Network Security Software Market Report

Published Date: 31 January 2026 | Report Code: network-security-software

Network Security Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Network Security Software market from 2023 to 2033, focusing on market trends, size, growth forecasts, regional insights, and technological advancements shaping the industry.

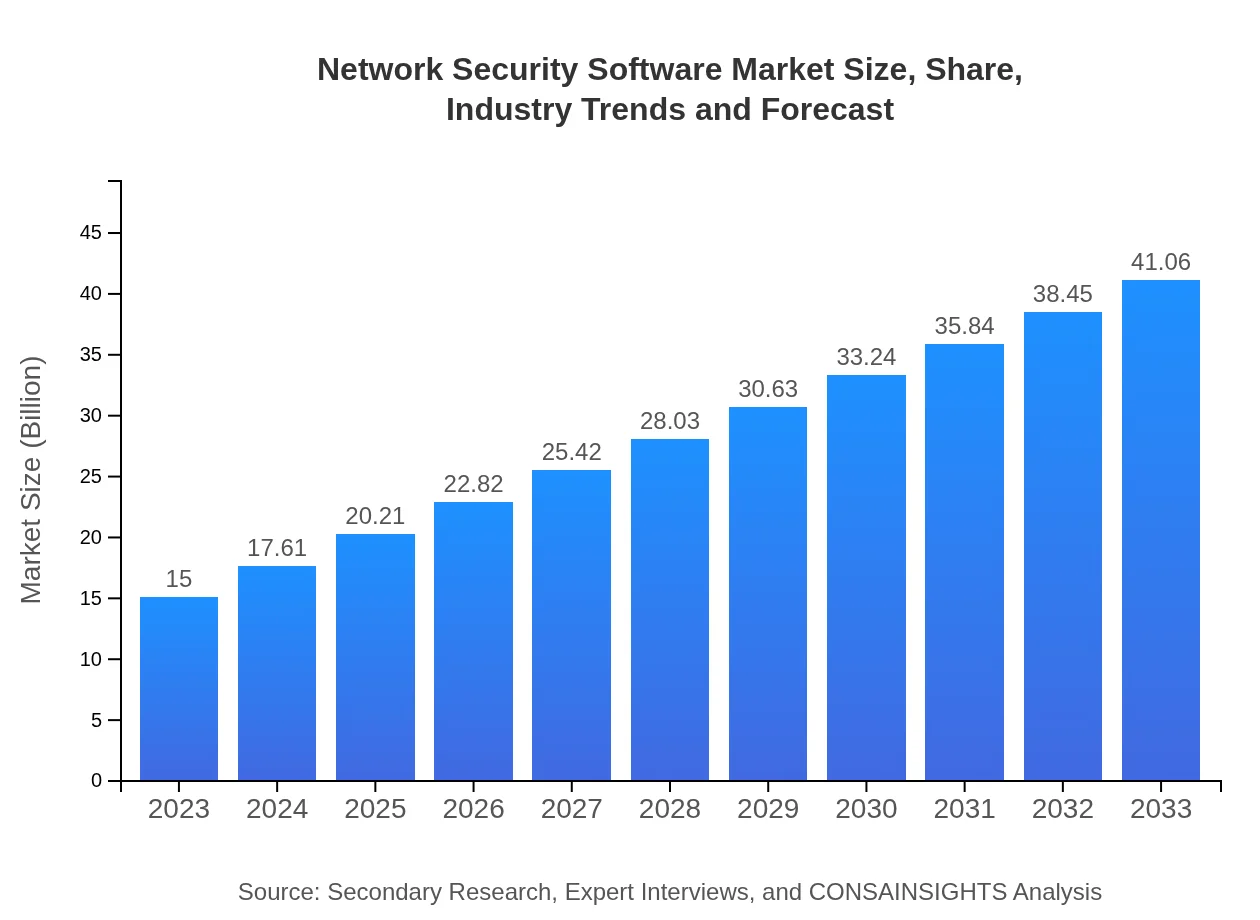

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $41.06 Billion |

| Top Companies | Cisco Systems, Inc., Palo Alto Networks, Inc., Fortinet, Inc., Check Point Software Technologies Ltd. |

| Last Modified Date | 31 January 2026 |

Network Security Software Market Overview

Customize Network Security Software Market Report market research report

- ✔ Get in-depth analysis of Network Security Software market size, growth, and forecasts.

