Sales Tax Software Market Report

Published Date: 31 January 2026 | Report Code: sales-tax-software

Sales Tax Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Sales Tax Software market, covering insights from market size, segmentation, trends, and forecasts for the period from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

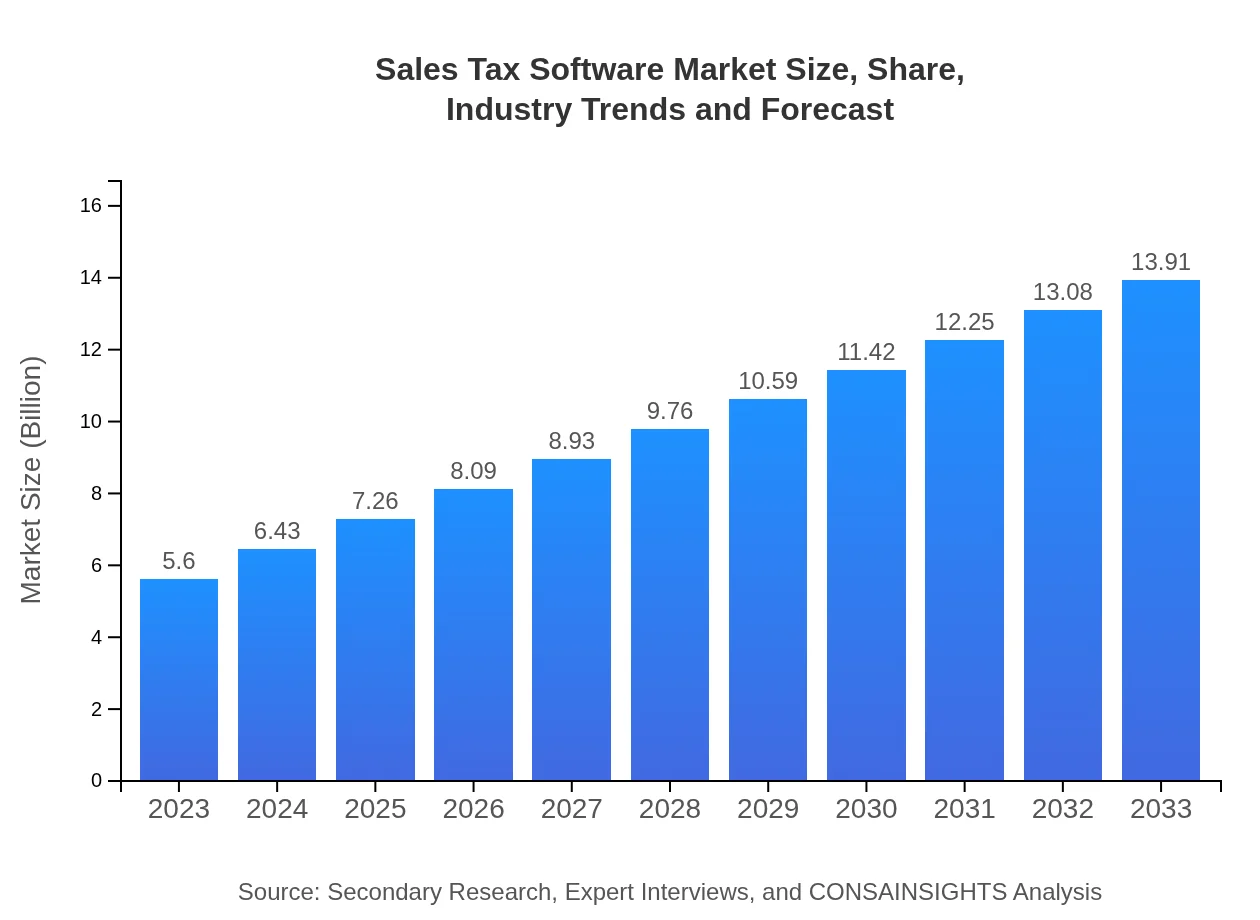

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $13.91 Billion |

| Top Companies | Avalara , Vertex, Thomson Reuters, Sovos, Intuit |

| Last Modified Date | 31 January 2026 |

Sales Tax Software Market Overview

Customize Sales Tax Software Market Report market research report

- ✔ Get in-depth analysis of Sales Tax Software market size, growth, and forecasts.

