Ptfe Membrane Market Report

Published Date: 22 January 2026 | Report Code: ptfe-membrane

Ptfe Membrane Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the PTFE Membrane market, covering market size, trends, segmentation, and regional insights. It forecasts growth from 2023 to 2033, offering valuable data for stakeholders looking to capitalize on market opportunities.

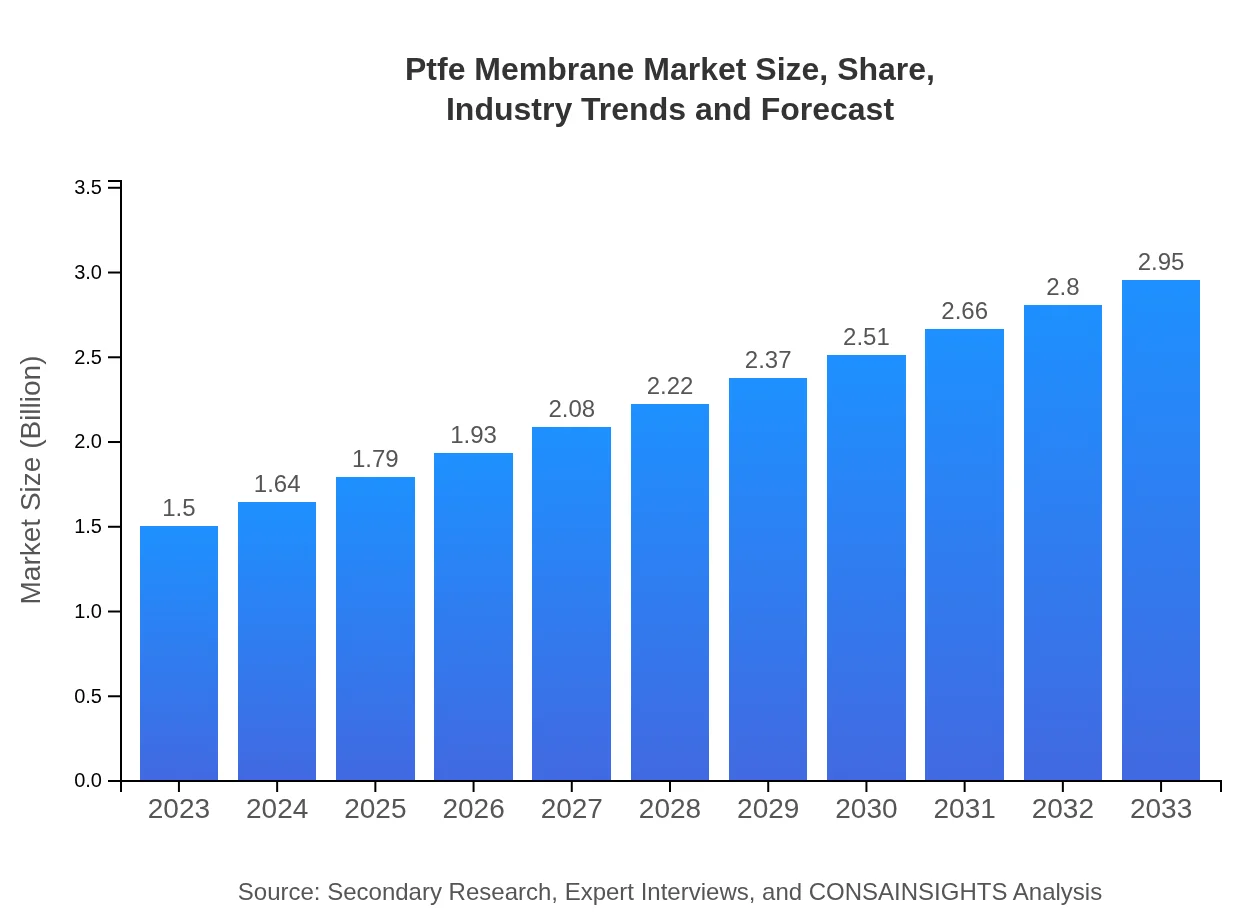

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.95 Billion |

| Top Companies | Gore-Tex, Chemours |

| Last Modified Date | 22 January 2026 |

PTFE Membrane Market Overview

Customize Ptfe Membrane Market Report market research report

- ✔ Get in-depth analysis of Ptfe Membrane market size, growth, and forecasts.

