Microdisplay Market Report

Published Date: 31 January 2026 | Report Code: microdisplay

Microdisplay Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the microdisplay market from 2023 to 2033, including insights on market size, growth trends, industry analysis, segmentation, and regional dynamics.

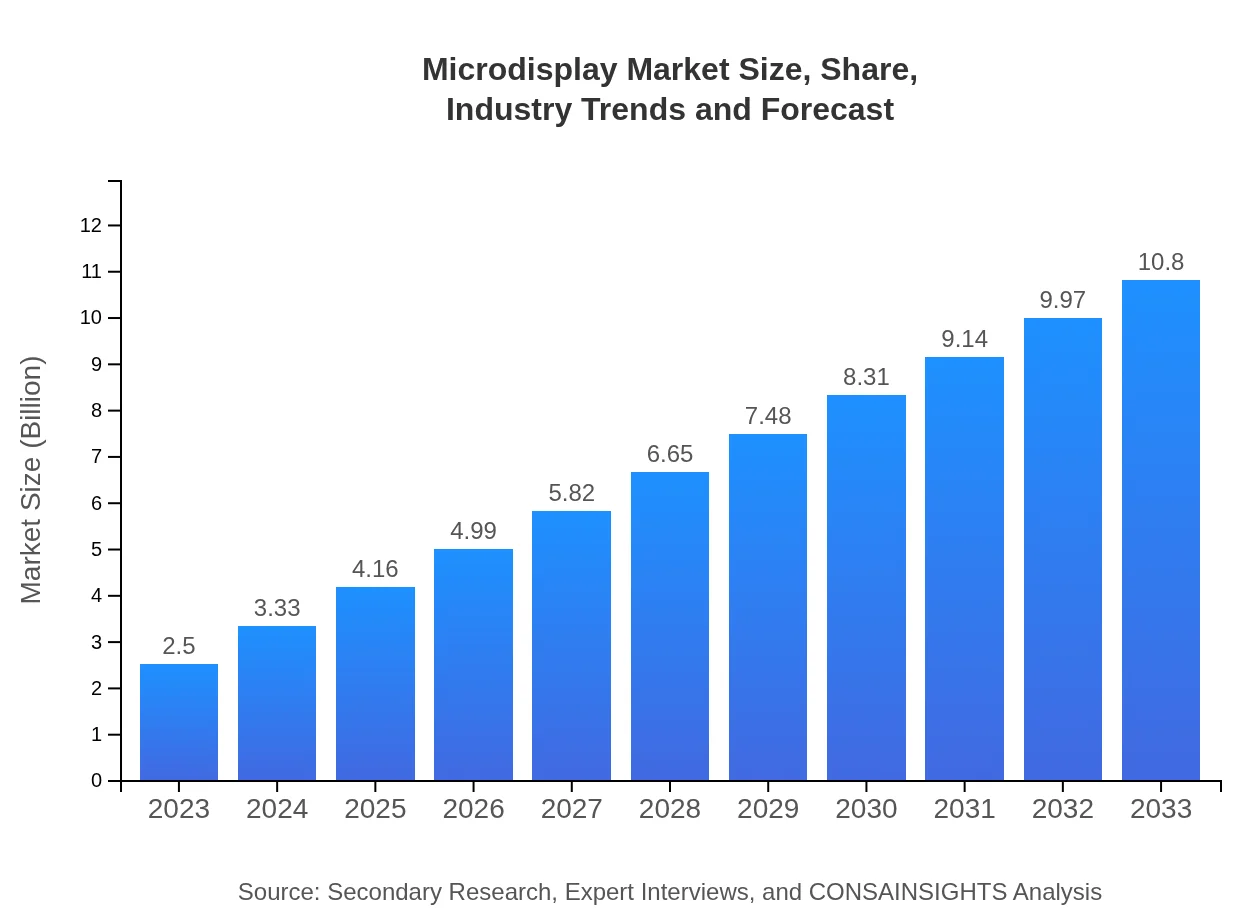

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 15% |

| 2033 Market Size | $10.80 Billion |

| Top Companies | Sony Corporation, Intel Corporation, Texas Instruments, MicroVision, Inc. |

| Last Modified Date | 31 January 2026 |

Microdisplay Market Overview

Customize Microdisplay Market Report market research report

- ✔ Get in-depth analysis of Microdisplay market size, growth, and forecasts.

