Telecom Towers Market Report

Published Date: 31 January 2026 | Report Code: telecom-towers

Telecom Towers Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Telecom Towers market from 2023 to 2033, detailing market size forecasts, regional insights, technology trends, and key players impacting growth within the industry.

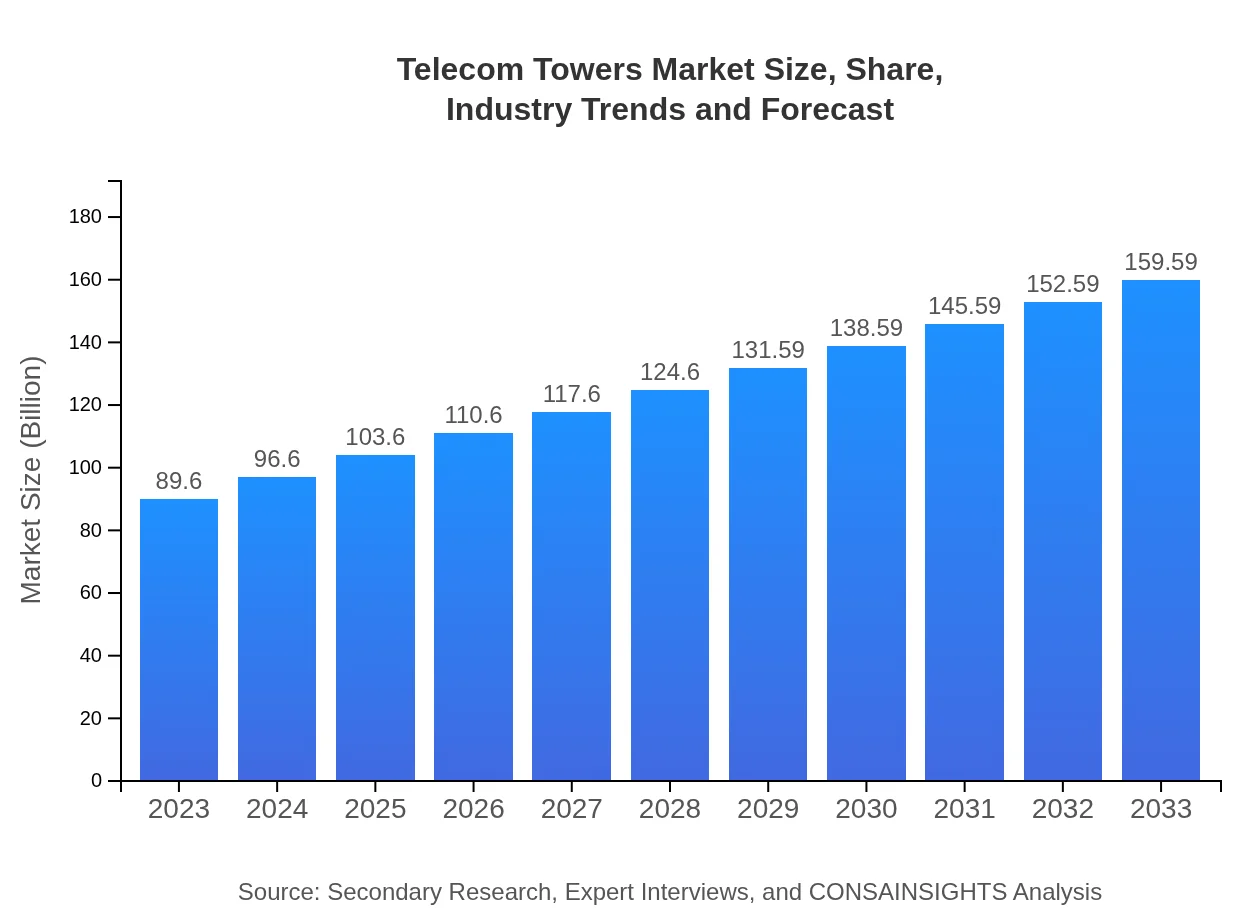

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $89.60 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $159.59 Billion |

| Top Companies | American Tower Corporation, Crown Castle International Corp., T-Mobile USA, Inc., Equinix Inc. |

| Last Modified Date | 31 January 2026 |

Telecom Towers Market Overview

Customize Telecom Towers Market Report market research report

- ✔ Get in-depth analysis of Telecom Towers market size, growth, and forecasts.

