Microspheres Market Report

Published Date: 02 February 2026 | Report Code: microspheres

Microspheres Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Global Microspheres Market, covering essential insights on market size, industry analysis, segmentation, regional performance, key players, and future trends from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

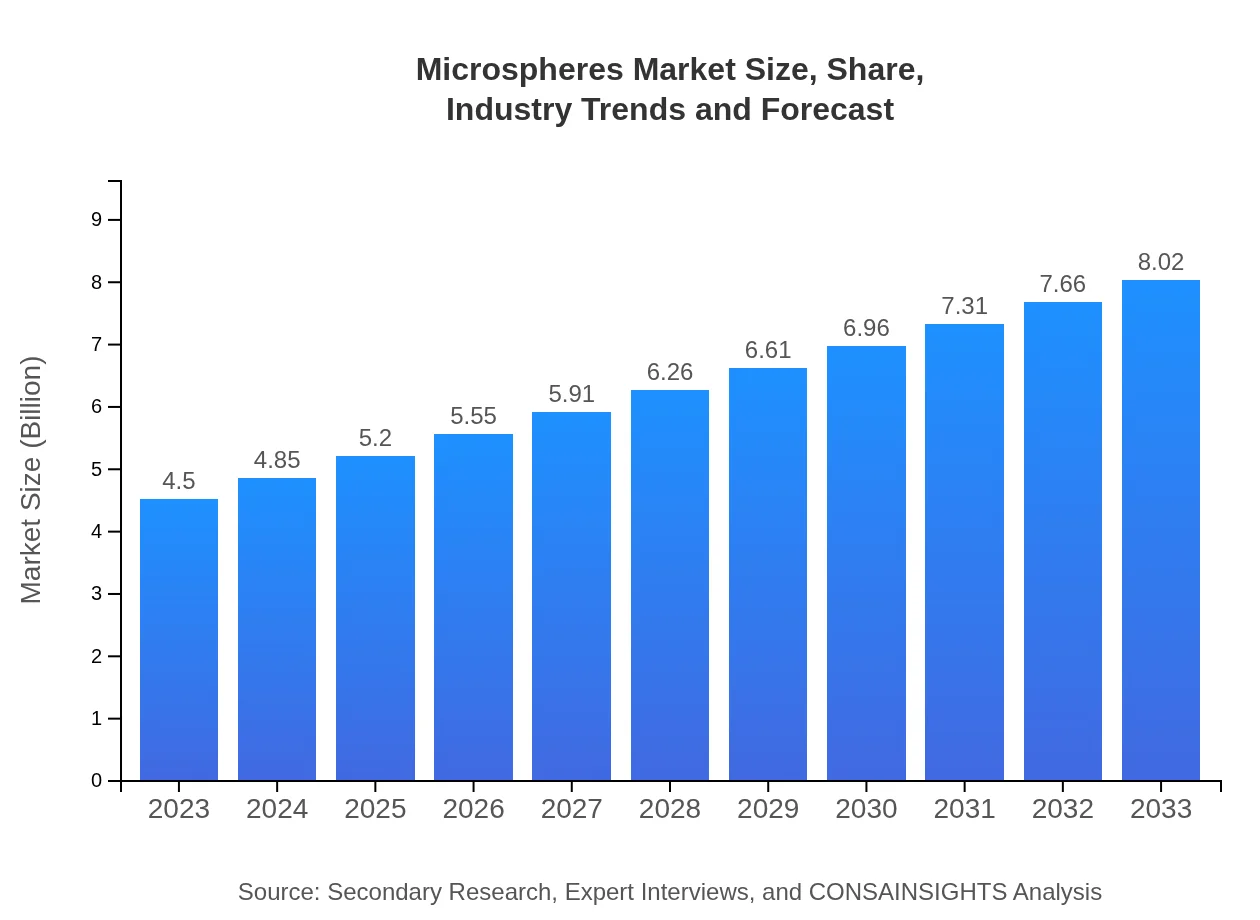

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $8.02 Billion |

| Top Companies | 3M Company, Hollow Glass Technologies, Wacker Chemie AG, Polysciences, Inc., Expancel |

| Last Modified Date | 02 February 2026 |

Microspheres Market Overview

Customize Microspheres Market Report market research report

- ✔ Get in-depth analysis of Microspheres market size, growth, and forecasts.