- ✔ Understand Sales Tax Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sales Tax Software

What is the Market Size & CAGR of Sales Tax Software market in 2023 and 2033?

Sales Tax Software Industry Analysis

Sales Tax Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sales Tax Software Market Analysis Report by Region

Europe Sales Tax Software Market Report:

The European Sales Tax Software market is projected to increase from $1.67 billion in 2023 to $4.15 billion by 2033. The region's stringent tax regulations and the need for businesses to comply with complex tax schemes are propelling market growth. Countries like Germany, France, and the UK lead in adoption rates.Asia Pacific Sales Tax Software Market Report:

The Asia Pacific Sales Tax Software market is projected to grow from $1.01 billion in 2023 to $2.52 billion in 2033. This region is witnessing increased adoption of digital solutions in tax management among businesses, driven by rapid economic growth and evolving tax regulations. Countries like China and India are spearheading this transformation as they enhance their compliance frameworks.North America Sales Tax Software Market Report:

North America remains a leading region, with the Sales Tax Software market anticipated to grow from $2.09 billion in 2023 to $5.19 billion by 2033. The U.S. market, in particular, is characterized by the presence of major software vendors and a highly competitive environment. Increased regulations and a drive for efficiency among businesses are primary growth drivers.South America Sales Tax Software Market Report:

In South America, the Sales Tax Software market is expected to grow from $0.36 billion in 2023 to $0.89 billion by 2033. The growth in this region is being driven by improvements in tax infrastructure and an emphasis on compliance due to stricter regulatory frameworks. Brazil and Argentina represent significant opportunities for market players.Middle East & Africa Sales Tax Software Market Report:

The Middle East and Africa's Sales Tax Software market is expected to grow from $0.47 billion in 2023 to $1.18 billion by 2033. Increased digital transformation and the introduction of VAT in several countries are stimulating demand for tax software solutions.Tell us your focus area and get a customized research report.

