Robot Operating System Market Report

Published Date: 31 January 2026 | Report Code: robot-operating-system

Robot Operating System Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Robot Operating System (ROS) market, exploring its size, trends, regional insights, and forecasts from 2023 to 2033. It aims to equip stakeholders with valuable insights for strategic planning and informed decision-making.

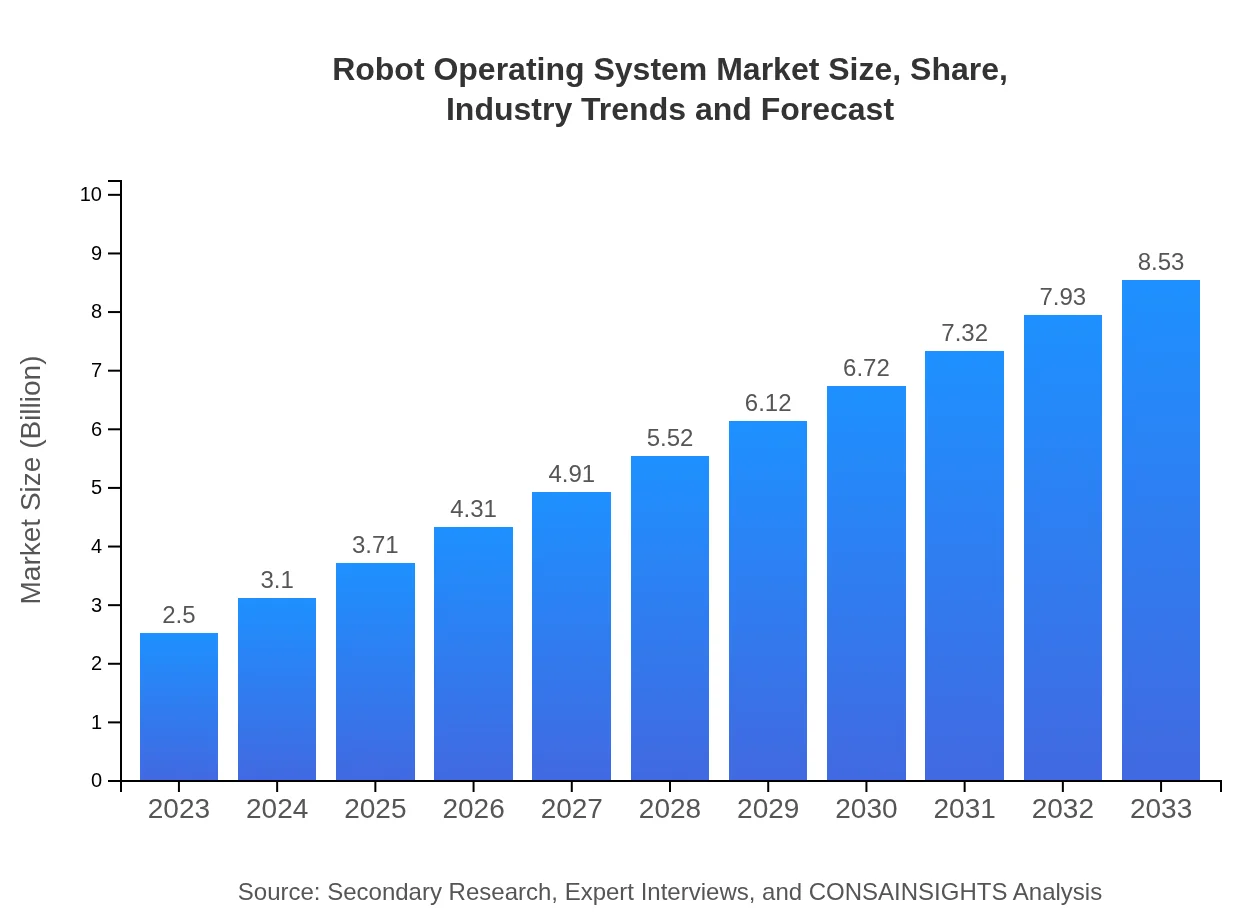

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 12.5% |

| 2033 Market Size | $8.53 Billion |

| Top Companies | Open Robotics, Robotis |

| Last Modified Date | 31 January 2026 |

Robot Operating System Market Overview

Customize Robot Operating System Market Report market research report

- ✔ Get in-depth analysis of Robot Operating System market size, growth, and forecasts.

