Target Drones Market Report

Published Date: 03 February 2026 | Report Code: target-drones

Target Drones Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Target Drones market from 2023 to 2033, featuring insights into market size, growth trends, regional dynamics, and key players shaping the industry landscape.

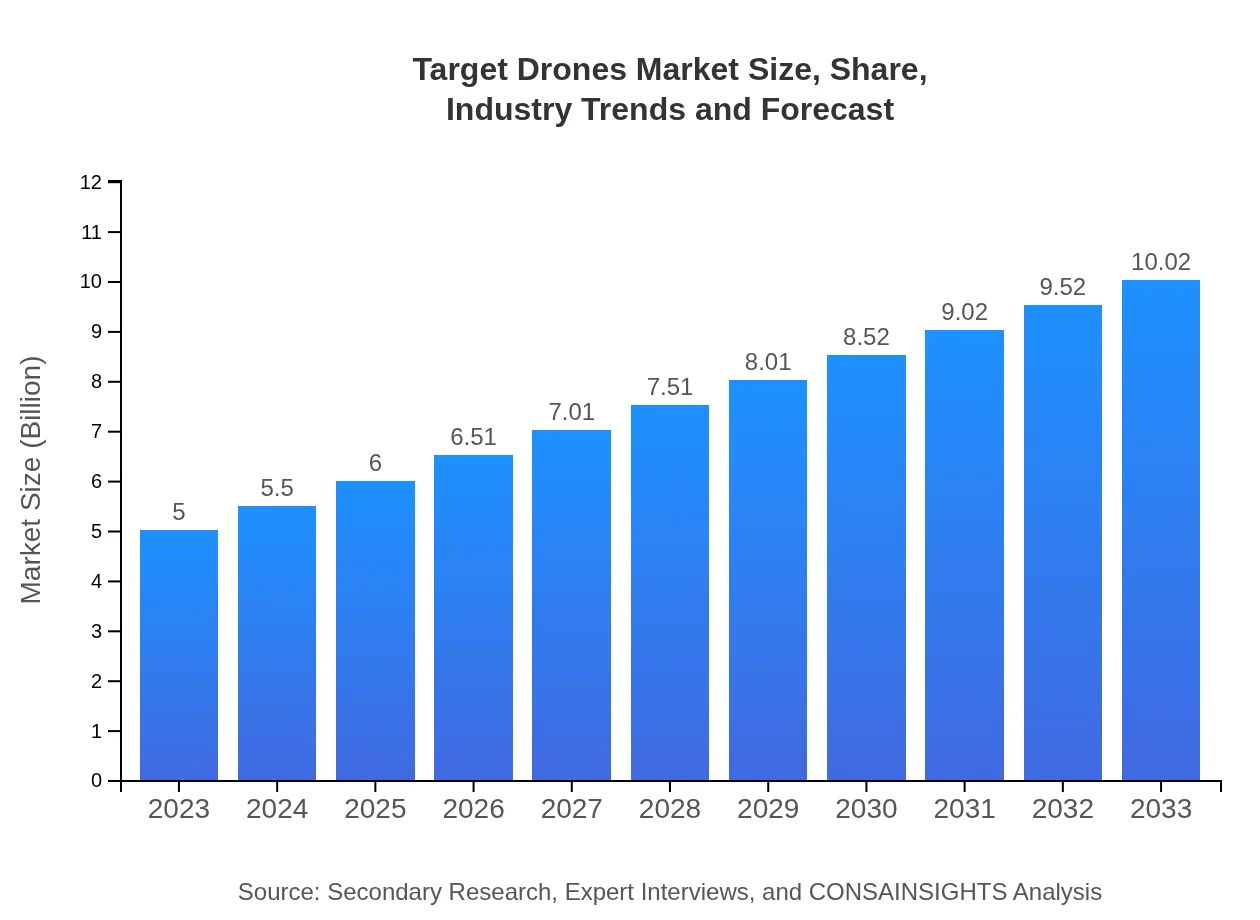

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $10.02 Billion |

| Top Companies | Northrop Grumman Corporation, General Atomics Aeronautical Systems, Inc., Elbit Systems Ltd., QinetiQ Group plc |

| Last Modified Date | 03 February 2026 |

Target Drones Market Overview

Customize Target Drones Market Report market research report

- ✔ Get in-depth analysis of Target Drones market size, growth, and forecasts.

