Micro Data Center Market Report

Published Date: 31 January 2026 | Report Code: micro-data-center

Micro Data Center Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Micro Data Center market, covering insights on market size, growth trends, regional analysis, and forecasts from 2023 to 2033. It aims to highlight opportunities and challenges within the industry.

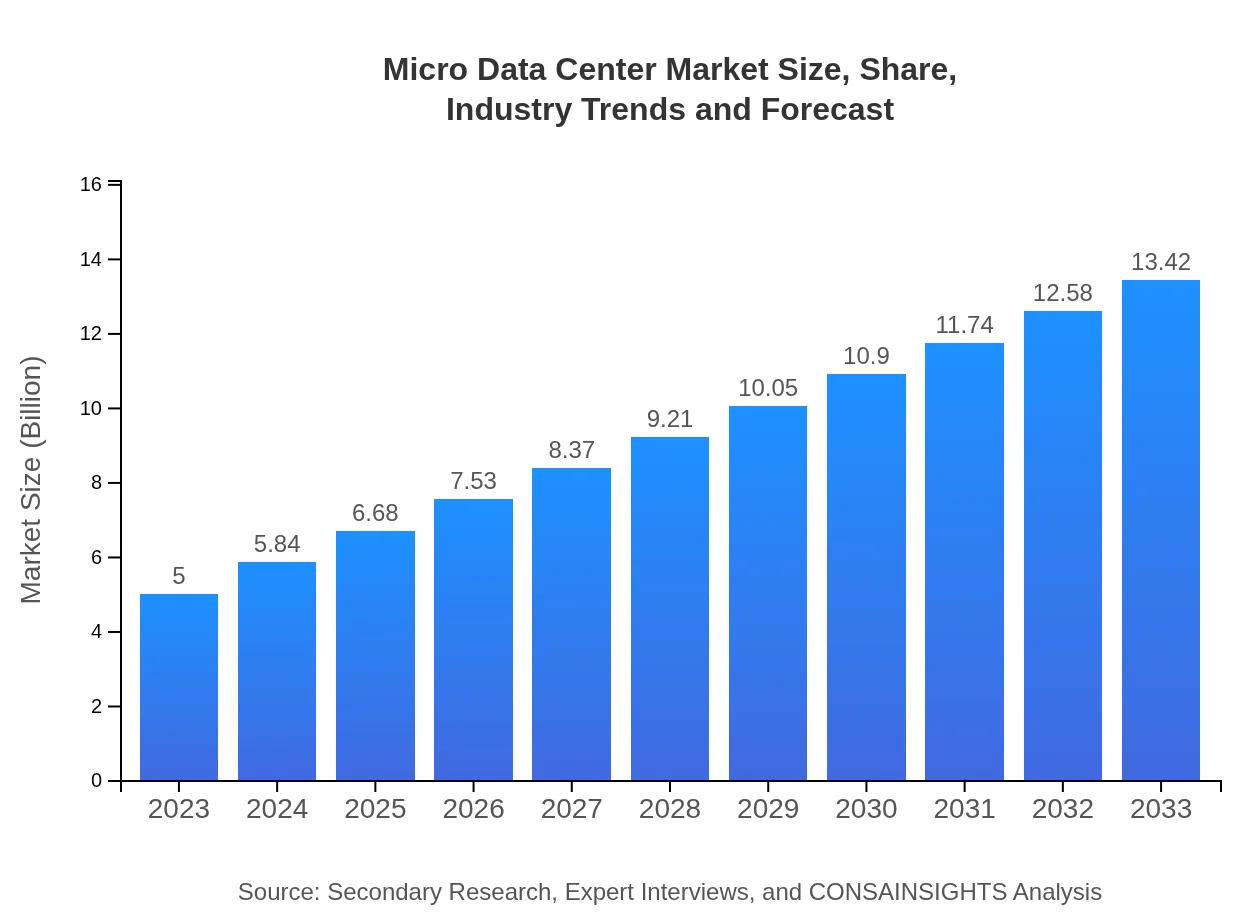

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $13.42 Billion |

| Top Companies | Schneider Electric, Dell Technologies, IBM, Hewlett Packard Enterprise (HPE) |

| Last Modified Date | 31 January 2026 |

Micro Data Center Market Overview

Customize Micro Data Center Market Report market research report

- ✔ Get in-depth analysis of Micro Data Center market size, growth, and forecasts.

