Metallized Film Market Report

Published Date: 02 February 2026 | Report Code: metallized-film

Metallized Film Market Size, Share, Industry Trends and Forecast to 2033

The Metallized Film Market Report provides insights on market size, trends, segmentation, and regional analysis from 2023 to 2033. It highlights key players, technological advancements, and forecasts future growth, serving as a comprehensive guide for stakeholders in the industry.

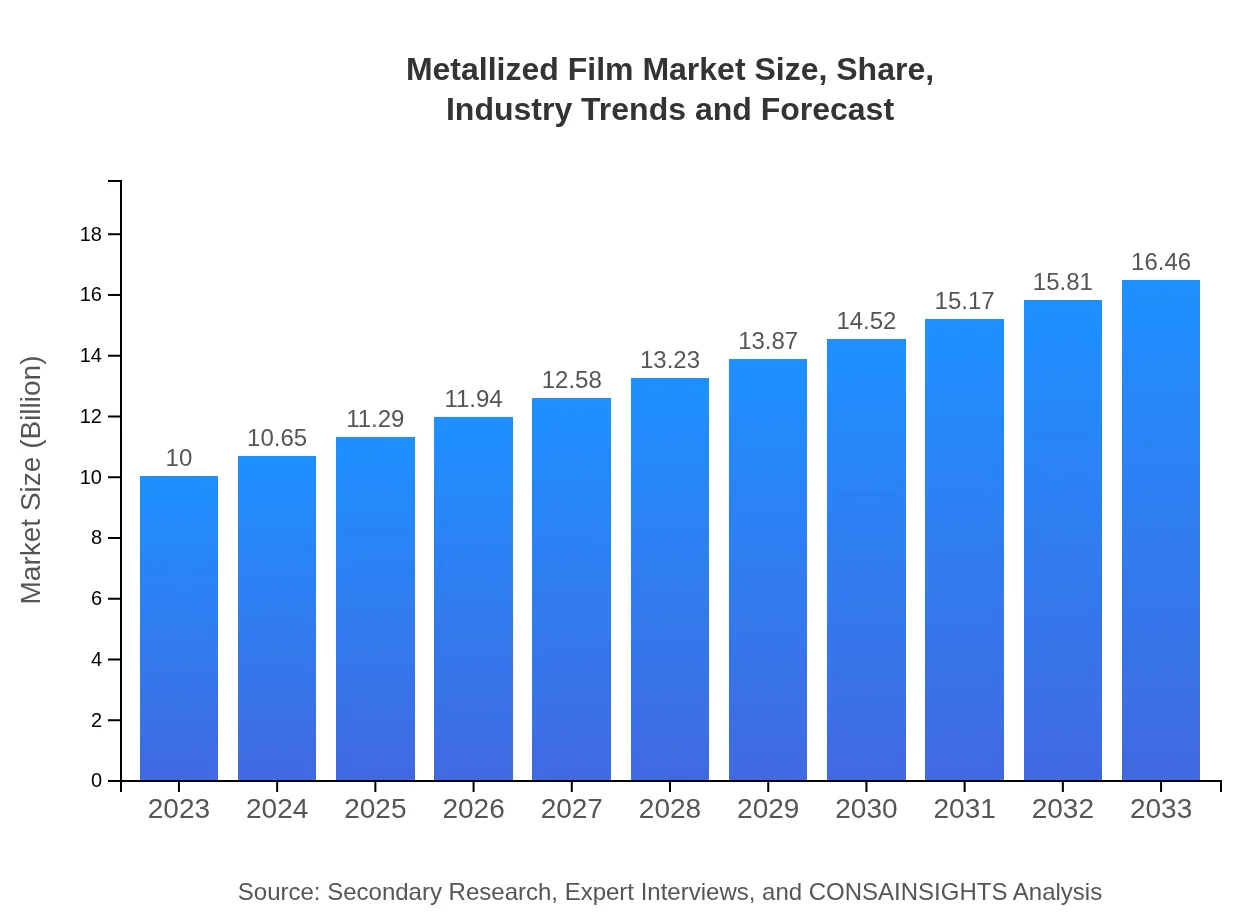

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | 3M Company, Mondi Group, Toray Industries, Inc., BASF SE |

| Last Modified Date | 02 February 2026 |

Metallized Film Market Overview

Customize Metallized Film Market Report market research report

- ✔ Get in-depth analysis of Metallized Film market size, growth, and forecasts.

