies in transportation systems, along with strong regulatory mandates, support this robust market growth.South America Mass Transit Security Market Report:

The South American market for Mass Transit Security is expected to expand from $1.43 billion in 2023 to $2.80 billion by 2033. The emphasis on improving transportation infrastructure and addressing security issues in urban areas is driving this growth.Middle East & Africa Mass Transit Security Market Report:

The Middle East and Africa market is anticipated to rise from $3.09 billion in 2023 to $6.08 billion by 2033. The growth is fueled by the region's expanding urban transit services and collaborative security efforts among nations to combat common threats.Tell us your focus area and get a customized research report.

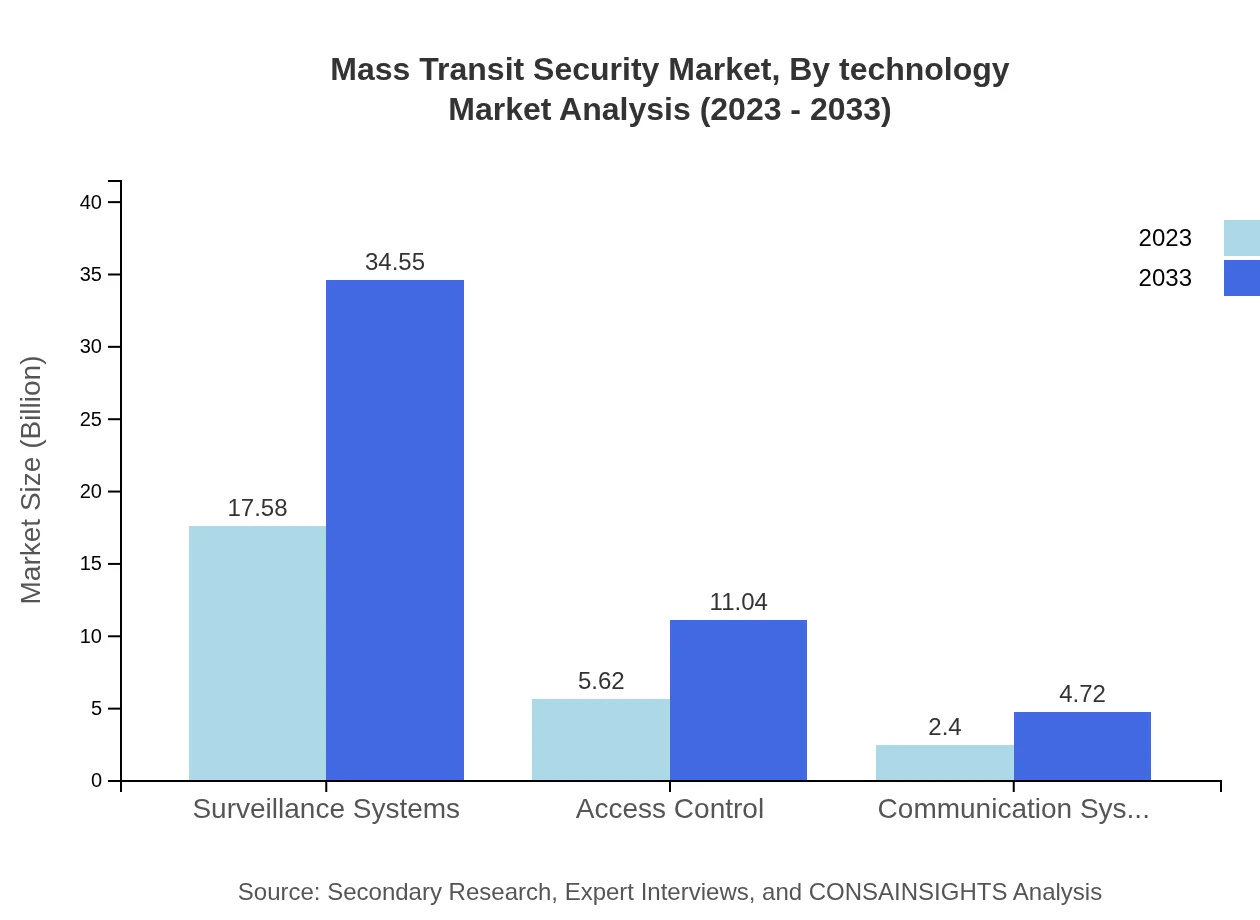

Mass Transit Security Market Analysis By Technology

The market is divided into various technological segments, including surveillance systems, access control, and communication systems. Surveillance systems dominate the market, representing $17.58 billion in 2023, growing to $34.55 billion by 2033. Access control systems follow, with significant growth expected due to increasing automation demands.

