Optical Sorter Market Report

Published Date: 22 January 2026 | Report Code: optical-sorter

Optical Sorter Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive insight into the Optical Sorter market from 2023 to 2033. It covers market size, segmentation, regional analysis, and forecasts, alongside trends, technology insights, and profiles of key players in the industry.

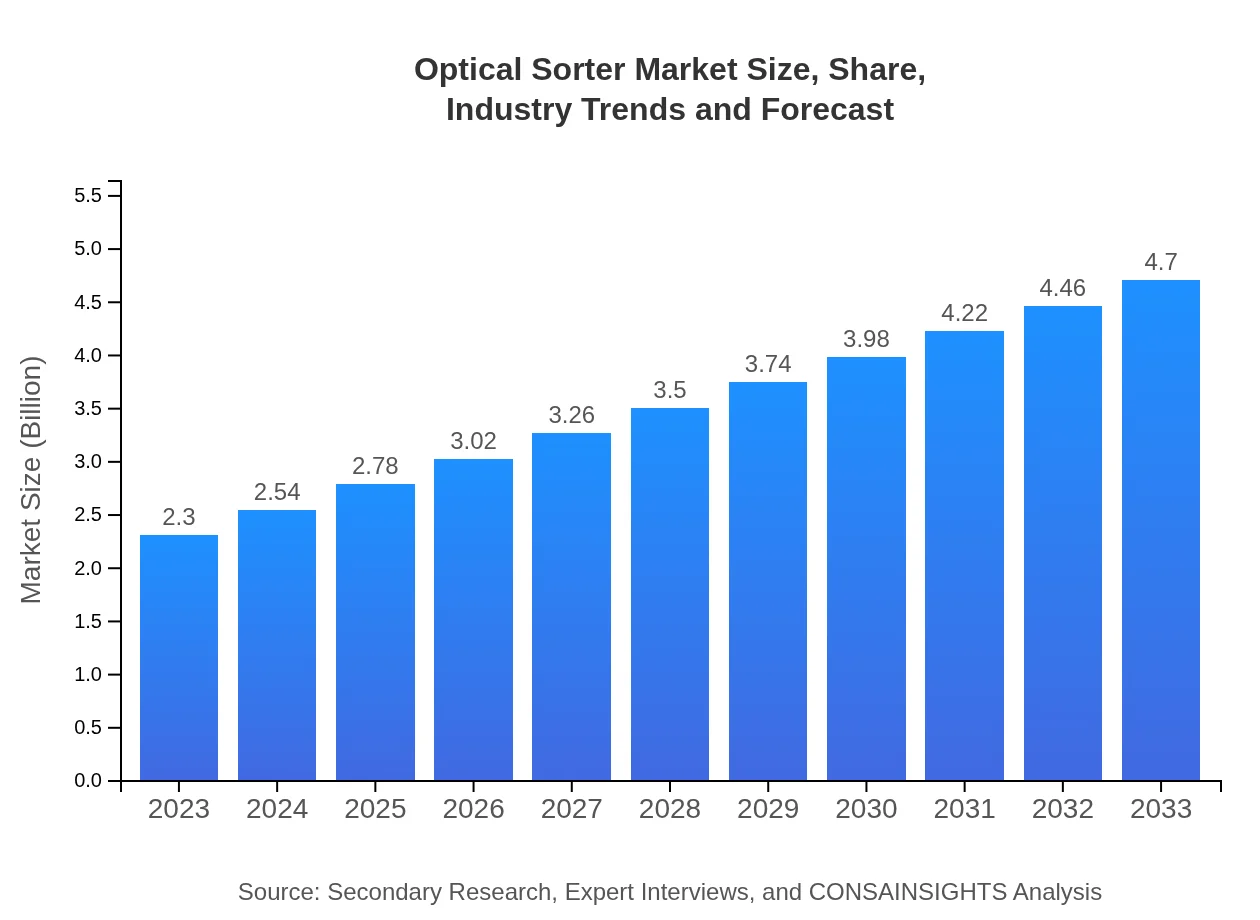

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.30 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $4.70 Billion |

| Top Companies | Tomra Systems ASA, Key Technology, Inc., Sesotec GmbH, Bulkmatic |

| Last Modified Date | 22 January 2026 |

Optical Sorter Market Overview

Customize Optical Sorter Market Report market research report

- ✔ Get in-depth analysis of Optical Sorter market size, growth, and forecasts.