- ✔ Understand Metallized Film's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Metallized Film

What is the Market Size & CAGR of Metallized Film market in 2023?

Metallized Film Industry Analysis

Metallized Film Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Metallized Film Market Analysis Report by Region

Europe Metallized Film Market Report:

Europe holds a substantial market position, projected to grow from 3.06 billion USD in 2023 to 5.04 billion USD by 2033. Stringent food safety regulations and a rising preference for sustainable packaging solutions are driving innovation and adoption of metallized films in various applications.Asia Pacific Metallized Film Market Report:

In the Asia Pacific region, the metallized film market is anticipated to grow from 1.89 billion USD in 2023 to 3.11 billion USD by 2033, owing to increasing industrialization and expanding end-user markets such as packaging and textiles. The region’s manufacturing advancements further support market growth, alongside rising consumer demand for packaged goods.North America Metallized Film Market Report:

North America exhibits a strong market presence, with size projected to increase from 3.56 billion USD in 2023 to 5.86 billion USD by 2033. The growth is propelled by heightened demand from food and beverage packaging sectors and significant investments in technologically advanced production techniques.South America Metallized Film Market Report:

South America is expected to witness modest growth, increasing from 0.53 billion USD in 2023 to 0.87 billion USD in 2033. While challenges such as economic fluctuations exist, opportunities in sustainable packaging and localized production are encouraging growth in the metallized film market.Middle East & Africa Metallized Film Market Report:

The Middle East and Africa region is expected to expand from 0.96 billion USD in 2023 to 1.58 billion USD by 2033. Growth in this region is influenced by increased infrastructural developments and a growing focus on sustainable packaging in various industries.Tell us your focus area and get a customized research report.

