Nas Network Memory Market Report

Published Date: 31 January 2026 | Report Code: nas-network-memory

Nas Network Memory Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Nas Network Memory market, covering market size forecasts, trends, regional insights, and competitive landscape from 2023 to 2033.

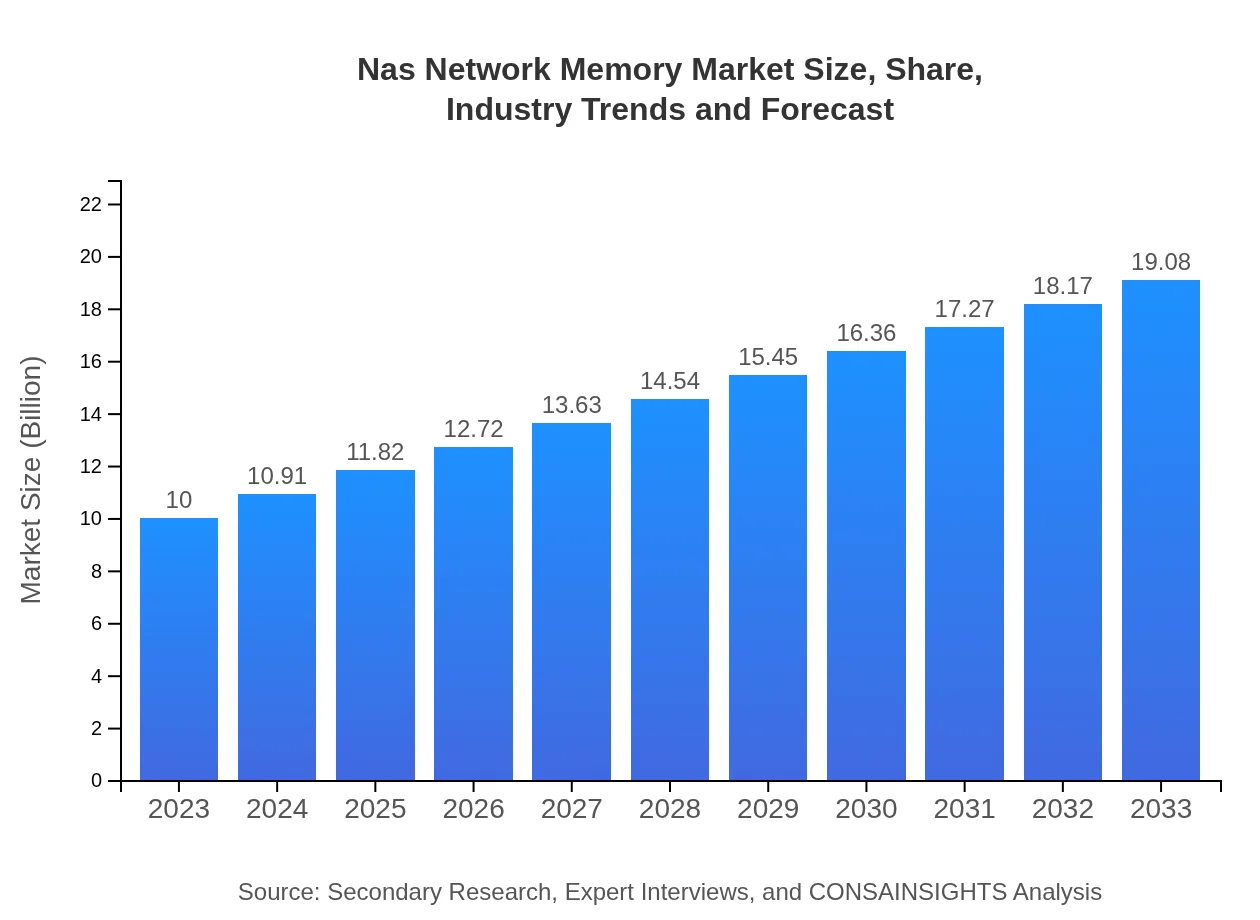

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $19.08 Billion |

| Top Companies | Synology Inc., QNAP Systems, Inc., Western Digital Corporation, Seagate Technology Holdings PLC |

| Last Modified Date | 31 January 2026 |

Nas Network Memory Market Overview

Customize Nas Network Memory Market Report market research report

- ✔ Get in-depth analysis of Nas Network Memory market size, growth, and forecasts.

