Lignin Products Market Report

Published Date: 02 February 2026 | Report Code: lignin-products

Lignin Products Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Lignin Products market, covering current trends, market size, forecast data, and insights into various segments from 2023 to 2033.

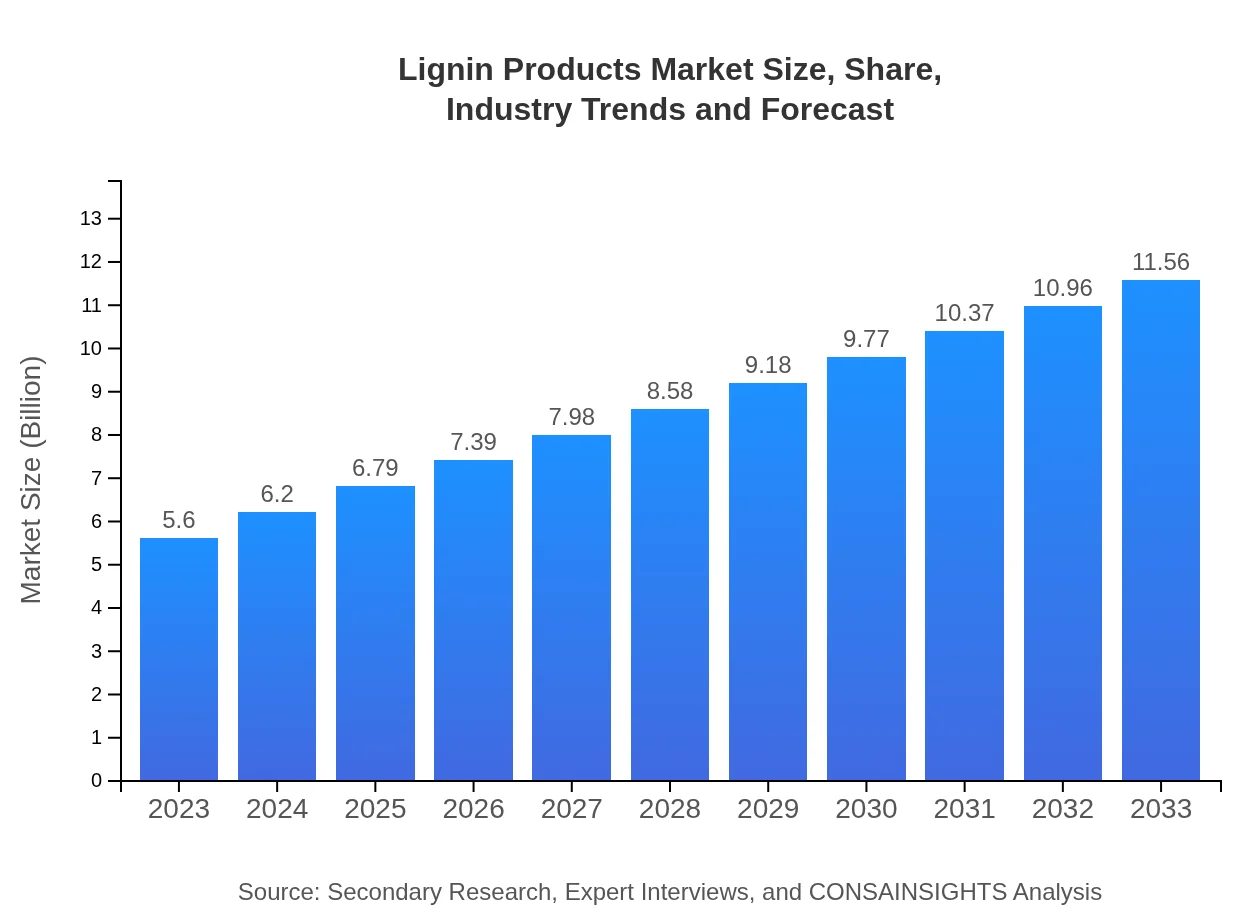

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $11.56 Billion |

| Top Companies | Domtar Corporation, Sappi Lanaken Mead, BASF SE, Tembec Inc., WestRock Company |

| Last Modified Date | 02 February 2026 |

Lignin Products Market Overview

Customize Lignin Products Market Report market research report

- ✔ Get in-depth analysis of Lignin Products market size, growth, and forecasts.

