Optical Encryption Market Report

Published Date: 31 January 2026 | Report Code: optical-encryption

Optical Encryption Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Optical Encryption market, covering market dynamics, size and forecast from 2023 to 2033, along with insights on technology, segments, and regional performance.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

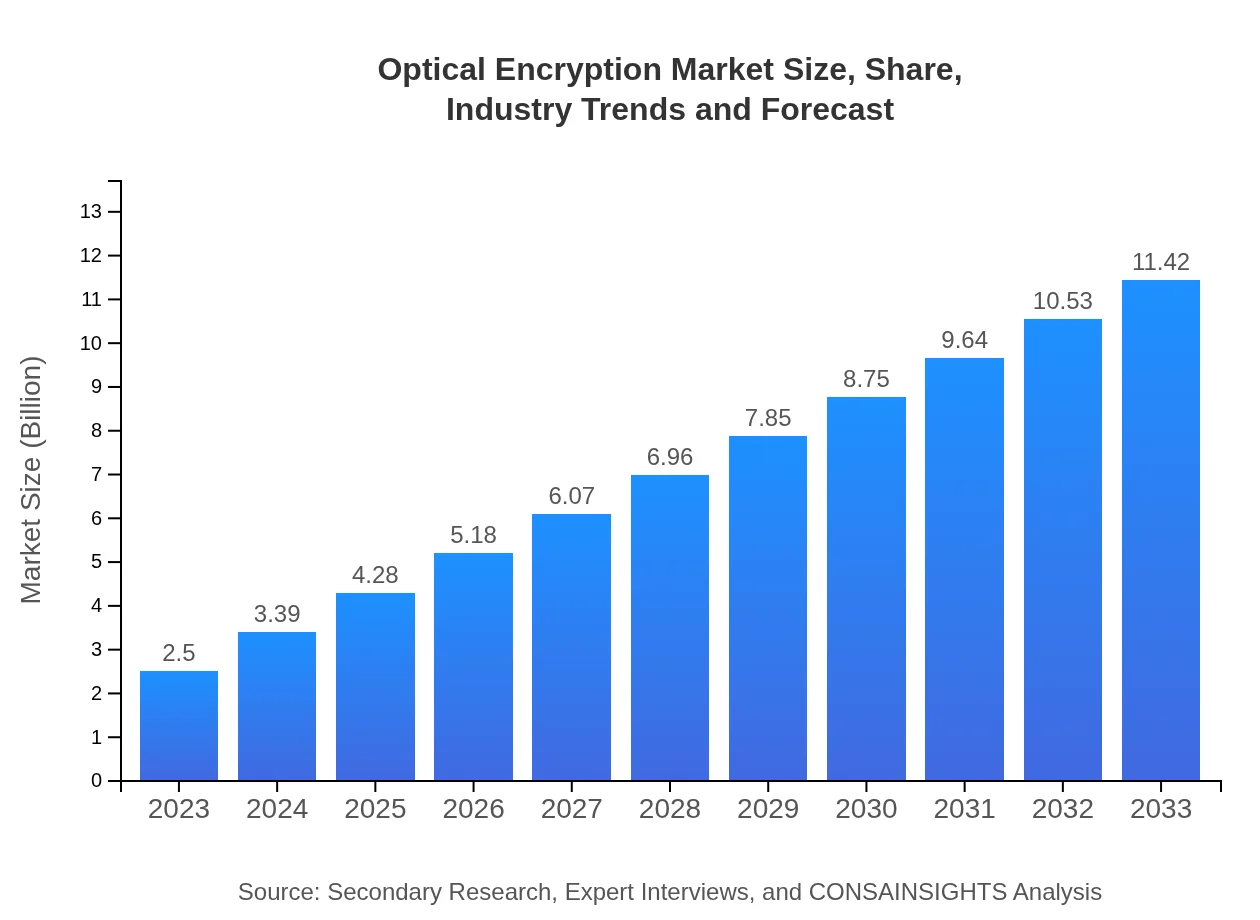

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 15.6% |

| 2033 Market Size | $11.42 Billion |

| Top Companies | Cisco Systems, AT&T, IBM, Thales Group |

| Last Modified Date | 31 January 2026 |

Optical Encryption Market Overview

Customize Optical Encryption Market Report market research report

- ✔ Get in-depth analysis of Optical Encryption market size, growth, and forecasts.