- ✔ Understand Telecom Towers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Telecom Towers

What is the Market Size & CAGR of Telecom Towers market in 2023?

Telecom Towers Industry Analysis

Telecom Towers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Telecom Towers Market Analysis Report by Region

Europe Telecom Towers Market Report:

In Europe, the market is forecasted to grow significantly from $25.77 billion in 2023 to $45.90 billion by 2033. The EU's emphasis on digital transformation and sustainability initiatives accelerates the deployment of advanced telecom infrastructure, reinforcing market expansion.Asia Pacific Telecom Towers Market Report:

In the Asia Pacific region, the Telecom Towers market is projected to grow from $18.74 billion in 2023 to approximately $33.37 billion by 2033. This growth is fueled by rapid urbanization, government initiatives to enhance rural connectivity, and increasing smartphone penetration in developing countries like India and China.North America Telecom Towers Market Report:

North America's market is estimated to expand from $29.44 billion in 2023 to $52.44 billion by 2033. The region's high demand for mobile data services, coupled with investments in 5G technology, drive this growth, alongside a robust regulatory framework that encourages infrastructure development.South America Telecom Towers Market Report:

The South American Telecom Towers market is expected to rise from $6.25 billion in 2023 to $11.12 billion in 2033. Emerging economies in this region are investing in telecommunications infrastructure to bridge the connectivity gap and support mobile network expansion.Middle East & Africa Telecom Towers Market Report:

The Middle East and Africa region is witnessing growth from $9.41 billion in 2023 to $16.76 billion by 2033, primarily due to increasing mobile penetration and the rise of smart cities, prompting investments in telecom infrastructure to support advanced connectivity requirements.Tell us your focus area and get a customized research report.

