Packaging Foams Market Report

Published Date: 02 February 2026 | Report Code: packaging-foams

Packaging Foams Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Packaging Foams market, providing comprehensive insights from 2023 to 2033, covering market dynamics, trends, segmentation, regional analysis, and key players shaping the industry landscape.

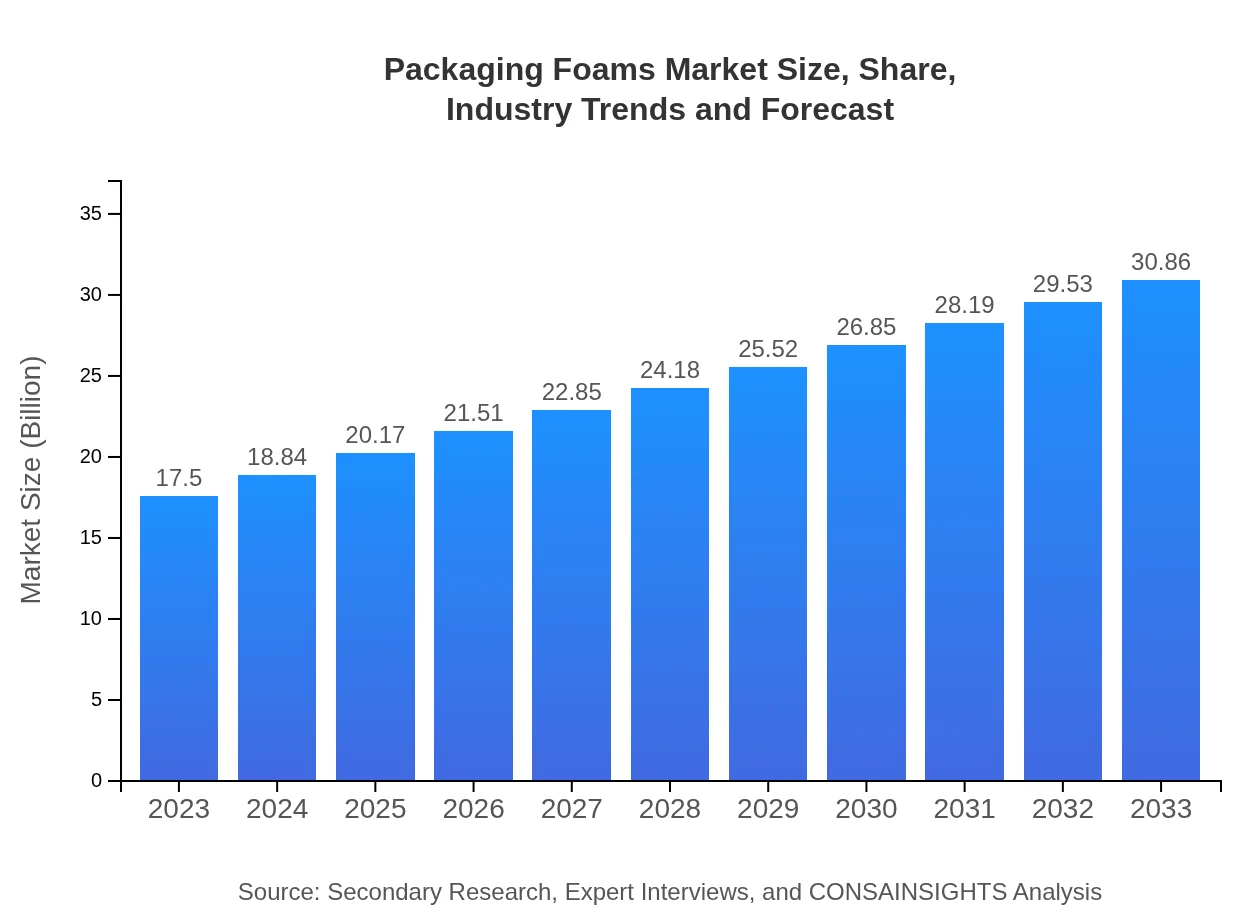

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $17.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $30.86 Billion |

| Top Companies | BASF SE, Sealed Air Corporation, Dow Chemical Company, Zotefoams plc |

| Last Modified Date | 02 February 2026 |

Packaging Foams Market Overview

Customize Packaging Foams Market Report market research report

- ✔ Get in-depth analysis of Packaging Foams market size, growth, and forecasts.

