Polyfilm Market Report

Published Date: 02 February 2026 | Report Code: polyfilm

Polyfilm Market Size, Share, Industry Trends and Forecast to 2033

This report covers a comprehensive analysis of the Polyfilm market, providing insights into market trends, size forecasts, segmentation, and technological advancements from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

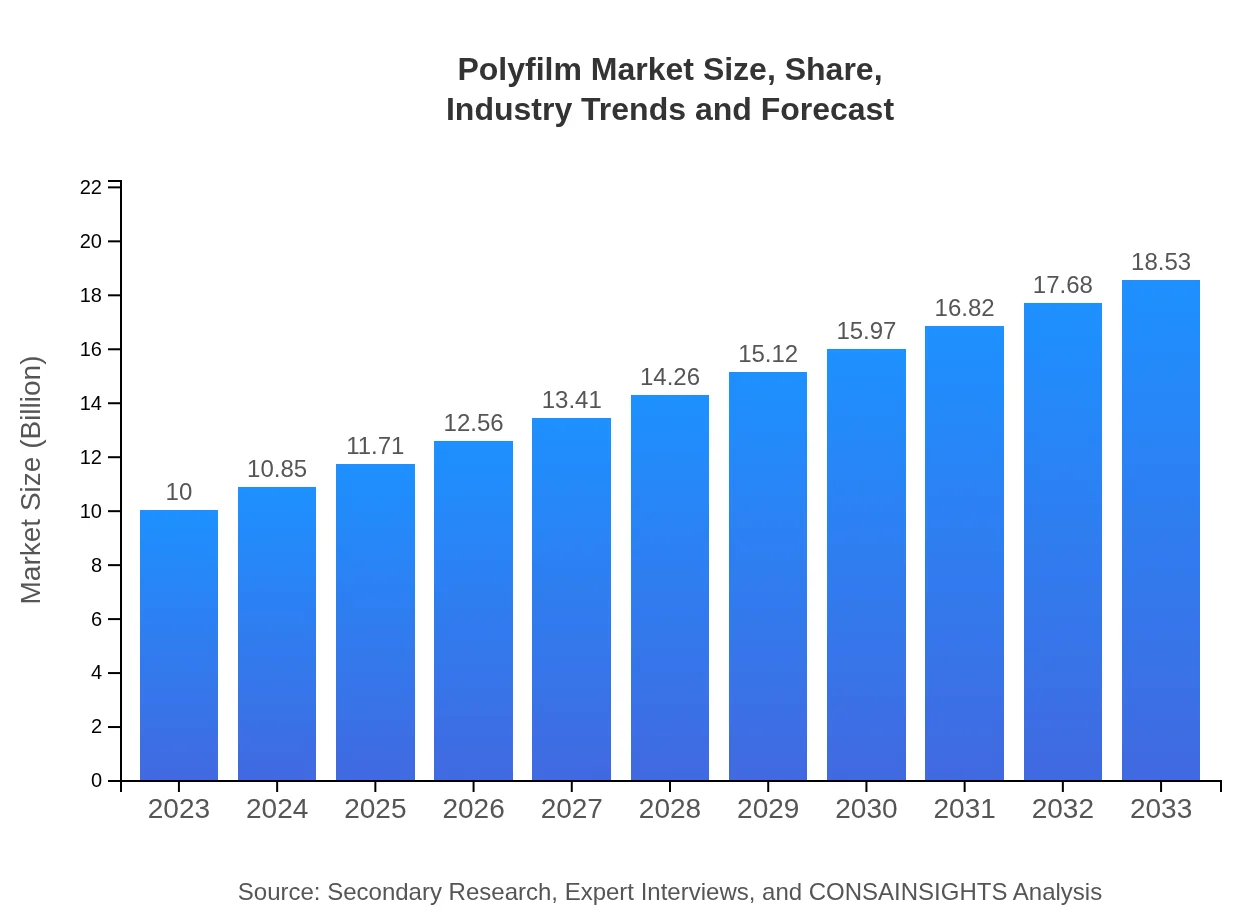

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $18.53 Billion |

| Top Companies | Berry Global Group, Inc., Amcor Plc, Sealed Air Corporation |

| Last Modified Date | 02 February 2026 |

Polyfilm Market Overview

Customize Polyfilm Market Report market research report

- ✔ Get in-depth analysis of Polyfilm market size, growth, and forecasts.