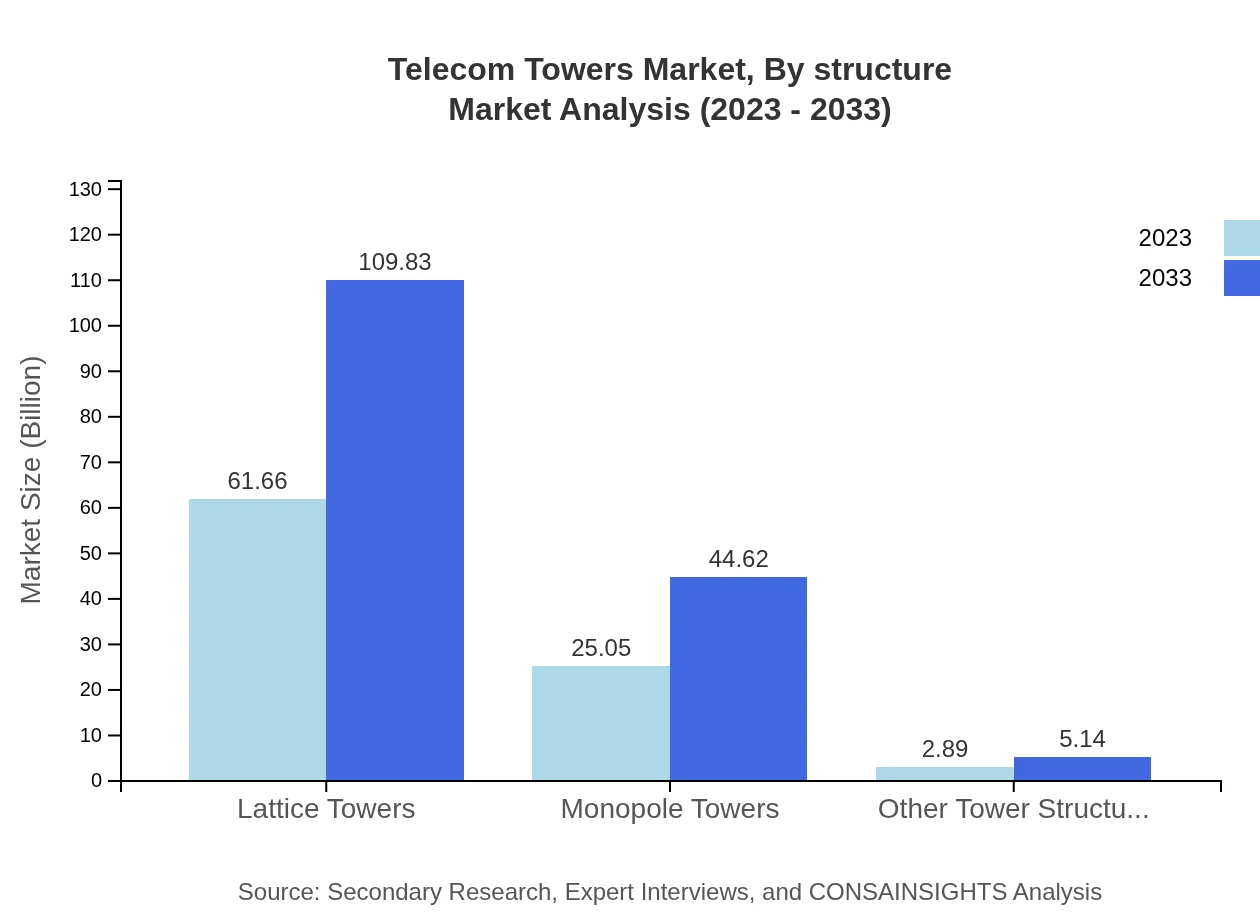

Telecom Towers Market Analysis By Structure

The Telecom Towers market by structure type includes Lattice Towers, Monopole Towers, and Concrete Towers. In 2023, Lattice Towers dominate with a market size of $61.66 billion and a share of 68.82%. By 2033, they are expected to grow to $109.83 billion. Monopole Towers and Concrete Towers also show promising growth, with respective figures of $25.05 billion and $44.62 billion by 2033.

