Metal Metal Manufactured Products Market Report

Published Date: 02 February 2026 | Report Code: metal-metal-manufactured-products

Metal Metal Manufactured Products Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Metal Metal Manufactured Products market from 2023 to 2033. It encompasses insights on market size, growth forecasts, segmentation, technological advancements, and regional dynamics, offering a comprehensive view of the industry's direction.

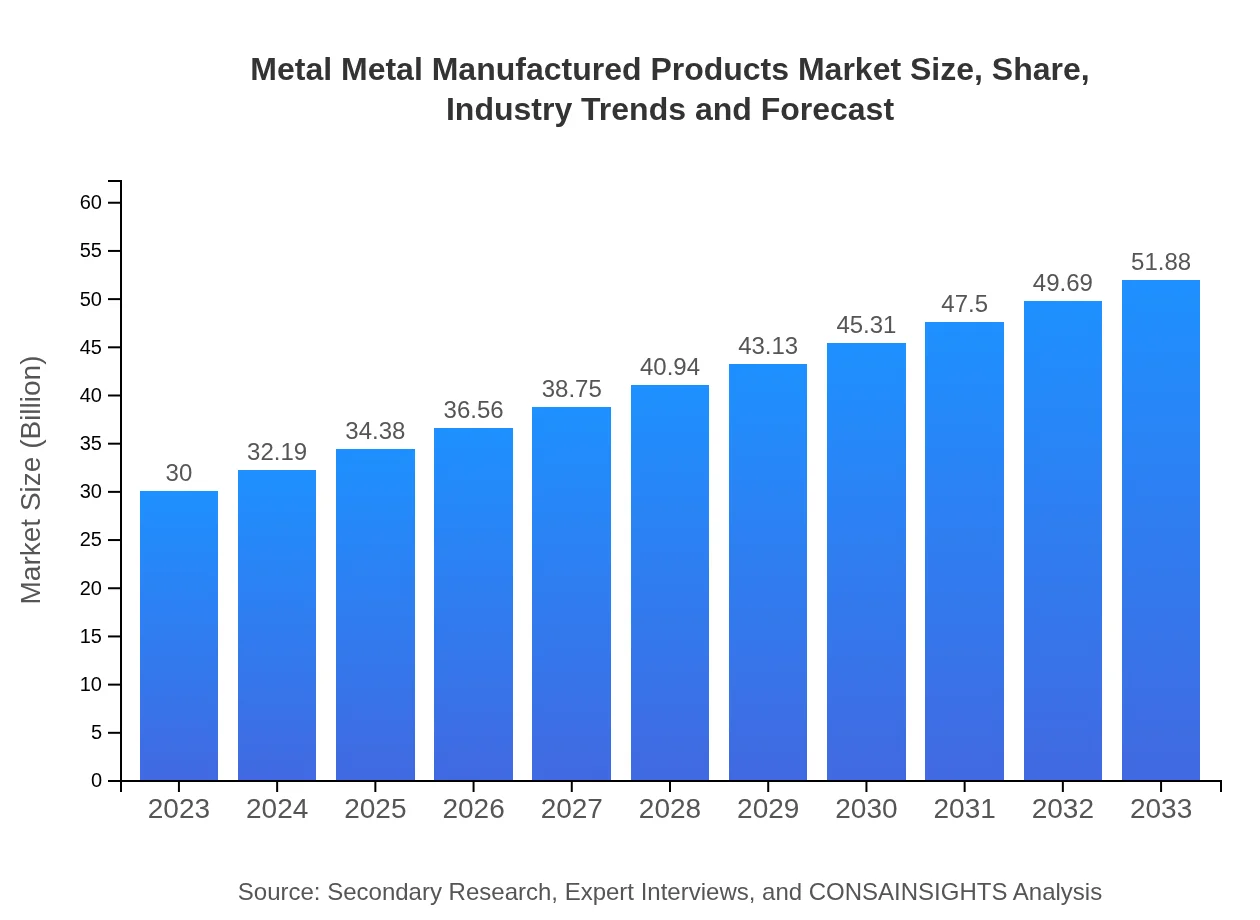

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 5.5% |

| 2033 Market Size | $51.88 Billion |

| Top Companies | Alcoa Corporation, ArcelorMittal, Novelis Inc., Thyssenkrupp AG, Nucor Corporation |

| Last Modified Date | 02 February 2026 |

Metal Metal Manufactured Products Market Overview

Customize Metal Metal Manufactured Products Market Report market research report

- ✔ Get in-depth analysis of Metal Metal Manufactured Products market size, growth, and forecasts.

