Silica Sand Market Report

Published Date: 02 February 2026 | Report Code: silica-sand

Silica Sand Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the silica sand market from 2023 to 2033, including market trends, key segments, technological advancements, and regional insights. It aims to deliver valuable data for stakeholders to navigate the evolving landscape of the silica sand industry.

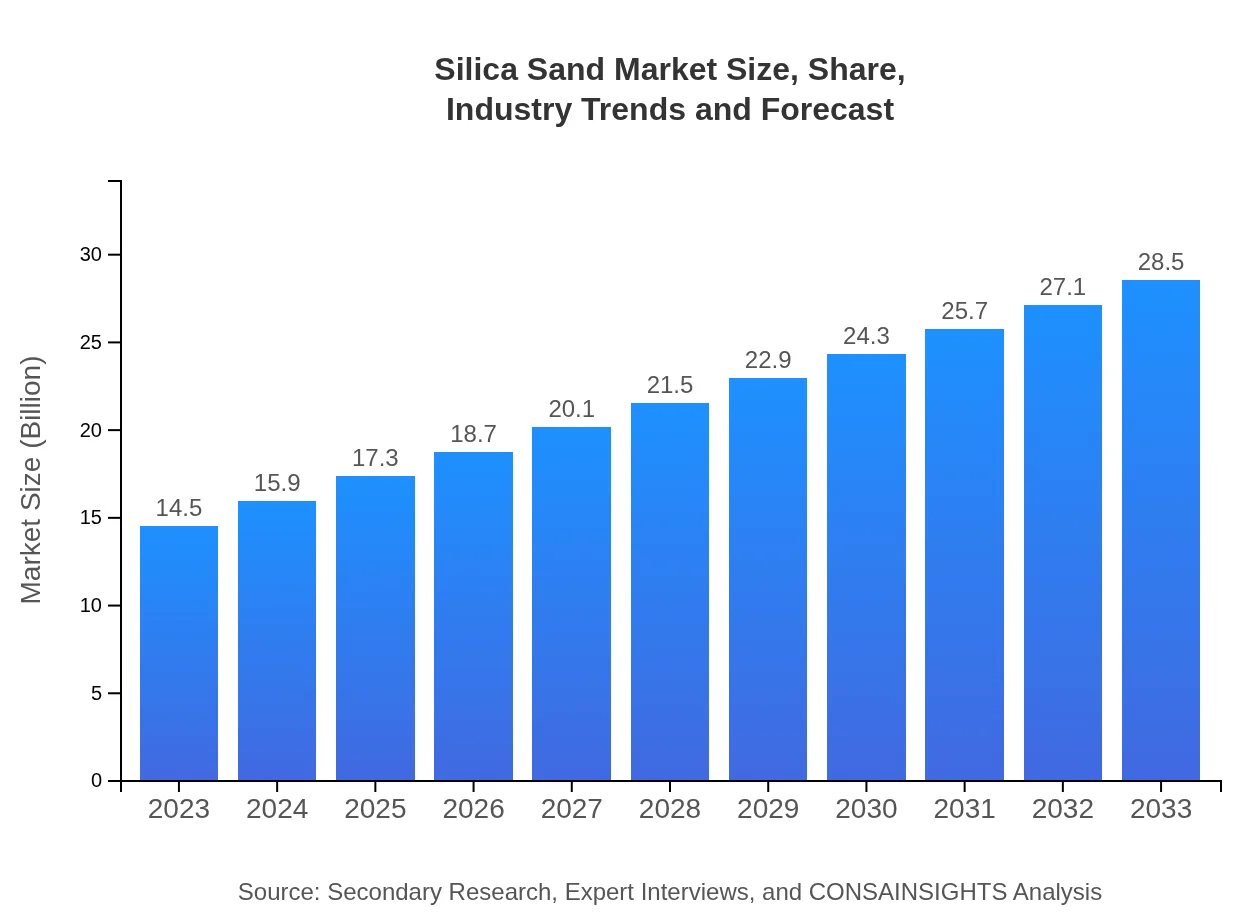

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $14.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $28.50 Billion |

| Top Companies | U.S. Silica Holdings, Inc., Covia Holdings Corporation, Sibelco, Screening and Crushing Solutions, LLC |

| Last Modified Date | 02 February 2026 |

Silica Sand Market Overview

Customize Silica Sand Market Report market research report

- ✔ Get in-depth analysis of Silica Sand market size, growth, and forecasts.

