Telecom Cloud Billing Market Report

Published Date: 31 January 2026 | Report Code: telecom-cloud-billing

Telecom Cloud Billing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Telecom Cloud Billing market, covering trends, challenges, and growth forecasts for 2023 to 2033. Insights include market size, CAGR, industry analysis, regional breakdowns, and profiles of leading companies.

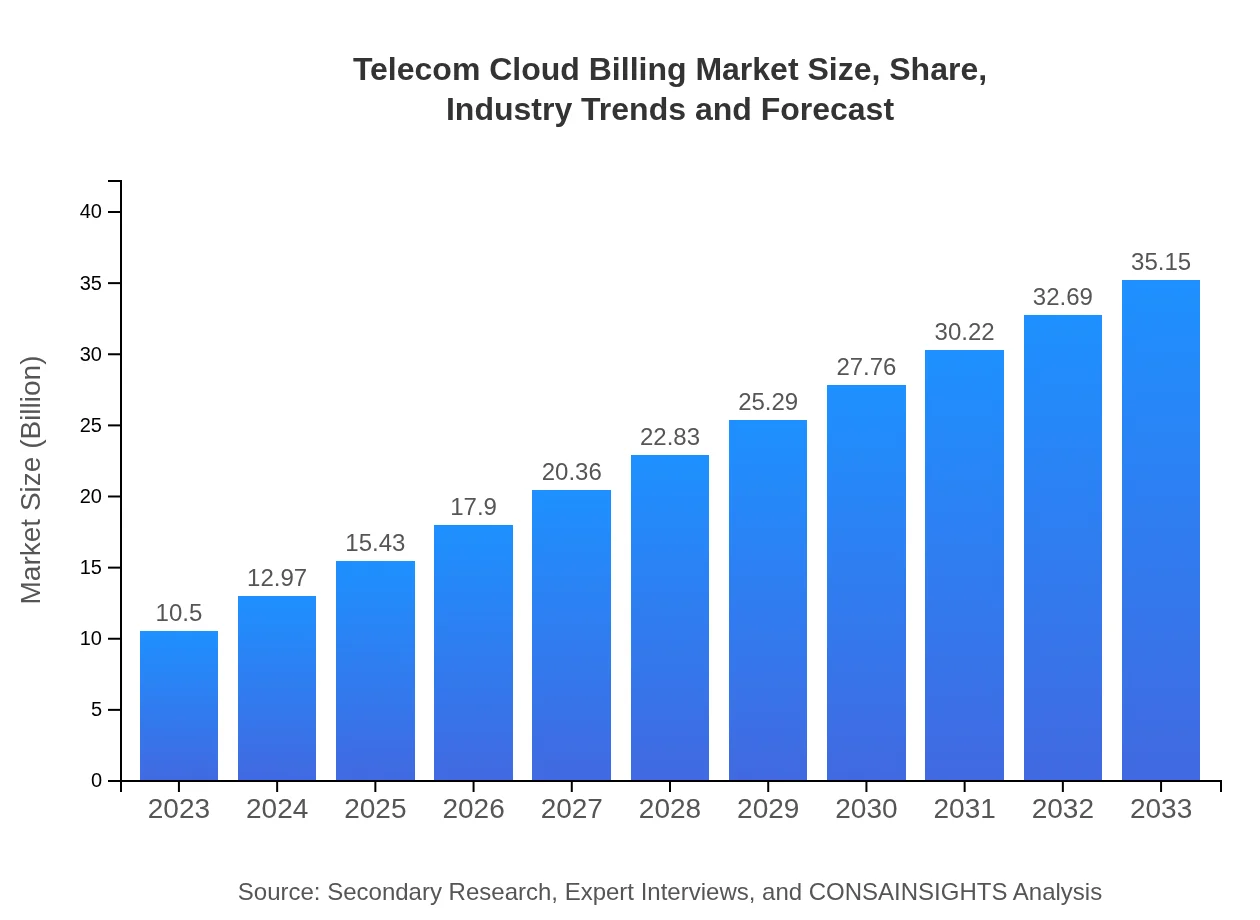

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $35.15 Billion |

| Top Companies | Amdocs Limited, Oracle Corporation, SAP SE, Ericsson , Nokia |

| Last Modified Date | 31 January 2026 |

Telecom Cloud Billing Market Overview

Customize Telecom Cloud Billing Market Report market research report

- ✔ Get in-depth analysis of Telecom Cloud Billing market size, growth, and forecasts.

