Tartaric Acid Market Report

Published Date: 02 February 2026 | Report Code: tartaric-acid

Tartaric Acid Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Tartaric Acid market from 2023 to 2033, covering market dynamics, size estimates, growth trends, and regional analyses. It aims to inform stakeholders about emerging trends and future forecasts.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

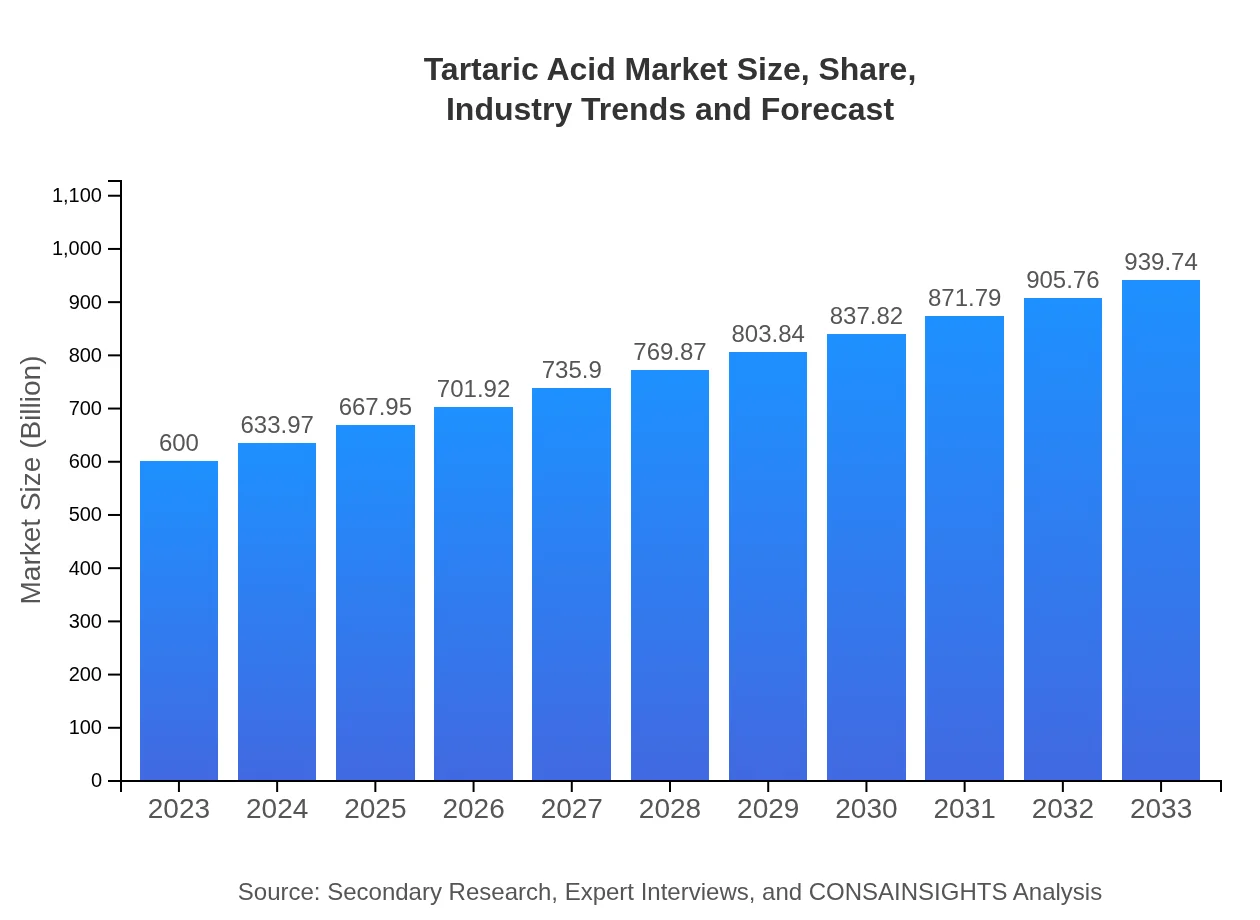

| 2023 Market Size | $600.00 Million |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $939.74 Million |

| Top Companies | Tarac Technologies, Pioneer Industries, Brenntag AG, Hangzhou Bioking Biochemical Engineering Co., Ltd. |

| Last Modified Date | 02 February 2026 |

Tartaric Acid Market Overview

Customize Tartaric Acid Market Report market research report

- ✔ Get in-depth analysis of Tartaric Acid market size, growth, and forecasts.

