Saas For Tax Compliance

Published Date: 31 January 2026 | Report Code: saas-for-tax-compliance

Saas For Tax Compliance Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the SaaS for Tax Compliance market, detailing key trends, market size, growth, and segmentation in the evolving landscape of digital tax solutions. Covering the forecast period from 2024 to 2033, the report offers detailed insights, strategic forecasts, and competitive analysis to inform stakeholders and drive effective strategic investments.

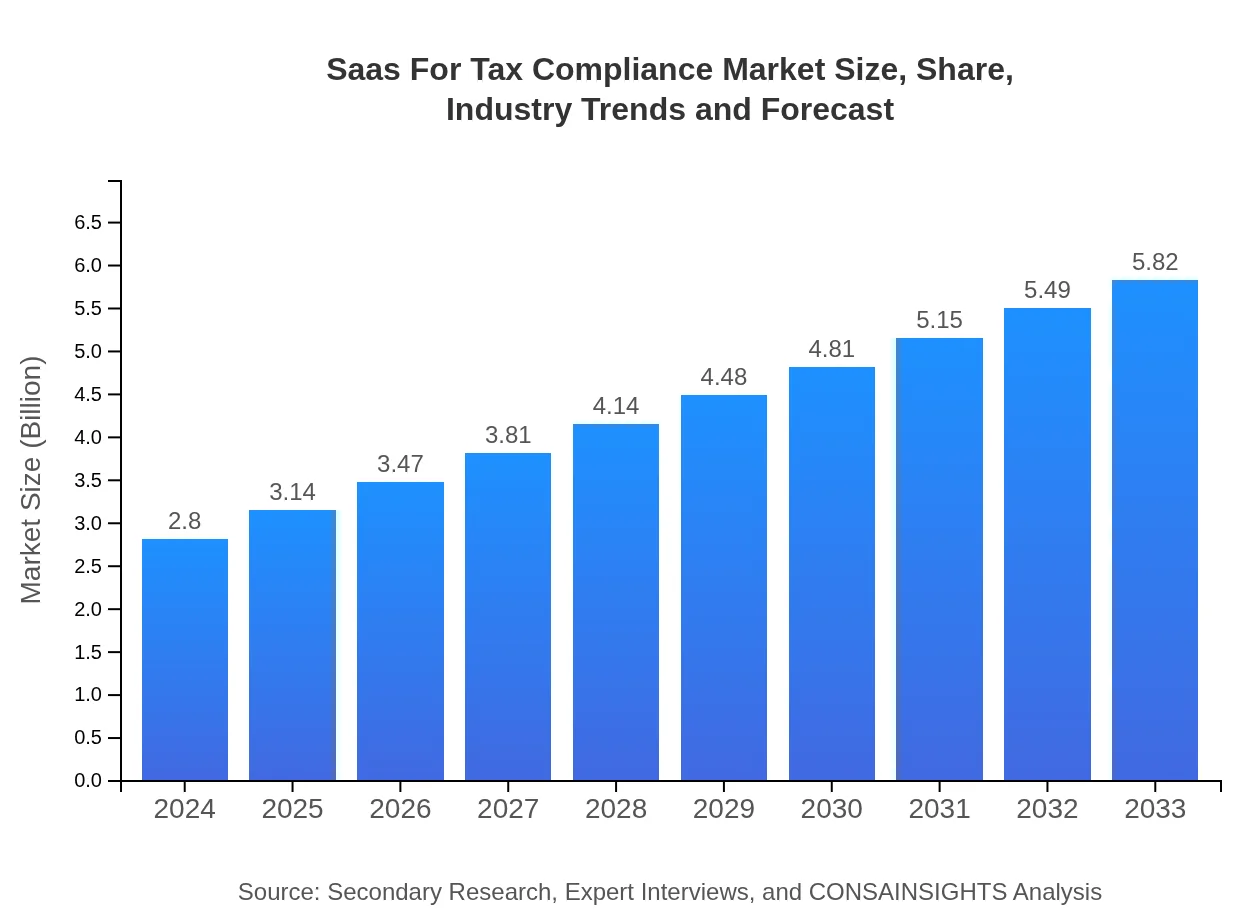

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $2.80 Billion |

| CAGR (2024-2033) | 8.2% |

| 2033 Market Size | $5.82 Billion |

| Top Companies | TaxSoft Solutions, ComplianceCloud Inc. |

| Last Modified Date | 31 January 2026 |

Saas For Tax Compliance Market Overview

Customize Saas For Tax Compliance market research report

- ✔ Get in-depth analysis of Saas For Tax Compliance market size, growth, and forecasts.