- ✔ Understand Lignin Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Lignin Products

What is the Market Size & CAGR of Lignin Products market in 2023?

Lignin Products Industry Analysis

Lignin Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Lignin Products Market Analysis Report by Region

Europe Lignin Products Market Report:

In Europe, the Lignin Products market is expected to grow from $1.35 billion in 2023 to $2.80 billion by 2033. The market is supported by stringent regulations aimed at reducing carbon emissions, driving demand for sustainable alternatives.Asia Pacific Lignin Products Market Report:

In the Asia Pacific region, the Lignin Products market is valued at approximately $1.16 billion in 2023 and is expected to grow to $2.40 billion by 2033. This growth is driven by increased industrialization, agricultural activities, and the rising demand for eco-friendly products.North America Lignin Products Market Report:

North America's Lignin Products market size was $1.96 billion in 2023, with forecasts estimating it to grow to $4.04 billion by 2033. This region is driven by technological advancements and a strong push for renewable materials in various industries.South America Lignin Products Market Report:

South America’s market for Lignin Products in 2023 stands at around $0.52 billion, projected to reach $1.07 billion by 2033. The emphasis on sustainable agriculture and bio-based materials supports market expansion in this region.Middle East & Africa Lignin Products Market Report:

The Lignin Products market in the Middle East and Africa was valued at $0.61 billion in 2023, anticipated to increase to $1.25 billion by 2033. Growth is attributed to the growing awareness of sustainability and investments in chemical innovations.Tell us your focus area and get a customized research report.