- ✔ Understand Tartaric Acid's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tartaric Acid

What is the Market Size & CAGR of the Tartaric Acid market in 2023?

Tartaric Acid Industry Analysis

Tartaric Acid Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tartaric Acid Market Analysis Report by Region

Europe Tartaric Acid Market Report:

In Europe, the Tartaric Acid market is projected to grow from $193.80 million in 2023 to $303.54 million by 2033. The increase in health-conscious consumers and the expansion of the organic food market are expected to bolster demand, thereby presenting numerous opportunities for growth.Asia Pacific Tartaric Acid Market Report:

The Tartaric Acid market in Asia Pacific is projected to grow from $115.80 million in 2023 to approximately $181.37 million by 2033, driven by an increase in food processing industries and a growing middle-class population seeking quality products. Regional players are advancing their facilities to meet the rising demand, focusing on sustainable practices.North America Tartaric Acid Market Report:

North America is anticipated to witness its Tartaric Acid market scale up from $196.38 million in 2023 to $307.58 million by 2033. With a robust food and beverage industry and greater inclination towards organic products, the region is set to lead innovations in Tartaric Acid applications.South America Tartaric Acid Market Report:

In South America, the market size is expected to grow from $24.30 million in 2023 to about $38.06 million by 2033. The wine industry remains a significant contributor to this growth, especially in countries such as Argentina and Chile, where Tartaric Acid serves as a critical ingredient in modern winemaking.Middle East & Africa Tartaric Acid Market Report:

The region's Tartaric Acid market is anticipated to rise from $69.72 million in 2023 to $109.20 million by 2033. Growing industries in cosmetics and natural food products are setting the tone for demand growth, particularly in countries emphasizing organic certifications.Tell us your focus area and get a customized research report.

