Oil And Gas Project Management Software Market Report

Published Date: 31 January 2026 | Report Code: oil-and-gas-project-management-software

Oil And Gas Project Management Software Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Oil And Gas Project Management Software industry, covering market trends, drivers, and forecasts from 2023 to 2033. Insights include market size, segmentation, regional analysis, and profiles of key players in the industry.

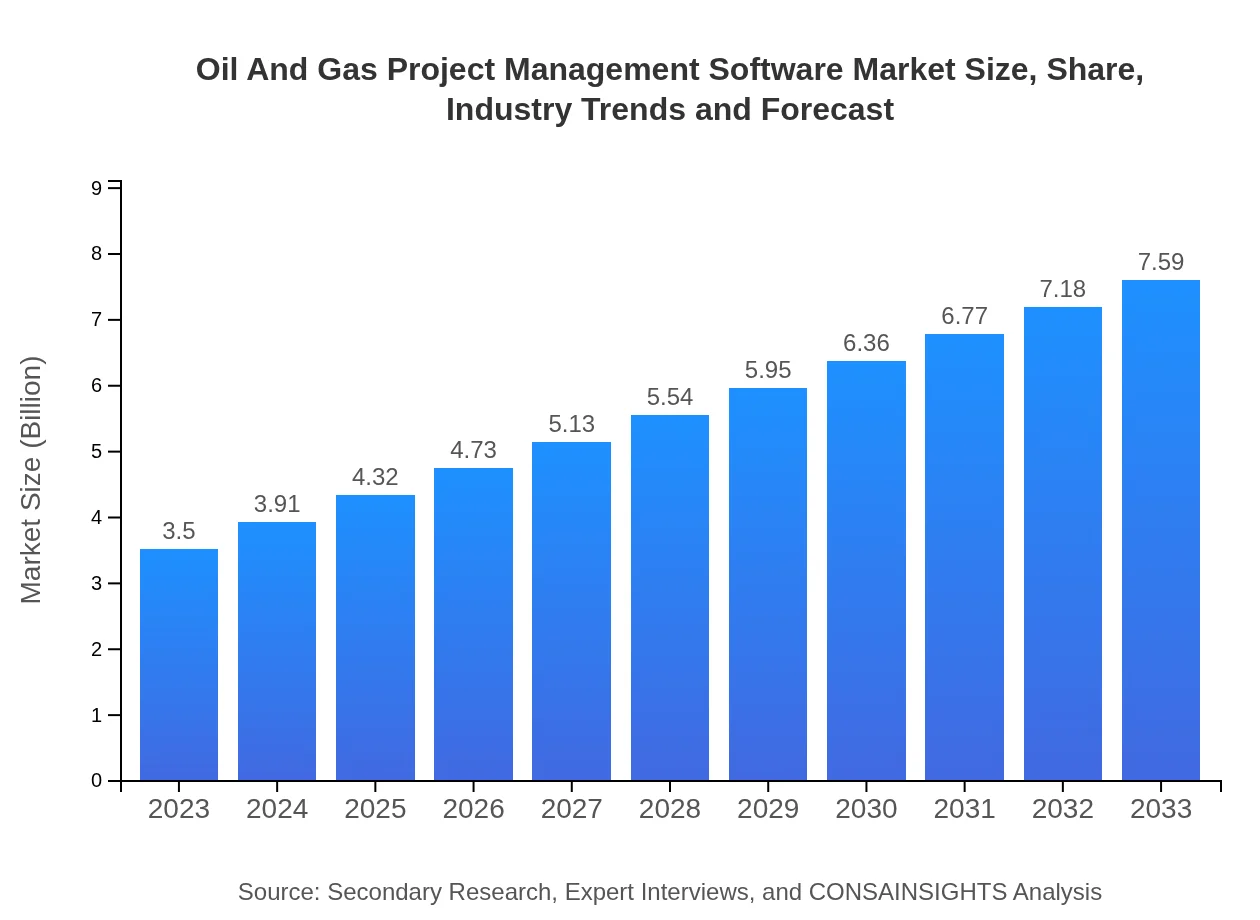

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $7.59 Billion |

| Top Companies | IBM, Schlumberger, AVEVA, SAP, Hexagon |

| Last Modified Date | 31 January 2026 |

Oil And Gas Project Management Software Market Overview

Customize Oil And Gas Project Management Software Market Report market research report

- ✔ Get in-depth analysis of Oil And Gas Project Management Software market size, growth, and forecasts.