- ✔ Understand Robot Operating System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Robot Operating System

What is the Market Size & CAGR of Robot Operating System market in 2023?

Robot Operating System Industry Analysis

Robot Operating System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Robot Operating System Market Analysis Report by Region

Europe Robot Operating System Market Report:

The European ROS market is forecasted to expand from $0.88 billion in 2023 to $2.99 billion by 2033. This growth is supported by stringent government regulations promoting automation, significant investments in smart factories, and a burgeoning demand for robotic solutions in areas like healthcare and logistics.Asia Pacific Robot Operating System Market Report:

In the Asia Pacific region, the ROS market is expected to grow from $0.44 billion in 2023 to $1.49 billion by 2033. The surge is attributable to the increasing investments in robotics by countries like China and Japan, focused on enhancing manufacturing and service robots. Moreover, the adoption of advanced technologies in various sectors further stimulates market growth.North America Robot Operating System Market Report:

North America holds a prominent position in the ROS market, with an expected growth from $0.81 billion in 2023 to $2.77 billion by 2033. The strong presence of major technology firms, coupled with high investment in R&D and infrastructure, significantly boosts the deployment of robotics solutions across various industries, including healthcare and manufacturing.South America Robot Operating System Market Report:

The South America market for ROS is projected to increase from $0.14 billion in 2023 to $0.49 billion by 2033. Factors driving this growth include improving economic conditions and the rising adoption of robotics in agriculture and logistics, enhancing productivity and efficiency within these sectors.Middle East & Africa Robot Operating System Market Report:

The Middle East and Africa ROS market is set to grow from $0.23 billion in 2023 to $0.79 billion by 2033. The growth is facilitated by a rising emphasis on automation and robotics in oil and gas operations, as well as in healthcare systems aiming to improve service delivery and patient care.Tell us your focus area and get a customized research report.

