Static Random Access Memory Sram Market Report

Published Date: 31 January 2026 | Report Code: static-random-access-memory-sram

Static Random Access Memory Sram Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Static Random Access Memory (SRAM) market from 2023 to 2033, covering market size, growth trends, technological advancements, and regional insights.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

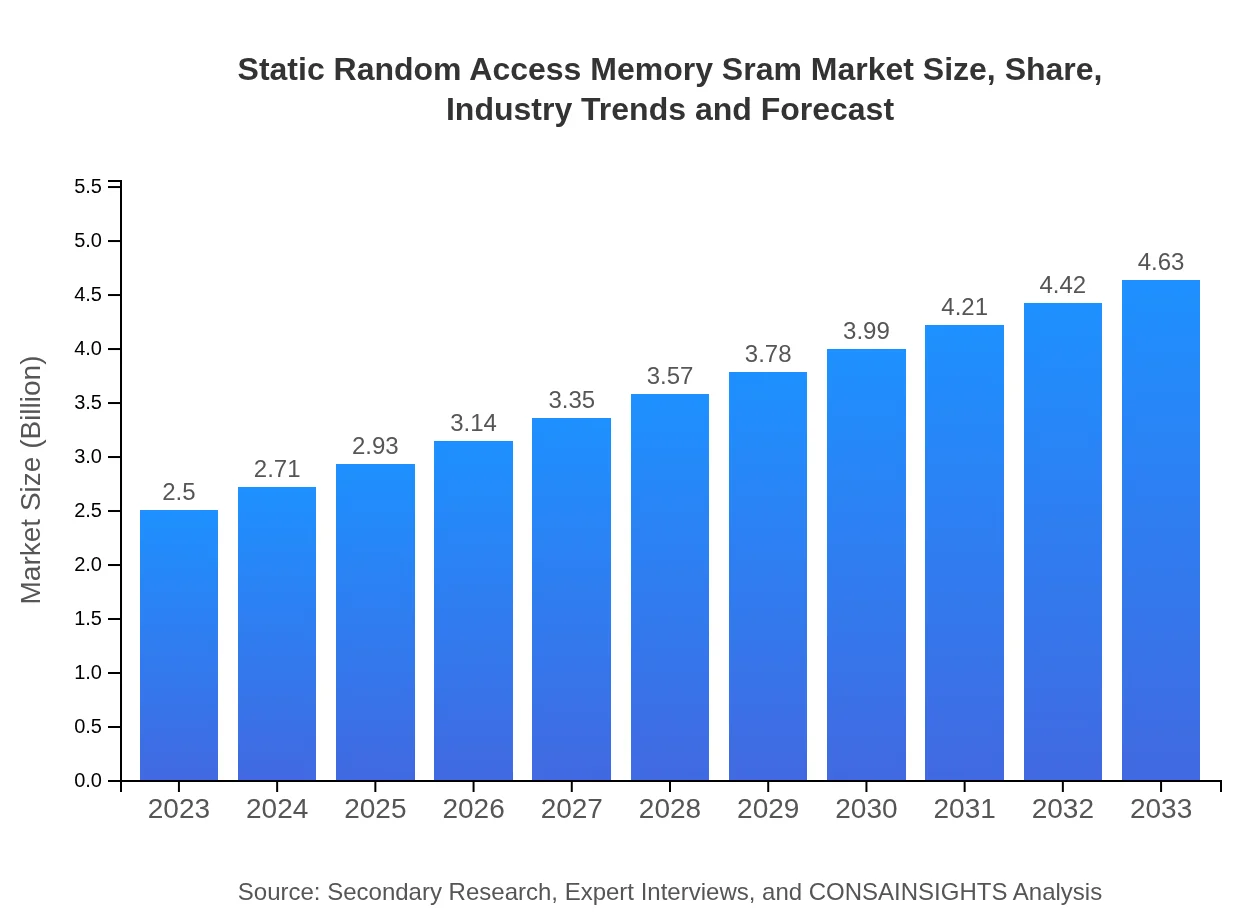

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $4.63 Billion |

| Top Companies | Micron Technology, Inc., STMicroelectronics, Samsung Electronics, NXP Semiconductors, Texas Instruments |

| Last Modified Date | 31 January 2026 |

Static Random Access Memory Sram Market Overview

Customize Static Random Access Memory Sram Market Report market research report

- ✔ Get in-depth analysis of Static Random Access Memory Sram market size, growth, and forecasts.