- ✔ Understand Silica Sand's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Silica Sand

What is the Market Size & CAGR of Silica Sand market in 2023?

Silica Sand Industry Analysis

Silica Sand Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Silica Sand Market Analysis Report by Region

Europe Silica Sand Market Report:

The European silica sand market is projected to grow from $4.72 billion in 2023 to $9.27 billion by 2033. Regulatory pressures to enhance environment-friendly practices in the construction and automotive sectors are driving innovation in silica sand applications.Asia Pacific Silica Sand Market Report:

The Asia Pacific region is projected to witness substantial growth in the silica sand market, anticipated to increase from $2.71 billion in 2023 to $5.33 billion by 2033. Rapid urbanization, infrastructure development, and increasing disposable income are propelling demand, particularly in countries like China and India, where construction activities are booming.North America Silica Sand Market Report:

North America holds a significant share of the silica sand market, valued at $4.91 billion in 2023, forecasted to reach $9.65 billion by 2033. The construction industry's recovery, coupled with increasing investments in renewable energy and water filtration, is stimulating demand across the United States and Canada.South America Silica Sand Market Report:

In South America, the market is expected to grow from $0.59 billion in 2023 to $1.16 billion in 2033. The expansion of construction and manufacturing sectors highlights an emerging need for silica sand, with key players exploring opportunities to enhance production capabilities in Brazil and Argentina.Middle East & Africa Silica Sand Market Report:

In the Middle East and Africa, the silica sand market is expected to see growth from $1.57 billion in 2023 to $3.08 billion in 2033. Economic diversification efforts in the Gulf Cooperation Council (GCC) countries and rising construction activities in Africa are contributing to accelerating demand.Tell us your focus area and get a customized research report.