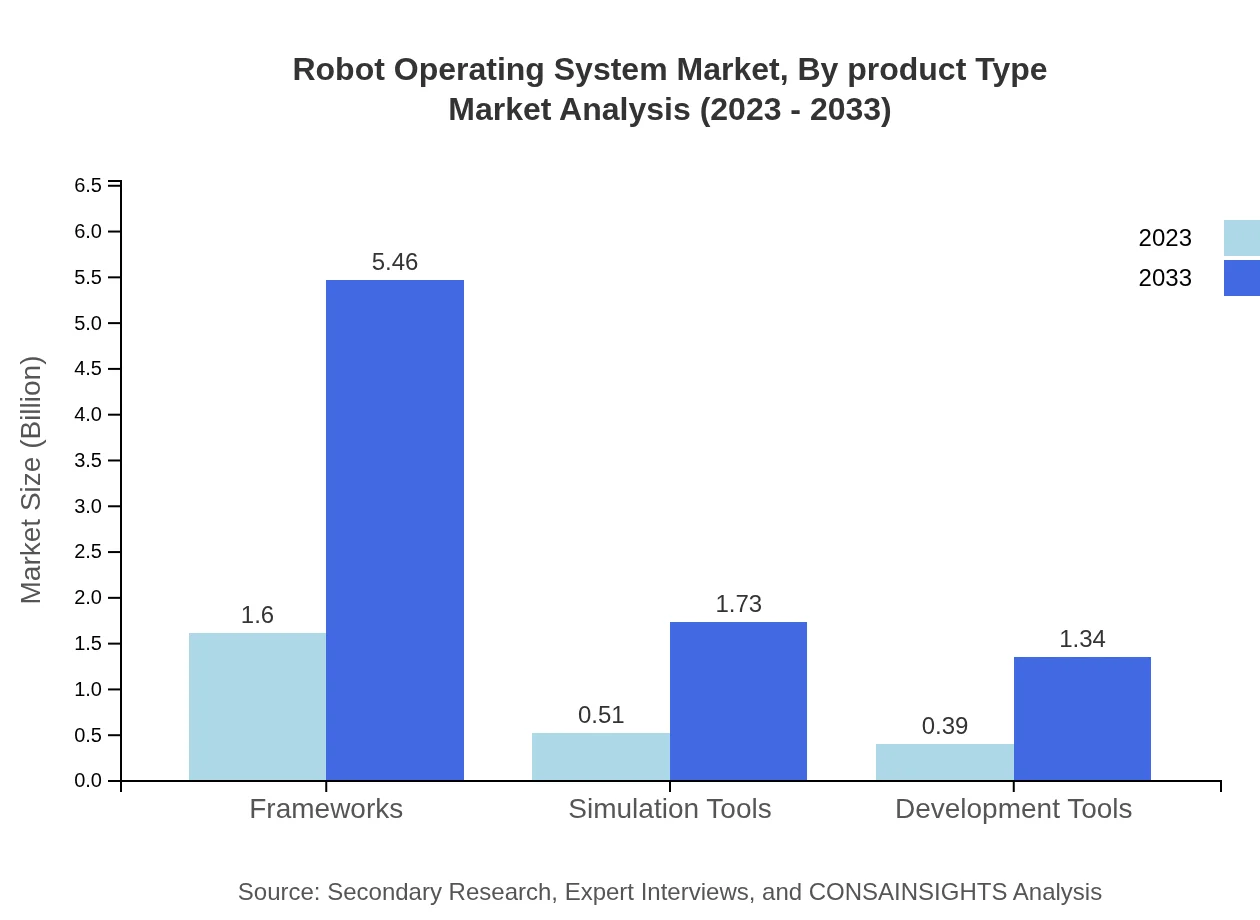

Robot Operating System Market Analysis By Product Type

The Robot Operating System market by product type is dominated by frameworks, which are projected to grow from $1.60 billion in 2023 to $5.46 billion by 2033, maintaining a significant market share of 64.03%. Simulation tools and development tools also contribute notably, showcasing the increasing reliance on sophisticated software solutions for robotic applications.