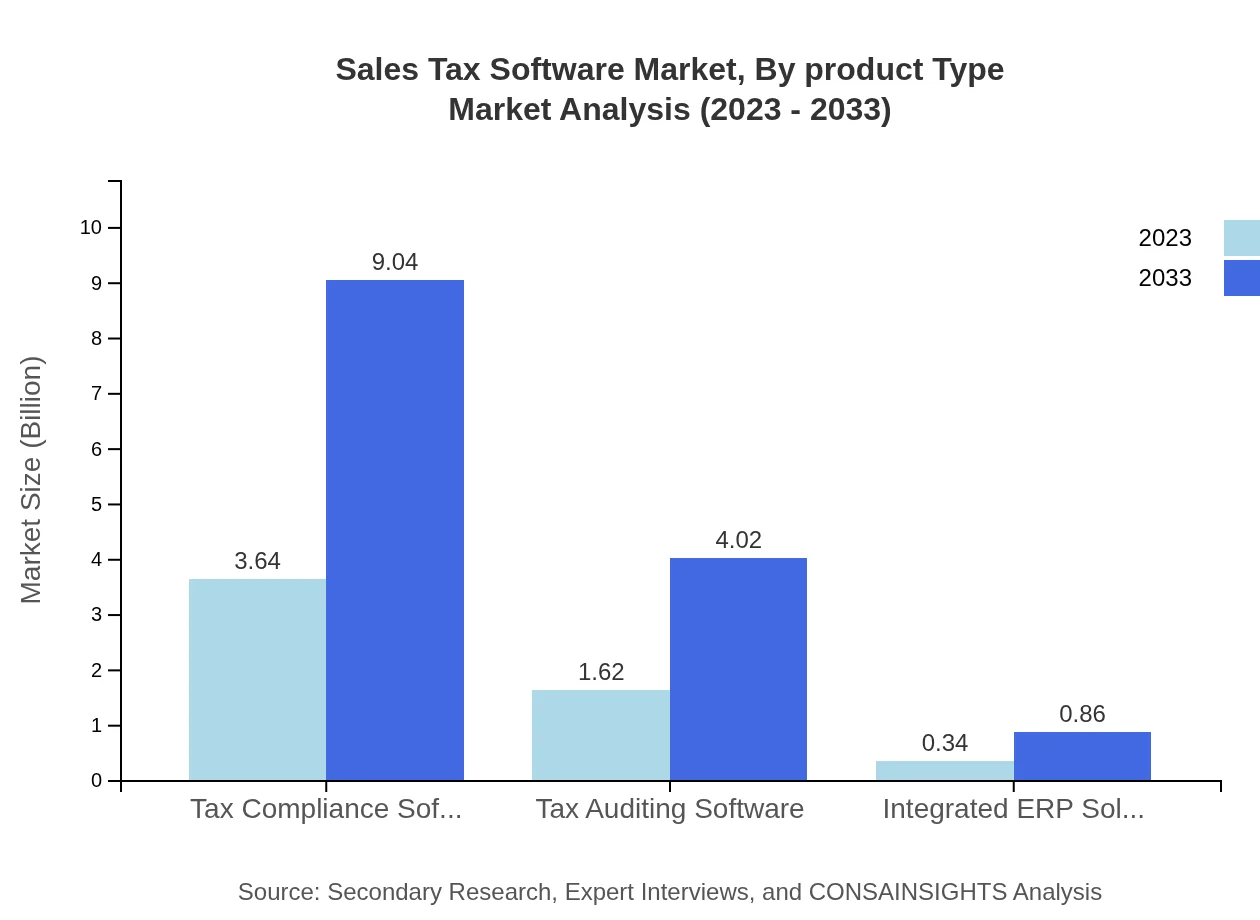

Sales Tax Software Market Analysis By Product Type

The key product types in the Sales Tax Software market include Tax Compliance Software, Tax Auditing Software, and Integrated ERP Solutions. Tax Compliance Software remains the largest segment, occupying approximately 64.96% of the market in 2023, projected to maintain this share in 2033. Tax Auditing and Compliance Management solutions are increasingly important, reflecting the industry's focus on mitigation of tax-related risks.