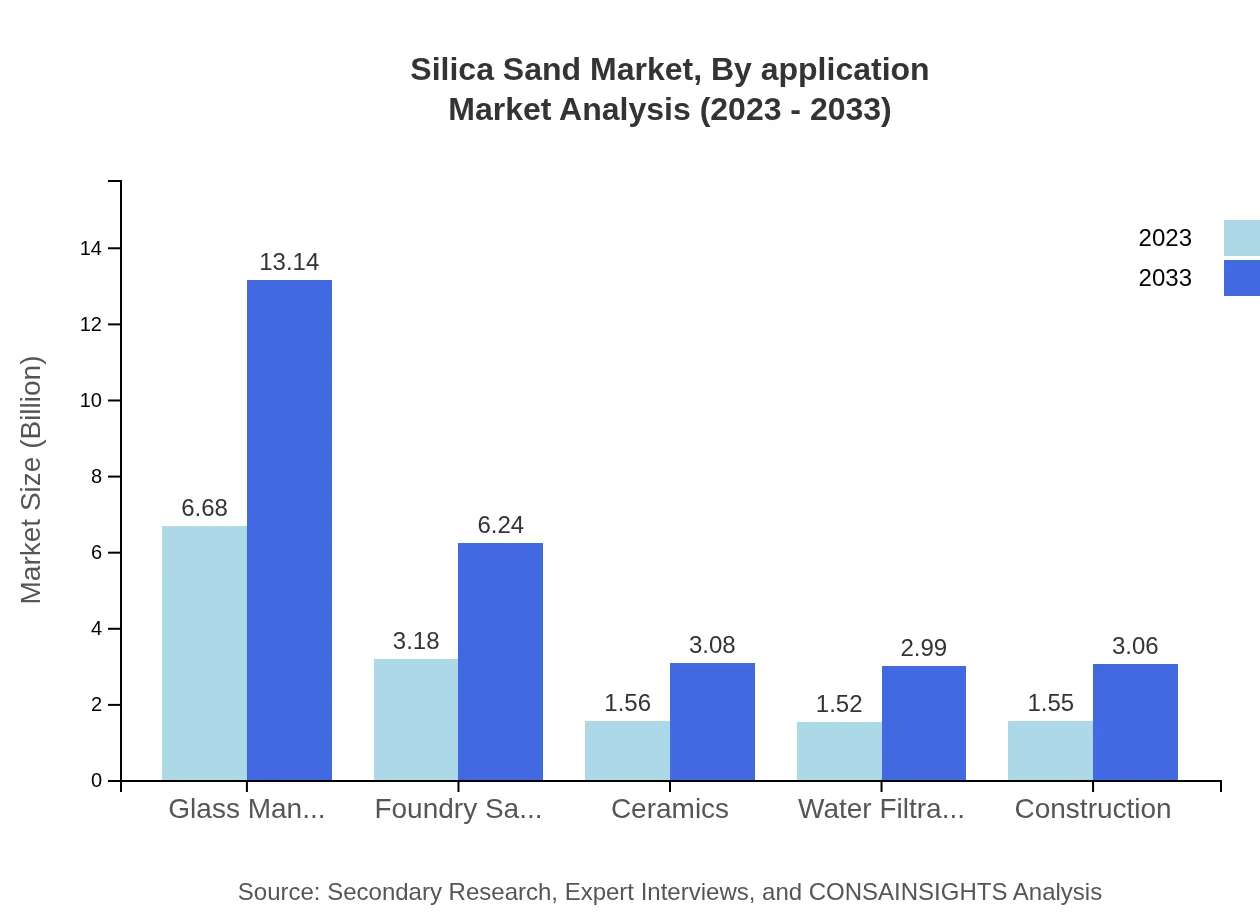

Silica Sand Market Analysis By Application

In 2023, the construction segment dominates the silica sand market, valued at $7.70 billion, and is expected to reach $15.14 billion by 2033. The glass manufacturing segment follows closely, projected to grow from $6.68 billion to $13.14 billion during the same period. Other significant segments include water treatment, ceramics, and foundry sand, each contributing to the overall market dynamics.

