Radome Market Report

Published Date: 03 February 2026 | Report Code: radome

Radome Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Radome market, detailing insights on market size, segmentation, regional analysis, and future trends from 2023 to 2033.

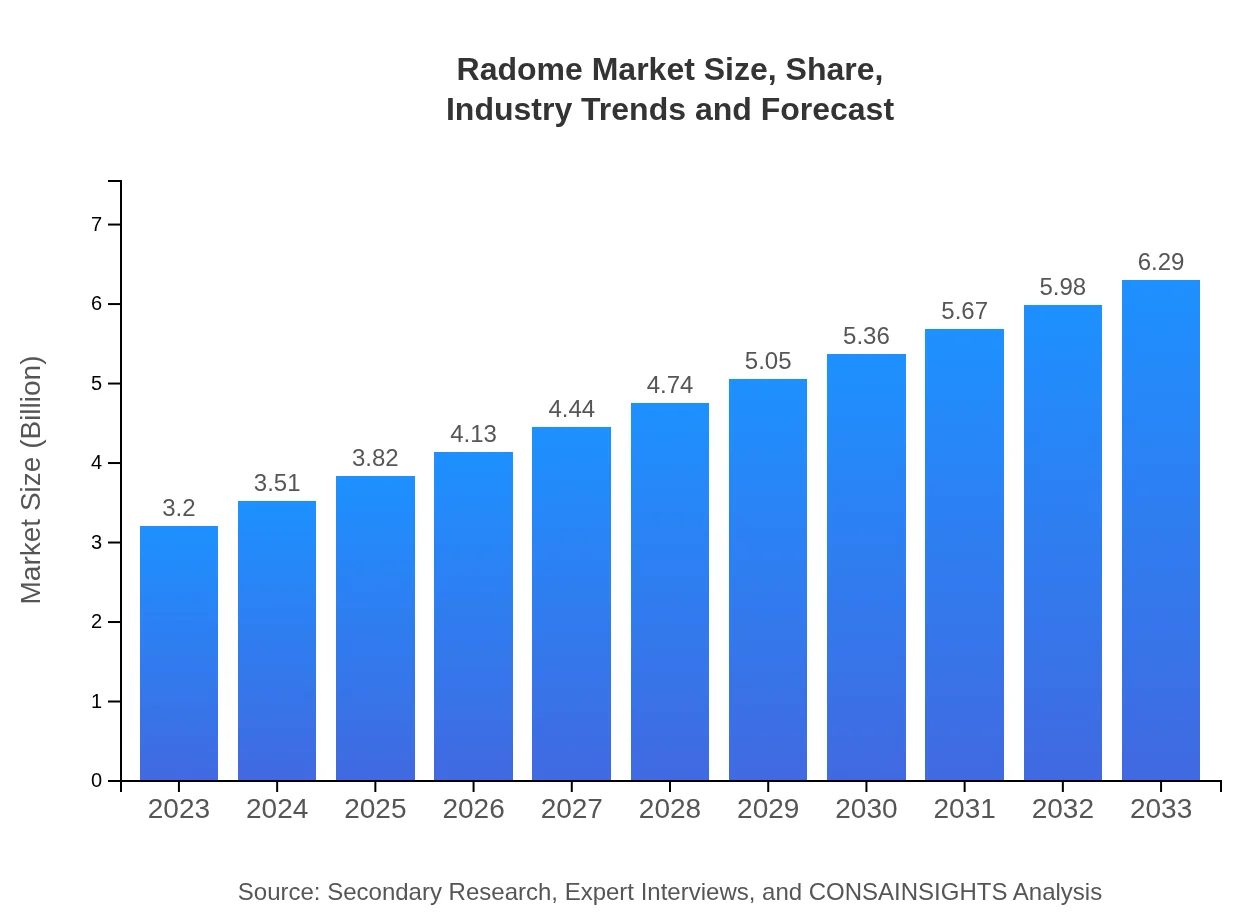

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.29 Billion |

| Top Companies | Raytheon Technologies, Northrop Grumman Corporation, General Dynamics Mission Systems |

| Last Modified Date | 03 February 2026 |

Radome Market Overview

Customize Radome Market Report market research report

- ✔ Get in-depth analysis of Radome market size, growth, and forecasts.