- ✔ Understand Telecom Cloud Billing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Telecom Cloud Billing

What is the Market Size & CAGR of Telecom Cloud Billing market in 2023?

Telecom Cloud Billing Industry Analysis

Telecom Cloud Billing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Telecom Cloud Billing Market Analysis Report by Region

Europe Telecom Cloud Billing Market Report:

In Europe, the market is estimated to grow from $3.46 billion in 2023 to $11.59 billion in 2033. Regulatory requirements and the demand for personalized customer experiences are among the factors propelling the growth of cloud billing solutions.Asia Pacific Telecom Cloud Billing Market Report:

In the Asia Pacific region, the Telecom Cloud Billing market is expected to grow from $1.95 billion in 2023 to $6.52 billion in 2033. The rapid expansion of telecom networks, fueled by rising smartphone penetration and the demand for 5G services, is driving the market's growth. Additionally, government initiatives to promote digitalization are contributing positively.North America Telecom Cloud Billing Market Report:

North America showcases a robust Telecom Cloud Billing market, projected to increase from $3.63 billion in 2023 to $12.14 billion by 2033. The presence of established telecom operators and a strong inclination toward innovative billing solutions in the region drive significant investments.South America Telecom Cloud Billing Market Report:

The South American market is anticipated to expand from $0.09 billion in 2023 to $0.31 billion by 2033. While the market is smaller in comparison, a shift towards modern billing solutions in the telecom sector is observed, propelled by increasing internet coverage and mobile service uptake.Middle East & Africa Telecom Cloud Billing Market Report:

The Telecom Cloud Billing market in the Middle East and Africa is poised to rise from $1.37 billion in 2023 to $4.60 billion by 2033, influenced by increasing mobile subscriptions, urbanization, and the implementation of digital transformation strategies.Tell us your focus area and get a customized research report.