- ✔ Understand Static Random Access Memory Sram's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Static Random Access Memory Sram

What is the Market Size & CAGR of Static Random Access Memory Sram market in 2023?

Static Random Access Memory Sram Industry Analysis

Static Random Access Memory Sram Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Static Random Access Memory Sram Market Analysis Report by Region

Europe Static Random Access Memory Sram Market Report:

The European market is expected to grow from $0.65 billion in 2023 to $1.20 billion by 2033, supported by an increasing focus on energy-efficient solutions in electronics and rising demand for automated systems across various applications.Asia Pacific Static Random Access Memory Sram Market Report:

The Asia Pacific region is projected to witness rapid growth, with the market valued at $0.52 billion in 2023 and expected to grow to $0.97 billion by 2033. Key drivers include significant investments in consumer electronics and automotive sectors in countries like China, Japan, and South Korea, coupled with a robust manufacturing base.North America Static Random Access Memory Sram Market Report:

North America currently leads the SRAM market with a valuation of $0.95 billion in 2023, projected to reach $1.77 billion by 2033. This growth is driven by the high penetration of advanced technology in consumer electronics and data centers, alongside substantial investment in automotive electronics innovations.South America Static Random Access Memory Sram Market Report:

In South America, the SRAM market is expected to grow from $0.06 billion in 2023 to $0.11 billion by 2033. The growth is attributed to increasing demand for electronic devices, although market expansion may be slower compared to other regions due to economic challenges.Middle East & Africa Static Random Access Memory Sram Market Report:

In the Middle East and Africa, the market is set to expand from $0.31 billion in 2023 to $0.58 billion by 2033. Growth drivers include advancements in telecommunications and increasing usage of mobile devices, although economic factors often dampen rapid expansion in this region.Tell us your focus area and get a customized research report.