- ✔ Understand Radome's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Radome

What is the Market Size & CAGR of Radome market in 2023?

Radome Industry Analysis

Radome Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Radome Market Analysis Report by Region

Europe Radome Market Report:

In Europe, the market is expected to experience growth from $1.09 billion in 2023 to $2.14 billion by 2033. Strong investments in defense and a focus on aerospace applications drive expansion as industry players innovate to meet the needs of advanced radar capabilities.Asia Pacific Radome Market Report:

The Asia Pacific region is witnessing rapid growth in the Radome market, with the market size expected to reach $1.17 billion by 2033, up from $0.60 billion in 2023. This growth is attributed to increasing defense budgets in countries like India and China, coupled with a growing demand for advanced radar systems.North America Radome Market Report:

North America leads the global Radome market with a projected increase from $1.05 billion in 2023 to $2.06 billion in 2033. The US Department of Defense’s significant expenditure on radar systems and military operations largely contributes to this growth.South America Radome Market Report:

In South America, the Radome market is anticipated to increase from $0.17 billion in 2023 to $0.33 billion in 2033. Growth is driven by modernization of defense infrastructure and the rise of commercial applications in telecommunications and transportation.Middle East & Africa Radome Market Report:

The Middle East and Africa's Radome market is set to grow from $0.30 billion in 2023 to $0.60 billion in 2033, fueled by rising military investments and regional conflicts, necessitating robust radar technologies for both defense and surveillance.Tell us your focus area and get a customized research report.