- ✔ Understand Target Drones's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Target Drones

What is the Market Size & CAGR of Target Drones market in 2023?

Target Drones Industry Analysis

Target Drones Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Target Drones Market Analysis Report by Region

Europe Target Drones Market Report:

The European Target Drones market is set to grow from USD 1.35 billion in 2023 to USD 2.71 billion by 2033. Increased defense budgets across various nations, introduction of stringent training requirements, and collaboration among EU countries to enhance defense capabilities are key drivers fostering this growth. Additionally, political tensions in the region encourage investment in advanced defense technologies.Asia Pacific Target Drones Market Report:

The Asia Pacific region is expected to experience significant growth in the Target Drones market, expanding from USD 0.96 billion in 2023 to USD 1.92 billion by 2033. This increase is primarily driven by the rise in defense spending among countries like India and Japan, along with the growing focus on homeland security. The region's technological advancements and increasing collaboration among defense contractors also contribute to this upward trend.North America Target Drones Market Report:

North America holds a significant share of the Target Drones market, with forecasts suggesting an increase from USD 1.94 billion in 2023 to USD 3.88 billion by 2033. The U.S. military's continuous investment in automated systems and advanced training solutions plays a crucial role in driving this market. Furthermore, the presence of leading drone manufacturers provides a competitive edge in innovation and development.South America Target Drones Market Report:

In South America, the Target Drones market is projected to grow from USD 0.07 billion in 2023 to USD 0.15 billion by 2033. The market is stimulated by modest investments in defense and security, with countries like Brazil looking to upgrade their military capabilities. However, growth is constrained by relatively low defense budgets compared to other regions.Middle East & Africa Target Drones Market Report:

In the Middle East and Africa, the Target Drones market is expected to grow significantly, moving from USD 0.68 billion in 2023 to USD 1.37 billion by 2033. Regional conflicts and the need for improved military capabilities drive the demand for target drones, alongside investments in advanced surveillance technologies for defense purposes.Tell us your focus area and get a customized research report.

