Microcontroller Market Report

Published Date: 31 January 2026 | Report Code: microcontroller

Microcontroller Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the microcontroller market from 2023 to 2033, covering market size, growth forecasts, industry insights, technological advancements, and regional market dynamics.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

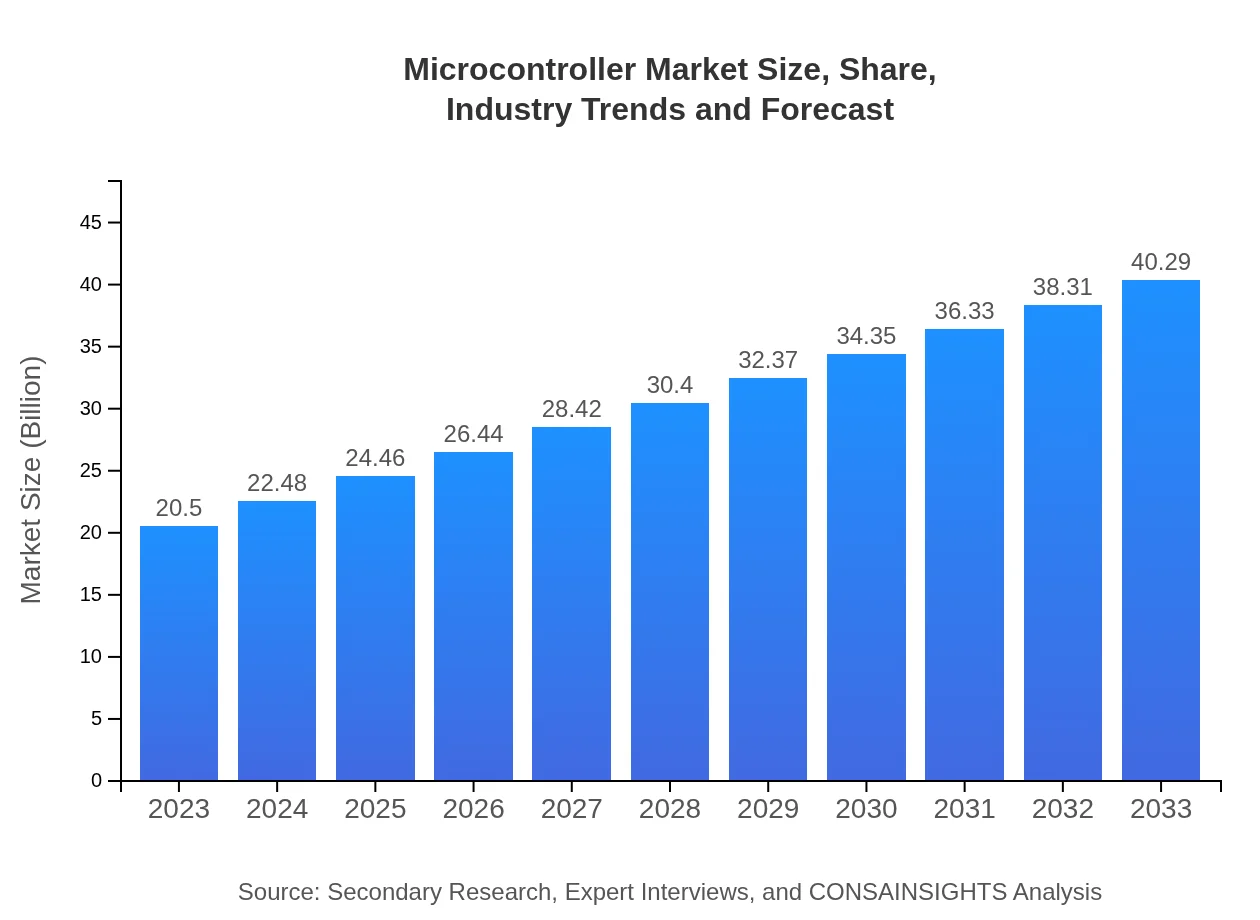

| 2023 Market Size | $20.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $40.29 Billion |

| Top Companies | Microchip Technology Inc., NXP Semiconductors, Texas Instruments, STMicroelectronics |

| Last Modified Date | 31 January 2026 |

Microcontroller Market Overview

Customize Microcontroller Market Report market research report

- ✔ Get in-depth analysis of Microcontroller market size, growth, and forecasts.