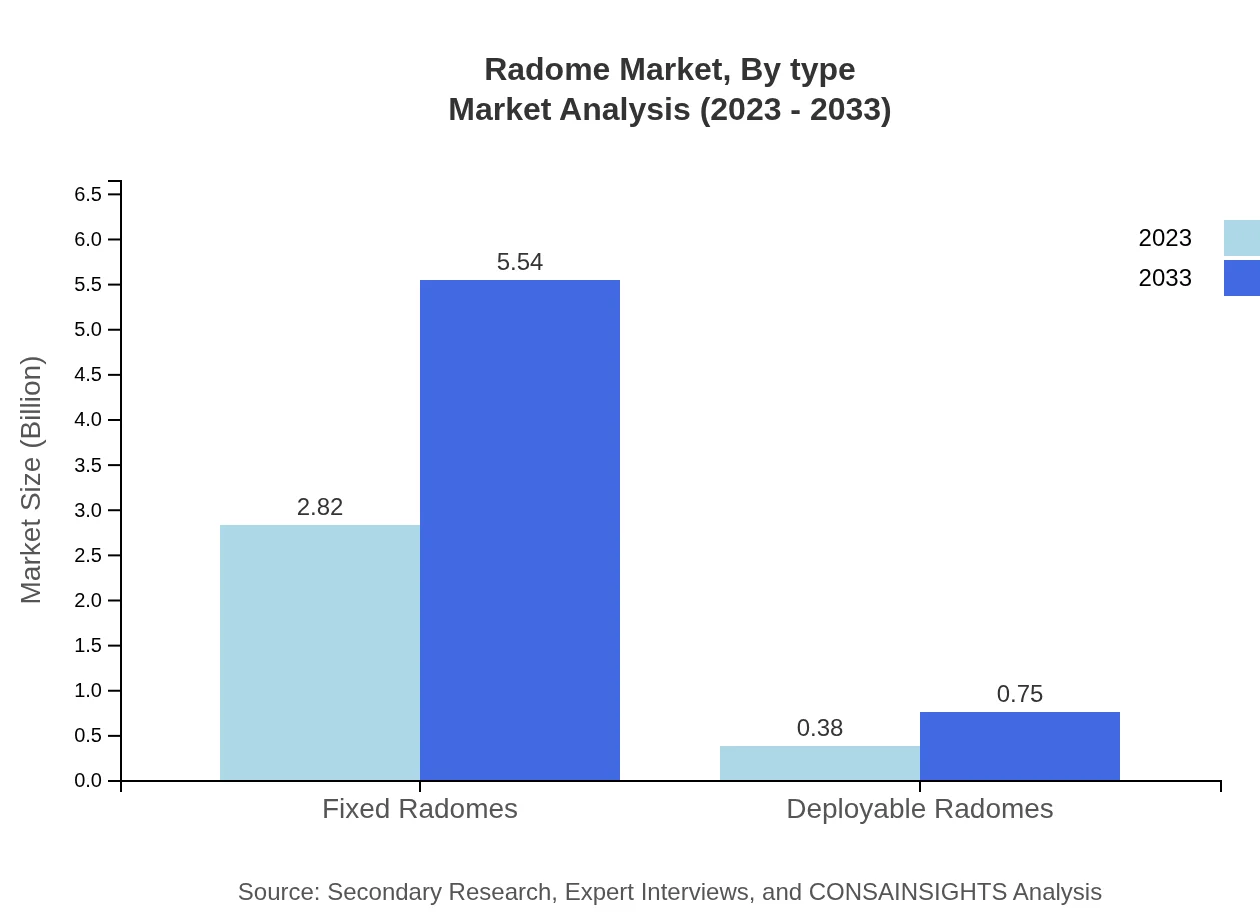

Radome Market Analysis By Type

The Radome market is divided into two primary types: fixed and deployable radomes. Fixed radomes dominate the market, accounting for approximately 88.07% of the share in 2023 and expected to maintain this share by 2033. In contrast, deployable radomes are experiencing a rise, growing from $0.38 billion in 2023 to $0.75 billion in 2033.