- ✔ Understand Oil And Gas Project Management Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oil And Gas Project Management Software

What is the Market Size & CAGR of Oil And Gas Project Management Software market in 2023?

Oil And Gas Project Management Software Industry Analysis

Oil And Gas Project Management Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oil And Gas Project Management Software Market Analysis Report by Region

Europe Oil And Gas Project Management Software Market Report:

In Europe, the market is expected to grow from $0.86 billion in 2023 to $1.86 billion by 2033. The ongoing shift toward sustainability and compliance with stringent environmental regulations is driving the adoption of sophisticated project management software by oil and gas companies in this region.Asia Pacific Oil And Gas Project Management Software Market Report:

The Asia-Pacific region is anticipated to grow significantly, with the market projected to reach $1.61 billion by 2033, rising from $0.74 billion in 2023. The increasing exploration activities and foreign investments in countries like India and China are propelling market demand. Furthermore, the adoption of advanced technologies to optimize operational efficiency is increasing across the region.North America Oil And Gas Project Management Software Market Report:

North America remains the largest market for Oil And Gas Project Management Software, with revenue projected to jump from $1.28 billion in 2023 to $2.78 billion by 2033. The high concentration of oil and gas companies, alongside heavy investments in technology, positions this region as a leader in adopting advanced software solutions.South America Oil And Gas Project Management Software Market Report:

In South America, the market is expected to grow from $0.14 billion in 2023 to $0.30 billion by 2033. This growth is primarily driven by the region's rich oil reserves and ongoing infrastructural developments. Countries like Brazil and Argentina are enhancing their oil industries by adopting modern project management solutions.Middle East & Africa Oil And Gas Project Management Software Market Report:

The Middle East and Africa market is set to increase from $0.48 billion in 2023 to $1.05 billion by 2033. As countries in this region look to diversify their economies away from oil dependency, investments in project management software are increasing to enhance efficiency in oil extraction and processing sectors.Tell us your focus area and get a customized research report.

