Mobile Robots Market Report

Published Date: 31 January 2026 | Report Code: mobile-robots

Mobile Robots Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Mobile Robots market, examining current trends, market size, and future forecasts from 2023 to 2033. It includes insights into key segments, regional analyses, and profiles of leading players in the industry.

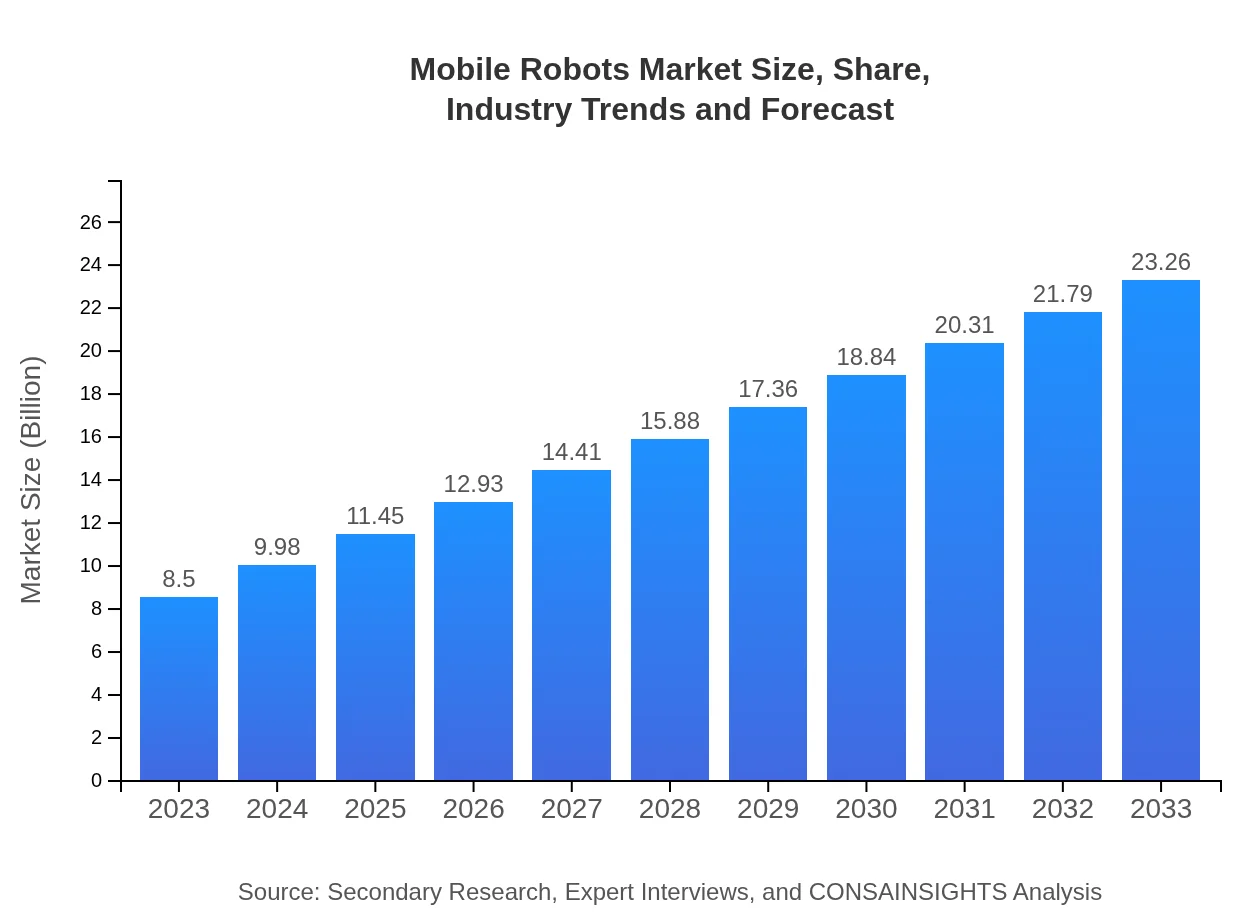

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $23.26 Billion |

| Top Companies | Boston Dynamics, ABB Robotics, iRobot, KUKA Robotics |

| Last Modified Date | 31 January 2026 |

Mobile Robots Market Overview

Customize Mobile Robots Market Report market research report

- ✔ Get in-depth analysis of Mobile Robots market size, growth, and forecasts.