Static Random Access Memory Sram Market Analysis By Product Type

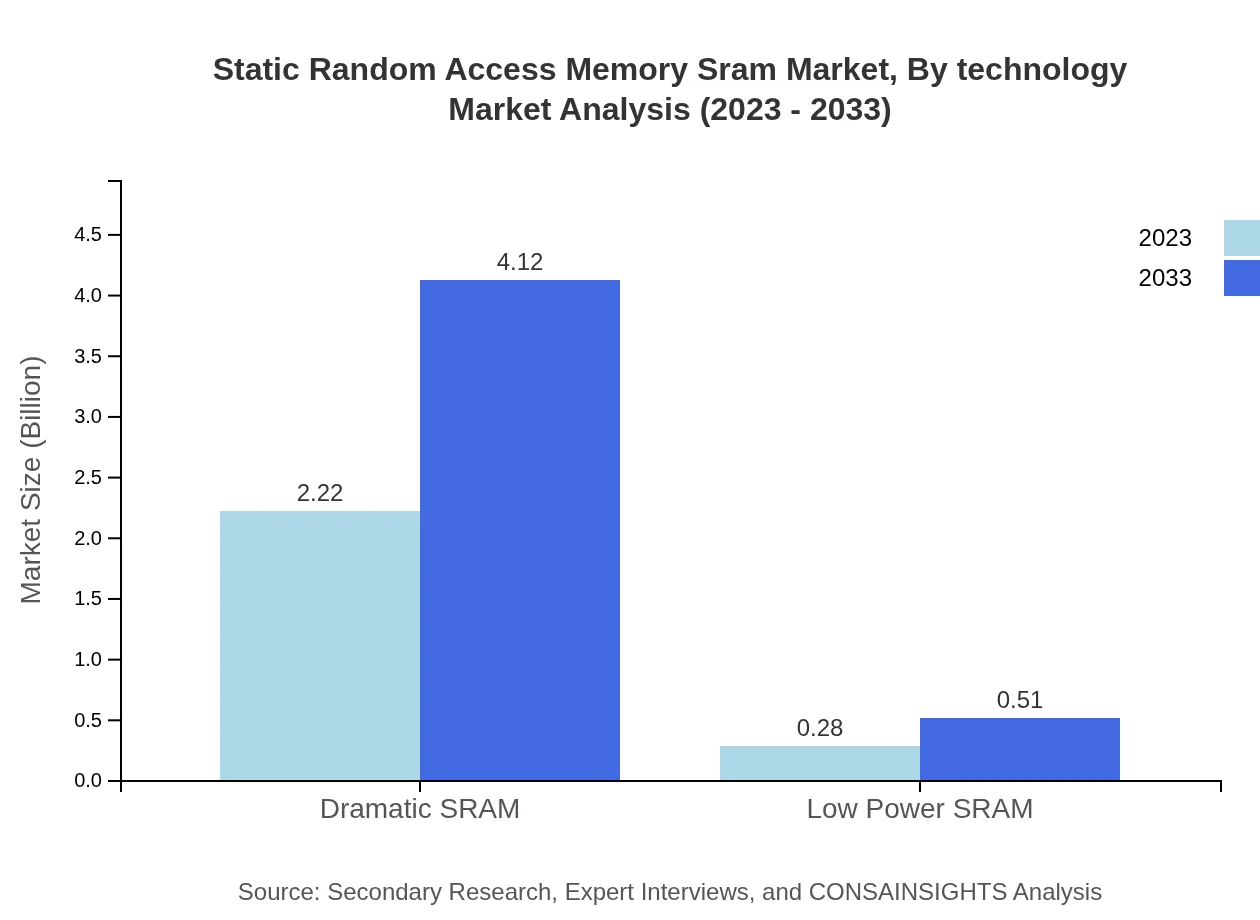

The SRAM market can be further examined by product type, with significant segments including Dramatic SRAM, Low Power SRAM, Asynchronous SRAM, and Synchronous SRAM. Dramatic SRAM commands the largest market share at 88.95%, owing to its widespread applicability in performance-intensive devices. Low Power SRAM, accounting for around 11.05%, is increasingly utilized where energy efficiency is crucial.