- ✔ Understand Packaging Foams's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Packaging Foams

What is the Market Size & CAGR of Packaging Foams market in 2023 and 2033?

Packaging Foams Industry Analysis

Packaging Foams Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Packaging Foams Market Analysis Report by Region

Europe Packaging Foams Market Report:

Europe's market for Packaging Foams is forecasted to expand from USD 5.68 billion in 2023 to USD 10.02 billion by 2033. The region emphasizes sustainable packaging solutions, boosting demand for eco-friendly foams across various applications.Asia Pacific Packaging Foams Market Report:

The Asia Pacific region, with a market size of USD 3.30 billion in 2023 and projected to reach USD 5.81 billion by 2033, is witnessing substantial growth driven by rapid industrialization and increasing disposable incomes that fuel demand for packaged goods.North America Packaging Foams Market Report:

North America is a strong market for Packaging Foams, valued at USD 6.21 billion in 2023, growing to USD 10.94 billion by 2033. The region is characterized by high demand in the electronics and automotive sectors, driving innovation in packaging solutions.South America Packaging Foams Market Report:

In South America, the market is smaller, estimated at USD 0.38 billion in 2023 and expected to grow to USD 0.67 billion by 2033, as the packaging industry expands alongside economic development and improved manufacturing capabilities.Middle East & Africa Packaging Foams Market Report:

The Middle East and Africa have a market size of USD 1.94 billion in 2023, expected to increase to USD 3.42 billion by 2033. Growth in this region is fueled by infrastructure developments and increasing food safety regulations enhancing demand for specialized food packaging.Tell us your focus area and get a customized research report.