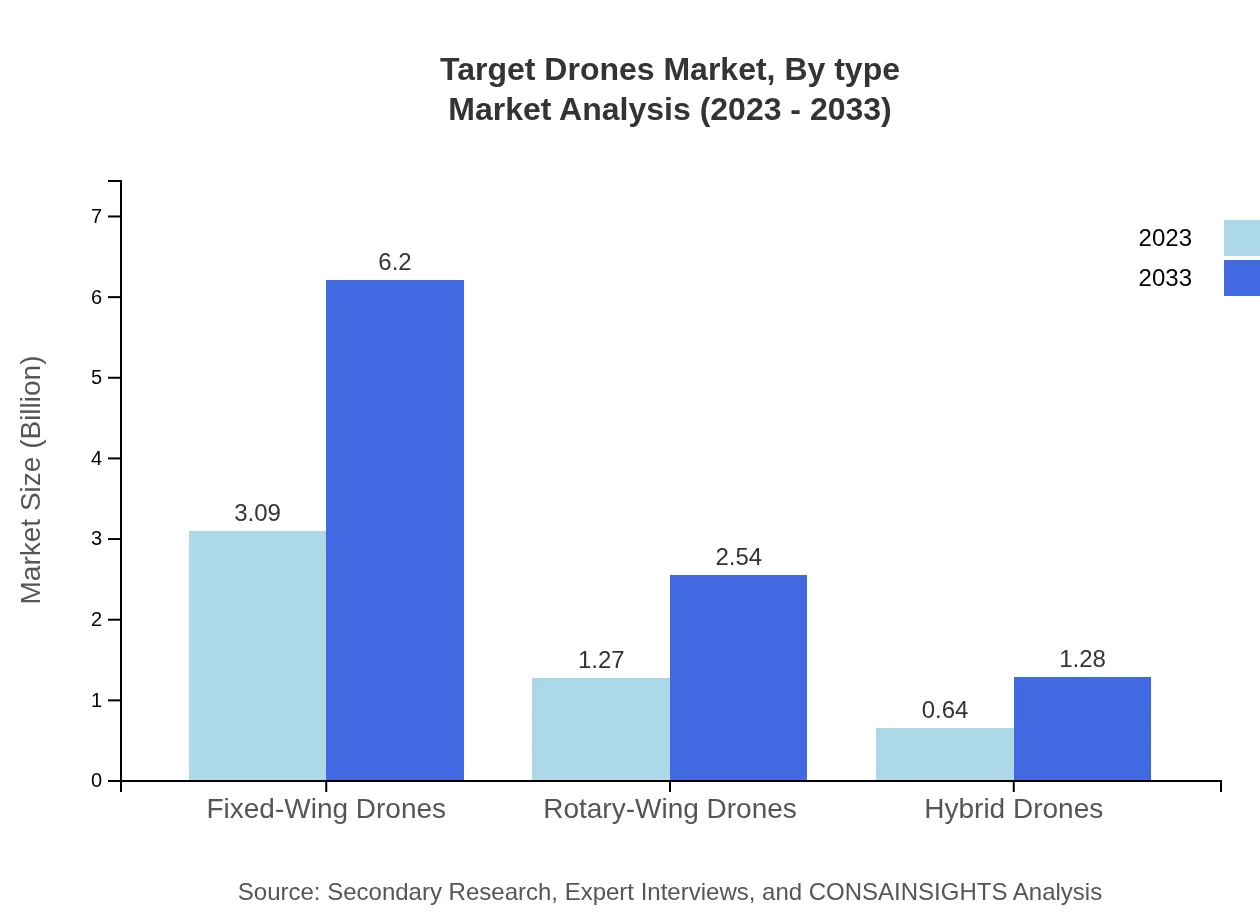

Target Drones Market Analysis By Type

The target drones market, categorized by type, includes Fixed-Wing Drones, Rotary-Wing Drones, and Hybrid Drones. Fixed-Wing Drones dominate the market with a size of USD 3.09 billion in 2023, expected to rise to USD 6.20 billion by 2033, holding a market share of 61.83%. Rotary-Wing Drones currently stand at USD 1.27 billion and are forecasted to reach USD 2.54 billion by 2033 (share: 25.35%). Hybrid Drones, while smaller, are projected to grow from USD 0.64 billion to USD 1.28 billion (share: 12.82%).