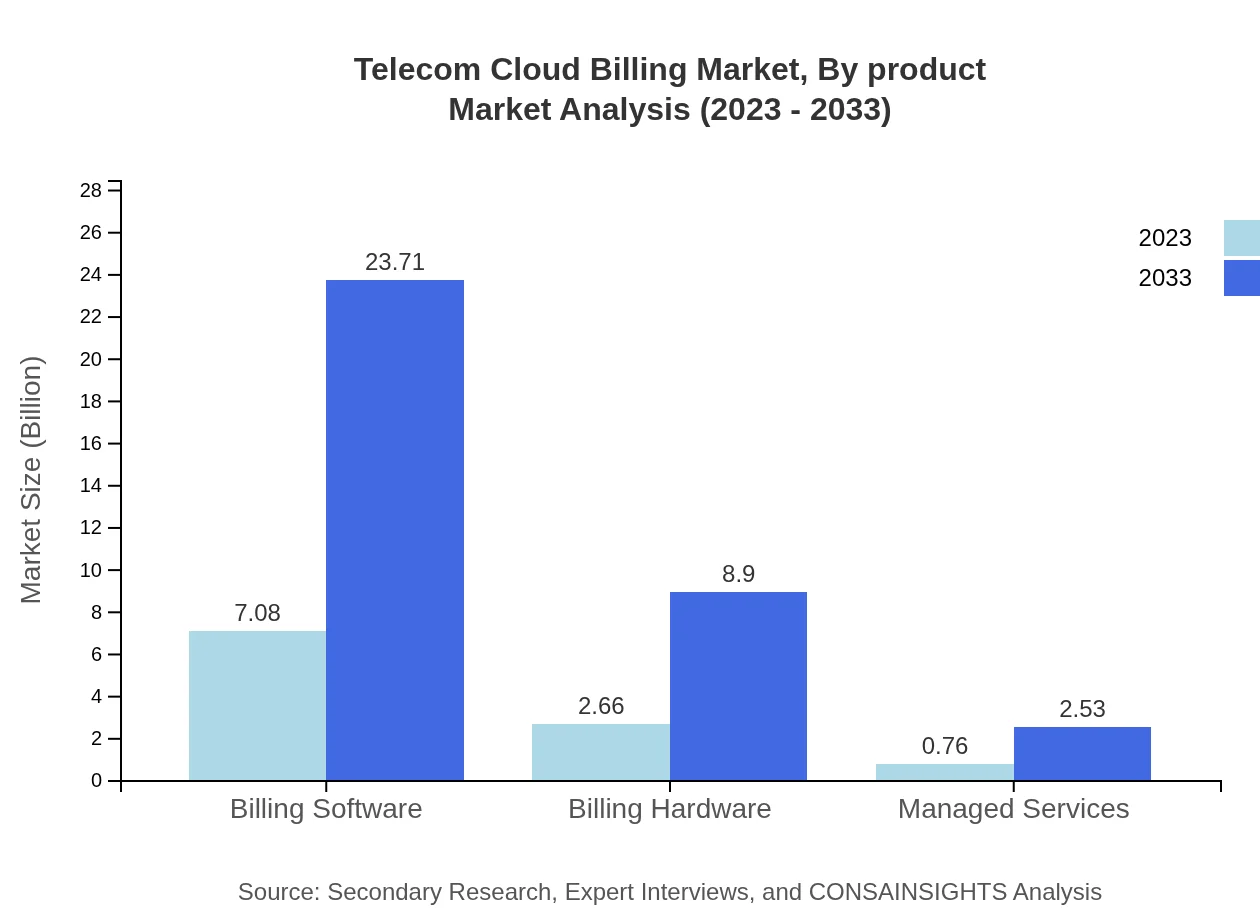

Telecom Cloud Billing Market Analysis By Product

The Telecom Cloud Billing market segment is divided into billing software, hardware, managed services, and others. Billing software is projected to dominate, with a size of $7.08 billion in 2023, expanding to $23.71 billion by 2033, showcasing a substantive share of 67.46%. Billing hardware is a smaller segment, valued at $2.66 billion in 2023, increasing to $8.90 billion in 2033, holding a market share of 25.33%. Managed services are expected to increase from $0.76 billion to $2.53 billion, capturing around 7.21% of the market share.

