Opaque Polymers Market Report

Published Date: 02 February 2026 | Report Code: opaque-polymers

Opaque Polymers Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the opaque polymers market, covering market size, growth rates, regional insights, and future forecasts for the period from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

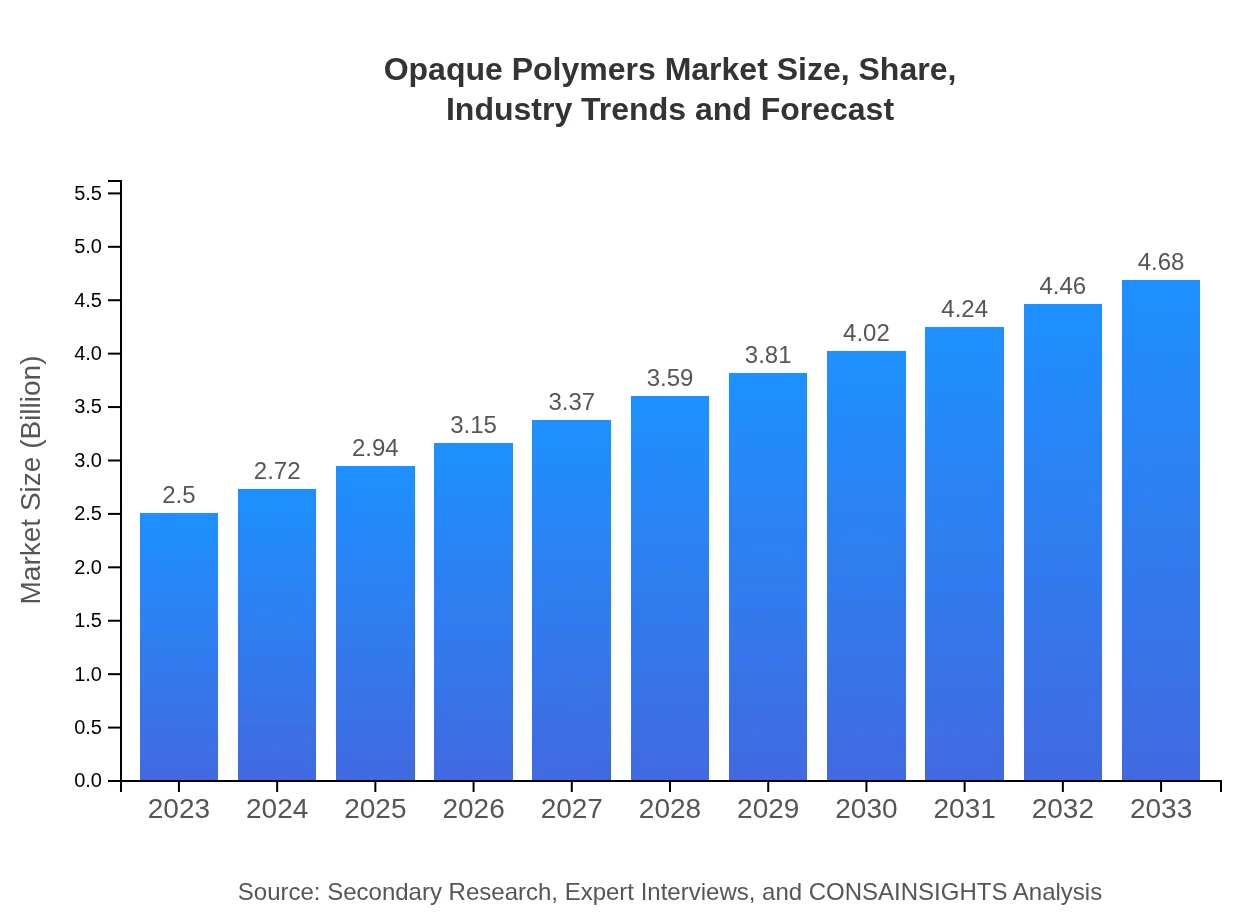

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $4.68 Billion |

| Top Companies | BASF SE, Dupont de Nemours, Inc., Clariant AG, Evonik Industries AG |

| Last Modified Date | 02 February 2026 |

Opaque Polymers Market Overview

Customize Opaque Polymers Market Report market research report

- ✔ Get in-depth analysis of Opaque Polymers market size, growth, and forecasts.