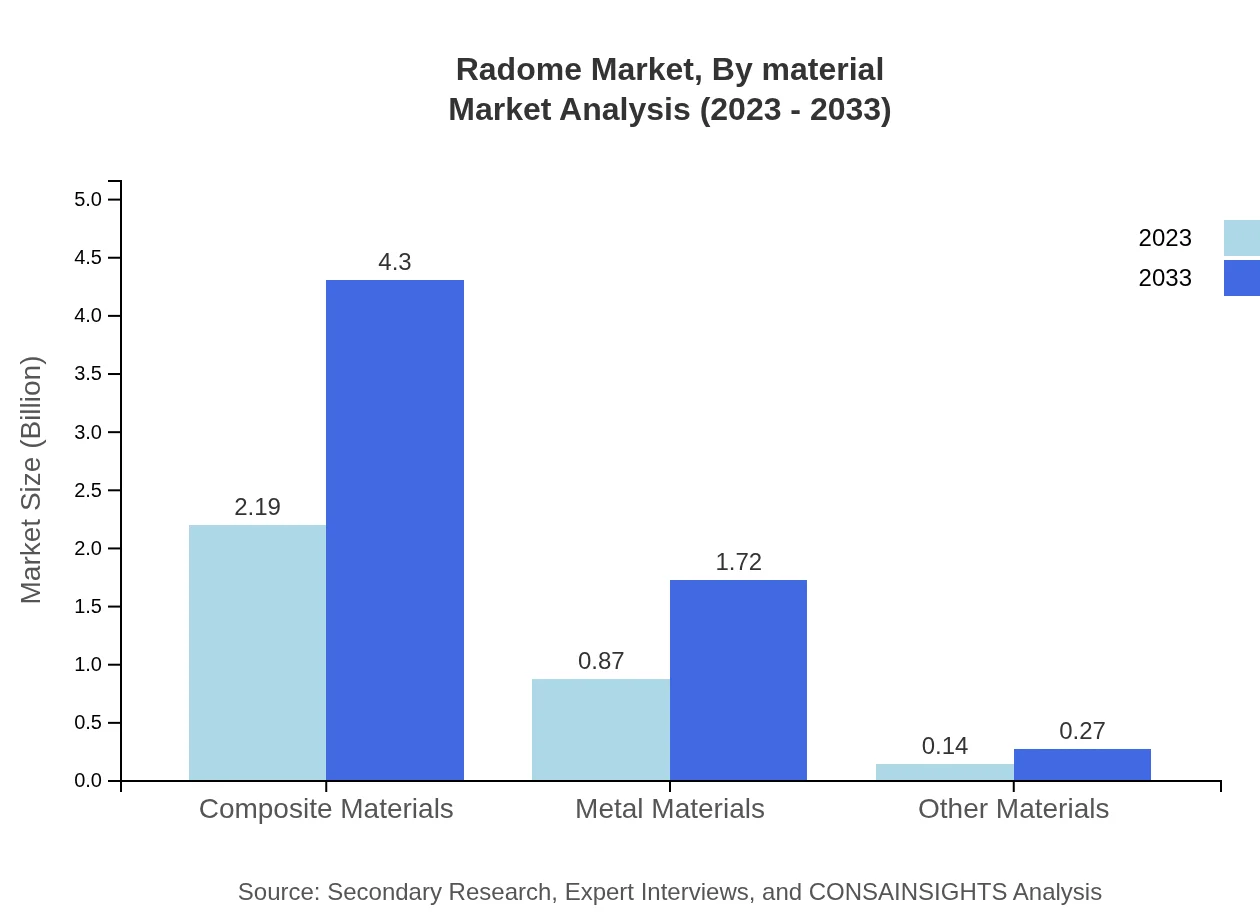

Radome Market Analysis By Material

The materials segment sees composite materials lead with a significant share of 68.32% in 2023, projected to grow alongside advancements in technology. Metal materials and others make up the remaining segments, with metal materials sharing 27.34% in 2023 and other varied materials around 4.34%.