- ✔ Understand Nas Network Memory's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Nas Network Memory

What is the Market Size & CAGR of Nas Network Memory market in 2023?

Nas Network Memory Industry Analysis

Nas Network Memory Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Nas Network Memory Market Analysis Report by Region

Europe Nas Network Memory Market Report:

The European market, starting at $2.96 billion in 2023, is expected to expand to $5.66 billion by 2033, fueled by data protection regulations and an escalating demand for storage solutions amid increasing digital transformation efforts.Asia Pacific Nas Network Memory Market Report:

In the Asia Pacific region, the Nas Network Memory market was valued at $1.82 billion in 2023 and is expected to grow to $3.47 billion by 2033. This growth is primarily driven by rapid technological adoption, increasing internet penetration, and rising consumer electronic sales across countries like China and India.North America Nas Network Memory Market Report:

North America holds a significant market share, growing from $3.79 billion in 2023 to $7.22 billion by 2033. The surge is attributed to high deployment rates of NAS devices driven by the presence of large corporations and advanced technological infrastructure.South America Nas Network Memory Market Report:

The South American Nas Network Memory market is projected to grow from $0.56 billion in 2023 to $1.07 billion by 2033. The market is being driven by increasing awareness of data security solutions and a gradual digital transformation across the region.Middle East & Africa Nas Network Memory Market Report:

In the Middle East and Africa, the market was valued at $0.87 billion in 2023, with forecasts showing growth to $1.65 billion by 2033. Growth factors include rising investments in IT infrastructure and a growing reliance on cloud computing solutions.Tell us your focus area and get a customized research report.