- ✔ Understand Microspheres's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Microspheres

What is the Market Size & CAGR of Microspheres market in 2023?

Microspheres Industry Analysis

Microspheres Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Microspheres Market Analysis Report by Region

Europe Microspheres Market Report:

Europe is estimated to experience notable growth, with market size anticipated to increase from USD 1.27 billion in 2023 to USD 2.26 billion by 2033. The region's commitment to sustainability and green technologies is fostering the development of eco-friendly microspheres.Asia Pacific Microspheres Market Report:

The Asia Pacific region is anticipated to witness robust growth, with the market size expected to reach USD 1.71 billion by 2033, from USD 0.96 billion in 2023. This growth is attributed to increasing industrialization, especially in countries like China and India, and rising consumer demands for innovative products in healthcare and construction sectors.North America Microspheres Market Report:

North America holds a significant share of the microspheres market, projected to reach USD 2.67 billion by 2033, up from USD 1.50 billion in 2023. The demand is largely driven by technological advancements and an increasing focus on innovation in pharmaceuticals and aerospace applications.South America Microspheres Market Report:

In South America, the microspheres market is forecasted to grow from USD 0.27 billion in 2023 to USD 0.49 billion by 2033. The construction sector's expansion and increasing healthcare investments are primarily propelling the market in this region.Middle East & Africa Microspheres Market Report:

The Middle East and Africa region is expected to grow from USD 0.50 billion in 2023 to USD 0.89 billion by 2033. The growing oil and gas sector is increasingly utilizing microspheres in drilling and exploration activities, providing a significant boost to market growth.Tell us your focus area and get a customized research report.