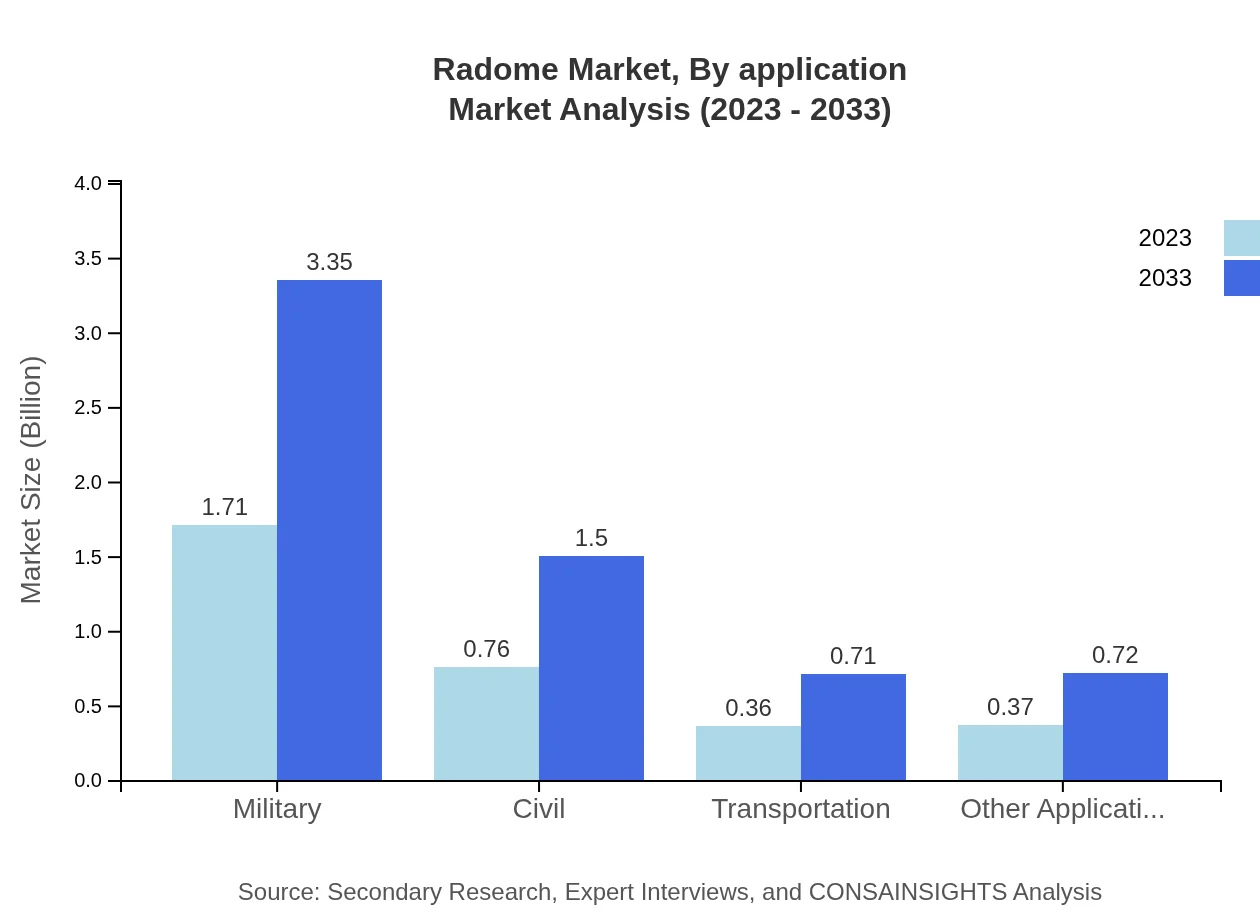

Radome Market Analysis By Application

The major applications of Radomes include military, civil, transportation, and other communication applications. Military applications make up the largest share at 53.34% in 2023, with expectations for growth alongside expanding defense budgets, while civil applications account for 23.85% share.