- ✔ Understand Ptfe Membrane's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ptfe Membrane

What is the Market Size & CAGR of PTFE Membrane market in 2023 and 2033?

PTFE Membrane Industry Analysis

PTFE Membrane Market Segmentation and Scope

Tell us your focus area and get a customized research report.

PTFE Membrane Market Analysis Report by Region

Europe Ptfe Membrane Market Report:

In Europe, the market is projected to grow from $0.49 billion in 2023 to $0.97 billion by 2033. The region's strict environmental regulations and increasing demand for high-quality filtration solutions drive market expansion in several sectors.Asia Pacific Ptfe Membrane Market Report:

The Asia-Pacific region is poised for significant growth in the PTFE membrane market, with a market size of $0.28 billion in 2023 projected to reach $0.54 billion by 2033. This growth is driven by rapid industrialization, increasing manufacturing activities, and a growing focus on environmental sustainability.North America Ptfe Membrane Market Report:

North America, with a market size of $0.51 billion in 2023, is expected to witness substantial growth to $1.00 billion by 2033, primarily due to rising technological advancements and the robust presence of key end-user industries.South America Ptfe Membrane Market Report:

South America has a modest but healthy market for PTFE membranes, estimated at $0.10 billion in 2023, with expectations to grow to $0.20 billion by 2033. The region's market potential is being awakened by investments in infrastructure and enhanced industrial processes.Middle East & Africa Ptfe Membrane Market Report:

The Middle East and Africa region shows potential for growth, with the market size expected to increase from $0.12 billion in 2023 to $0.24 billion by 2033. The region's investments in oil & gas, construction, and manufacturing industries are key growth drivers.Tell us your focus area and get a customized research report.

