Oil Well Cement Market Report

Published Date: 02 February 2026 | Report Code: oil-well-cement

Oil Well Cement Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Oil Well Cement market, covering insights such as market size, growth trends, and forecasts for the period 2023-2033. It also includes a detailed examination of market segmentation, regional analysis, and technology advancements.

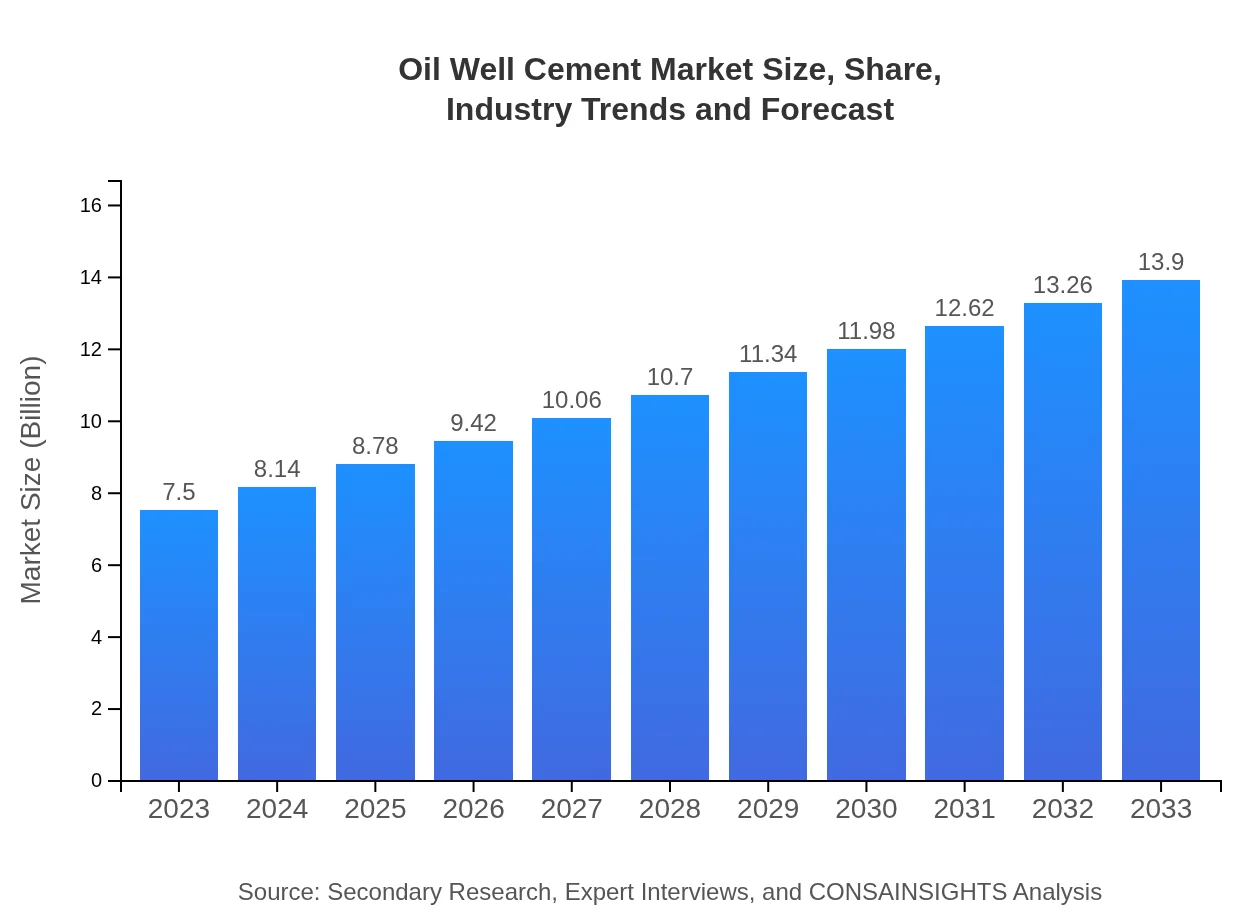

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $13.90 Billion |

| Top Companies | Schlumberger Limited, Halliburton Company, Baker Hughes, Cemex S.A.B. de C.V. |

| Last Modified Date | 02 February 2026 |

Oil Well Cement Market Overview

Customize Oil Well Cement Market Report market research report

- ✔ Get in-depth analysis of Oil Well Cement market size, growth, and forecasts.