- ✔ Understand Micro Data Center's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Micro Data Center

What is the Market Size & CAGR of the Micro Data Center market in 2023?

Micro Data Center Industry Analysis

Micro Data Center Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Micro Data Center Market Analysis Report by Region

Europe Micro Data Center Market Report:

The European Micro Data Center market is expected to rise from $1.45 billion in 2023 to $3.89 billion by 2033. Regulatory compliance regarding data security and energy efficiency standards are pivotal in driving the demand as companies seek scalable, sustainable solutions.Asia Pacific Micro Data Center Market Report:

The Asia Pacific Micro Data Center market is set to grow from $0.95 billion in 2023 to $2.56 billion by 2033, driven by increasing data demands and the expansion of telecommunications and cloud service providers in emerging economies. Growing urbanization and technological advancements are further bolstering market growth.North America Micro Data Center Market Report:

In North America, the Micro Data Center market reflects substantial growth, increasing from $1.85 billion in 2023 to $4.96 billion by 2033. The US market, in particular, is driven by high adoption rates of cloud services, edge computing solutions, and investments in modular and portable data center technologies by various enterprises.South America Micro Data Center Market Report:

The South America region is projected to expand from $0.31 billion in 2023 to $0.82 billion in 2033. The market growth is largely supported by the establishment of new telecom infrastructures and the adoption of digital technologies, especially in Brazil and Argentina.Middle East & Africa Micro Data Center Market Report:

The Middle East and Africa region is forecasted to grow from $0.44 billion in 2023 to $1.19 billion in 2033. The growth in this region is supported by significant investments in data infrastructure, particularly related to smart city projects and the digitization of various sectors.Tell us your focus area and get a customized research report.