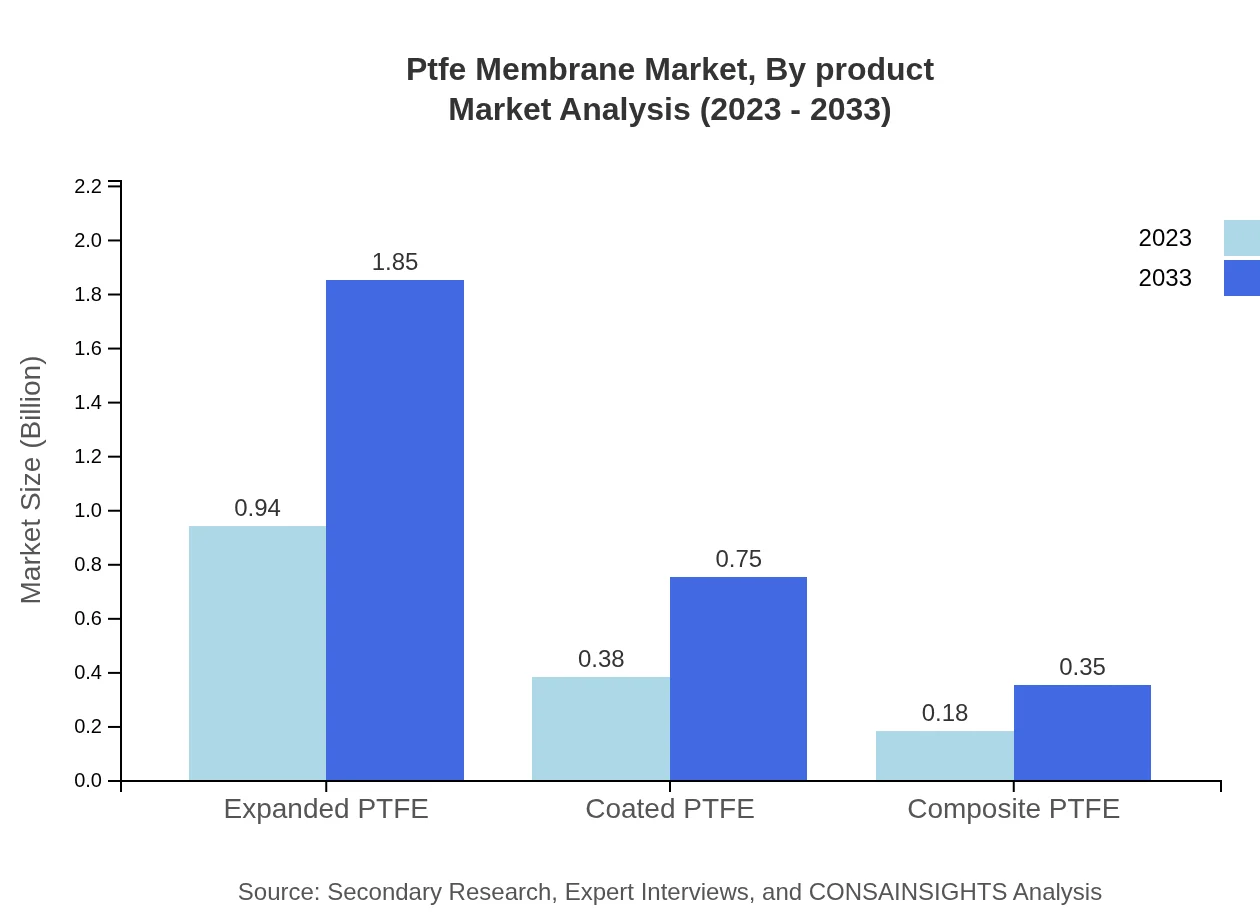

Ptfe Membrane Market Analysis By Product

The PTFE membrane market by product includes segments such as Expanded PTFE, Coated PTFE, and Composite PTFE. Expanded PTFE accounted for a significant share of the market in 2023, with a market size of approximately $0.94 billion, expected to grow to $1.85 billion by 2033, maintaining a consistent share of 62.73% throughout the forecast period.