- ✔ Understand Polyfilm's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Polyfilm

What is the Market Size & CAGR of Polyfilm market in 2023?

Polyfilm Industry Analysis

Polyfilm Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Polyfilm Market Analysis Report by Region

Europe Polyfilm Market Report:

The European Polyfilm market is valued at $2.56 billion in 2023 and expected to grow to $4.74 billion by 2033. Regulatory initiatives aimed at reducing plastic consumption and promoting reusable and recyclable materials are reshaping market dynamics, pushing manufacturers to innovate.Asia Pacific Polyfilm Market Report:

In 2023, the Asia Pacific region holds a market size of $1.95 billion, projected to reach $3.61 billion by 2033. This growth is driven by increasing manufacturing activities and rising demand for packaging materials, particularly in countries like China and India. The region's focus on infrastructural development and urbanization significantly boosts the use of Polyfilm products.North America Polyfilm Market Report:

With a market size of $3.90 billion in 2023, North America is projected to reach $7.22 billion by 2033. The region's emphasis on sustainable packaging and strong presence of established market players are key growth drivers, along with technological innovations in film production.South America Polyfilm Market Report:

The South American Polyfilm market is valued at $0.59 billion in 2023 and is expected to grow to $1.09 billion by 2033. The growth is influenced by expanding sectors such as retail and agriculture, where packaging solutions are increasingly adopted to enhance product integrity.Middle East & Africa Polyfilm Market Report:

In 2023, the Middle East and Africa market is valued at $1.01 billion, with a projected size of $1.87 billion by 2033. Key growth factors include developing logistics networks and an increase in packaging requirements across food and beverage industries.Tell us your focus area and get a customized research report.