- ✔ Understand Optical Sorter's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Optical Sorter

What is the Market Size & CAGR of Optical Sorter market in 2023?

Optical Sorter Industry Analysis

Optical Sorter Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Optical Sorter Market Analysis Report by Region

Europe Optical Sorter Market Report:

Europe's Optical Sorter market is projected to increase from $0.76 billion in 2023 to $1.56 billion by 2033, benefiting from stringent regulations on food safety and waste management. Countries like Germany and the UK are leading the investment in optical sorting technologies.Asia Pacific Optical Sorter Market Report:

The Asia Pacific region, projected to grow from a market size of $0.40 billion in 2023 to $0.82 billion by 2033, is witnessing increased demand for optical sorting solutions driven by rapid industrialization and urbanization. Moreover, investments in advanced food processing and recycling technologies further boost market growth.North America Optical Sorter Market Report:

North America will see growth from $0.82 billion in 2023 to $1.68 billion by 2033, fueled by the rise in automation and technological advancements across industries. The U.S. has been at the forefront of adopting innovative optical sorting systems, enhancing productivity in food processing and recycling.South America Optical Sorter Market Report:

In South America, the Optical Sorter market is expected to double from $0.19 billion in 2023 to $0.39 billion by 2033. Continued emphasis on sustainable practices in waste management and agriculture presents opportunities for growth, particularly in Brazil and Argentina.Middle East & Africa Optical Sorter Market Report:

The market in the Middle East and Africa is poised to grow from $0.12 billion in 2023 to $0.25 billion by 2033. The region's focus on improving plastic waste management and food quality will drive the adoption of optical sorting technologies.Tell us your focus area and get a customized research report.

