Phenol Market Report

Published Date: 02 February 2026 | Report Code: phenol

Phenol Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Phenol market, covering key dynamics, trends, and forecasts from 2023 to 2033. Insights include market sizing, regional analysis, industry segmentation, and competitive landscape.

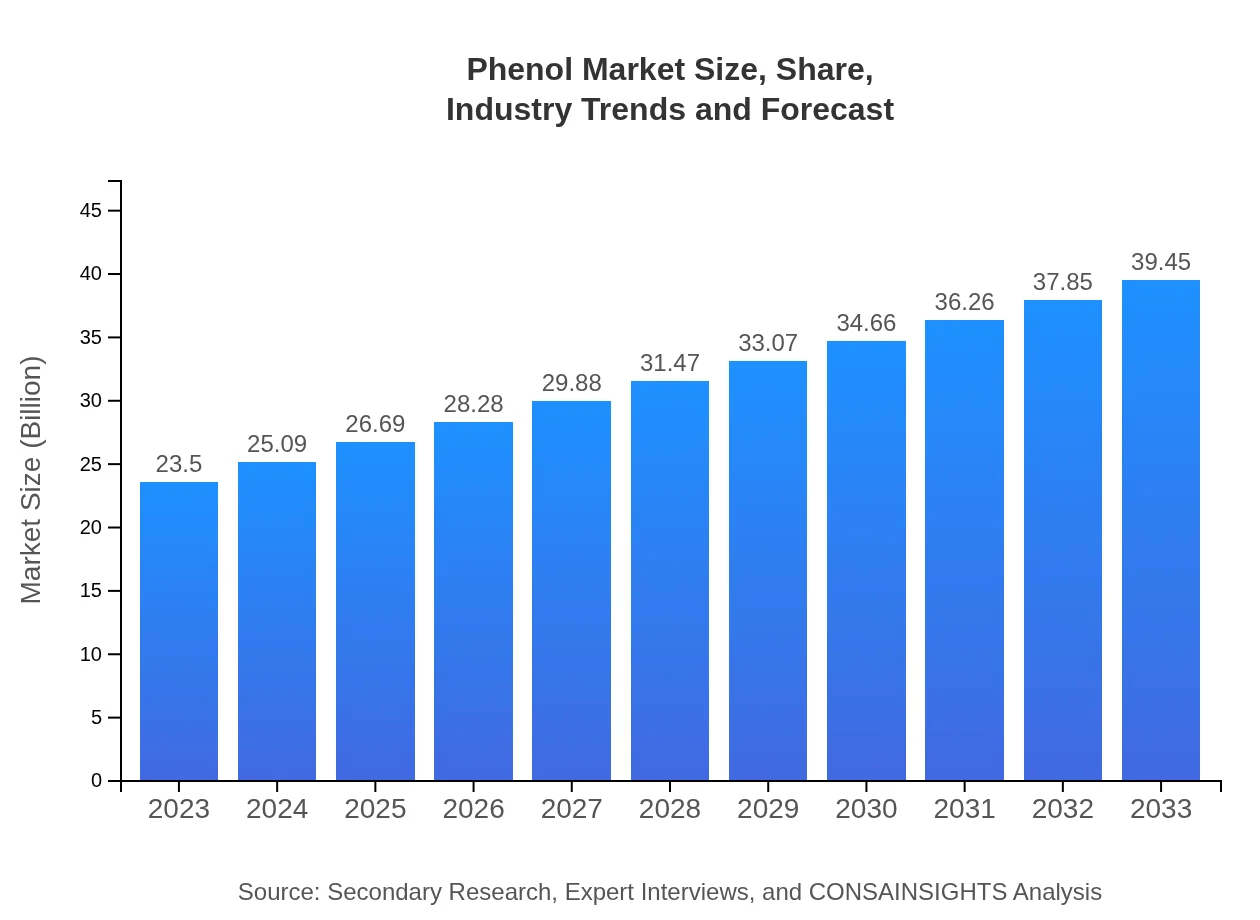

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $23.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $39.45 Billion |

| Top Companies | BASF, SI Group, Kraton Corporation, Ineos Phenol, Eastman Chemical Company |

| Last Modified Date | 02 February 2026 |

Phenol Market Overview

Customize Phenol Market Report market research report

- ✔ Get in-depth analysis of Phenol market size, growth, and forecasts.