- ✔ Understand Opaque Polymers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Opaque Polymers

What is the Market Size & CAGR of Opaque Polymers market in 2023?

Opaque Polymers Industry Analysis

Opaque Polymers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

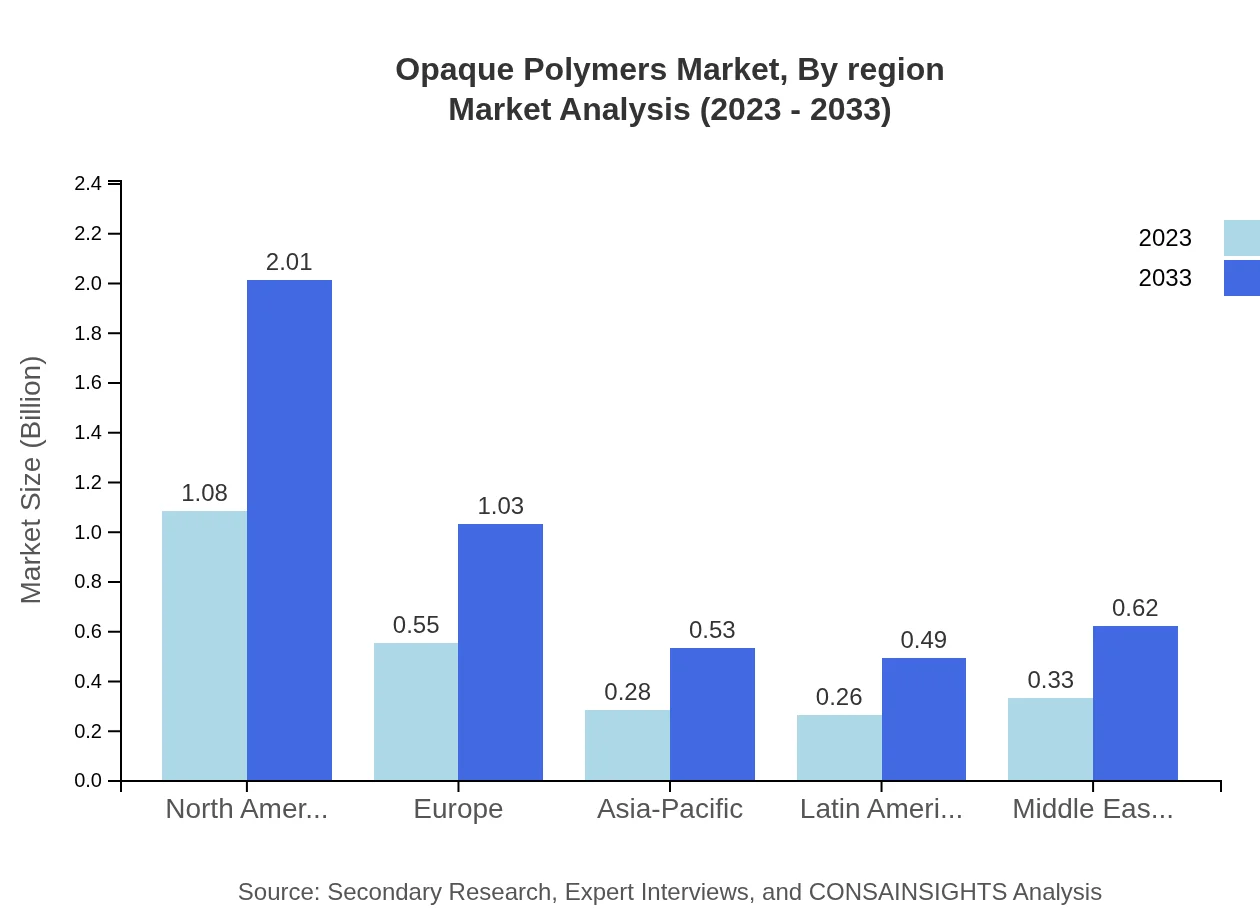

Opaque Polymers Market Analysis Report by Region

Europe Opaque Polymers Market Report:

The European market is poised to grow from $0.72 billion in 2023 to $1.36 billion in 2033, supported by stringent regulations promoting sustainable products and a growing inclination towards high-quality construction materials.Asia Pacific Opaque Polymers Market Report:

The Asia Pacific region is projected to experience significant growth, with the market expected to increase from $0.50 billion in 2023 to $0.93 billion by 2033. This growth is driven by expanding manufacturing sectors and rising consumer demand for quality goods.North America Opaque Polymers Market Report:

North America is the largest market, anticipated to grow from $0.84 billion in 2023 to $1.57 billion by 2033. The region's strong automotive and aerospace industries drive demand for opaque polymers, alongside substantial investments in durable consumer goods.South America Opaque Polymers Market Report:

In South America, the market size is expected to grow from $0.17 billion in 2023 to $0.33 billion by 2033. The region is focusing on enhancing industrial capabilities, fostering an environment for growth in various polymer applications.Middle East & Africa Opaque Polymers Market Report:

In the Middle East and Africa, the market is expected to increase from $0.26 billion in 2023 to $0.49 billion by 2033. The region's focus on industrialization and infrastructure development is likely to drive opaque polymer applications.Tell us your focus area and get a customized research report.

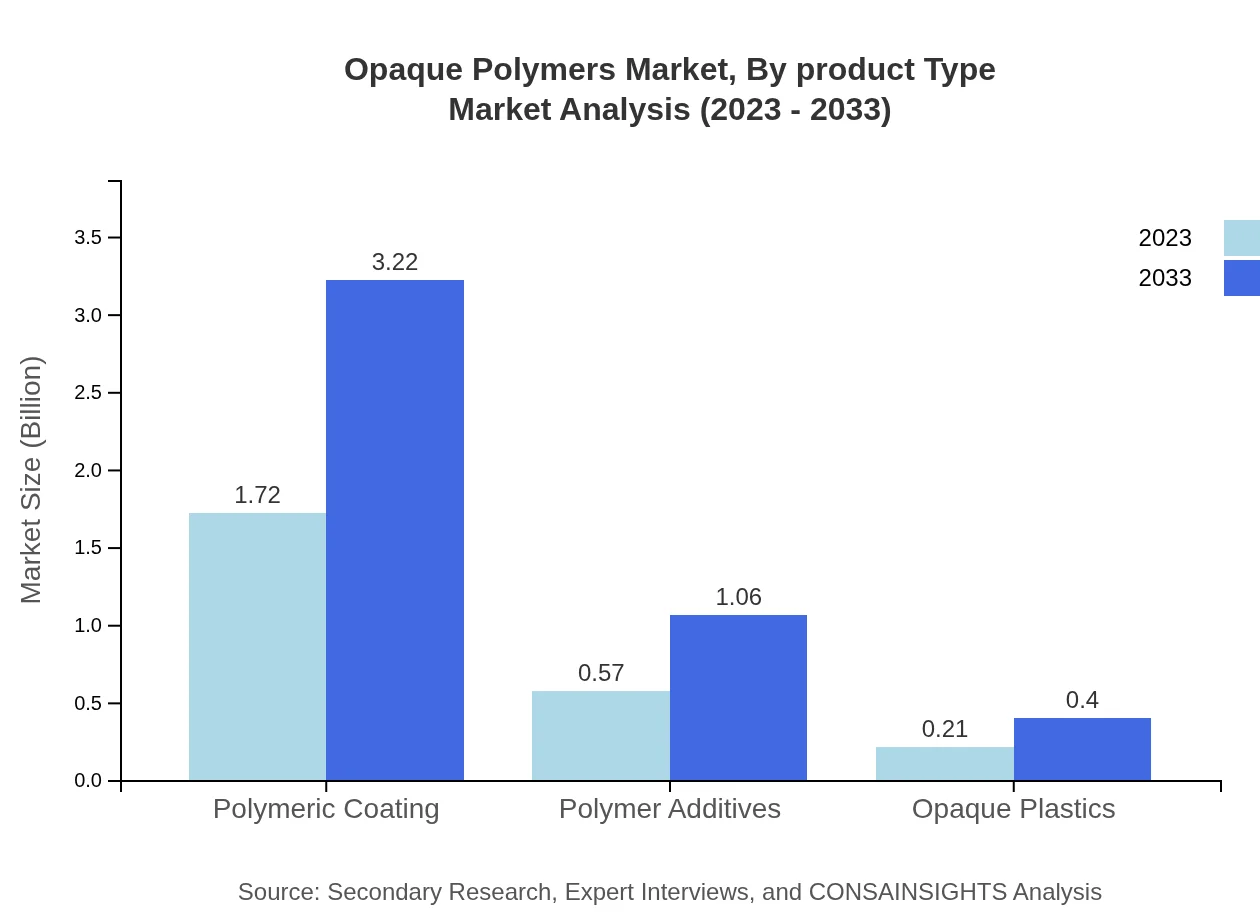

Opaque Polymers Market Analysis By Product Type

The opaque polymers market by product type is primarily driven by polymeric coatings, which dominate the segment due to their essential role in enhancing product durability and aesthetics. Additionally, polymer additives contribute significantly by improving the manufacturing processes of polymers. Opaque plastics are also gaining traction, particularly in the packaging industry.