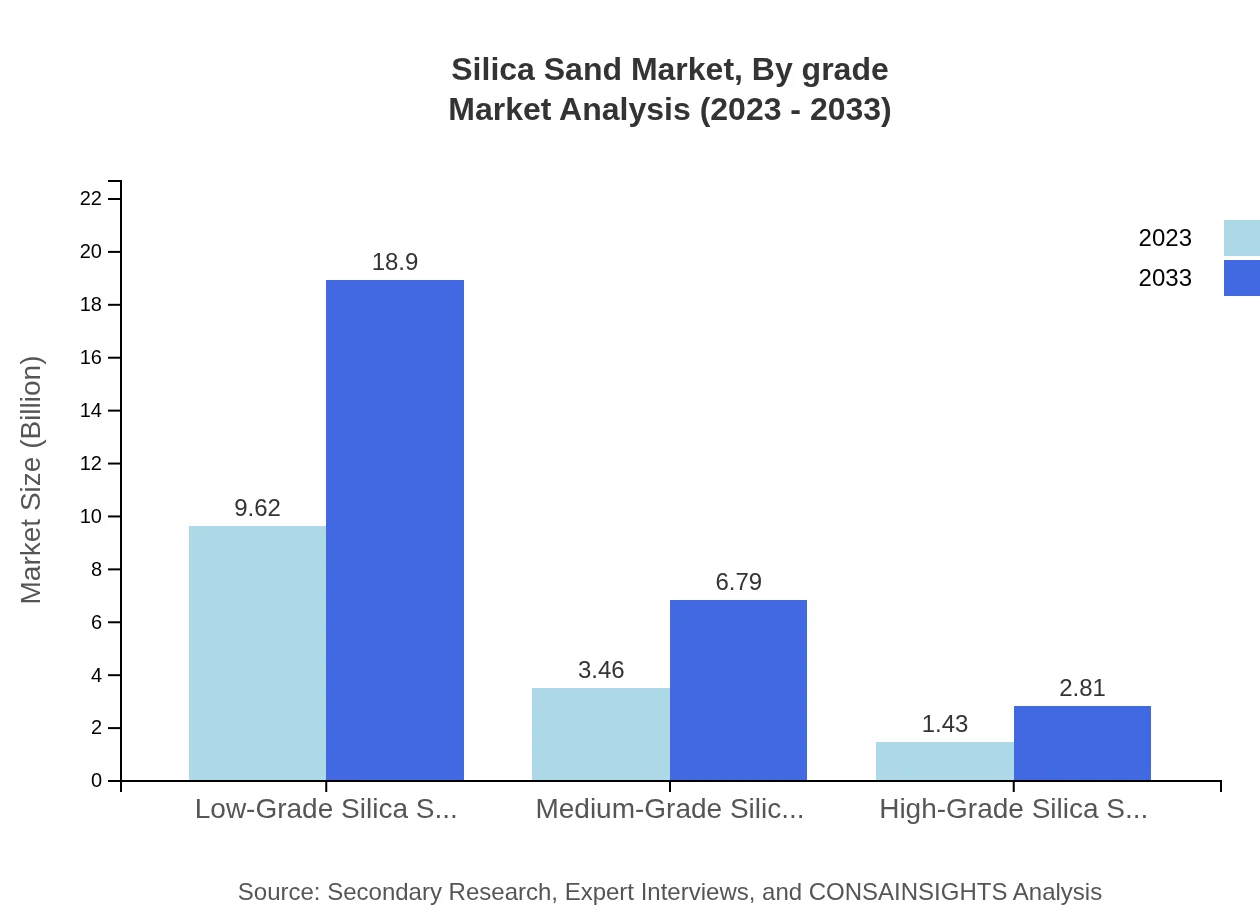

Silica Sand Market Analysis By Grade

The silica sand market is largely characterized by low-grade silica sand, which encompasses a market size of $9.62 billion in 2023, expected to reach $18.90 billion by 2033. Medium-grade silica sand, valued at $3.46 billion, is anticipated to grow to $6.79 billion, while high-grade silica sand shows steady growth from $1.43 billion to $2.81 billion over the same period.