- ✔ Understand Oil Well Cement's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oil Well Cement

What is the Market Size & CAGR of Oil Well Cement market in 2033?

Oil Well Cement Industry Analysis

Oil Well Cement Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oil Well Cement Market Analysis Report by Region

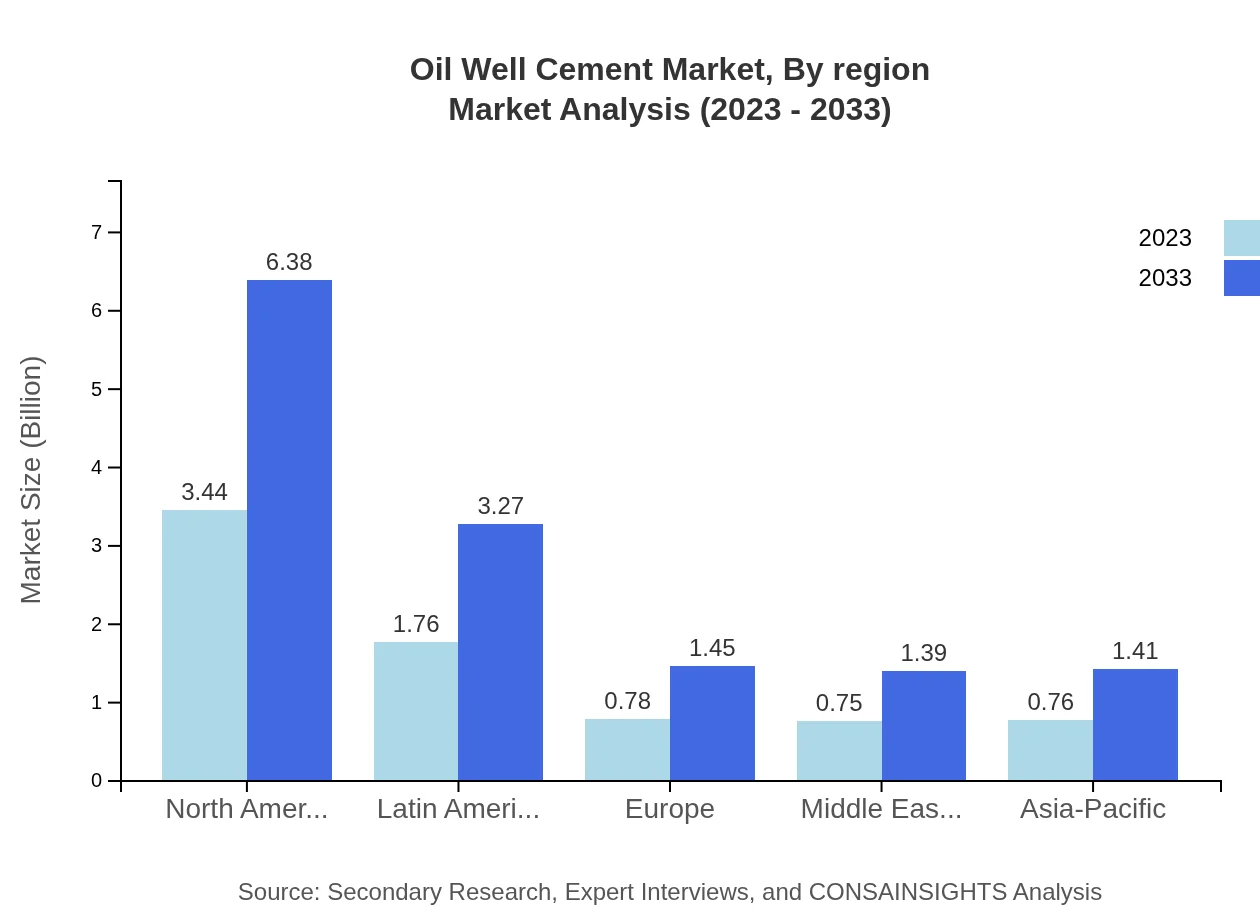

Europe Oil Well Cement Market Report:

Europe is projected to show moderate growth from $1.85 billion in 2023 to $3.42 billion in 2033 due to stringent environmental regulations and a shift towards cleaner energy sources. The region's mature oil industry is increasingly focused on enhancing existing facilities and recovering reserves.Asia Pacific Oil Well Cement Market Report:

The Asia Pacific region, projected to grow from $1.48 billion in 2023 to $2.75 billion by 2033, is experiencing an upsurge in oil production, driven by countries like China and India ramping up their exploration activities. The region's growing energy needs and investments in infrastructure improve demand for oil well cement with a focus on environmentally sustainable practices.North America Oil Well Cement Market Report:

North America, dominating the market with a size of $2.69 billion in 2023 anticipated to reach $4.98 billion by 2033, is driven by a strong resurgence in both onshore and offshore drilling activities. The United States remains a key player, with technology advancements and the push for energy independence fueling market expansion.South America Oil Well Cement Market Report:

In South America, the market is set to grow from $0.54 billion in 2023 to $1.00 billion by 2033. The region's reliance on oil exports, particularly from Brazil and Venezuela, is expected to stimulate the oil well cement market, despite political and economic uncertainties impacting overall industry growth.Middle East & Africa Oil Well Cement Market Report:

The Middle East and Africa region is projected to grow from $0.95 billion in 2023 to $1.76 billion by 2033. The region remains a powerhouse in oil production; advancements in cement formulations and increasing investment in infrastructure contribute to market growth.Tell us your focus area and get a customized research report.