- ✔ Understand Phenol's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Phenol

What is the Market Size & CAGR of Phenol market in 2023 and 2033?

Phenol Industry Analysis

Phenol Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Phenol Market Analysis Report by Region

Europe Phenol Market Report:

Europe is set to witness robust growth with the Phenol market expanding from $7.54 billion in 2023 to $12.65 billion by 2033. The region's stringent environmental policies encourage the adoption of sustainable chemical processes. Ongoing technological advancements and increased demand in sectors like construction and automotive contribute significantly to this positive outlook.Asia Pacific Phenol Market Report:

The Asia Pacific Phenol market is projected to grow from $4.88 billion in 2023 to $8.19 billion by 2033, driven by rising demands in the automotive and electronics sectors, particularly in China and India. The region’s rapid industrialization and urbanization are pivotal to this growth trajectory, alongside increasing investments in the chemical manufacturing base.North America Phenol Market Report:

North America’s Phenol market is estimated to grow from $7.56 billion in 2023 to $12.68 billion by 2033, propelled by a large-scale manufacturing base and strong investments in R&D. The U.S. remains a major hub for Phenol applications across key industries, including pharmaceuticals, consumer goods, and automotive sectors, augmented by innovations in production efficiency.South America Phenol Market Report:

Currently valued at $0.76 billion in 2023, the South American Phenol market is expected to reach $1.27 billion by 2033. Growth factors include expanding industrial bases in countries like Brazil and Argentina and increasing demand for pharmaceuticals and agricultural chemicals. However, market developments might be hindered by economic instability and fluctuating currency values.Middle East & Africa Phenol Market Report:

The Phenol market in the Middle East and Africa is anticipated to rise from $2.78 billion in 2023 to $4.66 billion by 2033. Factors influencing this growth include increased investments in petrochemical projects and rising demand from local manufacturing sectors. However, geopolitical tensions and economic fluctuations could pose challenges to market stability.Tell us your focus area and get a customized research report.