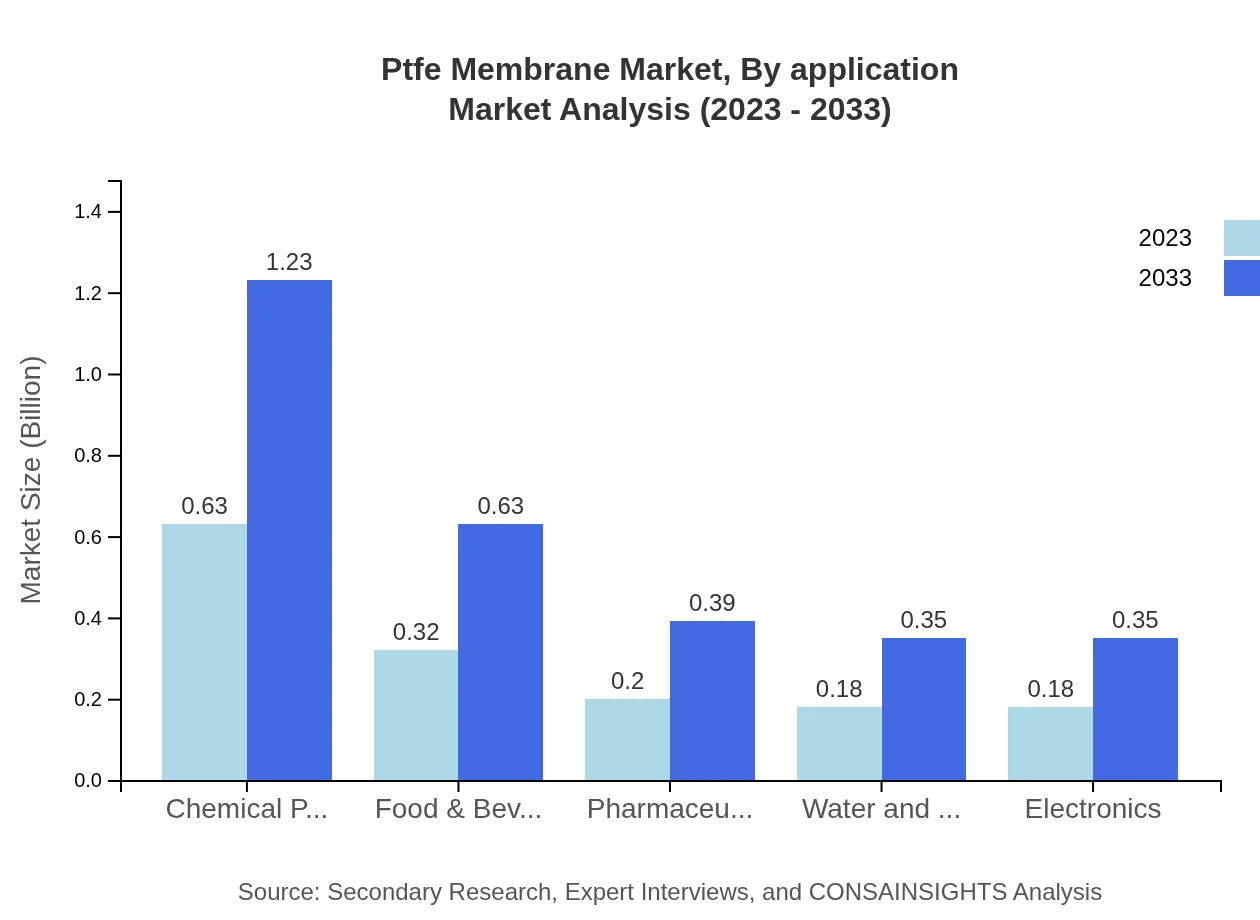

Ptfe Membrane Market Analysis By Application

In terms of application, the PTFE membrane market is dominated by sectors such as Oil & Gas, Chemical Processing, and Automotive. The Oil & Gas sector holds a remarkable market size of $0.63 billion in 2023, projected to increase to $1.23 billion by 2033, representing a stable share of 41.83%.