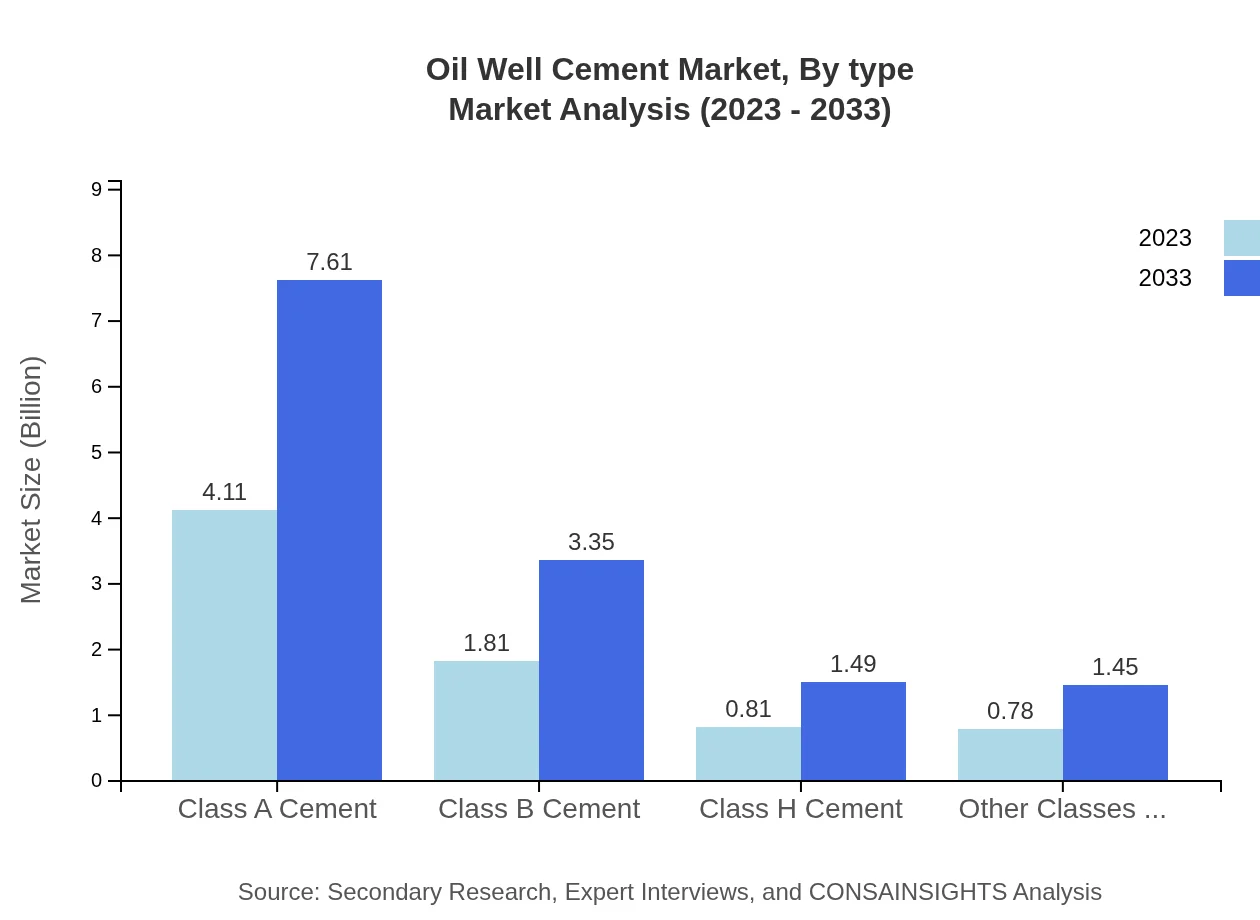

Oil Well Cement Market Analysis By Type

The Oil Well Cement market is segmented into Class A, Class B, Class H, and Other classes. Class A cement commands significant market share, valued at $4.11 billion in 2023, increasing to $7.61 billion by 2033, accounting for 54.75% of the overall share in the segment. Class B and Class H also exhibit substantial growth, with Class B cement expected to rise from $1.81 billion to $3.35 billion over the decade. Other cement classes cater to niche applications, cumulatively contributing to 10.42% share of the total.