- ✔ Understand Optical Encryption's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Optical Encryption

What is the Market Size & CAGR of Optical Encryption market in 2023?

Optical Encryption Industry Analysis

Optical Encryption Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Optical Encryption Market Analysis Report by Region

Europe Optical Encryption Market Report:

In Europe, the Optical Encryption market is anticipated to expand from $0.62 billion in 2023 to $2.83 billion by 2033, fuelled by stringent data protection regulations and the increasing need for secure communication platforms.Asia Pacific Optical Encryption Market Report:

In the Asia-Pacific region, the Optical Encryption market is projected to grow from $0.54 billion in 2023 to $2.48 billion by 2033, driven by increasing investments in digital infrastructure and the growing concerns around data privacy and protection.North America Optical Encryption Market Report:

North America is set to maintain its dominance in the market, projected to grow from $0.83 billion in 2023 to approximately $3.78 billion by 2033. The region’s robust IT infrastructure and significant investments in cybersecurity are key growth factors.South America Optical Encryption Market Report:

The South American Optical Encryption market is expected to increase from $0.18 billion in 2023 to $0.82 billion by 2033, as more organizations begin to adopt advanced encryption solutions amid rising cybersecurity threats.Middle East & Africa Optical Encryption Market Report:

The Middle East and Africa region is likely to witness growth from $0.33 billion in 2023 to $1.51 billion by 2033. The growth is attributed to rising threats from cyber activities and an increased focus on data sovereignty.Tell us your focus area and get a customized research report.

