Metal Coatings Market Report

Published Date: 02 February 2026 | Report Code: metal-coatings

Metal Coatings Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Metal Coatings market, covering market trends, forecasts from 2023 to 2033, and insights into industry dynamics including segmentation, regional analysis, and key players.

| Metric | Value |

|---|---|

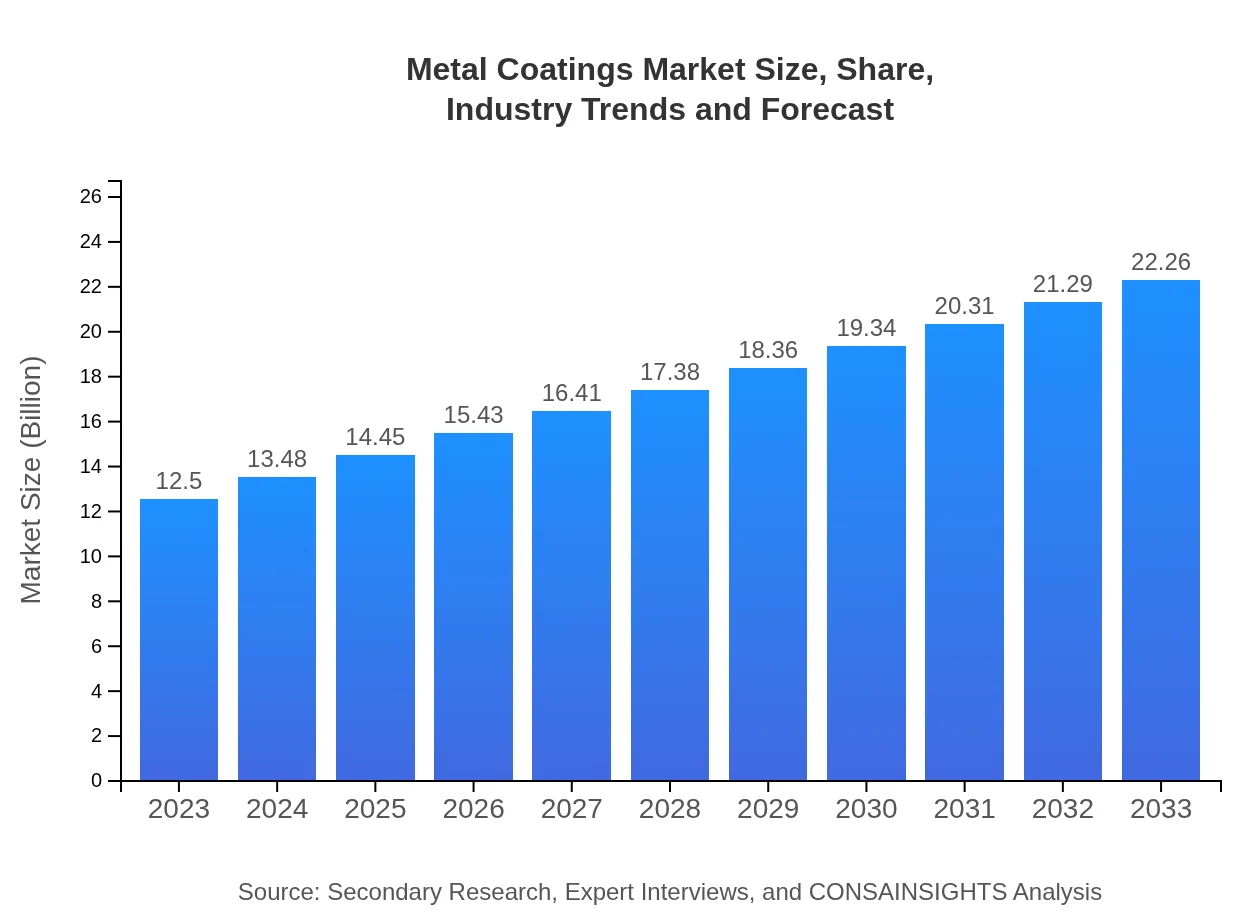

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $22.26 Billion |

| Top Companies | AkzoNobel N.V., PPG Industries, Inc., Sherwin-Williams Company, BASF SE, Henkel AG & Co. KGaA |

| Last Modified Date | 02 February 2026 |

Metal Coatings Market Overview

Customize Metal Coatings Market Report market research report

- ✔ Get in-depth analysis of Metal Coatings market size, growth, and forecasts.

