Pet Food Market Report

Published Date: 01 February 2026 | Report Code: pet-food

Pet Food Market Size, Share, Industry Trends and Forecast to 2033

This detailed market report on Pet Food provides insights into market size, segmentation, regional analysis, and future trends from 2023 to 2033, aimed at helping stakeholders make informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

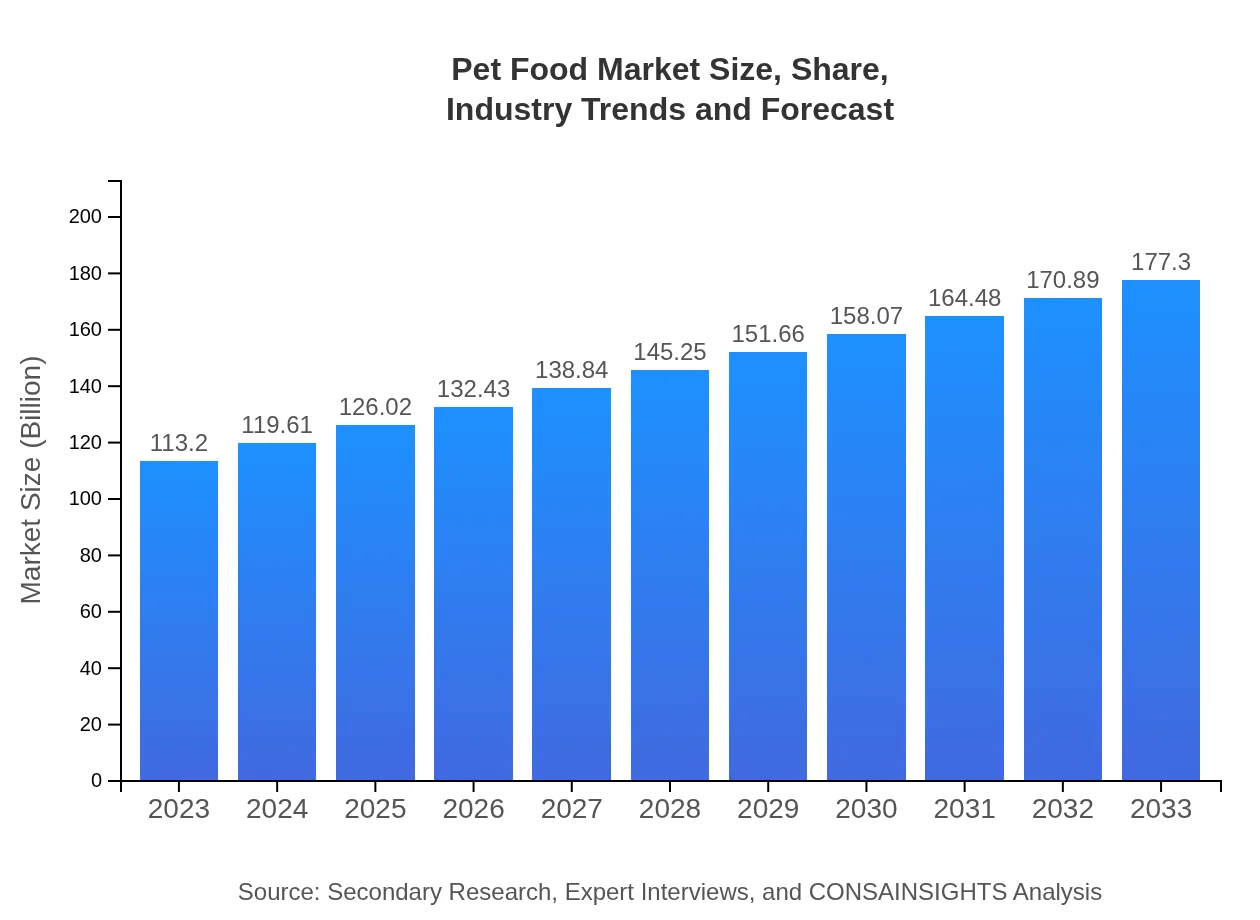

| 2023 Market Size | $113.20 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $177.30 Billion |

| Top Companies | Nestlé Purina PetCare, Mars Petcare, Hill's Pet Nutrition, Royal Canin |

| Last Modified Date | 01 February 2026 |

Pet Food Market Overview

Customize Pet Food Market Report market research report

- ✔ Get in-depth analysis of Pet Food market size, growth, and forecasts.