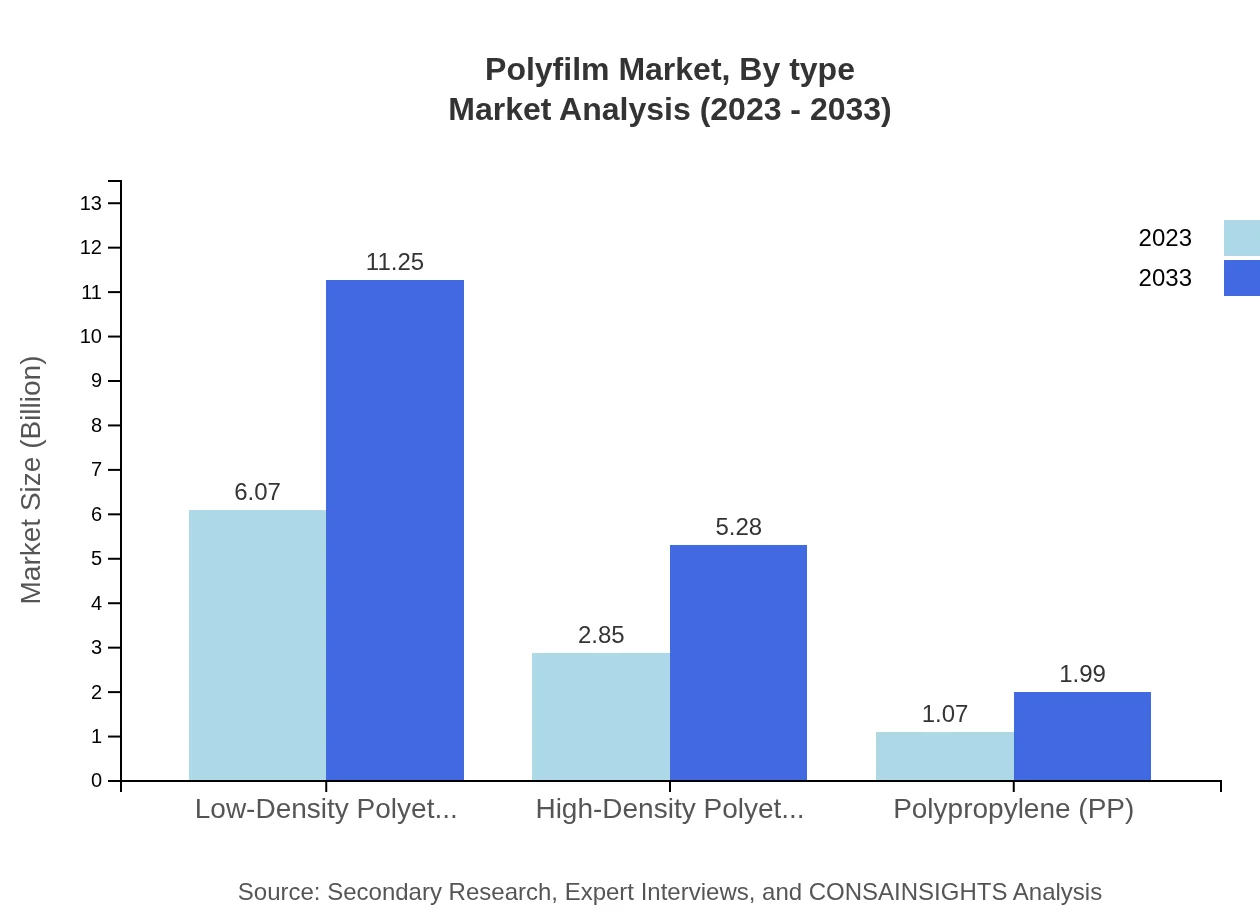

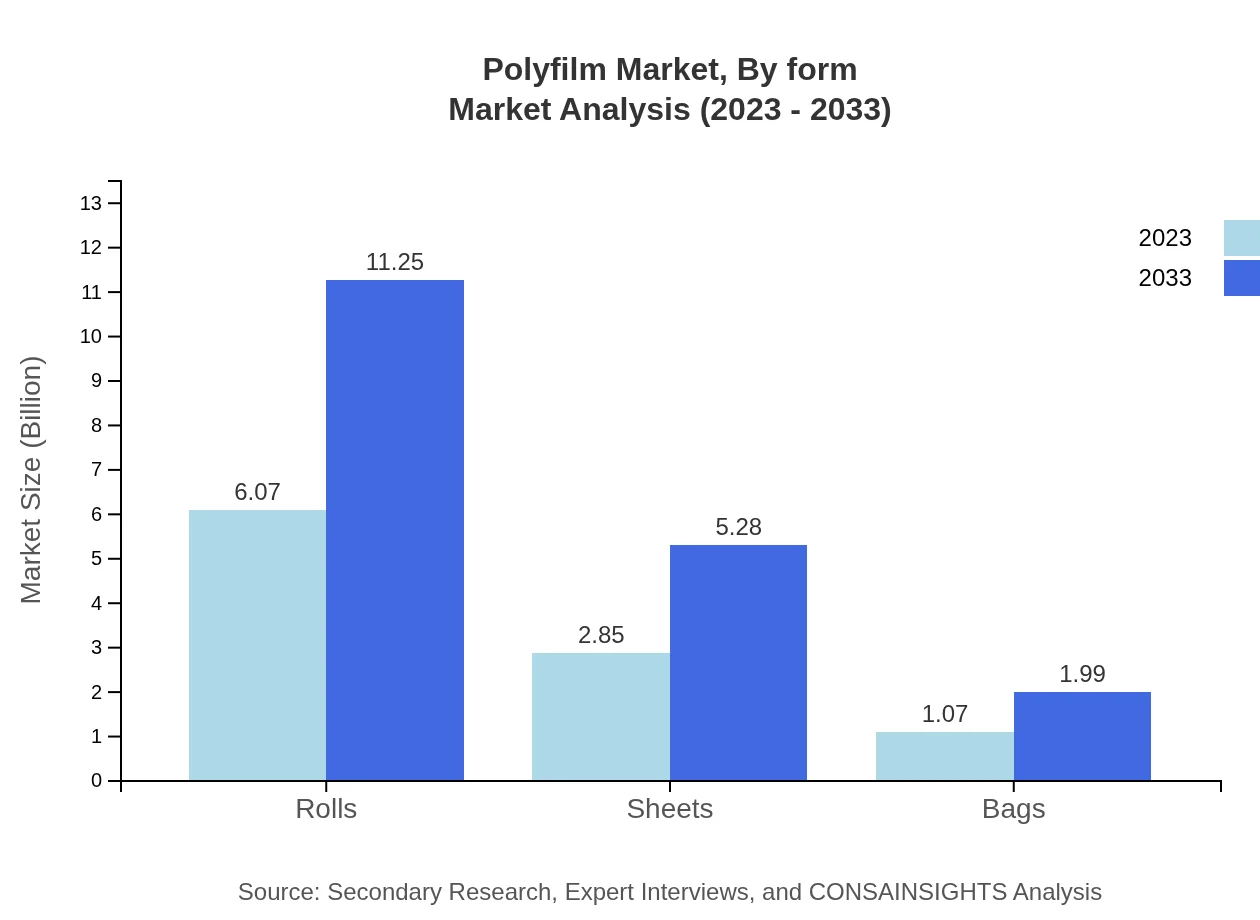

Polyfilm Market Analysis By Type

The Polyfilm market, segmented by type, is dominated by Low-Density Polyethylene (LDPE), which is projected to grow from $6.07 billion in 2023 to $11.25 billion in 2033. High-Density Polyethylene (HDPE) follows closely, with an increase from $2.85 billion to $5.28 billion over the same period. Polypropylene (PP) represents a significant niche, moving from $1.07 billion to $1.99 billion.