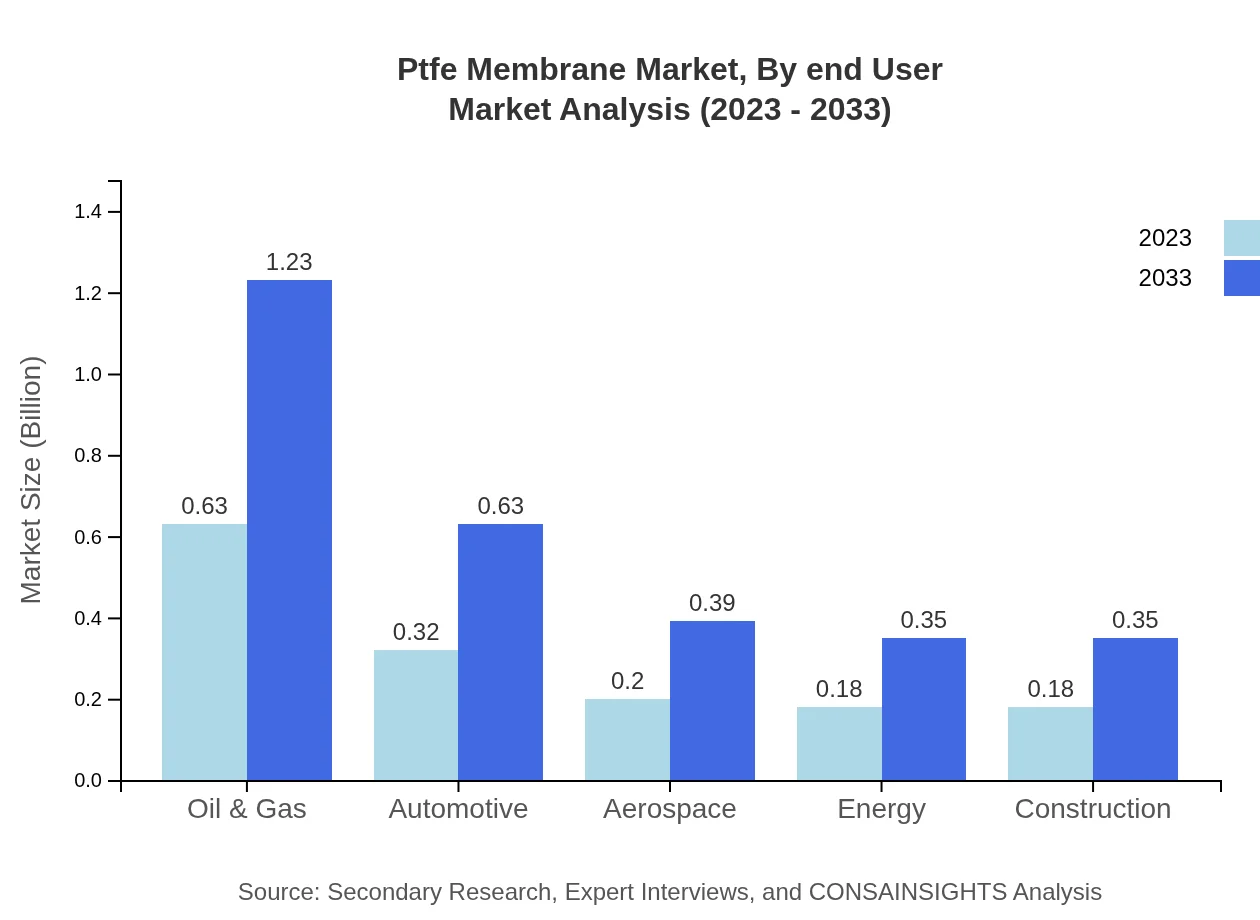

Ptfe Membrane Market Analysis By End User

The end-user industry segment includes pharmaceuticals, food and beverage processing, and electronics. Both pharmaceuticals and food & beverage processing account for around 13.29% and 21.24% market shares respectively, contributing significantly to the overall growth driven by the demand for high-purity processes.