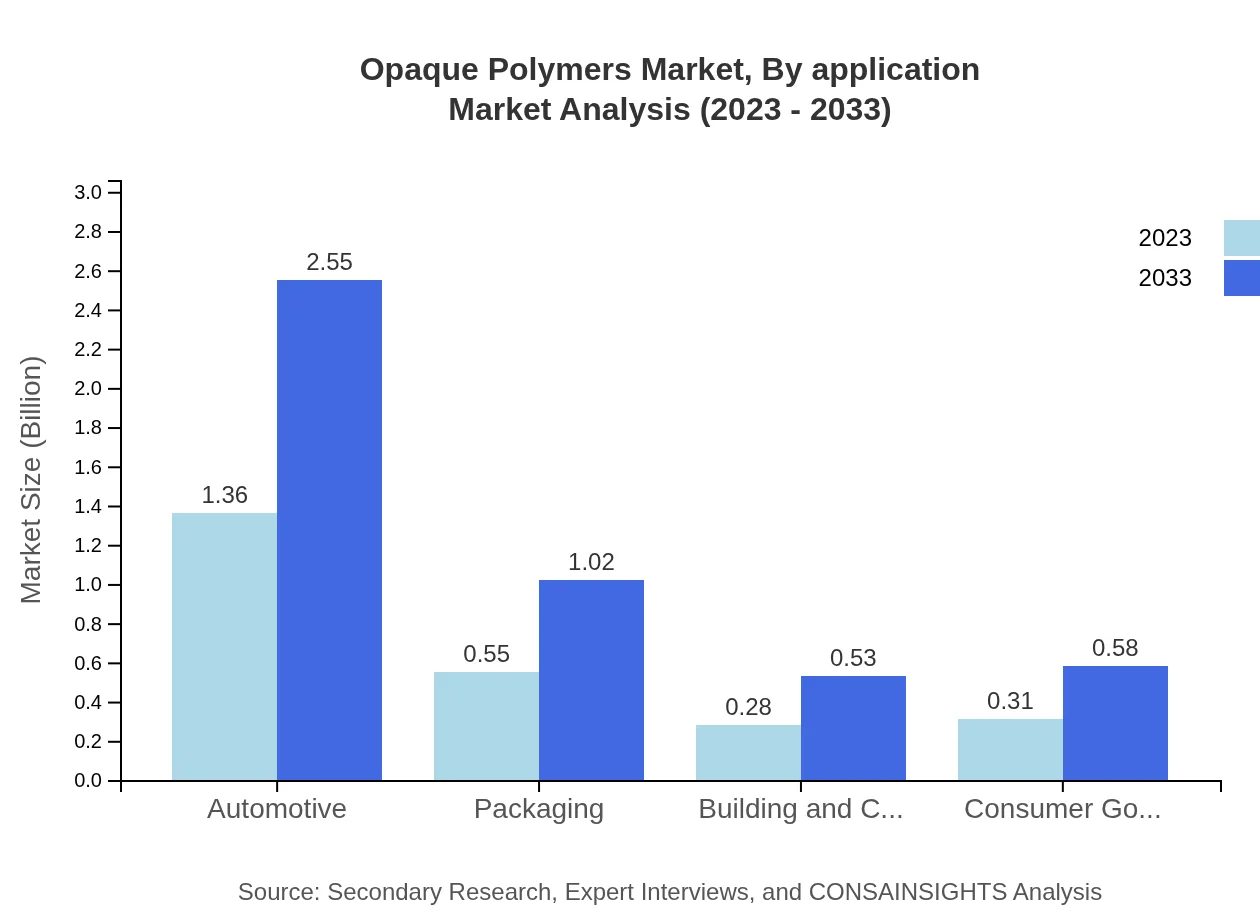

Opaque Polymers Market Analysis By Application

Applications of opaque polymers are wide-ranging, encompassing automotive, aerospace, medical, electronics, and packaging. The automotive and aerospace segments are among the largest consumers due to the need for lightweight, durable materials that meet stringent performance standards.