- ✔ Understand Network Security Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Network Security Software

What is the Market Size & CAGR of Network Security Software market in 2023?

Network Security Software Industry Analysis

Network Security Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Network Security Software Market Analysis Report by Region

Europe Network Security Software Market Report:

In Europe, the network security software market is expected to expand from $4.49 billion in 2023 to $12.28 billion by 2033. The European Union's GDPR has significantly influenced data protection awareness, pushing organizations to invest in network security solutions to comply with regulations.Asia Pacific Network Security Software Market Report:

In the Asia-Pacific region, the network security software market is projected to grow from $2.65 billion in 2023 to $7.24 billion by 2033. Increasing internet penetration, rapid digitization, and growing concerns about data breaches drive this growth. Countries like China, India, and Japan are at the forefront of enhancing their cybersecurity frameworks, further contributing to market expansion.North America Network Security Software Market Report:

North America remains the largest market for network security software, with size estimates of $5.78 billion in 2023, growing to $15.82 billion by 2033. The presence of major technology companies, stringent regulations regarding data security, and a proactive approach toward adopting advanced security measures are key factors driving this growth.South America Network Security Software Market Report:

The South American market for network security software is set to grow from $0.54 billion in 2023 to $1.49 billion by 2033. This growth is primarily attributed to the increasing awareness of cyber threats in the region, alongside rising investments in digital technologies across sectors such as banking and healthcare.Middle East & Africa Network Security Software Market Report:

The Middle East and Africa are projected to experience market growth from $1.54 billion in 2023 to $4.22 billion by 2033. The increasing frequency of cyber-attacks and government initiatives toward enhancing cybersecurity infrastructure are vital factors in this region’s market expansion.Tell us your focus area and get a customized research report.