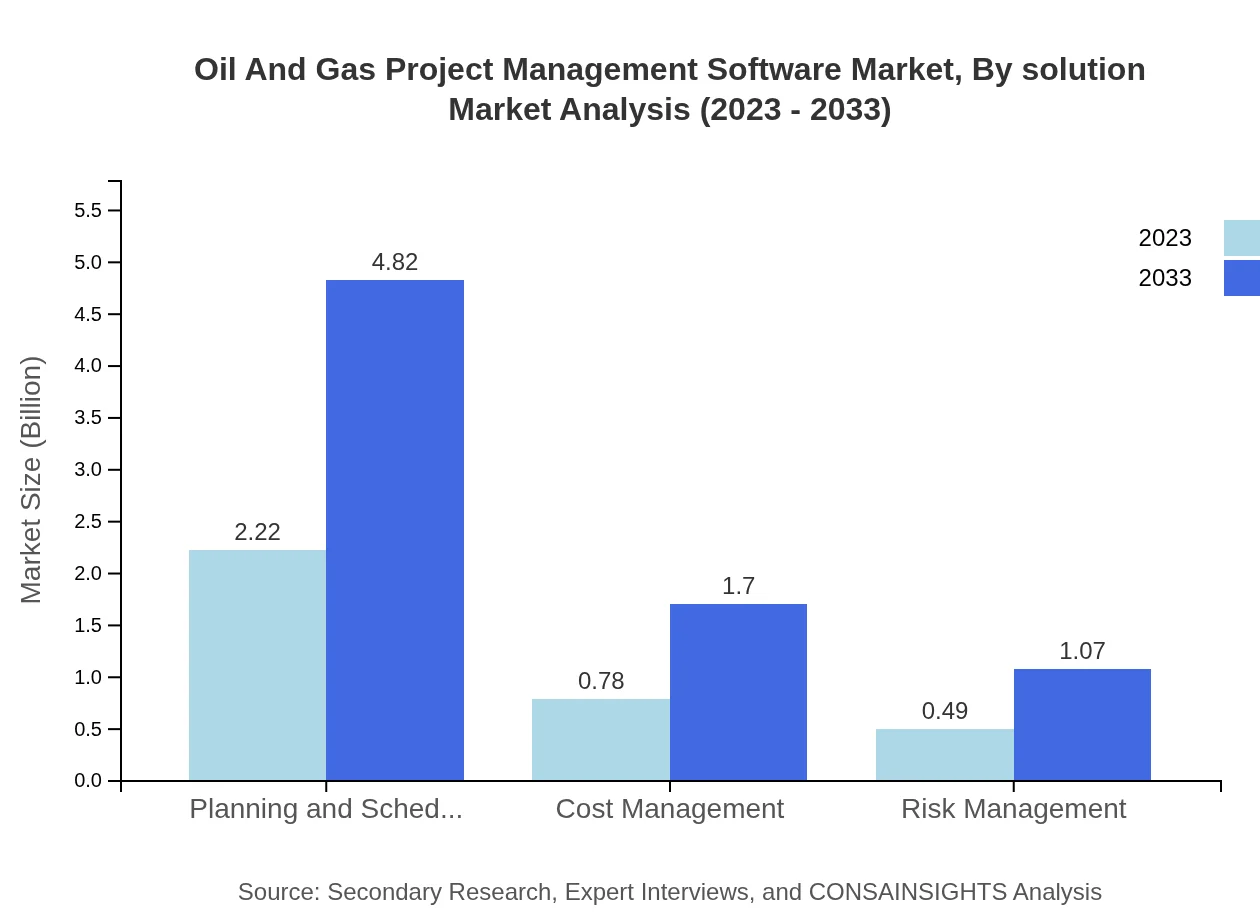

Oil And Gas Project Management Software Market Analysis By Solution

The Oil and Gas Project Management Software market can be segmented into several solutions, including planning and scheduling, cost management, and risk management. The planning and scheduling segment is currently the most dominant, accounting for a substantial market share of 63.54% in 2023, with an expected increase in market size from $2.22 billion in 2023 to $4.82 billion by 2033. Similarly, the cost management segment is witnessing growth from $0.78 billion in 2023 to $1.70 billion by 2033, emphasizing the critical nature of financial oversight in project execution.