- ✔ Understand Metal Metal Manufactured Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Metal Metal Manufactured Products

What is the Market Size & CAGR of Metal Metal Manufactured Products market in 2023?

Metal Metal Manufactured Products Industry Analysis

Metal Metal Manufactured Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Metal Metal Manufactured Products Market Analysis Report by Region

Europe Metal Metal Manufactured Products Market Report:

In Europe, the market is forecasted to grow from $7.97 billion in 2023 to $13.78 billion by 2033. Increasing focus on renewable energy sources and the automotive sector's shift towards electric vehicles are creating new opportunities for market participants.Asia Pacific Metal Metal Manufactured Products Market Report:

The Asia Pacific region is anticipated to witness significant growth, with the market projected to increase from $5.91 billion in 2023 to $10.22 billion in 2033. This growth is attributed to rapid industrialization, especially in China and India, alongside rising consumer demand for advanced metal products in automotive and electronic applications.North America Metal Metal Manufactured Products Market Report:

North America holds a leading position in the market, with a projected increase from $10.61 billion in 2023 to $18.34 billion by 2033. The region's advanced technological ecosystem and high demand for aerospace and automotive components are key factors propelling growth.South America Metal Metal Manufactured Products Market Report:

In South America, the market for Metal Metal Manufactured Products is expected to grow from $2.34 billion in 2023 to $4.04 billion in 2033. The region's growth is driven by a recovering economy and increasing investments in infrastructure and construction projects, which significantly bolster the demand for metal-based products.Middle East & Africa Metal Metal Manufactured Products Market Report:

The Middle East and Africa region is projected to grow from $3.17 billion in 2023 to $5.49 billion in 2033. Economic diversification efforts, particularly in the UAE and Saudi Arabia, are leading to enhanced investments in manufacturing capabilities.Tell us your focus area and get a customized research report.