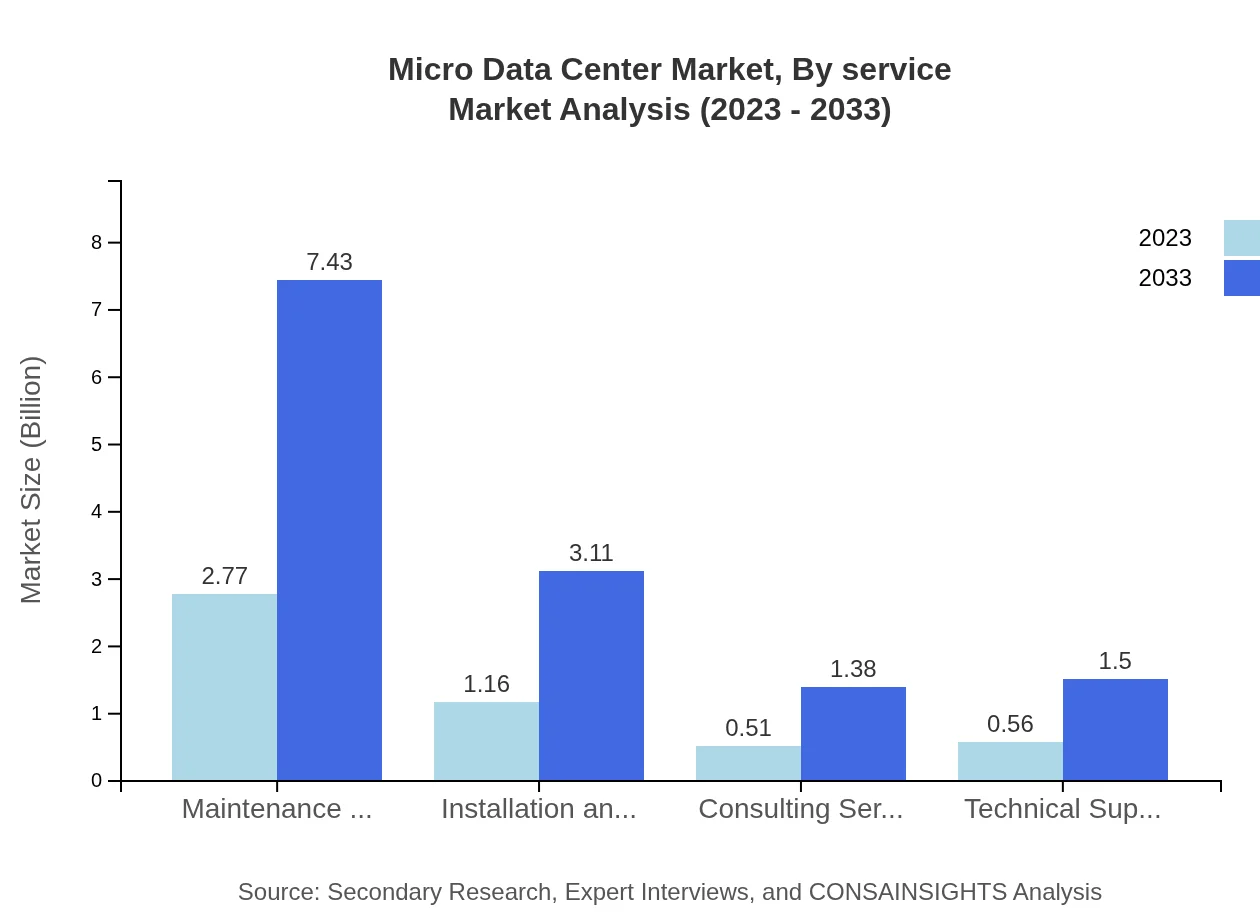

Micro Data Center Market Analysis By Service

The service segment of the Micro Data Center market includes maintenance services, installation and commissioning, consulting services, and technical support services. Maintenance services dominate, projected to grow from $2.77 billion in 2023 to $7.43 billion in 2033, representing 55.37% market share. Installation and commissioning services will follow with $1.16 billion in 2023 to $3.11 billion in 2033, while technical support services are also seen to grow significantly.