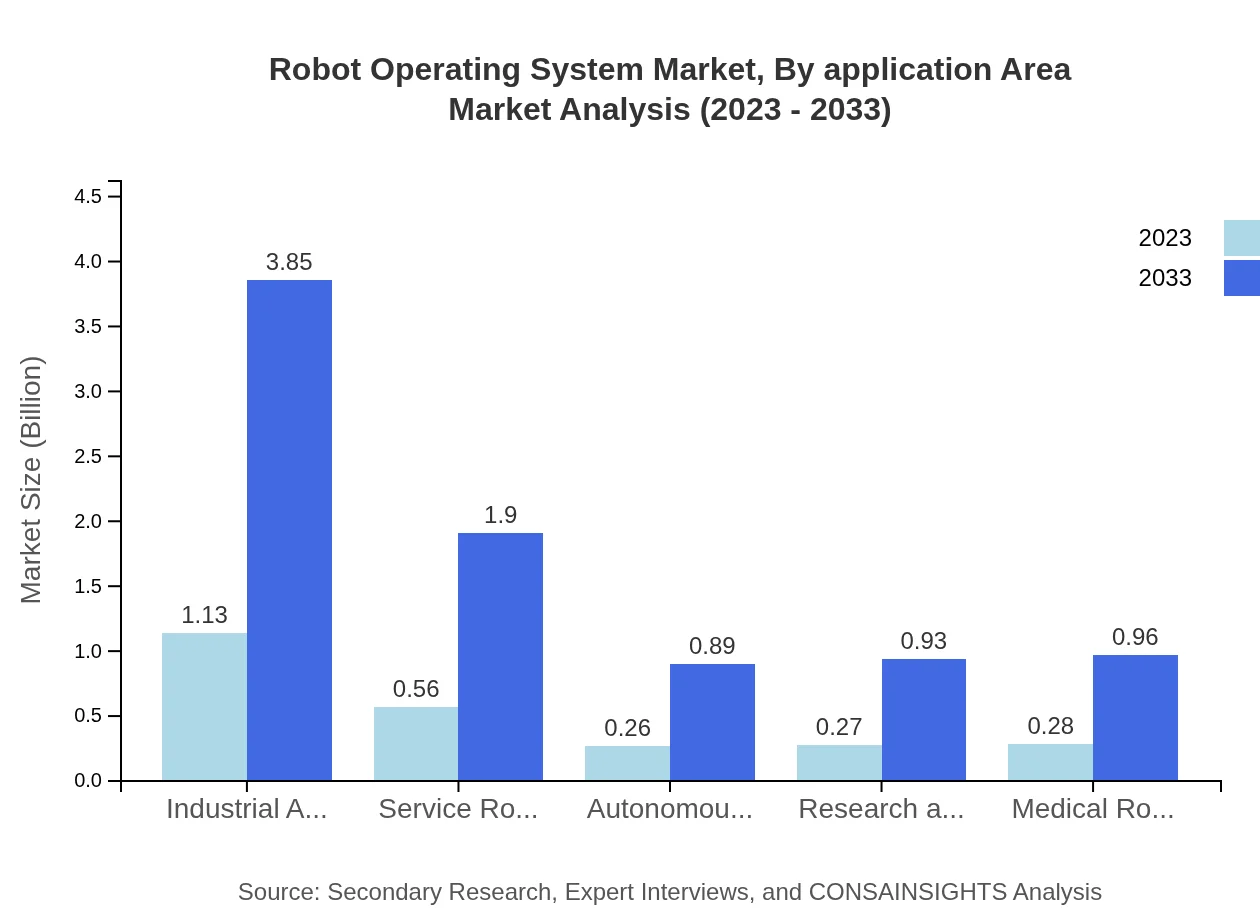

Robot Operating System Market Analysis By Application Area

In application areas, industrial automation is notable, with a market size expected to reach $3.85 billion by 2033 from $1.13 billion in 2023, equating to 45.17% market share. Other areas like healthcare and logistics are also emphasized, reflecting expansive opportunities for ROS adoption across various sectors.