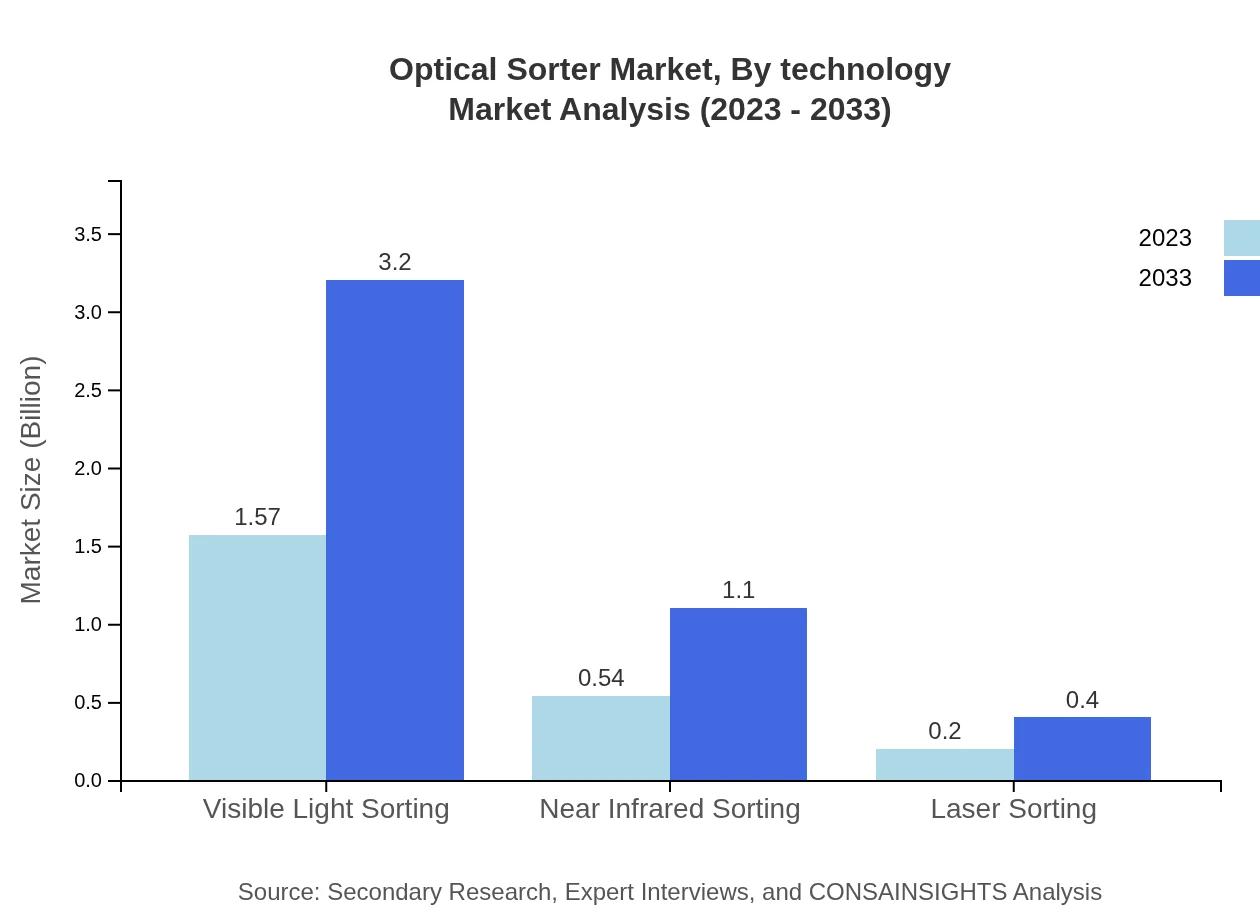

Optical Sorter Market Analysis By Technology

The market for Optical Sorters divided by technology shows significant differentiation. The Visible Light Sorting segment leads the market with a size of $1.57 billion in 2023, expanding to $3.20 billion by 2033, holding a dominant market share of 68.11%. Near Infrared Sorting follows with a growth from $0.54 billion to $1.10 billion, maintaining a 23.3% share over the period. Laser Sorting remains a smaller segment but is expected to see steady growth within niche applications.