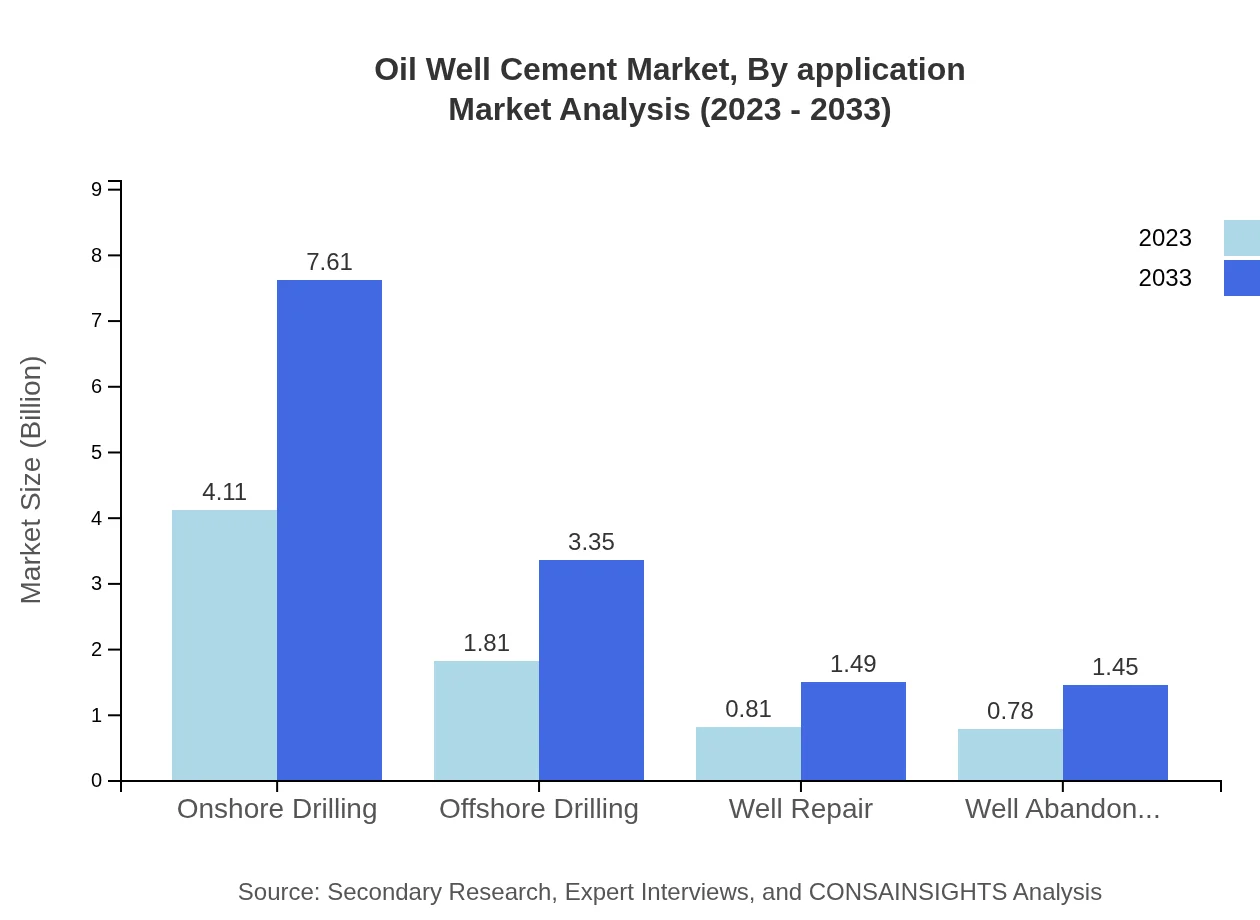

Oil Well Cement Market Analysis By Application

The applications of oil well cement include onshore drilling, offshore drilling, well repair, and well abandonment. Onshore drilling remains the largest segment, anticipated to grow from $4.11 billion to $7.61 billion by 2033, while offshore drilling and well repair segments are also expanding due to increasing drilling activities. Well abandonment practices, vital for environmental safety, are expected to gain momentum throughout the forecast period.

Oil Well Cement Market Analysis By Region

Geographically, the oil well cement market is segmented into North America, Asia Pacific, Europe, South America, and the Middle East and Africa. North America leads with significant demand from shale oil drilling, followed by Asia Pacific centers on substantial investment in gas exploration and production. Europe faces challenges with regulations., while South America and the Middle East remain critical regions for growth due to their abundant oil reserves.