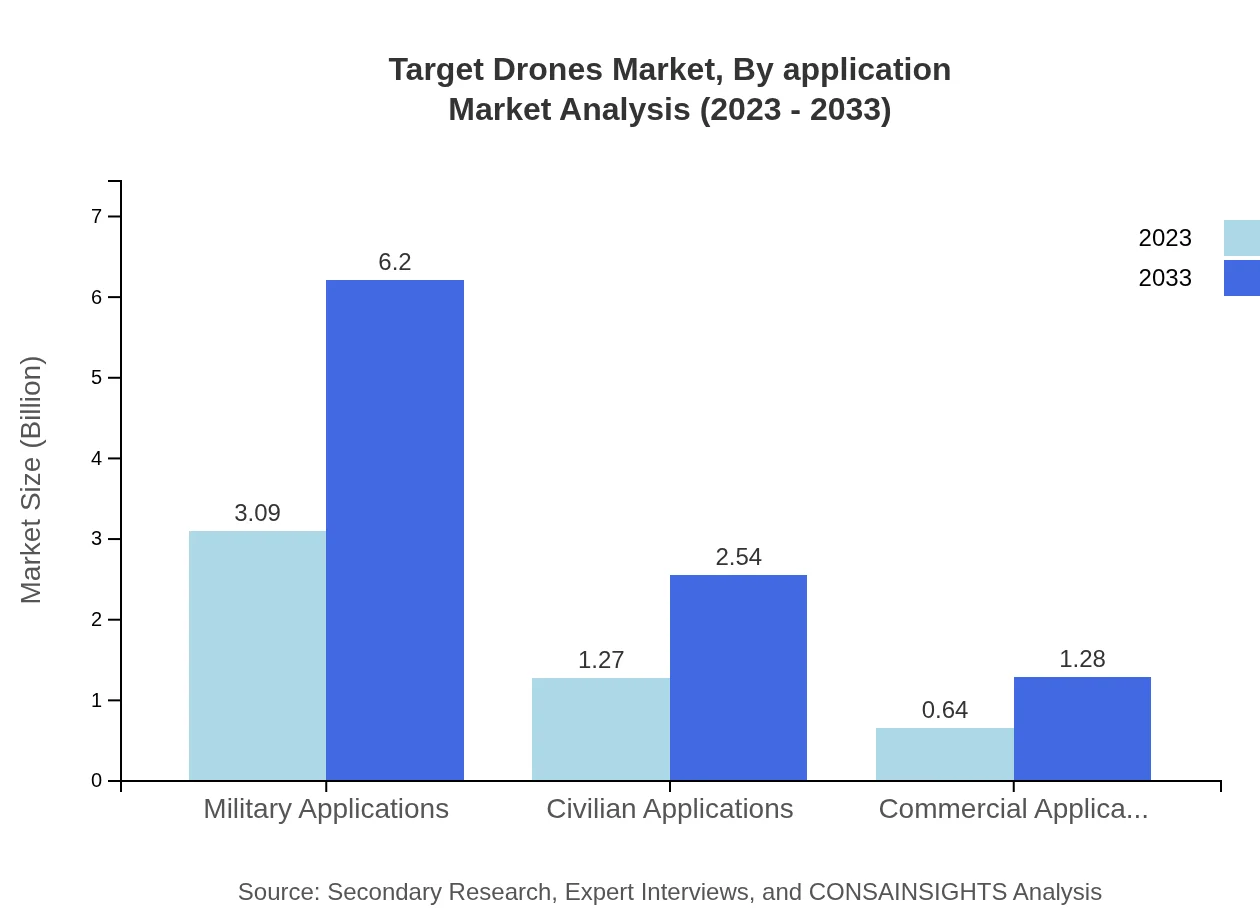

Target Drones Market Analysis By Application

The applications of target drones encompass Military, Civilian, and Commercial sectors. Military applications lead, with a current size of USD 3.09 billion, projected to expand to USD 6.20 billion by 2033, reflecting a share of 61.83%. Civilian applications are set to grow from USD 1.27 billion to USD 2.54 billion (share: 25.35%), while Commercial applications will rise from USD 0.64 billion to USD 1.28 billion (share: 12.82%).