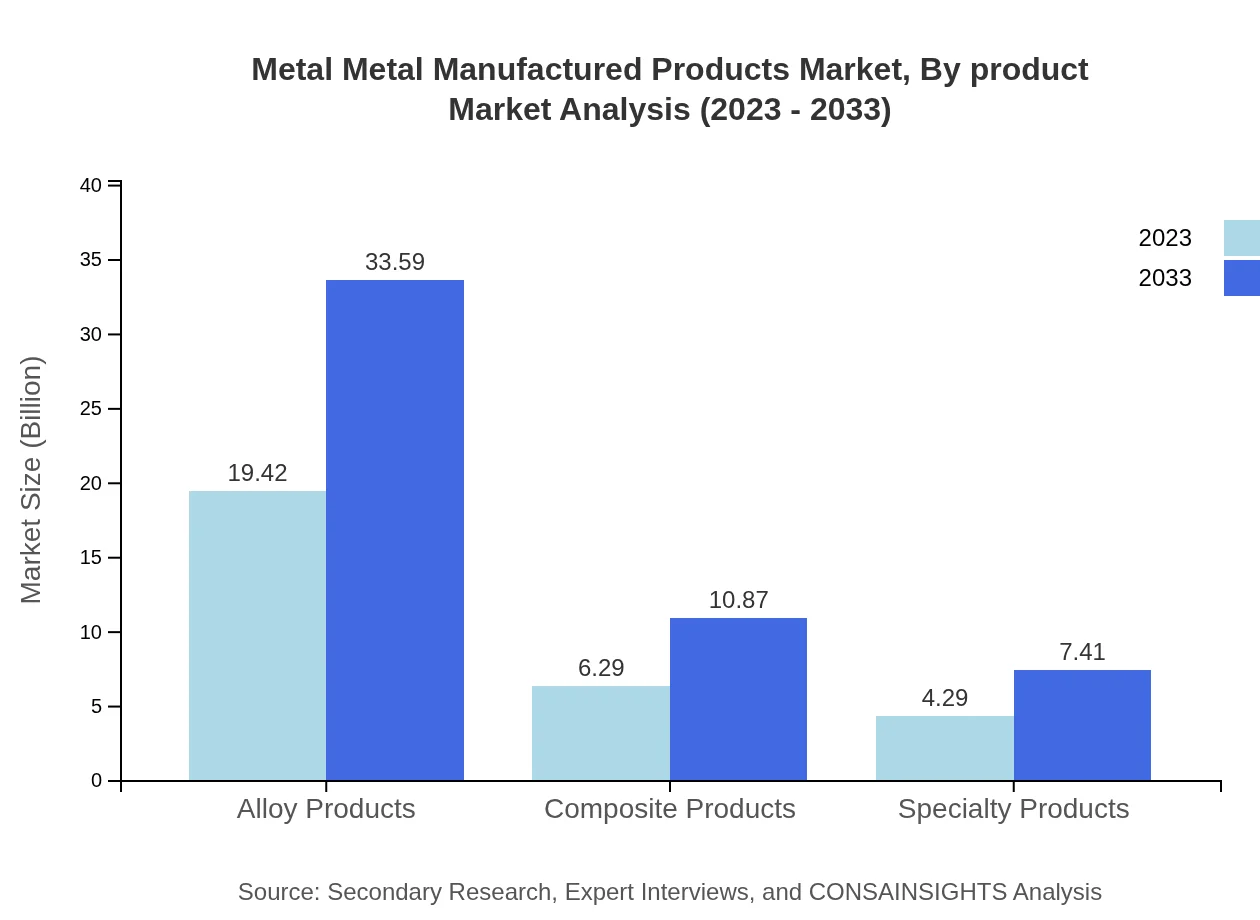

Metal Metal Manufactured Products Market Analysis By Product

The product segment of the market reveals critical insights into the performance and market shares of different types of products. Alloy Products dominate the market with an estimated size of $19.42 billion in 2023, expected to grow to $33.59 billion by 2033, retaining a market share of 64.75%. Composite and specialty products are also significant, with composite products projected to grow from $6.29 billion to $10.87 billion, maintaining a share of 20.96%.