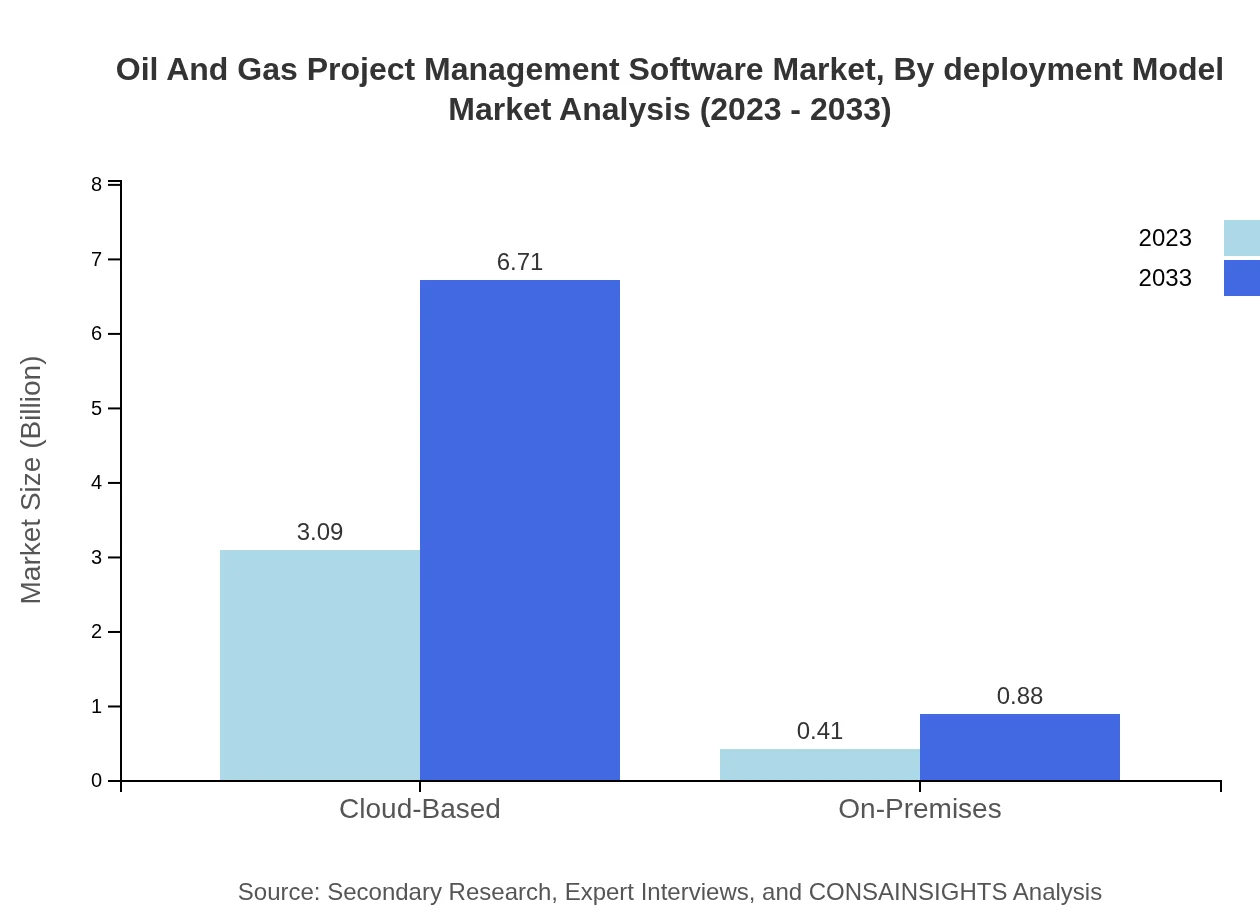

Oil And Gas Project Management Software Market Analysis By Deployment Model

The deployment model significantly influences the degree of flexibility and scalability in software usage. The analysis reveals that cloud-based solutions dominate the market with a share of 88.4% in 2023, forecasted to increase to $6.71 billion by 2033. On-premises solutions are less prevalent but crucial for organizations requiring greater control over their data, projected to grow from $0.41 billion to $0.88 billion over the same period.