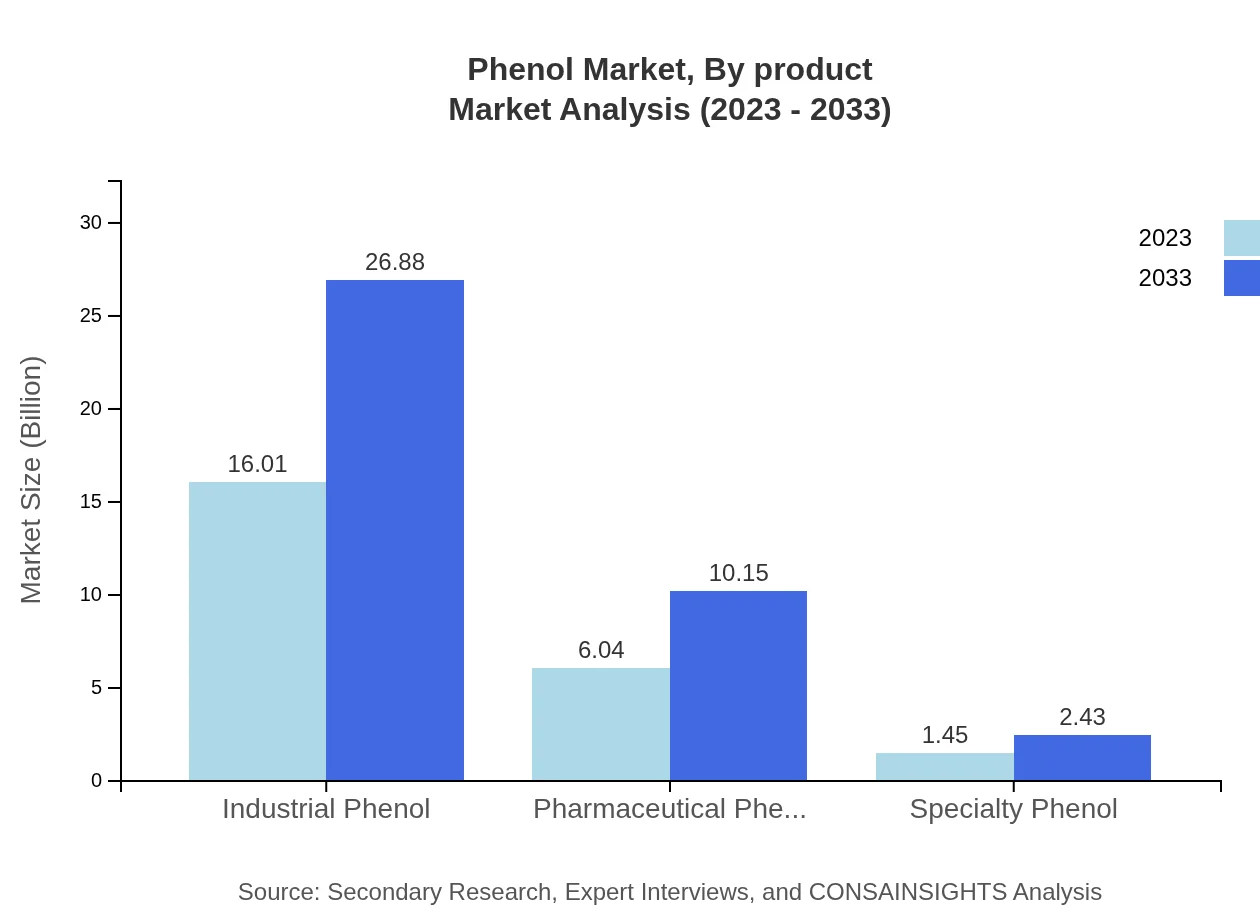

Phenol Market Analysis By Product

The product segmentation includes various types of Phenol, such as Industrial Phenol, Pharmaceutical Phenol, and Specialty Phenol. As of 2023, Industrial Phenol contributes substantially with a market size of $16.01 billion, accounting for 68.13% share, and is projected to reach $26.88 billion by 2033. Pharmaceutical Phenol follows with $6.04 billion in 2023, expanding to $10.15 billion, while Specialty Phenol starts at $1.45 billion and goes up to $2.43 billion.