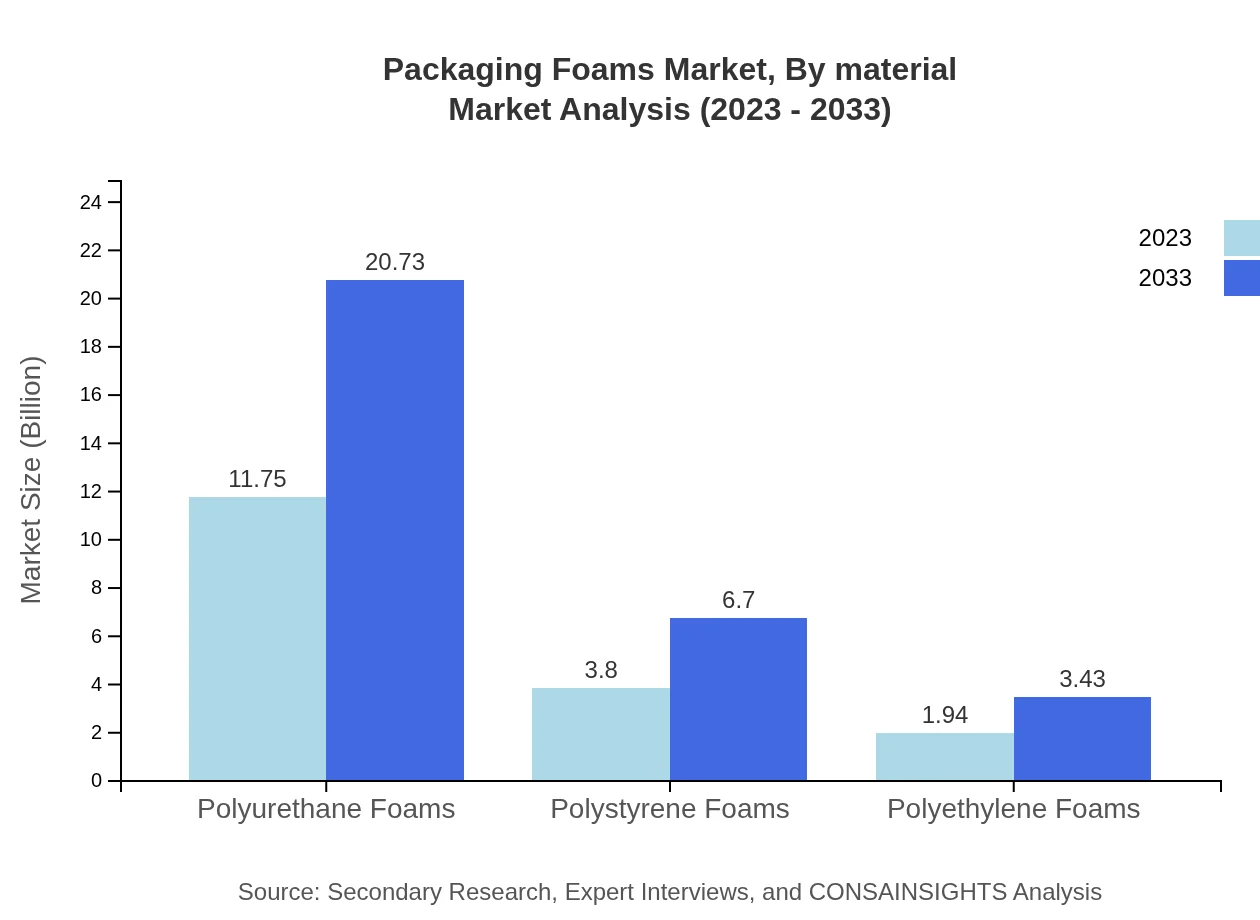

Packaging Foams Market Analysis By Material

The major material types in the Packaging Foams market include polyurethane, polystyrene, and polyethylene. Polyurethane foams dominate the market due to their versatility and excellent cushioning properties. In 2023, the market size for polyurethane foams is USD 11.75 billion, expected to grow to USD 20.73 billion by 2033, accounting for approximately 67.17% market share within the segment.