- ✔ Understand Metal Coatings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Metal Coatings

What is the Market Size & CAGR of Metal Coatings market in 2023?

Metal Coatings Industry Analysis

Metal Coatings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Metal Coatings Market Analysis Report by Region

Europe Metal Coatings Market Report:

Europe’s market is anticipated to grow from $3.85 billion in 2023 to $6.85 billion in 2033. Regulatory frameworks supporting environmental sustainability, combined with high demand from automotive and aerospace sectors, reinforce market expansion. Technological innovation is crucial in this mature market.Asia Pacific Metal Coatings Market Report:

The Asia Pacific region is anticipated to witness significant growth, expanding from approximately $2.21 billion in 2023 to $3.94 billion in 2033. Growth drivers include rapid industrialization, increasing construction activities, and heightened demand for automotive and electronic products. Countries like China and India are leading consumers due to their expanding manufacturing sectors.North America Metal Coatings Market Report:

The North American market is projected to grow from $4.70 billion in 2023 to $8.37 billion in 2033, benefitting from advanced manufacturing capabilities, technological advancements, and a robust automotive sector. The focus on sustainable coating solutions is also propelling market growth in the region.South America Metal Coatings Market Report:

In South America, the metal coatings market is expected to grow from $0.07 billion in 2023 to $0.12 billion by 2033, primarily driven by emerging economies. Infrastructure development and manufacturing uplift are central to the region's development, but growth is moderated by economic instability.Middle East & Africa Metal Coatings Market Report:

The Middle East and Africa market is expected to grow from $1.68 billion in 2023 to $2.99 billion by 2033, driven by rising construction projects, demands for improved infrastructure, and increased industrial manufacturing efforts in the region. However, political instability and economic challenges limit full potential.Tell us your focus area and get a customized research report.