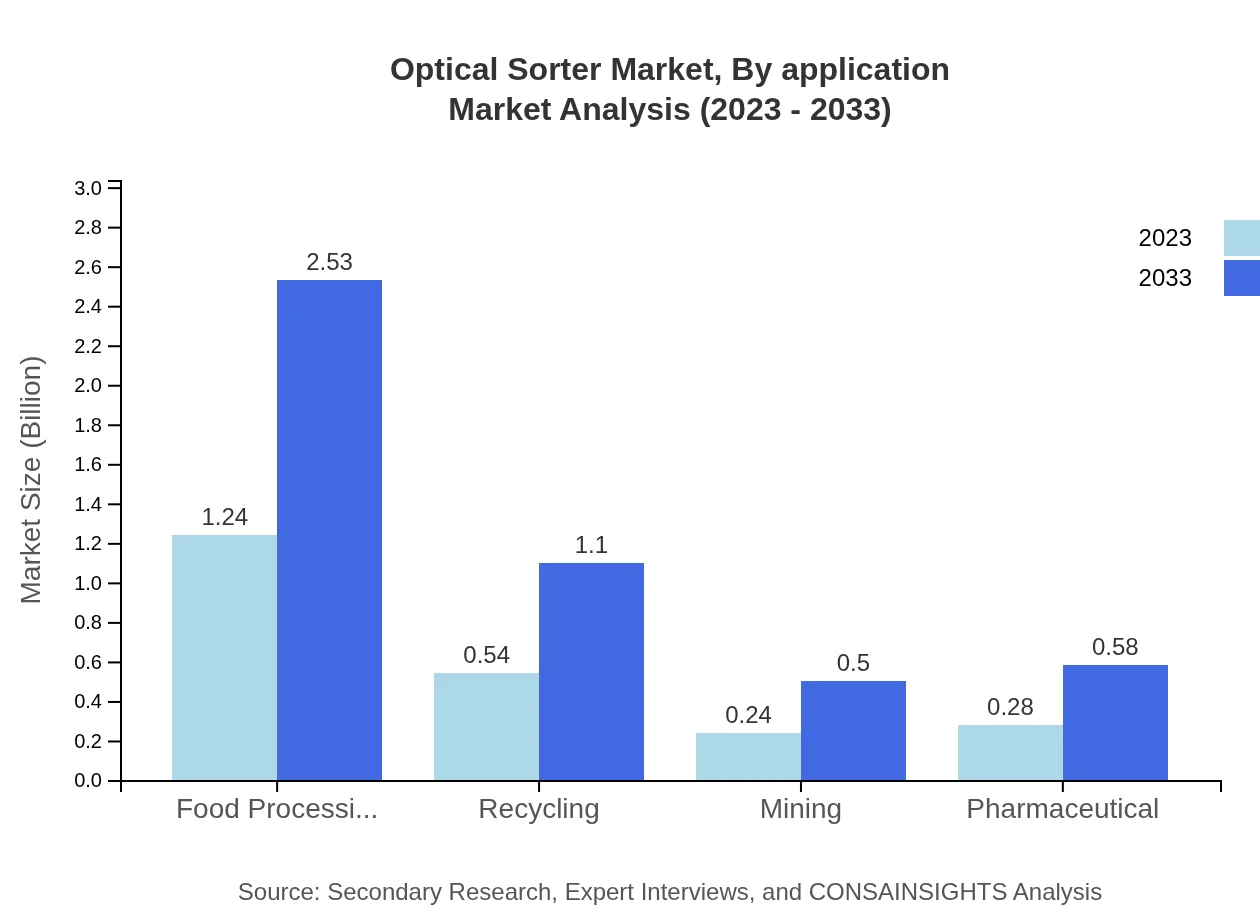

Optical Sorter Market Analysis By Application

In the application segment, Food Processing dominates with market sizes of $1.24 billion in 2023, anticipated to escalate to $2.53 billion by 2033, accounting for a 53.71% market share. Waste Management follows, showing growth from $0.54 billion to $1.10 billion, also with a significant share of 23.37%. This indicates strong reliance on optical sorting systems in processing to enhance quality and reduce waste.