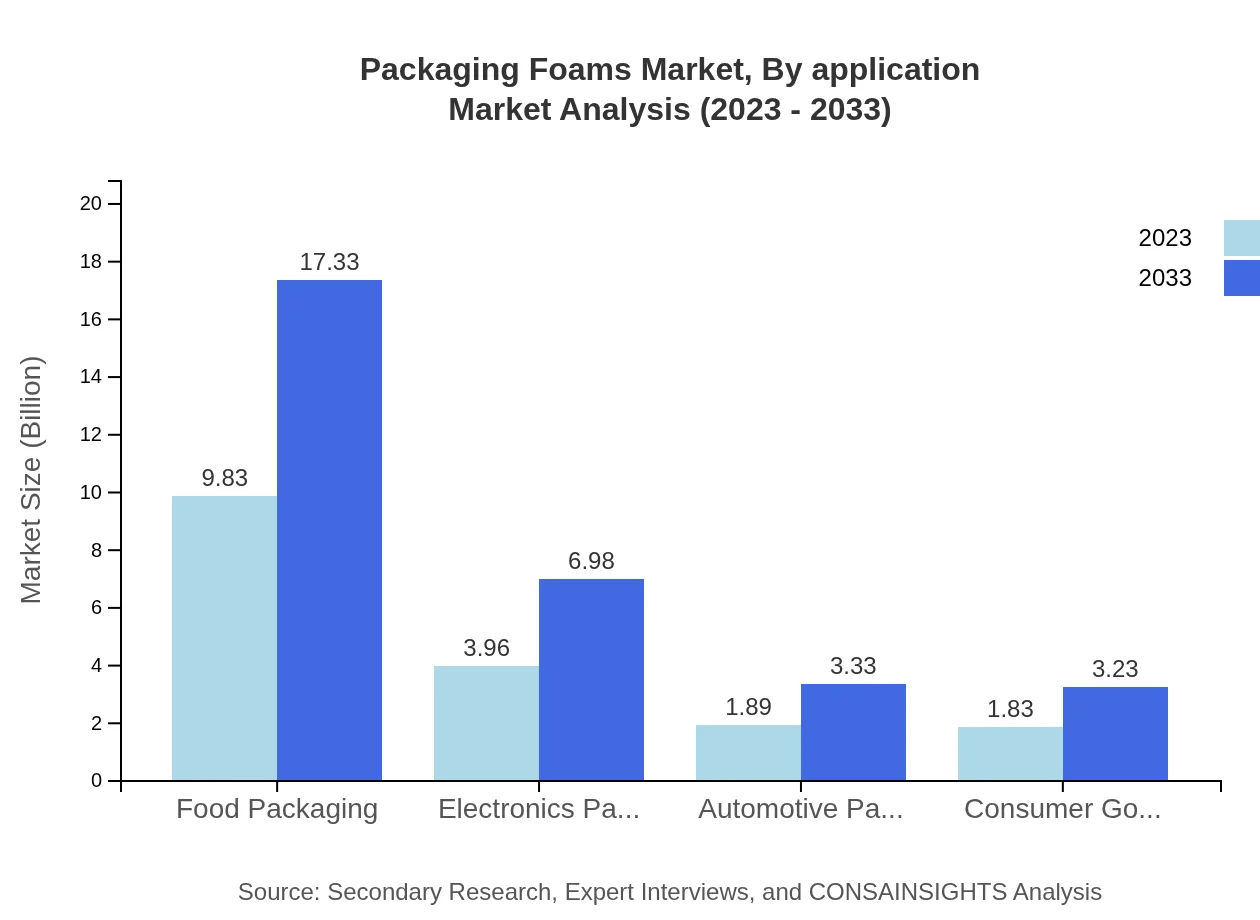

Packaging Foams Market Analysis By Application

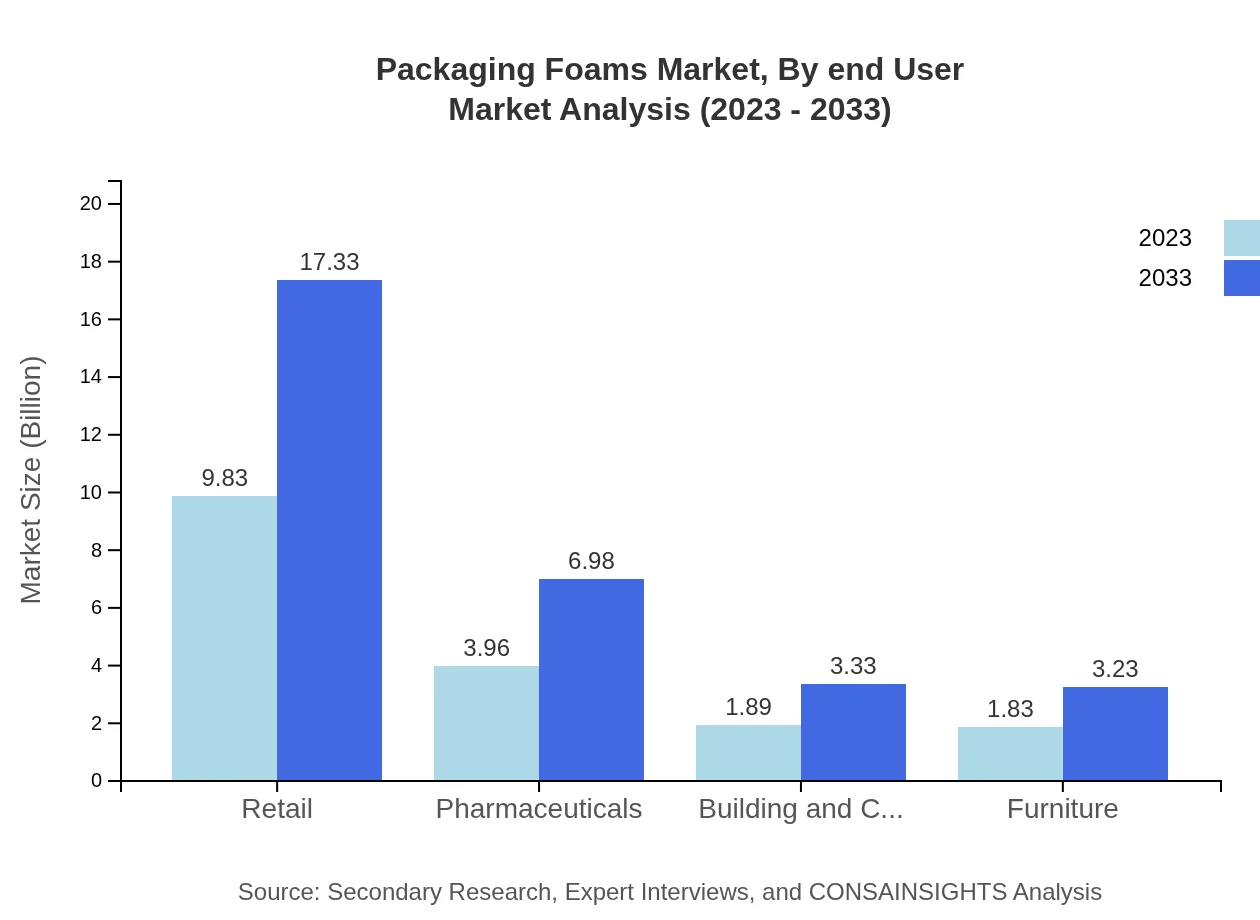

The applications of Packaging Foams are broad, covering food packaging, pharmaceuticals, electronics, and automotive sectors. Food packaging holds the largest market share at 56.15%, valued at USD 9.83 billion in 2023, and is projected to reach USD 17.33 billion by 2033. This growth reflects the increasing demand for safe food handling and transport solutions.