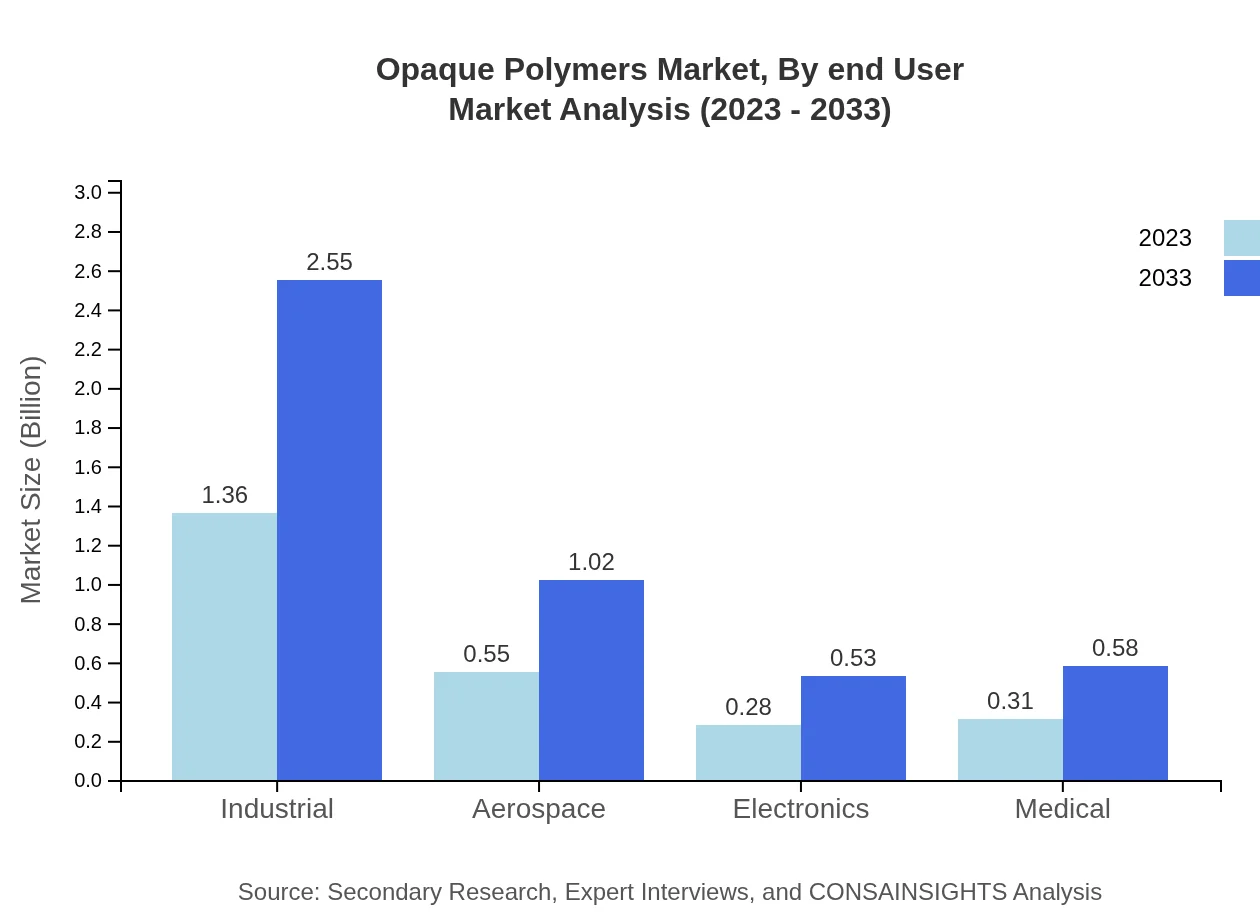

Opaque Polymers Market Analysis By End User

End-user industries such as automotive and construction are leading the market, accounting for significant shares due to their heavy reliance on durable materials. The medical and electronics sectors are also growing due to advancements in technology and the need for high-performance products.

Opaque Polymers Market Analysis By Region

Regional analysis indicates that North America leads the market, followed closely by Europe and the Asia Pacific. Emerging markets in South America and the Middle East are also expanding, driven by industrialization and a shift toward more sustainable production methods.

Opaque Polymers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Opaque Polymers Industry

BASF SE:

BASF SE is a global leader in chemical production, known for its innovative polymer solutions and commitment to sustainability.Dupont de Nemours, Inc.:

Dupont is a pioneer in materials science, focusing on high-performance polymers and advancing opaque polymer technology.Clariant AG:

Clariant specializes in specialty chemicals and advanced polymer solutions, playing a crucial role in the opaque polymers market.Evonik Industries AG:

Evonik is recognized for its broad range of polymer products, emphasizing innovation and environmental responsibility.We're grateful to work with incredible clients.

FAQs

What is the market size of opaque Polymers?

The opaque polymers market is currently valued at approximately $2.5 billion and is projected to grow at a CAGR of 6.3%. By 2033, this market is anticipated to expand significantly, reflecting an increasing demand across various industries.

What are the key market players or companies in this opaque Polymers industry?