- ✔ Understand Pet Food's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pet Food

What is the Market Size & CAGR of Pet Food market in 2023 and 2033?

Pet Food Industry Analysis

Pet Food Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pet Food Market Analysis Report by Region

Europe Pet Food Market Report:

The European pet food market, valued at $35.75 billion in 2023, is expected to grow to $55.99 billion by 2033. The shift towards natural and organic food options is a noteworthy trend in this region.Asia Pacific Pet Food Market Report:

The Asia-Pacific region is experiencing rapid growth in the pet food market, estimated at $19.53 billion in 2023 and projected to reach $30.58 billion by 2033. The region’s growth is supported by increasing pet ownership and a demand for premium pet food products.North America Pet Food Market Report:

North America remains a leading region for pet food consumption, with a market size of $42.94 billion in 2023, projected to increase to $67.25 billion by 2033. The market is driven by high pet ownership rates and an increasing trend of premiumization.South America Pet Food Market Report:

In South America, the market value in 2023 is approximately $11.18 billion, with expectations to grow to $17.52 billion by 2033. Urbanization and changing lifestyles are fostering a surge in demand for quality pet food.Middle East & Africa Pet Food Market Report:

The Middle East and Africa region's pet food market is valued at $3.80 billion in 2023 and projected to reach $5.96 billion by 2033. The growing middle class and increasing pet ownership are contributing to this market growth.Tell us your focus area and get a customized research report.