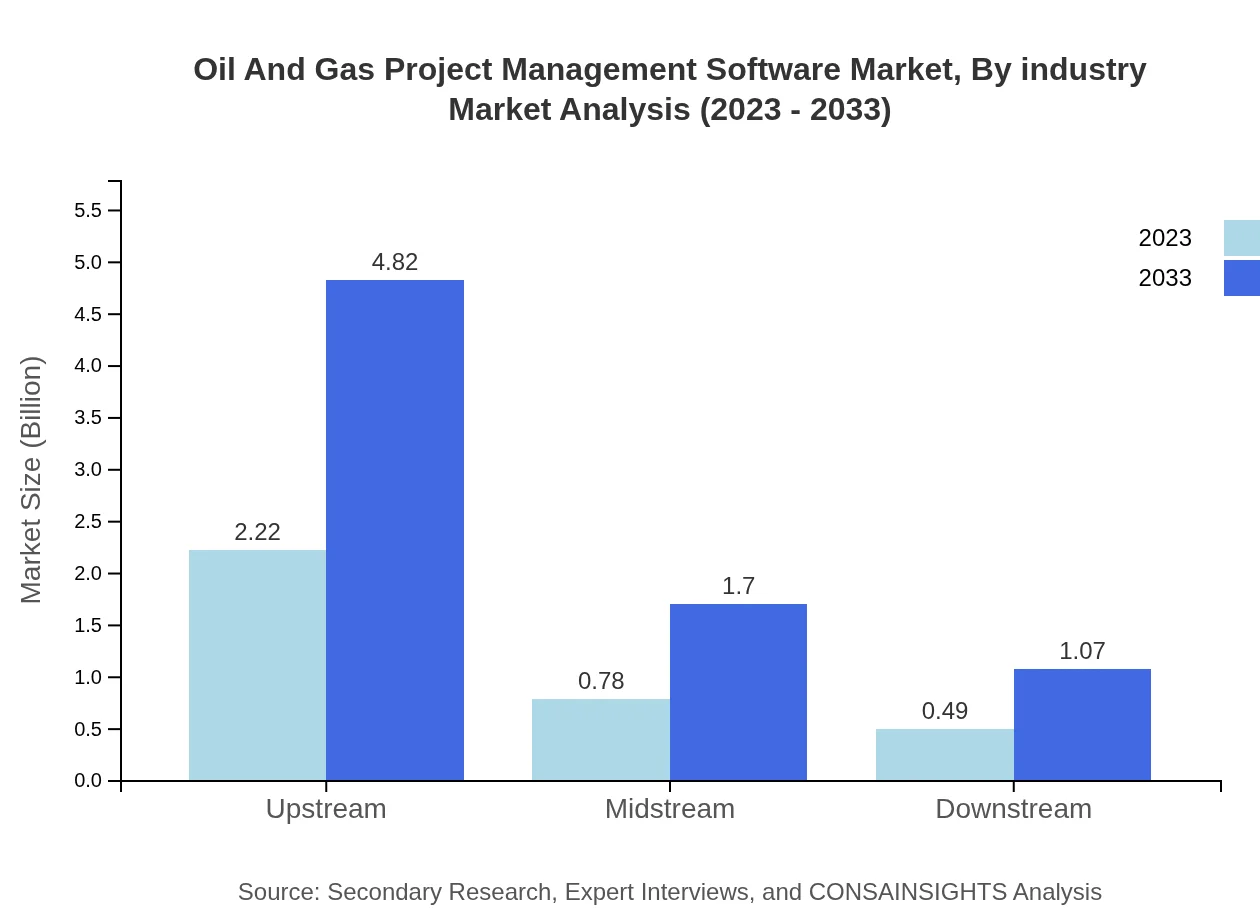

Oil And Gas Project Management Software Market Analysis By Industry

The market analysis delineates the critical contributions of various industries within the oil and gas sector. The upstream segment, accounting for 63.54% share in 2023, is expected to see its market size rise from $2.22 billion to $4.82 billion by 2033. Midstream operations follow, emphasizing logistics and transportation, with the expected market growth from $0.78 billion to $1.70 billion. The downstream segment, while smaller, is projected to grow from $0.49 billion to $1.07 billion.