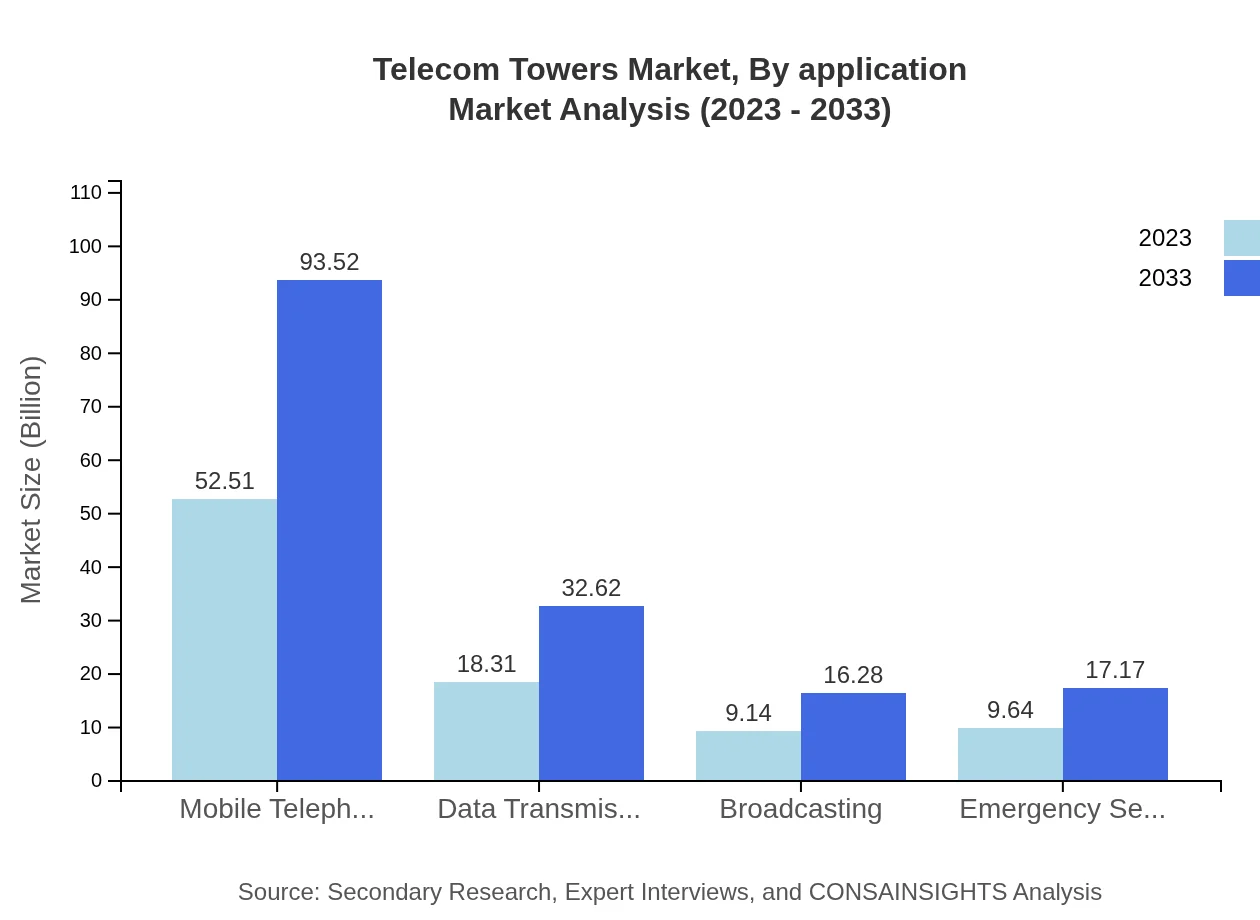

Telecom Towers Market Analysis By Application

The application segments for Telecom Towers include Mobile Telephony, Data Transmission, Broadcasting, and Emergency Services. Mobile telephony leads with a market size of $52.51 billion in 2023 and an expected growth to $93.52 billion by 2033. Data transmission currently sits at $18.31 billion and is projected to rise to $32.62 billion by 2033.