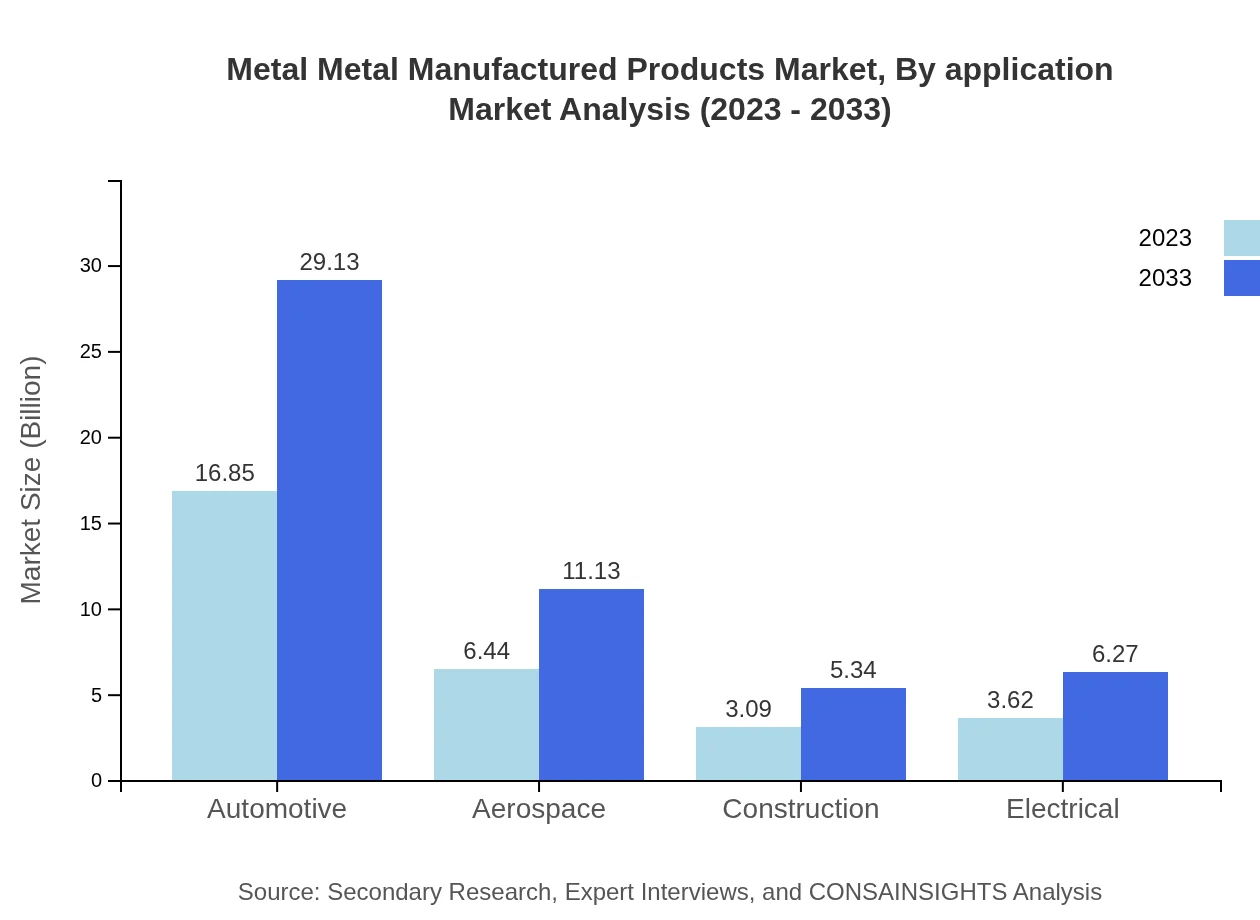

Metal Metal Manufactured Products Market Analysis By Application

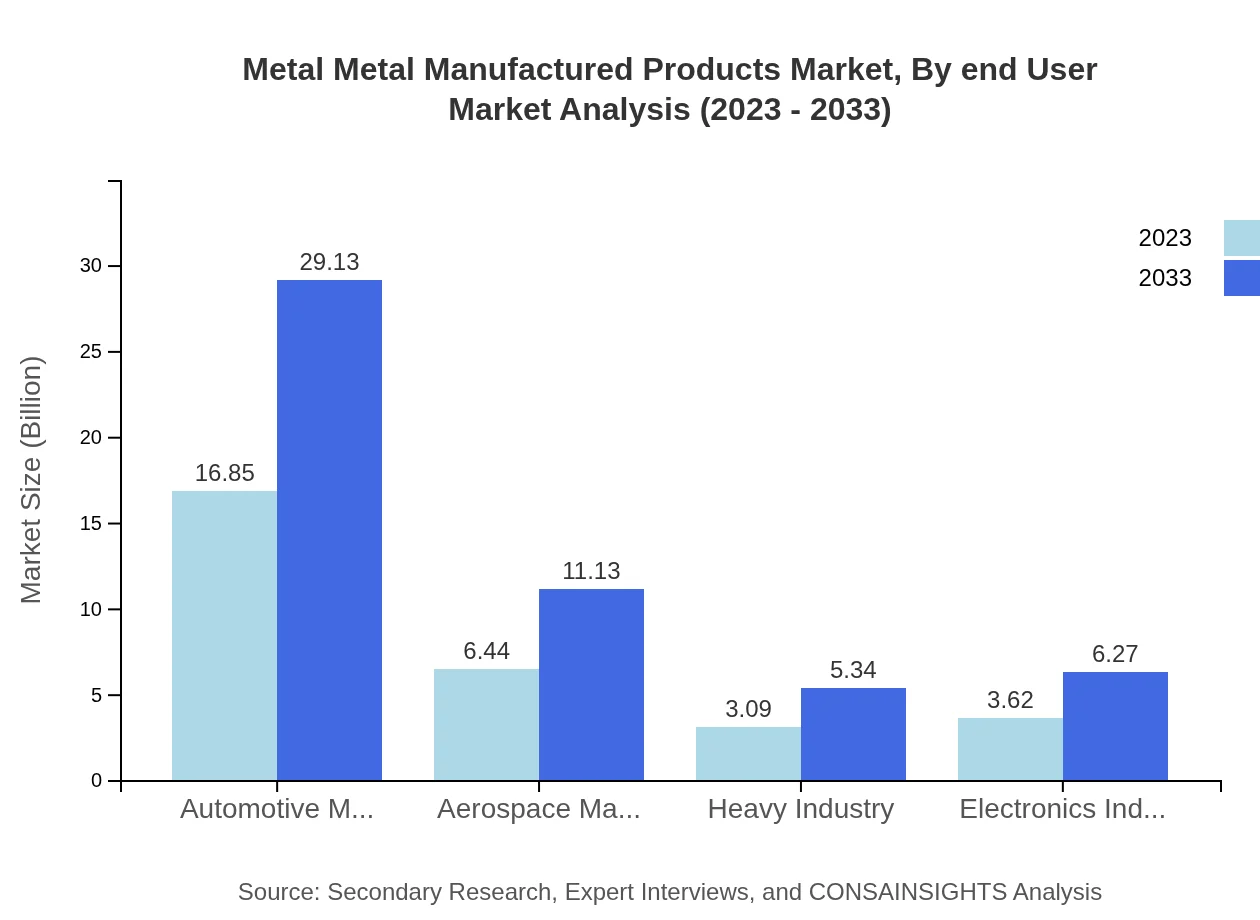

The application segment showcases the wide-ranging uses of metal manufactured products in various sectors. The automotive sector stands out, accounting for $16.85 billion in 2023, anticipated to reach $29.13 billion by 2033, making up a major share of 56.16%. Other sectors like aerospace ($6.44 billion to $11.13 billion; 21.46%) and heavy industry ($3.09 billion to $5.34 billion; 10.3%) play integral roles in market dynamics.