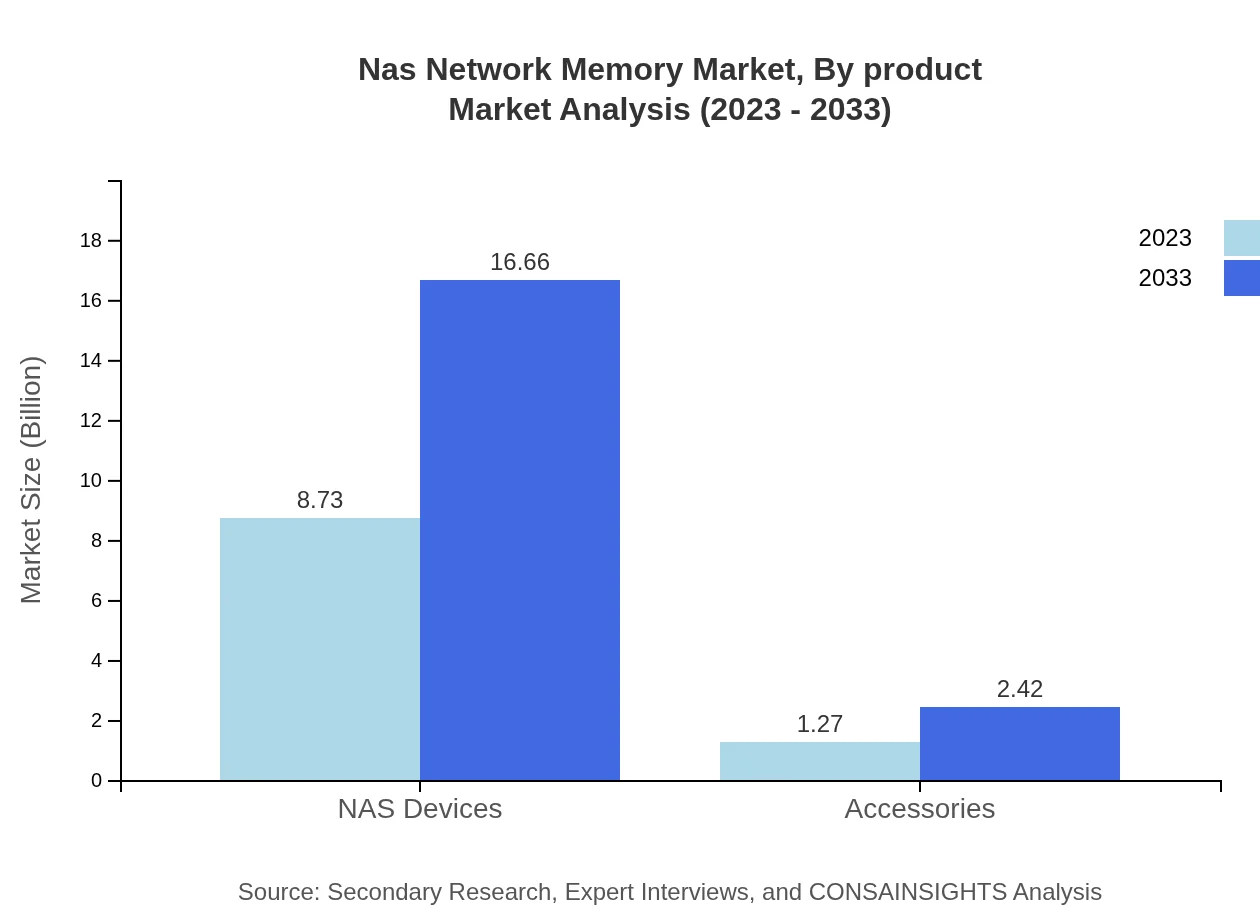

Nas Network Memory Market Analysis By Product

The key segment of the NAS Network Memory market is NAS devices, projected to grow from $8.73 billion in 2023 to $16.66 billion by 2033. This segment dominates the market due to the rising need for efficient data storage solutions. Accessories are also vital, growing from $1.27 billion to $2.42 billion in the same timeframe, though with lower market share.