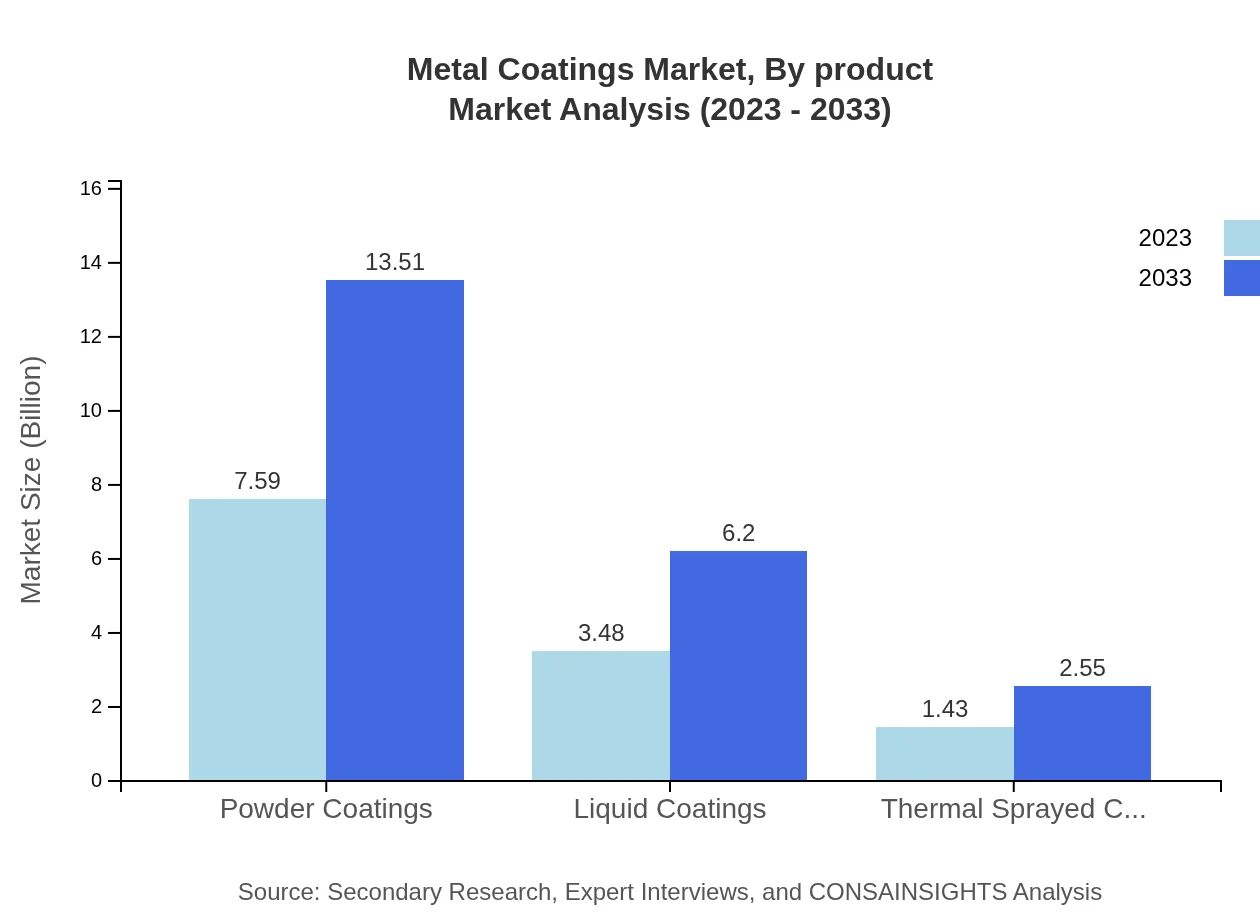

Metal Coatings Market Analysis By Product

Powder coatings dominate the market, forecasted to grow from $7.59 billion in 2023 to $13.51 billion in 2033, maintaining a share of 60.7%. Liquid coatings follow, expected to rise from $3.48 billion to $6.20 billion. Thermal sprayed coatings are also significant, increasing from $1.43 billion to $2.55 billion.