Static Random Access Memory Sram Market Analysis By Application

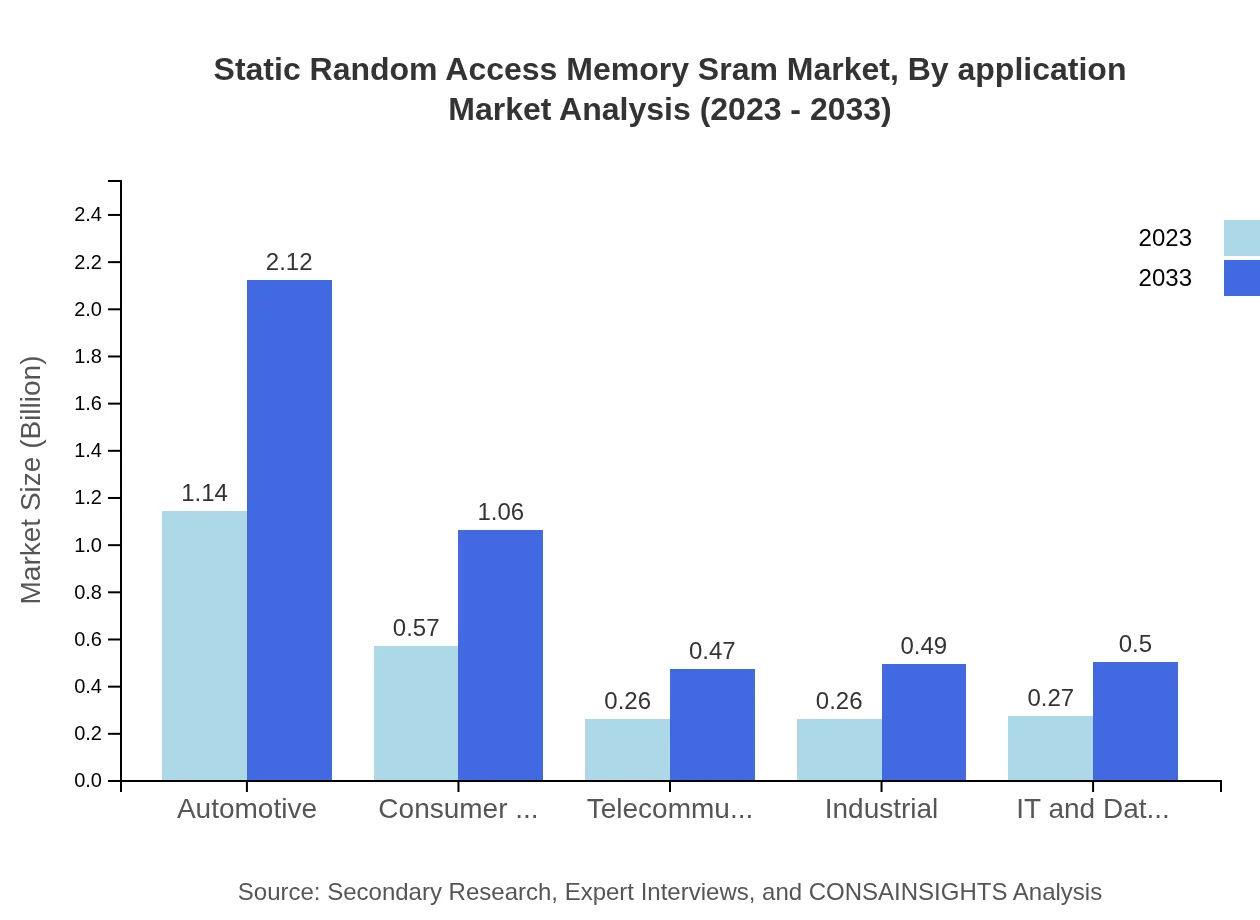

By applications, the market is dominated by Consumer Electronics, Automotive, Telecommunications, and IT services. Consumer Electronics accounts for a market share of approximately 58.98%, driven by the booming demand for smartphones, tablets, and other smart devices, while Automotive applications are gaining traction due to evolving smart vehicle technologies.