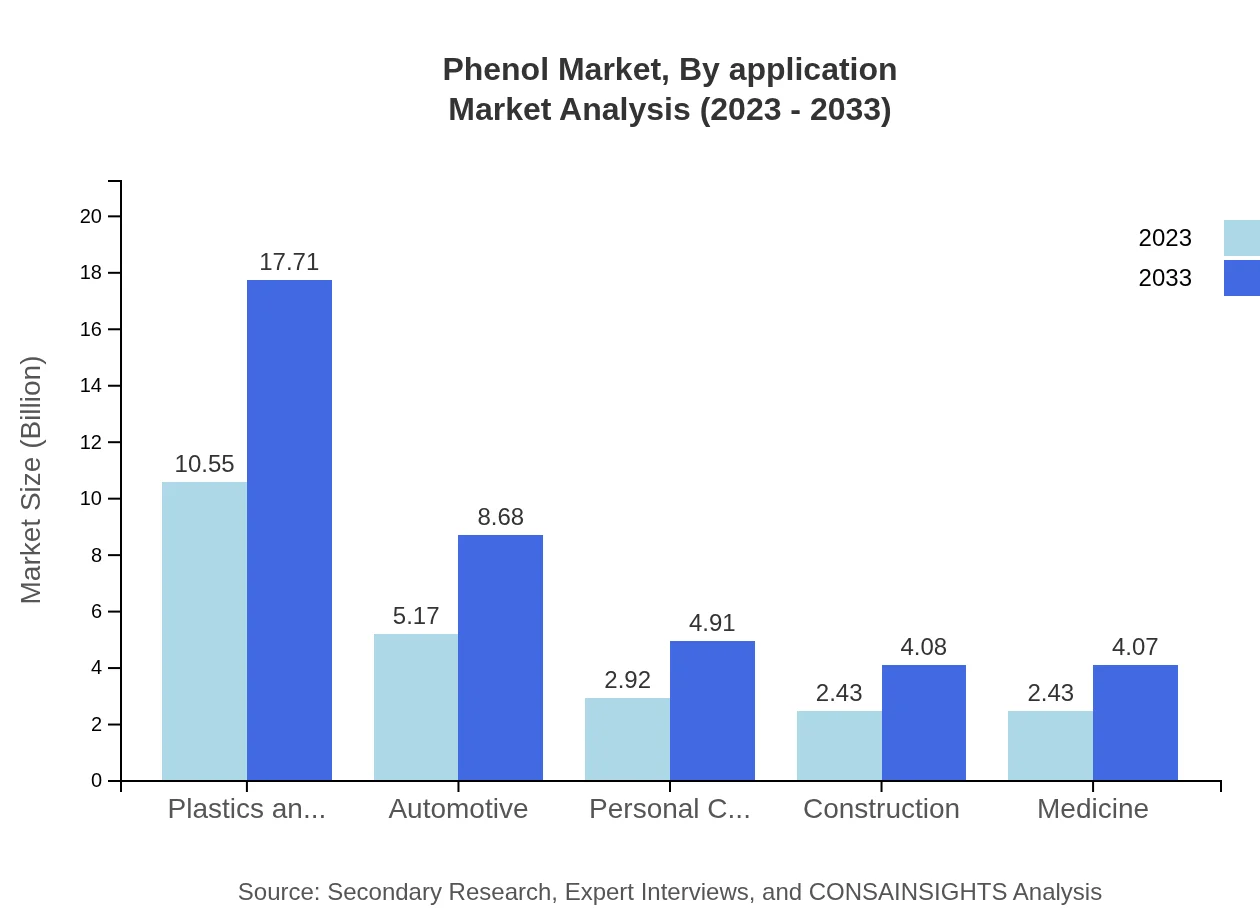

Phenol Market Analysis By Application

Key applications of Phenol include Automotive, Healthcare, Plastics, Personal Care, and Construction. The Automotive industry holds a significant share with a market size of $5.17 billion in 2023 (22.01% share), expected to reach $8.68 billion by 2033. The Healthcare segment is also critical, starting with $2.92 billion and projected to grow to $4.91 billion.