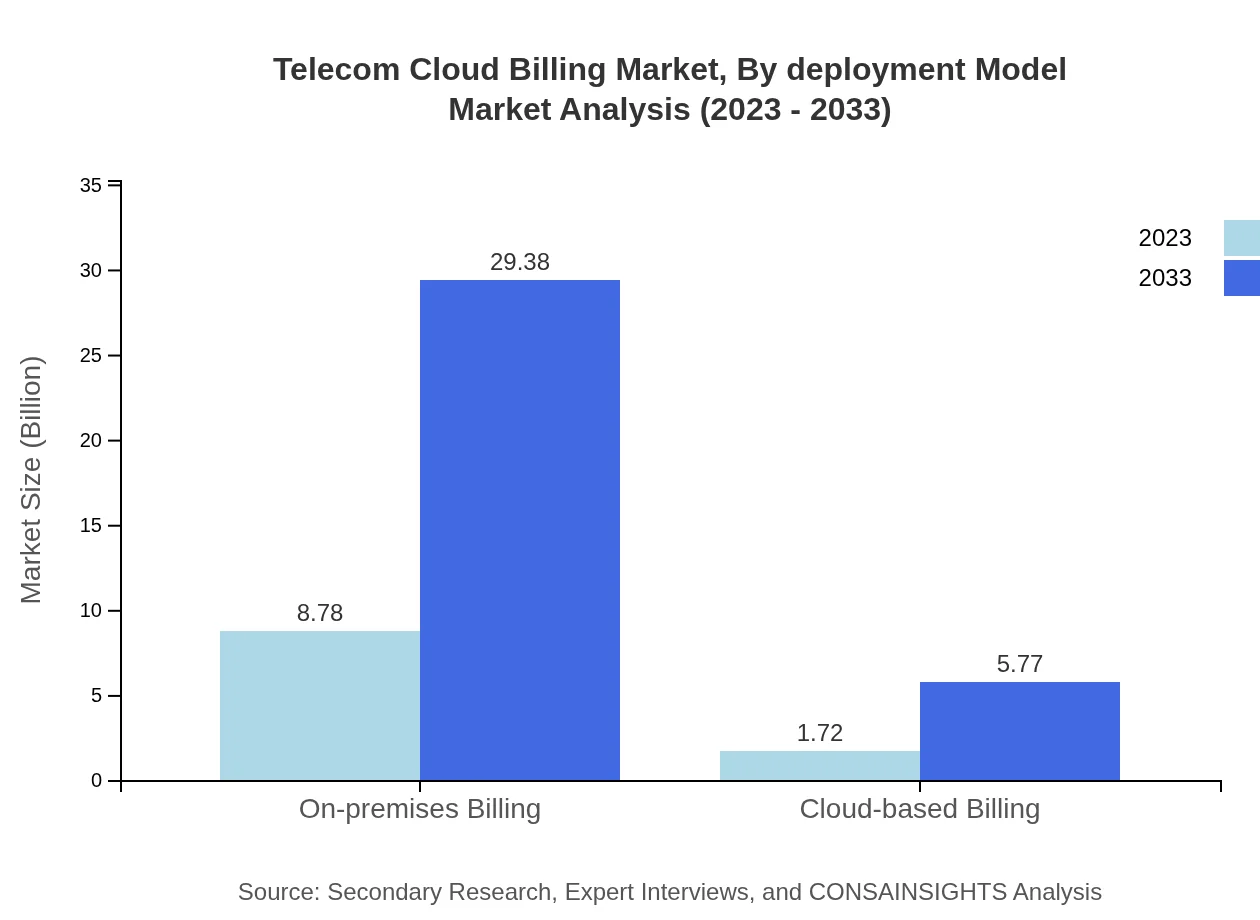

Telecom Cloud Billing Market Analysis By Deployment Model

The Telecom Cloud Billing market is further segmented by deployment models into on-premises and cloud-based billing solutions. On-premises billing accounted for a size of $8.78 billion in 2023 with an impressive share of 83.58%. Conversely, cloud-based billing is projected to grow from $1.72 billion to $5.77 billion by 2033, gaining a share of 16.42%. This trend indicates a gradual shift toward more flexible, scalable billing environments as telecom companies seek to adapt to evolving market demands.