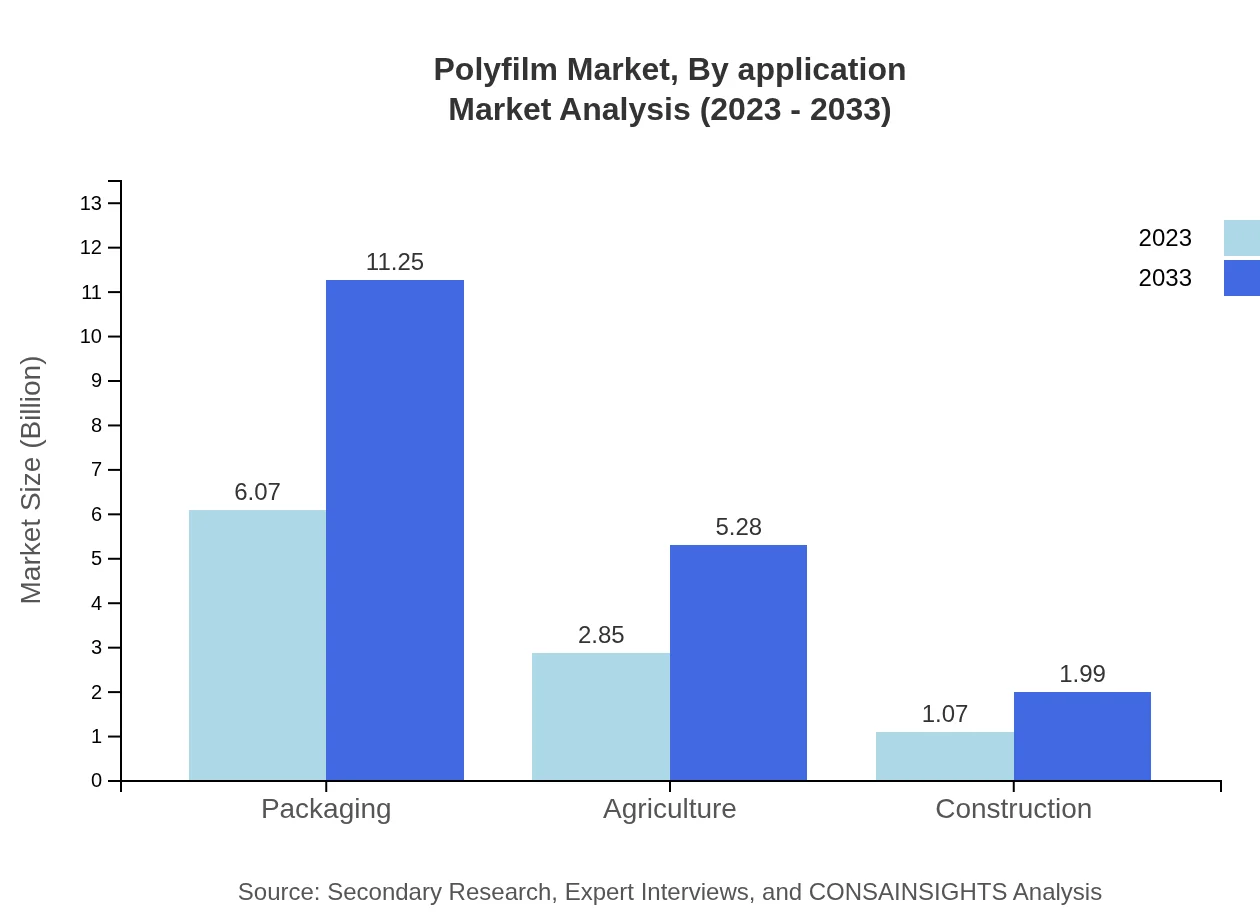

Polyfilm Market Analysis By Application

In applications, the food and beverage sector leads with a market size growing from $6.07 billion in 2023 to $11.25 billion by 2033. Healthcare follows with growth from $2.85 billion to $5.28 billion, reflecting increasing needs for sterile packaging. Other applications in industrial and agriculture segments indicate strong utilization but with smaller market shares.