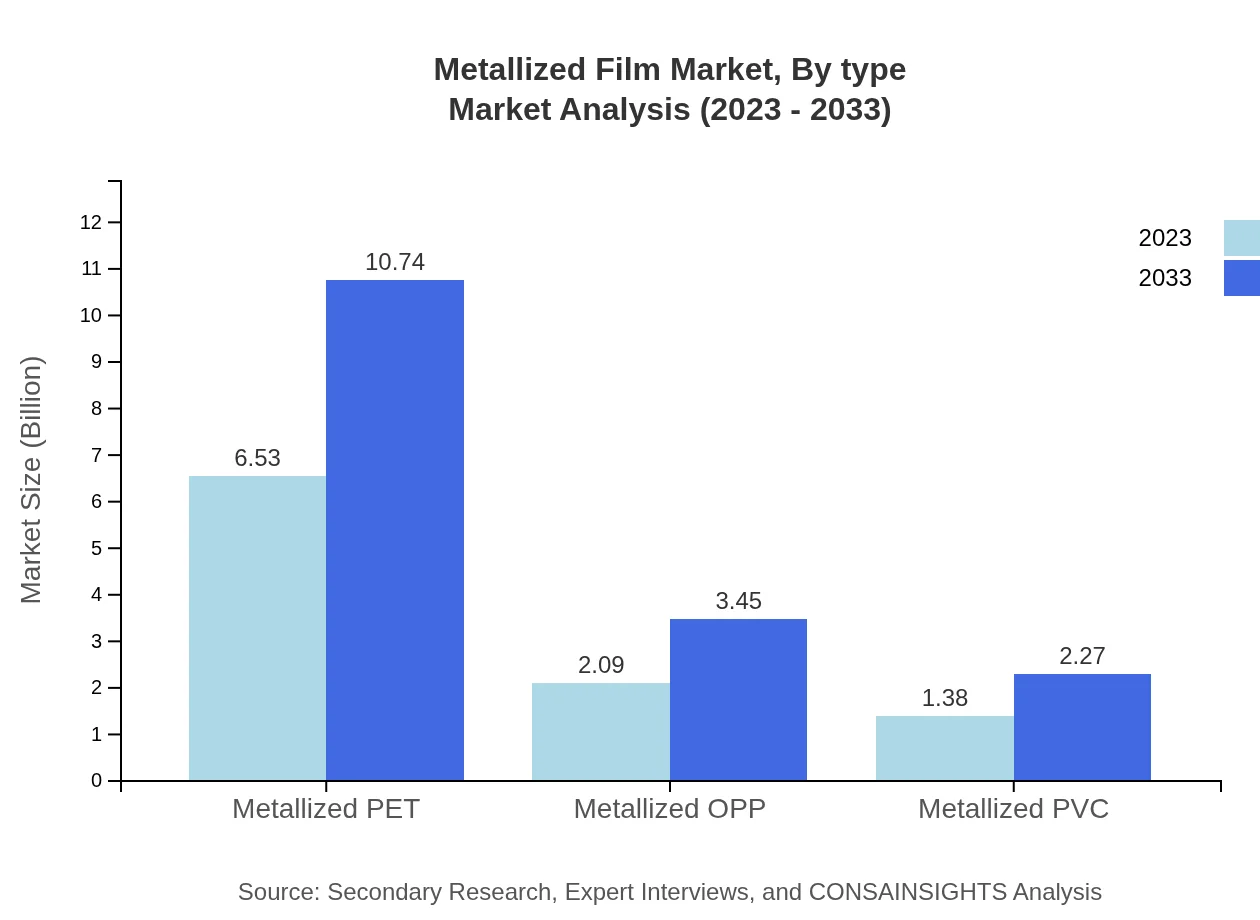

Metallized Film Market Analysis By Type

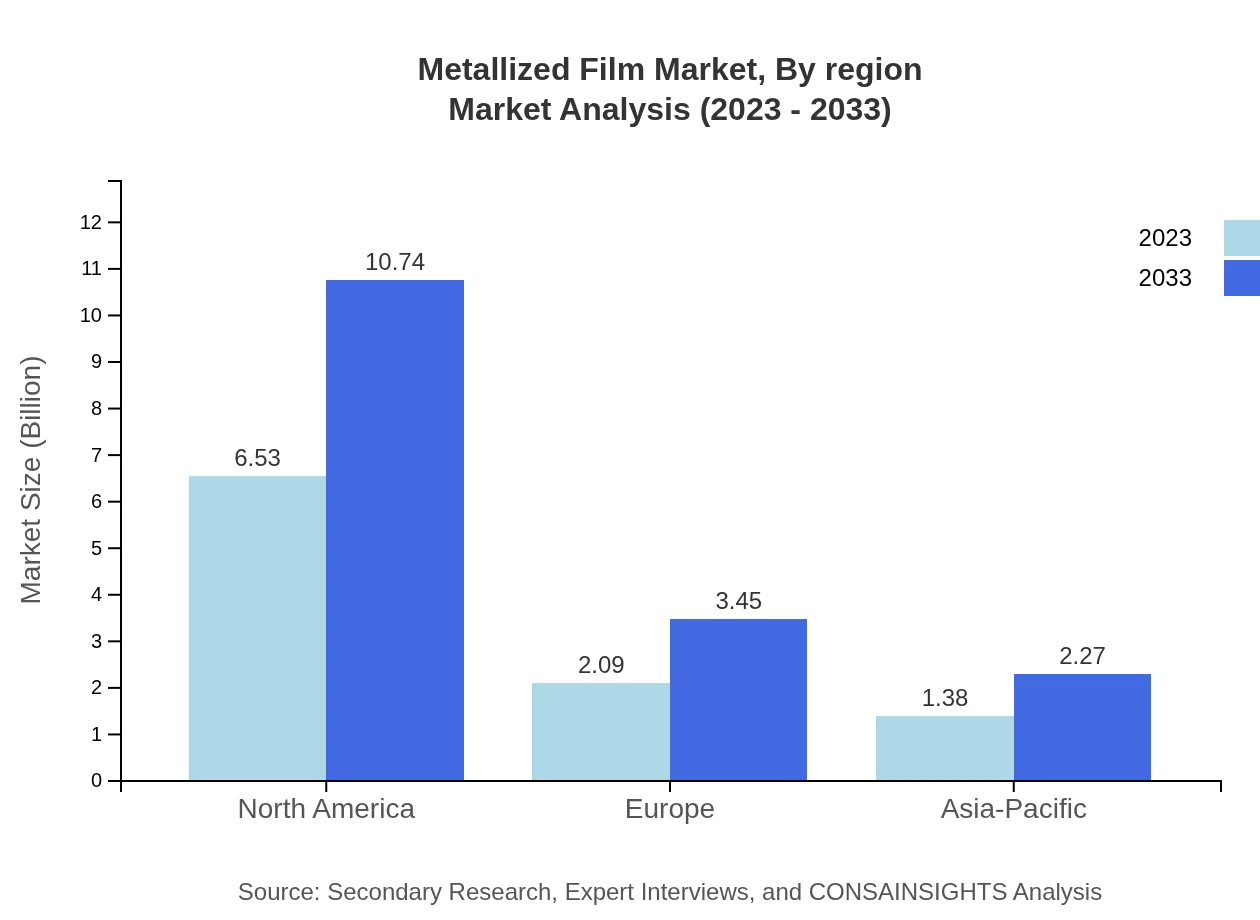

The metallized film market can be segmented effectively based on types, including Metallized PET, Metallized OPP, and Metallized PVC: 1. Metallized PET is expected to dominate the market, with a size of 6.53 billion USD in 2023, growing to 10.74 billion USD by 2033, capturing a market share of 65.26%. 2. Metallized OPP follows with a size increasing from 2.09 billion USD to 3.45 billion USD, holding a consistent market share of 20.95%, while 3. Metallized PVC increases in size from 1.38 billion USD to 2.27 billion USD, maintaining a share of 13.79%.