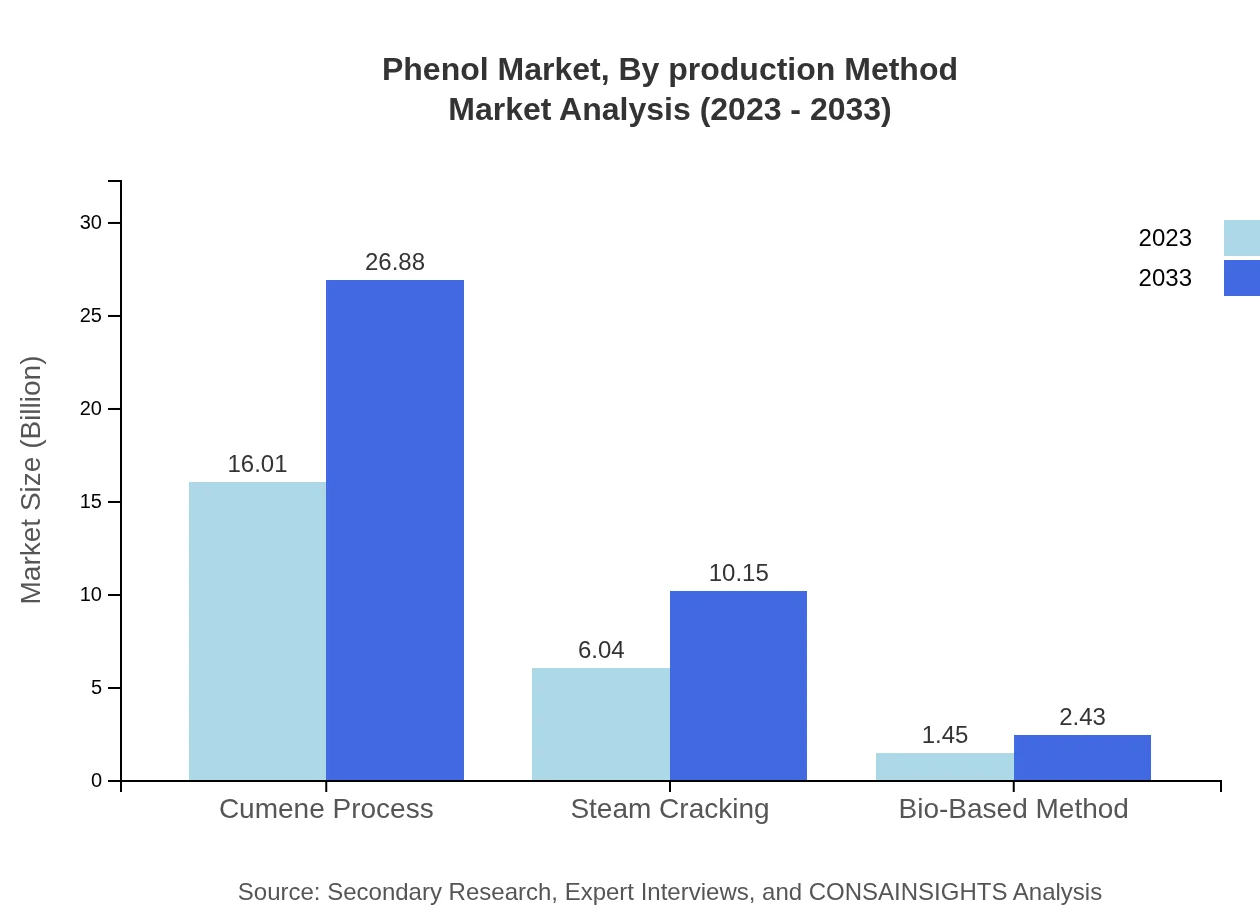

Phenol Market Analysis By Production Method

The Phenol production methods include the Cumene Process, Steam Cracking, and Bio-Based Methods. The Cumene process dominates the market with a size of $16.01 billion (68.13% share) in 2023, forecasted to reach $26.88 billion by 2033. Steam cracking will also see growth, from $6.04 billion to $10.15 billion.