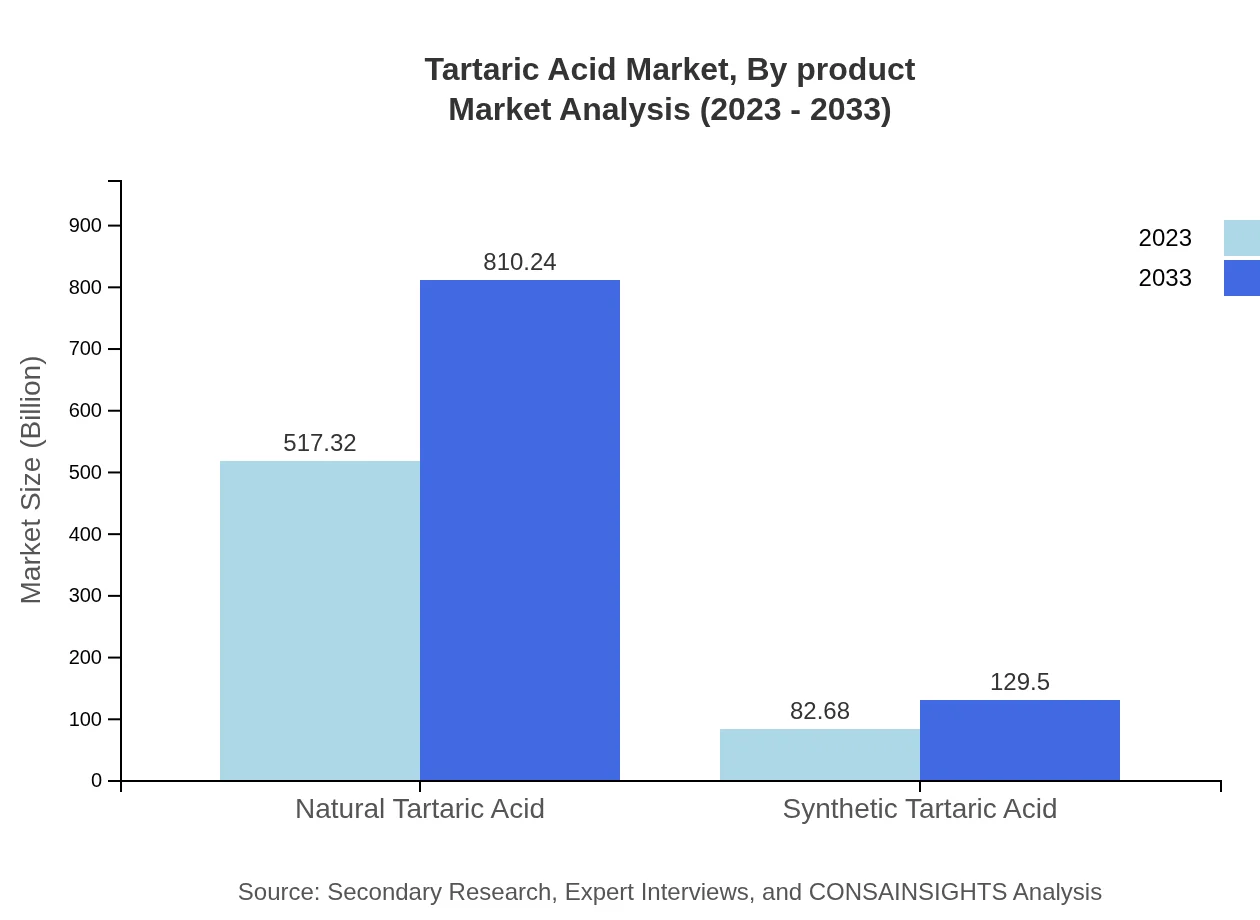

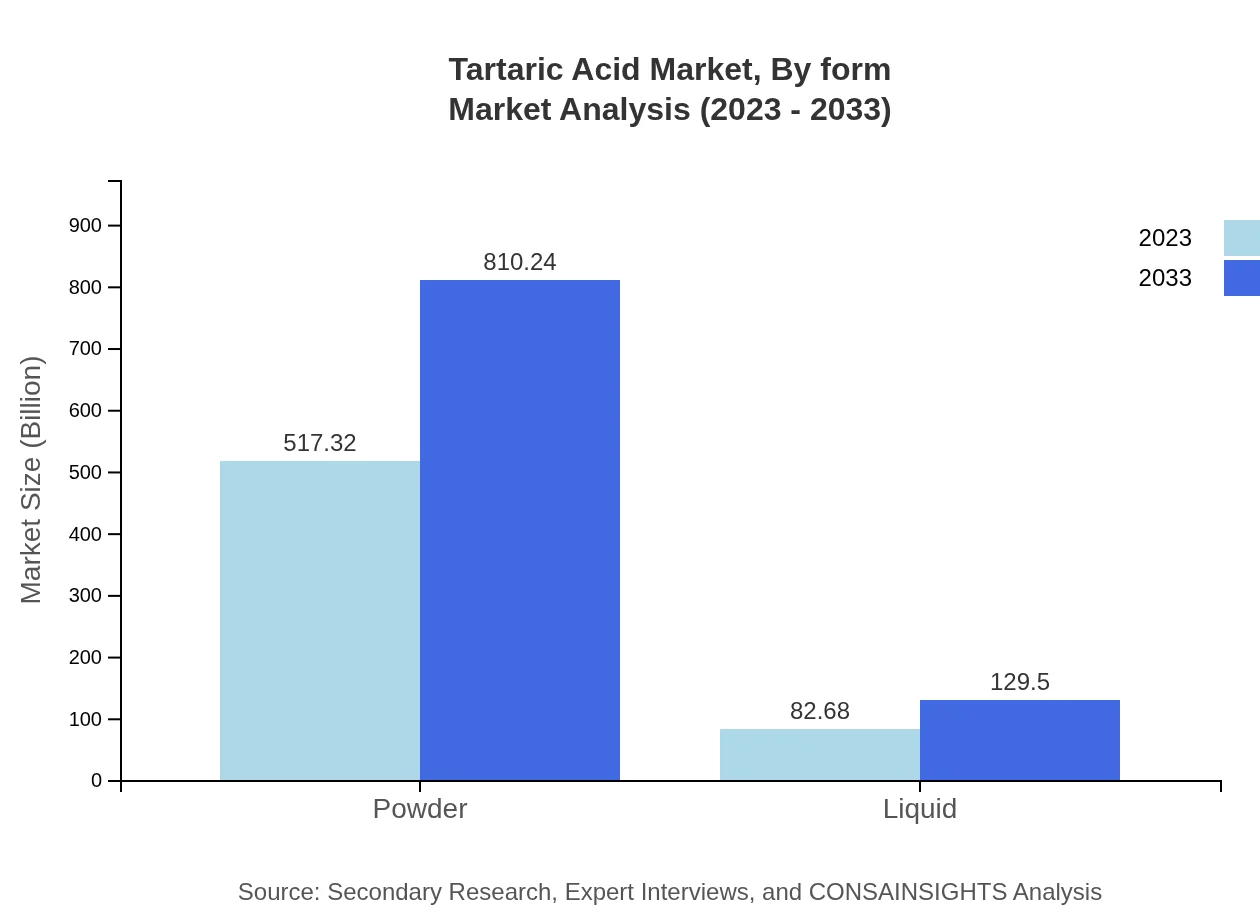

Tartaric Acid Market Analysis By Product

In 2023, the Powder segment dominates the Tartaric Acid market with a size of $517.32 million, growing to $810.24 million by 2033. The Liquid form holds a smaller share with $82.68 million in 2023 and projected growth to $129.50 million by 2033. Both natural and synthetic products are crucial here, with natural variants embedded in food applications being a primary focus for consumers.