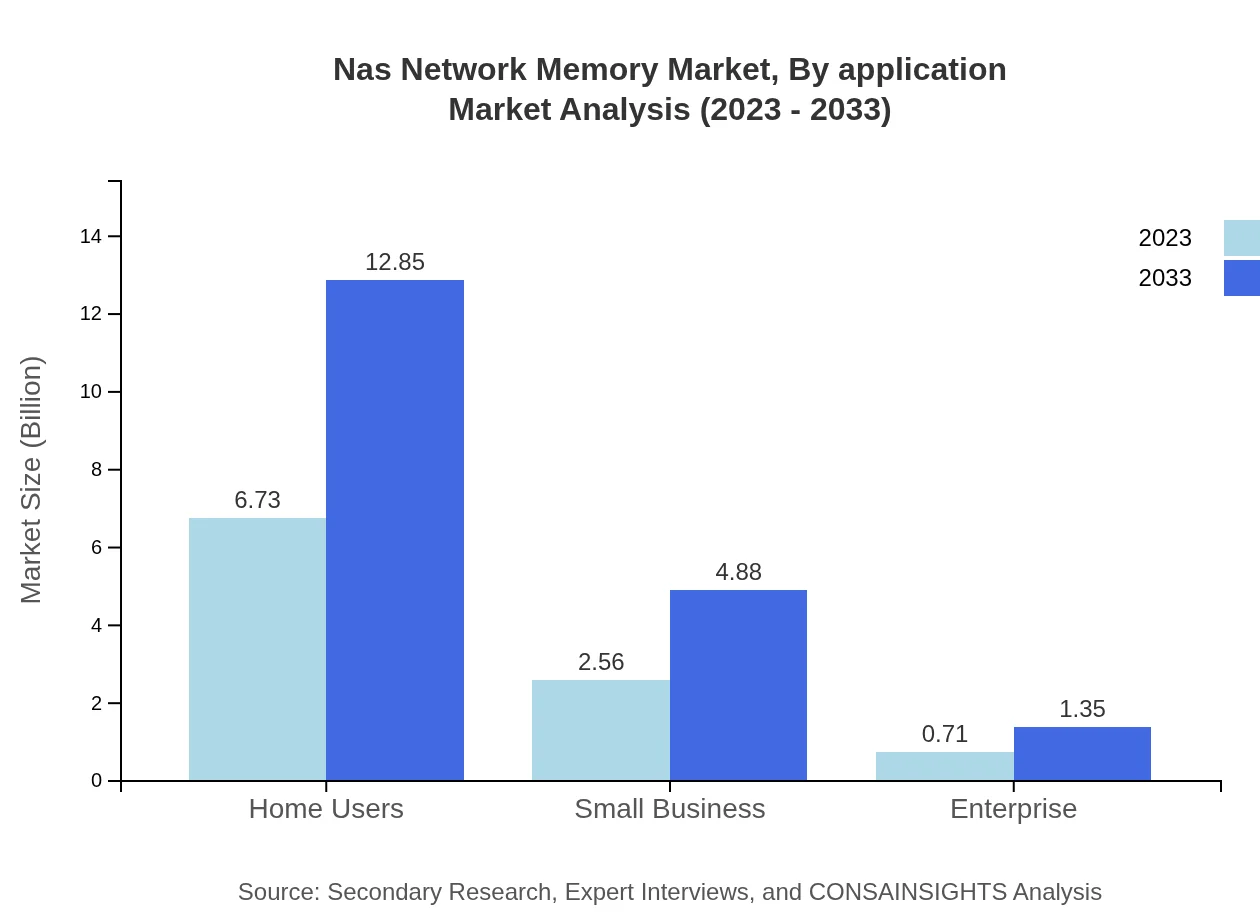

Nas Network Memory Market Analysis By Application

Applications of NAS include diverse user bases such as home users, small businesses, enterprises, and educational institutions. Home users significantly dominate the sector with a size of $6.73 billion in 2023, while educational institutions are expected to expand from $0.71 billion to $1.35 billion by 2033.