- ✔ Understand Mobile Robots's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mobile Robots

What is the Market Size & CAGR of Mobile Robots market in 2023?

Mobile Robots Industry Analysis

Mobile Robots Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mobile Robots Market Analysis Report by Region

Europe Mobile Robots Market Report:

Europe’s market for mobile robots is expected to expand from $2.33 billion in 2023 to $6.37 billion by 2033, fueled by advancements in robotics technology and increasing labor costs, particularly in Western Europe where automation is becoming critical.Asia Pacific Mobile Robots Market Report:

The Asia Pacific region is poised for substantial growth, with an expected market size of $4.48 billion by 2033, up from $1.64 billion in 2023. Major countries like China, Japan, and South Korea are investing heavily in automation, driving the demand for mobile robots in manufacturing and logistics.North America Mobile Robots Market Report:

North America leads the market with an anticipated size growth from $3.01 billion in 2023 to $8.24 billion by 2033. The U.S. and Canada are witnessing extensive integration of mobile robots in warehouses and retail, driven by e-commerce growth and workforce challenges.South America Mobile Robots Market Report:

In South America, the market size is projected to grow from $0.40 billion in 2023 to $1.09 billion by 2033. The region is seeing an increasing adoption of mobile robots in sectors like agriculture and logistics, contributing to overall market growth.Middle East & Africa Mobile Robots Market Report:

The Middle East and Africa market is forecasted to increase from $1.13 billion in 2023 to $3.08 billion by 2033. The growth is primarily attributed to expanding sectors such as healthcare and logistics, with more companies recognizing the benefits of deploying mobile robots.Tell us your focus area and get a customized research report.