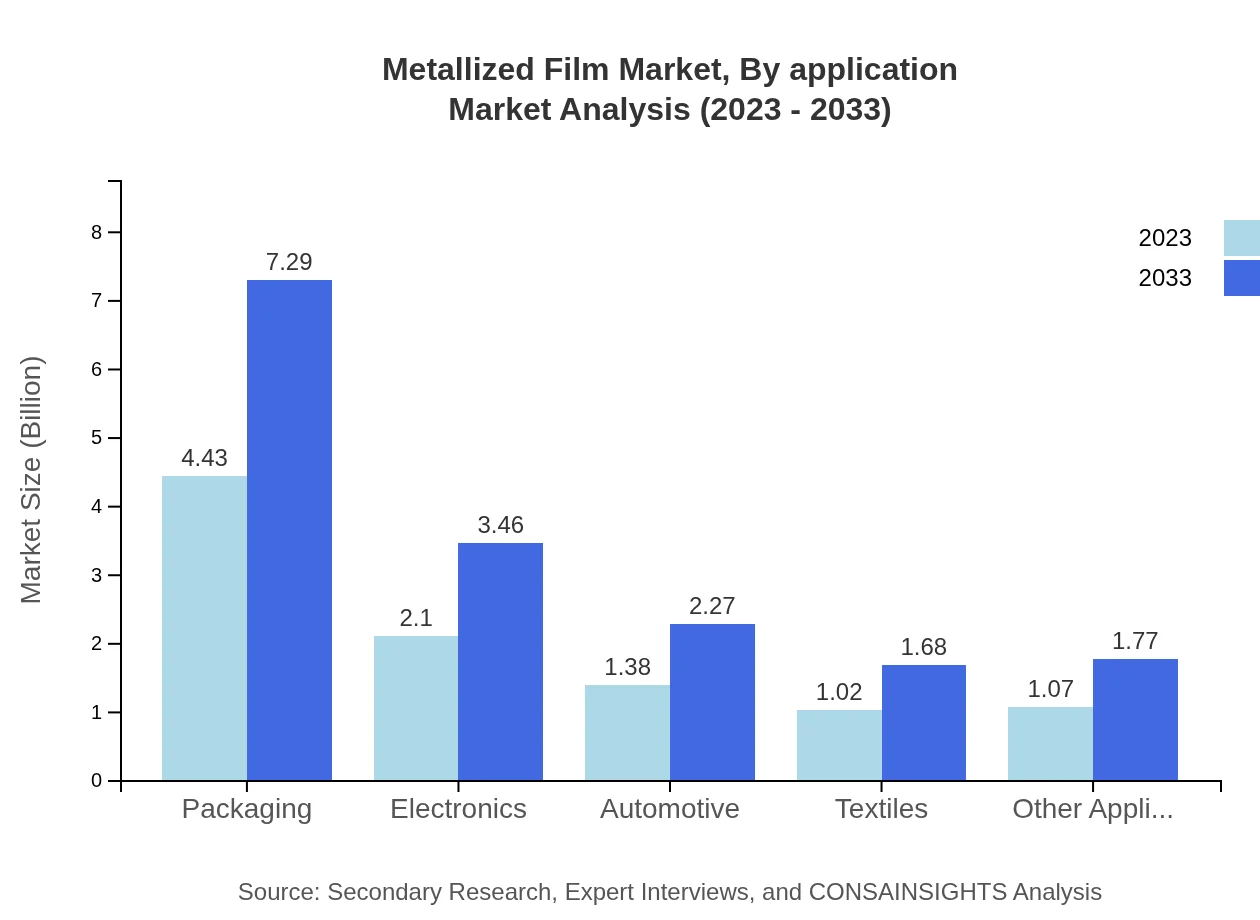

Metallized Film Market Analysis By Application

In terms of applications, the food and beverage sector leads, with an anticipated size growth from 5.49 billion USD in 2023 to 9.04 billion USD by 2033, accounting for 54.93% of the market share. Pharmaceuticals also show strong growth, increasing from 2.19 billion USD to 3.60 billion USD, maintaining a share of 21.86%. Other notable applications include automotive (1.11 billion to 1.83 billion, 11.11%) and textiles (1.02 billion to 1.68 billion, 10.19%).