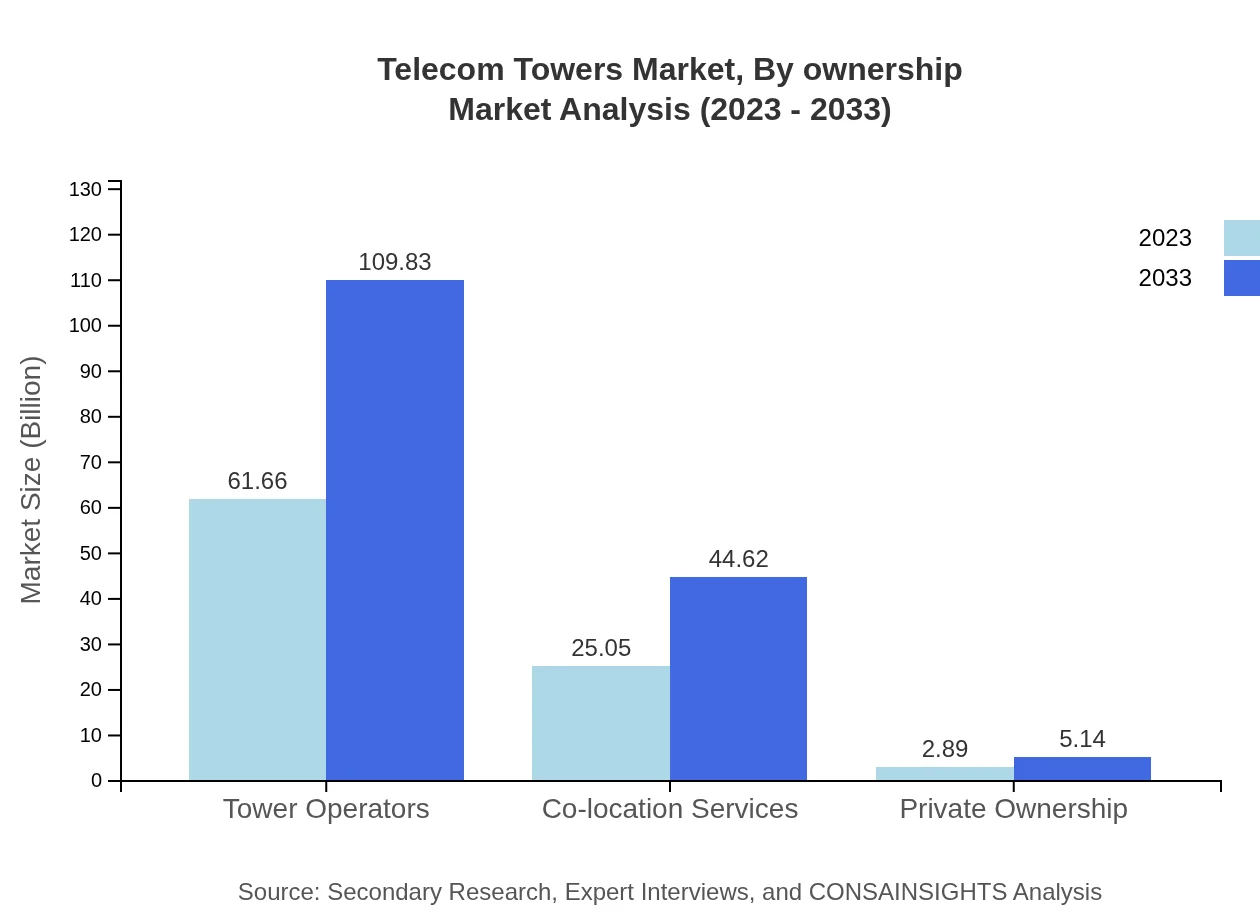

Telecom Towers Market Analysis By Ownership

Tower ownership consists of Tower Operators, Co-location Services, and Private Ownership. In 2023, Tower Operators (61.66 billion) hold the largest market share, which is expected to grow to $109.83 billion by 2033.