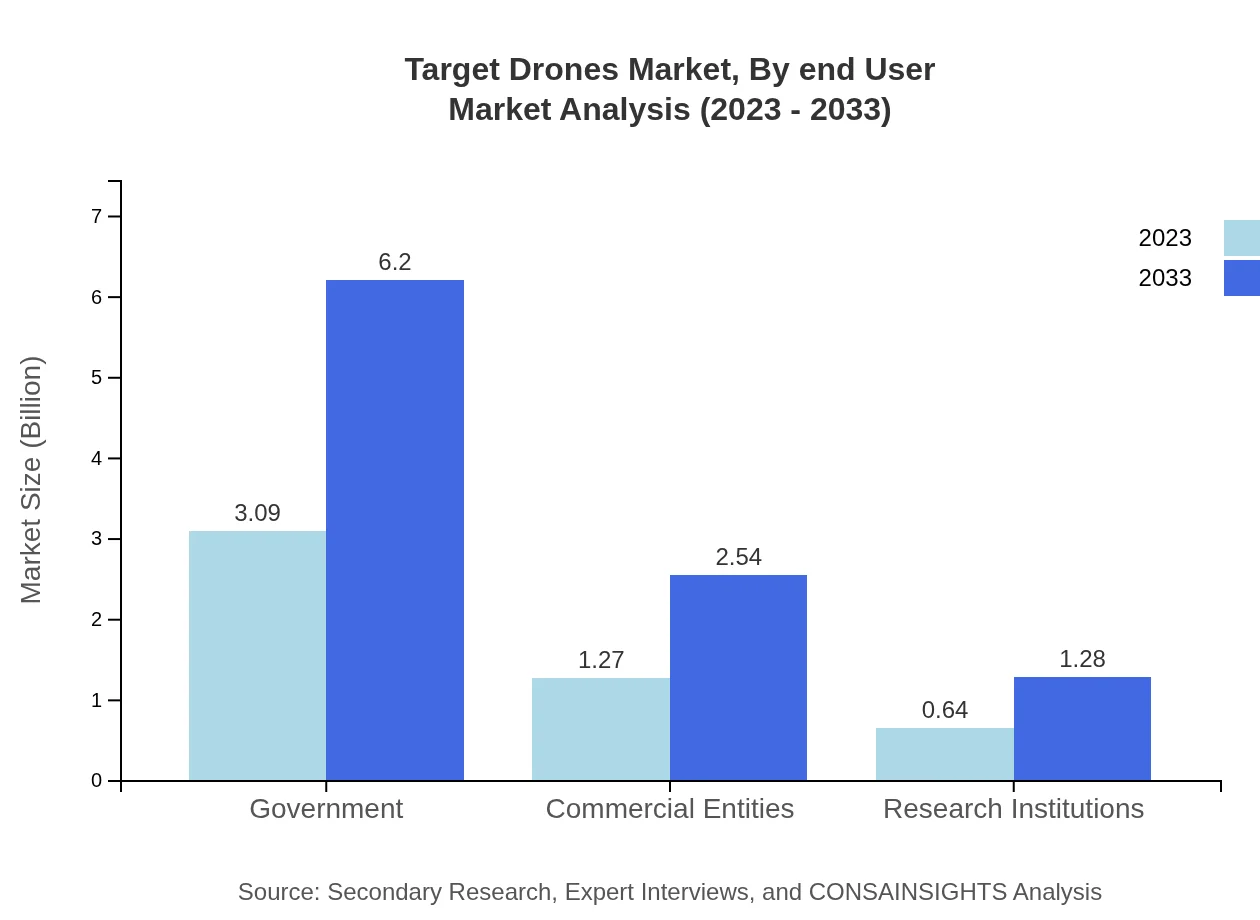

Target Drones Market Analysis By End User

Segments by end-users reveal Government, Commercial Entities, and Research Institutions as key players. The Government segment leads with a market size of USD 3.09 billion in 2023, anticipating the same growth trajectory as Military Applications. Commercial Entities are projected to experience growth from USD 1.27 billion to USD 2.54 billion (share: 25.35%), while Research Institutions will increase from USD 0.64 billion to USD 1.28 billion (share: 12.82%).