- ✔ Understand Saas For Tax Compliance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Saas For Tax Compliance

What is the Market Size & CAGR of Saas For Tax Compliance market in {Year}?

Saas For Tax Compliance Industry Analysis

Saas For Tax Compliance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Saas For Tax Compliance Market Analysis Report by Region

Europe Saas For Tax Compliance:

Europe represents a mature market where digital tax compliance solutions have been widely adopted due to comprehensive data privacy laws and strong regulatory standards. Market growth in the region is significant, with projected valuations rising from 0.82 in 2024 to 1.70 by 2033. Continued innovation and strategic partnerships are fostering a competitive marketplace focused on compliance efficiency and data security.Asia Pacific Saas For Tax Compliance:

In the Asia Pacific region, growth in digital tax compliance is accelerating as governments and enterprises prioritize technological modernization. Market estimates show an increase from a valuation of 0.53 in 2024 to 1.11 in 2033, driven by expanding IT infrastructures and proactive regulatory reforms aimed at enhancing financial transparency and security.North America Saas For Tax Compliance:

North America remains a key player in the SaaS for Tax Compliance market with robust investments in technology and innovation. The market is expected to grow from a valuation of 1.03 in 2024 to 2.15 in 2033. High rates of software adoption, driven by stringent compliance standards and the need for integrated financial systems, continue to support this upward trend.South America Saas For Tax Compliance:

South America is witnessing gradual market maturation with increasing adoption of cloud-based tax solutions. The region’s market dynamics, characterized by smaller initial investments and evolving regulatory frameworks, are projected to experience steady growth. This sustainable progress reflects improved business confidence and targeted initiatives encouraging digital transformation within the tax compliance space.Middle East & Africa Saas For Tax Compliance:

The Middle East and Africa region is emerging as a promising market segment, showing incremental improvements in SaaS adoption. With market valuations progressing from 0.21 in 2024 to 0.45 in 2033, regional growth is bolstered by ongoing economic reforms, increased investments in IT infrastructure, and a rising awareness of the benefits provided by automated tax compliance systems.Tell us your focus area and get a customized research report.