- ✔ Understand Microdisplay's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Microdisplay

What is the Market Size & CAGR of Microdisplay market in 2023?

Microdisplay Industry Analysis

Microdisplay Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Microdisplay Market Analysis Report by Region

Europe Microdisplay Market Report:

The European microdisplay market is valued at $0.79 billion in 2023, anticipating a considerable rise to $3.43 billion by 2033. The strong emphasis on quality, innovation, and sustainability is leading to increased adoption of microdisplays in various industries, including healthcare and automotive sectors, particularly in countries like Germany, France, and the UK.Asia Pacific Microdisplay Market Report:

In 2023, the microdisplay market in the Asia-Pacific region is valued at approximately $0.46 billion, projected to grow to about $1.99 billion by 2033. The region is a manufacturing hub for electronics, with countries like China and Japan leading in technology development and production. The increasing adoption of microdisplays in mobile devices and AR/VR applications is driving growth in this region, aided by strong investment in R&D.North America Microdisplay Market Report:

In North America, the microdisplay market reaches approximately $0.91 billion in 2023, with projections suggesting it will grow to around $3.91 billion by 2033. This region benefits from advanced technological infrastructure and a strong focus on innovation. The adoption of microdisplays in military applications and the automotive sector are key growth drivers here.South America Microdisplay Market Report:

The microdisplay market in South America is valued at about $0.19 billion in 2023, expecting significant growth to $0.81 billion by 2033. Factors driving this growth include the rising demand for advanced technology in consumer electronics and a growing interest in innovative display solutions across various sectors, including advertising and retail.Middle East & Africa Microdisplay Market Report:

For the Middle East and Africa, the microdisplay market stands at roughly $0.15 billion in 2023, projected to reach $0.65 billion by 2033. The region's market growth is driven by advancements in digital signage and the increasing demand for smart technology in urban development, notably in the Gulf countries.Tell us your focus area and get a customized research report.