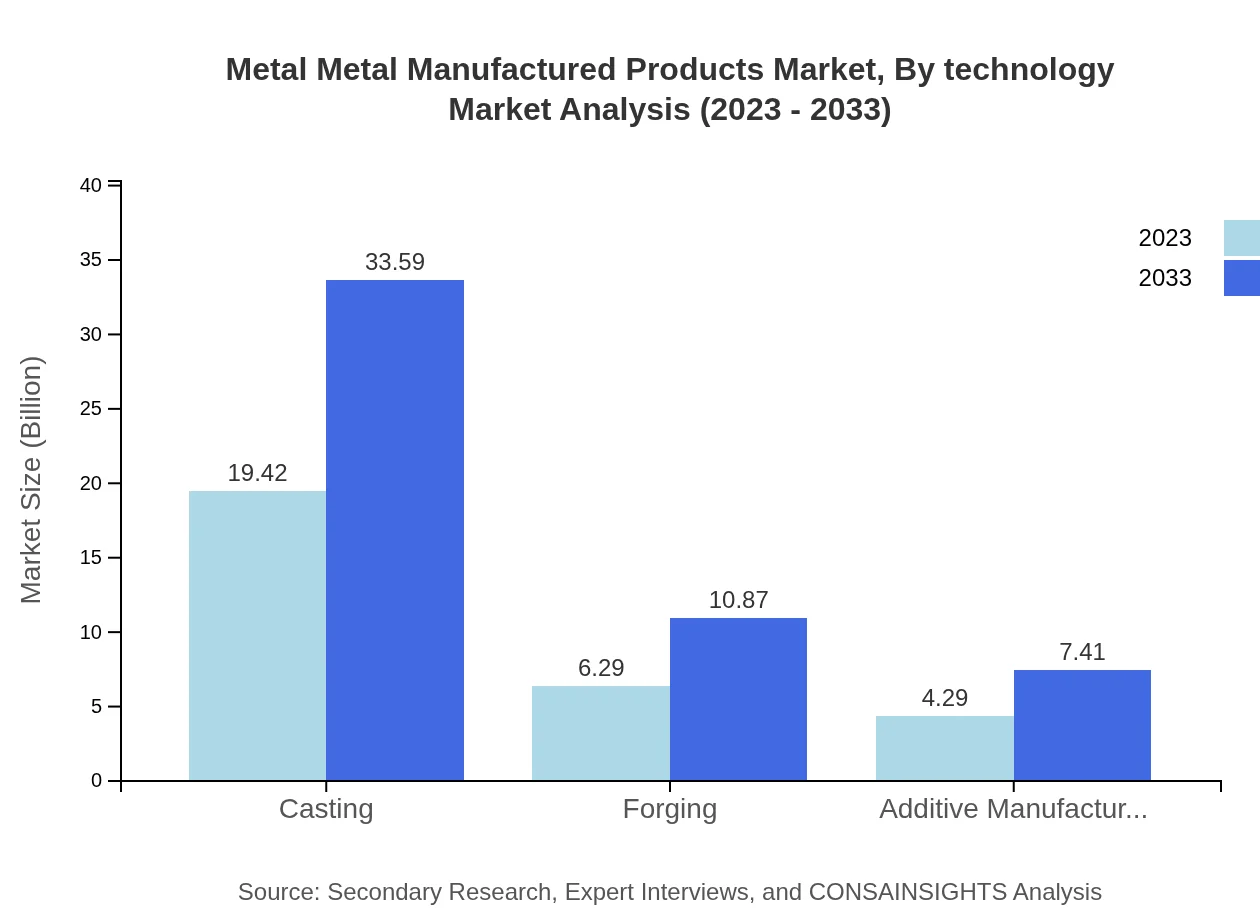

Metal Metal Manufactured Products Market Analysis By Technology

Technologically, the industry is evolving with additive manufacturing at the forefront, projected to contribute $4.29 billion to $7.41 billion of market growth from 2023 to 2033, representing a share of 14.29%. Advancements in casting and forging technologies are also notable, critical to enhancing production efficiencies and quality.

Metal Metal Manufactured Products Market Analysis By End User

End-user analysis reveals that sectors such as automotive and aerospace remain the dominant consumers of metal manufactured products, with projections highlighting substantial market shares. The automotive sector’s ongoing transition towards electric mobility is vital, signifying a shift in product development trends towards lightweight and energy-efficient metals.

Metal Metal Manufactured Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Metal Metal Manufactured Products Industry

Alcoa Corporation:

A leading player in lightweight metals engineering, Alcoa is focused on developing advanced aluminum solutions for various industries.ArcelorMittal:

As the world’s leading steel and mining company, ArcelorMittal is committed to innovative products and sustainable practices.Novelis Inc.:

Specializing in aluminum rolled products, Novelis is a leader in sustainability, emphasizing recycled materials in its production.Thyssenkrupp AG:

With global operations, Thyssenkrupp provides high-quality steel and has diversified into advanced technologies for several applications.Nucor Corporation:

One of the largest steel producers in the U.S., Nucor is known for its cutting-edge manufacturing processes and sustainability initiatives.We're grateful to work with incredible clients.

FAQs

What is the market size of Metal-Metal-Manufactured Products?

The global market size for Metal-Metal-Manufactured Products is projected to reach $30 billion by 2033, growing at a CAGR of 5.5%. This growth is driven by increased industrial applications and technological innovations in the manufacturing processes.

What are the key market players or companies in this Metal-Metal-Manufactured Products industry?

Key market players in the Metal-Metal-Manufactured Products industry include major global manufacturers and suppliers who focus on alloy and composite products. They also innovate in specialty and automotive product segments, ensuring competitiveness and market share.

What are the primary factors driving the growth in the Metal-Metal-Manufactured Products industry?

The growth in the Metal-Metal-Manufactured Products industry is driven by increasing demand from various sectors such as automotive and aerospace, advancements in manufacturing technologies, and a focus on lightweight materials to enhance energy efficiency in end-use applications.

Which region is the fastest Growing in the Metal-Metal-Manufactured Products?

The Asia Pacific region is the fastest-growing market for Metal-Metal-Manufactured Products, with expected growth from $5.91 billion in 2023 to $10.22 billion by 2033, reflecting a rise in manufacturing and industrial activities in countries like China and India.

Does ConsaInsights provide customized market report data for the Metal-Metal-Manufactured Products industry?

Yes, ConsaInsights offers customized market report data covering specific needs and insights in the Metal-Metal-Manufactured Products industry. Clients can request tailored reports focusing on unique market segments or regional analyses.

What deliverables can I expect from this Metal-Metal-Manufactured Products market research project?

From the Metal-Metal-Manufactured Products market research project, you can expect comprehensive deliverables including market size forecasts, segment analysis, competitive landscape, and regional growth projections tailored to your informational needs.

What are the market trends of Metal-Metal-Manufactured Products?

Current market trends in Metal-Metal-Manufactured Products include a shift towards sustainable and recyclable materials, increased automation in manufacturing processes, and the integration of advanced technologies like additive manufacturing to reduce production costs.