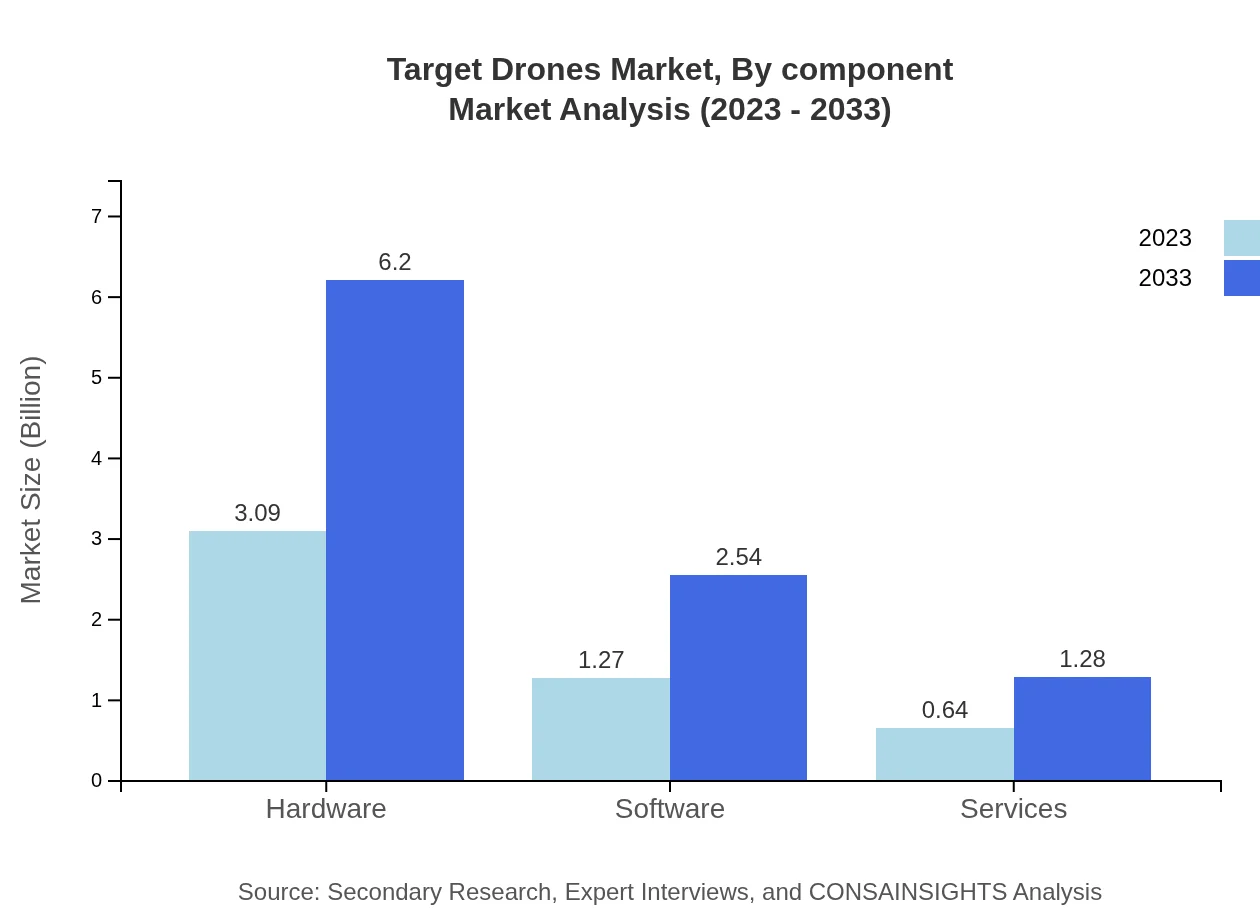

Target Drones Market Analysis By Component

The target drones market segmentation by components shows Hardware, Software, and Services. Hardware dominates with a size of USD 3.09 billion in 2023, projected to double by 2033 (share: 61.83%). Software and Services segments are expected to grow from USD 1.27 billion to USD 2.54 billion and from USD 0.64 billion to USD 1.28 billion, respectively, holding shares of 25.35% and 12.82%.