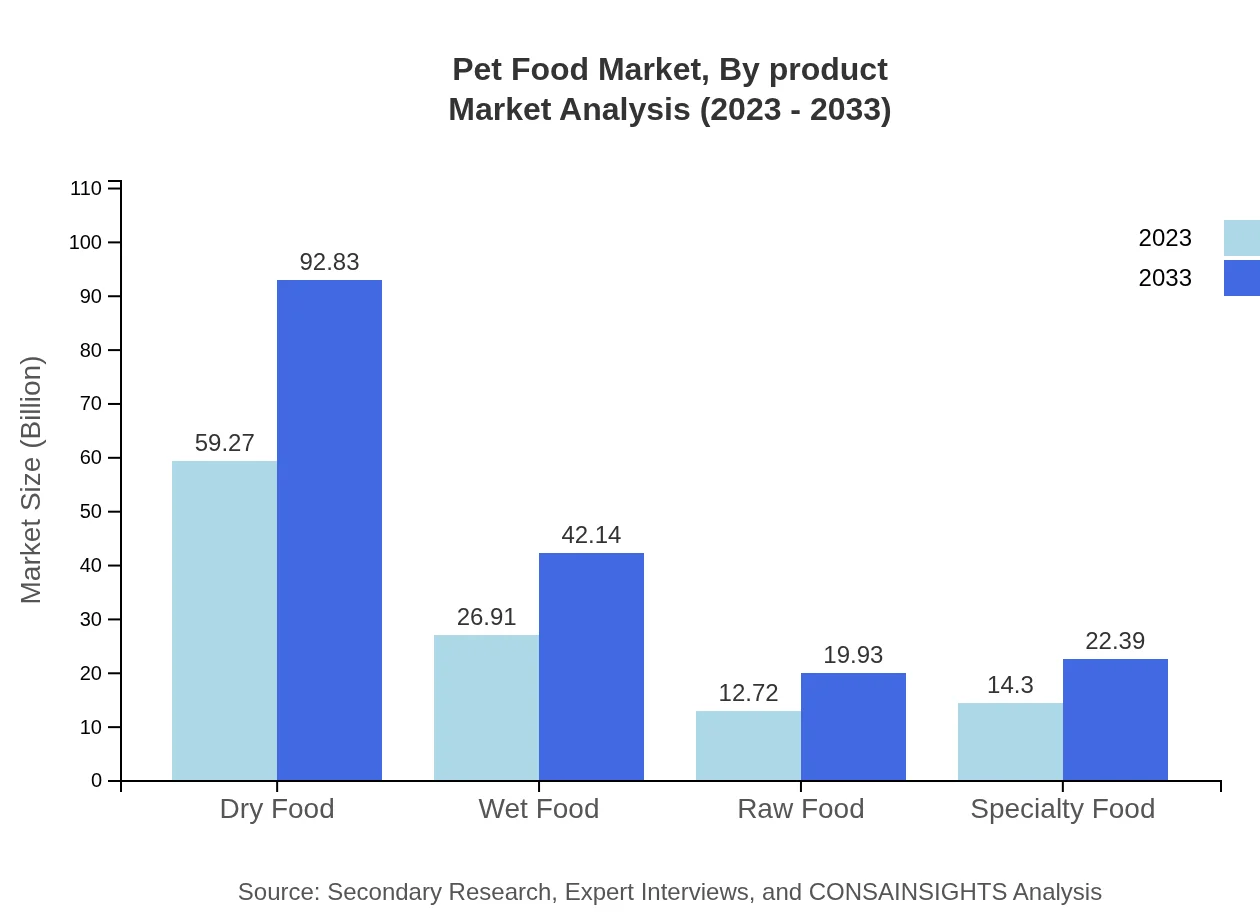

Pet Food Market Analysis By Product

The dry food segment dominates the market with a size of $59.27 billion in 2023, expected to grow to $92.83 billion by 2033. Wet food follows with a market size of $26.91 billion, anticipated to reach $42.14 billion. Raw food and specialty food are also gaining traction, reflecting consumer preference for natural and nutritious options.