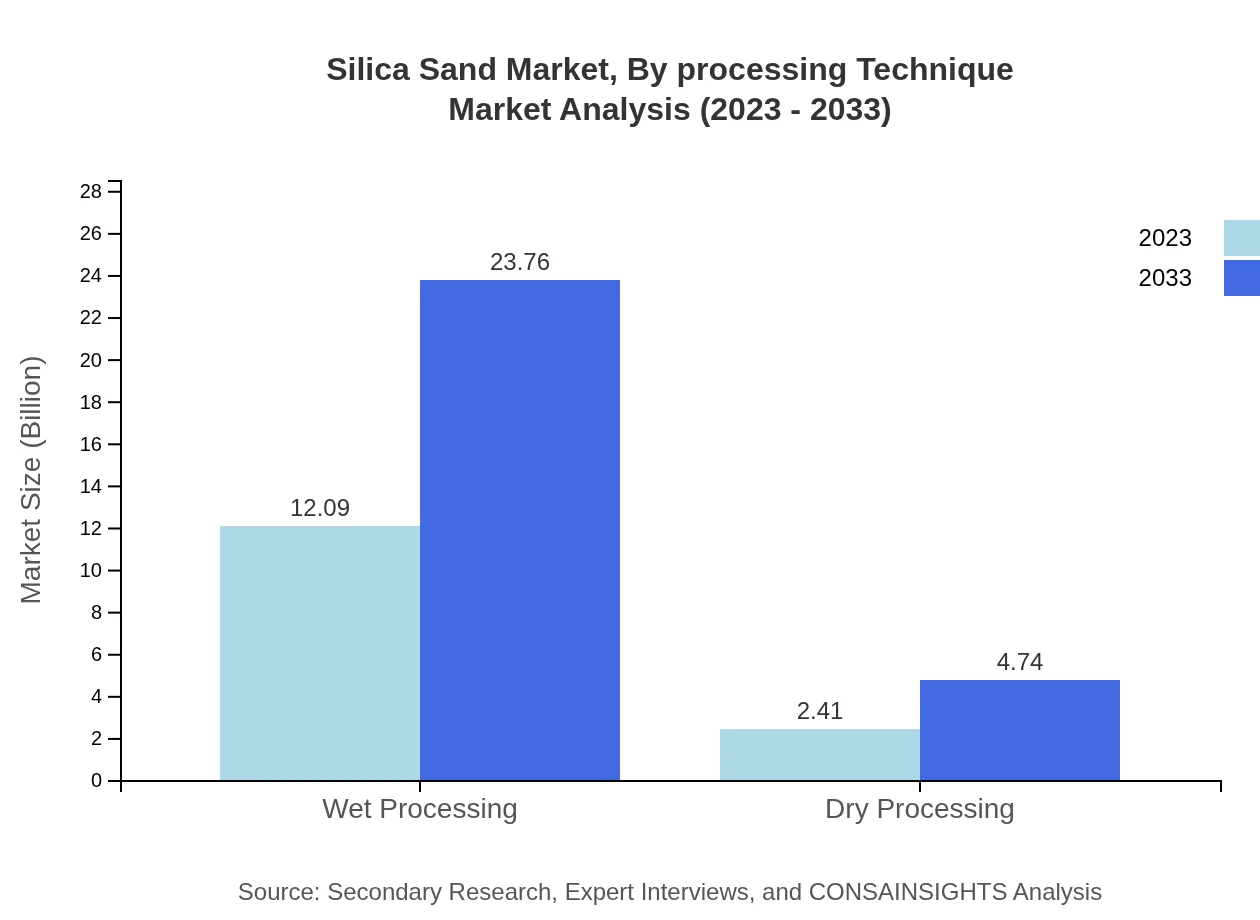

Silica Sand Market Analysis By Processing Technique

Wet processing dominates the silica sand market with a size of $12.09 billion in 2023, growing to $23.76 billion by 2033. Dry processing accounts for a smaller share, starting at $2.41 billion and projected to grow to $4.74 billion. The wet processing method is preferred due to its effectiveness in producing high-quality silica sand.