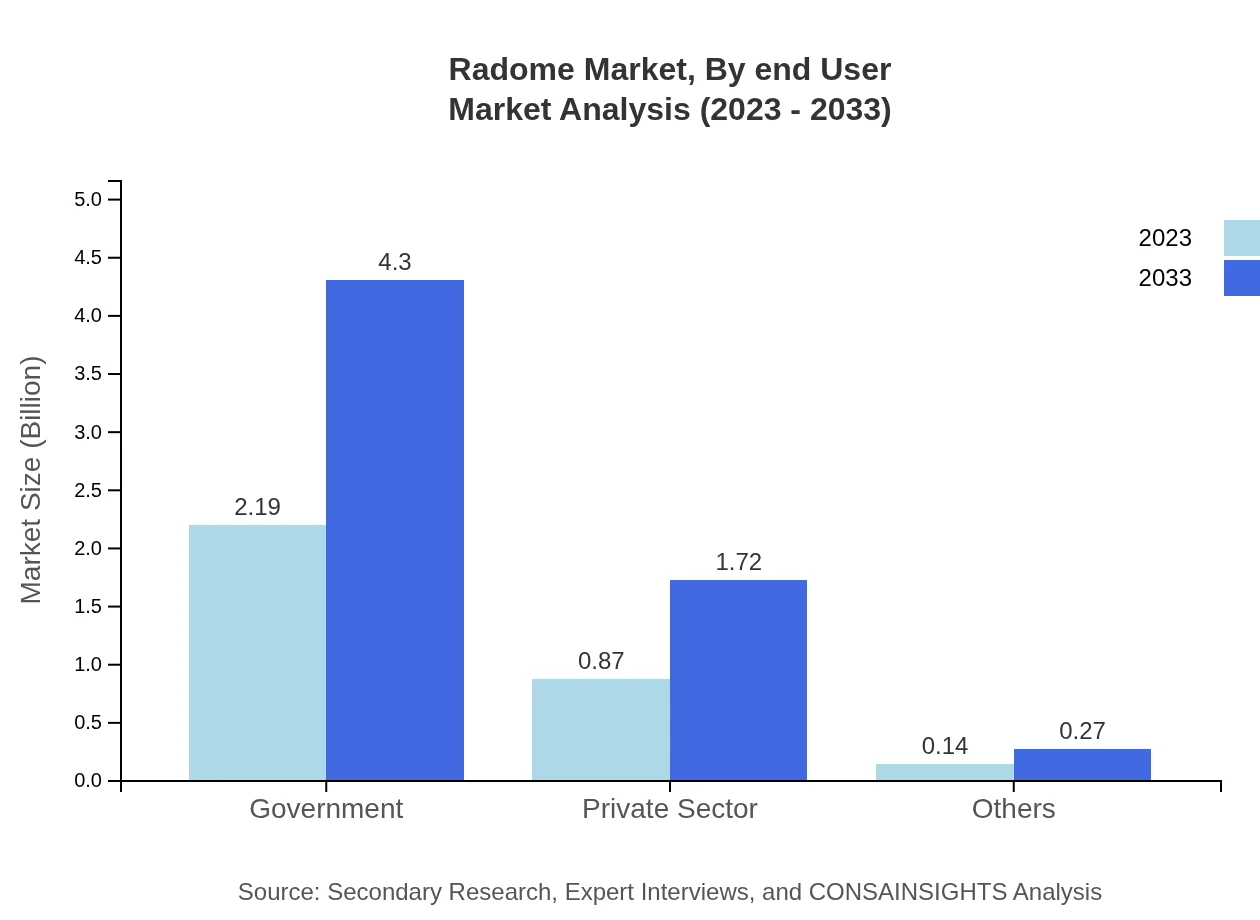

Radome Market Analysis By End User

The key end-users for Radome technology are primarily the military and civil sectors. The military segment is expected to represent more than 50% of the market share due to substantial defense investments, while the civil sector is growing steadily as commercial applications for communication increase.