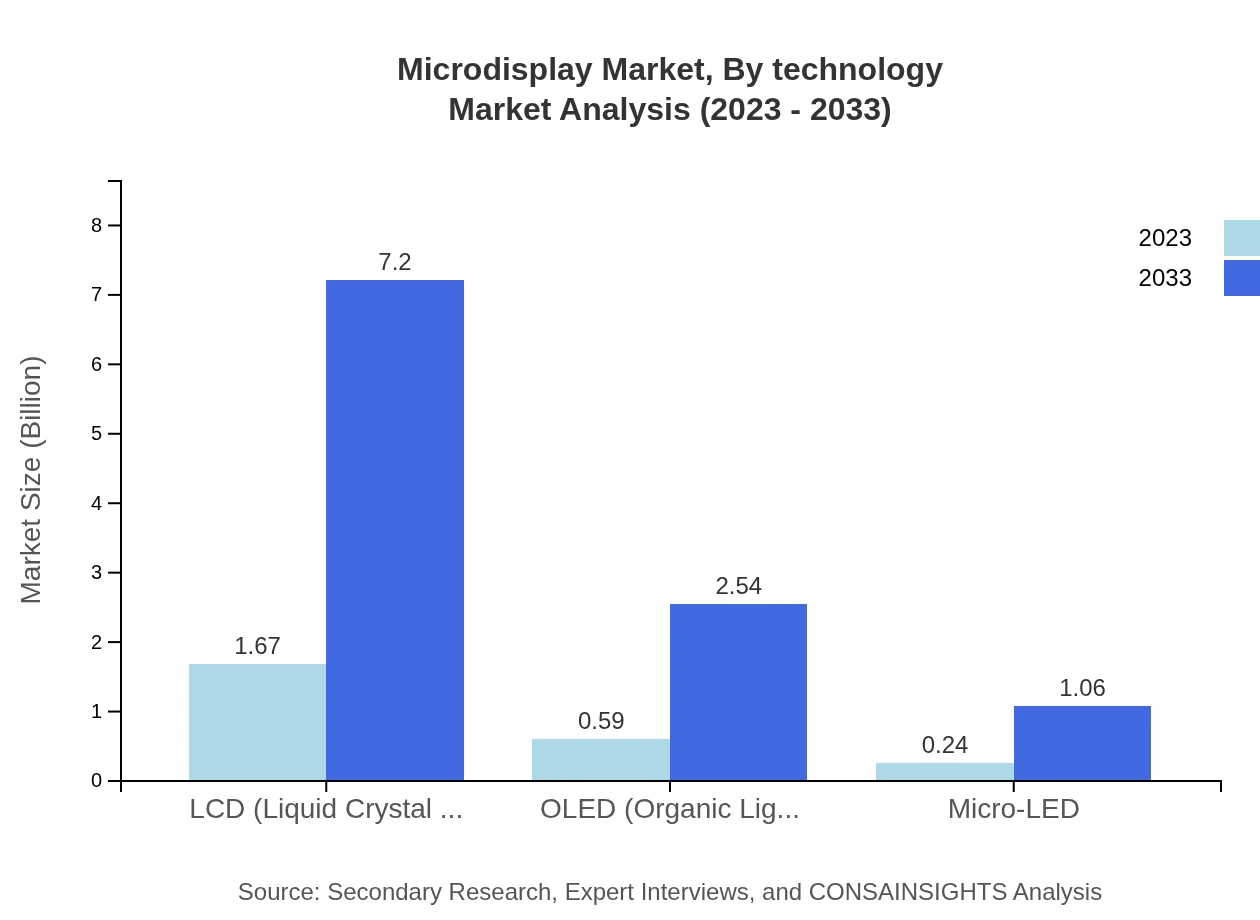

Microdisplay Market Analysis By Technology

The microdisplay market is segmented by technology, including LCD, OLED, and Micro-LED. As of 2023, LCD holds a market size of approximately $1.67 billion, making up 66.65% of the market share, while OLED is valued at $0.59 billion with a share of 23.56%. The newer Micro-LED technology, valued at $0.24 billion, captures 9.79% due to its potential for superior brightness and efficiency.