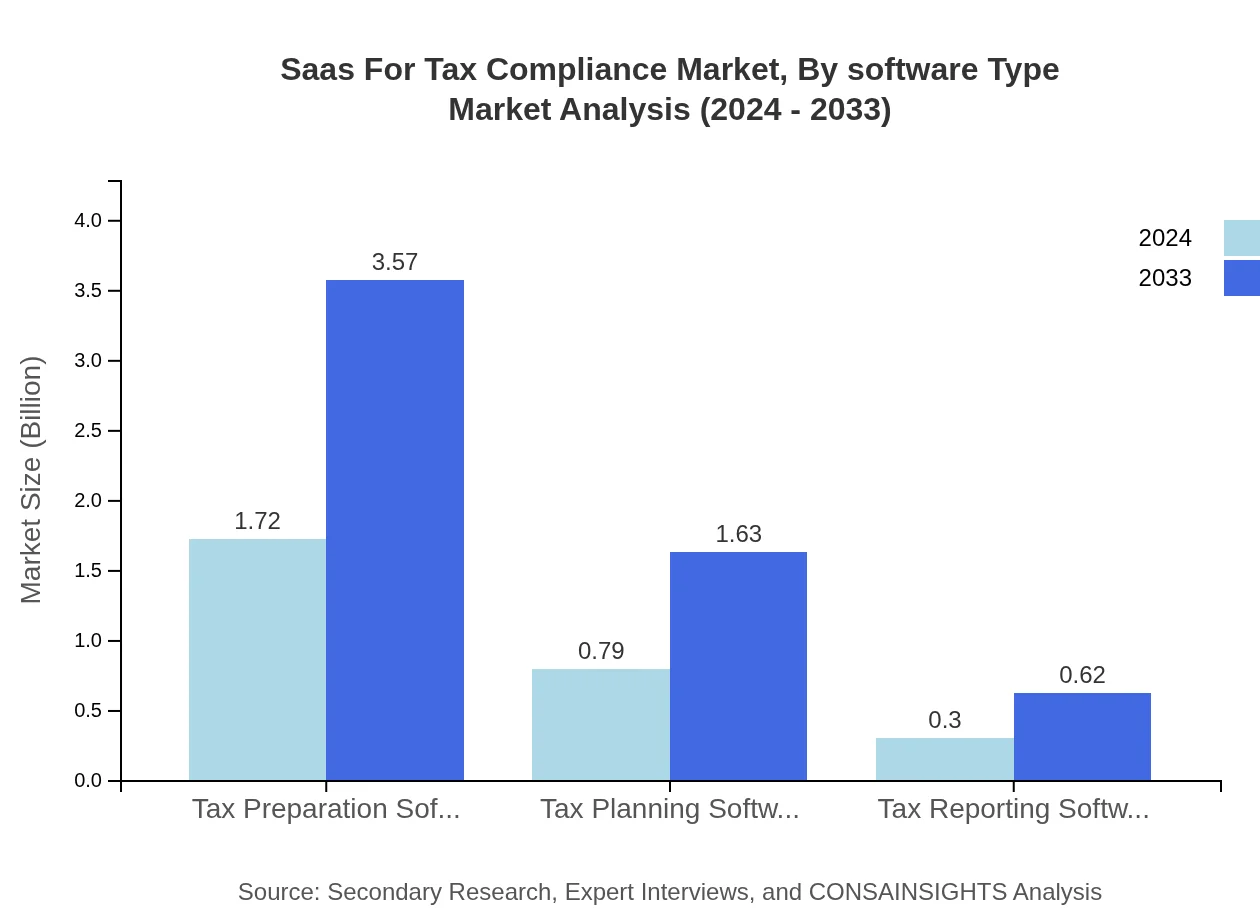

Saas For Tax Compliance Market Analysis By Software Type

The by-software-type segment focuses on various software solutions including Tax Preparation Software, Tax Planning Software, and Tax Reporting Software. Each category caters to distinct aspects of tax management; for instance, tax preparation solutions streamline filing processes while tax planning tools facilitate strategic fiscal management. Enhanced with features like automation, analytics, and security, these solutions offer significant operational benefits. The segment mirrors the increasing reliance on digital strategies for better compliance and accuracy, highlighting both efficiency gains and a reduction in manual errors. As organizations push for comprehensive, tailor-made solutions, the by-software-type category continues to attract robust investment, leading to a competitive environment and dynamic product evolution.