- ✔ Understand Microcontroller's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Microcontroller

What is the Market Size & CAGR of Microcontroller market in 2023?

Microcontroller Industry Analysis

Microcontroller Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Microcontroller Market Analysis Report by Region

Europe Microcontroller Market Report:

Europe's microcontroller market is projected to expand from USD 5.21 billion in 2023 to USD 10.24 billion by 2033. The region benefits from strict regulations on energy efficiency and growing automation trends in industrial sectors. Countries such as Germany, France, and the UK are leading in microcontroller development and implementation.Asia Pacific Microcontroller Market Report:

The Asia Pacific microcontroller market is projected to grow from USD 3.94 billion in 2023 to USD 7.75 billion by 2033, driven by the robust expansion of the electronics manufacturing sector and increasing adoption of IoT technologies. Major players in countries like China, Japan, and South Korea are heavily investing in R&D to foster innovation in microcontroller applications.North America Microcontroller Market Report:

The North American microcontroller market is anticipated to grow significantly, from USD 7.88 billion in 2023 to USD 15.49 billion by 2033. The region is characterized by higher adoption rates of advanced technologies and significant investments in the automotive and aerospace sectors. Major tech companies and startups in the U.S. are driving the market forward.South America Microcontroller Market Report:

The South American microcontroller market is expected to grow from USD 2.03 billion in 2023 to USD 3.99 billion by 2033, benefiting from an increase in consumer electronics production and rising demand from the automotive sector. Countries like Brazil and Argentina are key contributors to this growth, focusing on local innovations.Middle East & Africa Microcontroller Market Report:

The Middle East and Africa microcontroller market is forecast to grow from USD 1.44 billion in 2023 to USD 2.82 billion by 2033, driven by the increasing penetration of smart technologies in various sectors like healthcare and automotive. The region is expected to witness growth due to rising investments in infrastructure and technological advancements.Tell us your focus area and get a customized research report.