Static Random Access Memory Sram Market Analysis By Technology

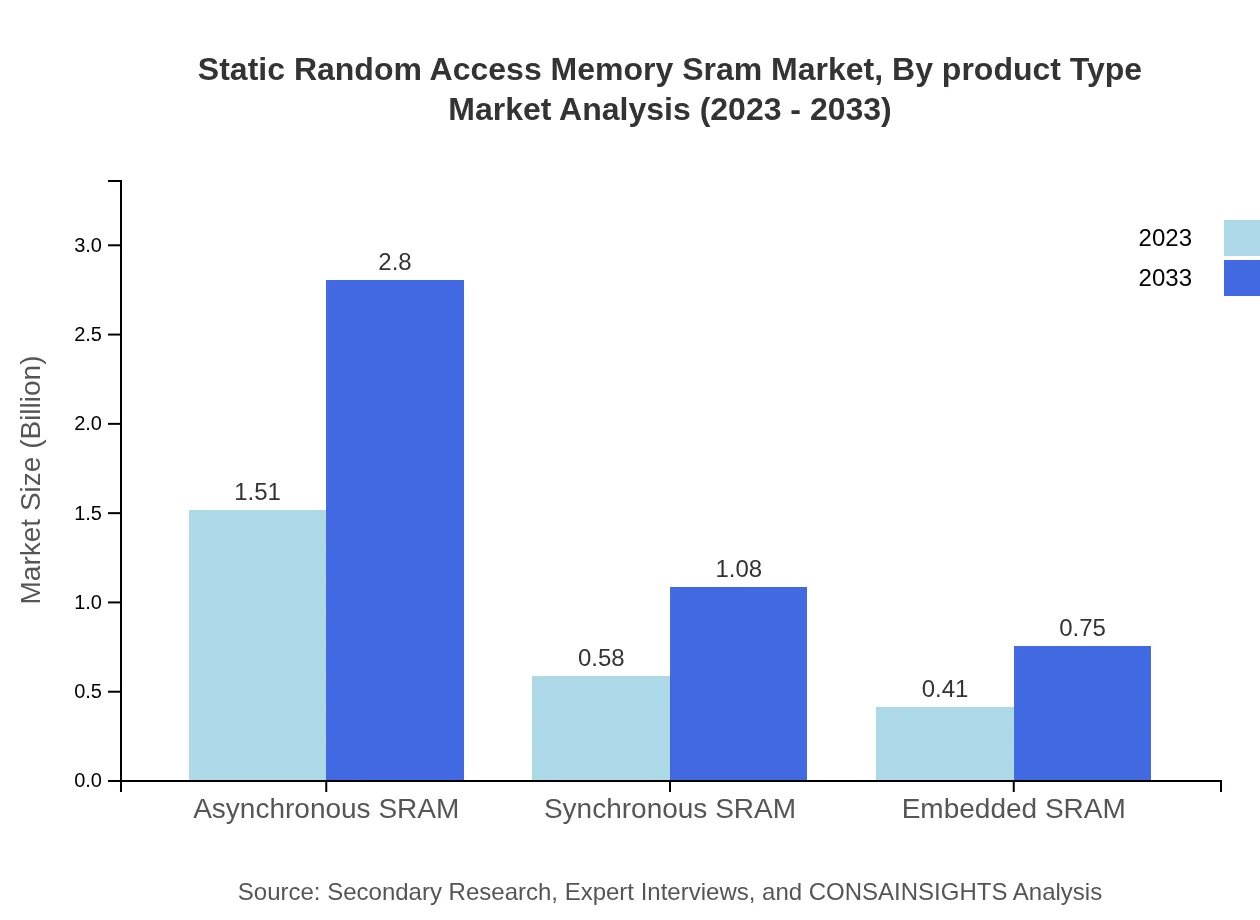

Innovations in technology, particularly in Asynchronous and Synchronous SRAM, are crucial to market dynamics. Asynchronous SRAM holds a share of 60.5% in the market due to its faster speed and efficiency in performance-critical applications. Synchronous SRAM, while smaller at 23.27%, is essential in high-speed data communication and memory interfacing.