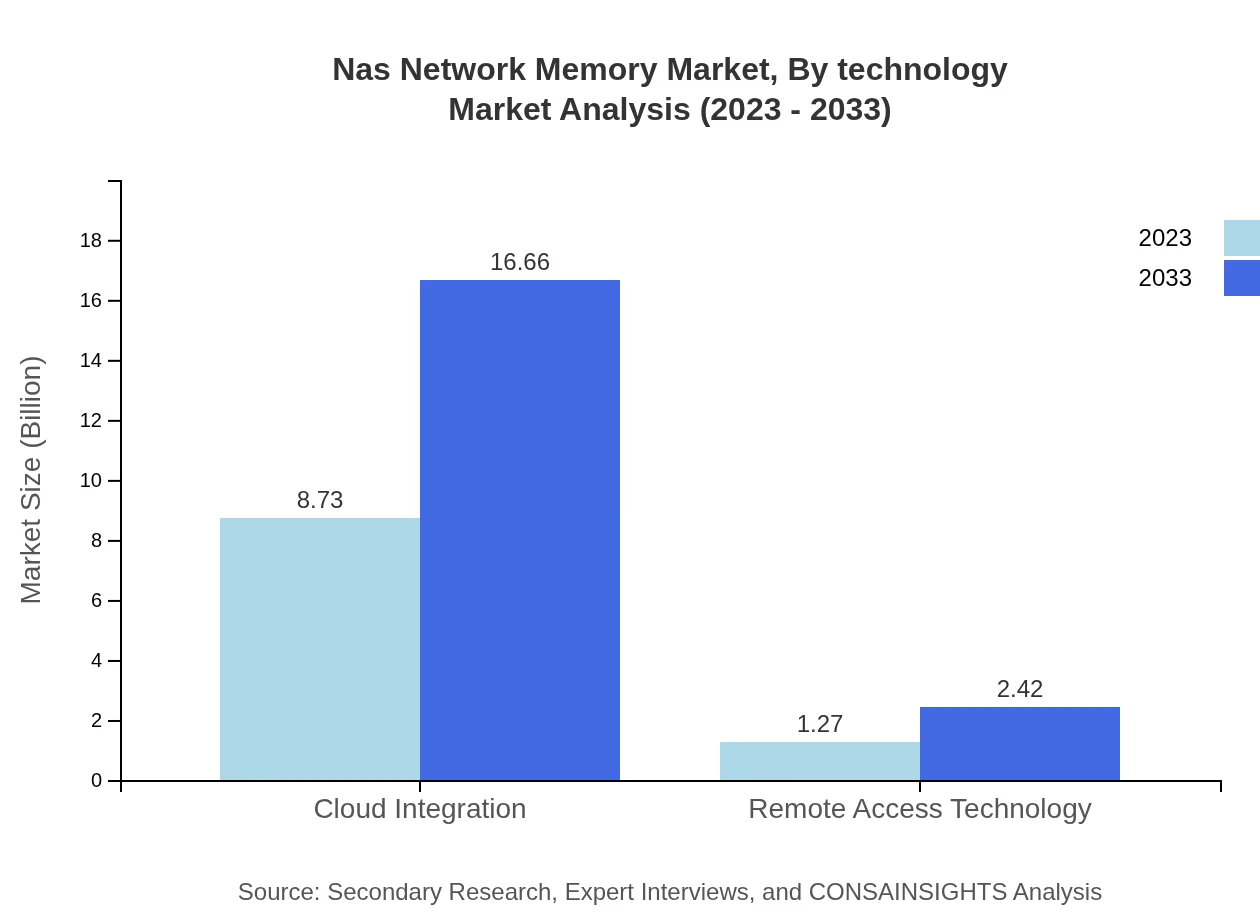

Nas Network Memory Market Analysis By Technology

Emerging technologies impacting the NAS market include cloud integration and remote access technology, enhancing the flexibility and usability of NAS devices. These sectors are projected to expand significantly, supporting the convenience of cloud-based solutions and remote work setups.