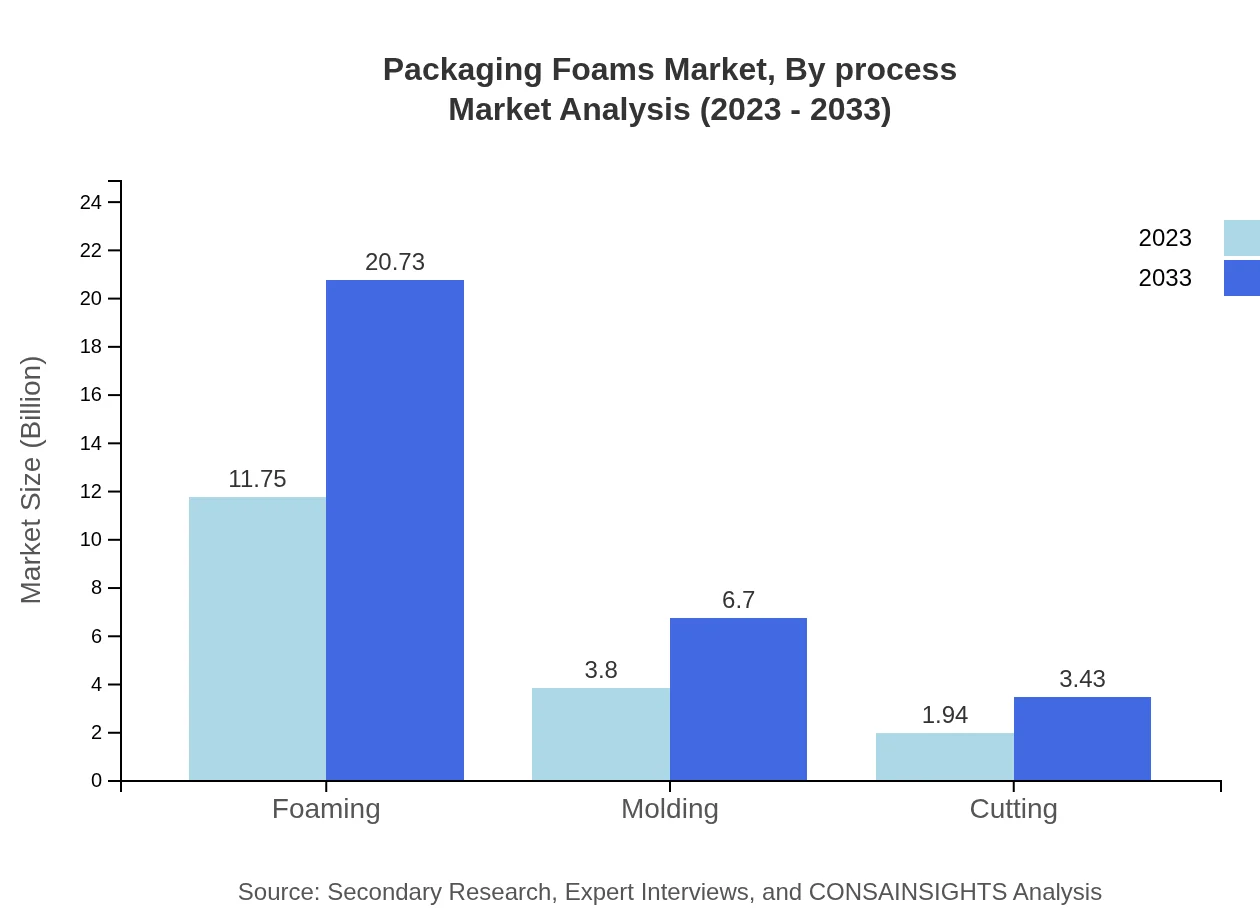

Packaging Foams Market Analysis By Process

The processes involved in manufacturing Packaging Foams include foaming, cutting, molding, and shaping. Foaming is the leading process, accounting for 67.17% of the market share in 2023, with a size of USD 11.75 billion, expected to grow to USD 20.73 billion by 2033, driven by technological advancements enhancing foaming efficiency.