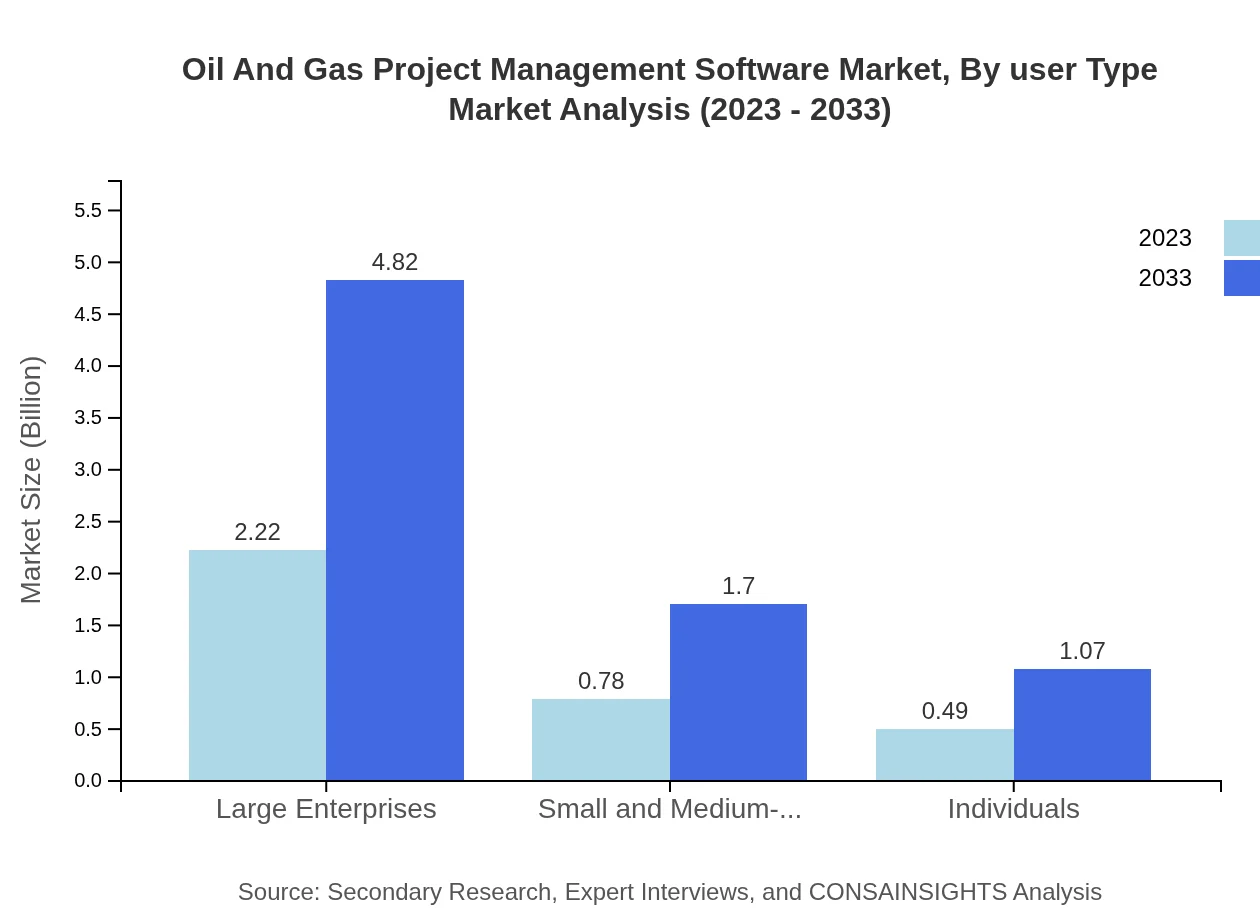

Oil And Gas Project Management Software Market Analysis By User Type

Market segmentation by user type shows significant differentiation between large enterprises and small to medium-sized enterprises (SMEs). Large enterprises represent a substantial share of 63.54%, with market growth from $2.22 billion in 2023 to $4.82 billion by 2033. Conversely, SMEs will see their share increase with growth from $0.78 billion to $1.70 billion, supported by programs aimed at enhancing their project management capabilities.