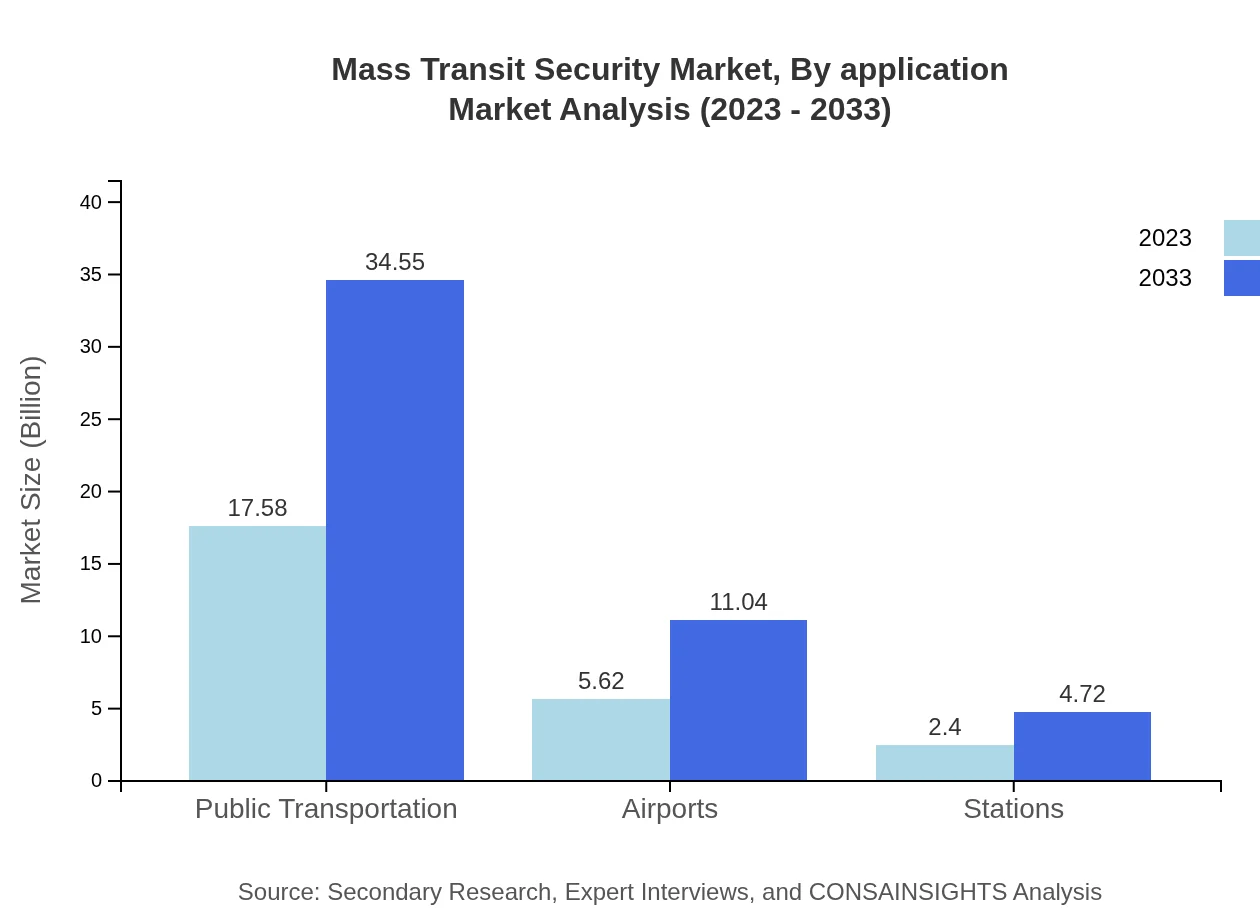

Mass Transit Security Market Analysis By Application

Applications of Mass Transit Security include public transportation, airports, and train stations. Public transportation systems account for a majority share, amounting to $17.58 billion in 2023 and predicted to reach $34.55 billion by 2033, reflecting the need for safety in daily commutes.