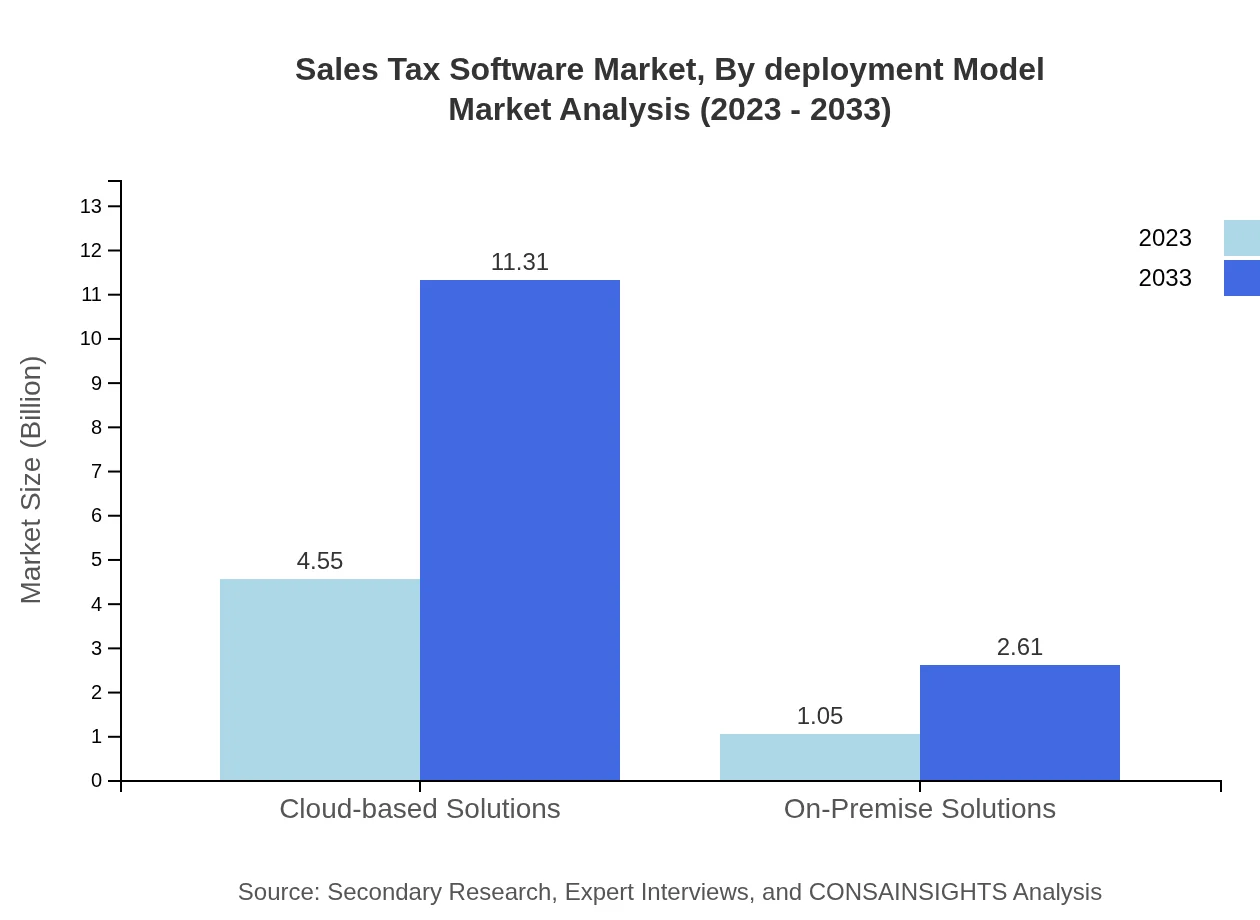

Sales Tax Software Market Analysis By Deployment Model

Cloud-based solutions currently dominate the market, holding around 81.26% share as of 2023, with expectations to continue their lead through to 2033. This trend indicates a marked shift towards SaaS offerings due to flexibility, scalability, and cost-effectiveness. On-premise solutions constitute a smaller share, appealing primarily to enterprises with specific IT infrastructure preferences.

