Laminating Film Market Report

Published Date: 02 February 2026 | Report Code: laminating-film

Laminating Film Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Laminating Film market, encompassing market size, growth trends, regional analysis, and key players from 2023 to 2033.

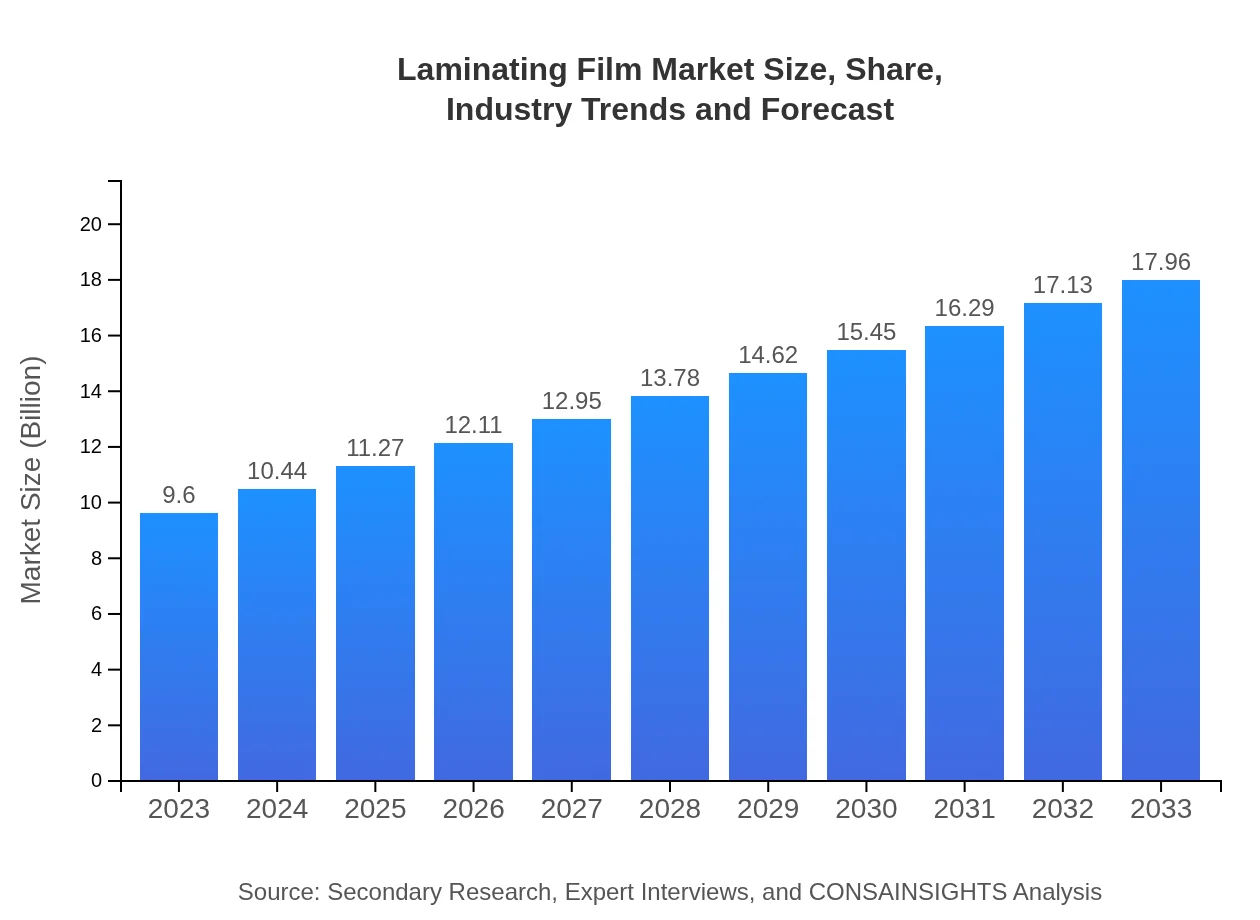

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.60 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $17.96 Billion |

| Top Companies | 3M Company, DOW Chemical Company, Avery Dennison Corporation, Mondi Group, Gerber Technology, Inc. |

| Last Modified Date | 02 February 2026 |

Laminating Film Market Overview

Customize Laminating Film Market Report market research report

- ✔ Get in-depth analysis of Laminating Film market size, growth, and forecasts.