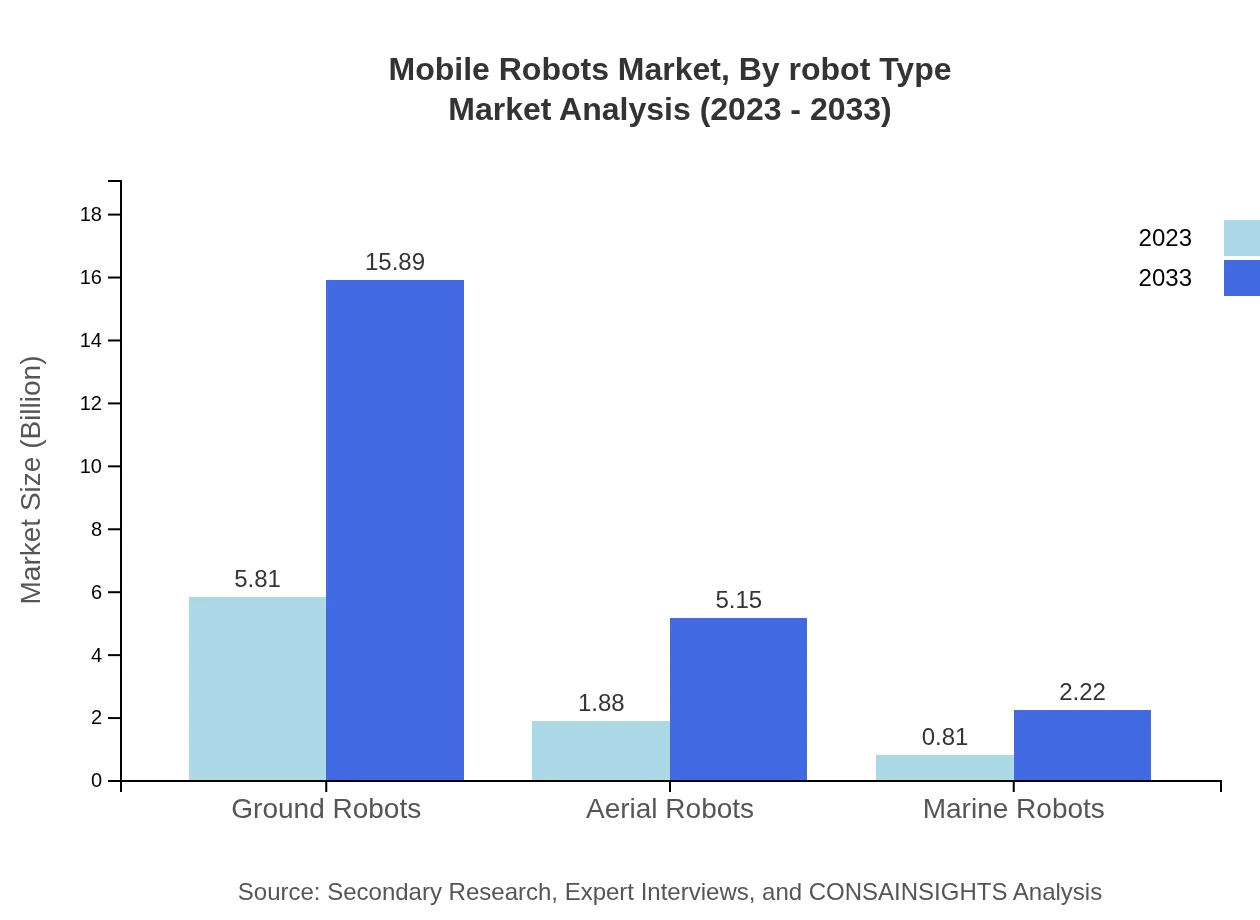

Mobile Robots Market Analysis By Robot Type

The Mobile Robots market, segmented by robot type, shows ground robots dominating the market with a size of $5.81 billion in 2023, projected to grow to $15.89 billion by 2033. Aerial robots and marine robots follow with respective sizes of $1.88 billion and $0.81 billion in 2023, showing robust growth trends in specialized areas such as surveillance and underwater tasks.