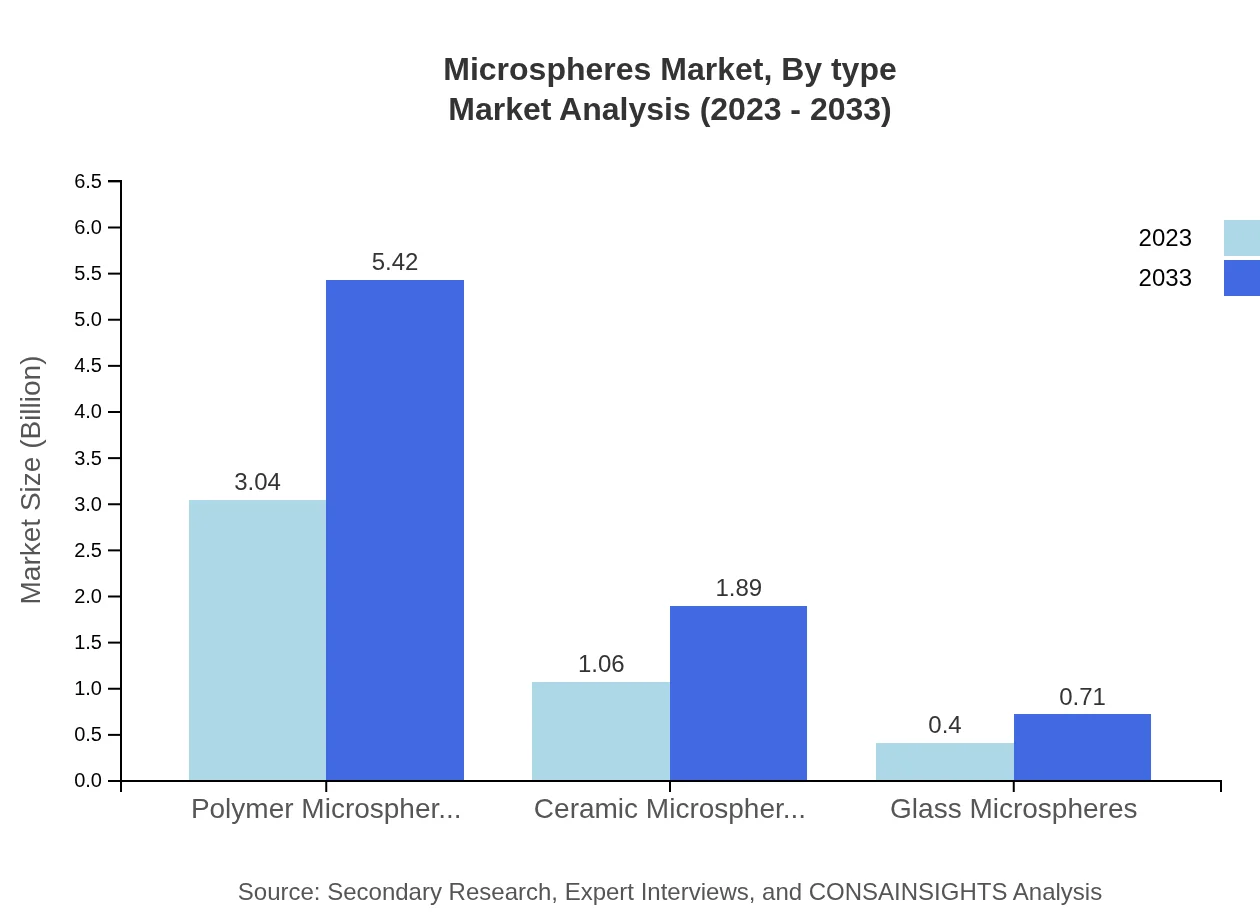

Microspheres Market Analysis By Type

The microspheres market is categorized by type into polymer microspheres, ceramic microspheres, and glass microspheres. Polymer microspheres dominate the market with a size of USD 3.04 billion in 2023, expected to grow to USD 5.42 billion by 2033, representing a robust 67.65% market share. Ceramic microspheres follow with significant growth potential, shifting from USD 1.06 billion to USD 1.89 billion, holding a 23.52% share. Glass microspheres, while smaller at USD 0.40 billion, are also expected to grow, accounting for 8.83% of the market.