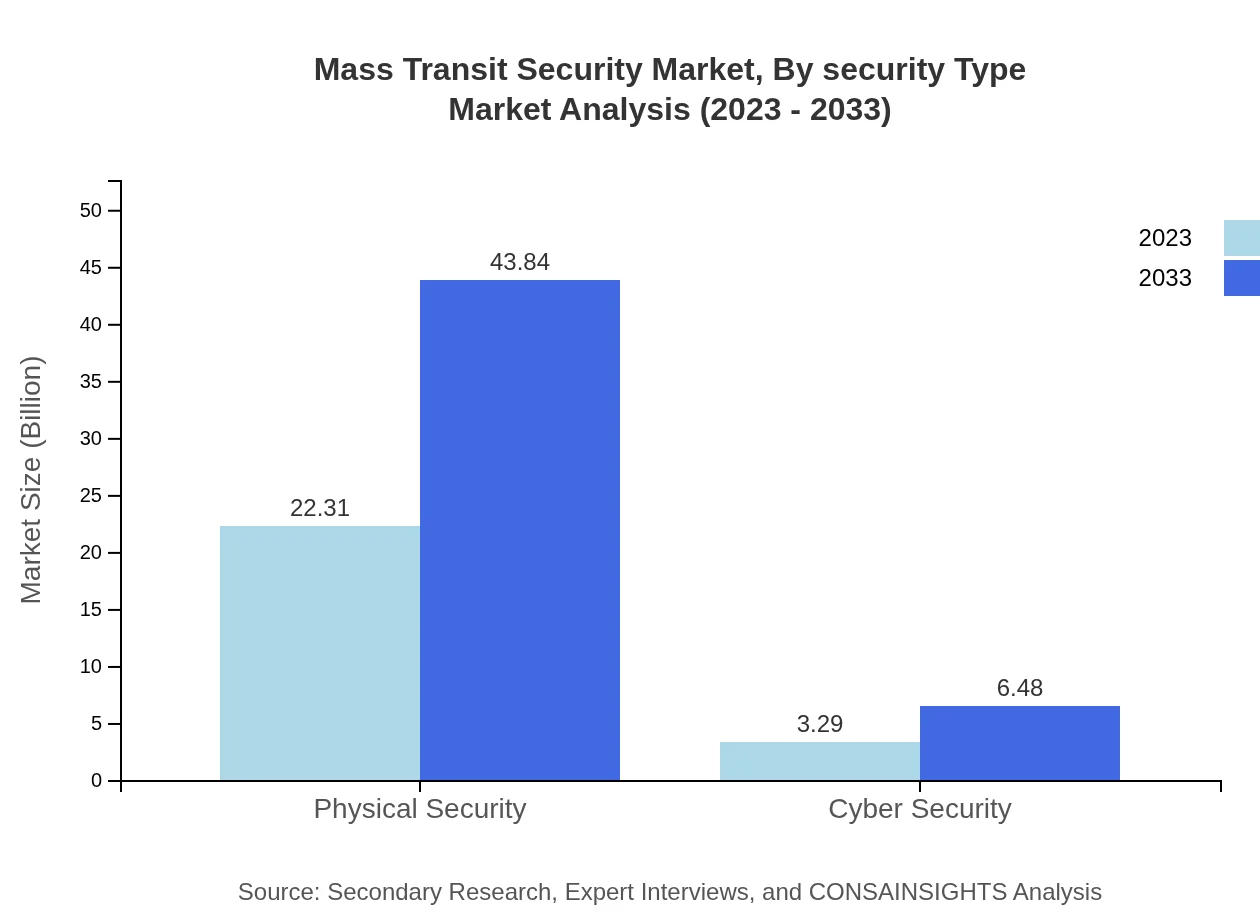

Mass Transit Security Market Analysis By Security Type

The Mass Transit Security market is divided into physical security and cybersecurity. Physical security accounts for $22.31 billion in 2023, growing to $43.84 billion in 2033. Cybersecurity solutions will also see growth, increasing from $3.29 billion to $6.48 billion.