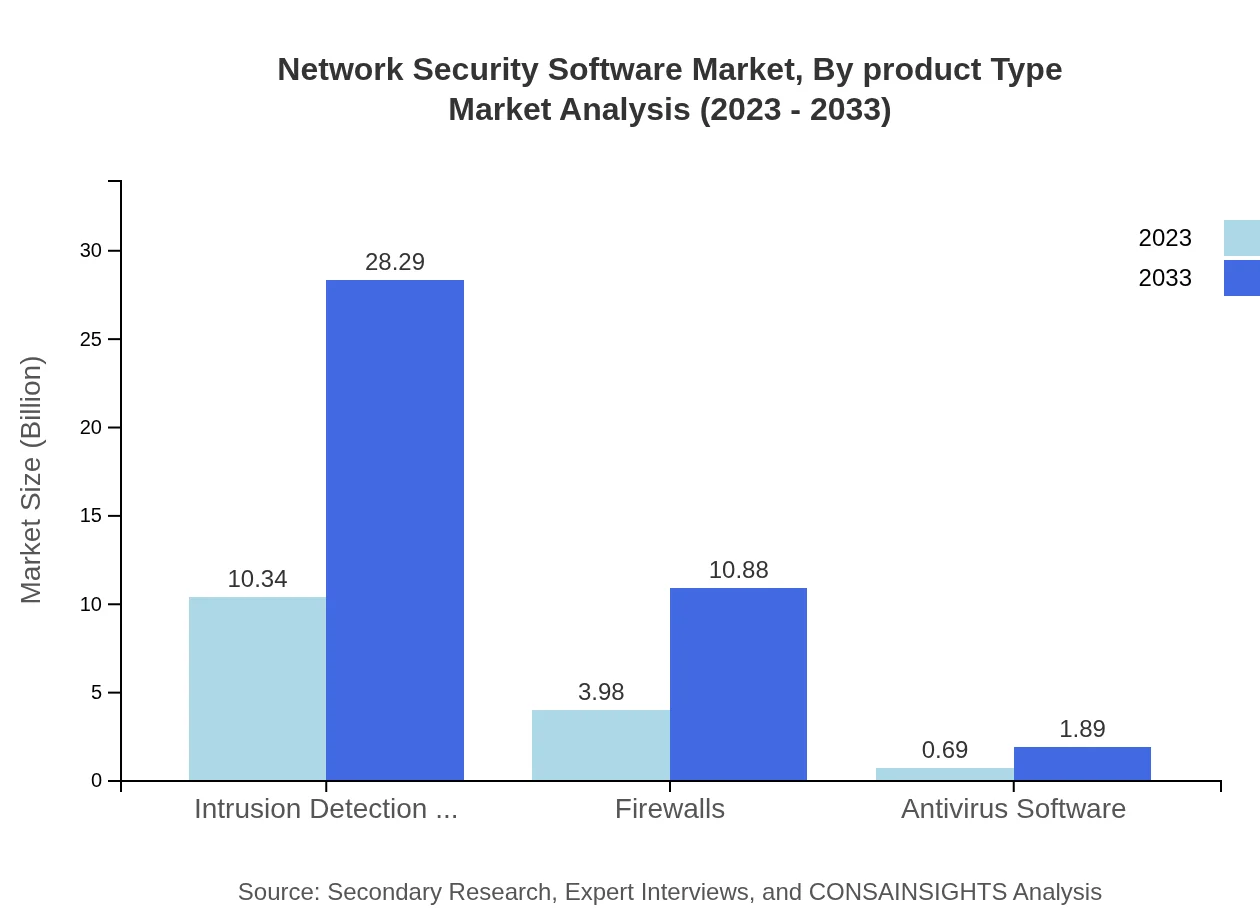

Network Security Software Market Analysis By Product Type

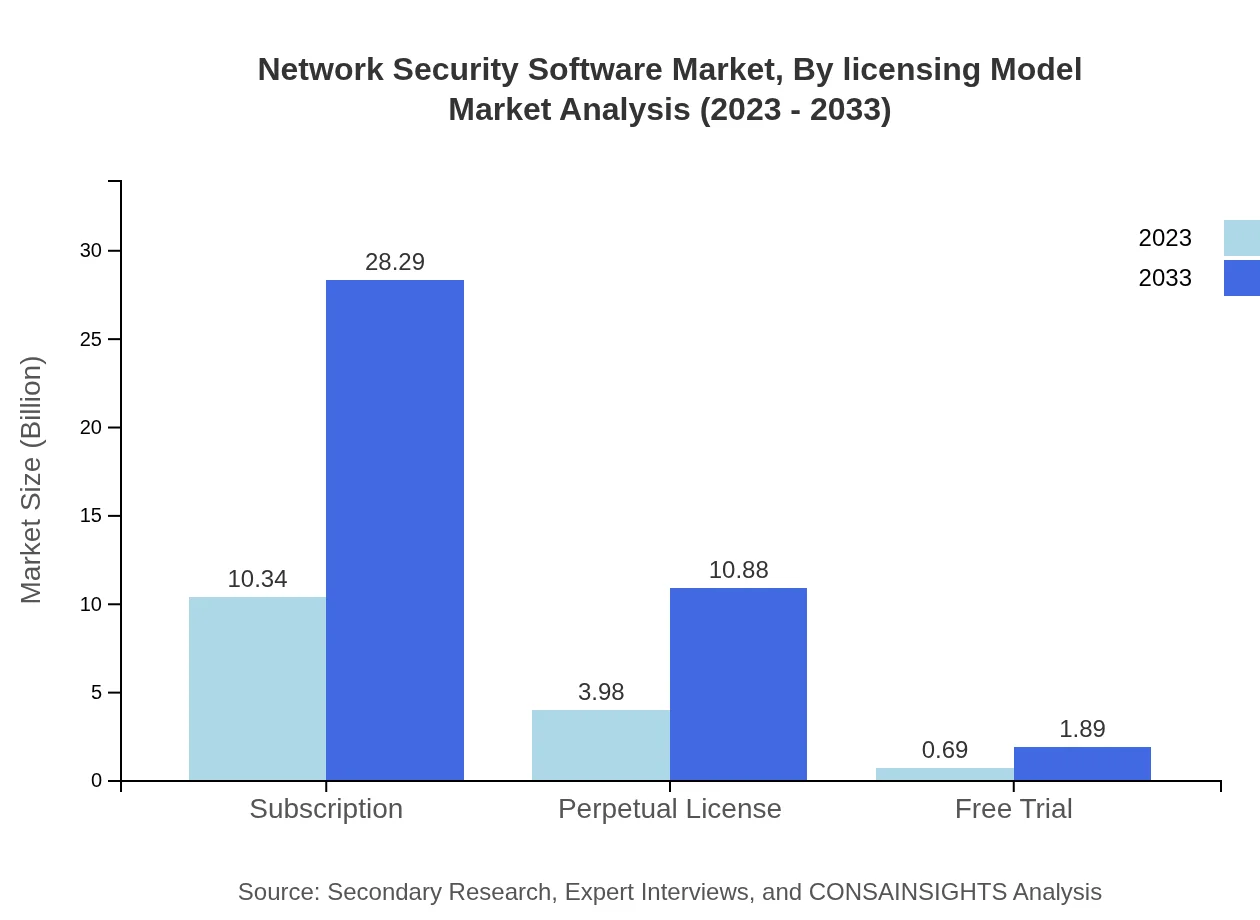

The segmentation of the network security software market by product type indicates a growing emphasis on intrusion detection systems, which dominate the market with a size of $10.34 billion in 2023 and expected to reach $28.29 billion by 2033. Firewalls follow closely, growing from $3.98 billion in 2023 to $10.88 billion by 2033. Meanwhile, cloud security solutions are gaining traction as businesses transition to cloud environments.