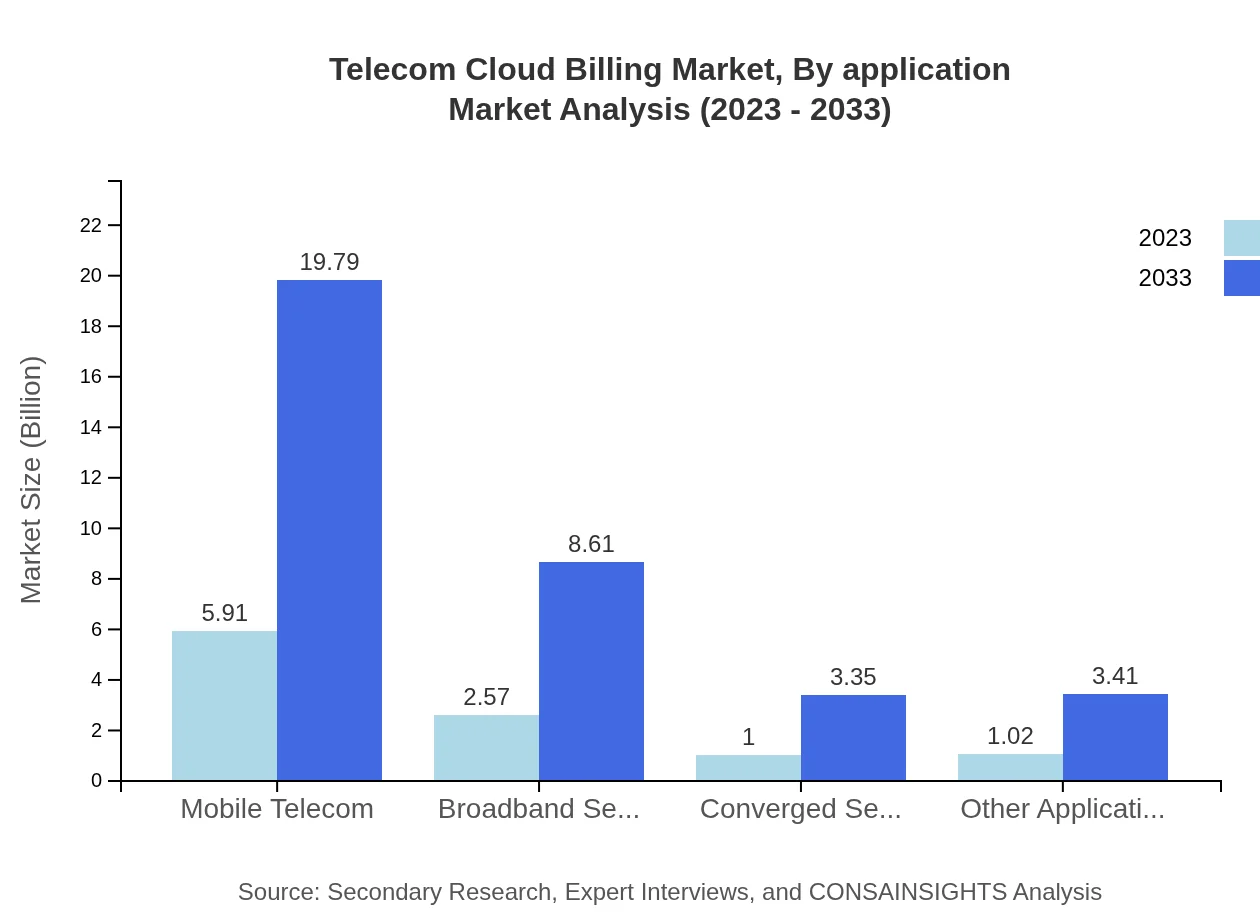

Telecom Cloud Billing Market Analysis By Application

The application segment includes mobile telecom, broadband services, converged services, and others. The mobile telecom segment leads with a size of $5.91 billion in 2023, projected to reach $19.79 billion by 2033. Broadband services also show significant growth, expanding from $2.57 billion to $8.61 billion, showcasing immense potential for billing solutions tailored to this market. Converged services are set to grow as well, from $1.00 billion to $3.35 billion over the same period.