- ✔ Understand Laminating Film's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laminating Film

What is the Market Size & CAGR of Laminating Film market in 2023?

Laminating Film Industry Analysis

Laminating Film Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Laminating Film Market Analysis Report by Region

Europe Laminating Film Market Report:

The European Laminating Film market is projected to expand from $2.75 billion in 2023 to $5.14 billion by 2033. The focus on sustainable packaging and stringent regulations regarding plastic use are influencing market trends, with manufacturers investing in eco-friendly laminating materials.Asia Pacific Laminating Film Market Report:

In the Asia-Pacific region, the Laminating Film market is expected to grow from $1.87 billion in 2023 to $3.50 billion by 2033, driven by rapid industrialization and increasing consumer goods production. Countries like China and India are leading this growth due to their expanding manufacturing sector and rising disposable income levels.North America Laminating Film Market Report:

In North America, the market is forecasted to rise from $3.43 billion in 2023 to $6.42 billion by 2033. Strong demand from the food and beverage sector and the ongoing shift towards environmentally friendly packaging options are key growth drivers.South America Laminating Film Market Report:

The South American Laminating Film market is poised for growth, increasing from $0.55 billion in 2023 to $1.03 billion by 2033. Key factors include urbanization and a growing retail sector which demands better packaging solutions to enhance product visibility.Middle East & Africa Laminating Film Market Report:

The Middle East and Africa region will witness growth in the Laminating Film market, increasing from $1.00 billion in 2023 to $1.88 billion by 2033, supported by rising investments in food packaging and construction industries.Tell us your focus area and get a customized research report.