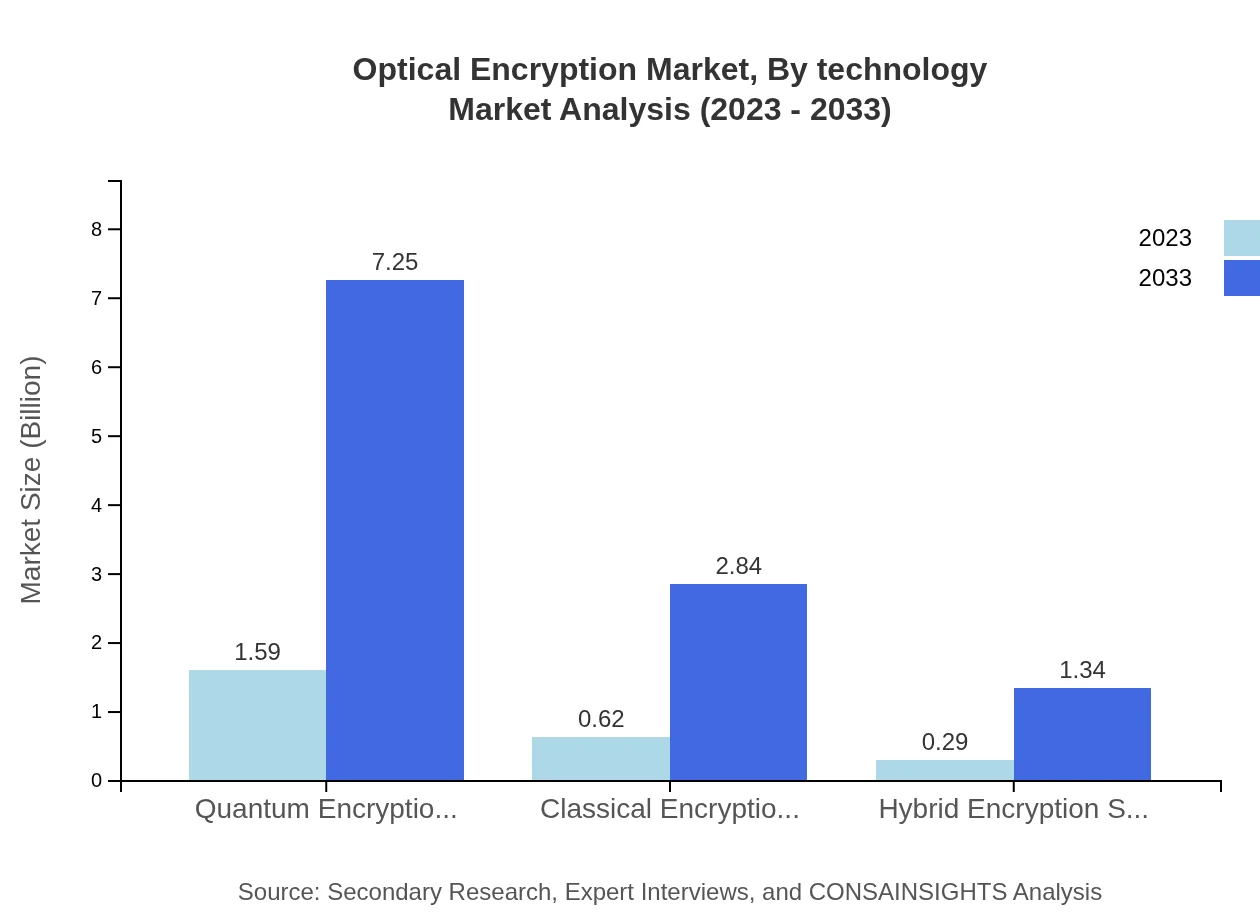

Optical Encryption Market Analysis By Technology

The technology segment includes Quantum Encryption Techniques, which dominate the market with a size of $1.59 billion in 2023 and is expected to reach $7.25 billion by 2033, holding a share of 63.47%. Classical Encryption Techniques, with a market size of $0.62 billion in 2023, will grow to $2.84 billion while maintaining a share of 24.82%. Hybrid Encryption Solutions represent a smaller segment with a size of $0.29 billion in 2023, anticipated to grow to $1.34 billion.