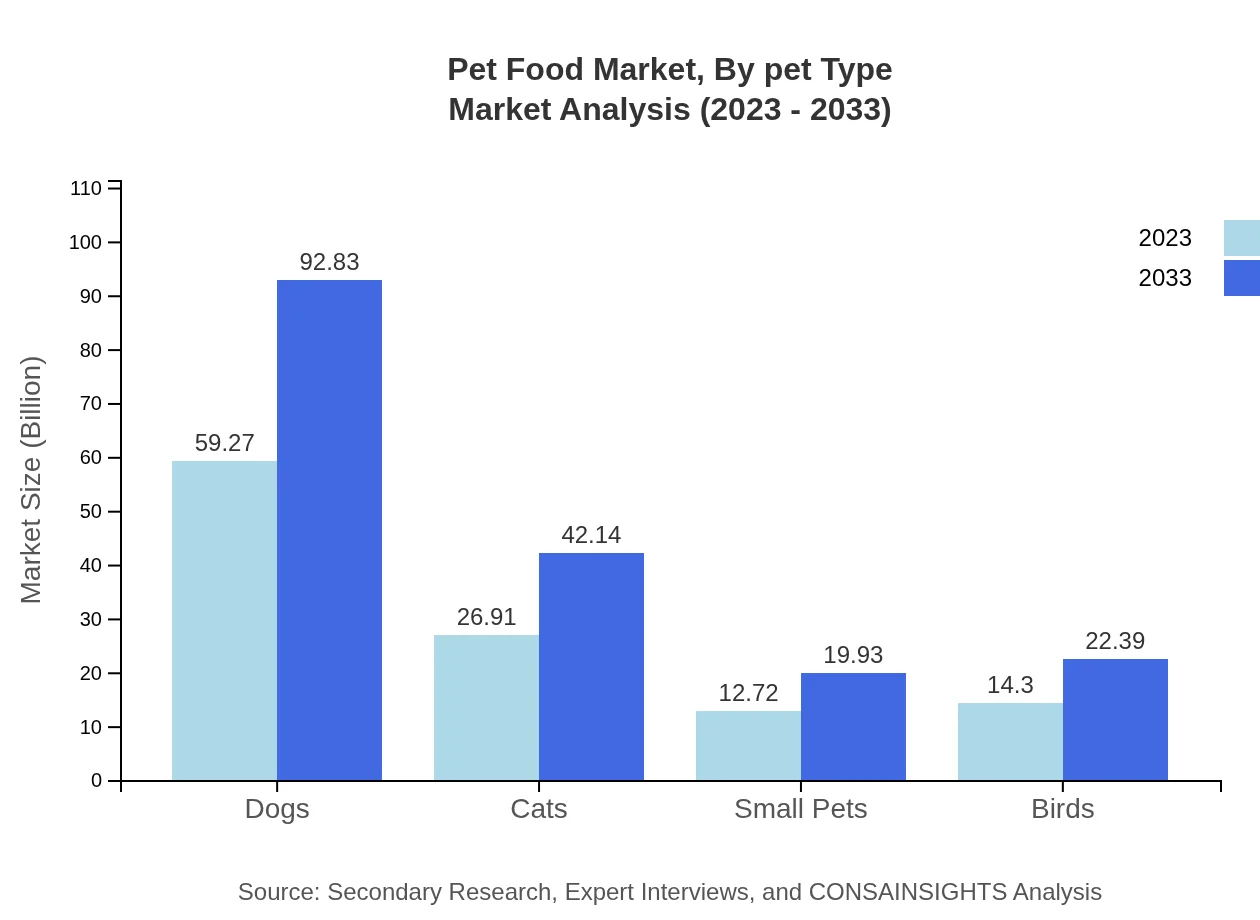

Pet Food Market Analysis By Pet Type

The pet type segment highlights significant growth for dog food with a market share of $59.27 billion in 2023, projected to grow to $92.83 billion by 2033. Cat food, valued at $26.91 billion in 2023, is poised for growth as well, attaining $42.14 billion by 2033. Small pets and birds also show compelling demand.