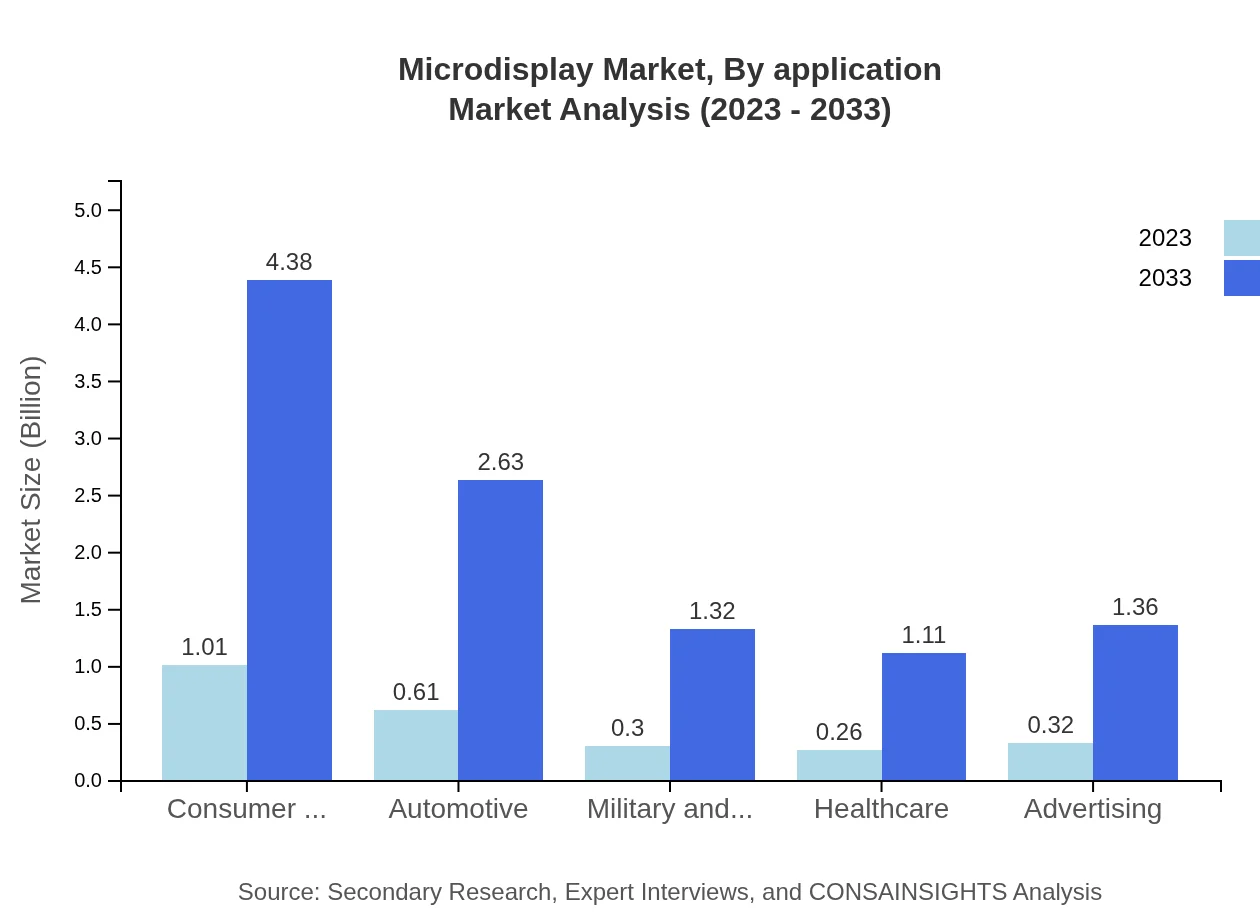

Microdisplay Market Analysis By Application

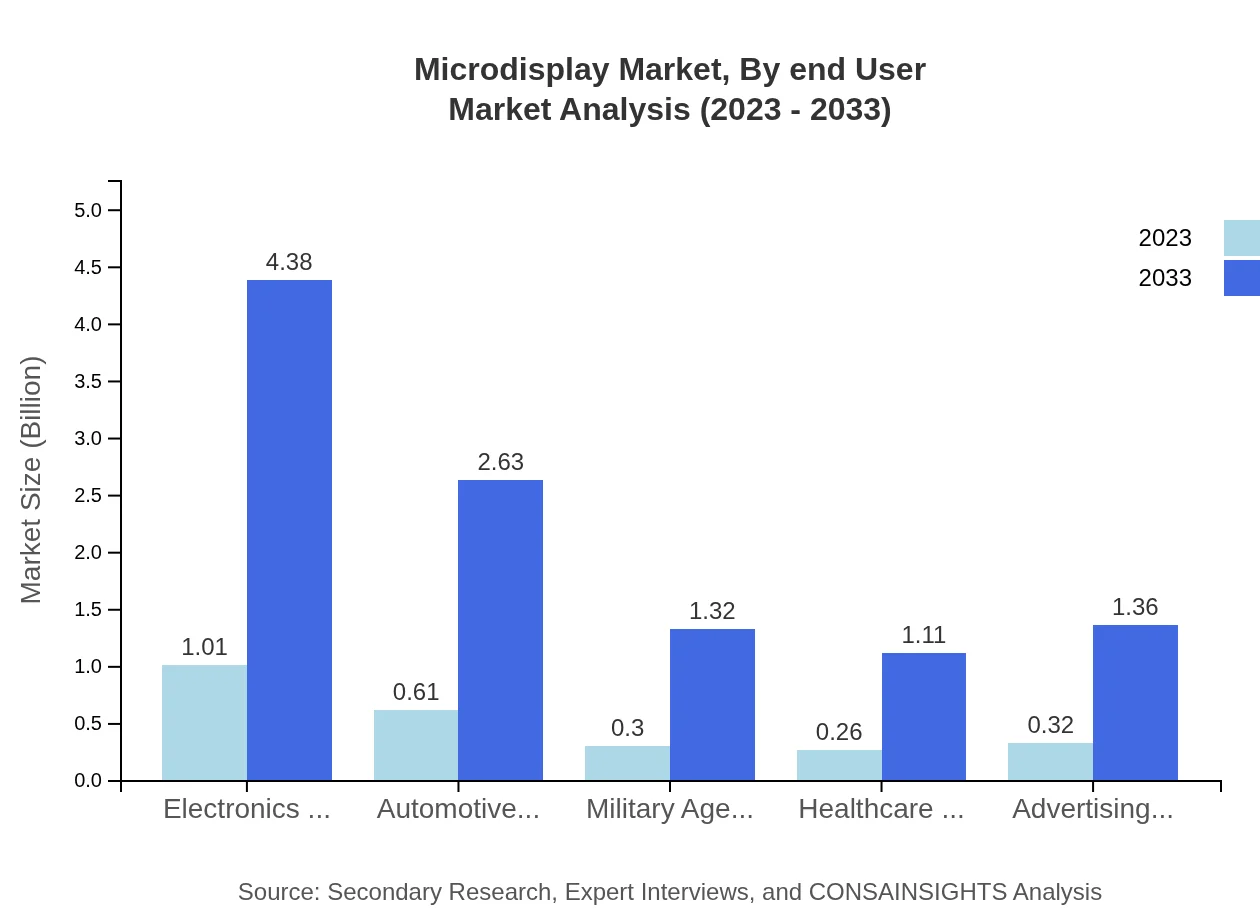

In terms of application, consumer electronics command the largest market share, valued at $1.01 billion in 2023, making up 40.55% of the market. The automotive segment is worth approximately $0.61 billion with a share of 24.34%, while military applications hold around $0.30 billion, representing 12.19% of the market. Other significant segments include healthcare and advertising, demonstrating strong demand for microdisplay technologies.