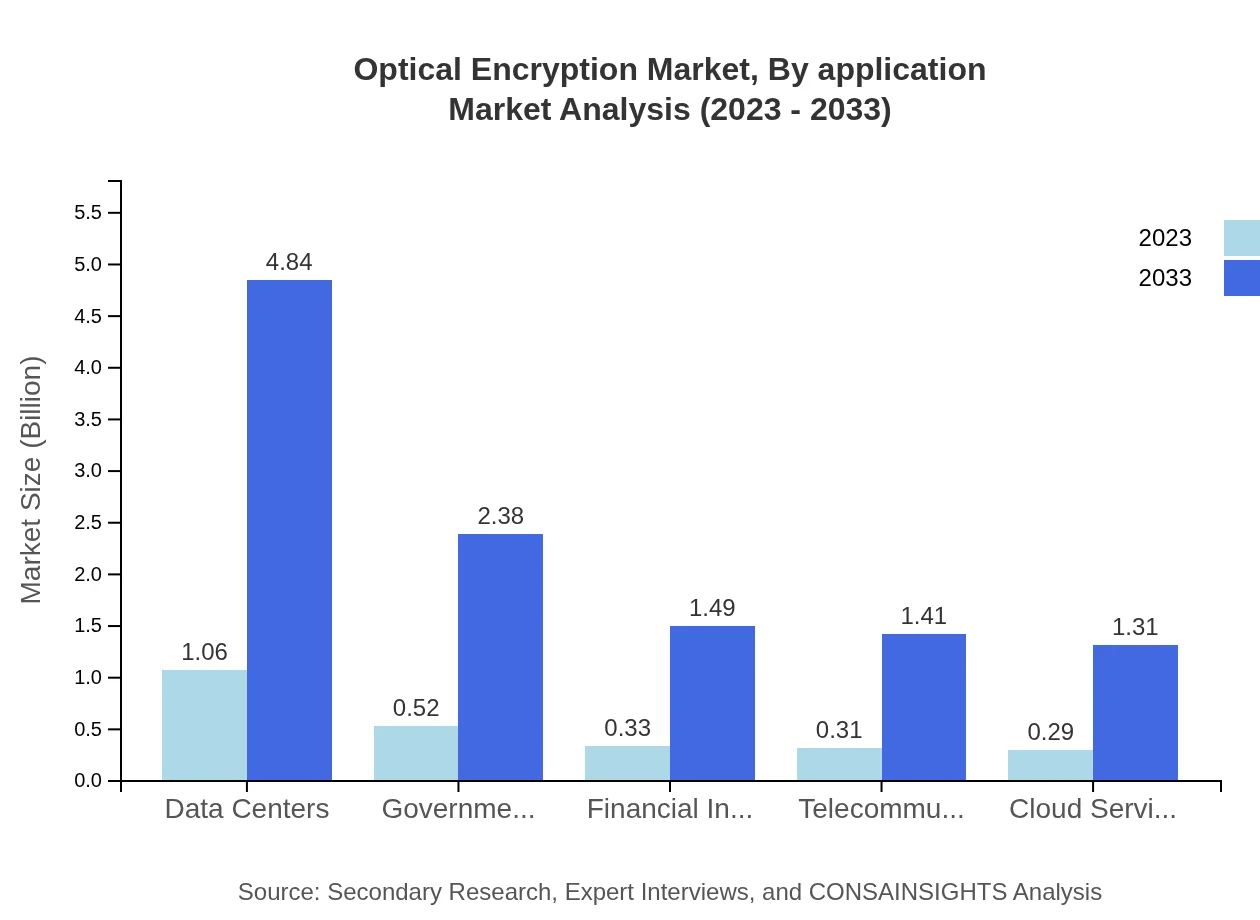

Optical Encryption Market Analysis By Application

The applications segment reveals significant insights with IT and Telecom at the forefront, expected to grow from $1.06 billion in 2023 to $4.84 billion by 2033, capturing a substantial market share of 42.39%. Banking and Finance is projected to rise from $0.52 billion to $2.38 billion, holding a 20.8% share. Other sectors like Defense, Healthcare, and various other industries are also noted for their critical need for optical encryption solutions.