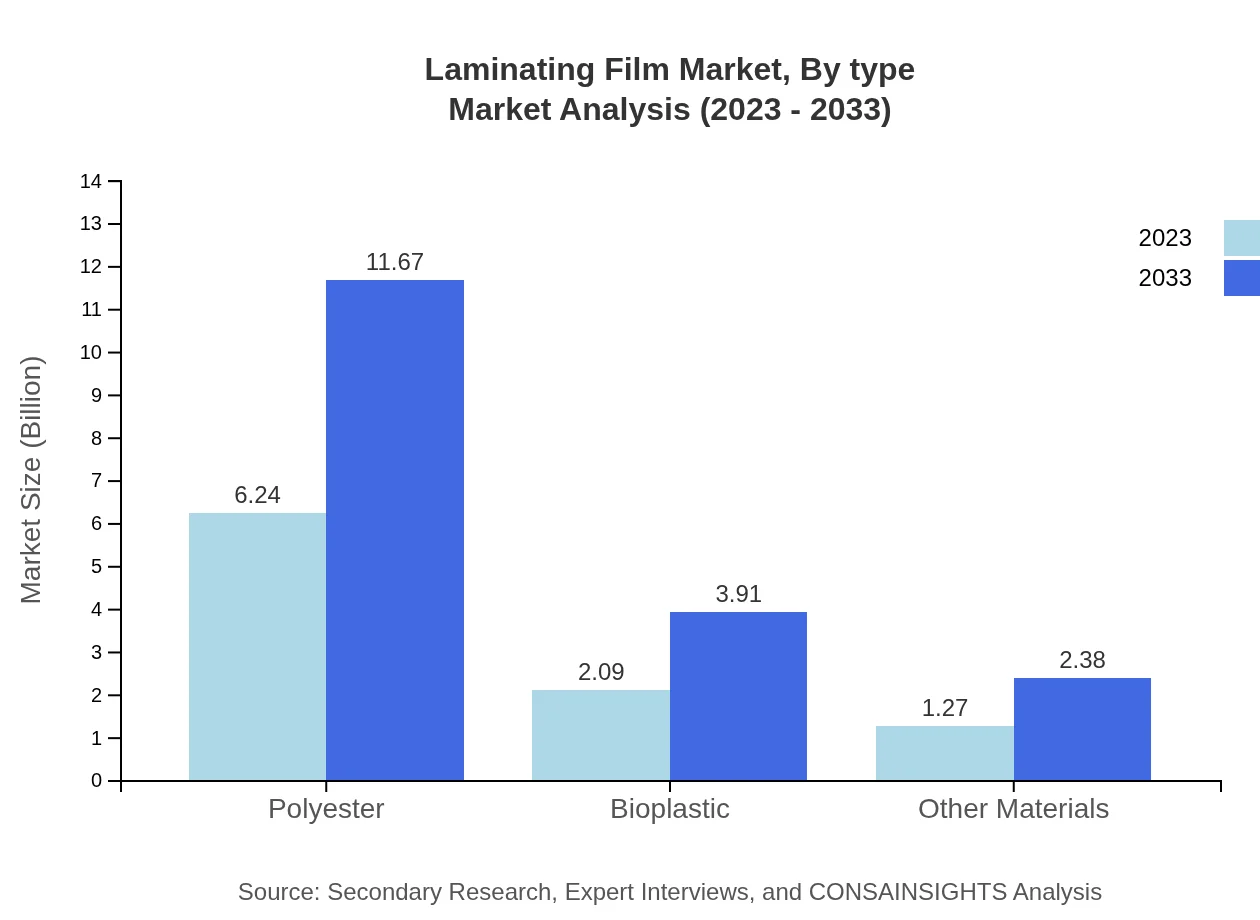

Laminating Film Market Analysis By Type

The Laminating Film market by type includes the following key materials: 1. Polyester: Market size projected to increase from $6.24 billion in 2023 to $11.67 billion in 2033, accounting for 64.99% share. 2. Bioplastic: Expected to grow from $2.09 billion to $3.91 billion, maintaining a share of 21.76%. 3. Other Materials: Anticipated to rise from $1.27 billion to $2.38 billion, holding a 13.25% share.