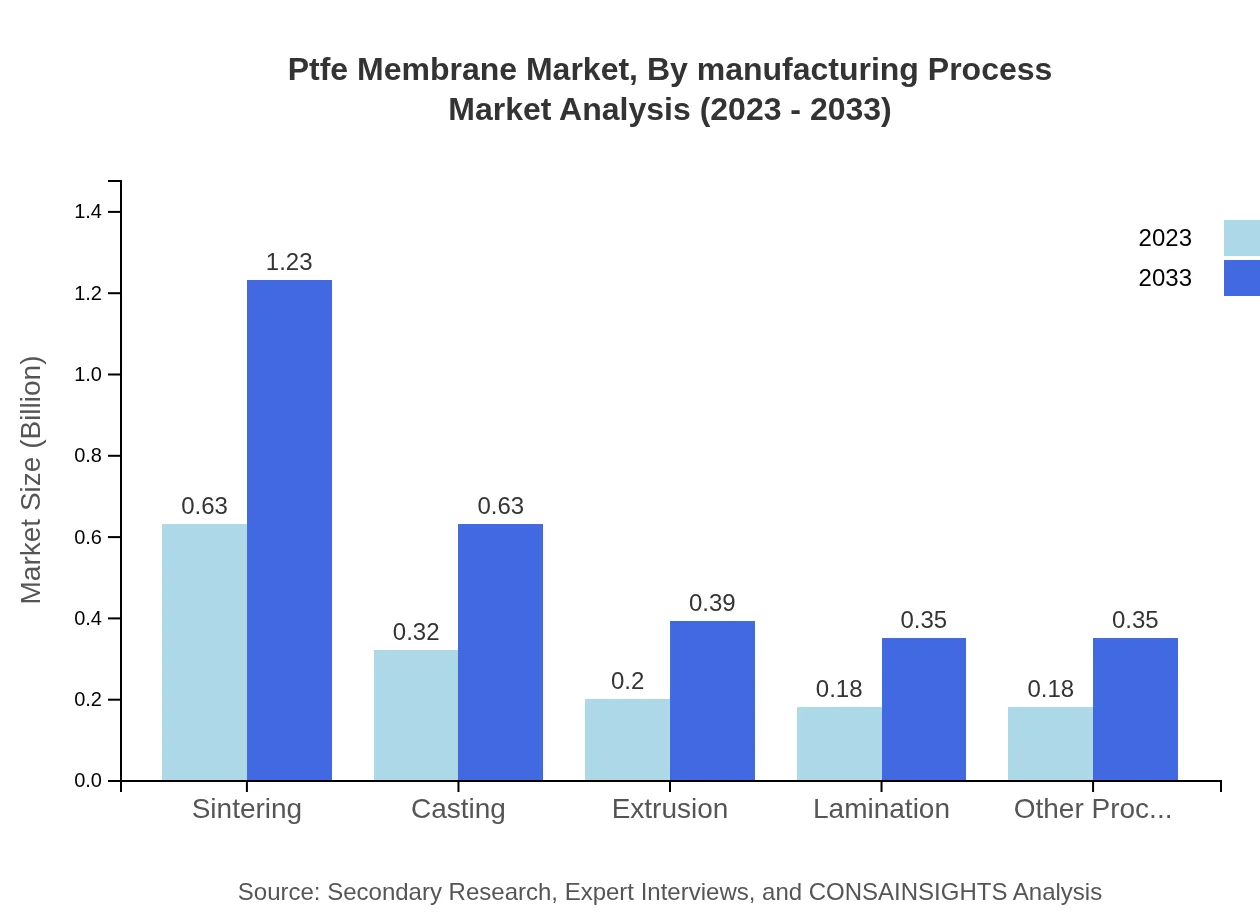

Ptfe Membrane Market Analysis By Manufacturing Process

Key manufacturing processes involved in the PTFE membrane market include Sintering, Casting, and Extrusion, with Sintering contributing notably with a size of $0.63 billion in 2023 and projecting growth to $1.23 billion by 2033, showcasing a consistent share of 41.83%.