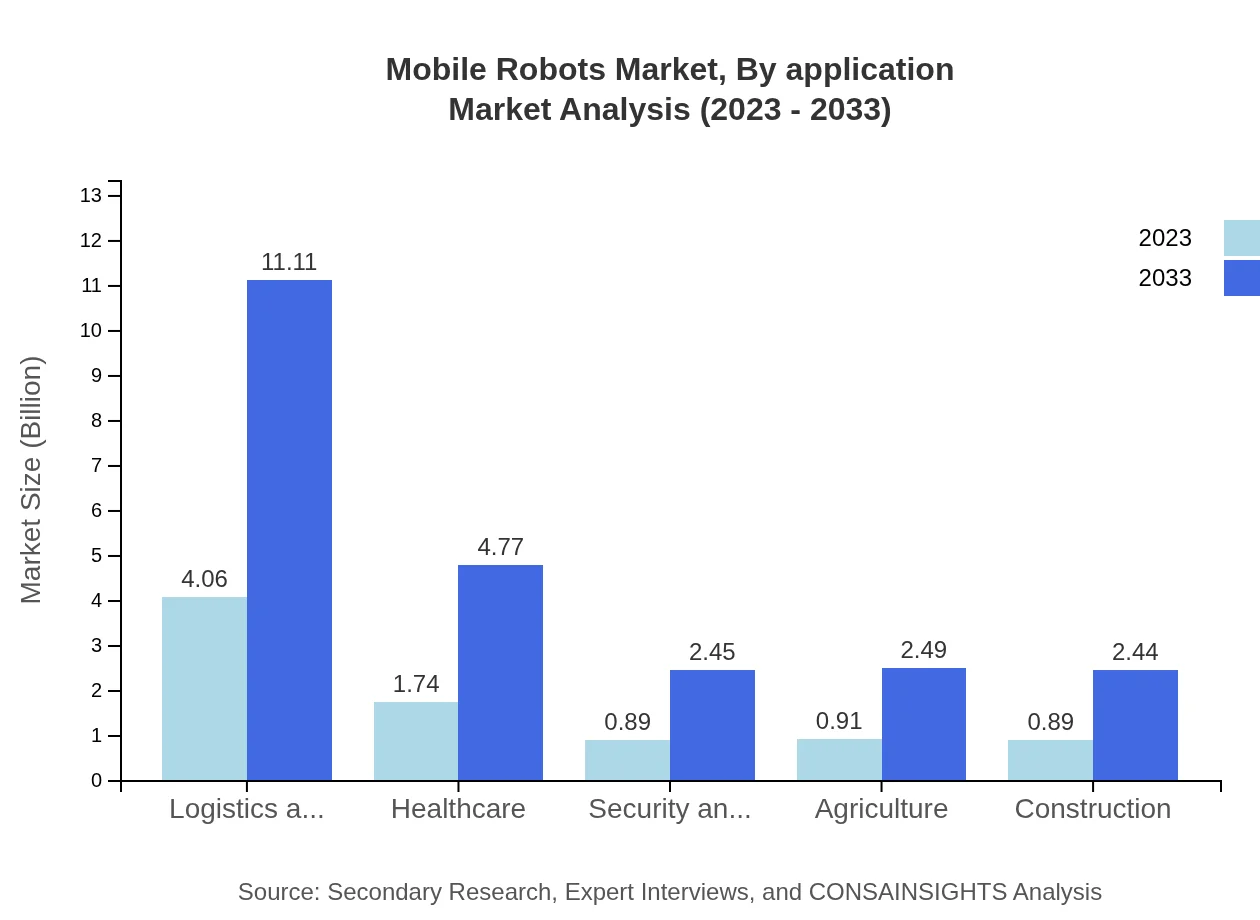

Mobile Robots Market Analysis By Application

By application, the logistics and warehousing sector leads with a market size of $4.06 billion in 2023 and is expected to reach $11.11 billion by 2033. Other significant applications include healthcare and retail, reflecting the diverse functional roles mobile robots play in enhancing operational efficiency.