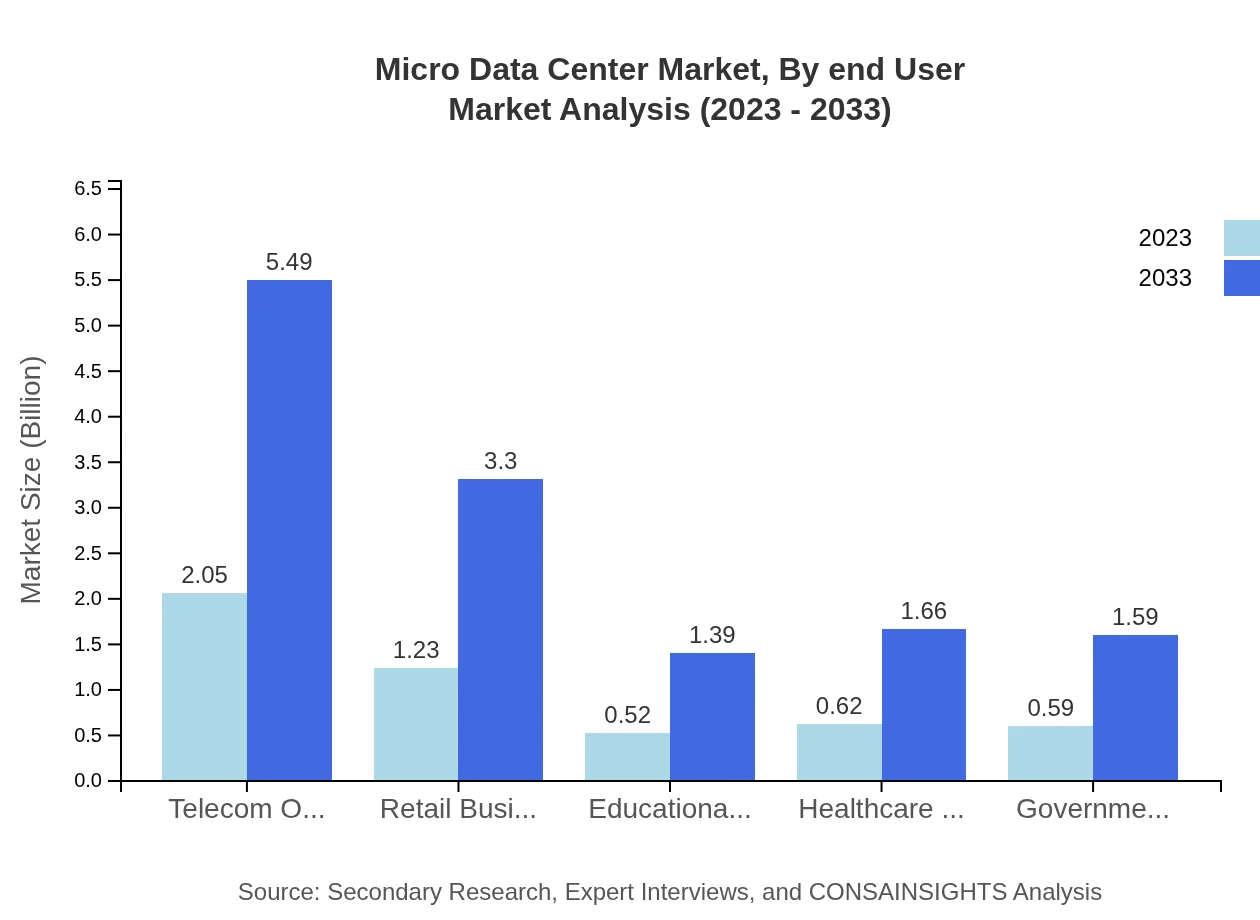

Micro Data Center Market Analysis By End User

The end-user market is segmented into government organizations, healthcare providers, educational institutions, telecom operators, and retail businesses. Telecom operators lead with significant growth from $2.05 billion in 2023 to $5.49 billion in 2033. Retail businesses also show substantial growth, expected to expand their market from $1.23 billion in 2023 to $3.30 billion in 2033.