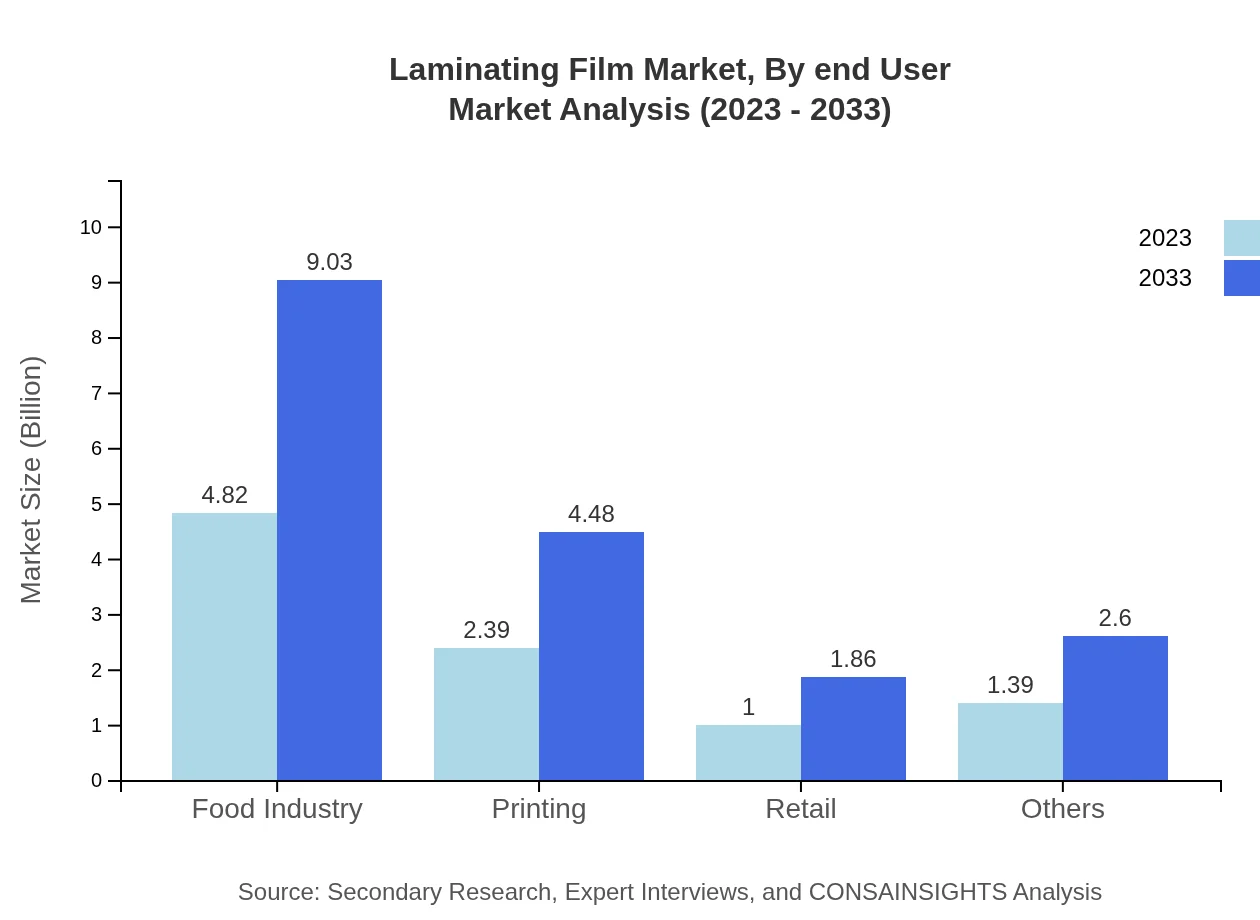

Laminating Film Market Analysis By Application

Analyzing the Laminating Film market by application reveals distinct sectors contributing to market expansion: 1. Food Industry: Market size projected to grow from $4.82 billion in 2023 to $9.03 billion in 2033, accounting for 50.26% of the share. 2. Printing: Expected growth from $2.39 billion to $4.48 billion, holding a 24.92% share. 3. Retail: Estimated increase from $1.00 billion to $1.86 billion, comprising 10.37%. 4. Others: Anticipated growth from $1.39 billion to $2.60 billion, capturing a 14.45% share.