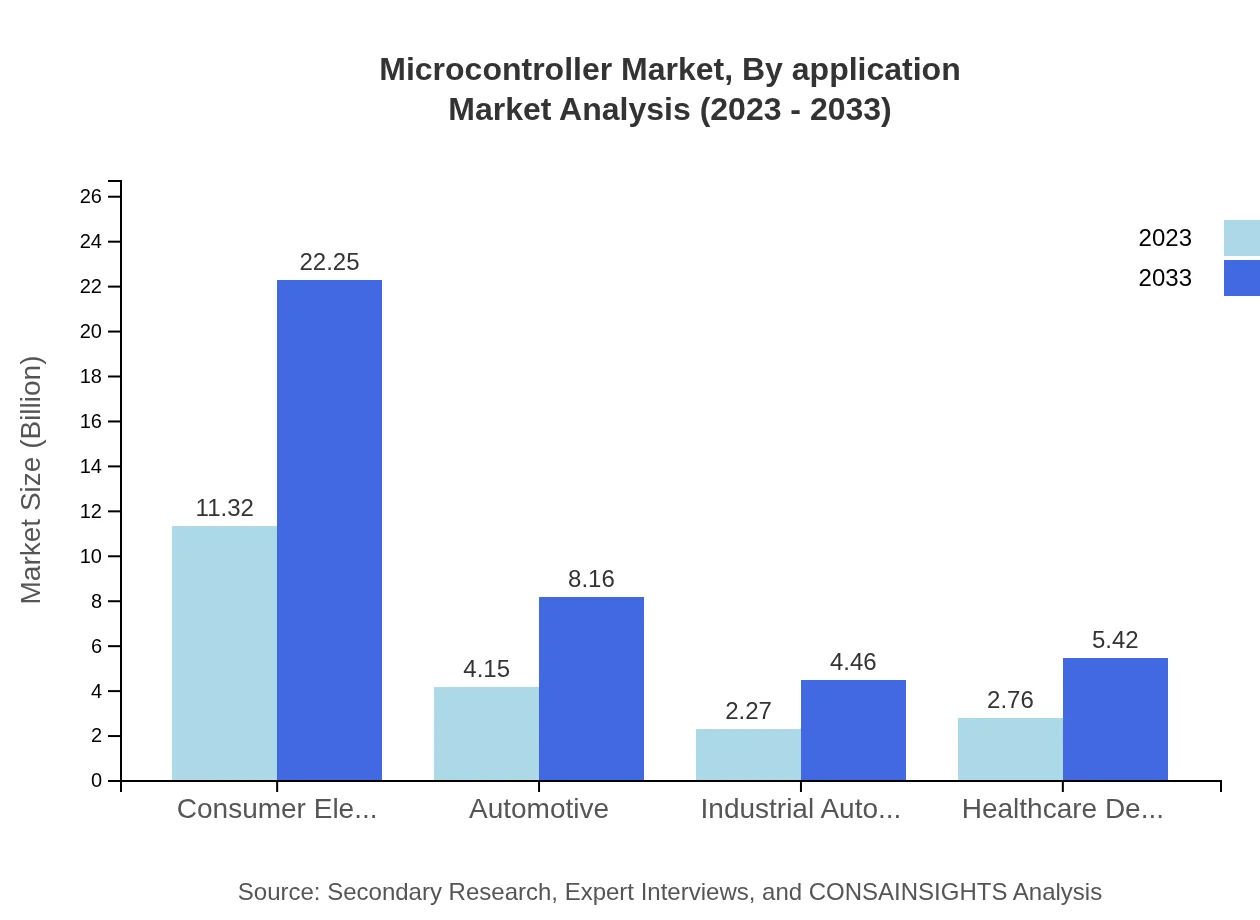

Microcontroller Market Analysis By Application

In 2023, the IT and Telecommunication application segment accounts for USD 11.32 billion, holding 55.22% of the market share, and it is projected to grow to USD 22.25 billion by 2033. Automotive applications follow, with a market size of USD 4.15 billion and a forecast of USD 8.16 billion by 2033, depicting a stable growth trend due to the increasing demand for smart vehicles.