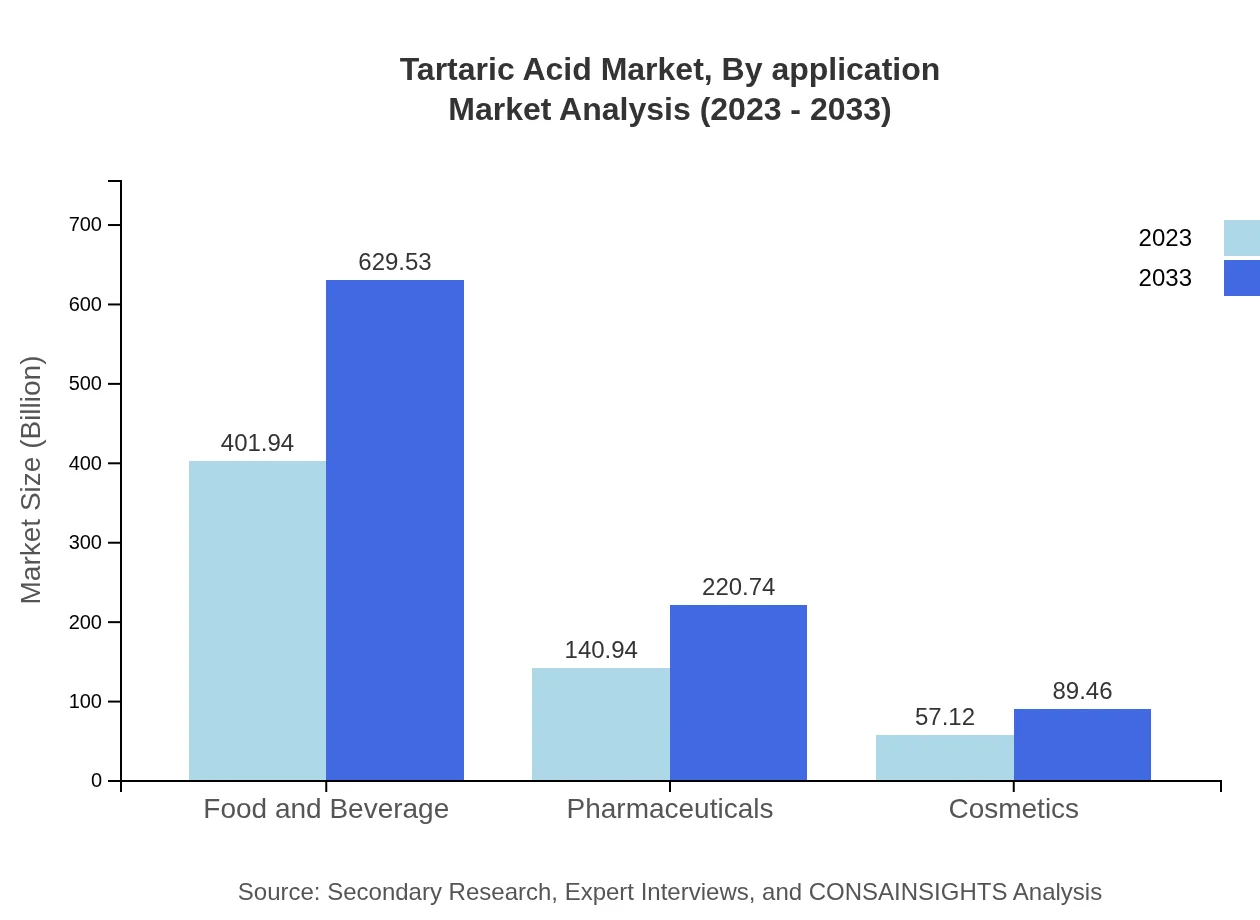

Tartaric Acid Market Analysis By Application

The Food Industry leads applications, with a size of $401.94 million in 2023 expected to reach $629.53 million by 2033. Following closely, the Beverage Industry showcases increasing demand, translating from $140.94 million in 2023 to $220.74 million by 2033. Pharmaceutical applications are also notable, currently at $57.12 million, projected to expand to $89.46 million in the same period.