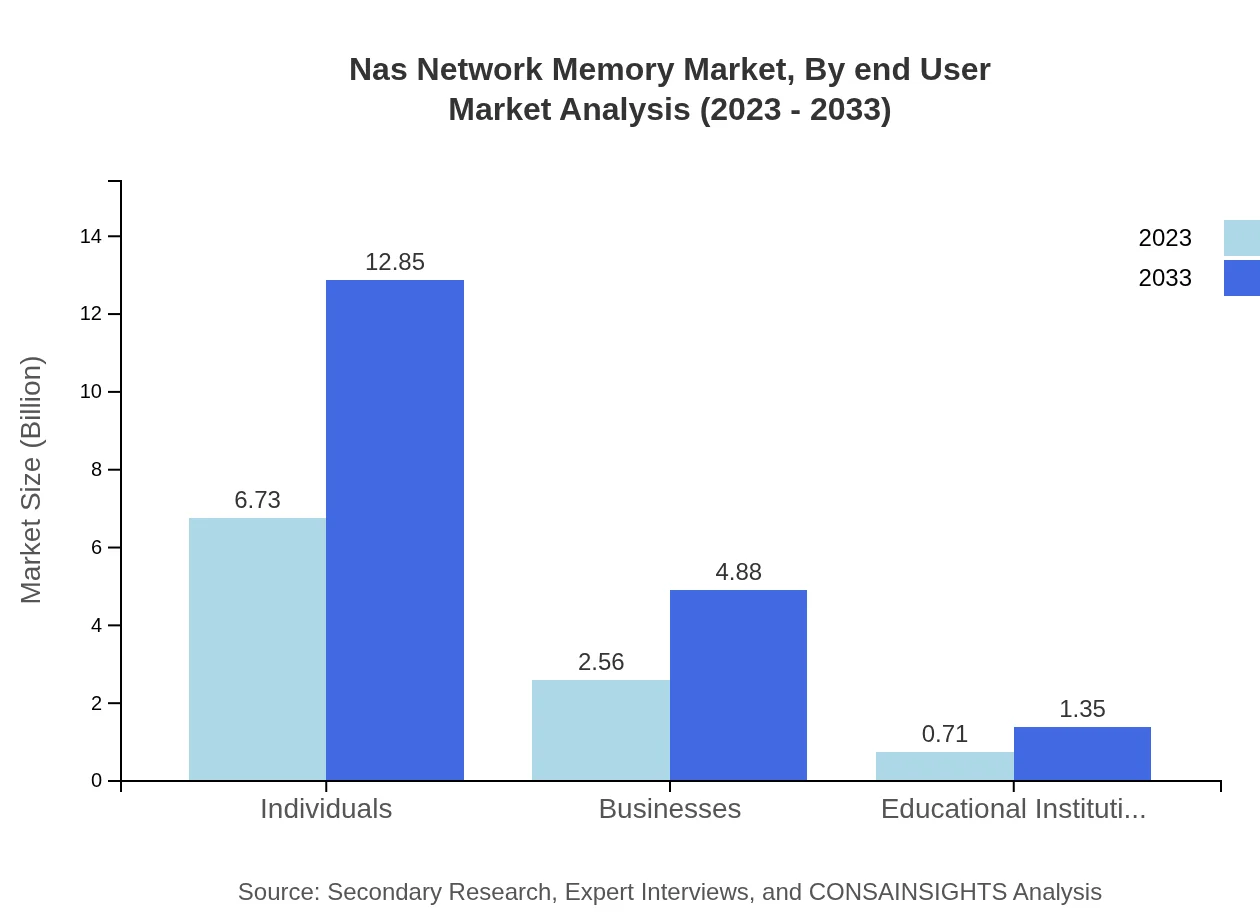

Nas Network Memory Market Analysis By End User

End-user segmentation showcases diverse growth opportunities. Individuals account for a significant market share, with sizes projected at $6.73 billion in 2023 and $12.85 billion by 2033. Businesses are expected to grow from $2.56 billion to $4.88 billion, indicating a substantial interest in storage solutions for organizational data management.

Nas Network Memory Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Nas Network Memory Industry

Synology Inc.:

A leading provider of NAS solutions known for its innovative software and hardware products designed for individual and business users.QNAP Systems, Inc.:

An established brand in the NAS market, known for high-performance and versatile NAS devices catering to various storage and multimedia applications.Western Digital Corporation:

A prominent storage solution provider offering a wide range of NAS products, focusing on reliability and performance for personal and professional use.Seagate Technology Holdings PLC:

Known for its extensive data storage offerings, Seagate manufactures NAS devices that provide high capacity and speed, appealing to both personal and enterprise markets.We're grateful to work with incredible clients.

FAQs

What is the market size of nas Network Memory?

The NAS Network Memory market is valued at approximately $10 billion in 2023. It is projected to exhibit a CAGR of 6.5%, reaching significant growth levels by 2033.

What are the key market players or companies in this nas Network Memory industry?

Key players in the NAS Network Memory market include leading tech companies specializing in networking solutions, data storage, and NAS devices, with many focusing on innovation in memory technologies and enhancing data management capabilities.

What are the primary factors driving the growth in the nas Network Memory industry?

Growth drivers for the NAS Network Memory industry include the increasing demand for data storage, advancements in cloud computing, growing home and enterprise networking needs, and the rise in remote work setups necessitating robust memory solutions.

Which region is the fastest Growing in the nas Network Memory?

The fastest-growing region in the NAS Network Memory market is North America, expected to grow from $3.79 billion in 2023 to $7.22 billion by 2033, reflecting strong demand for advanced memory solutions.

Does ConsInsights provide customized market report data for the nas Network Memory industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the NAS Network Memory industry, helping businesses make informed decisions based on precise market insights.

What deliverables can I expect from this nas Network Memory market research project?

You can expect comprehensive deliverables including detailed market analysis, growth forecasts, competitor profiling, consumer behavior insights, and strategic recommendations tailored to the NAS Network Memory market.

What are the market trends of nas Network Memory?

Current market trends in the NAS Network Memory industry include increased adoption of cloud integration, growth in remote access technologies, and a rising emphasis on energy-efficient memory solutions suitable for both individuals and businesses.