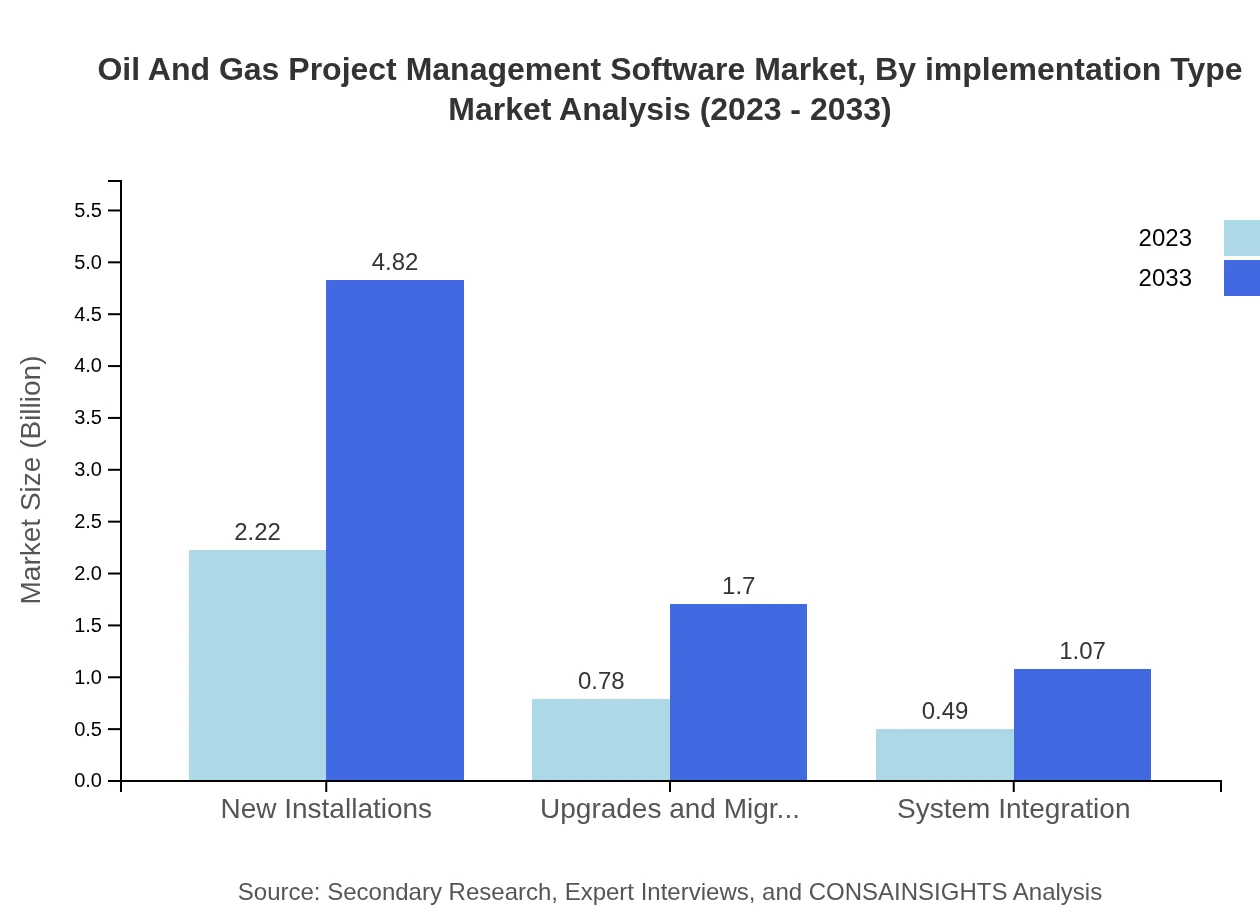

Oil And Gas Project Management Software Market Analysis By Implementation Type

Implementation type analysis reveals distinct trends in how organizations adopt technology. New installations dominate the approach to deploying project management solutions, with market size growing from $2.22 billion in 2023, representing 63.54% of the market share, to $4.82 billion by 2033. Upgrades and migrations also reflect growing demands for enhanced capabilities, increasing from $0.78 billion to $1.70 billion.

Oil And Gas Project Management Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oil And Gas Project Management Software Industry

IBM:

IBM provides state-of-the-art project management software solutions for the oil and gas sector, emphasizing data analytics and cloud technologies to enhance operational efficiency.Schlumberger:

Schlumberger is a leading provider of integrated project management software, streamlining operations in upstream, midstream, and downstream segments.AVEVA:

AVEVA offers comprehensive software solutions that help oil and gas companies with project planning, execution, and efficient resource management.SAP:

SAP’s dedicated project management tools focus on improving financial performance and operational visibility in the oil and gas domain.Hexagon:

Hexagon provides solutions that integrate digital engineering and project management tools specifically designed for managing oil and gas projects efficiently.We're grateful to work with incredible clients.

FAQs

What is the market size of oil And Gas Project Management Software?

The oil-and-gas-project-management-software market is valued at approximately $3.5 billion in 2023, with a projected CAGR of 7.8% through 2033, indicating substantial growth in demand for software solutions in the energy sector.

What are the key market players or companies in this oil And Gas Project Management Software industry?

Key players in the oil-and-gas-project-management-software industry include major software providers and energy service companies, which actively contribute to innovation and the development of tailored solutions for project management and efficiency.

What are the primary factors driving the growth in the oil And Gas Project Management Software industry?

Growth in the oil-and-gas-project-management-software industry is driven by increasing operational efficiency demands, the need for advanced project tracking solutions, and the integration of technology to manage complex projects and reduce costs.

Which region is the fastest Growing in the oil And Gas Project Management Software?

The Asia-Pacific region is the fastest-growing market for oil-and-gas-project-management-software, expanding from $0.74 billion in 2023 to $1.61 billion by 2033, driven by rising investments in energy infrastructure.

Does ConsaInsights provide customized market report data for the oil And Gas Project Management Software industry?

Yes, ConsaInsights offers customized market report data tailored to individual client needs in the oil-and-gas-project-management-software industry, ensuring precise insights on market dynamics and trends.

What deliverables can I expect from this oil And Gas Project Management Software market research project?

Deliverables from this market research project typically include comprehensive market analysis, trend projections, competitive landscapes, and segmented reports detailing regional and industry-specific insights.

What are the market trends of oil And Gas Project Management Software?

Current market trends in oil-and-gas-project-management-software include a shift toward cloud-based solutions, enhancing collaboration, real-time data analytics, and a focus on sustainability and risk management in project implementations.