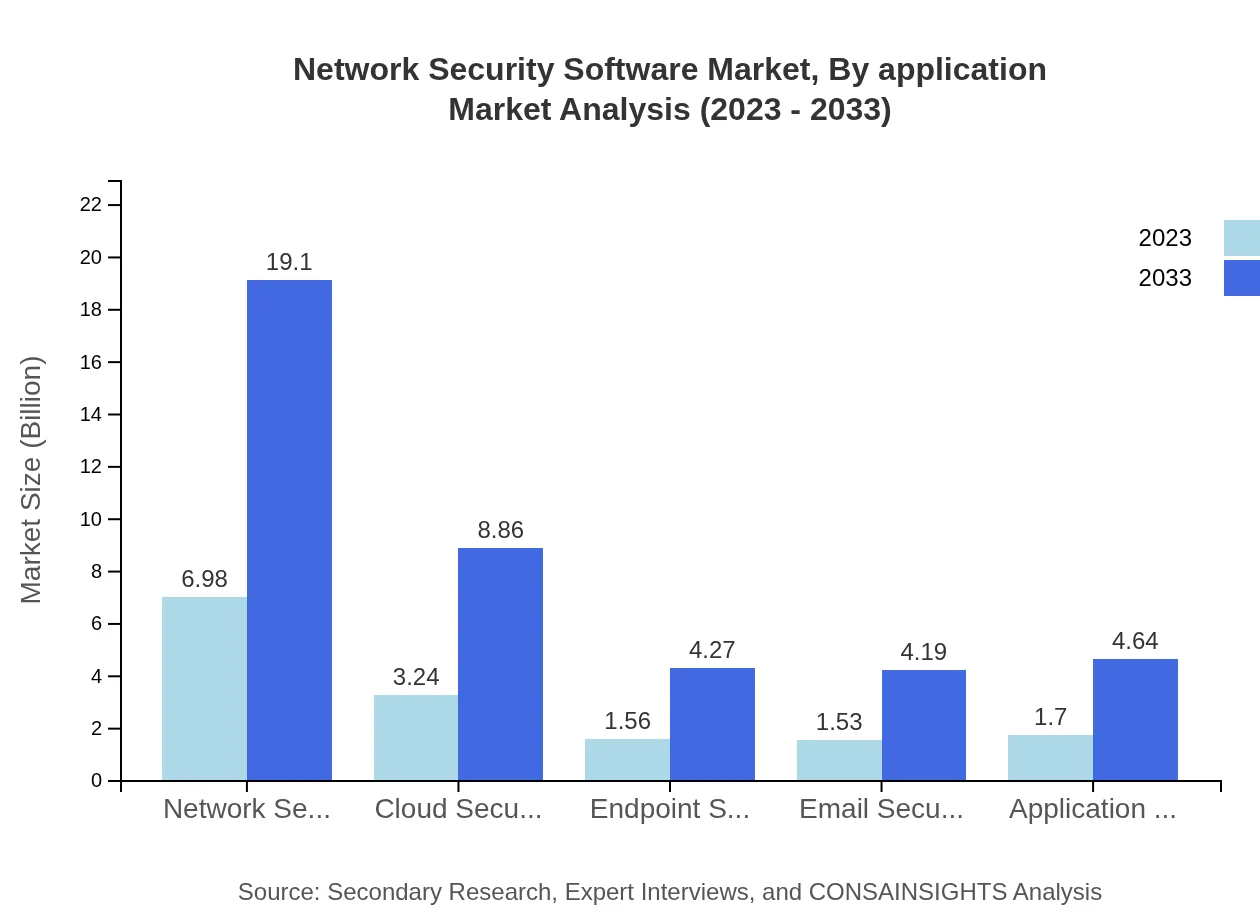

Network Security Software Market Analysis By Application

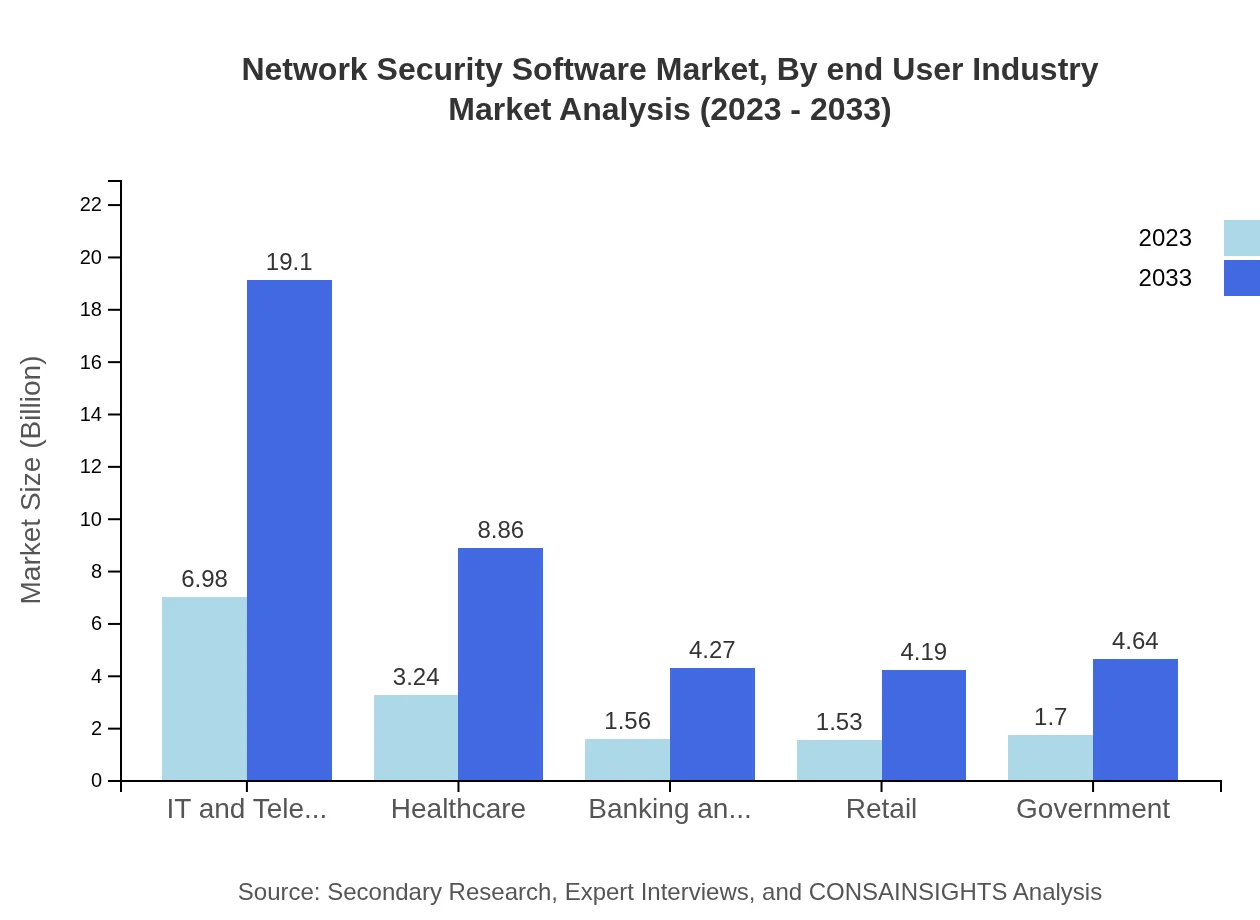

Market analysis by application reveals that the IT and telecom sector holds a substantial share, standing at a market size of $6.98 billion in 2023, expected to reach $19.10 billion by 2033. Healthcare and banking sectors are also significant contributors, focusing on compliance and data protection measures.