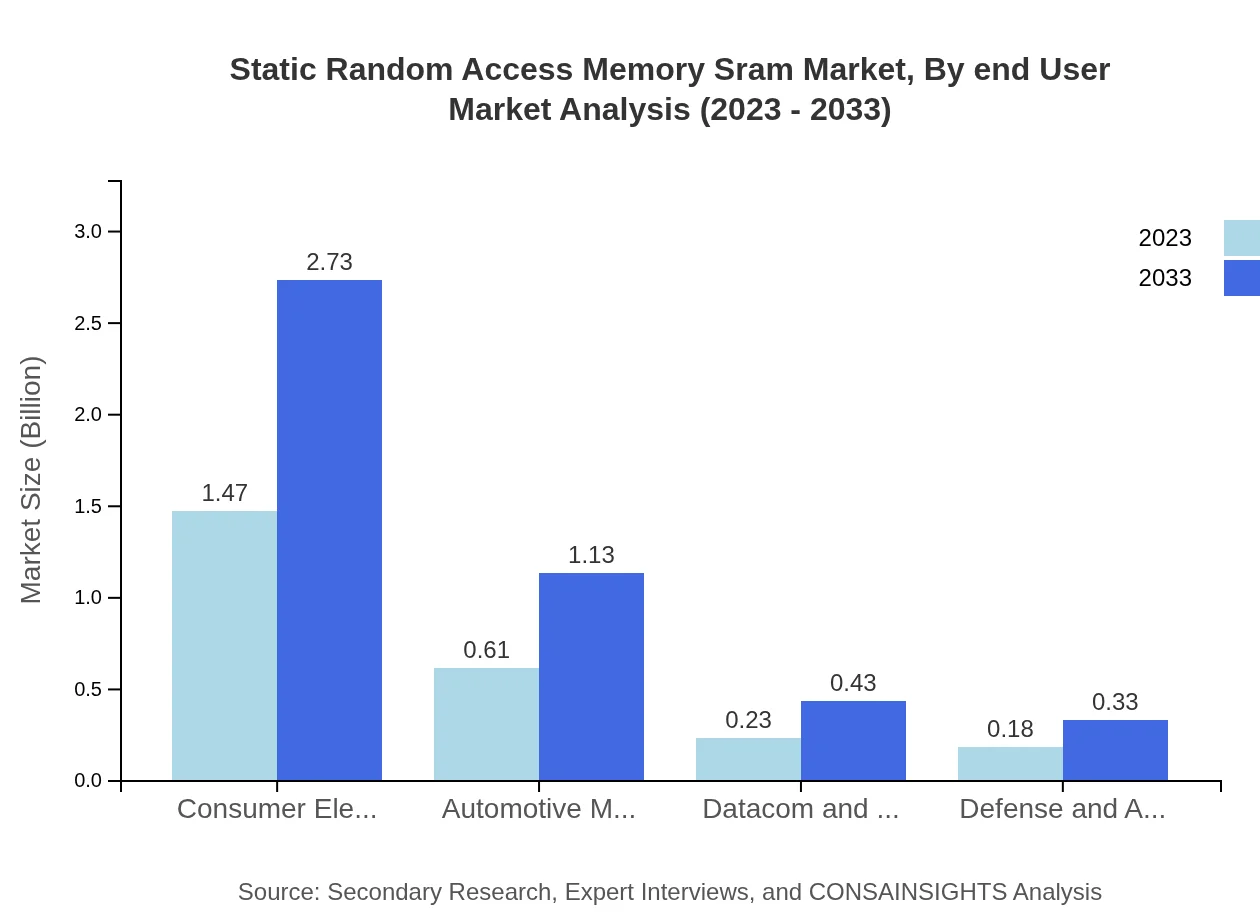

Static Random Access Memory Sram Market Analysis By End User

The primary end-users of SRAM include Consumer Electronics manufacturers, Automotive manufacturers, and Defense and Aerospace. Consumer Electronics account for a considerable share contributing over 22.82% of the total market, driven by the surge in demand for compacter and faster memory modules.