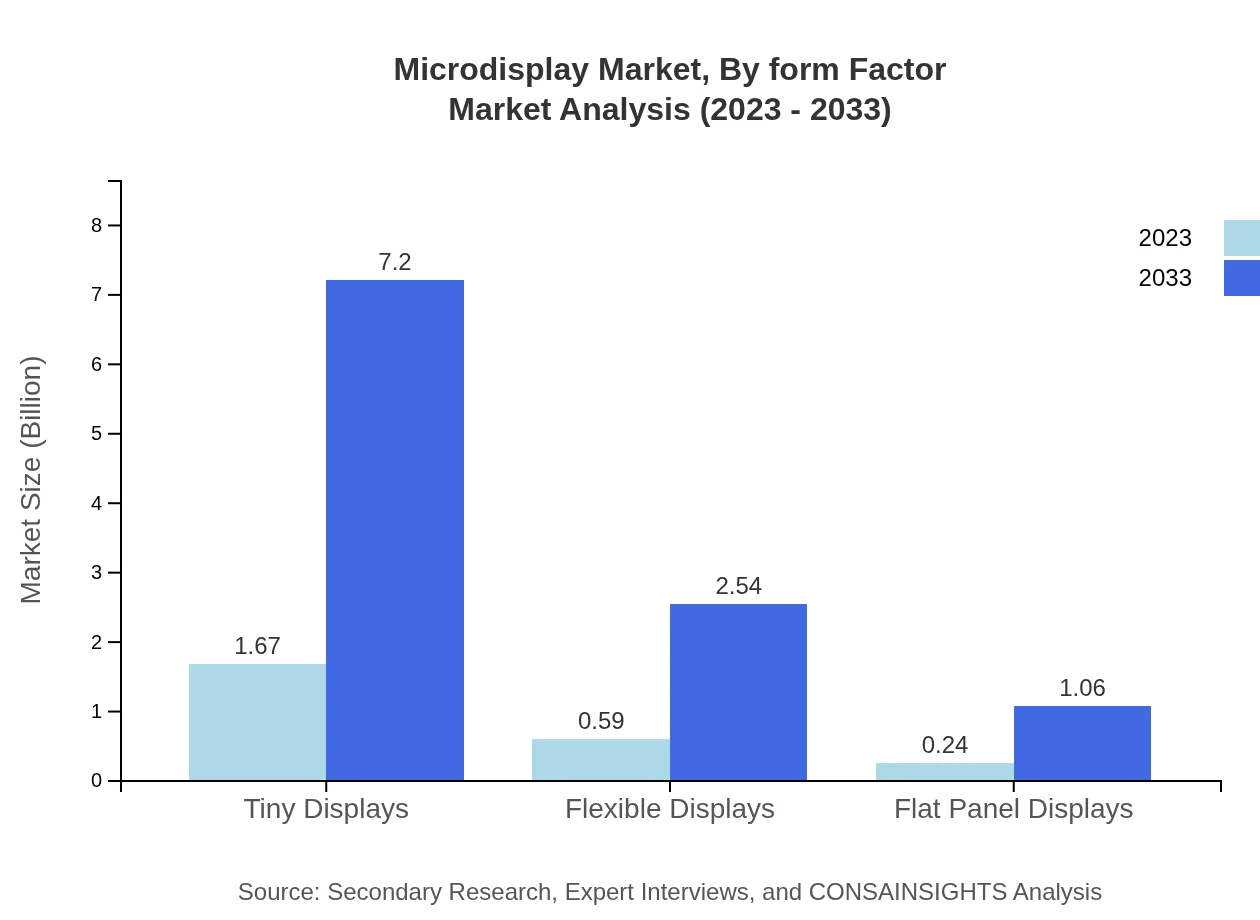

Microdisplay Market Analysis By Form Factor

Microdisplays are categorized by form factor, which includes various shapes and sizes tailored for specific uses. This segmentation allows manufacturers to optimize designs for applications ranging from portable gadgets to large-scale installations, significantly influencing market dynamics. Emerging trends highlight a continual push towards more compact and efficient designs.

Microdisplay Market Analysis By End User

End-user segmentation of the microdisplay market includes consumer electronics, automotive, military, healthcare, and advertising sectors. The consumer electronics sector is driving demand due to increasing smartphone and wearables use, while automotive applications are expanding through heads-up displays and navigation systems, ensuring sustained market growth.