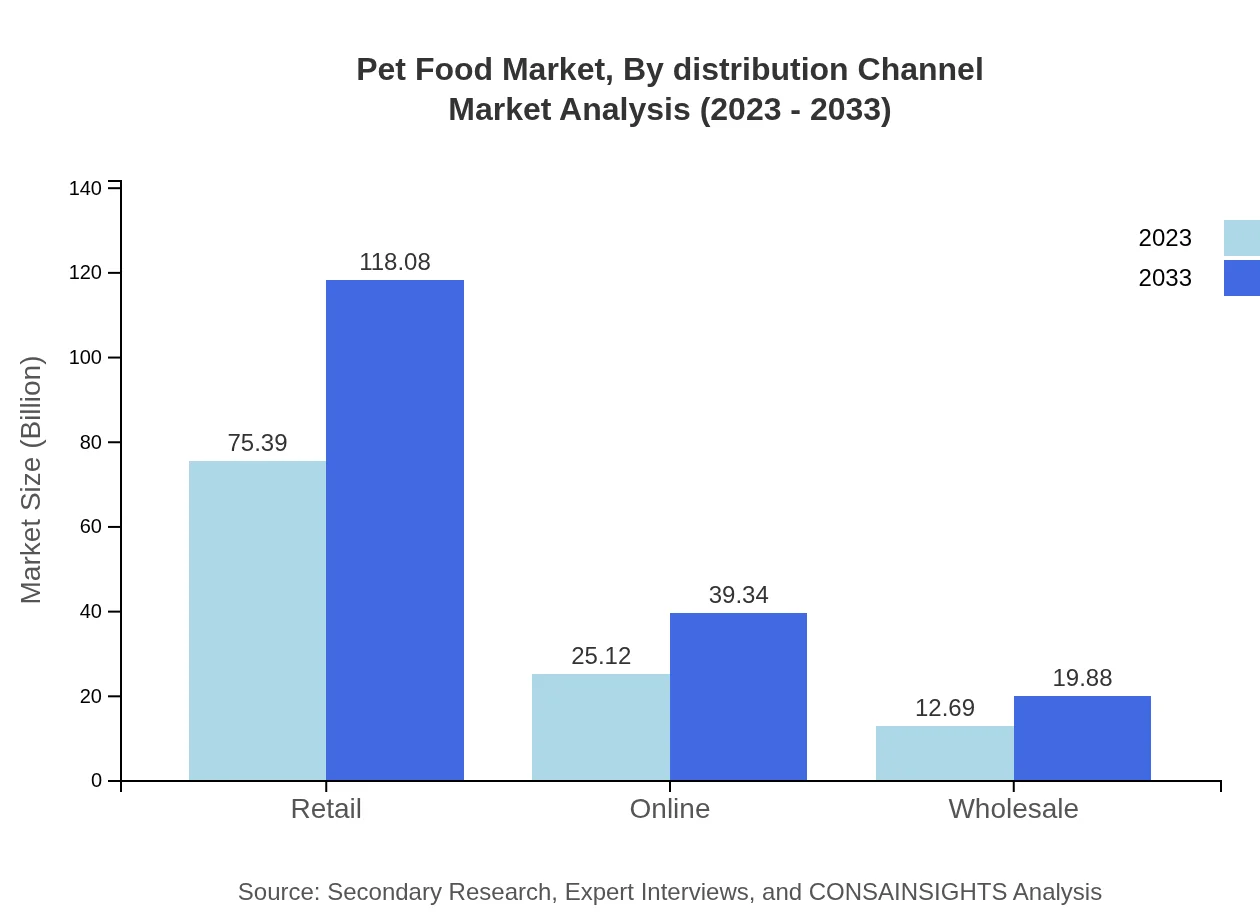

Pet Food Market Analysis By Distribution Channel

The retail segment accounts for a significant share of the pet food market, valued at $75.39 billion in 2023, expected to reach $118.08 billion by 2033. Online sales are also expanding rapidly, increasing from $25.12 billion to $39.34 billion in the same period.