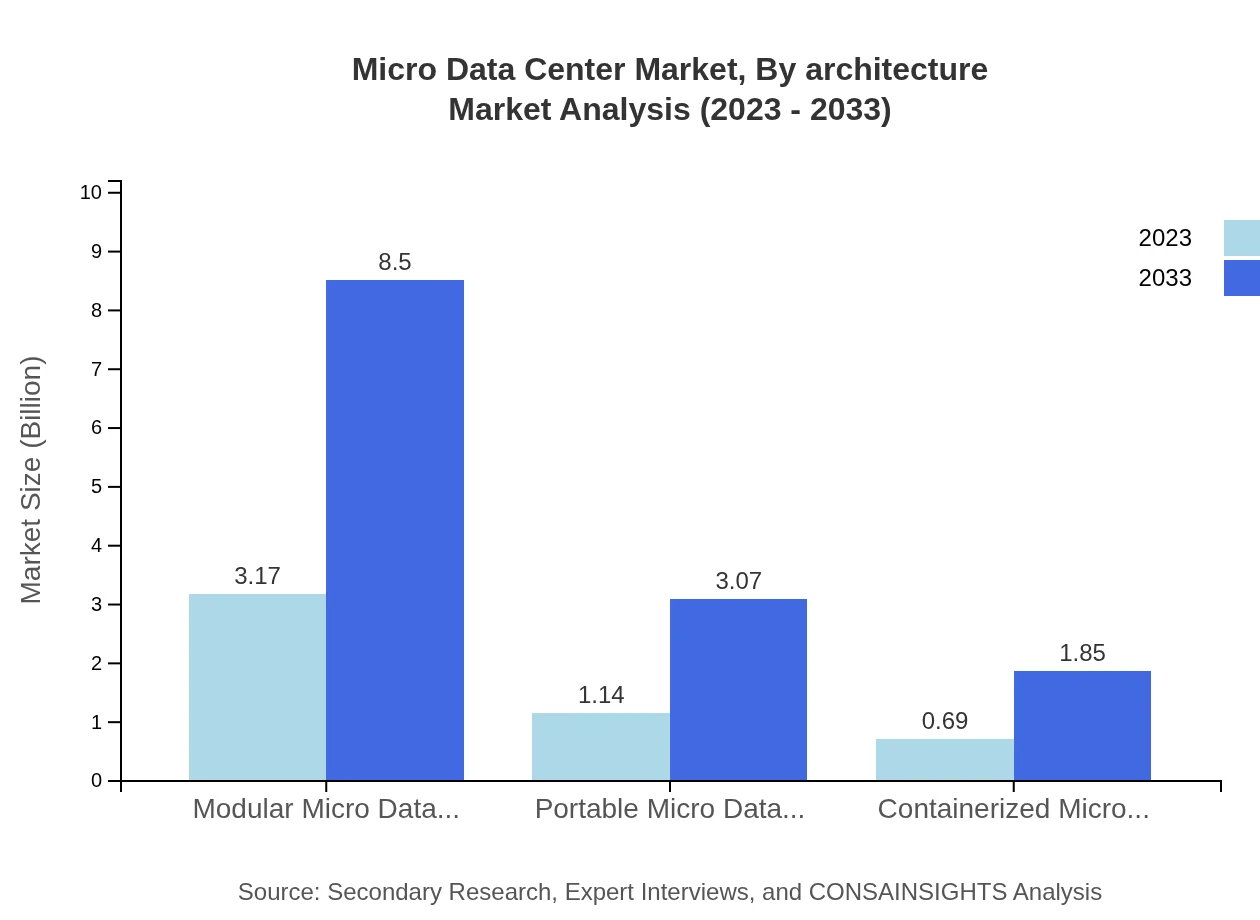

Micro Data Center Market Analysis By Architecture

The architecture segment comprises modular, portable, and containerized Micro Data Centers. Modular Micro Data Centers hold the largest share, estimated at 63.36%. Following this, portable Micro Data Centers are growing rapidly, expected to reach $3.07 billion by 2033 from $1.14 billion in 2023.