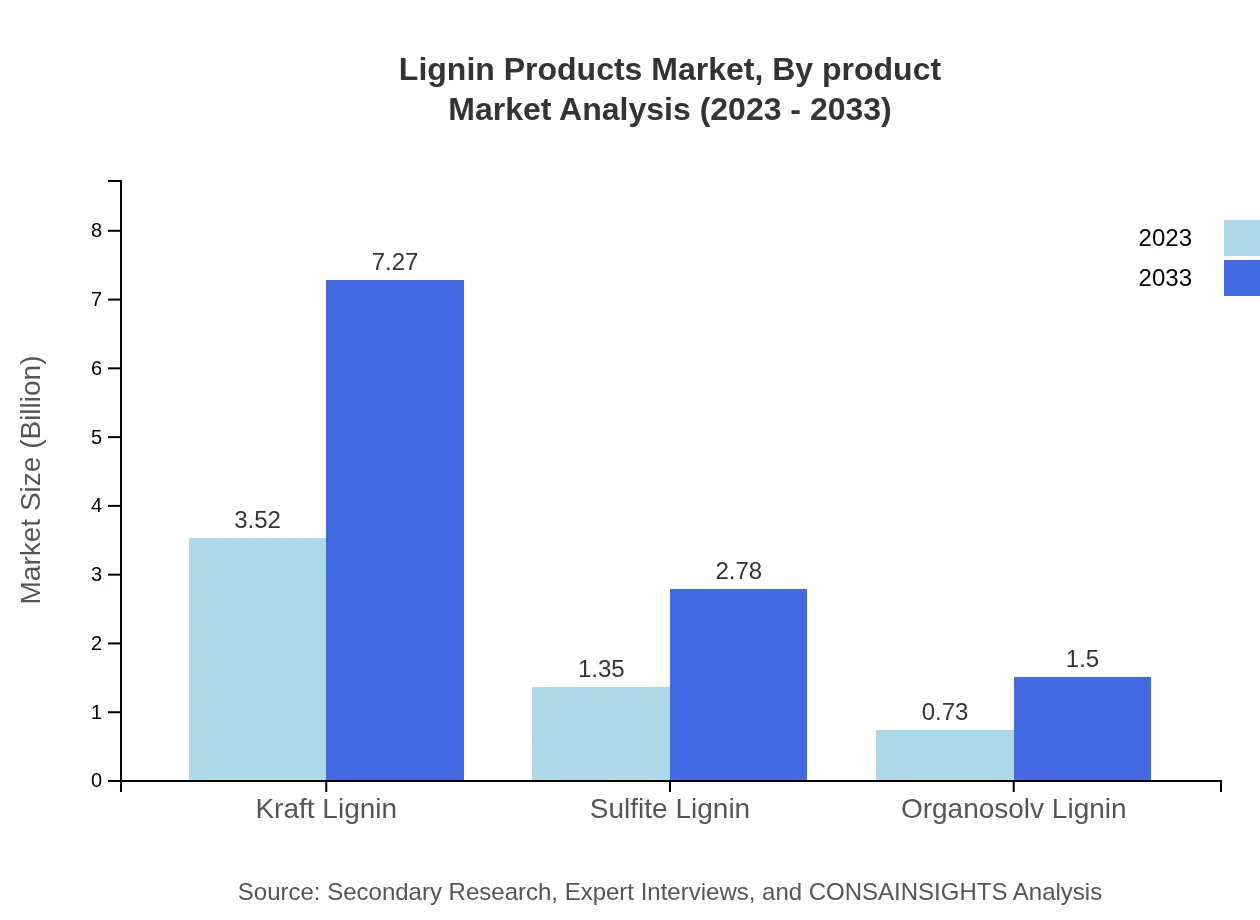

Lignin Products Market Analysis By Product

The Lignin Products market is primarily divided into several product types: Kraft Lignin, Sulfite Lignin, Organosolv Lignin, and Pyrolytic Lignin. In 2023, Kraft Lignin holds a market size of $3.52 billion, maintaining a 62.93% share, expected to grow to a size of $7.27 billion by 2033. Sulfite Lignin, with $1.35 billion in 2023 and sharing 24.06%, is projected to reach $2.78 billion by 2033. Organosolv Lignin accounts for $0.73 billion, holding 13.01% of the market in 2023 and anticipating growth to $1.50 billion by 2033.