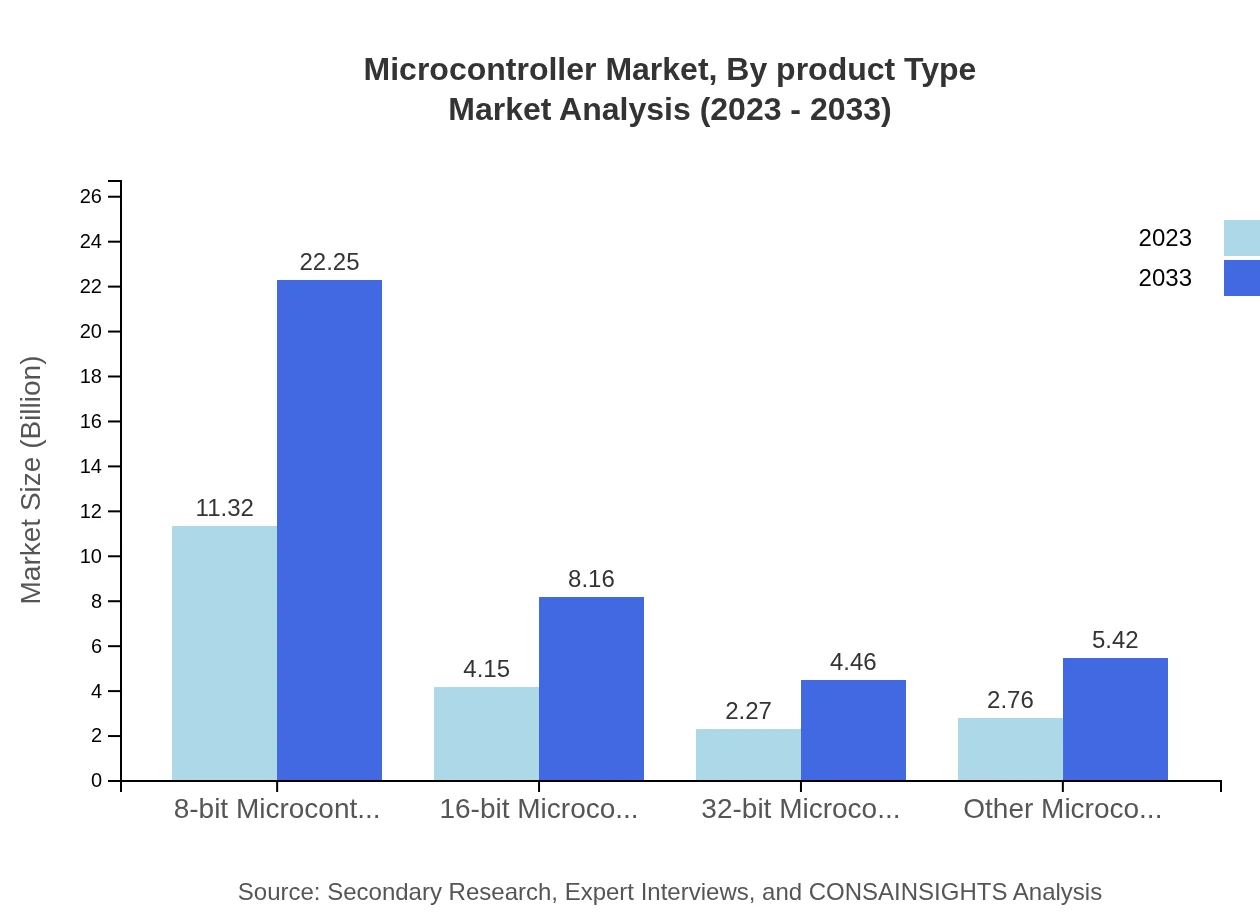

Microcontroller Market Analysis By Product Type

8-bit microcontrollers dominate the product category with a size of USD 11.32 billion in 2023 and projected to double to USD 22.25 billion by 2033. Digital microcontrollers currently represent USD 5.52 billion in 2023, with a projected increase to USD 10.86 billion by 2033, reflecting a growing trend towards digital integration in devices.