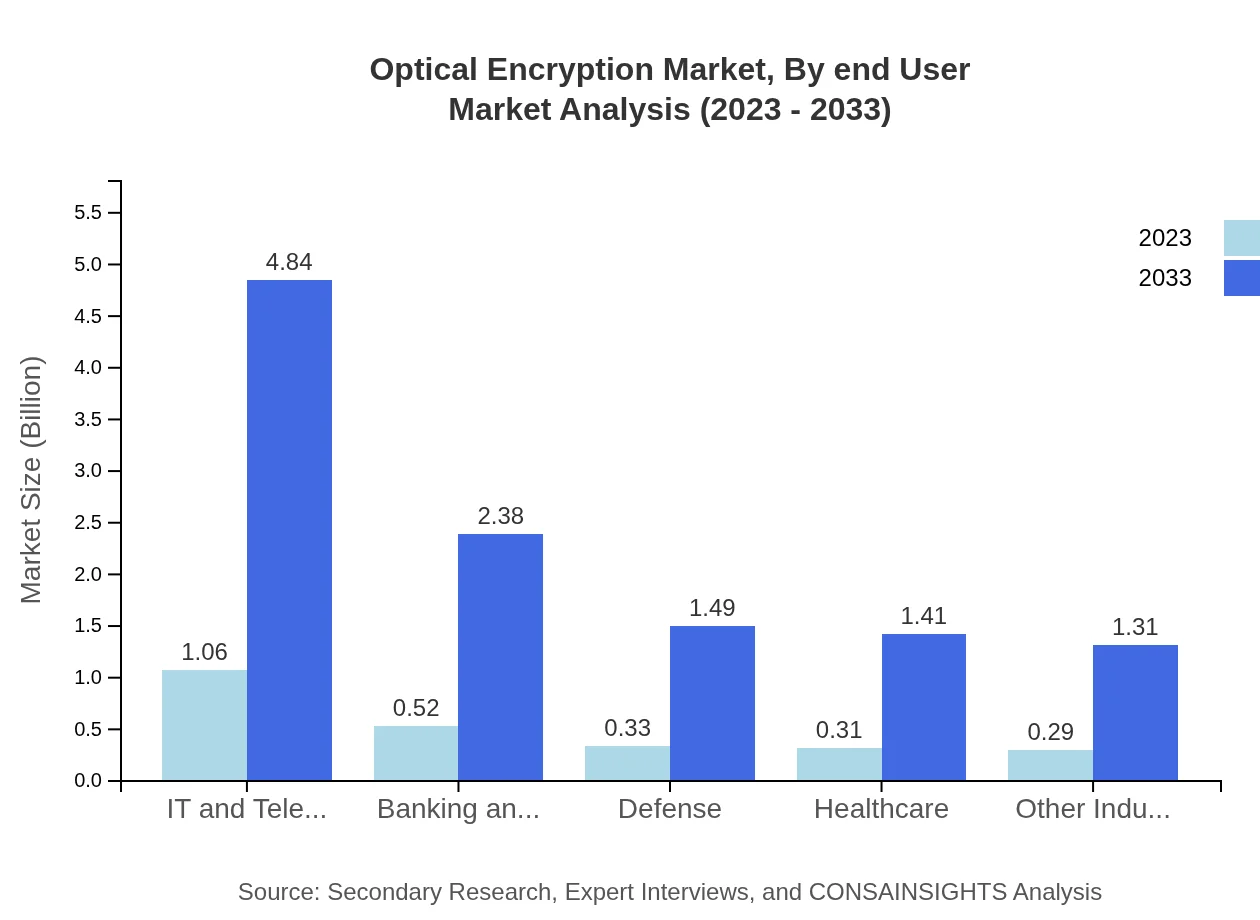

Optical Encryption Market Analysis By End User

Key end-user segments include Financial Institutions and Government Security, with anticipated market sizes of $0.33 billion and $0.52 billion in 2023 respectively, both showing substantial growth prospects. Telecommunications and Cloud Services are significant segments as they account for 12.33% and 11.47% market shares respectively, showing continued adoption of optical encryption strategies.