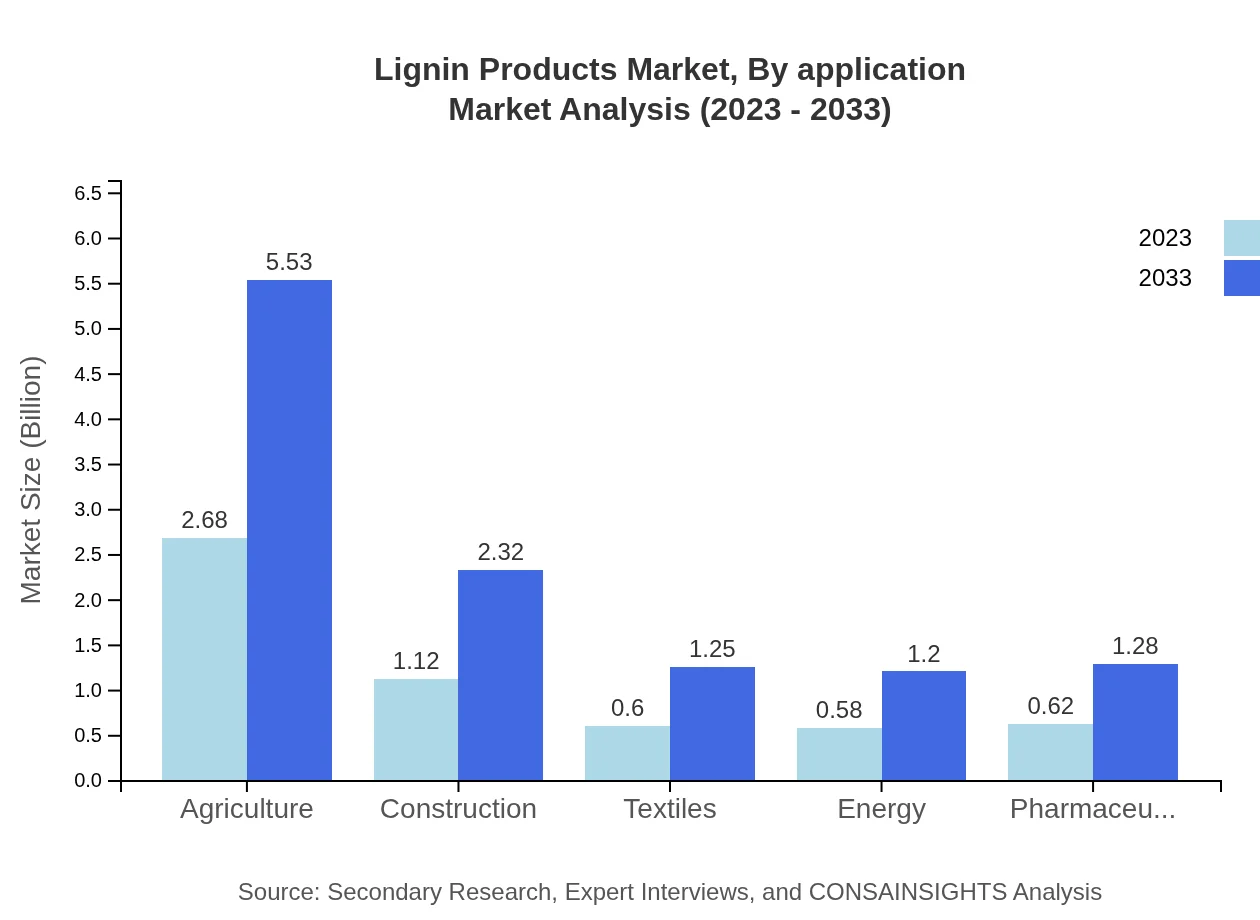

Lignin Products Market Analysis By Application

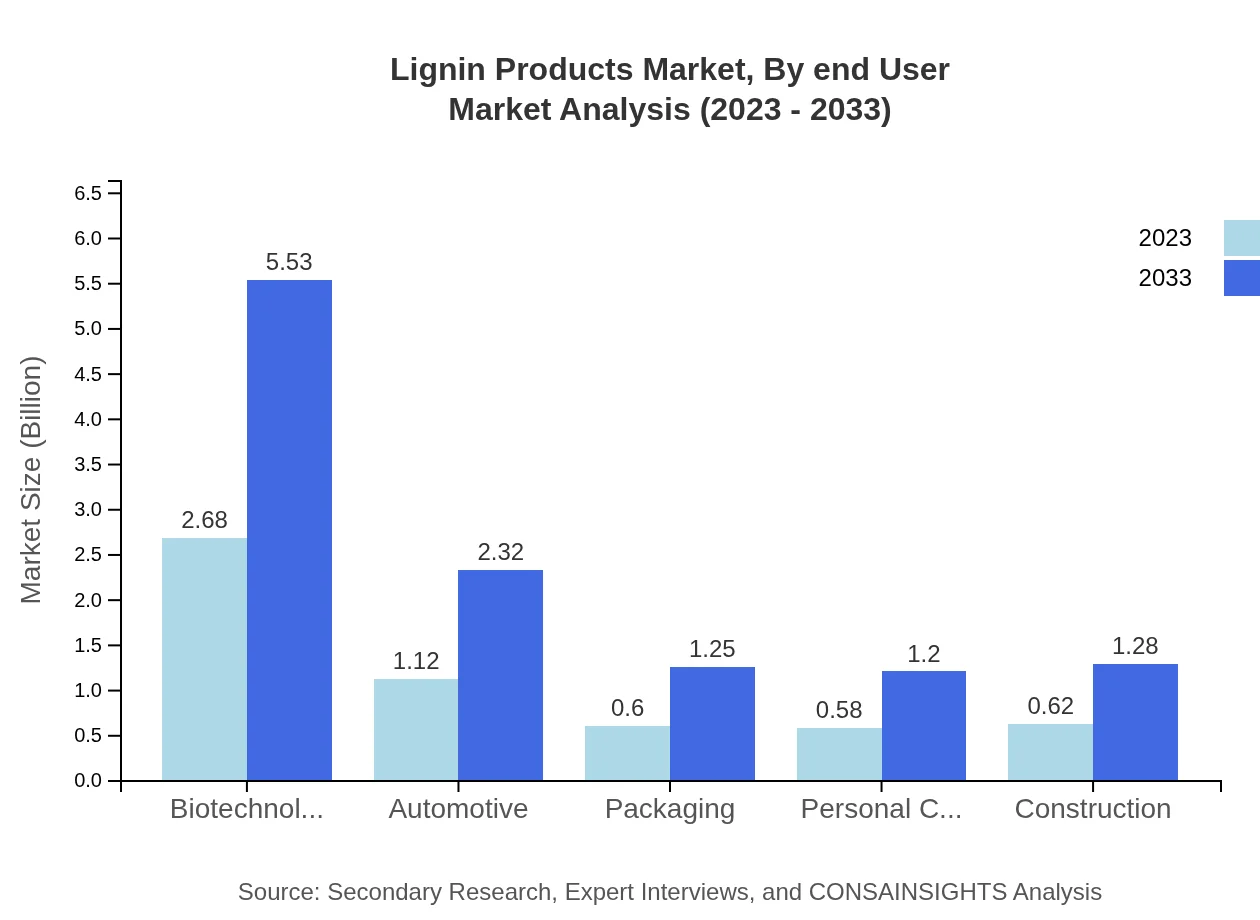

The application segment for Lignin Products encompasses various industries such as Biotechnology, Automotive, Packaging, Personal Care, and Construction. The Biotechnology sector presents significant potential, with a size of $2.68 billion in 2023 and forecasted to reach $5.53 billion by 2033. Automotive applications account for $1.12 billion and are expected to increase to $2.32 billion. Packaging uses represent a size of $0.60 billion in 2023 and are projected to reach $1.25 billion. Personal Care and Construction applications are also poised for robust growth.

Lignin Products Market Analysis By End User

The end-user segmentation for Lignin Products includes Agriculture, Pharmaceuticals, Textiles, and Energy sectors. The Agriculture industry leads with a market size of $2.68 billion in 2023, expected to expand to $5.53 billion by 2033, reflecting the growing demand for bio-based pesticides and fertilizers. Pharmaceuticals and Textiles are also notable segments, projected to grow steadily as natural alternatives gain traction.