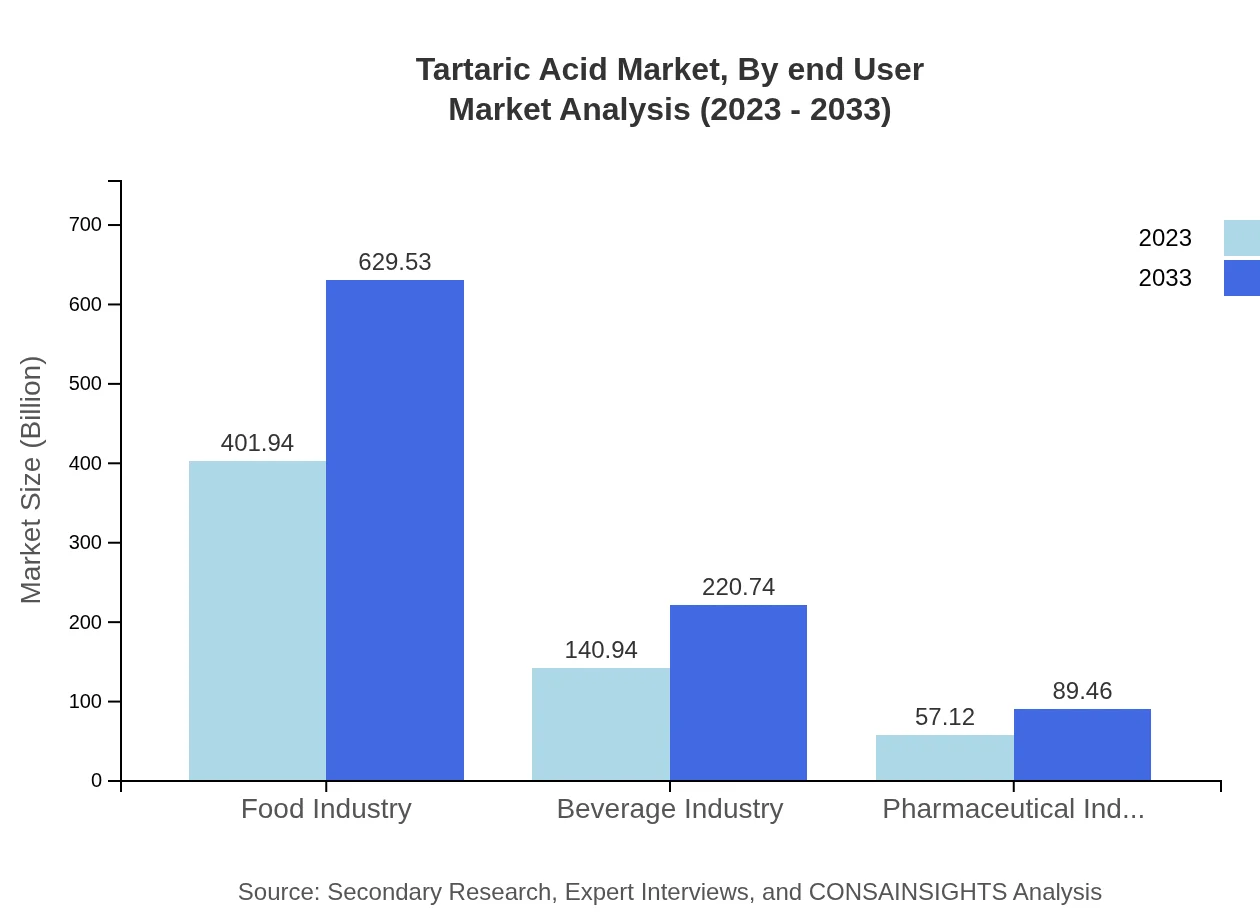

Tartaric Acid Market Analysis By End User

End-user segments reveal trends with Food & Beverage dominating, expected to increase from $401.94 million in 2023 to $629.53 million by 2033. The Pharmaceutical industry segment is set to rise in tandem, moving from $57.12 million to $89.46 million, driven by growing health awareness and the demand for naturally sourced ingredients.

Tartaric Acid Market Analysis By Form

The segment analysis indicates that the Powder form of Tartaric Acid maintains a strong market presence. The Powder market size is valued at $517.32 million for 2023 and is expected to grow significantly by 2033. The Liquid form, while smaller in scale at $82.68 million in 2023, presents growth potential with an increase forecasted due to varied applications across sectors.