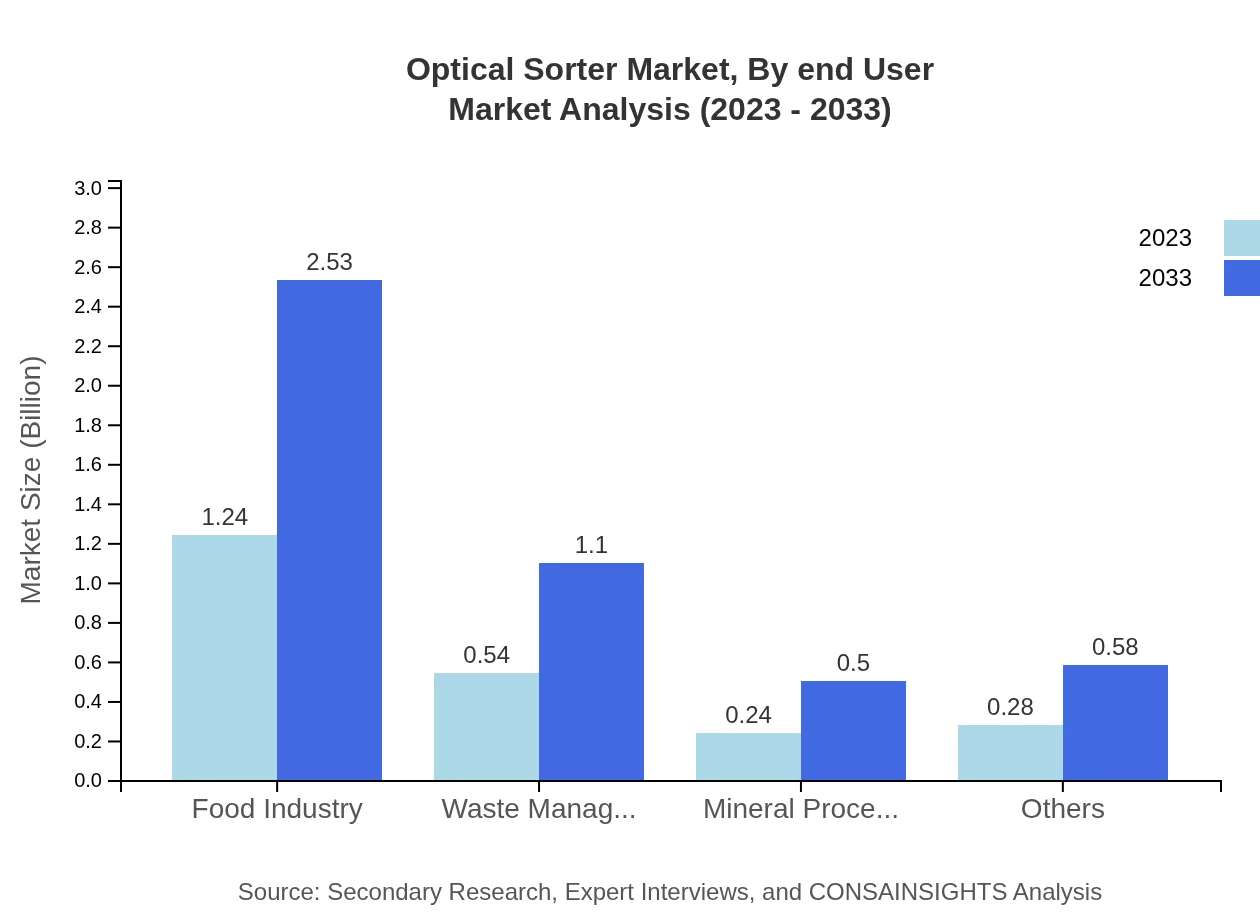

Optical Sorter Market Analysis By End User

The end-user analysis highlights the Food Industry as the leading sector for optical sorting technologies, projected to grow from $1.24 billion in 2023 to $2.53 billion by 2033, emphasizing its critical role in ensuring food safety and quality. Other key sectors include Waste Management and Recycling, anticipated to grow from $0.54 billion to $1.10 billion, indicating heightened focus on sustainability.