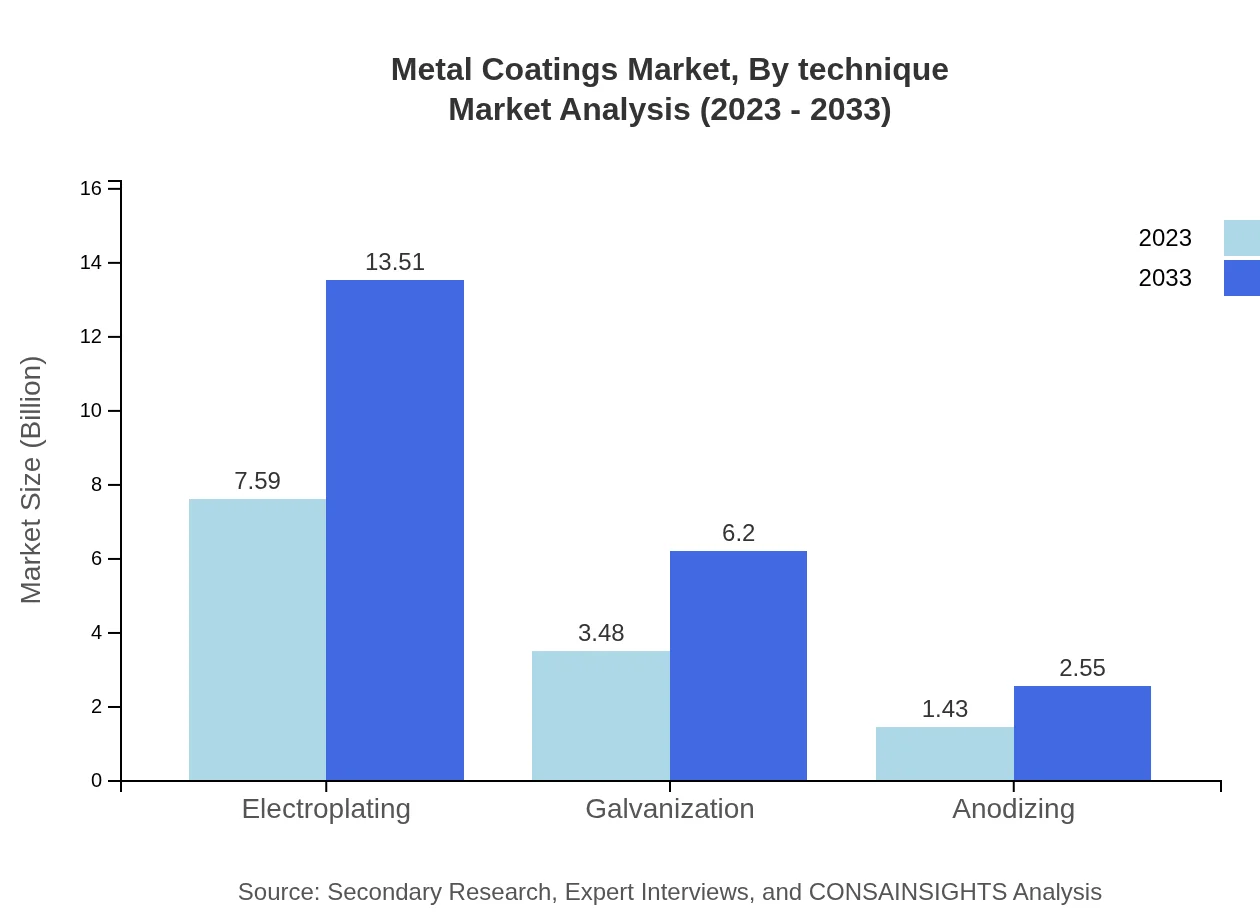

Metal Coatings Market Analysis By Technique

Electroplating remains a critical technique, projected to grow alongside powder coatings, reflecting the industry's focus on protective measures. Galvanization and anodizing also provide considerable contributions, particularly in the automotive and manufacturing sectors.