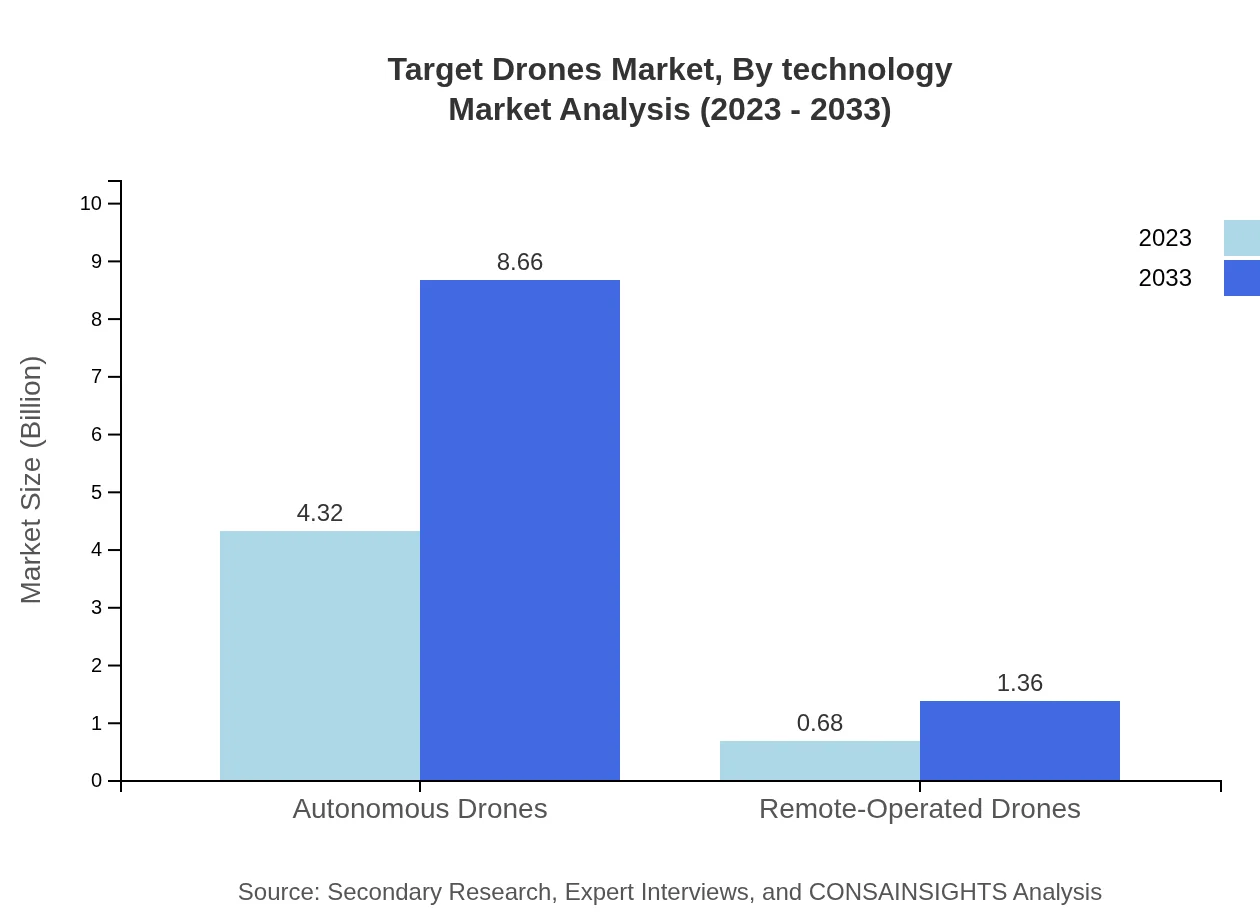

Target Drones Market Analysis By Technology

By technology, the market diverges into Autonomous Drones and Remote-Operated Drones. Autonomous Drones, making up the majority, will increase from USD 4.32 billion in 2023 to USD 8.66 billion by 2033, representing 86.45% market share. Remote-Operated Drones will grow from USD 0.68 billion to USD 1.36 billion by 2033 (share: 13.55%).

Target Drones Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Target Drones Industry

Northrop Grumman Corporation:

A leading global aerospace and defense technology company, Northrop Grumman provides advanced target drones and innovative training systems to military customers worldwide.General Atomics Aeronautical Systems, Inc.:

Recognized for its expertise in drone technology, General Atomics develops and manufactures high-performance target drones that support training and defense missions across the globe.Elbit Systems Ltd.:

Elbit Systems specializes in high-tech solution development, including unmanned aerial vehicles and target drones for military applications, enhancing operational capabilities.QinetiQ Group plc:

A global leader in the defense and aerospace sectors, QinetiQ designs and manufactures cost-effective target drones that provide realistic training simulations for military operations.We're grateful to work with incredible clients.

FAQs

What is the market size of Target Drones?

The target drones market is projected to reach approximately $5 billion by 2033, growing from its current valuation. It is expected to witness a compound annual growth rate (CAGR) of 7% during this period.

What are the key market players or companies in the Target Drones industry?

Key players in the Target Drones industry include major manufacturers and technology providers, focusing on innovative designs and enhanced capabilities in both military and civilian applications. This includes market leaders known for their diversified product portfolios.

What are the primary factors driving the growth in the Target Drones industry?

Growth in the target drones industry is driven by increasing defense budgets, the rising demand for training and simulation systems, and technological advancements in drone technology, leading to enhanced functionality and efficiency.

Which region is the fastest Growing in the Target Drones?

The fastest-growing region in the target drones market is North America, projected to grow from $1.94 billion in 2023 to $3.88 billion by 2033. Europe and Asia Pacific also show significant growth potential.

Does ConsaInsights provide customized market report data for the Target Drones industry?

Yes, ConsaInsights offers customized market report services tailored to the specific needs of clients in the Target Drones industry, enabling detailed insights based on unique market parameters and requirements.

What deliverables can I expect from this Target Drones market research project?

Expected deliverables from the Target Drones market research project include comprehensive market assessments, competitive analyses, segmented market insights, and trend analyses that outline opportunities and strategic recommendations.

What are the market trends of Target Drones?

Key trends in the target drones market include advancements in autonomous flight systems, increased adoption in military training scenarios, and growing interest in commercial applications, focusing on flexibility and cost-effectiveness.