Key players in the opaque polymers market include major chemical manufacturers and specialized polymer producers. These companies are consistently innovating with product developments to cater to end-user industries like coatings, automotive, and packaging.

What are the primary factors driving the growth in the opaque Polymers industry?

The growth of the opaque polymers market is driven by increasing demand in the coatings industry, a shift towards sustainable solutions, and innovations in product formulations that enhance performance. Additionally, rising environmental concerns are pushing manufacturers towards eco-friendly alternatives.

Which region is the fastest Growing in the opaque Polymers?

The Asia-Pacific region is the fastest-growing in the opaque polymers market. From a market size of $0.50 billion in 2023, it is projected to reach $0.93 billion by 2033, driven by industrialization and increased demand for coatings.

Does ConsaInsights provide customized market report data for the opaque Polymers industry?

Yes, ConsaInsights offers customized market report data tailored to the opaque polymers industry. This allows stakeholders to obtain specific insights relevant to their business strategies and market needs.

What deliverables can I expect from this opaque Polymers market research project?

In a typical opaque polymers market research project, you can expect comprehensive reports, market trend analyses, competitive landscape overviews, and regional breakdowns, along with specific insights into key segments and growth forecasts.

What are the market trends of opaque Polymers?

Current trends in the opaque polymers market include innovations in sustainable materials, increased application in the automotive and aerospace sectors, and a shift towards the use of advanced polymer technologies to enhance product properties like durability and opacity.