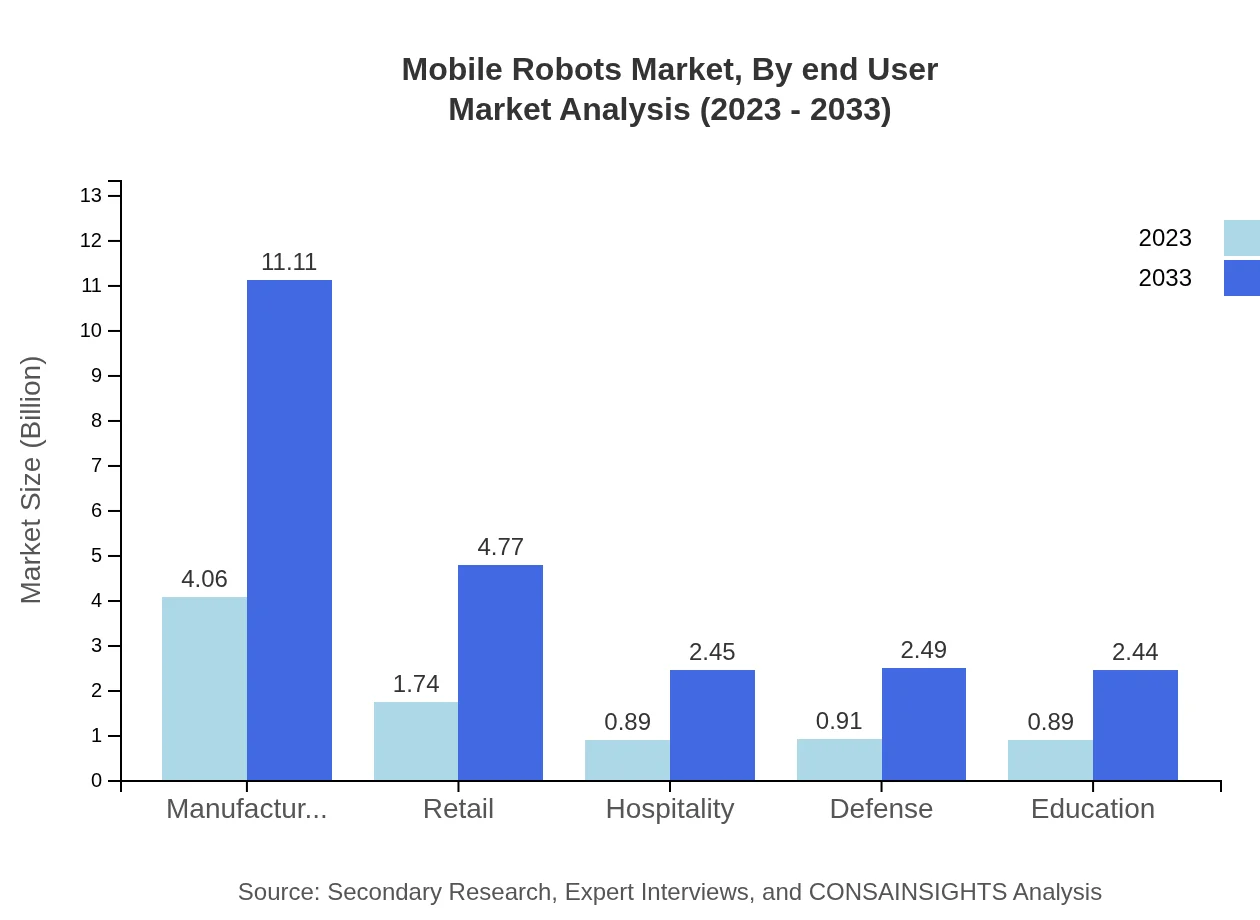

Mobile Robots Market Analysis By End User

The end-user segment reveals the manufacturing sector as a key contributor to market growth, valued at $4.06 billion in 2023 and expected to rise to $11.11 billion by 2033, highlighting the critical role of mobile robots in automated production lines.