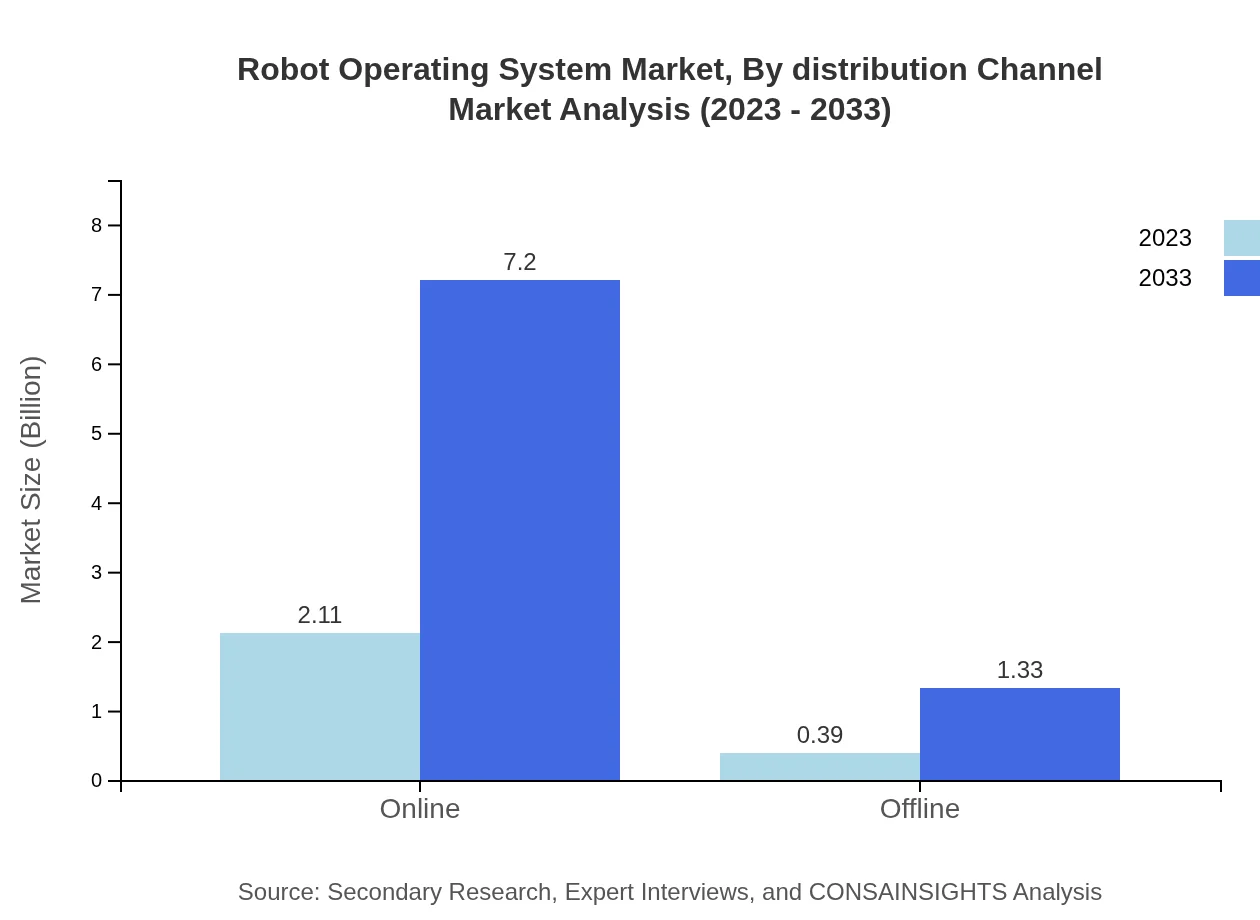

Robot Operating System Market Analysis By Distribution Channel

The online distribution channel is anticipated to dominate the ROS market, growing from $2.11 billion in 2023 to $7.20 billion by 2033, securing 84.43% market share. This surge reflects the increasing trend of e-commerce and online purchasing behavior among consumers and businesses for robotic solutions.