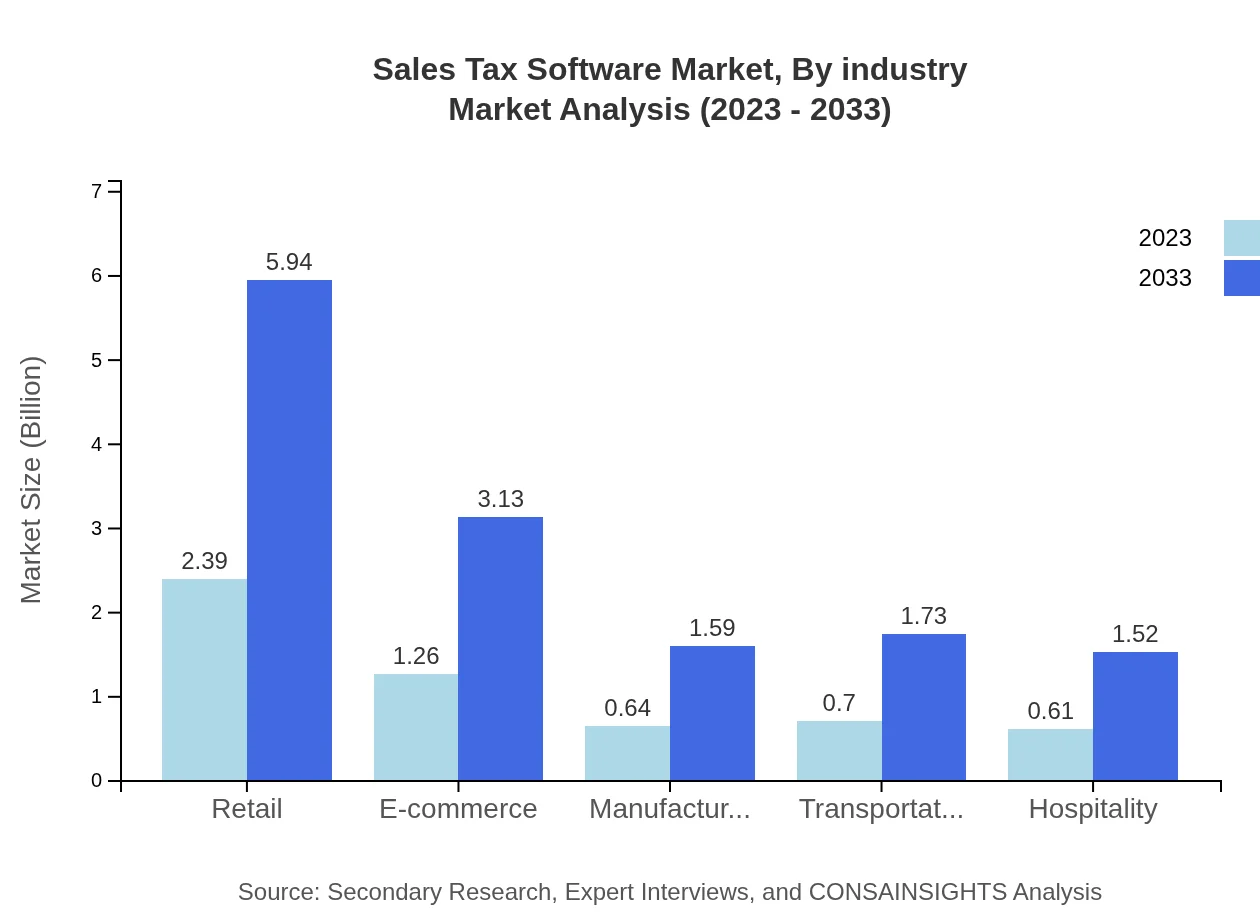

Sales Tax Software Market Analysis By Industry

The major industries utilizing Sales Tax Software include Retail, E-commerce, Manufacturing, Transportation, and Hospitality. The Retail segment is expected to retain its leading position, growing from $2.39 billion in 2023 to $5.94 billion by 2033, driven by the sector's need for effective sales tax management amid evolving tax laws.