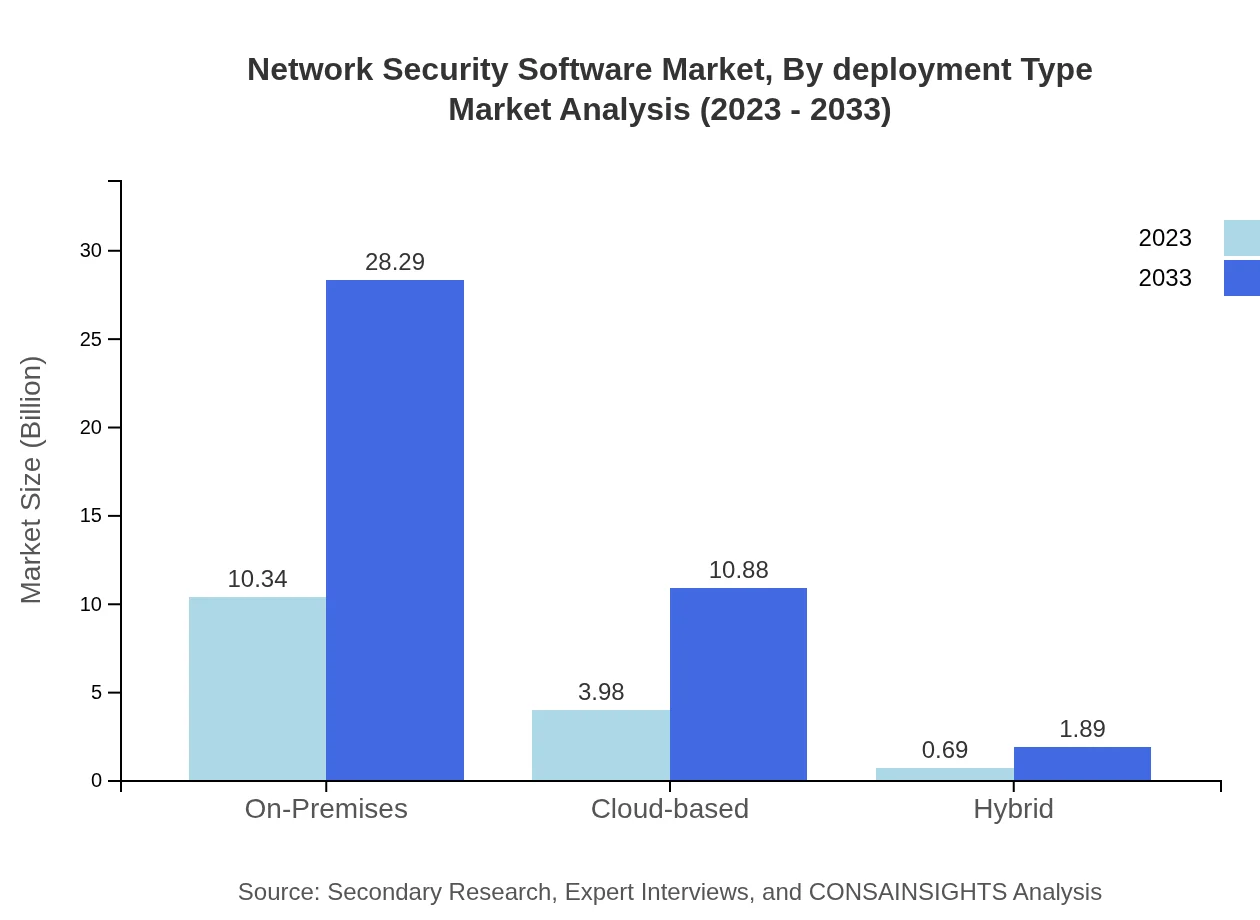

Network Security Software Market Analysis By Deployment Type

When considering deployment type, on-premises solutions lead the market with a size of $10.34 billion in 2023, while cloud-based deployments are rapidly growing from $3.98 billion to $10.88 billion over the same period due to increasing preferences for cloud security.

Network Security Software Market Analysis By End User Industry

In terms of end-user industries, IT and telecom dominate with a market size of $6.98 billion in 2023. The healthcare sector is also noteworthy, with a size of $3.24 billion, reflecting the critical need for data privacy in patient information.

Network Security Software Market Analysis By Licensing Model

Licensing models in this market show that subscription-based models are prevalent, representing a size of $10.34 billion in 2023 and projected to grow to $28.29 billion by 2033. Perpetual licensing remains an option for certain businesses but is increasingly overshadowed by the flexibility of subscription models.

Network Security Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Network Security Software Industry

Cisco Systems, Inc.:

A leading provider of network security solutions, Cisco offers a wide array of products including firewalls, intrusion detection systems, and unified threat management to enhance network safety.Palo Alto Networks, Inc.:

Palo Alto Networks specializes in advanced firewalls and cloud-based security solutions, recognized for its innovation and proactive threat defense strategies.Fortinet, Inc.:

Known for providing integrated cybersecurity solutions, Fortinet offers a robust security fabric that protects networks from various cyber threats.Check Point Software Technologies Ltd.:

Check Point is distinguished for its comprehensive security software and hardware, safeguarding networks through multi-layered security measures and threat intelligence.We're grateful to work with incredible clients.

FAQs

What is the market size of network Security Software?

The global market size for Network Security Software is projected at $15 billion in 2023, with a compounded annual growth rate (CAGR) of 10.2%, indicating significant growth throughout the decade.

What are the key market players or companies in this network Security Software industry?

Leading companies in the network security software market include Cisco, Palo Alto Networks, Fortinet, and Symantec. These companies dominate the market through innovative solutions and comprehensive security offerings.

What are the primary factors driving the growth in the network Security Software industry?

Key growth drivers in the network security software industry include increasing cyber threats, the rise of remote work, and growing regulatory compliance requirements, prompting businesses to invest in robust security solutions.

Which region is the fastest Growing in the network Security Software?

The Asia-Pacific region is expected to be the fastest-growing market, increasing from $2.65 billion in 2023 to $7.24 billion by 2033, reflecting heightened investment in cybersecurity solutions across various sectors.

Does ConsaInsights provide customized market report data for the network Security Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the network security software industry, addressing unique business challenges and market dynamics.

What deliverables can I expect from this network Security Software market research project?

Deliverables from the network security software market research project include comprehensive market analysis, trend forecasts, competitive landscape assessments, and detailed segments analysis, ensuring well-informed strategic decisions.

What are the market trends of network Security Software?

Current trends in the network security software market include increasing adoption of cloud-based solutions, emphasis on proactive threat detection, and growing integration of artificial intelligence in security frameworks.