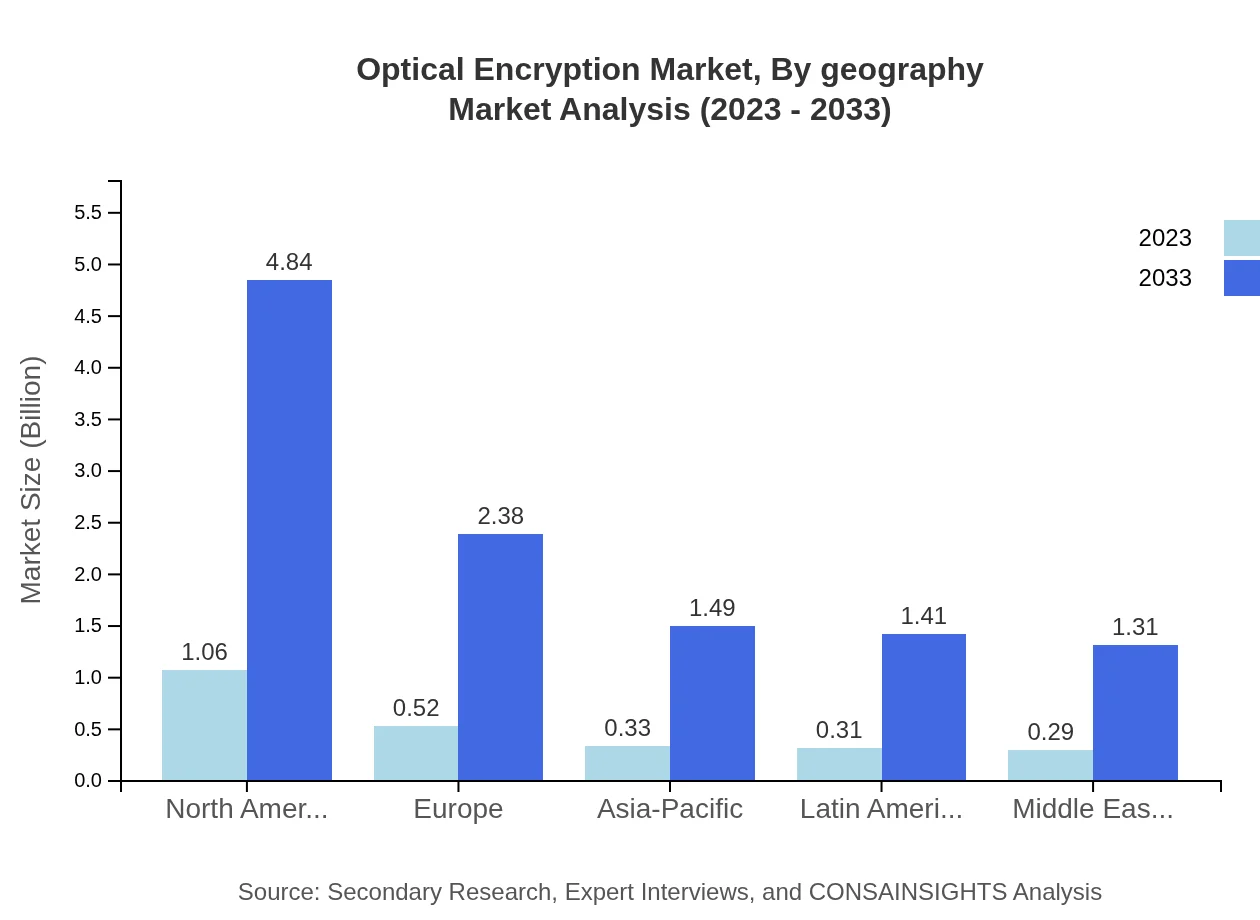

Optical Encryption Market Analysis By Geography

Geographically, North America leads the Optical Encryption market due to high demand stemming from data-heavy industries. In contrast, the Asia-Pacific region is advancing rapidly, potentially becoming a key player in the optical encryption landscape by 2033. Europe follows closely, influenced by strong regulations driving the need for enhanced data security.

Optical Encryption Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Optical Encryption Industry

Cisco Systems:

A leading provider of optical encryption technologies with significant contributions to cybersecurity by developing advanced network solutions that secure data transmission.AT&T:

A prominent telecommunications company investing heavily in optical encryption to ensure secure communications and protect client information from cyber threats.IBM:

Innovating data encryption solutions, including optical security measures, IBM plays a crucial role in shaping the future of secure data transactions.Thales Group:

Thales offers robust encryption technologies and is recognized for its comprehensive solutions aimed at protecting sensitive data across various sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of optical encryption?

The optical encryption market is projected to grow from $2.5 billion in 2023 to significant levels by 2033, with a CAGR of 15.6%. This growth reflects increased demand for secure data transmission across industries.

What are the key market players or companies in the optical encryption industry?

Key market players in optical encryption include leading technology firms specializing in cybersecurity solutions, encryption hardware providers, and telecommunication companies that prioritize data security in their offerings.

What are the primary factors driving the growth in the optical encryption industry?

Primary growth drivers in the optical encryption industry include the rise in cyber threats, increasing data security regulations, growing demand for secure communication, and advancements in encryption technology, fostering innovation.

Which region is the fastest Growing in the optical encryption market?

The fastest-growing region in the optical encryption market is North America, expected to expand from $0.83 billion in 2023 to $3.78 billion by 2033, driven by technological advancements and high demand for data security.

Does ConsaInsights provide customized market report data for the optical encryption industry?

Yes, ConsaInsights offers tailored market report data for the optical encryption industry, catering to specific business needs, enabling companies to access detailed insights relevant to their objectives.

What deliverables can I expect from this optical encryption market research project?

Expect comprehensive deliverables such as detailed market analysis, growth projections, competitive landscape insights, and segment data for diverse industries such as IT, banking, defense, and healthcare.

What are the market trends of optical encryption?

Market trends in optical encryption include the shift towards quantum encryption techniques, increased investment in cybersecurity infrastructure, the rise of hybrid solutions, and expanding applications across various sectors, enhancing security.