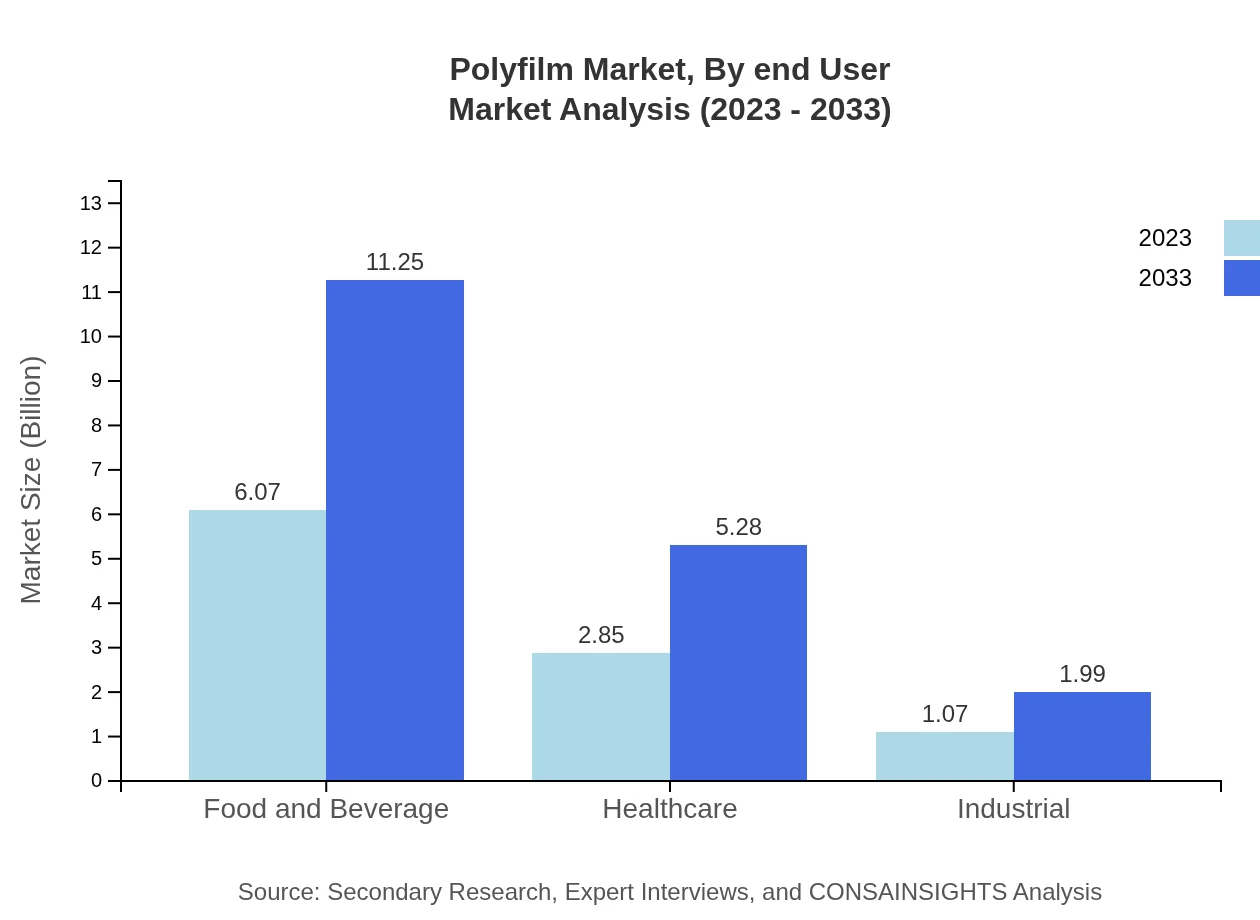

Polyfilm Market Analysis By End User

The end-user industry analysis shows that the packaging sector dominates, making up 60.74% of the total market share for Polyfilm in 2023. Significant growth is also seen in agriculture and construction, emphasizing the versatility of Polyfilm in various industrial contexts.