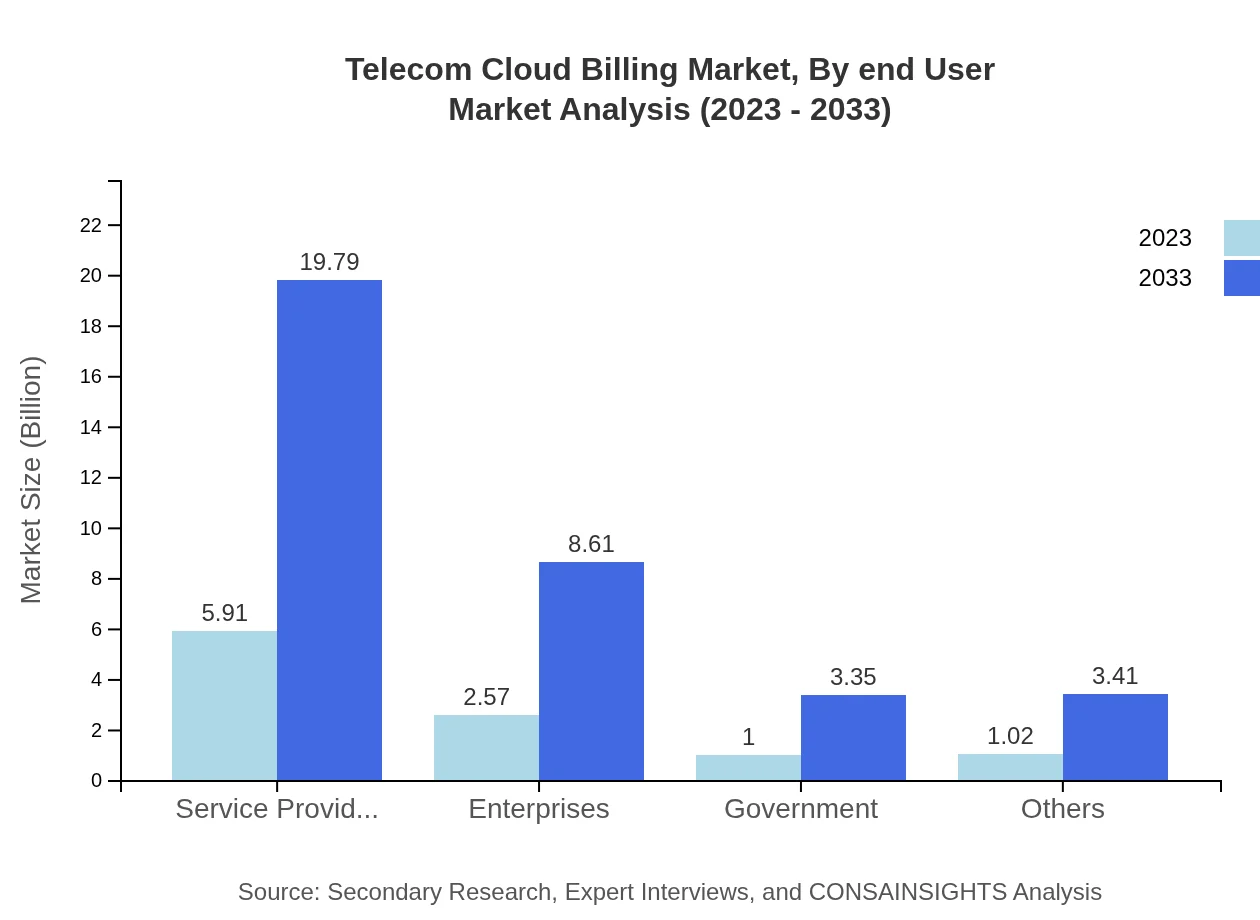

Telecom Cloud Billing Market Analysis By End User

The Telecom Cloud Billing market serves diverse end-users, including government, enterprises, service providers, and others. Service providers hold the largest share at 56.3%, with a market size increasing from $5.91 billion in 2023 to $19.79 billion by 2033. Enterprises and government entities show steady growth too, with enterprises forecasted to rise from $2.57 billion to $8.61 billion and government funding rising from $1.00 billion to $3.35 billion.

Telecom Cloud Billing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Telecom Cloud Billing Industry

Amdocs Limited:

Amdocs is a leading provider of software and services for communications and media companies. Their cloud billing solutions enable operators to deliver real-time billing and customer experiences.Oracle Corporation:

Oracle offers a wide array of enterprise software products and services, including robust billing solutions for telecom companies that enhance revenue management and customer engagement.SAP SE:

SAP delivers business software and cloud solutions that optimize billing processes within the telecom sector, enabling more efficient financial operations and customer satisfaction.Ericsson :

Ericsson provides technology services and solutions in the telecom domain, including cloud billing services that are critical in managing the complexities of new subscription models.Nokia :

Nokia offers telecom solutions that encompass modern billing systems, facilitating transition to cloud environments for greater flexibility and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of telecom Cloud Billing?

The global telecom cloud billing market is projected to reach approximately $10.5 billion by 2033, with a compound annual growth rate (CAGR) of 12.3%. This growth reflects the increasing demand for cloud-based solutions in telecommunications.

What are the key market players or companies in the telecom Cloud Billing industry?

Key players in the telecom-cloud-billing market include renowned companies like Amdocs, Oracle, SAP, and Ericsson. These firms lead in providing robust billing solutions that cater to the evolving needs of telecom operators.

What are the primary factors driving the growth in the telecom Cloud Billing industry?

Key drivers behind the growth of telecom cloud billing include the rising demand for automated billing systems, regulatory changes, and the need for enhanced customer experience. Additionally, cloud technology enables scalable and flexible billing solutions.

Which region is the fastest Growing in the telecom Cloud Billing?

The fastest-growing region in the telecom cloud billing market is expected to be Europe, with the market size projected to grow from $3.46 billion in 2023 to $11.59 billion by 2033, reflecting significant adoption of cloud solutions.

Does ConsaInsights provide customized market report data for the telecom Cloud Billing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the telecom-cloud-billing industry. Clients can request detailed insights and analytics that meet their strategic goals.

What deliverables can I expect from this telecom Cloud Billing market research project?

Deliverables from this telecom-cloud-billing market research project typically include comprehensive reports, market forecasts, segment analysis, competitive landscape, and actionable insights to guide strategic decision-making.

What are the market trends of telecom Cloud Billing?

Current market trends in telecom cloud billing include a shift towards on-premises billing solutions, with significant market shares held by mobile telecom and broadband services. The adoption of cloud-based billing systems is also gaining momentum.