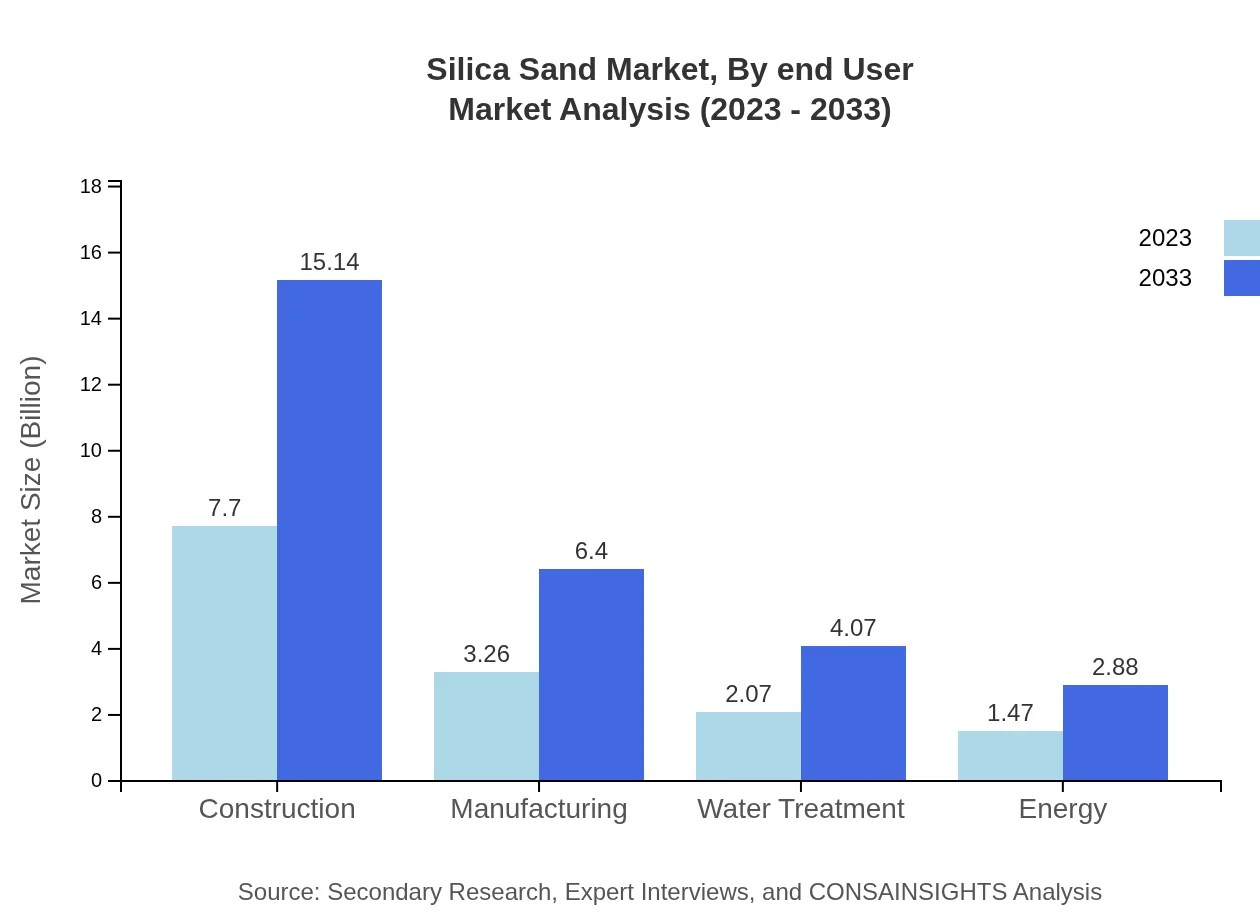

Silica Sand Market Analysis By End User

Among end-user industries, construction remains the largest segment, expected to maintain a $7.70 billion market size in 2023, growing to $15.14 billion by 2033. The manufacturing sector, while smaller at $3.26 billion and growing to $6.40 billion, highlights the rising importance of silica sand in industrial processes.

Silica Sand Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Silica Sand Industry

U.S. Silica Holdings, Inc.:

A leading producer of silica sand, U.S. Silica offers innovative solutions and a broad range of products to cater to various industries, including construction and energy.Covia Holdings Corporation:

Covia provides a wide array of industrial and specialty products, leveraging sustainable practices in the silica sand industry, while focusing on operational excellence.Sibelco:

Sibelco is a global leader in material solutions, providing silica sand products to diverse markets while emphasizing environmental sustainability and innovation.Screening and Crushing Solutions, LLC:

Specializing in high-quality silica sand processing, this company aims to serve the construction and industrial sectors through advanced technologies and customer-focused solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of silica sand?

The global silica sand market is valued at approximately $14.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8%, indicating robust growth prospects over the next decade.

What are the key market players or companies in the silica sand industry?

Key players in the silica sand market include Covia Holdings, U.S. Silica Holdings, and Fairmount Santrol. These companies lead through advanced processing technologies and extensive distribution networks, contributing significantly to market growth.

What are the primary factors driving the growth in the silica sand industry?

Growth in the silica sand industry is driven by increased demand from construction, glass manufacturing, and water treatment sectors. Urbanization and infrastructure projects further propel this demand, promising continued expansion in the market.

Which region is the fastest Growing in the silica sand market?

The Asia Pacific region is the fastest-growing market for silica sand, projected to rise from $2.71 billion in 2023 to $5.33 billion by 2033, fueled by rapid industrialization and infrastructure development.

Does ConsaInsights provide customized market report data for the silica sand industry?

Yes, ConsaInsights offers customized market reports for the silica sand industry, tailored to specific client needs, which can include detailed analyses of market trends and competitive landscapes.

What deliverables can I expect from this silica sand market research project?

Deliverables from this silica sand market research project typically include comprehensive reports detailing market size, growth forecasts, key players, competitive analysis, and trends across various segments and regions.

What are the market trends of silica sand?

Current trends in the silica sand market include a shift towards sustainable mining practices and increased utilization in green technologies, reflecting a broader industry focus on environmental responsibility and efficiency.