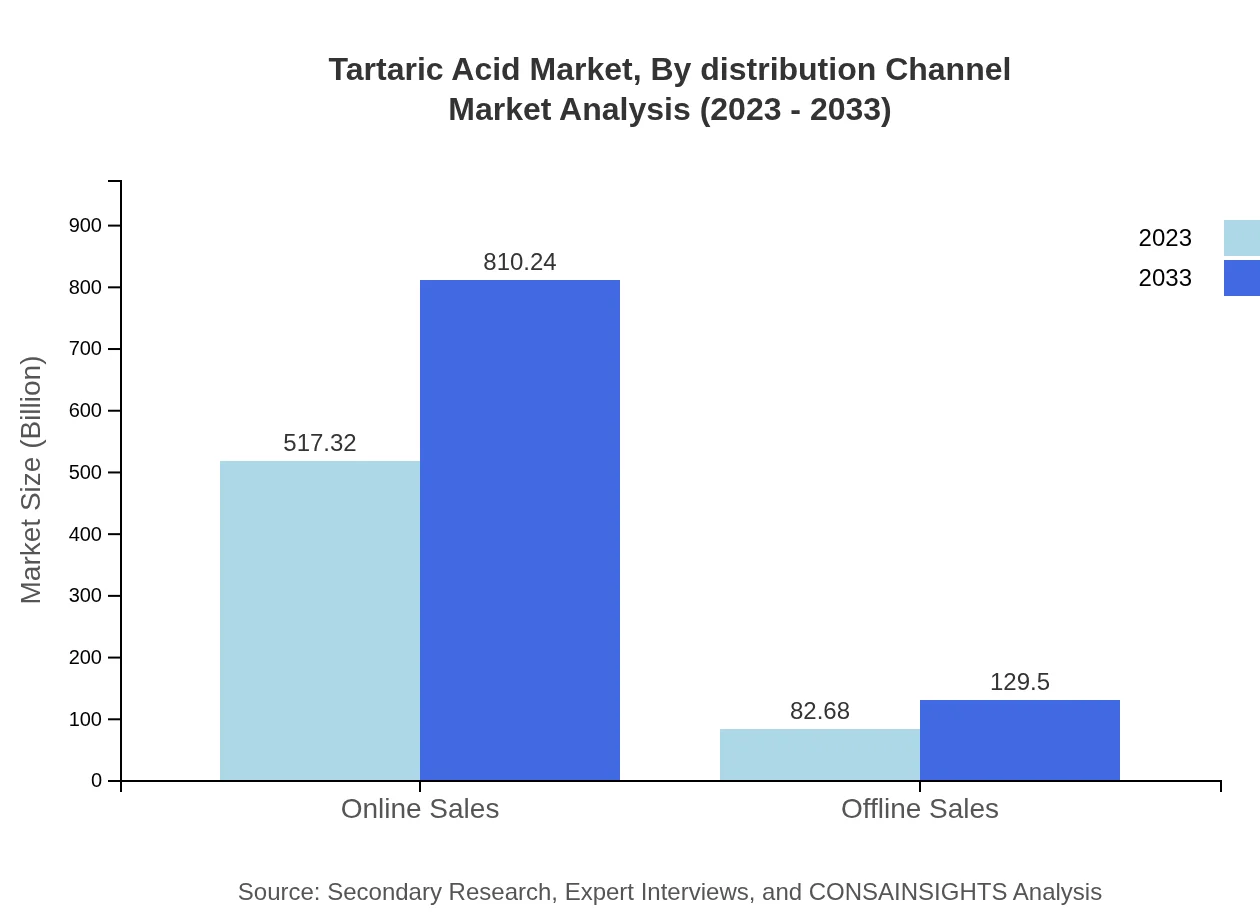

Tartaric Acid Market Analysis By Distribution Channel

Distribution channels have been segmented into Online and Offline Sales, with Online Sales attaining $517.32 million in 2023, significantly outperforming Offline Sales at $82.68 million. This trend is projected to continue into 2033, reflecting shifting consumer behaviors towards e-commerce and digital platforms for ingredient procurement.

Tartaric Acid Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tartaric Acid Industry

Tarac Technologies:

Tarac Technologies is a prominent player in the Tartaric Acid market known for its innovative sustainable production processes catering to natural food applications.Pioneer Industries:

Pioneer Industries specializes in manufacturing high-quality tartaric acid for the wine industry, investing in R&D to enhance its product offerings.Brenntag AG:

Brenntag AG is a global leader in chemical distribution, supplying Tartaric Acid to various industry sectors, significantly expanding its market presence through strategic partnerships.Hangzhou Bioking Biochemical Engineering Co., Ltd.:

Hangzhou Bioking focuses on the production of natural Tartaric Acid and serves the pharmaceutical and food industries, continuously innovating in sustainable practices.We're grateful to work with incredible clients.

FAQs

What is the market size of tartric acid?

The market size for tartaric acid is projected at approximately $600 million in 2023. With a compound annual growth rate (CAGR) of 4.5%, the market is expected to grow significantly over the next decade.

What are the key market players in the tartaric acid industry?

Key market players in the tartaric acid industry include chemical manufacturers and suppliers such as SOCMA, Tarac Technologies, and some large global suppliers. These companies lead through innovation, product quality, and market reach.

What are the primary factors driving growth in the tartaric acid industry?

Growth in the tartaric acid industry is driven by increased demand in the food and beverage sector, the rising popularity of natural food additives, expansion in the pharmaceutical industry, and advancements in technology that enable efficient production.

Which region is the fastest Growing in the tartaric acid market?

The Asia-Pacific region is the fastest-growing market for tartaric acid, projected to grow from $115.80 million in 2023 to $181.37 million by 2033. This growth is fueled by expanding food and beverage industries.

Does ConsaInsights provide customized market report data for the tartaric acid industry?

Yes, ConsaInsights offers customized market report data for the tartaric acid industry. This enables businesses to gain tailored insights that cater to their specific market needs and strategic planning.

What deliverables can I expect from this tartaric acid market research project?

Expect comprehensive deliverables including detailed market analysis, trends, forecasts, key player insights, segmentation data, and regional overviews, which will enhance your understanding of the tartaric acid market.

What are the market trends of tartaric acid?

Current market trends for tartaric acid include a shift towards natural products, rising application in the food and beverage sectors, and increasing use in pharmaceuticals. Additionally, innovation in production techniques is notable.