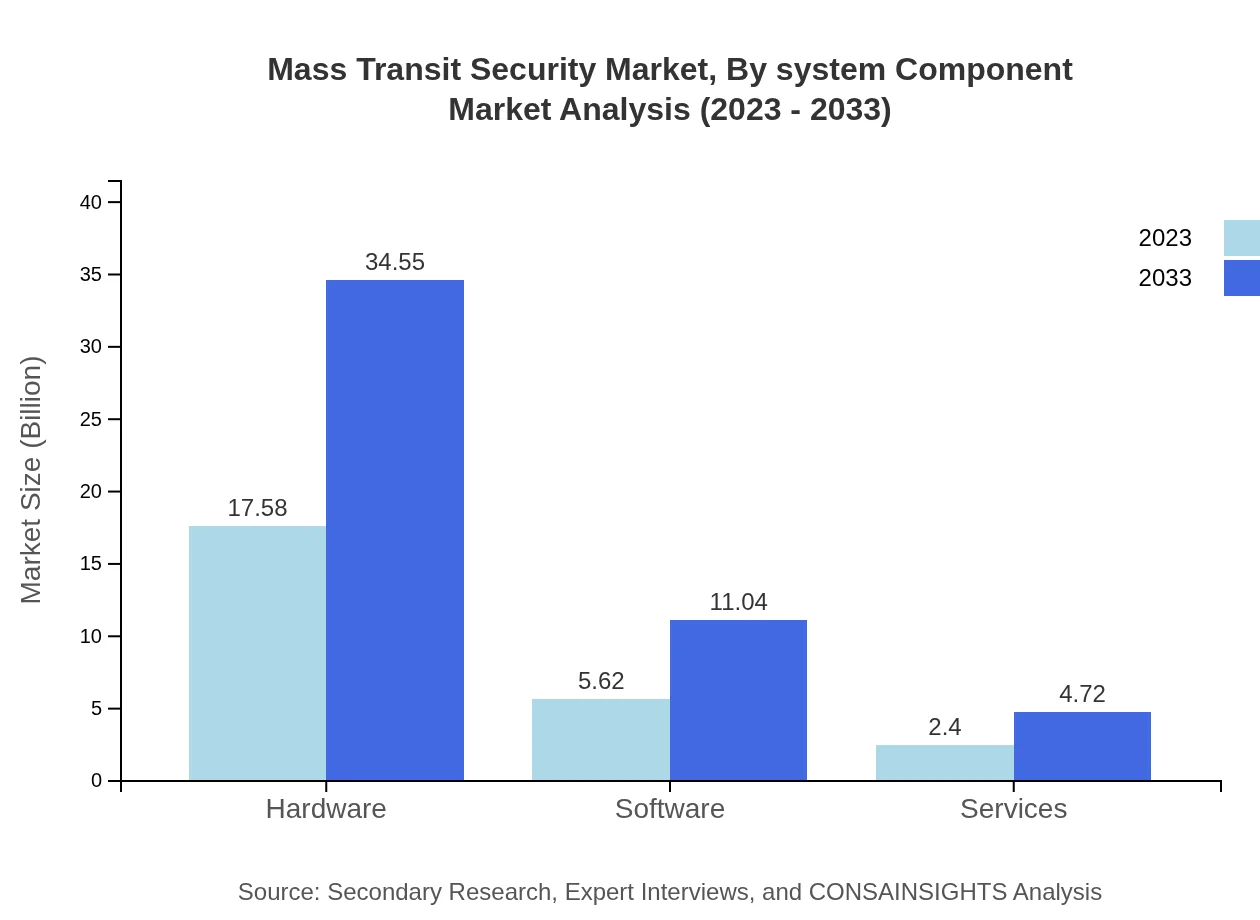

Mass Transit Security Market Analysis By System Component

This segment includes hardware, software, and services. Hardware constitutes a significant portion at $17.58 billion in 2023, with a projection of $34.55 billion in 2033. Software type solutions will double their market size as users increasingly depend on digital interfaces.