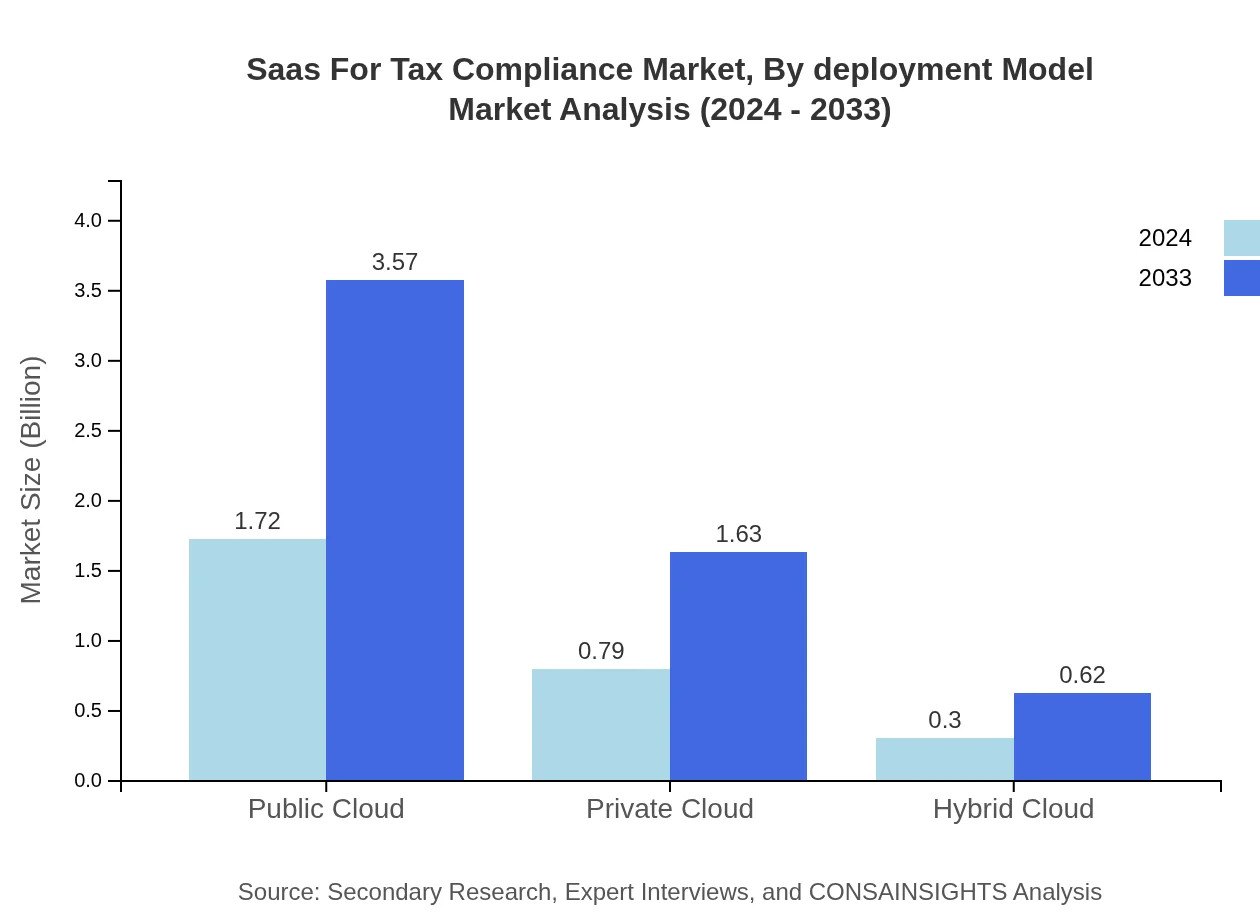

Saas For Tax Compliance Market Analysis By Deployment Model

The deployment model segment emphasizes the ongoing transition from conventional on-premises systems to agile, cloud-based deployments. This shift is evident in the rising adoption of public, private, and hybrid cloud models, which provide greater scalability, flexibility, and enhanced security for managing sensitive financial data. Organizations opt for these deployment options to achieve reduced IT overheads and improved responsiveness to regulatory changes. With digital transformation accelerating across industries, the market sees cloud-based models as a critical enabler of continuous updates, real-time data access, and cost-effective operational management in the tax compliance landscape.