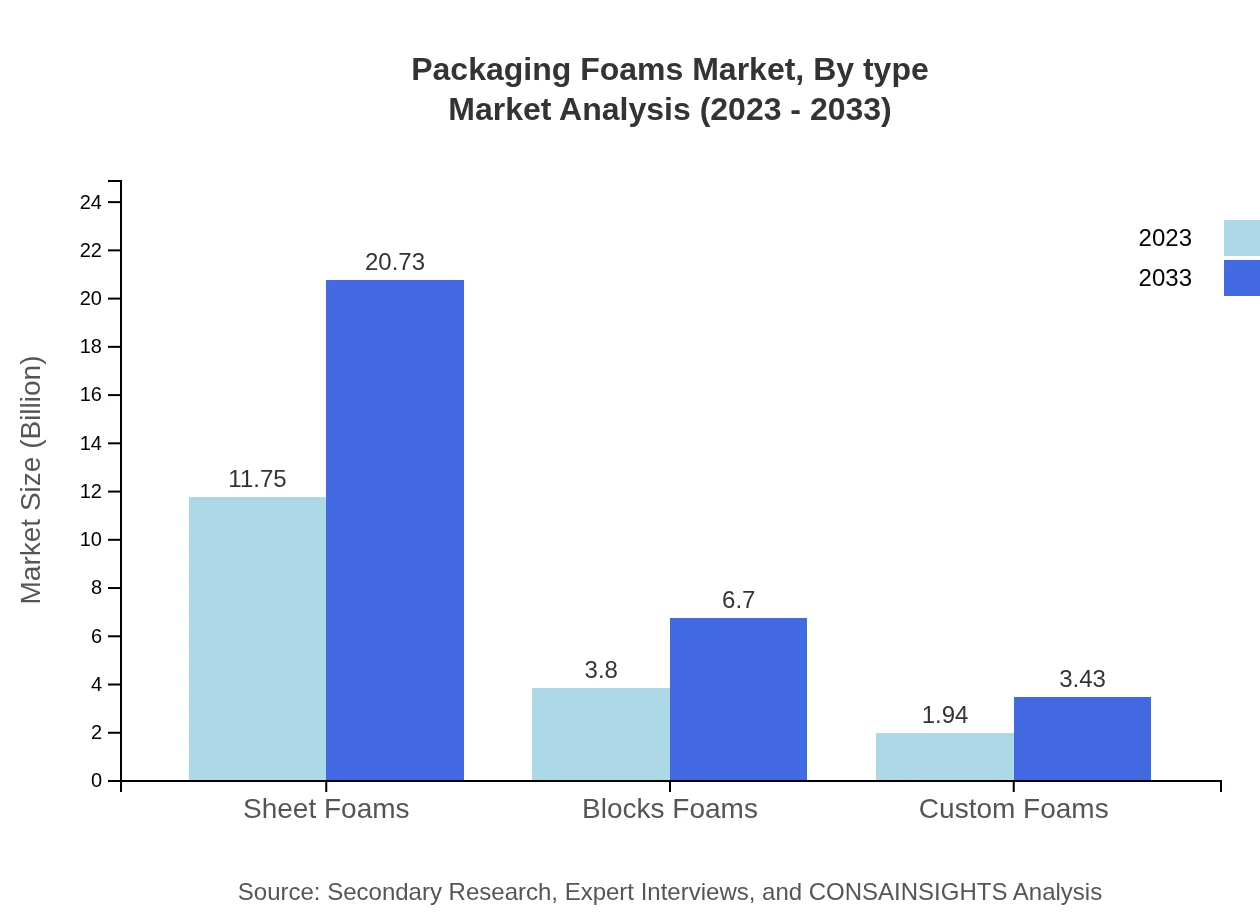

Packaging Foams Market Analysis By Type

The market is segmented into types including sheet foams, block foams, and custom foams. Sheet foams occupy a significant portion of the market with a size of USD 11.75 billion in 2023 and anticipated to grow to USD 20.73 billion by 2033, representing market resilience with consistent demand across industries.

Packaging Foams Market Analysis By End User

Key end-user industries include food and beverage, pharmaceuticals, electronics, and automotive. The food and beverage industry is the largest consumer of Packaging Foams, with 56.15% market share driven by a booming e-commerce sector and increasing consumer demand for packaged foods.

Packaging Foams Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Packaging Foams Industry

BASF SE:

A leading chemical company, BASF SE provides a range of polyurethane products and solutions for the Packaging Foams market, focusing on sustainability and innovation.Sealed Air Corporation:

Specializing in protective packaging solutions, Sealed Air Corporation is a key player in the Packaging Foams market with a strong emphasis on food safety and product protection.Dow Chemical Company:

Dow operates in various segments including packaging, providing innovative foam solutions that enhance product performance while focusing on reducing environmental impact.Zotefoams plc:

Zotefoams is known for its pioneering developments in foamed materials, producing high-performance packaging solutions that meet diverse customer needs.We're grateful to work with incredible clients.

FAQs

What is the market size of packaging foams?

The packaging foams market is projected to reach a size of $17.5 billion by 2033, growing at a CAGR of 5.7% from 2023. This significant growth is driven by increasing demand across various sectors such as food and electronics.

What are the key market players or companies in this packaging foams industry?

Key players in the packaging foams industry include major manufacturers and suppliers committed to innovation and sustainability. Companies such as Sealed Air Corporation, DuPont, and BASF are among the leaders contributing to market advancements and shaping industry standards.

What are the primary factors driving the growth in the packaging foams industry?

The growth of the packaging foams industry is driven by several factors, including rising e-commerce activities, increasing demand for lightweight packaging solutions, and the need for enhanced product protection during transit. Additionally, the shift towards sustainable packaging materials amplifies market growth.

Which region is the fastest Growing in the packaging foams?

The European region is the fastest-growing in the packaging foams market, projected to grow from $5.68 billion in 2023 to $10.02 billion by 2033. Growth is also notable in Asia-Pacific, increasing from $3.30 billion to $5.81 billion during the same period.

Does ConsaInsights provide customized market report data for the packaging foams industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the packaging foams industry. This service ensures that businesses have access to relevant insights and detailed information to make informed decisions.

What deliverables can I expect from this packaging foams market research project?

From the packaging foams market research project, clients can expect detailed reports including market size, growth forecasts, competitive analysis, and trends, as well as insights into consumer behavior and regional demand variations.

What are the market trends of packaging foams?

Key market trends in packaging foams include a growing preference for biodegradable materials, innovations in foam technology, and increasing collaborations among manufacturers to enhance product offerings. Additionally, there is a focus on reducing the carbon footprint in packaging.