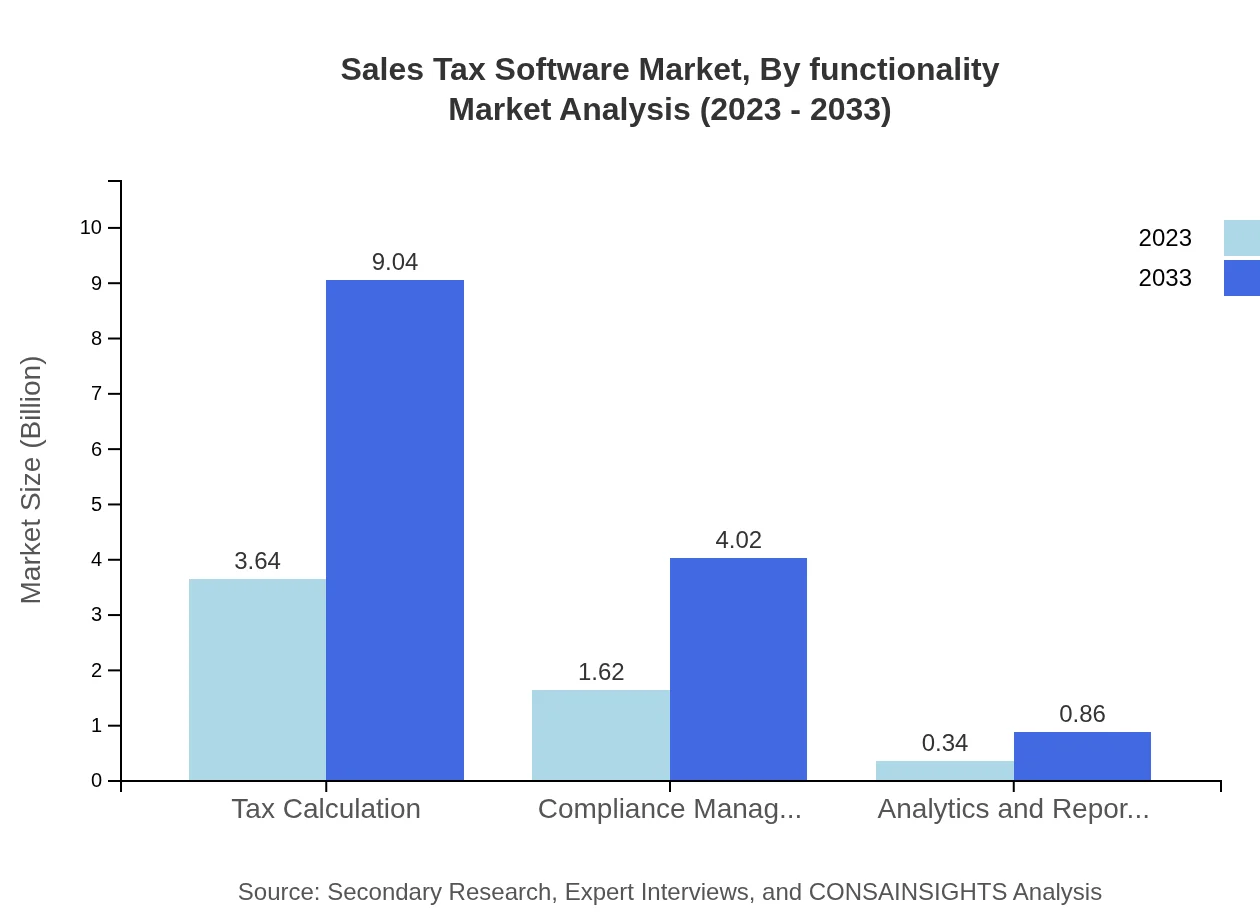

Sales Tax Software Market Analysis By Functionality

Key functionalities in Sales Tax Software include Tax Calculation, Compliance Management, and Analytics and Reporting. Tax Calculation tops the segment, valued at $3.64 billion in 2023 and forecasted to grow significantly, underscoring its fundamental role in operational tax processes.