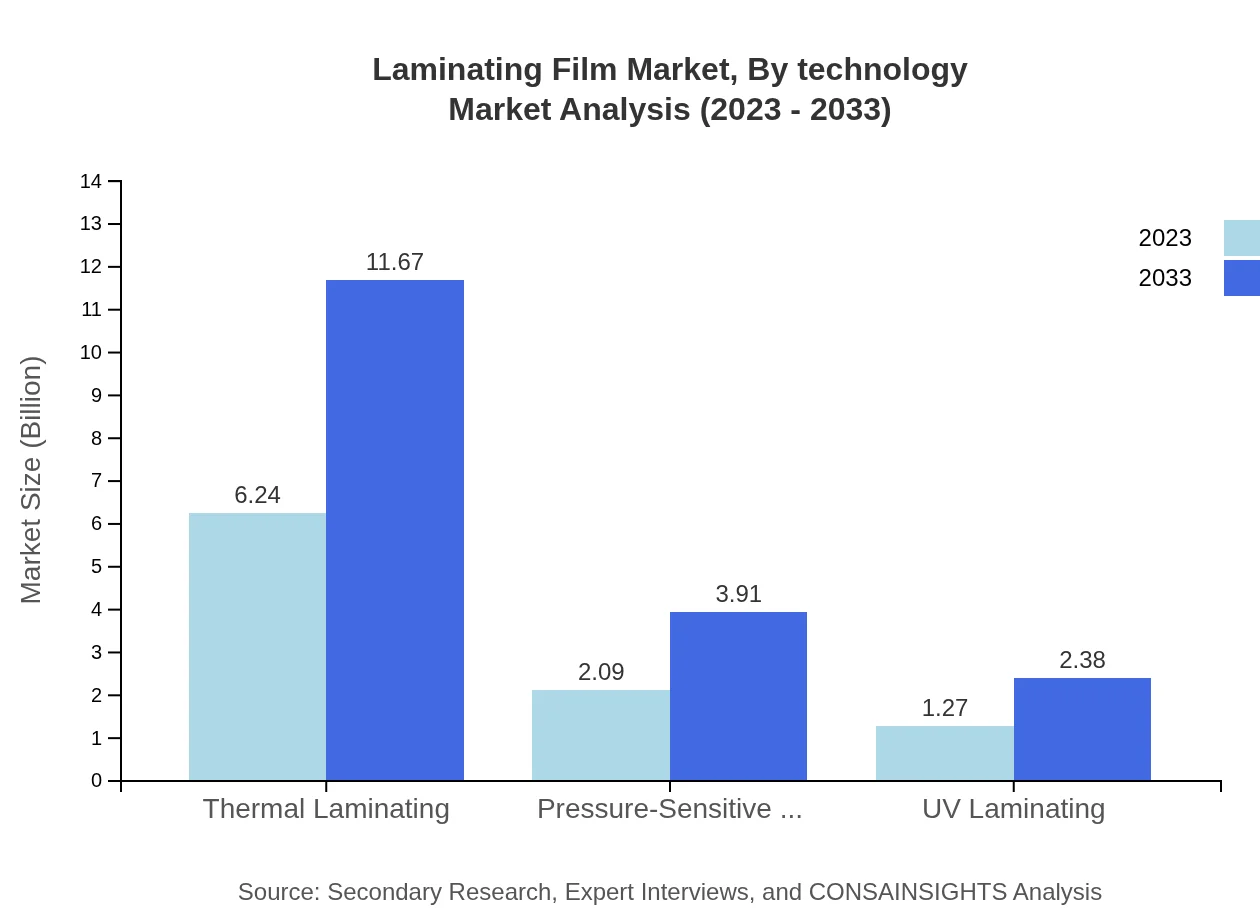

Laminating Film Market Analysis By Technology

The Laminating Film market, driven by technological advancements, includes: 1. Thermal Laminating: Market size predicted to escalate from $6.24 billion to $11.67 billion, maintaining a consistent 64.99% share. 2. Pressure-Sensitive Laminating: Projected growth from $2.09 billion to $3.91 billion, retaining a 21.76% share. 3. UV Laminating: Expected to grow from $1.27 billion to $2.38 billion, with a 13.25% market share.