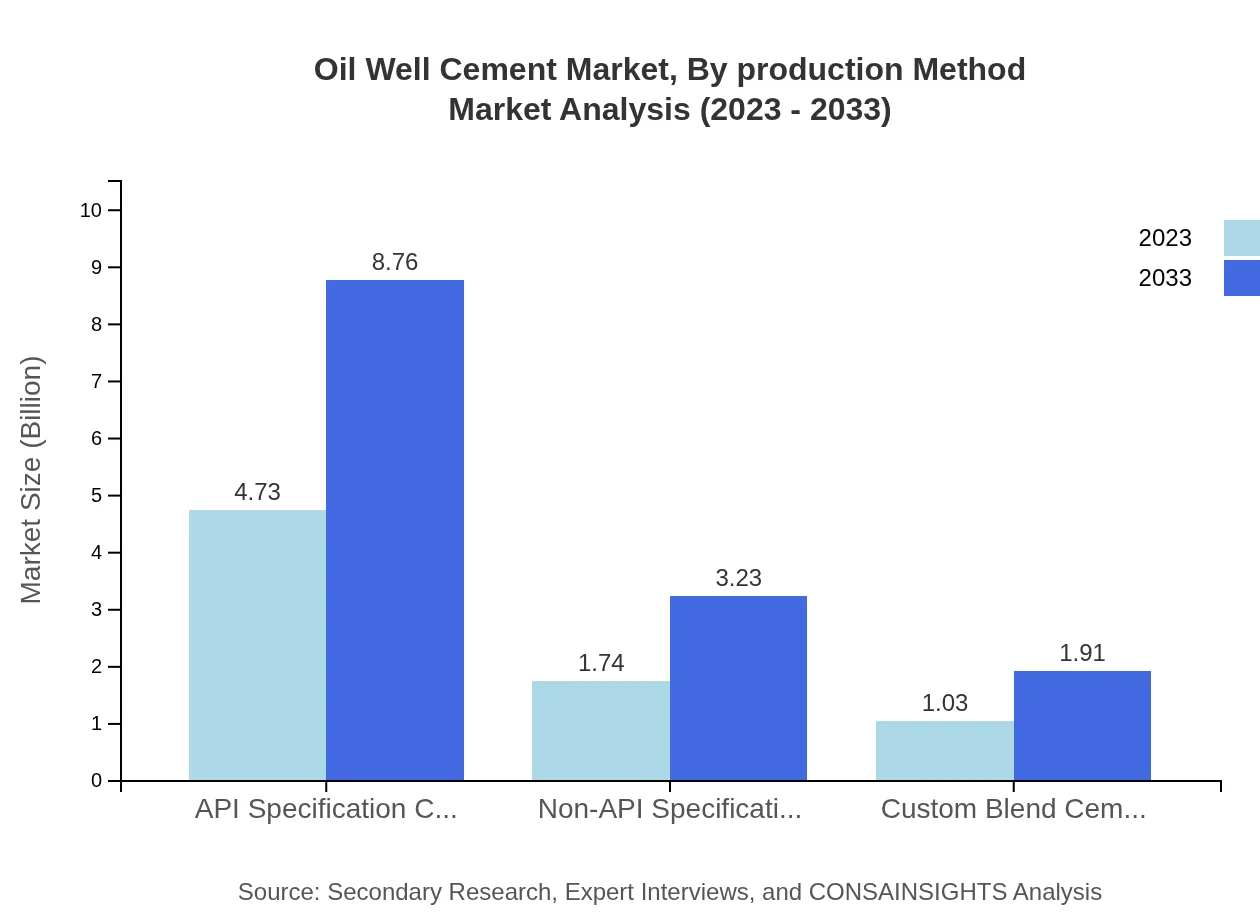

Oil Well Cement Market Analysis By Production Method

Cement production techniques in this market mainly include API specification cement and non-API specification cement. API specification cement, which follows stringent quality and safety norms, constitutes a considerable share of the market due to its crucial role in ensuring well integrity under high-pressure conditions. Non-API cement is also essential for specific applications, particularly in regions with fewer regulations.