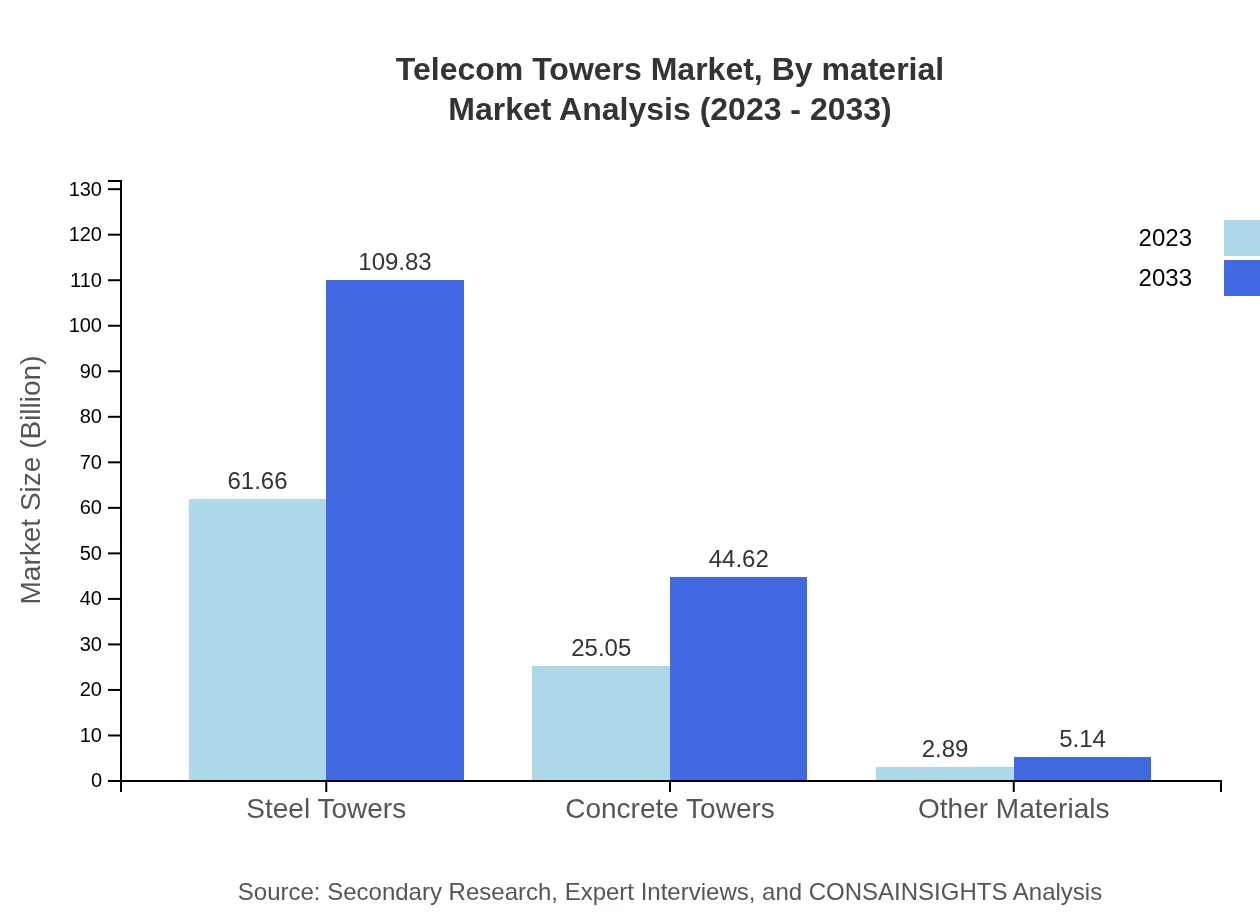

Telecom Towers Market Analysis By Material

The market analysis by material indicates a strong presence of Steel Towers and Concrete Towers. Steel structures currently dominate the market with a size of $61.66 billion in 2023 growing to $109.83 billion by 2033, while Concrete Towers grow from $25.05 billion to $44.62 billion in the same period.