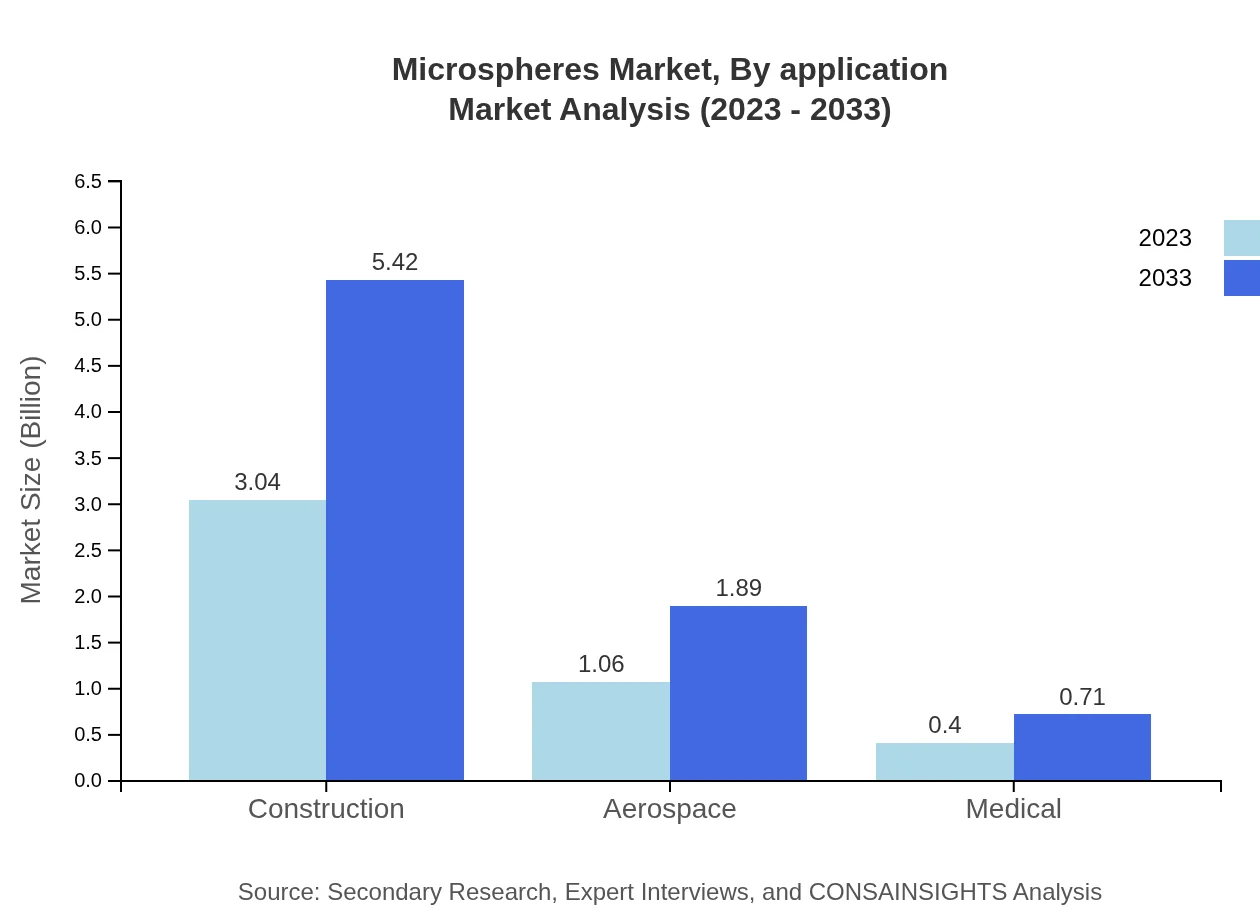

Microspheres Market Analysis By Application

Applications of microspheres are critical in various industries, with pharmaceuticals and construction sectors leading the way. The pharmaceutical segment's market size is set to expand from USD 3.04 billion in 2023 to USD 5.42 billion by 2033, maintaining a 67.65% market share. The construction sector similarly promises growth from USD 3.04 billion to USD 5.42 billion, also holding a significant 67.65% share, underlining its importance in enhancing materials.