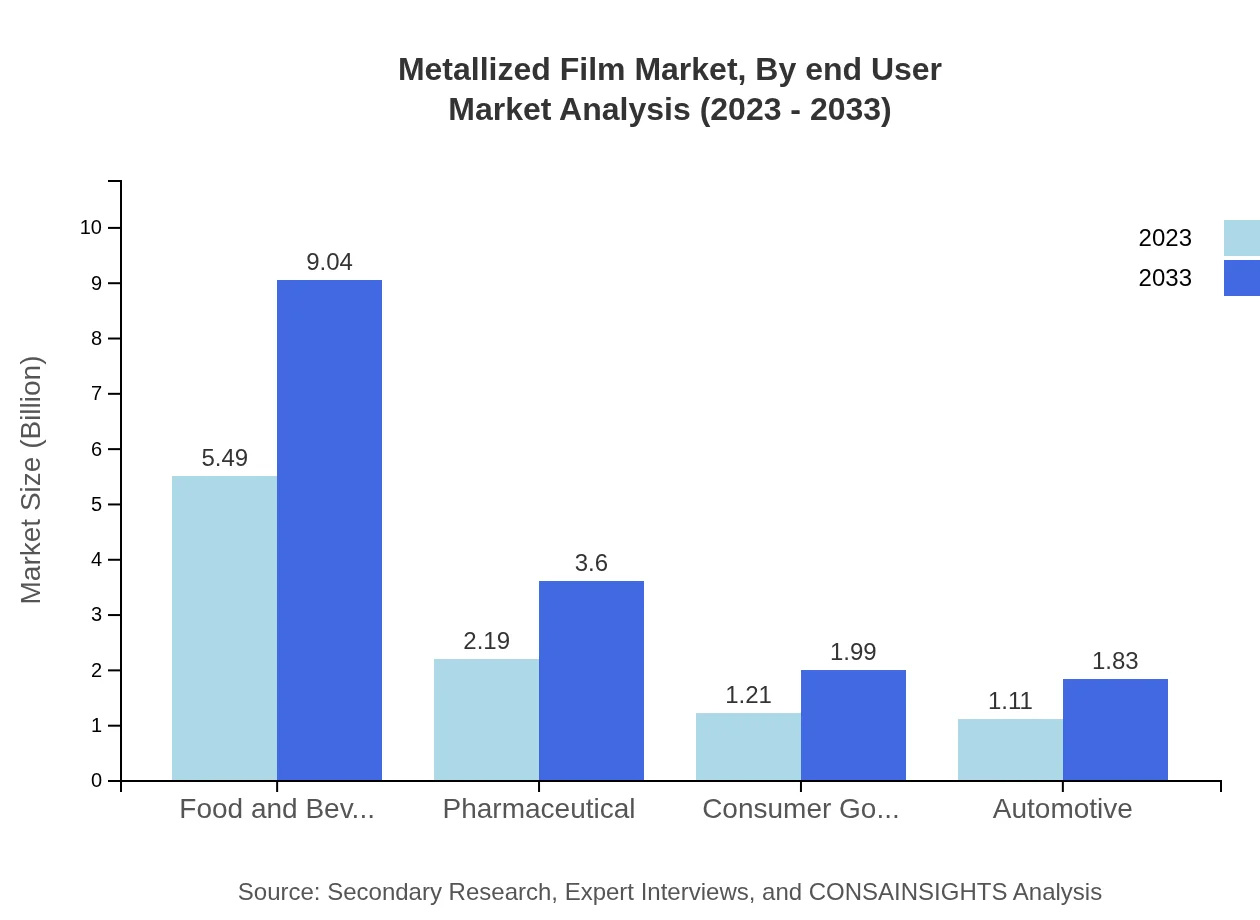

Metallized Film Market Analysis By End User

The market segmentation by end-user indicates strong demand in diverse sectors. Key industries utilizing metallized films include food and beverage (54.93% share), pharmaceuticals (21.86% share), automotive (11.11% share), and electronics (21% share). This segmentation underscores the versatility of metallized films to address specific performance requirements across varied industries.

Metallized Film Market Analysis By Region

Geographically, the North America region is poised to lead in market size, driven by advancements in packaging technologies and increased demand from consumer sectors. The Asia Pacific region is rapidly growing, fueled by industrial advancements and increased consumption. Europe continues to leverage innovation in sustainable film technologies, while Latin America and the Middle East and Africa present emerging opportunities.

Metallized Film Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Metallized Film Industry

3M Company:

3M Company is a leader in adhesive technologies and materials. Known for its innovation, 3M provides high-performance metallized films used extensively in multiple applications.Mondi Group:

Mondi Group is a global leader in packaging and paper, well-regarded for their sustainable metallized film solutions catering to various consumer and industrial applications.Toray Industries, Inc.:

Toray Industries specializes in advanced materials, including metallized films that cater to the packaging and electronics markets, focusing on sustainability and innovation.BASF SE:

BASF SE is a leading chemical company whose diverse portfolio includes high-quality metallized films, significantly contributing to various industries such as packaging and automotive.We're grateful to work with incredible clients.

FAQs

What is the market size of metallized Film?

The global metallized film market is currently valued at approximately $10 billion in 2023, with a projected growth rate of 5% CAGR until 2033.

What are the key market players or companies in this metallized Film industry?

Key players in the metallized film market include major manufacturers and suppliers that are contributing to innovative product developments and expansions, but specific company names are not provided in the data.

What are the primary factors driving the growth in the metallized film industry?

Key drivers of growth in the metallized film market include rising demand in packaging, increased consumer preferences for sustainable and protective materials, and advancements in manufacturing technologies.

Which region is the fastest Growing in the metallized film report?

The fastest-growing region in the metallized film market is projected to be Asia-Pacific, with the market expected to grow from $1.89 billion in 2023 to $3.11 billion by 2033.

Does ConsaInsights provide customized market report data for the metallized film industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications for the metallized film industry, ensuring relevant insights based on specific needs.

What deliverables can I expect from this metallized film market research project?

Deliverables from the metallized film market research project typically include comprehensive reports, infographics, market insights, and segment analysis to support strategic decision-making.

What are the market trends of metallized film?

Current trends in the metallized film market include a shift towards eco-friendly materials, innovation in product aesthetics, and increased applications in food packaging and electronics.