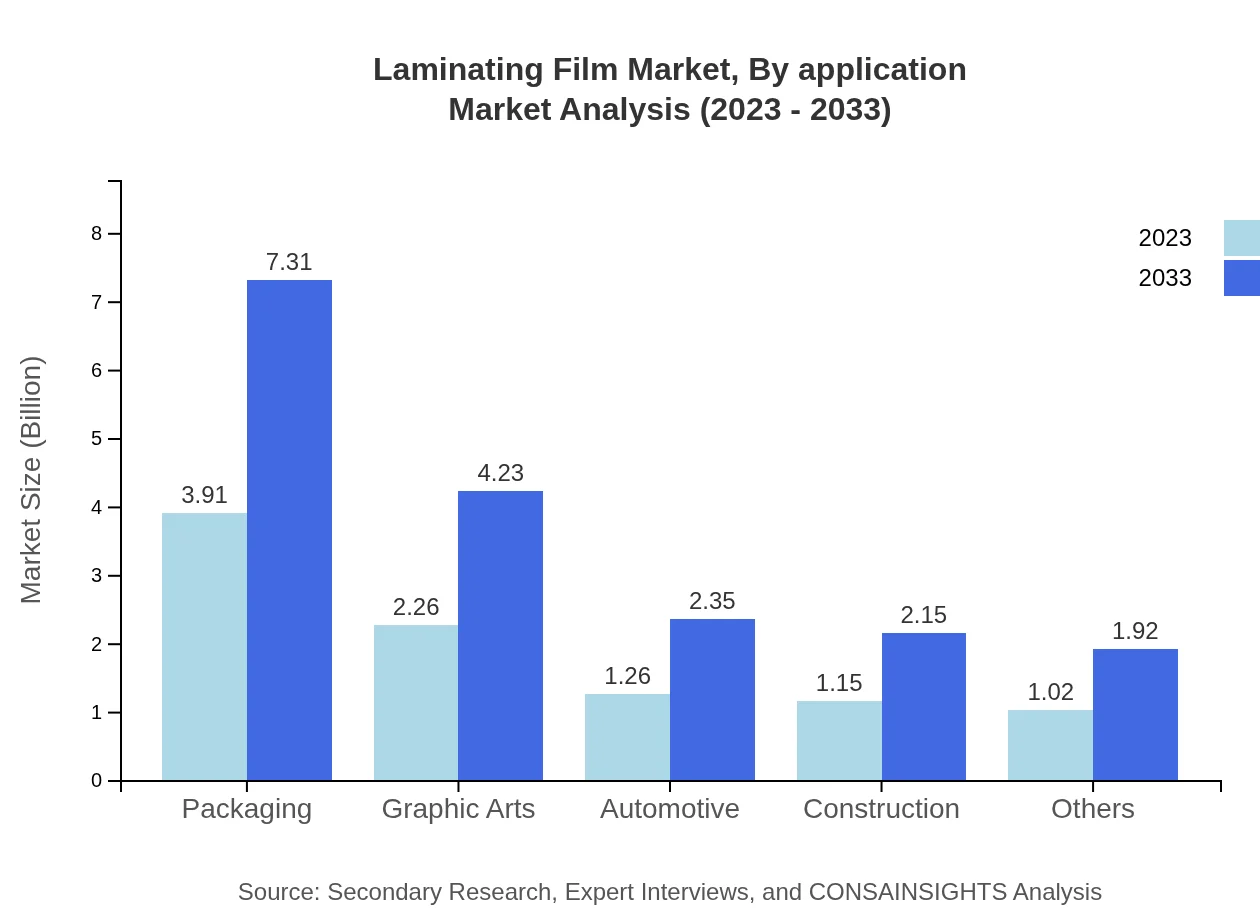

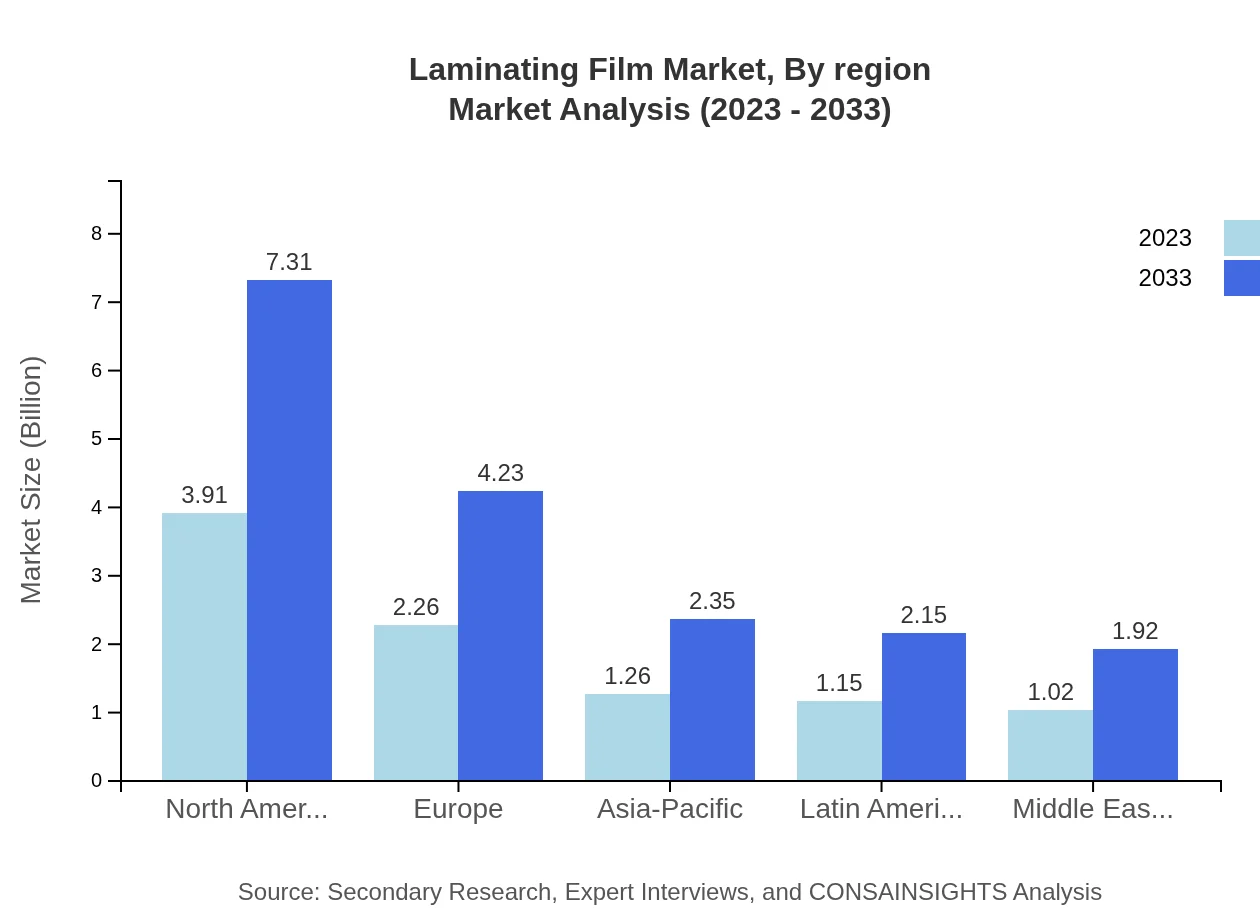

Laminating Film Market Analysis By End User

The Laminating Film market is significantly influenced by various end-users: 1. Packaging: Market size projected to rise from $3.91 billion to $7.31 billion, retaining a 40.7% share. 2. Graphic Arts: Estimated growth from $2.26 billion to $4.23 billion, representing a 23.55% share. 3. Automotive: Increasing from $1.26 billion to $2.35 billion, accounting for 13.1%. 4. Others: Projected increase from $1.02 billion to $1.92 billion, comprising 10.67%.

Laminating Film Market Analysis By Region

Geographical segmentation demonstrates diverse growth patterns. Regions such as North America and Europe highlight strong potentials due to advanced industrial frameworks. Meanwhile, the Asia-Pacific region is expected to experience the highest growth rates, driven by manufacturing and consumer goods. Sustainable packaging initiatives are anticipated to shape market dynamics across all regions.

Laminating Film Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laminating Film Industry

3M Company:

A global leader in adhesive and film technology, 3M specializes in creating innovative laminating solutions that cater to various industries, including packaging and graphic arts.DOW Chemical Company:

DOW is known for its advanced materials solutions, offering a range of laminating films that enhance product protection and sustainability across packaging applications.Avery Dennison Corporation:

As a renowned global manufacturer, Avery Dennison focuses on providing pressure-sensitive labeling and laminating materials that support branding and product presentation.Mondi Group:

Mondi is committed to sustainability and innovative packaging solutions, producing high-performing laminating films widely used across food and beverage industries.Gerber Technology, Inc.:

Specializing in operational efficiency, Gerber Technology offers technological advancements in lamination processes, enhancing the overall production capabilities of laminating films.We're grateful to work with incredible clients.