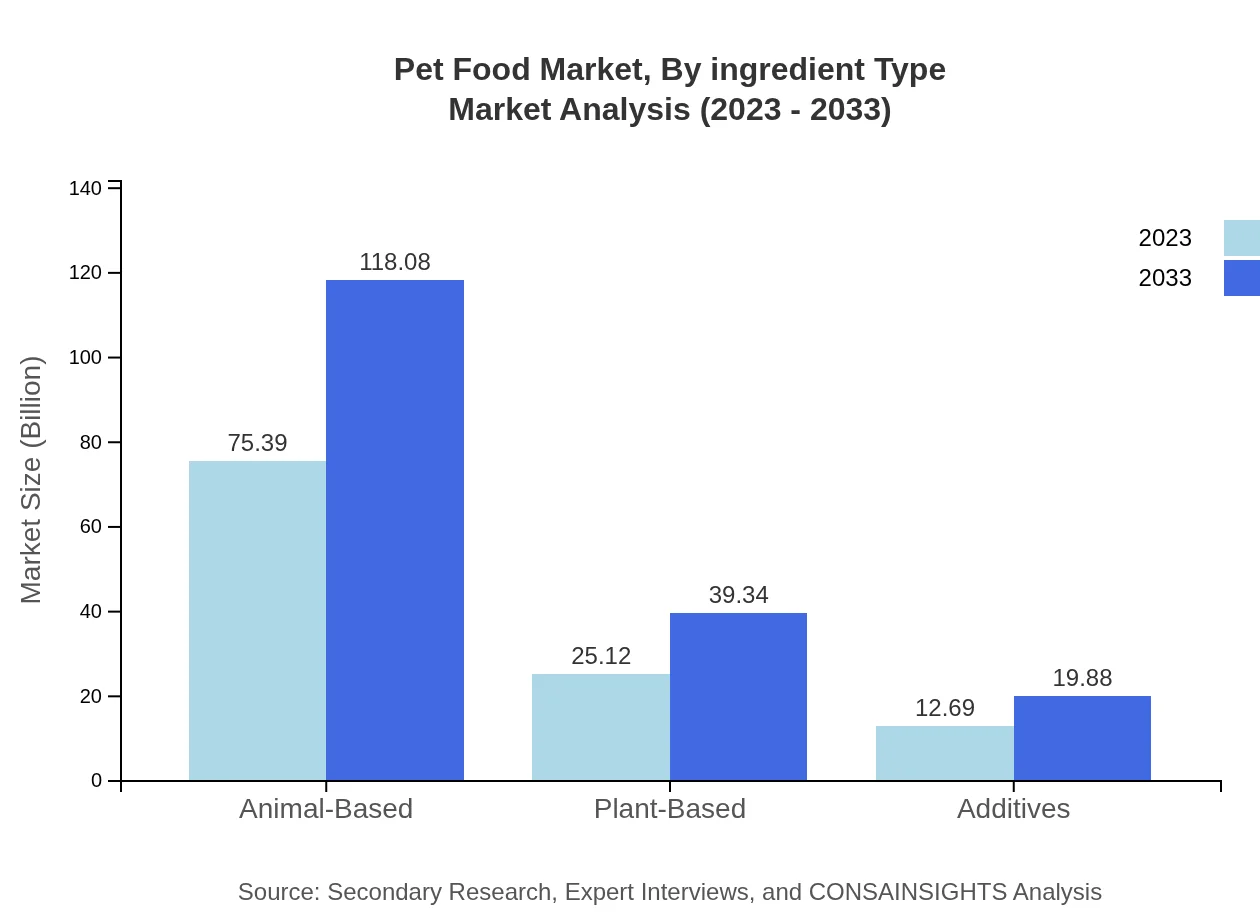

Pet Food Market Analysis By Ingredient Type

Animal-based ingredients are preferred, holding a market size of $75.39 billion in 2023, growing to $118.08 billion by 2033. Plant-based alternatives are also on the rise, from $25.12 billion to $39.34 billion, catering to specific consumer health preferences.