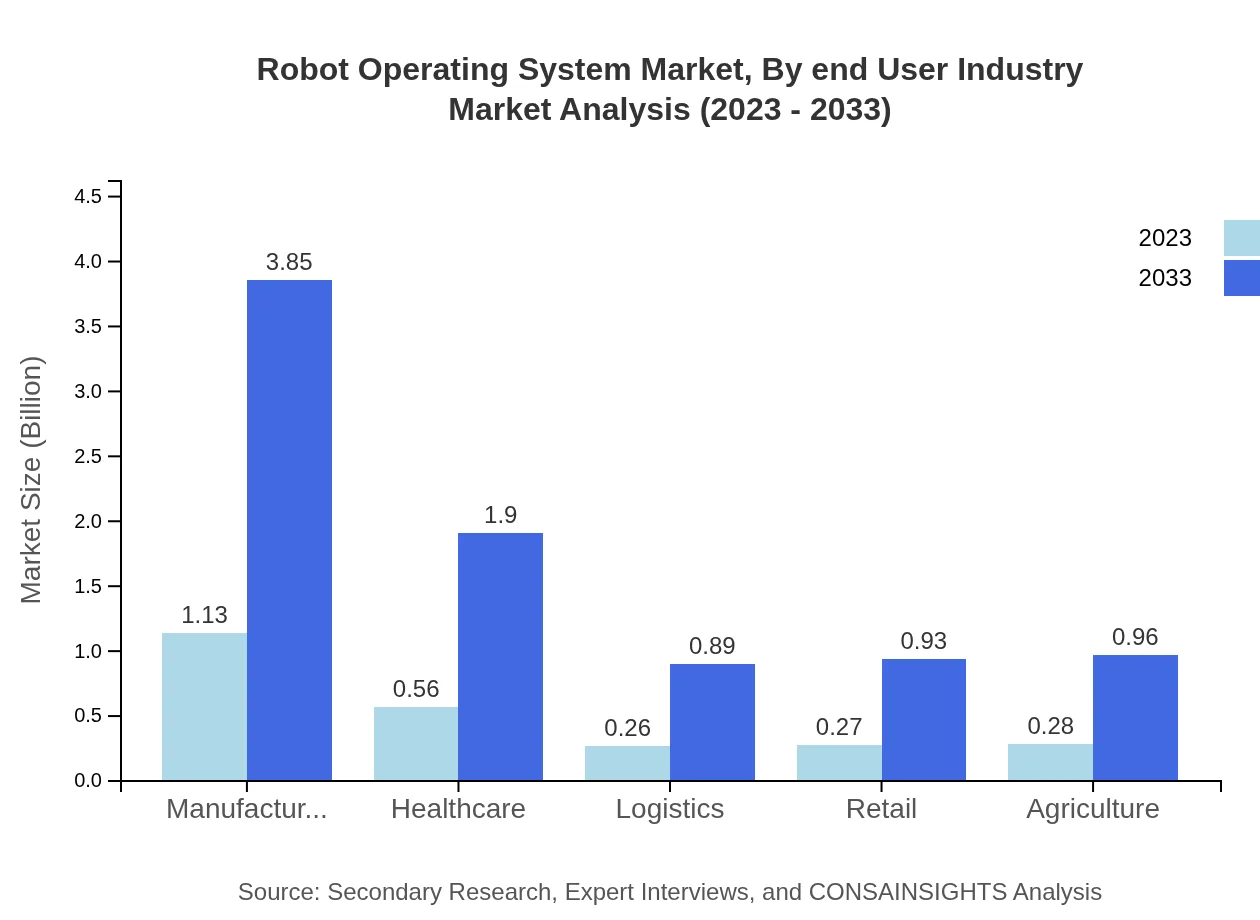

Robot Operating System Market Analysis By End User Industry

Manufacturing is a leading end-user industry for ROS, with growth projected from $1.13 billion in 2023 to $3.85 billion by 2033, holding a market share of 45.17%. Other industries such as healthcare and agriculture are gaining traction, driven by the move towards automation and innovation in processes.