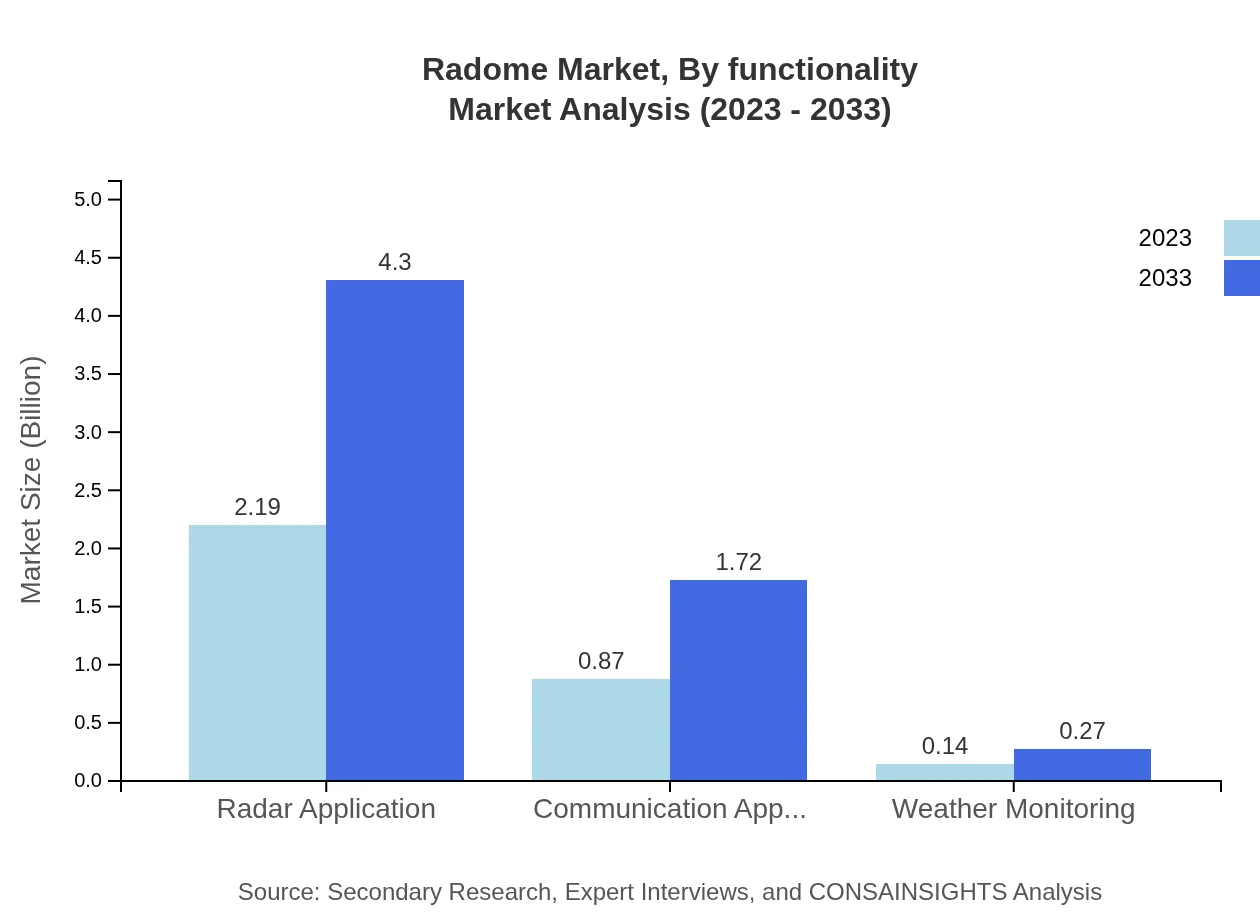

Radome Market Analysis By Functionality

Radomes serve several functions, such as providing protection, weather resistance, and performance enhancement for radar systems. The military functionality takes precedence, focusing on enhancing the accuracy of surveillance systems, while civil functionalities are also gaining attention for communication robustness.

Radome Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Radome Industry

Raytheon Technologies:

A leading American technology company specializing in aerospace and defense systems, Raytheon is a significant player in the Radome industry, known for its innovative solutions.Northrop Grumman Corporation:

A major defense contractor in the US, Northrop Grumman offers advanced radar and communication systems, with expertise in Radome technologies.General Dynamics Mission Systems:

Providing comprehensive solutions in defense technologies, General Dynamics focuses on radar systems and their protective radomes, contributing to significant advancements in the area.We're grateful to work with incredible clients.

FAQs

What is the market size of radome?

The global radome market was valued at approximately $3.2 billion in 2023, with an expected growth rate of 6.8% CAGR. By 2033, the market is anticipated to continue expanding, driven by increasing demand from various sectors.

What are the key market players or companies in this radome industry?

Key players in the radome industry include major aerospace companies, government contractors, and telecommunications providers. Their innovations and investments in advanced materials and technology significantly contribute to the operational efficiency and performance of radomes.

What are the primary factors driving the growth in the radome industry?

Growth in the radome industry is driven by increased defense spending, technological advancements, and the growing demand for connectivity in aviation and telecommunications. Additionally, the shift towards composite materials enhances product performance and durability.

Which region is the fastest Growing in the radome?

The Asia Pacific region is the fastest-growing market for radomes, expected to escalate from $0.60 billion in 2023 to $1.17 billion by 2033. This growth is attributed to increased defense expenditures and rising demand for telecommunication infrastructure.

Does ConsaInsights provide customized market report data for the radome industry?

Yes, ConsaInsights offers customized market research reports tailored to client specifications for the radome industry. This includes in-depth analysis, forecasts, and insights specific to your business needs, ensuring actionable data.

What deliverables can I expect from this radome market research project?

Deliverables for the radome market research project will include comprehensive reports, market analysis, segment details, growth forecasts, and strategic recommendations. These insights will support informed decision-making and strategic planning.

What are the market trends of radome?

Current trends in the radome market include a shift towards lightweight composite materials, advancements in radar technologies, and increased integration of radomes in commercial and military applications. The focus on sustainable materials is also gaining traction.