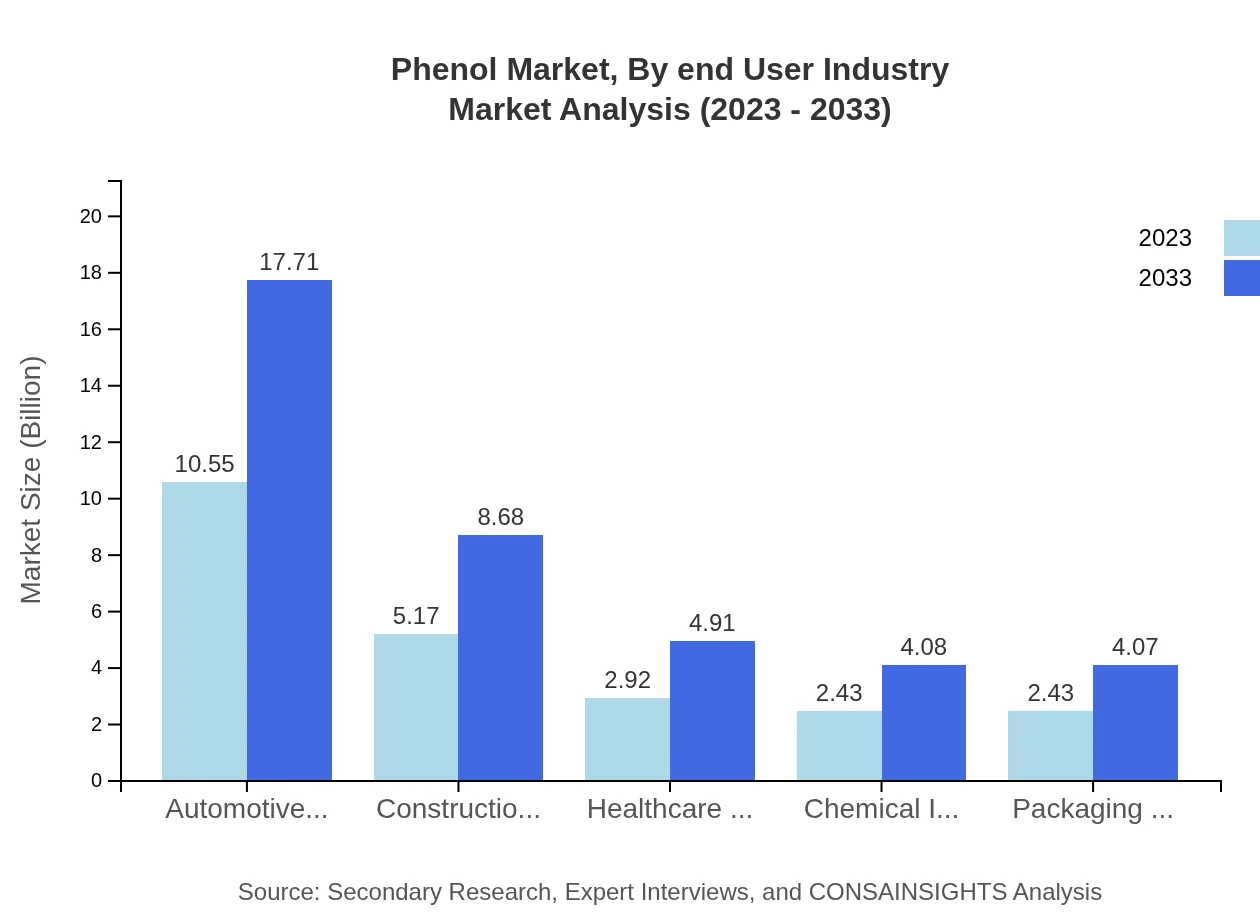

Phenol Market Analysis By End User Industry

End-users in the Phenol market span Automotive, Construction, Healthcare, and Chemical industries. Significant market leaders are in automotive production, with revenues of $10.55 billion (44.89% share) in 2023 and expected to grow to $17.71 billion by 2033. Construction and Healthcare industries also show promising growth with respective projections.