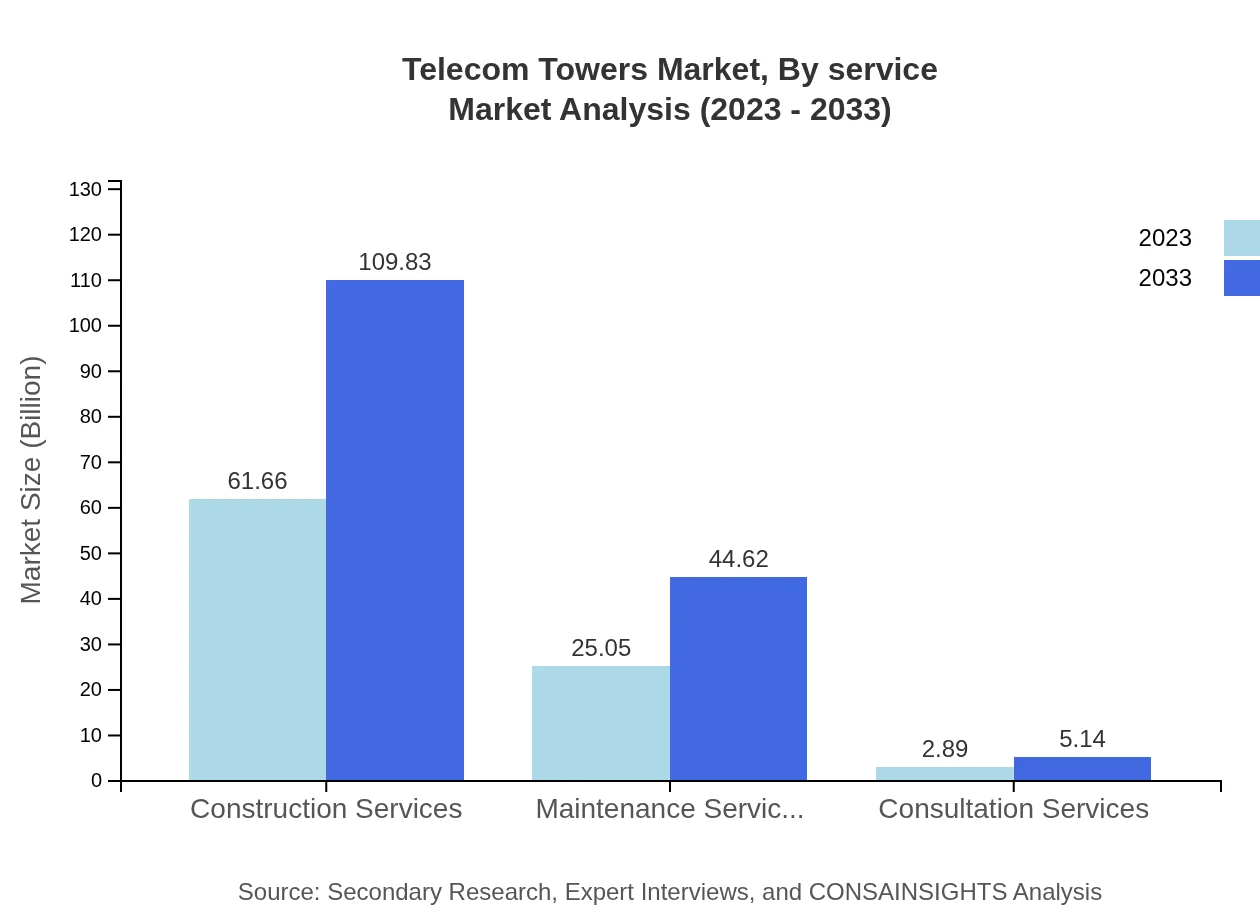

Telecom Towers Market Analysis By Service

The service segments categorize the market into Construction Services, Maintenance Services, and Consultation Services. Construction Services, leading with a market size of $61.66 billion in 2023, is projected to rise to $109.83 billion by 2033, while Maintenance Services is expected to grow from $25.05 billion to $44.62 billion.

Telecom Towers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Telecom Towers Industry

American Tower Corporation:

A leading independent owner and operator of multi-tenant communications real estate, American Tower has a significant portfolio across the globe, facilitating the roll-out of 5G and enhancing mobile infrastructure.Crown Castle International Corp.:

Crown Castle operates a vast portfolio of towers, making it a critical player in the US telecom sector, focusing on expanding fiber and tower infrastructure to support mobile broadband.T-Mobile USA, Inc.:

As a major telecommunications company, T-Mobile USA plays a crucial role in advancing telecom infrastructure and services while pushing for innovative solutions in the mobile sector.Equinix Inc.:

A global leader in interconnection and data center services, Equinix supports telecom towers through its extensive infrastructure capabilities, enhancing connectivity and service delivery.We're grateful to work with incredible clients.

FAQs

What is the market size of Telecom Towers?

The global telecom towers market is currently valued at approximately $89.6 billion, with a projected annual growth rate (CAGR) of 5.8%, expected to rise significantly by the end of 2033.

What are the key market players or companies in the Telecom Towers industry?

Key players in the telecom towers market include major telecom providers, tower construction firms, and operators specializing in infrastructure services, driving innovation and competitive growth.

What are the primary factors driving the growth in the Telecom Towers industry?

Growth is driven by increased mobile data consumption, demand for enhanced connectivity, technological advancements in telecommunications, and growth in 5G infrastructure, fueling expansion worldwide.

Which region is the fastest Growing in the Telecom Towers market?

The Asia Pacific region emerges as the fastest-growing in the telecom towers market, with expected growth from $18.74 billion in 2023 to $33.37 billion by 2033, reflecting rapid urbanization and technological adoption.

Does ConsaInsights provide customized market report data for the Telecom Towers industry?

Yes, ConsaInsights offers tailored market reports for the telecom towers industry, allowing clients to access specific data and insights relevant to their business needs and market strategies.

What deliverables can I expect from this Telecom Towers market research project?

Expect detailed market analysis reports, segment data, trend forecasting, competitive landscape assessments, and regional insights tailored to your strategic objectives in the telecom towers market.

What are the market trends of Telecom Towers?

Key trends include the shift towards 5G infrastructure, rising demand for colocation services, increasing investment in tower construction, and a greater emphasis on sustainable building practices within the telecom sector.