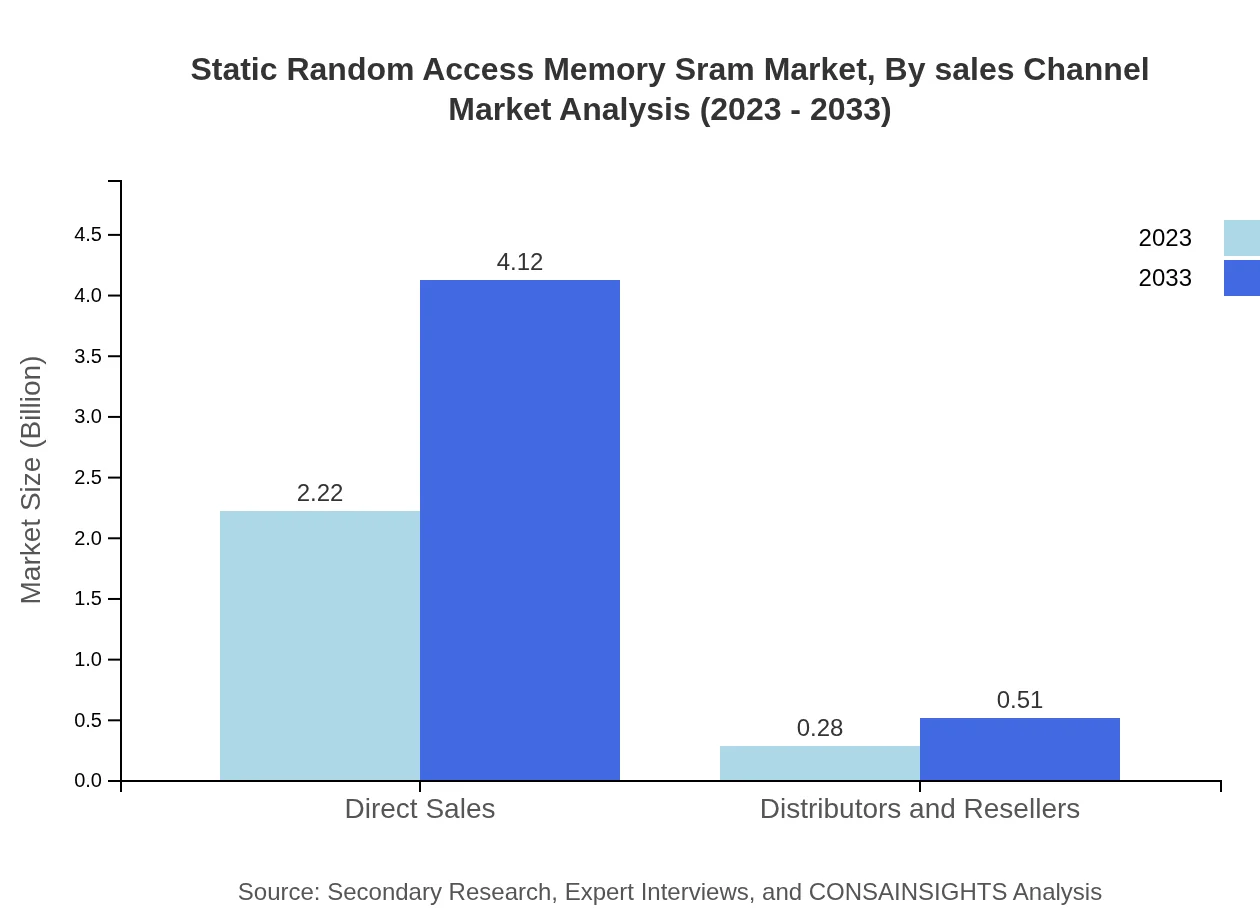

Static Random Access Memory Sram Market Analysis By Sales Channel

Sales channels are categorized into Direct Sales and Distributors/Resellers, with Direct Sales enjoying the larger share of 88.95%. The rise of e-commerce platforms has significantly impacted the sales landscape, facilitating broader market reach and improved accessibility to potential buyers.

Static Random Access Memory Sram Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Static Random Access Memory Sram Industry

Micron Technology, Inc.:

A leader in memory solutions, Micron provides innovative SRAM products used extensively in mobile and consumer electronics.STMicroelectronics:

STMicroelectronics is known for its cutting-edge technology in the SRAM space, offering a variety of efficient solutions for automotive and industrial applications.Samsung Electronics:

Samsung is a significant player in the SRAM market, focusing on high-performance memory for various applications, including mobile devices and automotive systems.NXP Semiconductors:

NXP specializes in automotive-grade SRAM, offering solutions that are integral to the development of advanced vehicle electronics.Texas Instruments:

Texas Instruments serves the SRAM market by delivering specialized products catering to the industrial and telecommunications sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of static Random Access Memory Sram?

The global Static Random Access Memory (SRAM) market is projected to reach approximately $2.5 billion by 2033, with a CAGR of 6.2% from 2023. This growth reflects increasing demand in numerous applications such as consumer electronics and automotive sectors.

What are the key market players or companies in this static Random Access Memory Sram industry?

Key players in the SRAM industry include major semiconductor manufacturers such as Intel, STMicroelectronics, Micron Technology, and Cypress Semiconductor, which are known for their innovative solutions and continuous investment in research and development to enhance technology offerings.

What are the primary factors driving the growth in the static Random Access Memory Sram industry?

Growth in the SRAM market is primarily driven by the increasing demand for high-speed memory in consumer electronics, automotive applications, and advancements in telecommunications which require faster data processing capabilities to support emerging technologies.

Which region is the fastest Growing in the static Random Access Memory Sram?

The Asia Pacific region emerges as the fastest-growing market for SRAM, expected to expand from $0.52 billion in 2023 to $0.97 billion by 2033, driven by rapid industrialization and high demand in electronics manufacturing within this region.

Does ConsaInsights provide customized market report data for the static Random Access Memory Sram industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the SRAM industry. This allows clients to gain insights that are particularly relevant to their business objectives and market strategies.

What deliverables can I expect from this static Random Access Memory Sram market research project?

From the SRAM market research project, you can expect comprehensive reports, data analytics, market segmentation analysis, competitive landscape overviews, and actionable insights that help in making informed decisions.

What are the market trends of static Random Access Memory Sram?

Current trends in the SRAM market include the rising adoption of low-power SRAM technologies, growth in automotive applications, and increasing integration of SRAM in advanced computing systems alongside a push for enhanced data processing speeds.