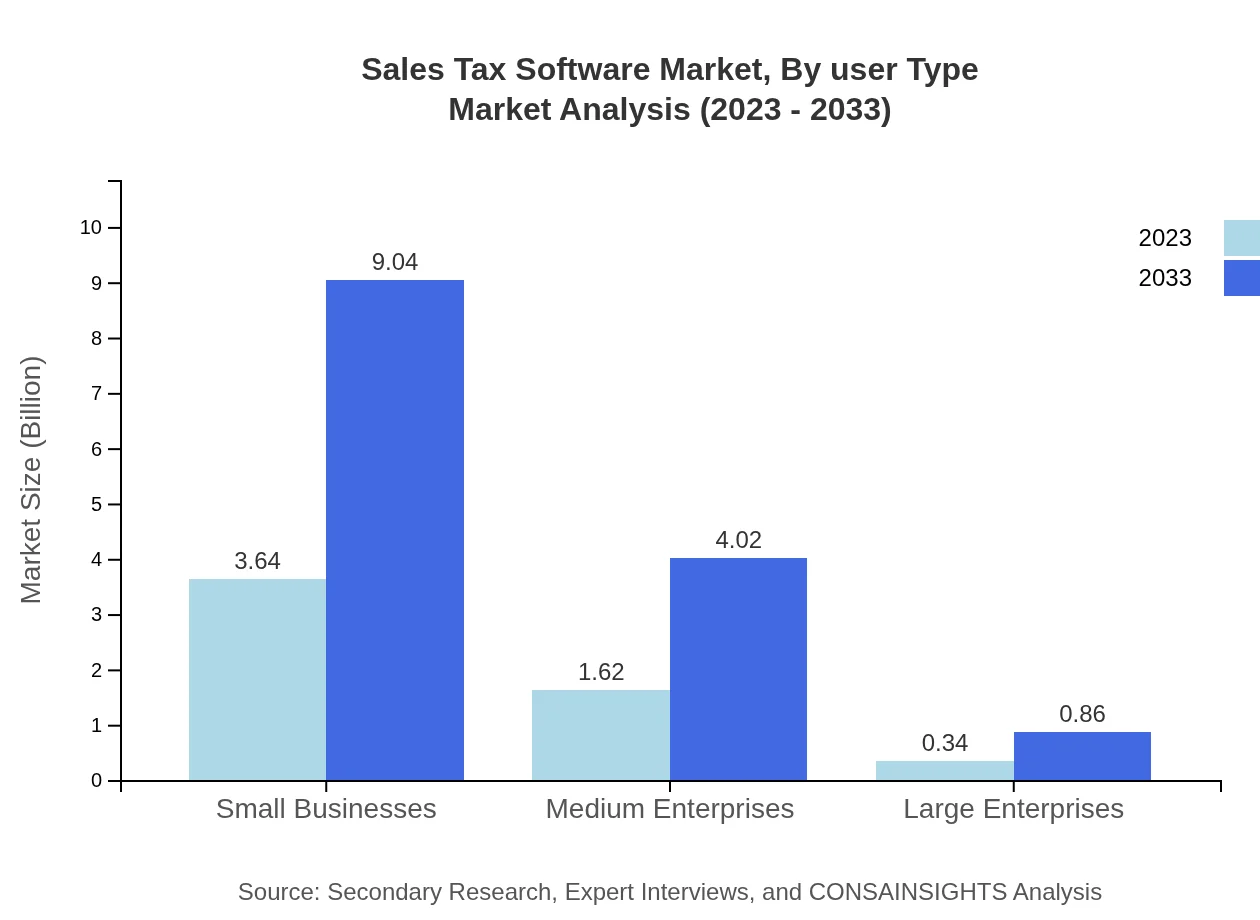

Sales Tax Software Market Analysis By User Type

User types are categorized into Small Businesses, Medium Enterprises, and Large Enterprises. Small businesses command a crucial share, holding 64.96% of the market in 2023, reflecting the widespread necessity for streamlined tax solutions, especially amidst regulatory pressures.

Sales Tax Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sales Tax Software Industry

Avalara :

Avalara provides a comprehensive cloud-based tax compliance platform designed to automate tax calculations, compliance, and reporting processes, making it easier for businesses to manage their sales tax obligations.Vertex:

Vertex introduces robust solutions for managing sales and use tax compliance. Their software is widely adopted by large enterprises to integrate seamlessly with existing enterprise resource planning (ERP) systems.Thomson Reuters:

Thomson Reuters offers innovative tax compliance and management software, renowned for its accuracy and ability to keep up with changing regulations, supporting businesses of all sizes.Sovos:

Sovos delivers end-to-end solutions for sales tax management, including compliance, reporting, and audit capabilities, making it a trusted partner for businesses navigating complex tax environments.Intuit:

Intuit's products, primarily focused on small to medium-sized businesses, provide user-friendly software to manage sales tax compliance effectively within broader accounting functions.We're grateful to work with incredible clients.

FAQs

What is the market size of Sales Tax Software?

The Sales Tax Software market is valued at approximately $5.6 billion in 2023, with a projected CAGR of 9.2% from 2023 to 2033. This rapid growth indicates increasing adoption and demand for efficient tax management solutions globally.

What are the key market players or companies in the Sales Tax Software industry?

Key players in the Sales Tax Software industry include Avalara, Vertex, Intuit, and Thomson Reuters. These companies lead in providing comprehensive solutions that streamline tax compliance and reporting, contributing significantly to market growth.

What are the primary factors driving the growth in the Sales Tax Software industry?

Key drivers of growth in the Sales Tax Software industry include increasing e-commerce activities, rising regulatory compliance needs, and advancements in cloud-based technology. These elements foster a demand for reliable tax calculation and management solutions across various sectors.

Which region is the fastest Growing in the Sales Tax Software market?

The fastest-growing region in the Sales Tax Software market is North America, with a projected market size increase from $2.09 billion in 2023 to $5.19 billion by 2033. Rapid adoption of technology and strong regulatory frameworks support this growth.

Does ConsaInsights provide customized market report data for the Sales Tax Software industry?

Yes, ConsaInsights offers customized market report data tailored to the Sales Tax Software industry. Clients can expect insights specific to their needs, including market trends, competitive landscape, and forecasts tailored to regional or sectoral focuses.

What deliverables can I expect from this Sales Tax Software market research project?

From the Sales Tax Software market research project, you can anticipate comprehensive reports containing market size, growth forecasts, competitive analysis, segmentation data, and regional market insights that inform strategic decision-making.

What are the market trends of Sales Tax Software?

Current trends in the Sales Tax Software market include increased migration to cloud-based solutions, demand for integrated tax solutions, and the emphasis on analytics and reporting capabilities. These trends reflect a shift towards more efficient and automated tax processes.