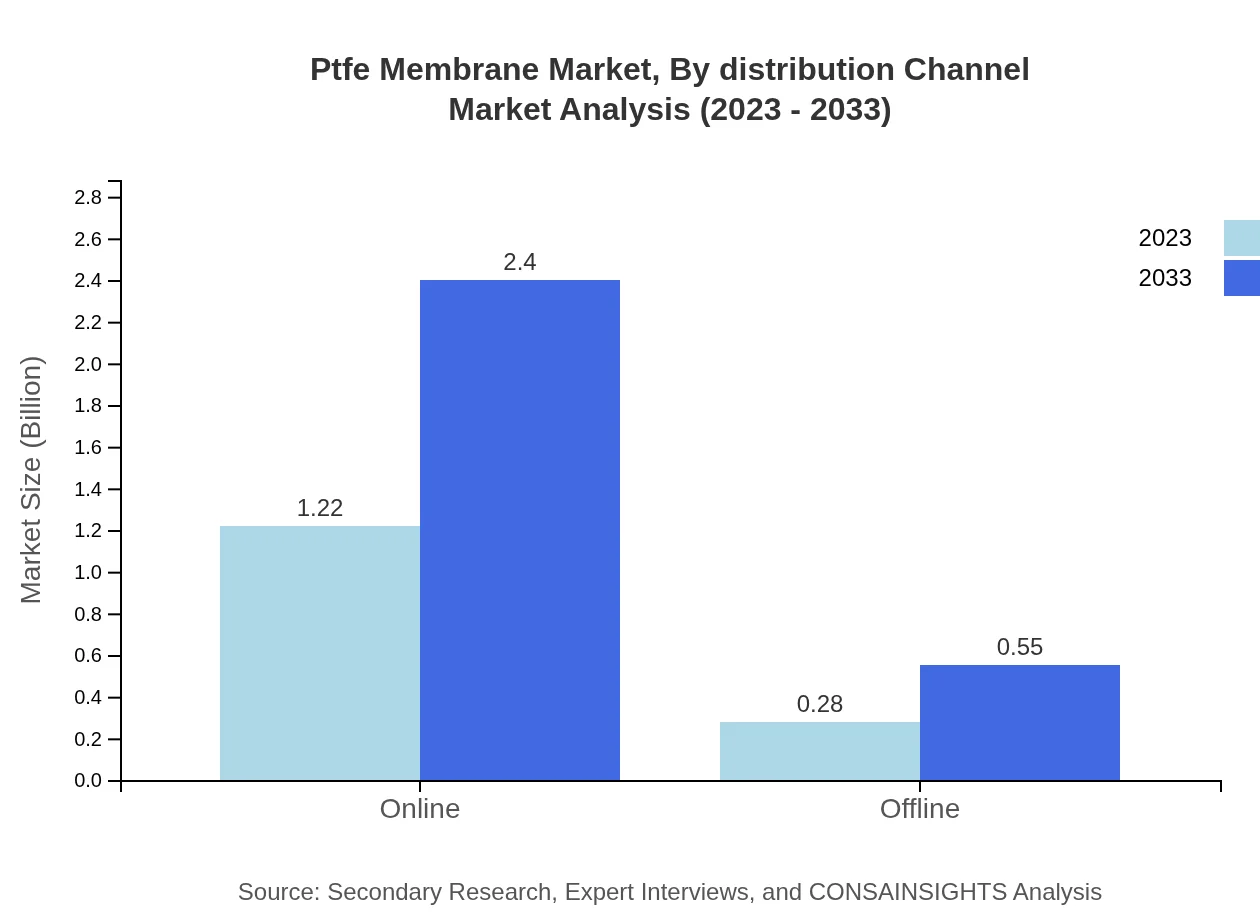

Ptfe Membrane Market Analysis By Distribution Channel

The distribution channels for PTFE membranes range between online and offline platforms. Online channels dominate with a market size of $1.22 billion in 2023 and projected to increase to $2.40 billion by 2033, representing a robust 81.4% market share due to increased digitalization in distribution.

PTFE Membrane Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in PTFE Membrane Industry

Gore-Tex:

Gore-Tex is a leading manufacturer in the PTFE membrane sector, known for its high-quality filtration and waterproof materials used in various applications, including outdoor apparel and industrial filtration.Chemours:

Chemours is a significant player in the PTFE membranes market, focusing on innovation and sustainability in chemical processing applications, offering diverse solutions tailored to industry demands.We're grateful to work with incredible clients.

FAQs

What is the market size of PTFE membrane?

The PTFE membrane market is valued at approximately $1.5 billion in 2023, and it is expected to expand at a CAGR of 6.8% through 2033. This growth highlights the increasing demand across various applications and industries.

What are the key market players or companies in the PTFE membrane industry?

Key players in the PTFE membrane industry include prominent manufacturers such as Gore, W. L. Gore & Associates, Inc., and Saint-Gobain. These companies lead through innovation and comprehensive product offerings in various segments.

What are the primary factors driving the growth in the PTFE membrane industry?

Growth drivers include the rising demand for efficient filtration solutions in industries like Oil & Gas, Chemical Processing, and Pharmaceuticals. The superior properties of PTFE membranes such as chemical resistance and durability further fuel market expansion.

Which region is the fastest Growing in the PTFE membrane market?

North America is projected to be the fastest-growing region in the PTFE membrane market, with the market expected to grow from $0.51 billion in 2023 to $1.00 billion by 2033, driven by industrial applications and technological innovations.

Does ConsaInsights provide customized market report data for the PTFE membrane industry?

Yes, ConsaInsights offers customized market report data for the PTFE membrane industry tailored to specific client needs. This includes in-depth analysis, regional insights, and segment-specific data to support strategic decision-making.

What deliverables can I expect from this PTFE membrane market research project?

Deliverables from the PTFE membrane market research include comprehensive reports detailing market size, growth rates, competitive analysis, and regional data, alongside strategic recommendations and forecasts for future trends.

What are the market trends of the PTFE membrane?

Current market trends in PTFE membranes include increasing adoption in filtration applications, growth in the energy sector, and advancements in product offerings. The ongoing development of cost-efficient manufacturing processes is also notable.