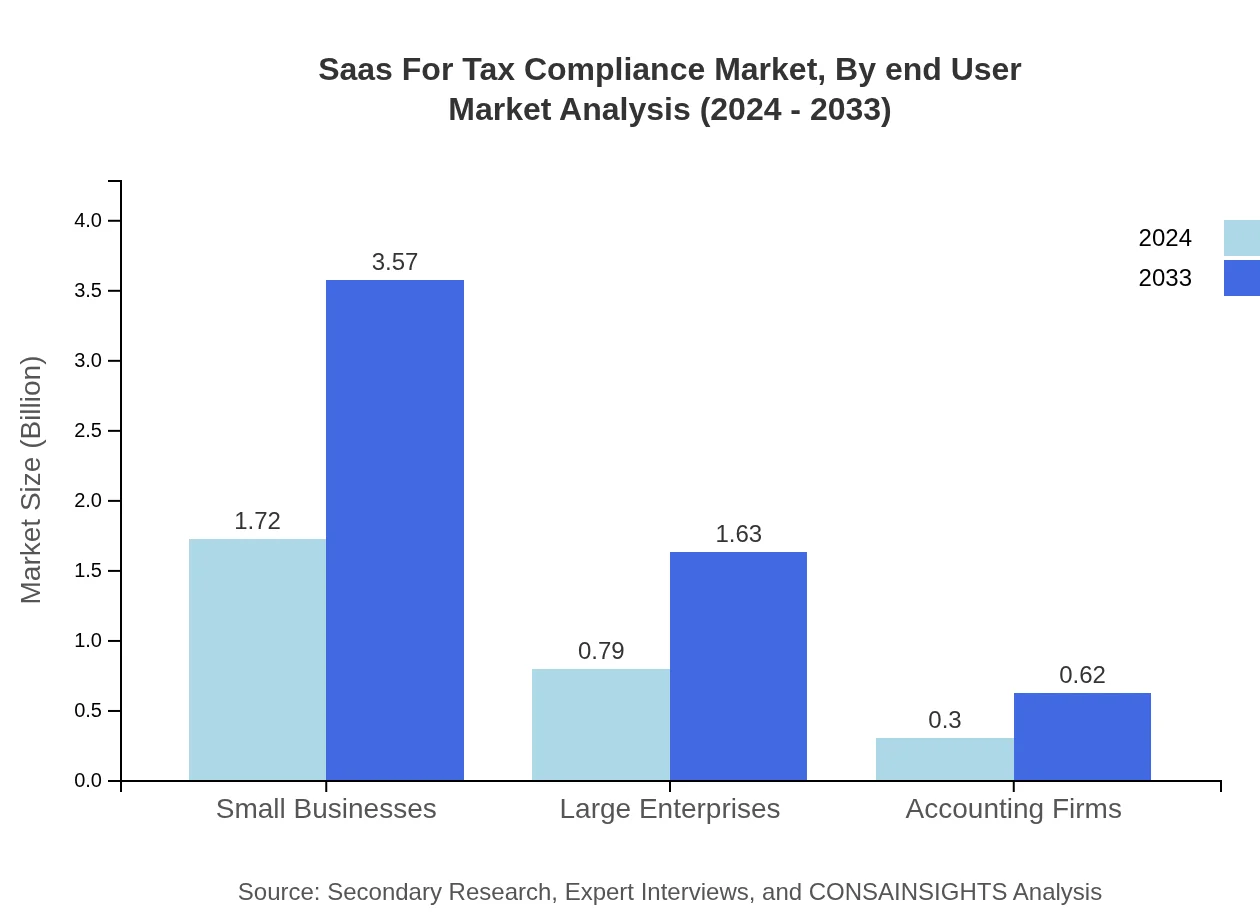

Saas For Tax Compliance Market Analysis By End User

The end-user segment dissects the market into distinct groups including small businesses, large enterprises, and specialized accounting firms. Each segment faces unique tax compliance challenges and thus benefits from customized software solutions. Small businesses are inclined towards cost-effective, efficient platforms that automate routine tasks, while large enterprises require robust, integrated systems to manage complex, multi-national tax requirements. Accounting firms leverage these tools to streamline client operations and maintain high compliance standards. This segmentation ensures that vendors can develop targeted strategies to meet specific customer needs, fostering increased adoption and continuous product enhancements.