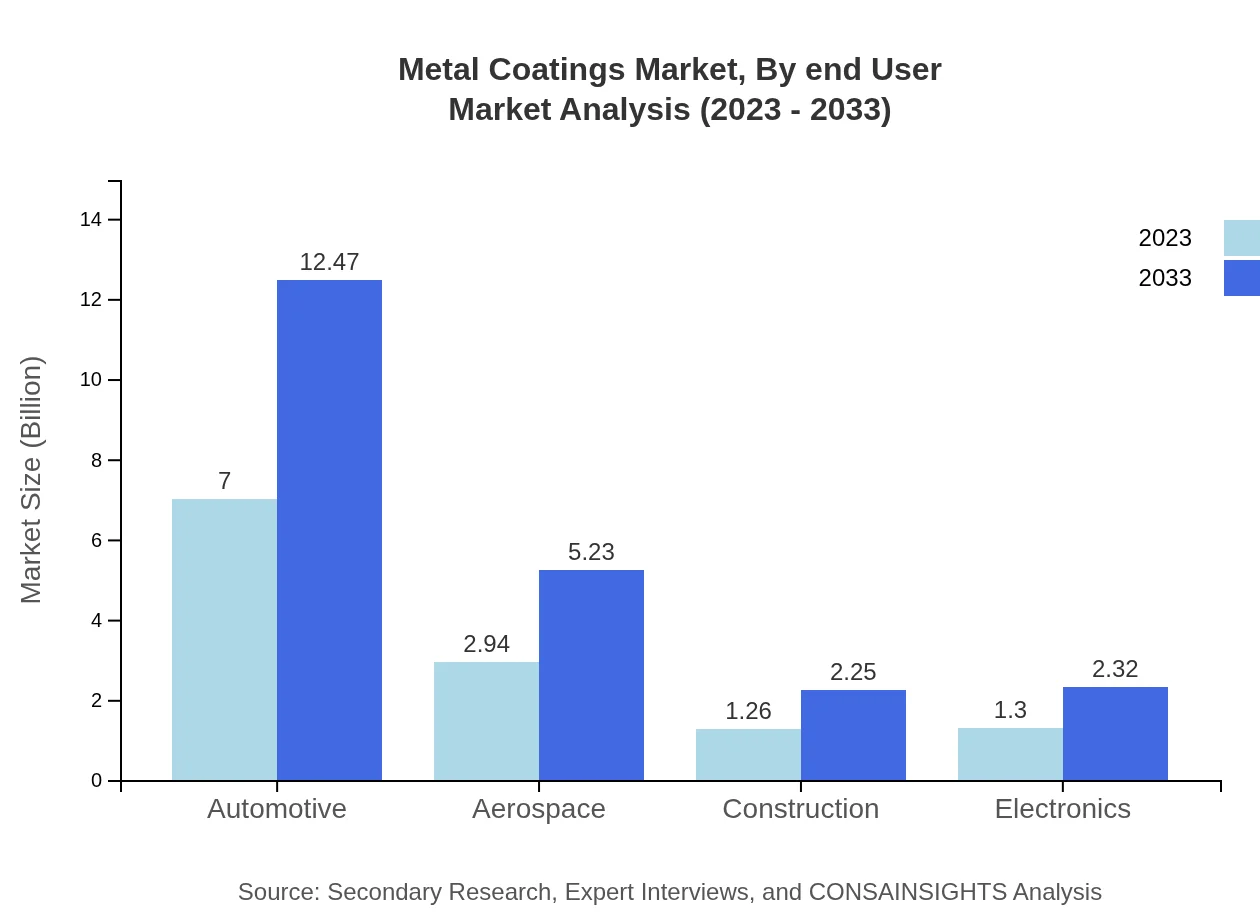

Metal Coatings Market Analysis By End User

The automotive sector represents the largest end-user, accounting for $7.00 billion in 2023 and expected to grow to $12.47 billion. Aerospace and electronics also exhibit significant growth potential, with aerospace projected to rise from $2.94 billion to $5.23 billion.