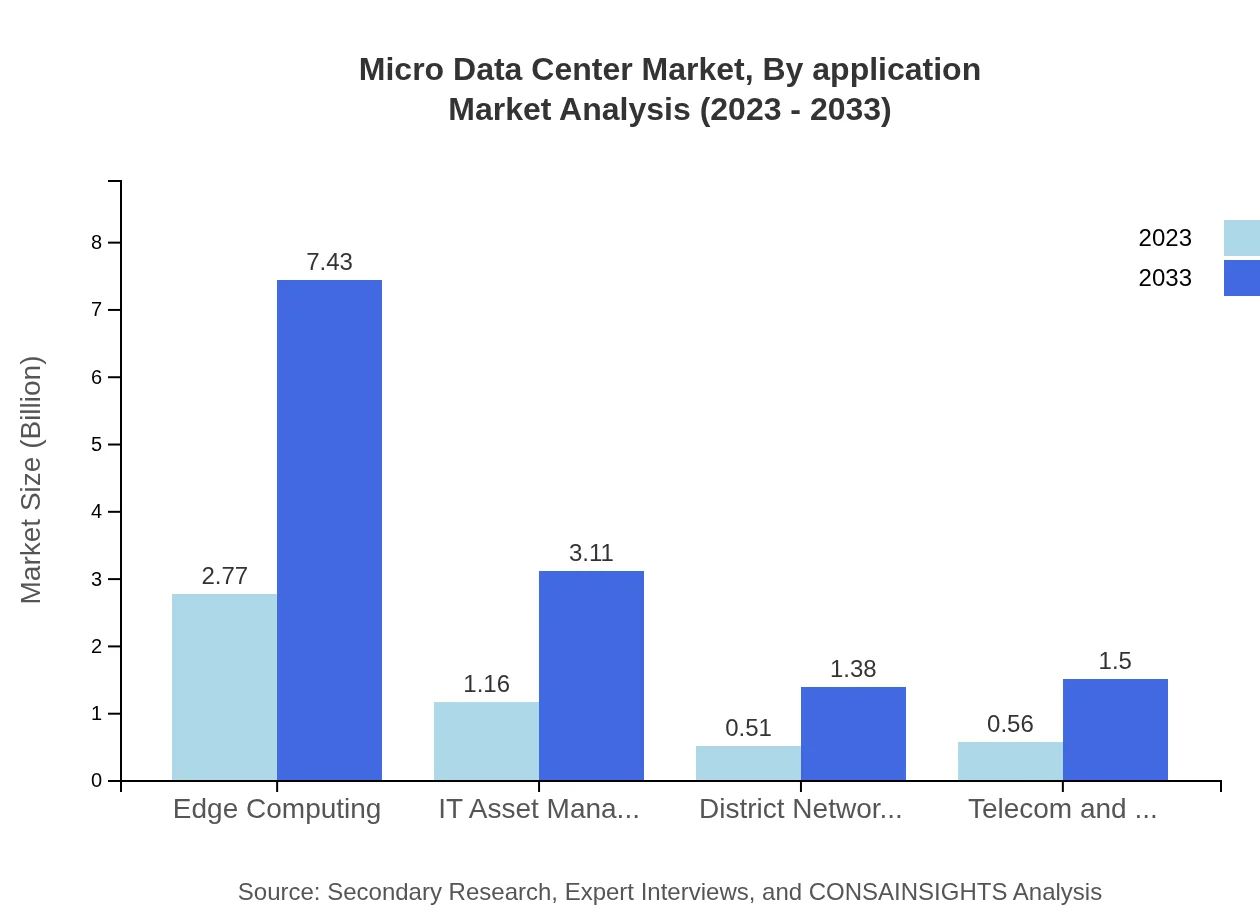

Micro Data Center Market Analysis By Application

Applications of Micro Data Centers span across telecom, healthcare, education, and retail. The telecom sector utilizes Micro Data Centers extensively, indicated by their high market share and their projected growth rate from $2.05 billion in 2023 to $5.49 billion in 2033.