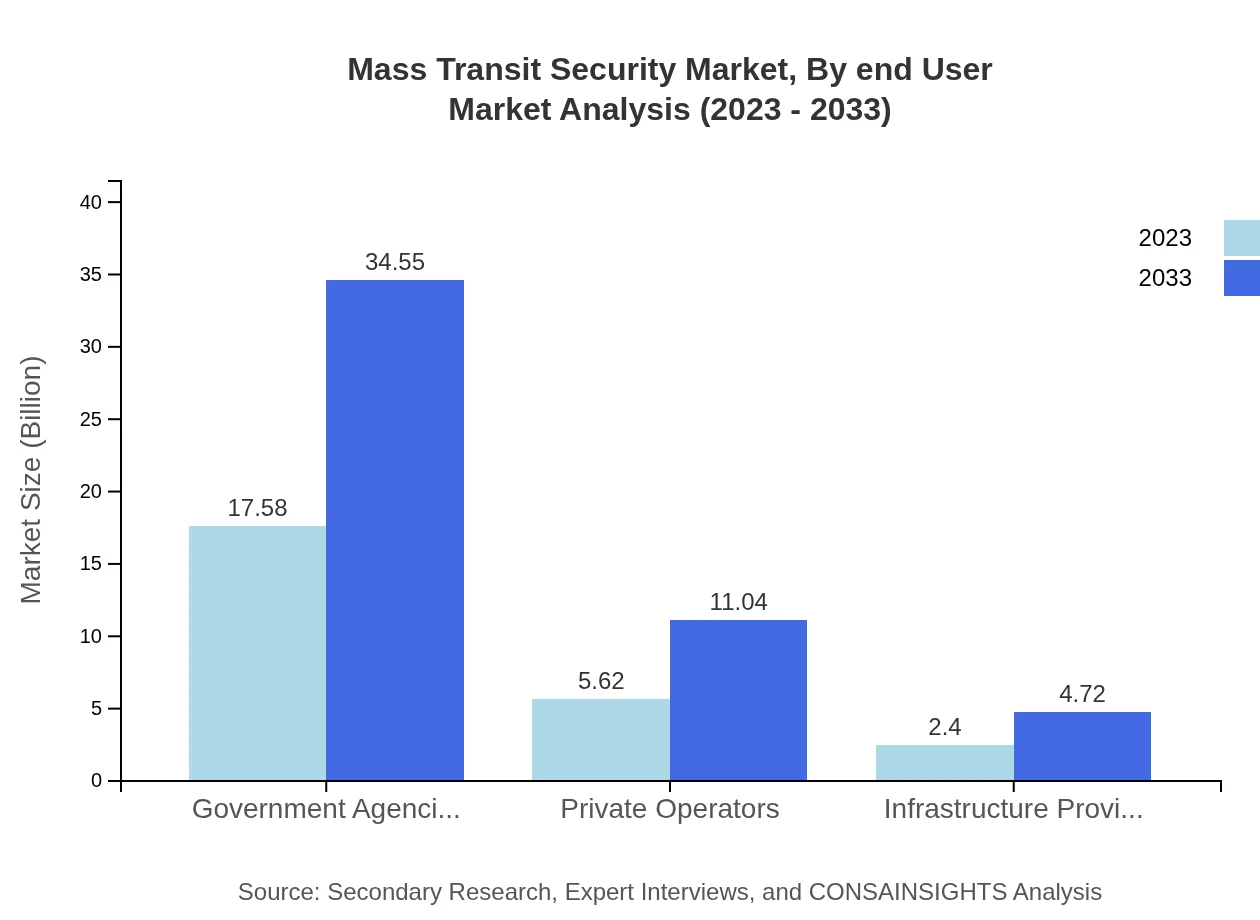

Mass Transit Security Market Analysis By End User

The key end-users in the Mass Transit Security market are government agencies, private operators, and infrastructure providers. Government agencies will hold the largest market share throughout the forecast period, expanding significantly from $17.58 billion to $34.55 billion.

Mass Transit Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mass Transit Security Industry

Hikvision:

A leading provider of security products that help safeguard transit systems with advanced video surveillance and access control systems.Honeywell :

Known for its comprehensive range of safety and security solutions tailored for mass transit, Honeywell integrates technological innovations into operational frameworks.Siemens :

A prominent player in the provision of mass transit security systems, specializing in advanced infrastructure and transport security solutions.Dahua Technology:

Offers a variety of intelligent Video surveillance solutions designed to enhance safety in mass transit networks worldwide.Tyco Integrated Security:

Provides significant contributions to the development of integrated security systems for various transportation modes.We're grateful to work with incredible clients.

FAQs

What is the market size of Mass Transit Security?

The global market size of Mass Transit Security is projected to reach $25.6 billion by 2033, growing at a CAGR of 6.8% from 2023. This growth reflects increasing investments in security measures across transit systems worldwide.

What are the key market players or companies in this Mass Transit Security industry?

Key market players in the Mass Transit Security industry include major security technology firms, integrated service providers, and government entities focused on public safety. These companies are instrumental in implementing advanced security solutions like surveillance and access control.

What are the primary factors driving the growth in the Mass Transit Security industry?

The growth of the Mass Transit Security industry is primarily driven by increasing security threats, regulatory requirements, and technological advancements. The demand for advanced surveillance systems and integrated security solutions further contributes to this market expansion.

Which region is the fastest Growing in the Mass Transit Security?

The fastest-growing region in the Mass Transit Security market is North America, projected to grow from $8.25 billion in 2023 to $16.21 billion by 2033. Europe and Asia-Pacific also exhibit strong growth trends, reflecting higher security investments.

Does ConsaInsights provide customized market report data for the Mass Transit Security industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Mass Transit Security industry. Clients can request bespoke analyses and insights based on unique parameters and requirements relevant to their business.

What deliverables can I expect from this Mass Transit Security market research project?

Deliverables from the Mass Transit Security market research project include detailed reports, market forecasts, growth opportunities, competitive analysis, and segment breakdowns. Clients will receive actionable insights to inform strategic decision-making.

What are the market trends of Mass Transit Security?

Market trends in Mass Transit Security indicate a shift towards integrated solutions combining physical and cyber security. Increasing automation, AI-driven surveillance, and enhanced regulatory frameworks are shaping the future of security in transit systems.