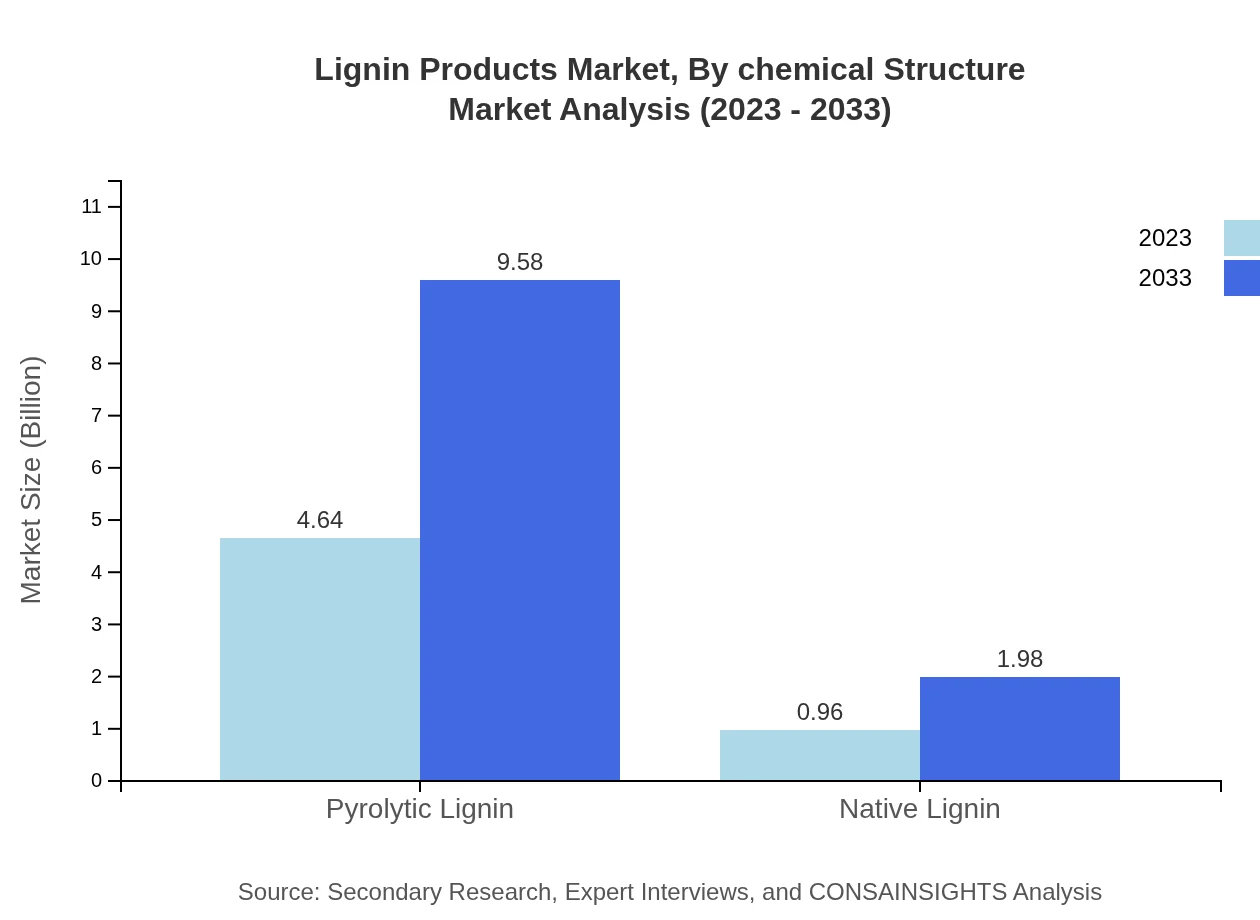

Lignin Products Market Analysis By Chemical Structure

The Lignin Products market is categorized by chemical structure, including Native Lignin and Pyrolytic Lignin. In 2023, Pyrolytic Lignin is anticipated to represent a substantial market share of $4.64 billion, projected to reach $9.58 billion by 2033. Native Lignin has an emerging share with a current size of $0.96 billion, expected to achieve growth towards $1.98 billion.