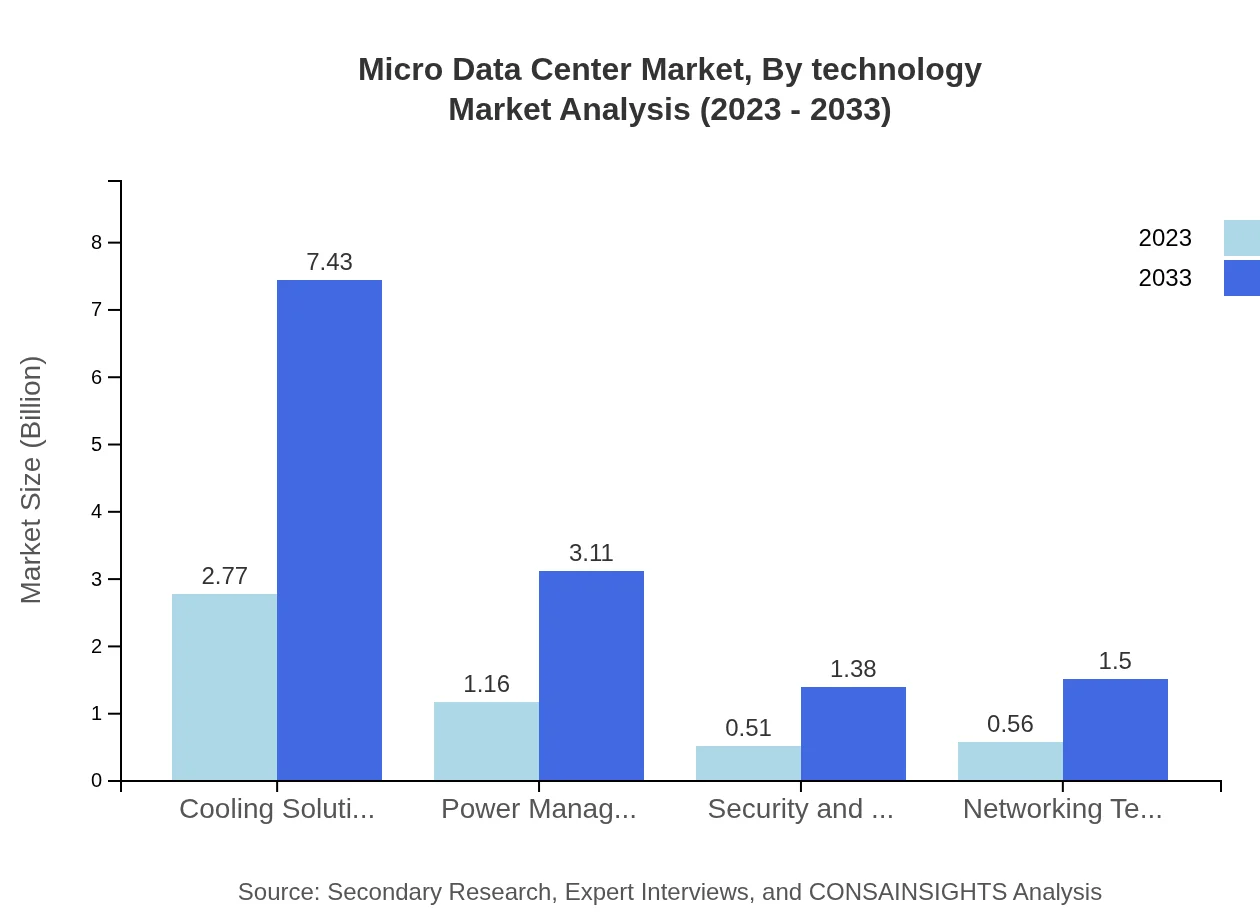

Micro Data Center Market Analysis By Technology

Key technological components such as cooling solutions, power management, security, and monitoring technologies are critical to Micro Data Center performance. Cooling solutions alone account for a market value of $2.77 billion in 2023, growing to $7.43 billion by 2033.

Micro Data Center Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Micro Data Center Industry

Schneider Electric:

Schneider Electric is a leader in energy management and automation, developing innovative Micro Data Center solutions that emphasize sustainability and energy efficiency.Dell Technologies:

Dell Technologies offers a wide range of Micro Data Center solutions, leveraging advanced technologies to enhance performance and scalability for different business needs.IBM:

IBM's focus on hybrid cloud and edge computing includes robust Micro Data Center offerings that cater to various sectors needing localized processing.Hewlett Packard Enterprise (HPE):

HPE provides edge-to-cloud solutions that incorporate Micro Data Centers, allowing companies to efficiently manage and analyze data at customer proximity.We're grateful to work with incredible clients.

FAQs

What is the market size of micro Data Center?

The micro-data-center market is projected to reach $5 billion by 2033, with a compound annual growth rate (CAGR) of 10% from 2023 to 2033. The conventional deployment strategy for micro-data-centers is witnessing rapid adoption.

What are the key market players or companies in this micro Data Center industry?

Key players in the micro-data-center industry include Schneider Electric, Hewlett Packard Enterprise, IBM, Dell Technologies, and Vertiv. These companies are driving innovation and market growth through advancements in their product offerings.

What are the primary factors driving the growth in the micro Data Center industry?

The growth of the micro-data-center industry is driven by increased demand for cloud computing, the rise of edge computing, and the need for energy-efficient data processing solutions. Moreover, the proliferation of IoT devices continues to boost market interest.

Which region is the fastest Growing in the micro Data Center market?

The Asia-Pacific region is experiencing the fastest growth in the micro-data-center market, with projections showing it will expand from $0.95 billion in 2023 to $2.56 billion by 2033, fueled by technological advancements and increased digital adoption.

Does ConsaInsights provide customized market report data for the micro Data Center industry?

Yes, ConsaInsights offers customized market report data for the micro-data-center industry, allowing clients to obtain specific insights based on their unique requirements, market segments or geographic regions of interest, enhancing decision-making capabilities.

What deliverables can I expect from this micro Data Center market research project?

Expected deliverables include comprehensive market analysis reports, segment data, regional insights, competitor analysis, and growth forecasts. Additionally, clients receive actionable recommendations tailored to their strategic objectives.

What are the market trends of micro Data Centers?

Key market trends in micro-data-centers include the shift towards modular architectures, increased adoption of portable and containerized solutions, and the integration of advanced cooling and power management technologies to optimize energy efficiency.