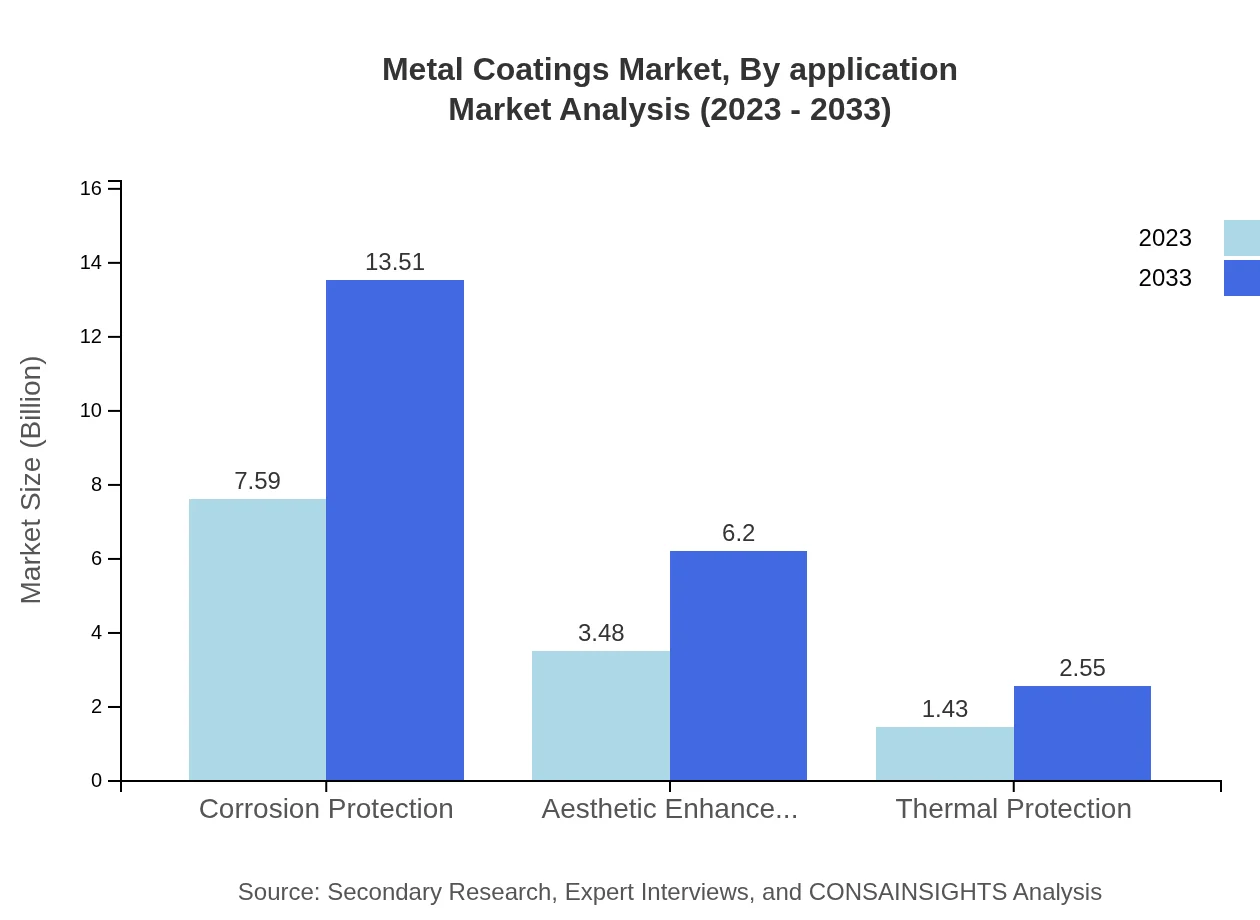

Metal Coatings Market Analysis By Application

Applications focusing on corrosion protection and aesthetic enhancements are vital, with the former representing a significant share. Industries are increasingly adopting coatings for added protection and aesthetic improvements, reflecting evolving consumer preferences and regulatory environments.