Lignin Products Market Analysis By Geography

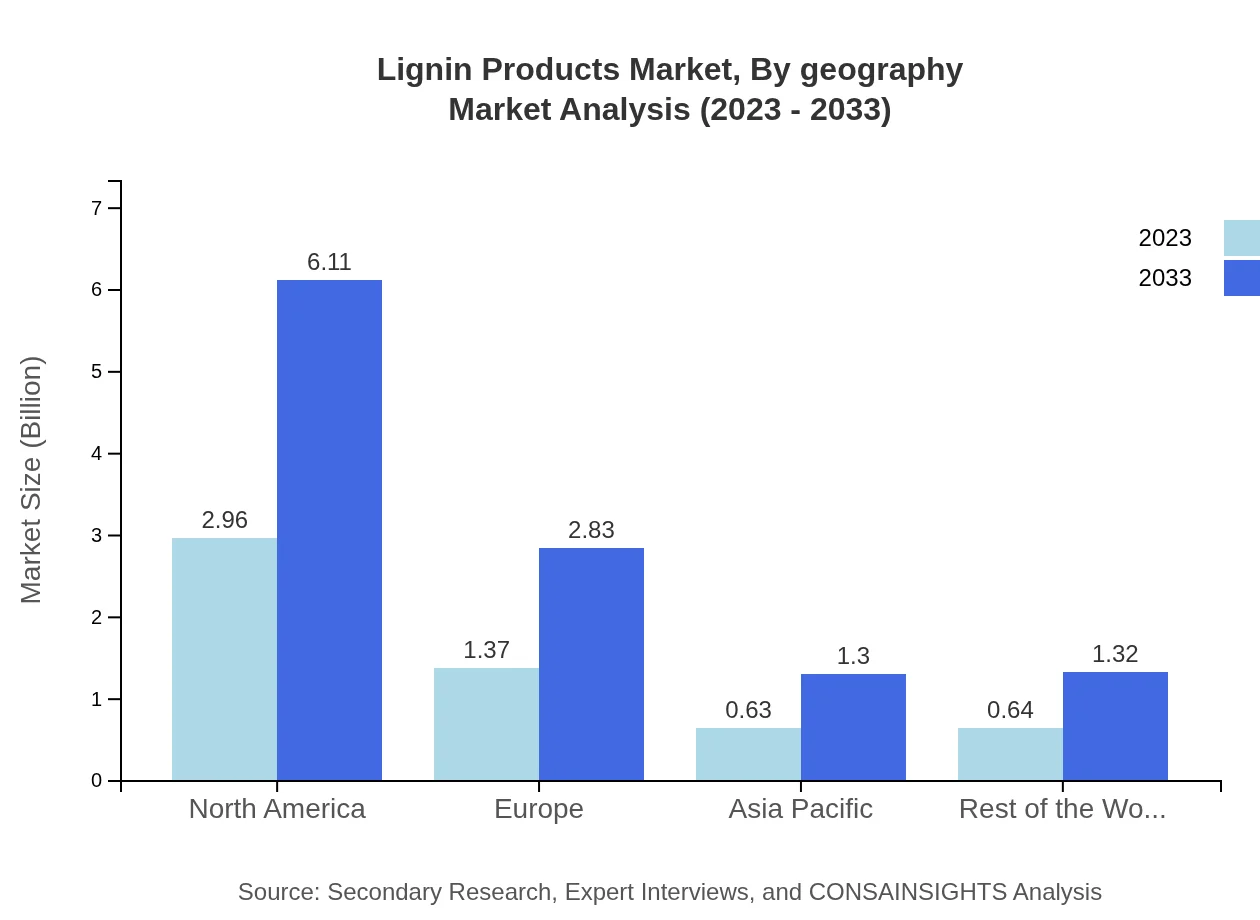

Geographically, the Lignin Products market shows distinct patterns of consumption and growth. North America contributes significantly with $2.96 billion in 2023, expected to grow to $6.11 billion. Europe is anticipated to expand from $1.37 billion to $2.83 billion, while the Asia Pacific region is projected for steady growth from $0.63 billion to $1.30 billion. Each region presents unique opportunities based on industry demands and regulatory pressures.

Lignin Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Lignin Products Industry

Domtar Corporation:

A leader in sustainable products, Domtar Corporation specializes in a range of paper products and vigorously pursues innovative lignin extraction technologies.Sappi Lanaken Mead:

Sappi is a major player in the production of specialty cellulose and paper products, significantly contributing to the lignin market with their advanced biorefinery processes.BASF SE:

BASF SE is a global chemical company that offers a portfolio of lignin-based solutions, focusing on sustainability and innovative product development.Tembec Inc.:

A significant participant in the forest products sector, Tembec emphasizes the sustainable use of lignin and its applications in various industries.WestRock Company:

WestRock Company offers a range of sustainable packaging solutions and actively utilizes lignin in its products, embracing innovative technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of lignin Products?

The global lignin-products market is projected to reach USD 5.6 billion by 2033, growing at a CAGR of 7.3%. In 2023, the market is valued at various segments, indicating significant potential for future expansion.

What are the key market players or companies in the lignin Products industry?

Key players in the lignin-products market include prominent companies engaged in producing lignin from wood sources. They focus on innovation and sustainability in developing applications ranging from bioplastics to pharmaceuticals.

What are the primary factors driving the growth in the lignin Products industry?

Growth in the lignin-products industry is driven by increasing demand for sustainable materials, advancements in extraction technologies, and a rising trend towards eco-friendly alternatives in various applications including automotive and construction.

Which region is the fastest Growing in the lignin Products?

The North American region is the fastest-growing in the lignin-products market, expected to grow from USD 1.96 billion in 2023 to USD 4.04 billion in 2033. This reflects a strong increasing trend in sustainable material sourcing.

Does ConsaInsights provide customized market report data for the lignin Products industry?

Yes, ConsaInsights offers customized market research reports tailored to specific client needs in the lignin-products industry. This includes detailed analyses of market dynamics, trends, and forecasts.

What deliverables can I expect from this lignin Products market research project?

Deliverables from the lignin-products market research project typically include a comprehensive report with market insights, regional analysis, competitive landscape, and segmented data to support strategic decision-making.

What are the market trends of lignin Products?

Key market trends for lignin-products include the rising shift towards renewable resources, increased investments in lignin-based technologies, and the integration of lignin in sectors like agriculture and bioplastics.