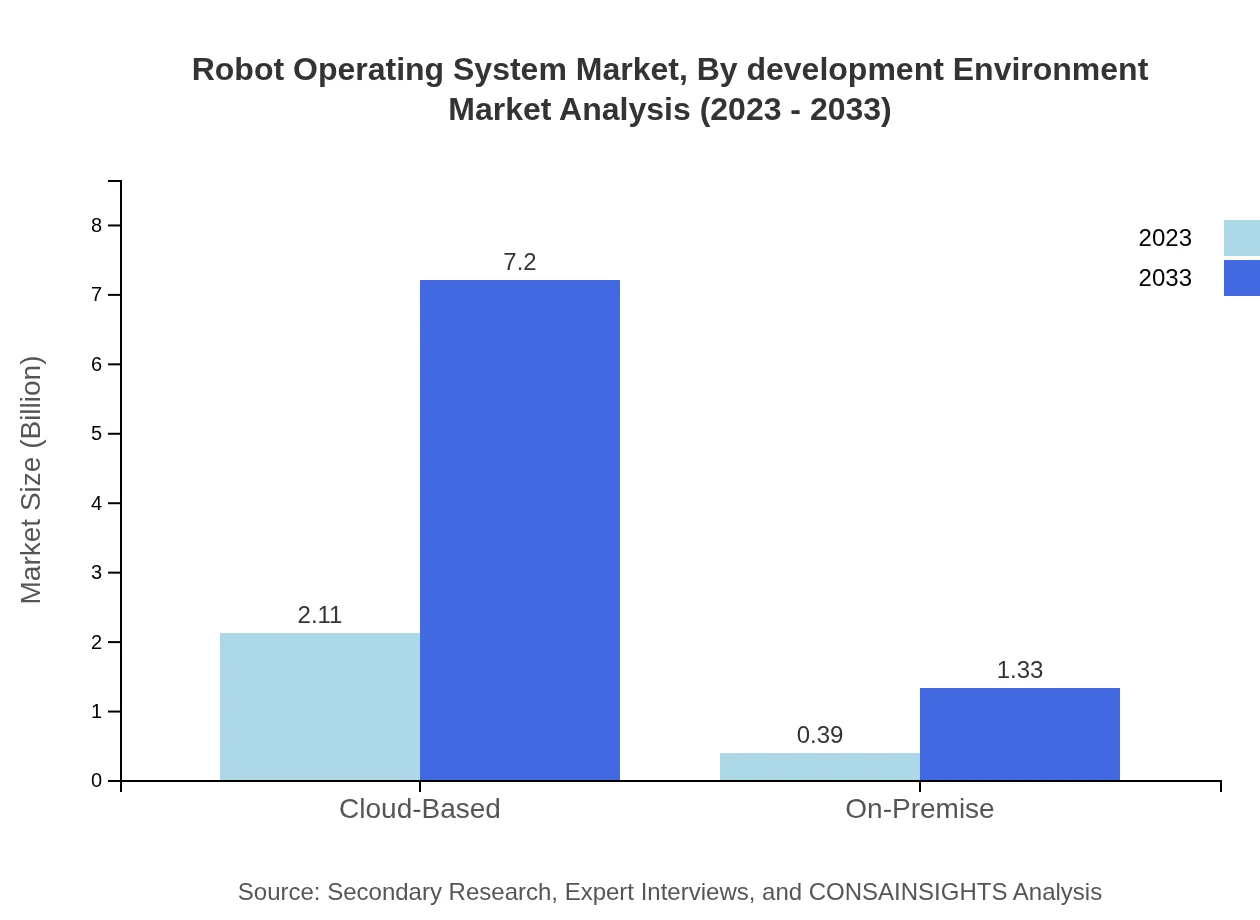

Robot Operating System Market Analysis By Development Environment

Cloud-based development environments are projected to dominate, with a significant market size increasing from $2.11 billion in 2023 to $7.20 billion by 2033, representing an 84.43% share. This trend aligns with the growing preference for scalability and flexibility offered by cloud solutions in the development of robotic systems.

Robot Operating System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Robot Operating System Industry

Open Robotics:

Open Robotics is a key player in the ROS market, dedicated to the advancement of robotic software and applications, significantly contributing to the development of ROS and its various tools.Robotis:

Robotis specializes in robotics hardware and software solutions, and actively collaborates in the development of ROS, providing valuable frameworks and simulation tools.We're grateful to work with incredible clients.

FAQs

What is the market size of robot Operating System?

The robot operating system market size is projected to reach approximately $2.5 billion by 2033, growing at a CAGR of 12.5%. This growth reflects increasing adoption across various industries and advancements in robotics technology.

What are the key market players or companies in this robot Operating System industry?

Key market players in the robot operating system industry include major technology firms and startups specializing in robotics and automation solutions. They continue to innovate and provide frameworks, tools, and applications for enhanced operational efficiencies in robotics.

What are the primary factors driving the growth in the robot Operating System industry?

The growth in the robot operating system industry is driven by advancements in AI and machine learning, increasing demand for automation in various sectors, and the rising need for efficient robotic solutions, especially in manufacturing and logistics.

Which region is the fastest Growing in the robot Operating System?

The fastest-growing region in the robot operating system market is Europe, projected to grow from $0.88 billion in 2023 to $2.99 billion by 2033. This growth indicates a rising interest in robotics across various industries in the region.

Does ConsaInsights provide customized market report data for the robot Operating System industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs within the robot operating system industry, offering insights and comprehensive analyses that can focus on segments or regions per client requirements.

What deliverables can I expect from this robot Operating System market research project?

From the robot operating system market research project, you can expect detailed reports including market size, growth forecasts, competitive analysis, segment breakdowns, and actionable insights to support strategic decision-making.

What are the market trends of robot Operating System?

Key market trends for the robot operating system include increasing integration with cloud technologies, enhancements in simulation tools, and a shift towards real-time analytics and AI-driven automation solutions across various applications.