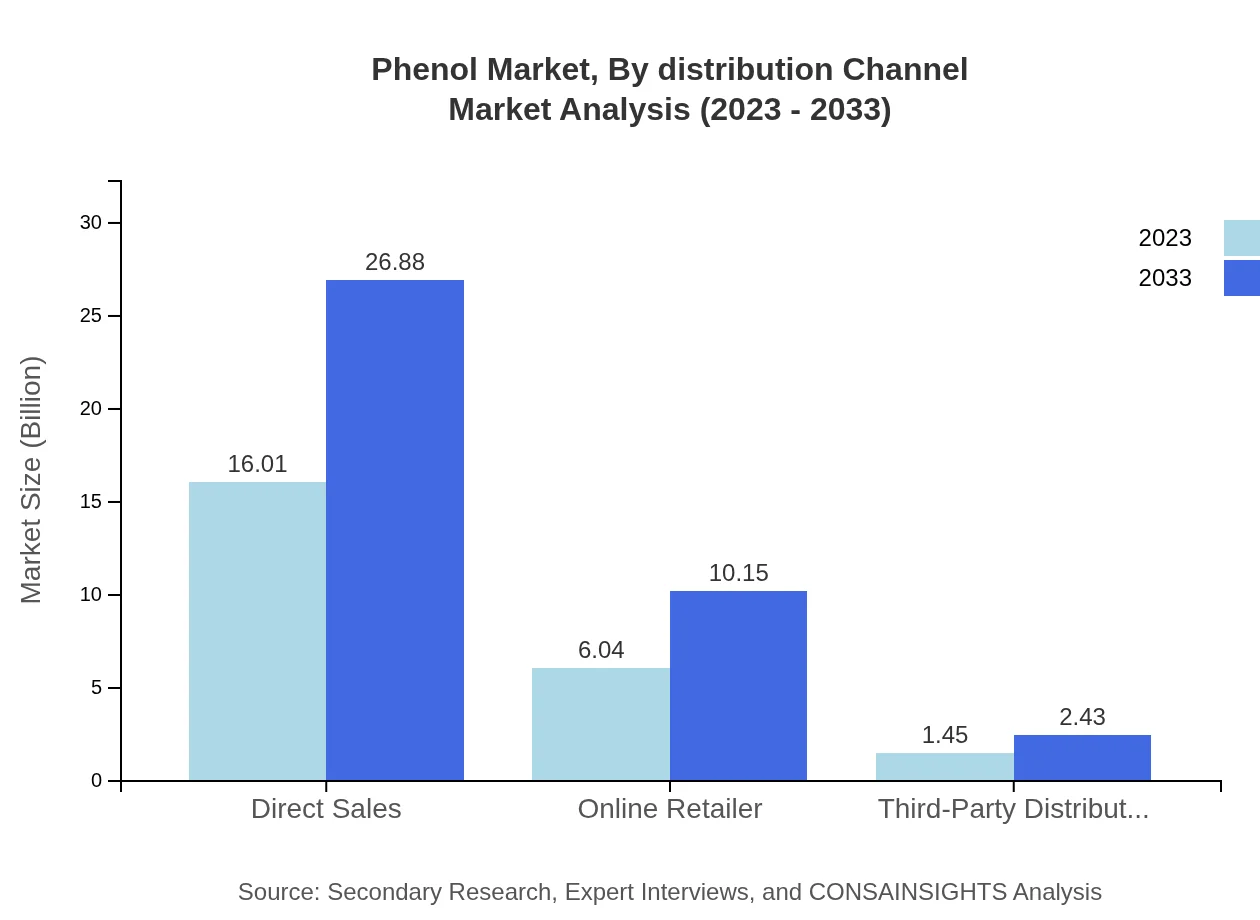

Phenol Market Analysis By Distribution Channel

Distribution channels for Phenol include Direct Sales, Online Retail, and Third-Party Distributors. Direct Sales represent the biggest segment with $16.01 billion (68.13% share) in 2023, expected to rise to $26.88 billion. Online Retailing follows with $6.04 billion, continuing its upward trend.

Phenol Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Phenol Industry

BASF:

BASF is a global leader in the chemical industry, producing a diverse array of products including phenol and phenolic derivatives critical for various industrial applications.SI Group:

SI Group is a prominent chemical manufacturer specializing in advanced specialty products. Their contributions to phenolic resins play a crucial role in the automotive, electronics, and construction sectors.Kraton Corporation:

Kraton is a leading global producer of bio-based materials and specialty polymers that include phenolic compounds used in adhesives and coatings.Ineos Phenol:

Ineos Phenol is one of the world’s largest producers of phenol and acetone, supplying a wide range of industries with essential chemical intermediates.Eastman Chemical Company:

Eastman Chemical Company is a major player in manufacturing various phenol derivatives used in consumer products, healthcare, and coatings.We're grateful to work with incredible clients.

FAQs

What is the market size of phenol?

The global phenol market is projected to reach approximately $23.5 billion by 2033, growing at a CAGR of 5.2% from 2023. This growth is driven by increasing demand across various industries and innovations in production techniques.

What are the key market players or companies in this phenol industry?

Key players in the phenol industry include major chemical manufacturers such as BASF, ArcelorMittal, and SABIC. These companies dominate the market by leveraging advanced technologies and extensive distribution networks to enhance their competitiveness.

What are the primary factors driving the growth in the phenol industry?

Growth in the phenol industry is primarily driven by the increasing demand for plastics and resins, coupled with the rise in automotive production. Additionally, strong growth in the pharmaceutical sector and developments in bio-based production methods further fuel market expansion.

Which region is the fastest Growing in the phenol?

The fastest-growing region in the phenol market is expected to be Europe, with market size projected to grow from $7.54 billion in 2023 to $12.65 billion in 2033. The Asia-Pacific region is also witnessing significant growth, indicating robust demand.

Does ConsaInsights provide customized market report data for the phenol industry?

Yes, ConsaInsights offers customized market report data for the phenol industry, tailored to specific needs. Clients can obtain insights catered to particular segments or geographical regions, ensuring relevant information for strategic decision-making.

What deliverables can I expect from this phenol market research project?

From the phenol market research project, you can expect comprehensive deliverables, including market size analysis, segment breakdowns, competitive landscape insights, forecasts, and actionable recommendations tailored to help stakeholders make informed decisions.

What are the market trends of phenol?

Current trends in the phenol market indicate a shift towards bio-based production methods and sustainability. There is a growing emphasis on developing eco-friendly products, along with a notable increase in demand from the automotive and pharmaceutical sectors.