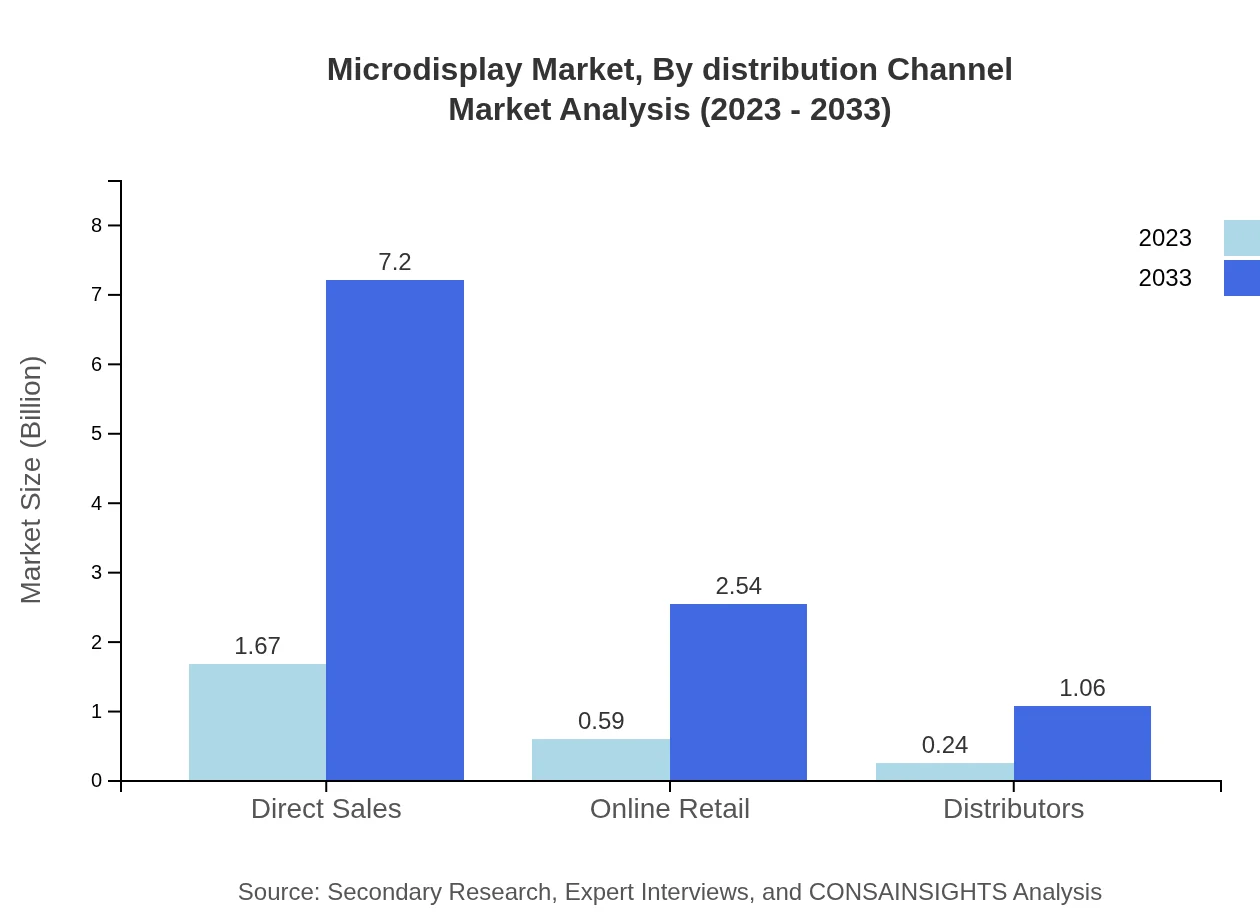

Microdisplay Market Analysis By Distribution Channel

Distribution channels for microdisplays encompass direct sales, online retail, and distributors. Direct sales dominate the market with significant revenues, accounting for $1.67 billion in 2023 and a share of 66.65%. Online retail is also a strong channel, capturing 23.56% of market revenue.

Microdisplay Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Microdisplay Industry

Sony Corporation:

A leader in the consumer electronics space, Sony manufactures OLED microdisplays primarily used in AR and VR applications.Intel Corporation:

Intel is at the forefront of microdisplay technology, driving innovations in smart glasses and AR applications.Texas Instruments:

Known for DLP technology, Texas Instruments provides solutions for microdisplay applications in projection systems and other electronic devices.MicroVision, Inc.:

MicroVision specializes in microdisplay technology for automotive and augmented reality displays, focusing on the development of laser beam scanning technology.We're grateful to work with incredible clients.

FAQs

What is the market size of microdisplay?

The microdisplay market size is projected to reach $2.5 billion by 2033, with a notable CAGR of 15%. This growth reflects a significant increase from its current value, showcasing robust demand within the industry.

What are the key market players or companies in the microdisplay industry?

Key players in the microdisplay industry include prominent companies focusing on innovative display technologies such as OLED and Micro-LED. These industry leaders drive advancements in various applications, including consumer electronics and military sectors.

What are the primary factors driving the growth in the microdisplay industry?

The growth of the microdisplay industry is primarily driven by advancements in display technologies, increased demand in consumer electronics, and a surge in applications across sectors like automotive, healthcare, and military, reflecting evolving consumer preferences.

Which region is the fastest Growing in the microdisplay?

The fastest-growing region for the microdisplay market is Europe, expected to expand from $0.79 billion in 2023 to $3.43 billion in 2033. Meanwhile, Asia Pacific will also demonstrate robust growth, reaching $1.99 billion.

Does ConsaInsights provide customized market report data for the microdisplay industry?

Yes, ConsaInsights offers customized market report data for the microdisplay industry, tailored to specific needs. This enables clients to obtain in-depth insights and analysis to make informed business decisions.

What deliverables can I expect from this microdisplay market research project?

From the microdisplay market research project, clients can expect comprehensive reports, detailed segmentation analysis, regional data, market trends, and growth forecasts, all designed to support strategic planning and investment decisions.

What are the market trends of microdisplay?

Current market trends in microdisplays include a shift towards OLED and Micro-LED technologies, growing applications in augmented reality, and increased incorporation of advanced features in consumer devices, reflecting innovations driving market expansion.