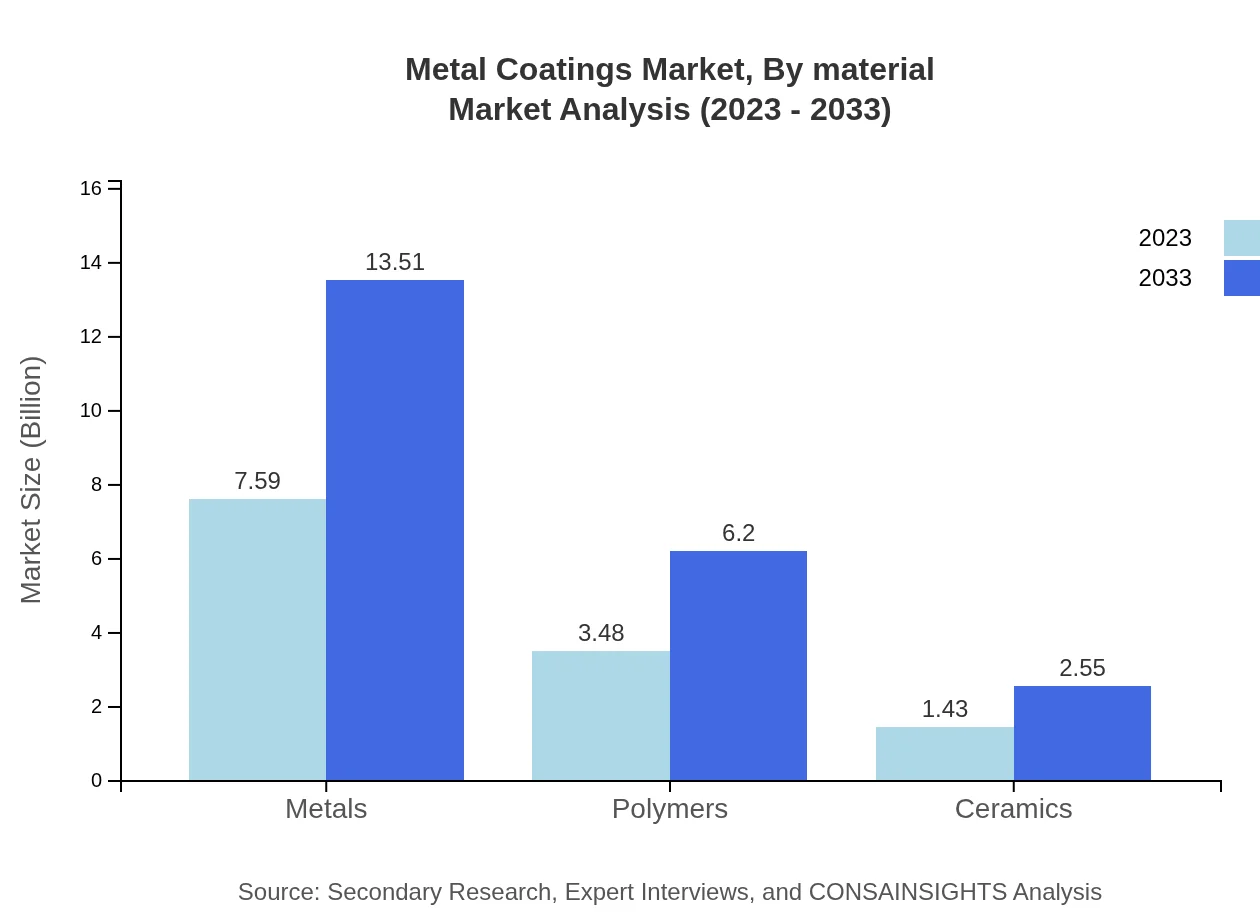

Metal Coatings Market Analysis By Material

In materials, metals dominate with projections of increasing market share, as innovations extend their applicability in diverse sectors. Polymers and ceramics are growing spheres in the coatings market as innovations enhance their performance.

Metal Coatings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Metal Coatings Industry

AkzoNobel N.V.:

A leading global paints and coatings company, specializing in innovative solutions for automotive, aerospace, and general industrial applications.PPG Industries, Inc.:

A major player in the coatings market, PPG offers wide-ranging materials and services with a strong emphasis on sustainability and advanced technologies.Sherwin-Williams Company:

Sherwin-Williams produces a comprehensive range of high-performance coating solutions for various end-user sectors, focusing on innovation and quality.BASF SE:

BASF is known for its diverse product portfolio, specifically in automotive coatings, with a strong commitment to environmental protection.Henkel AG & Co. KGaA:

Henkel provides coatings that enhance performance and aesthetics, heavily invested in research and development to meet industry needs.We're grateful to work with incredible clients.

FAQs

What is the market size of metal Coatings?

The global metal coatings market is projected to reach a size of $12.5 billion by 2033, growing at a CAGR of 5.8% from 2023. This indicates increasing demand for protective and aesthetic coatings across various industries.

What are the key market players or companies in the metal Coatings industry?

Key players in the metal coatings industry include large multinational companies like PPG Industries, Sherwin-Williams, AkzoNobel, and BASF, known for their innovative products and significant market share in various coating technologies.

What are the primary factors driving the growth in the metal coatings industry?

Growth in the metal coatings industry is driven by increasing demand in automotive, aerospace, and construction sectors, advancements in coating technologies, and rising awareness of protective coatings against corrosion and wear.

Which region is the fastest Growing in the metal coatings market?

The Asia Pacific region is the fastest-growing market for metal coatings, projecting an increase from $2.21 billion in 2023 to $3.94 billion by 2033, driven by rapid industrialization and urbanization.

Does ConsaInsights provide customized market report data for the metal coatings industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the metal coatings industry, identifying unique trends, insights, and forecasts based on market requirements.

What deliverables can I expect from this metal coatings market research project?

Deliverables for the metal coatings market research project include comprehensive market analysis reports, detailed regional breakdowns, competitive landscape assessments, and forecasts up to 2033.

What are the market trends of metal coatings?

Current market trends in metal coatings include the shift towards eco-friendly options, advancements in application technologies, and an increasing focus on enhancing surface durability and aesthetics.