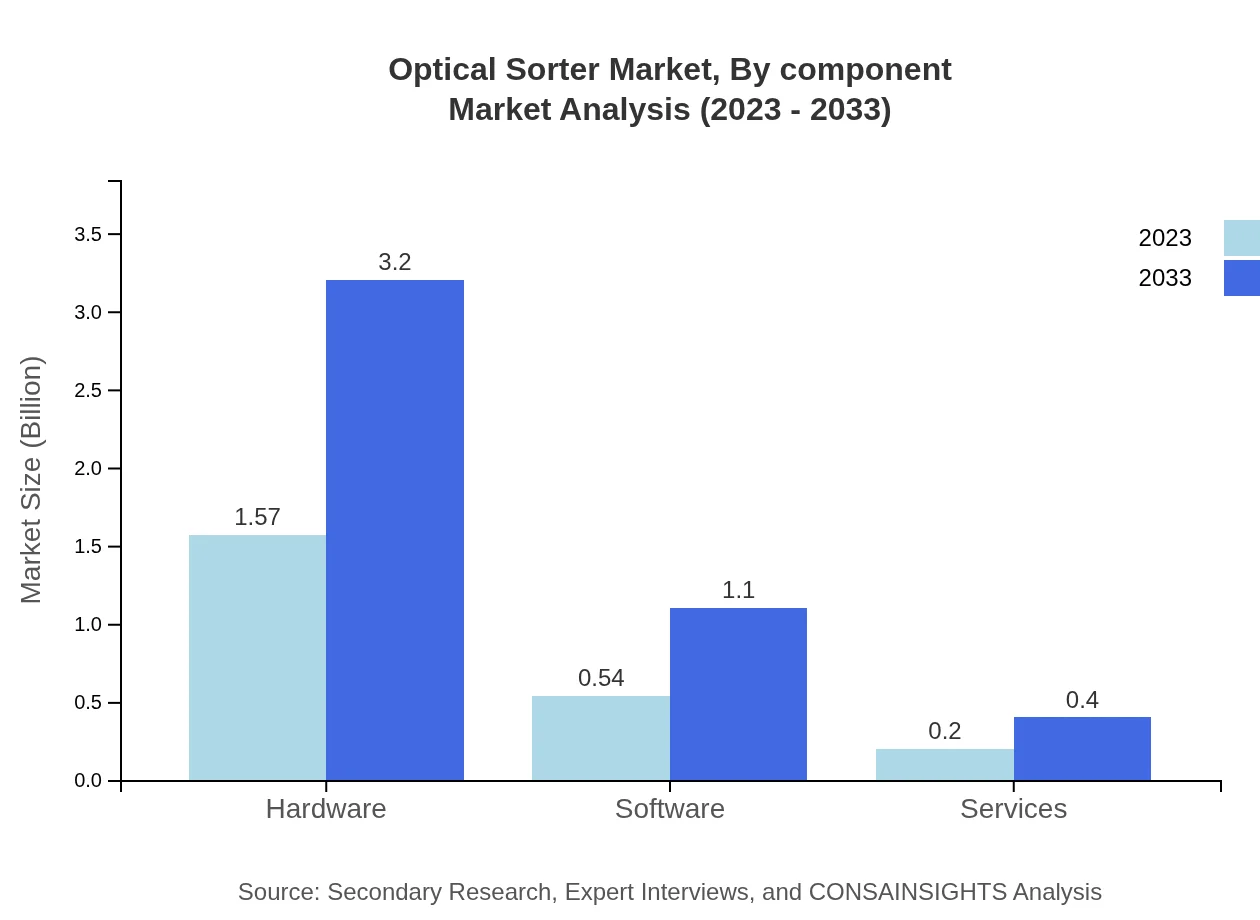

Optical Sorter Market Analysis By Component

When analyzing by component, the hardware segment leads with a 68.11% share, expanding from $1.57 billion in 2023 to $3.20 billion by 2033. Software solutions are also vital, expected to grow alongside hardware, moving from $0.54 billion to $1.10 billion. As technology evolves, integration and compatibility between software and hardware components will drive market growth.

Optical Sorter Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Optical Sorter Industry

Tomra Systems ASA:

Tomra is a leading provider of sensor-based sorting solutions, specializing in the food and recycling industries. Their innovations have set the standard for the Optical Sorter market.Key Technology, Inc.:

Key Technology offers high-performance optical sorting equipment, primarily focusing on food processing, and delivers comprehensive sortation solutions designed to increase efficiency.Sesotec GmbH:

Sesotec is a major player in the market known for its cutting-edge technology in contamination detection and removal, ensuring product quality in various industries.Bulkmatic:

Bulkmatic specializes in bulk material handling and offers advanced optical sorting solutions in the recycling industry.We're grateful to work with incredible clients.

FAQs

What is the market size of optical Sorter?

The optical sorter market is currently valued at $2.3 billion in 2023, with a strong growth projection at a CAGR of 7.2%. This indicates a robust demand and expansion in various applications across industries.

What are the key market players or companies in the optical Sorter industry?

Key players in the optical sorter industry include established companies that specialize in advanced sorting technologies and automated solutions. They are focused on product innovation and expanding their market presence globally.

What are the primary factors driving the growth in the optical sorter industry?

Factors driving growth include technological advancements in sorting technology, increasing demand for food safety, and a rise in recycling practices. These elements contribute significantly to the market's expansion across several sectors.

Which region is the fastest Growing in the optical sorter market?

The fastest-growing region in the optical sorter market is Asia Pacific, with a projected market value increase from $0.40 billion in 2023 to $0.82 billion by 2033. This reflects the region's rising industrial activities.

Does ConsaInsights provide customized market report data for the optical Sorter industry?

Yes, ConsaInsights offers customized market report data tailored to specific interests within the optical sorter industry. Clients can request detailed insights and analytics based on their unique requirements.

What deliverables can I expect from this optical Sorter market research project?

Documented deliverables from the optical sorter market research include comprehensive reports, data analytics, segment analysis, and strategic recommendations that cater to client needs for informed decision-making.

What are the market trends of optical sorter?

Current trends in the optical sorter market include increasing automation, the adoption of AI in sorting processes, and growth in industries such as food processing and recycling, highlighting shifting consumer preferences for quality.