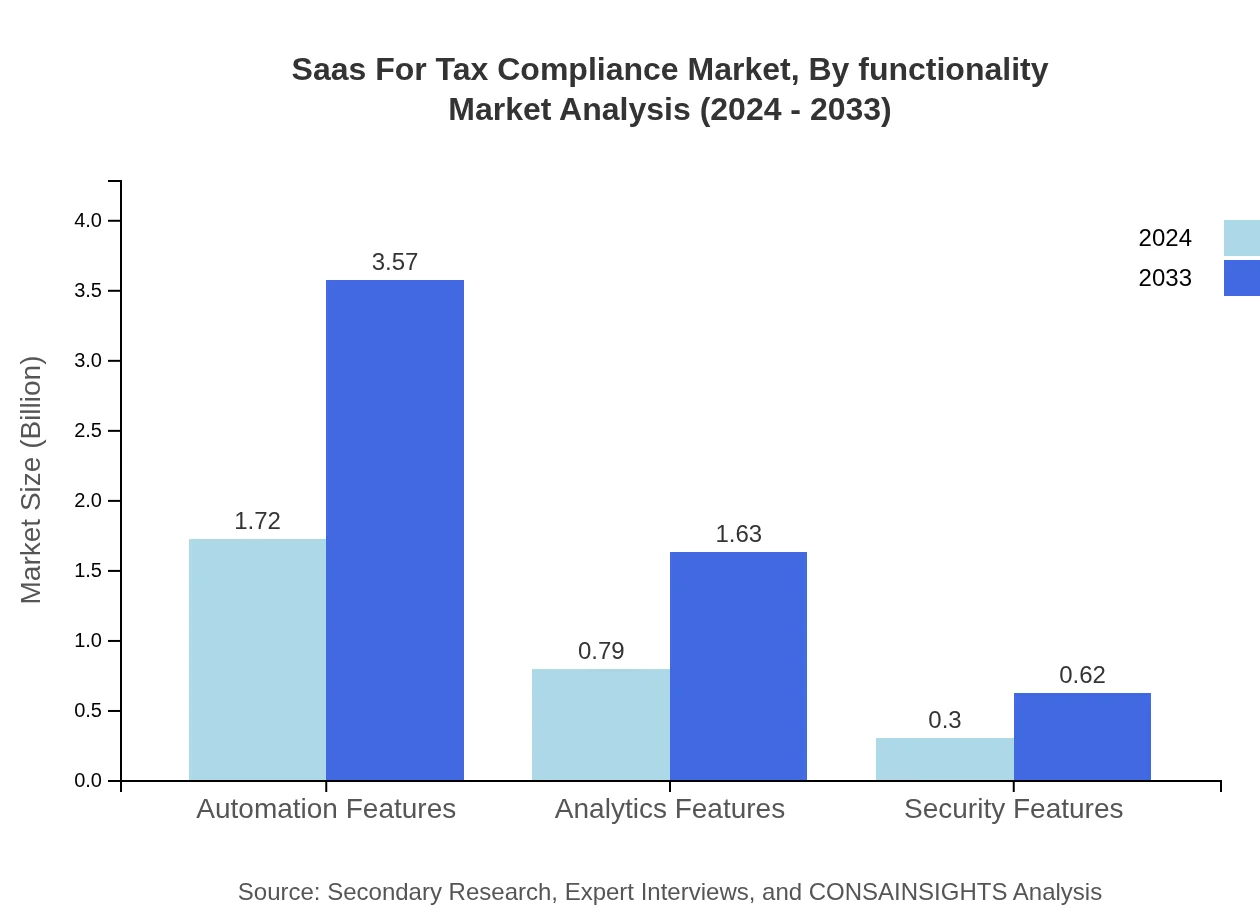

Saas For Tax Compliance Market Analysis By Functionality

This segment delves into the critical functionalities that drive market growth, such as automation, analytics, and security. Automation features reduce manual effort and errors, paving the way for more efficient tax processing. Analytics capabilities offer real-time insights and data-driven decision making, while robust security measures ensure compliance with ever-tightening data protection regulations. Together, these functionalities not only streamline operations but also enhance overall system reliability and user confidence, making them indispensable components of modern tax compliance solutions. The continuous evolution of these features is integral to maintaining competitive advantage and addressing the emerging needs of a diverse clientele.

Saas For Tax Compliance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Saas For Tax Compliance Industry

TaxSoft Solutions:

TaxSoft Solutions is a pioneering player in the SaaS for Tax Compliance sphere, known for its innovative cloud-based tax management systems. Their robust platforms integrate advanced automation and real-time analytics, enabling organizations to streamline compliance processes effectively while ensuring data integrity and security.ComplianceCloud Inc.:

ComplianceCloud Inc. has established itself as a leader by offering comprehensive tax compliance solutions that cater to both small businesses and large enterprises. Their emphasis on continuous product innovation and agile deployment has helped clients navigate complex regulatory environments and achieve operational excellence.We're grateful to work with incredible clients.

FAQs

What is the market size of saas For Tax Compliance?

The SaaS for tax compliance market is estimated to reach $2.8 billion by 2033, with a compound annual growth rate (CAGR) of 8.2%. This growth reflects the increasing demand for efficient and automated tax solutions globally.

What are the key market players or companies in this saas For Tax Compliance industry?

Key players include major cloud service companies and specialized SaaS tax providers focused on automation and compliance. This competitive landscape is characterized by continuous innovation and investment in advanced analytics and security features.

What are the primary factors driving the growth in the saas For Tax Compliance industry?

The growth is driven by increasing regulatory complexities, the need for real-time data access, automation of tax processes, and the rise of cloud-based solutions that enhance scalability and efficiency for businesses.

Which region is the fastest Growing in the saas For Tax Compliance?

North America is currently the fastest-growing region, projected to expand from $1.03 billion in 2024 to $2.15 billion by 2033. Following closely, Europe and Asia Pacific are also experiencing significant growth.

Does ConsaInsights provide customized market report data for the saas For Tax Compliance industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the SaaS for tax compliance industry, enabling clients to select parameters that best suit their strategic goals and operational frameworks.

What deliverables can I expect from this saas For Tax Compliance market research project?

Deliverables typically include a comprehensive market analysis report detailing market size, competitive landscape, growth drivers, consumer behavior analysis, and segmented data regarding various product types and regional performances.

What are the market trends of saas For Tax Compliance?

Current trends include the adoption of AI and machine learning for tax automation, increased focus on data privacy and cybersecurity, and growing integration of SaaS solutions with existing financial and ERP systems to streamline processes.