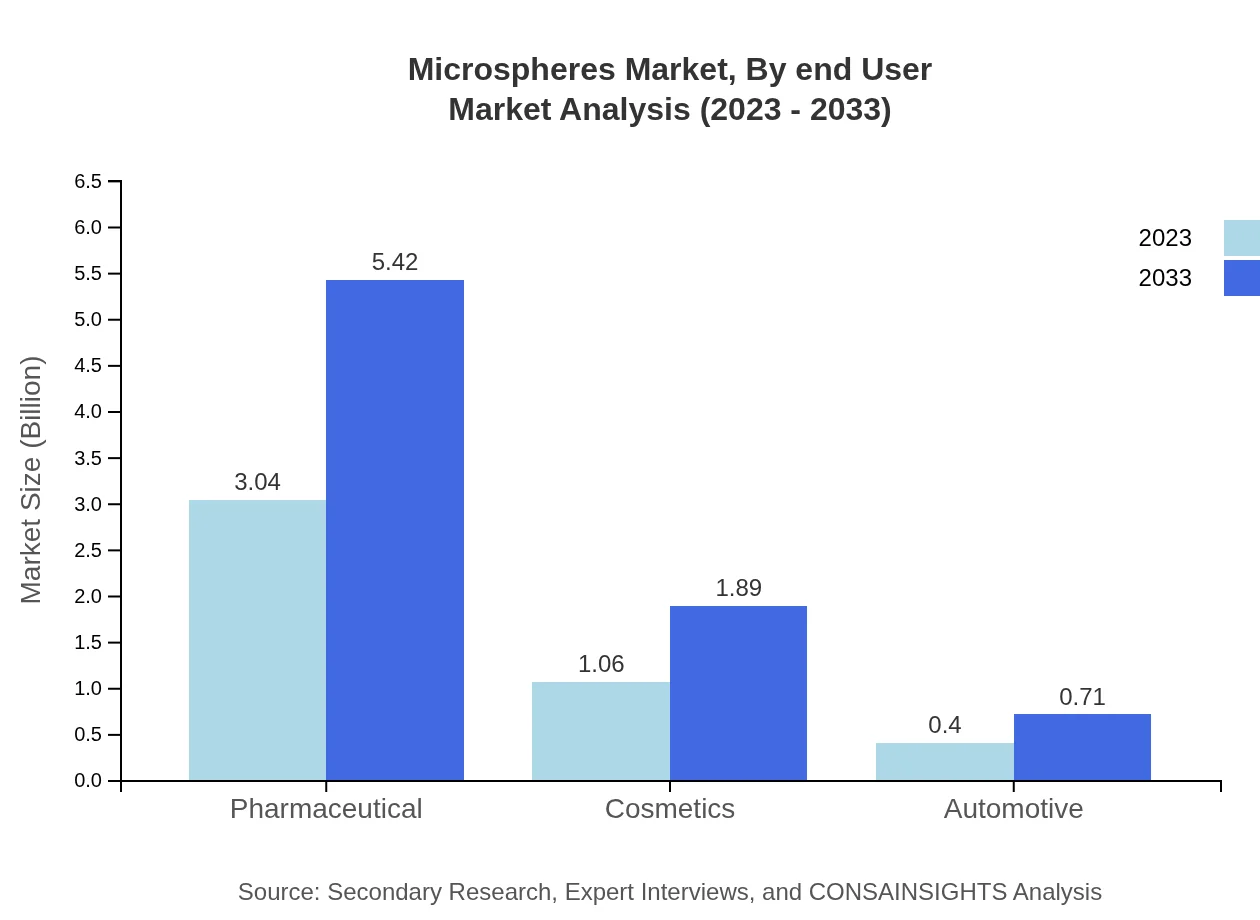

Microspheres Market Analysis By End User

In terms of end-user industries, the microspheres market sees extensive demand from the pharmaceutical and construction sectors. The pharmaceutical industry not only contributes a significant revenue driver but also leads in innovation and application of microspheres for drug delivery systems. The construction sector is equally prominent due to its substantial consumption of microspheres for developing high-performance materials.