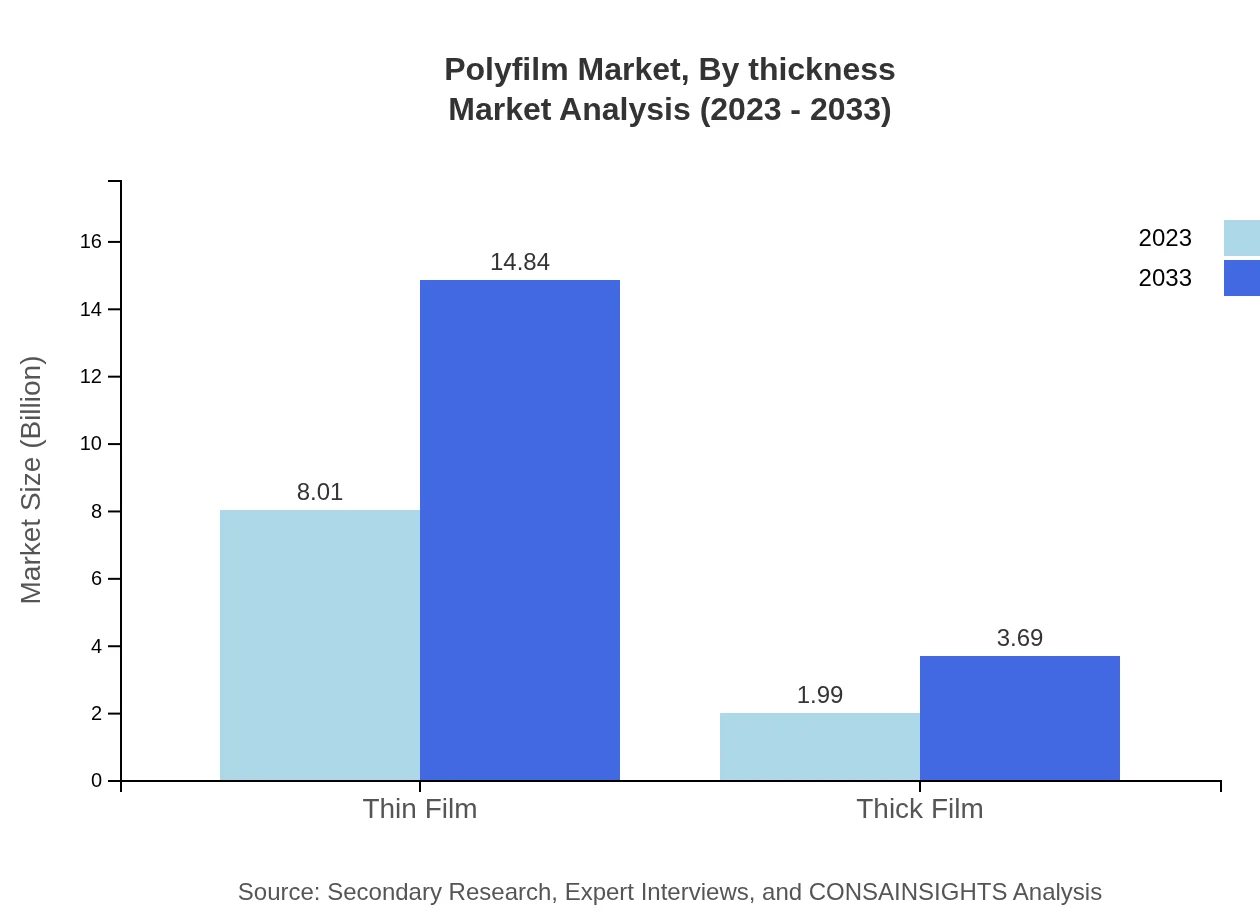

Polyfilm Market Analysis By Thickness

Thin films represent the largest segment with a market size of $8.01 billion and a share of 80.07% in 2023. Thick films are expected to grow from $1.99 billion to $3.69 billion, accounting for the remaining demand, particularly in heavier-duty applications.

Polyfilm Market Analysis By Form

Polyfilm is available in various forms, predominantly in rolls, which amount to a market size of $6.07 billion in 2023. Sheets and bags constitute minor segments, with specific applications in specialized packaging solutions and distribution environments.

Polyfilm Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Polyfilm Industry

Berry Global Group, Inc.:

A leading global supplier of innovative packaging solutions, Berry Global focuses on sustainable practices and has a wide range of Polyfilm products for various industries.Amcor Plc:

A multinational packaging corporation renowned for its commitment to sustainability, Amcor manufactures high-quality Polyfilm for the food, healthcare, and beverage sectors.Sealed Air Corporation:

Innovator in protective packaging, Sealed Air offers Polyfilm solutions tailored toward demanding applications ensuring product integrity and sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of polyfilm?

The global polyfilm market is valued at approximately $10 billion in 2023 and is projected to grow at a CAGR of 6.2%, reaching substantial growth by 2033. This expansion is driven by the increasing demand for packaging solutions.

What are the key market players or companies in the polyfilm industry?

Key players in the polyfilm industry include major packaging companies and manufacturers specializing in polyethylene products. Their continuous innovation and expansion strategies contribute significantly to the market growth and competitiveness.

What are the primary factors driving the growth in the polyfilm industry?

Growth in the polyfilm industry is driven by increased demand for sustainable packaging, advancements in product technology, and rising consumption in sectors such as food, beverage, and healthcare. Regulatory support for eco-friendly products also boosts industry prospects.

Which region is the fastest Growing in the polyfilm market?

Asia Pacific is the fastest-growing region in the polyfilm market, expected to rise from $1.95 billion in 2023 to $3.61 billion by 2033. This growth is fueled by rapid industrialization and increasing consumer demand in emerging economies.

Does ConsaInsights provide customized market report data for the polyfilm industry?

Yes, ConsaInsights offers tailored market reports for the polyfilm industry, allowing clients to gain specific insights based on their unique needs and requirements. Customization includes focus on particular segments or regional markets.

What deliverables can I expect from this polyfilm market research project?

Expected deliverables from the polyfilm market research project include comprehensive reports, detailed market analyses, segmentation data, growth forecasts, and actionable insights tailored for strategic decision-making.

What are the market trends of polyfilm?

Current trends in the polyfilm market include a shift towards biodegradable materials, increased adoption in e-commerce packaging, and innovation in film technology aimed at reducing environmental impact while enhancing product shelf life.