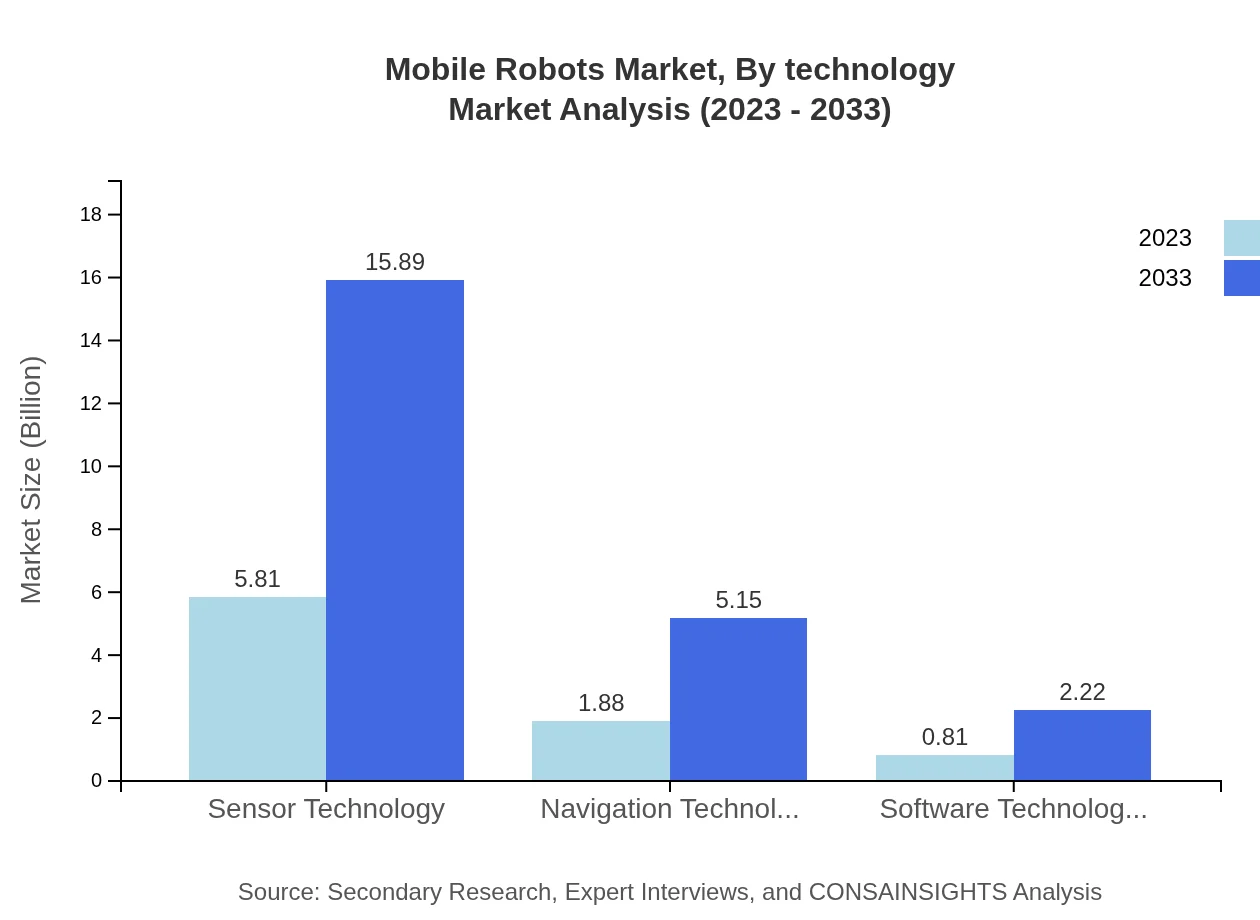

Mobile Robots Market Analysis By Technology

The analysis by technology segment shows a prominent position for sensor technology, valued at $5.81 billion in 2023, and projected to expand to $15.89 billion by 2033, supporting advancements in navigation and operation for mobile robots.