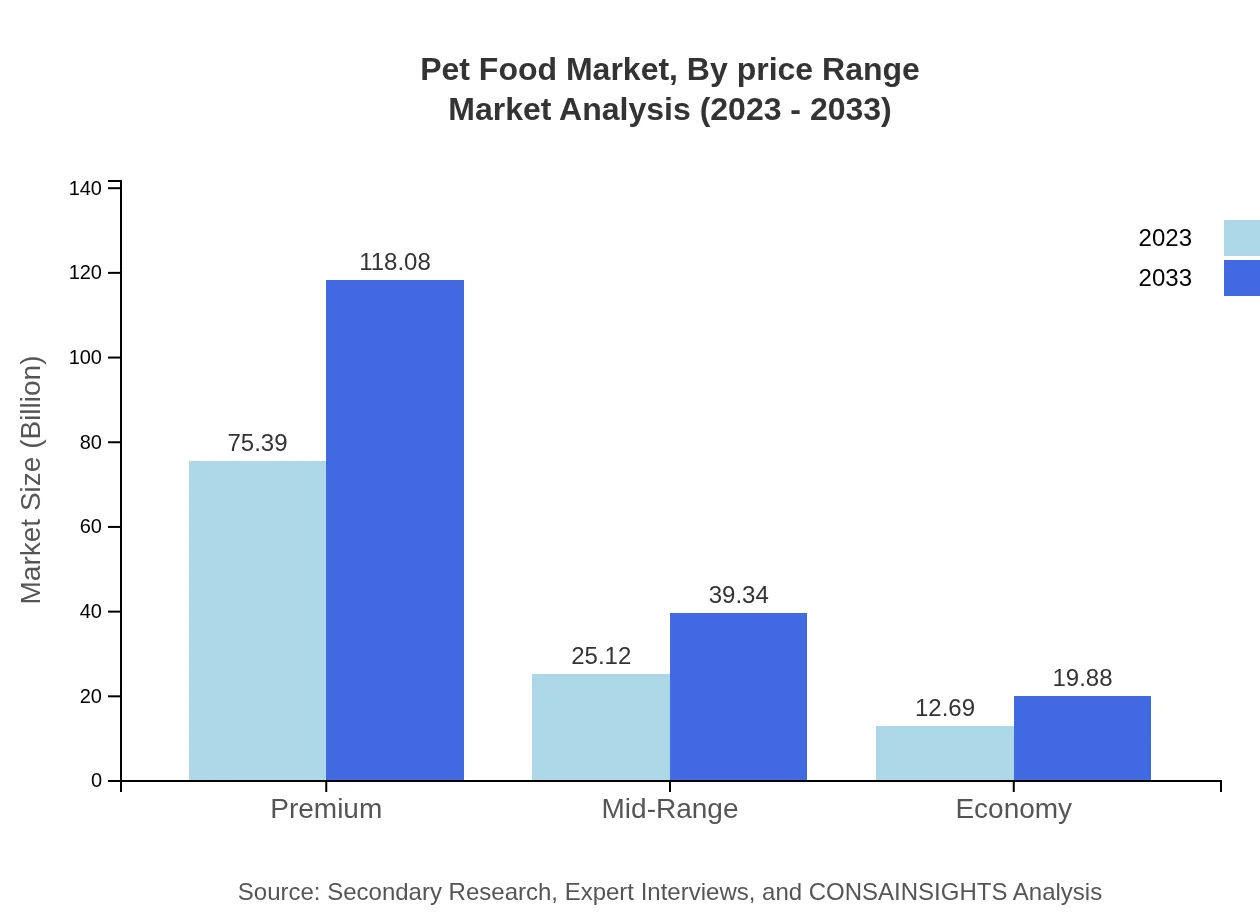

Pet Food Market Analysis By Price Range

The premium pet food segment leads the market at $75.39 billion in 2023, forecast to reach $118.08 billion by 2033. Mid-range and economy segments are also vital, reflecting varied consumer purchasing power and preferences.

Pet Food Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pet Food Industry

Nestlé Purina PetCare:

A global player in pet food, renowned for its innovative products and commitment to pet nutrition, operating many popular brands like Purina Pro Plan.Mars Petcare:

One of the largest pet food manufacturers worldwide, recognized for a diverse portfolio that includes iconic brands such as Pedigree and Whiskas.Hill's Pet Nutrition:

Specializes in pet food for health management, it's well-regarded for its science-based products and veterinary partnerships.Royal Canin:

Known for its specialized nutrition based on breed, size, and age, Royal Canin has a strong presence in both pet food and veterinary diets.We're grateful to work with incredible clients.

FAQs

What is the market size of Pet Food?

The global pet food market is valued at approximately $113.2 billion in 2023, with a projected CAGR of 4.5%. This growth indicates a strong consumer demand and evolving trends in pet care over the coming years.

What are the key market players or companies in the Pet Food industry?

Key market players in the pet food industry include major brands and manufacturers. These companies lead innovation, distribution, and marketing efforts, enhancing competition and product diversity in the pet food sector.

What are the primary factors driving growth in the Pet Food industry?

Factors driving growth in the pet food industry include rising pet ownership, increased disposable income, and growing awareness of pet nutrition. The demand for premium and specialized diets also plays a significant role in market expansion.

Which region is the fastest Growing in the Pet Food market?

North America is the fastest-growing region in the pet food market, projected to increase from $42.94 billion in 2023 to $67.25 billion by 2033. Europe and Asia Pacific also show robust growth trends in this industry.

Does ConsaInsights provide customized market report data for the Pet Food industry?

Yes, ConsaInsights offers customized market report data tailored to the pet food industry. This includes in-depth analysis, specific market segments, and trends to fit unique business needs.

What deliverables can I expect from this Pet Food market research project?

Deliverables from the pet food market research project include comprehensive market analysis, segment insights, competitive landscape overview, and forecasts. Clients receive actionable insights to support decision-making.

What are the market trends of Pet Food?

Current trends in the pet food market include a shift towards premium and specialty diets, growing demand for plant-based options, and an increase in online retail. Consumers prioritize nutrition and product quality for their pets.