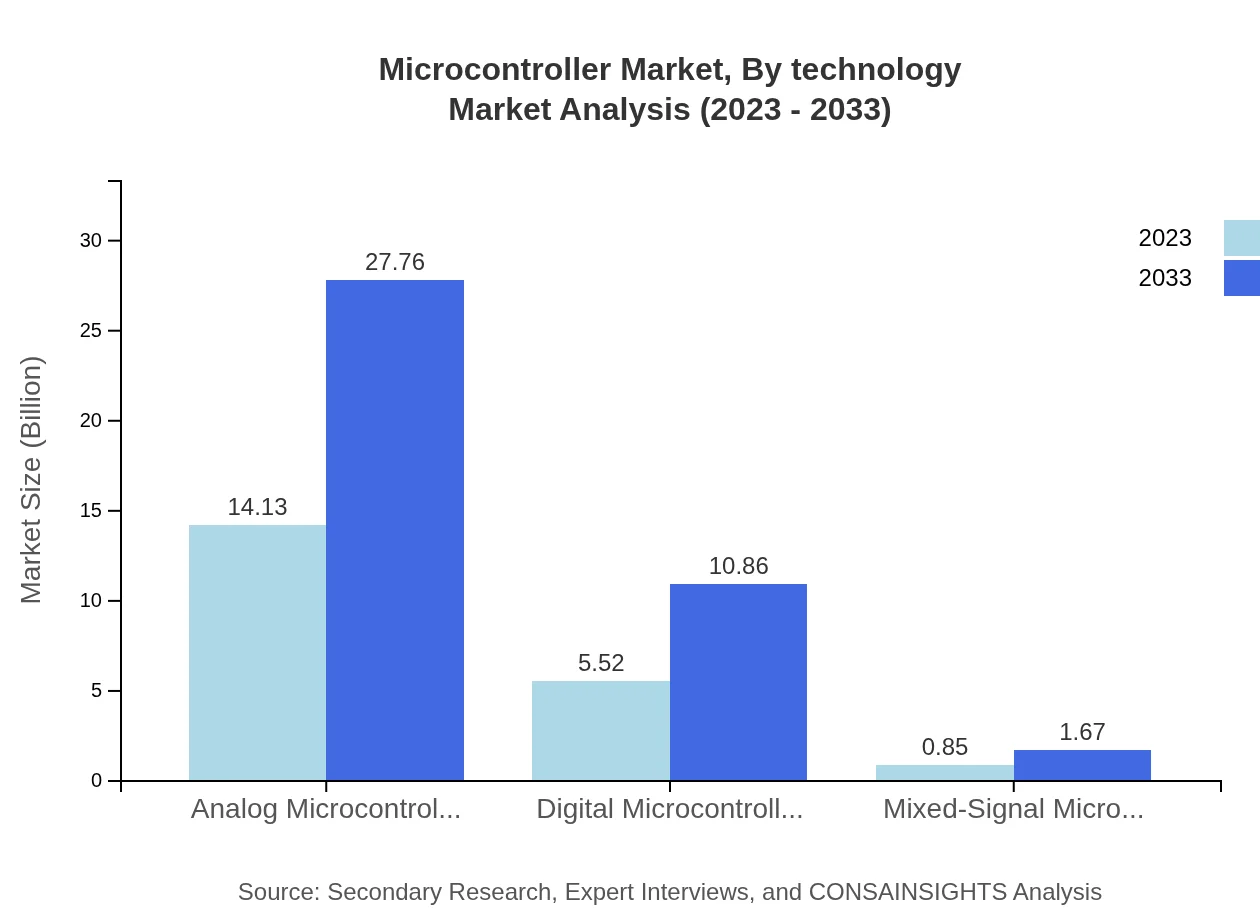

Microcontroller Market Analysis By Technology

The microcontroller market is seeing a significant tilt towards online shopping channels, which contribute USD 18.01 billion in 2023 with an expected growth to USD 35.40 billion by 2033. Offline channels continue to hold a notable share of USD 2.49 billion, projected to increase to USD 4.89 billion, but with a declining percentage share due to the rise of e-commerce.

Microcontroller Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Microcontroller Industry

Microchip Technology Inc.:

A leading provider of microcontroller, analog, and mixed-signal products, Microchip Technology offers architectures supporting low power, high performance with extensive design resources.NXP Semiconductors:

NXP specializes in secure connectivity solutions for embedded applications, driving innovation in IoT and automotive microcontrollers.Texas Instruments:

A prominent player in the market, Texas Instruments provides a wide range of analog and embedded processing products that support various application areas.STMicroelectronics:

STMicroelectronics is known for its energy-efficient products, including a comprehensive portfolio of microcontrollers for automotive and industrial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of microcontroller?

The global microcontroller market is valued at approximately $20.5 billion in 2023 and is projected to grow at a CAGR of 6.8%. By 2033, the market size is expected to increase significantly, reflecting the rising demand for advanced electronic applications.

What are the key market players or companies in the microcontroller industry?

Key players in the microcontroller market include industry leaders such as Microchip Technology Inc., STMicroelectronics, NXP Semiconductors, Texas Instruments, and Infineon Technologies, all contributing significantly to the market with innovative products.

What are the primary factors driving the growth in the microcontroller industry?

Growth in the microcontroller industry is primarily driven by the increasing demand for IoT devices, automation in industrial sectors, advancements in automotive electronics, and the rising trend of smart home devices, enhancing the overall market expansion.

Which region is the fastest Growing in the microcontroller industry?

North America is the fastest-growing region in the microcontroller market, with a projected increase from $7.88 billion in 2023 to $15.49 billion by 2033. This growth is fueled by robust technology infrastructure and innovation in consumer electronics.

Does ConsaInsights provide customized market report data for the microcontroller industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the microcontroller industry, ensuring detailed insights and analyses that align with targeted business objectives.

What deliverables can I expect from this microcontroller market research project?

From this research project, clients can expect comprehensive market analysis reports, segmented insights, competitive landscape evaluations, growth forecasts, and actionable recommendations based on the latest industry trends and data.

What are the market trends of microcontroller?

Key trends in the microcontroller market include increased integration of AI in microcontrollers, a shift towards 32-bit architectures, and a growing focus on energy-efficient solutions, reflecting the industry's adaptation to evolving technological demands.