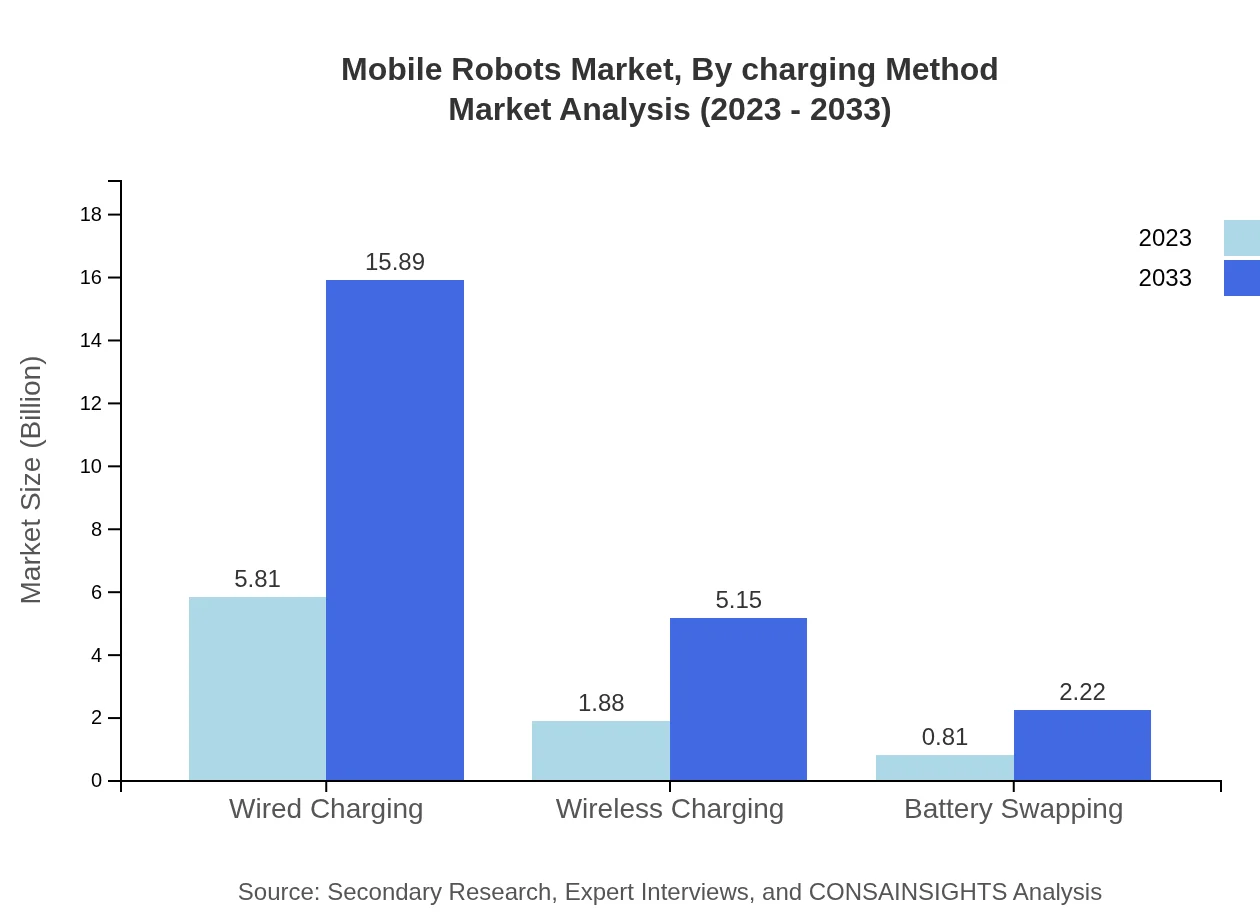

Mobile Robots Market Analysis By Charging Method

The charging method segmentation highlights wired charging as the dominant method, with a market size of $5.81 billion in 2023, growing to $15.89 billion by 2033, reflecting user preferences for reliable and fast recharging solutions.

Mobile Robots Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mobile Robots Industry

Boston Dynamics:

Known for its advanced robotics capabilities, Boston Dynamics specializes in designing mobile robots that can perform complex tasks across various industries.ABB Robotics:

ABB provides innovative automation and robotics solutions, contributing significantly to integrated mobile robot systems for manufacturing and logistics.iRobot:

Famed for household robots, iRobot has expanded into commercial applications, focusing on creating intelligent robots for diverse uses.KUKA Robotics:

A leading provider of industrial robots and automation solutions, KUKA is notable for its cutting-edge mobile robots aimed at streamlining production process.We're grateful to work with incredible clients.

FAQs

What is the market size of mobile Robots?

As of 2023, the global mobile robots market is valued at approximately $8.5 billion, with a projected CAGR of 10.2% over the next decade, signaling robust growth as industries adopt robotic solutions for efficiency.

What are the key market players or companies in this mobile Robots industry?

Key players in the mobile robots market include prominent companies like Boston Dynamics, iRobot, KUKA, and ABB. These firms are spearheading innovation and development in robotic automation technology, addressing various applications across industries.

What are the primary factors driving the growth in the mobile Robots industry?

Growth in the mobile robots industry is fueled by increased automation, advances in AI and sensor technologies, demand for efficient logistics solutions, and a rise in e-commerce. Companies seek to enhance productivity through robotics integration in operations.

Which region is the fastest Growing in the mobile Robots market?

North America is currently the fastest-growing region in the mobile robots market. By 2033, its market size is expected to reach $8.24 billion, driven by technological innovations and strategic investments in automation.

Does ConsaInsights provide customized market report data for the mobile Robots industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the mobile robots industry. This helps businesses make informed decisions based on their unique market dynamics and competitive landscape.

What deliverables can I expect from this mobile Robots market research project?

Expect comprehensive market analysis, in-depth competitor insights, segmentation data across regions and applications, trends, forecasts, and strategic recommendations. Deliverables aim to equip stakeholders with vital information for effective decision-making.

What are the market trends of mobile Robots?

Current market trends in mobile robots include increasing adoption of ground robots in manufacturing, advancements in AI-driven navigation technologies, and a growing focus on logistics. Retail and healthcare sectors are also witnessing heightened robotic integration.