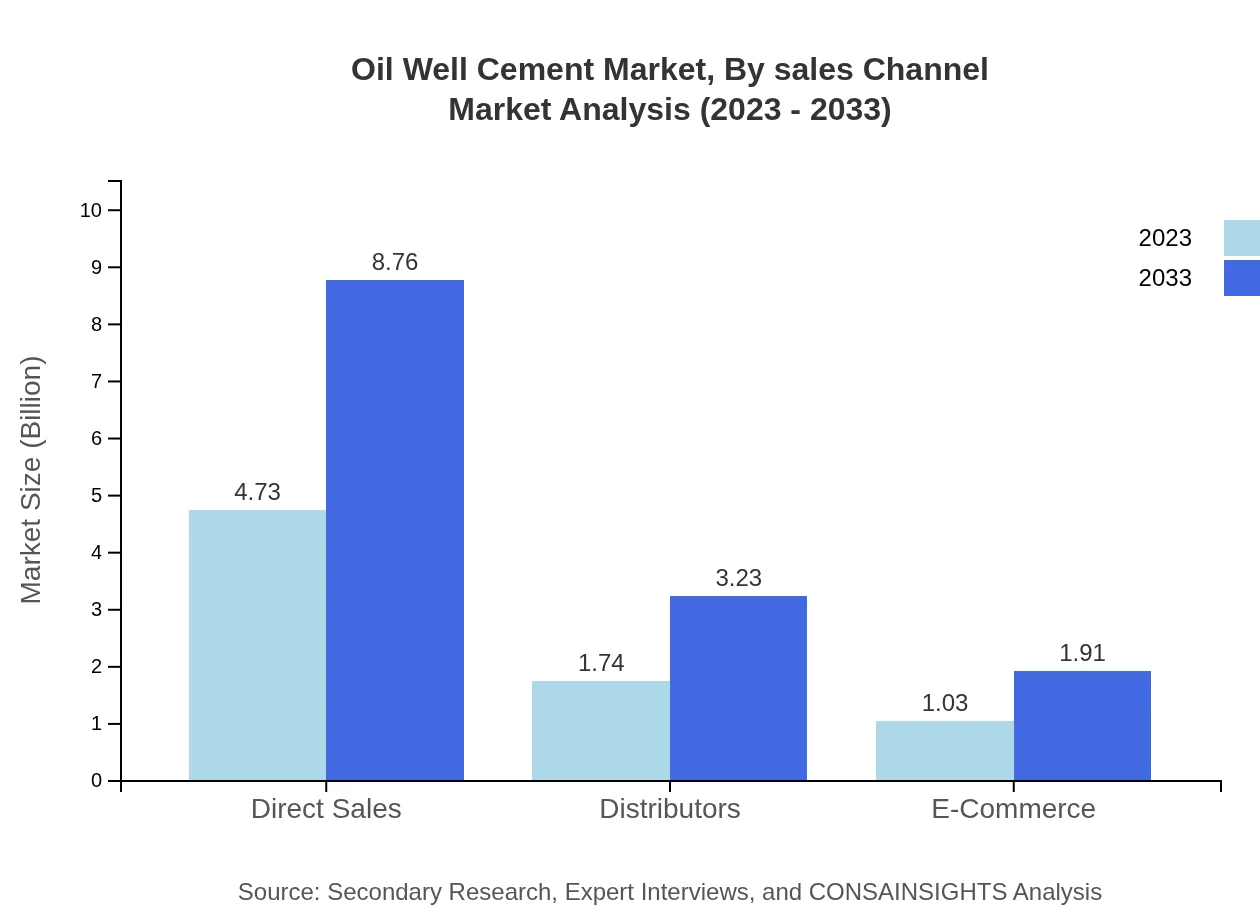

Oil Well Cement Market Analysis By Sales Channel

Sales channels for oil well cement include direct sales, distributors, and e-commerce. Direct sales have the highest market share, with $4.73 billion in 2023 growing to $8.76 billion in 2033. Distributors contribute significantly to distribution networks in diverse geographical settings, while e-commerce is emerging as a valuable channel for reaching niche markets and reducing distribution costs.

Oil Well Cement Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oil Well Cement Industry

Schlumberger Limited:

A leading oilfield service company offering a wide range of technical services for exploration and production, including cementing and well services focused on sustainable practices.Halliburton Company:

One of the largest providers of products and services to the energy industry, known for innovative cementing techniques and advanced material solutions to enhance well performance.Baker Hughes:

A key player in oilfield products and services, offering comprehensive solutions for cementing and stimulation in various drilling environments.Cemex S.A.B. de C.V.:

A global building materials company engaged in cement manufacturing with significant contributions to the oil and gas industry through its specialty cement products.We're grateful to work with incredible clients.

FAQs

What is the market size of oil Well Cement?

The global oil well cement market is valued at approximately $7.5 billion in 2023, with a projected CAGR of 6.2% up to 2033. This growth is fueled by the rising demand in drilling and cementing applications.

What are the key market players or companies in the oil Well Cement industry?

Key players in the oil-well-cement market include major companies such as Halliburton Company, Schlumberger Limited, LafargeHolcim, and CEMEX. These companies dominate by providing innovative and high-quality products in global markets.

What are the primary factors driving the growth in the oil well cement industry?

Growth in the oil well cement industry is primarily driven by increasing exploration activities, technological advancements, and the construction of new oil and gas infrastructure, along with rising oil prices positively impacting investments.

Which region is the fastest Growing in the oil well cement market?

North America represents the fastest-growing region in the oil well cement market, expected to grow from $2.69 billion in 2023 to $4.98 billion by 2033, supported by increasing shale gas extraction and drilling activities.

Does ConsaInsights provide customized market report data for the oil well cement industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the oil well cement industry, providing detailed insights and data analysis suited for unique business requirements.

What deliverables can I expect from this oil well cement market research project?

Deliverables from the oil well cement market research project include comprehensive reports outlining market trends, growth forecasts, competitive analysis, and regional segmentations with strategic recommendations for stakeholders.

What are the market trends of oil Well Cement?

Current market trends in oil-well-cement include an increasing shift towards sustainable cement formulations, the rise of advanced cementitious materials, and a growing focus on enhancing drilling efficiency and safety in operations.