FAQs

What is the market size of laminating Film?

The laminating film market is projected to reach a size of approximately $9.6 billion by 2033, growing at a CAGR of 6.3%. The market reflects a strong demand due to various application sectors including packaging and printing.

What are the key market players or companies in this laminating Film industry?

Key players in the laminating film industry include major corporations specializing in packaging and laminating materials. These companies compete through innovation and strategic partnerships, contributing to overall market growth.

What are the primary factors driving the growth in the laminating film industry?

Growth in the laminating film market is driven by increasing demand for packaging across various sectors, technological advancements in film production, and a rising emphasis on sustainable materials.

Which region is the fastest Growing in the laminating film market?

The North America region is currently the fastest-growing in the laminating film market, with projections indicating an increase from $3.43 billion in 2023 to $6.42 billion by 2033, highlighting significant regional demand.

Does ConsaInsights provide customized market report data for the laminating film industry?

Yes, ConsaInsights provides customizable market report data tailored to specific needs within the laminating film industry, allowing clients to focus on relevant data based on regional or segment interests.

What deliverables can I expect from this laminating Film market research project?

Deliverables from the laminating film market research include detailed market analysis, forecasts, competitive landscape insights, and regional growth opportunities, ensuring comprehensive intelligence for strategic decisions.

What are the market trends of laminating film?

Current trends in the laminating film market include a shift towards environmentally friendly bioplastics, advancements in lamination technology, and a focus on multi-functional products to enhance packaging solutions.