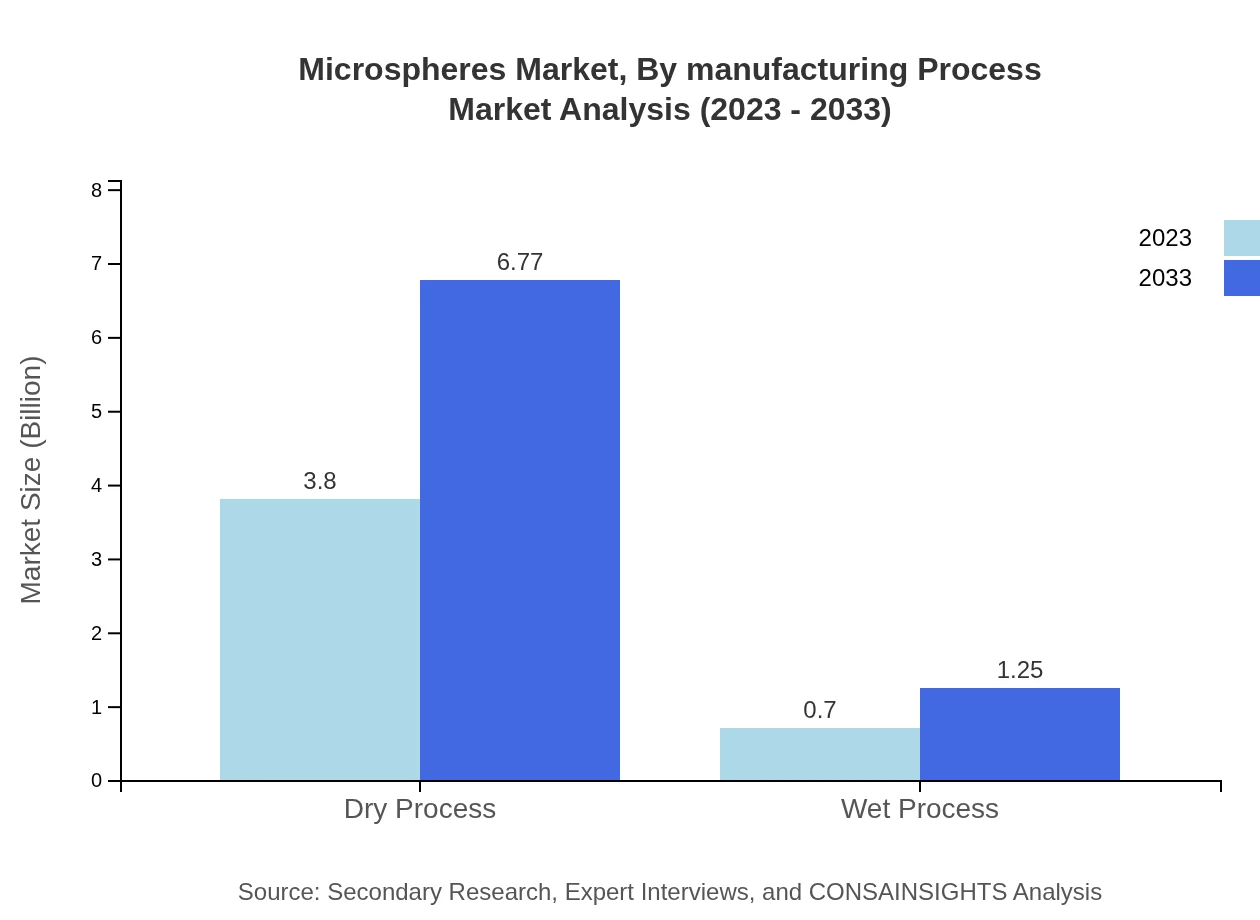

Microspheres Market Analysis By Manufacturing Process

The microspheres market is divided based on manufacturing process into dry and wet processing methods. The dry process is prevalent, accounting for a size of USD 3.80 billion in 2023, with expectations to rise to USD 6.77 billion by 2033, holding an 84.46% market share. The wet process, while smaller at USD 0.70 billion, shows potential growth to USD 1.25 billion, capturing 15.54% of the market.

Microspheres Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Microspheres Industry

3M Company:

A market leader in the production of glass microspheres, 3M is known for its innovative applications in multiple industries including automotive, aerospace, and healthcare.Hollow Glass Technologies:

Specializes in glass microspheres with applications in construction and coatings, committed to developing sustainable products.Wacker Chemie AG:

A key player providing silicone-coated polymer microspheres used in various applications from cosmetics to pharmaceuticals.Polysciences, Inc.:

Offers a range of polymer microspheres and innovative formulations for scientific applications, including drug delivery systems.Expancel:

Known for its expandable microspheres used in various sectors such as automotive, textiles, and coatings, focusing on lightweight and eco-friendly solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of microspheres?

The global microspheres market is projected to reach a value of approximately $4.5 billion by 2033, growing from $4.5 billion in 2023, at a CAGR of 5.8%. This growth signifies a robust expansion trajectory within the sector.

What are the key market players or companies in this microspheres industry?

The microspheres industry features significant players such as 3M Company, AkzoNobel N.V., and Momentive Performance Materials Inc. These companies are pivotal due to their innovations and sustainable practices, shaping market trends and competitive dynamics.

What are the primary factors driving the growth in the microspheres industry?

Key drivers for growth in the microspheres market include increasing demand from pharmaceuticals for drug delivery systems, advancements in technology enhancing manufacturing processes, and the expanding cosmetics sector focusing on innovative formulations.

Which region is the fastest Growing in the microspheres market?

The Asia Pacific region is the fastest-growing in the microspheres market, expected to reach $1.71 billion by 2033 from $0.96 billion in 2023, showcasing significant market potential and increased industrial applications.

Does ConsaInsights provide customized market report data for the microspheres industry?

Yes, ConsaInsights offers tailored market report data for the microspheres industry, enabling clients to access specific insights that align with their strategic goals, including market size, trends, and competitive landscapes.

What deliverables can I expect from this microspheres market research project?

Clients can expect comprehensive deliverables, including detailed market reports, segmented data analysis, competitive benchmarking, and trends analysis, all crafted to support informed decision-making in the microspheres sector.

What are the market trends of microspheres?

Current trends in the microspheres market include a shift towards environmentally friendly materials, innovation in production technology, and increased application in diverse sectors such as aerospace, construction, and pharmaceuticals, driving overall market dynamics.